|

市場調查報告書

商品編碼

1851563

沉浸式虛擬實境:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Immersive Virtual Reality - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

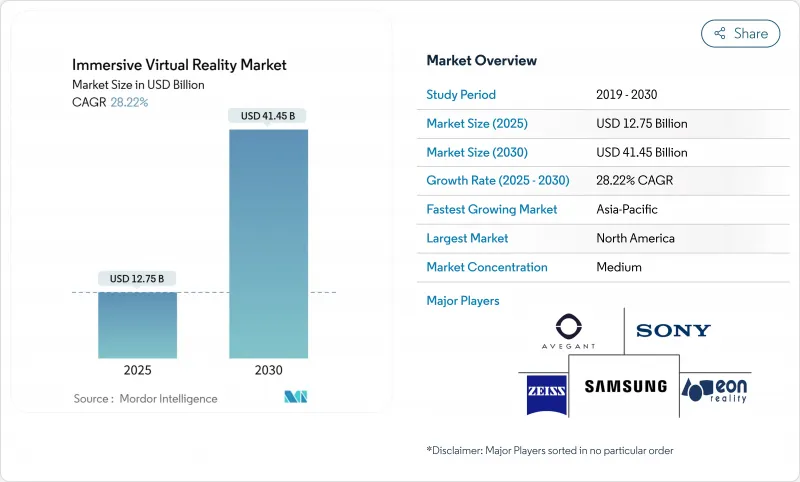

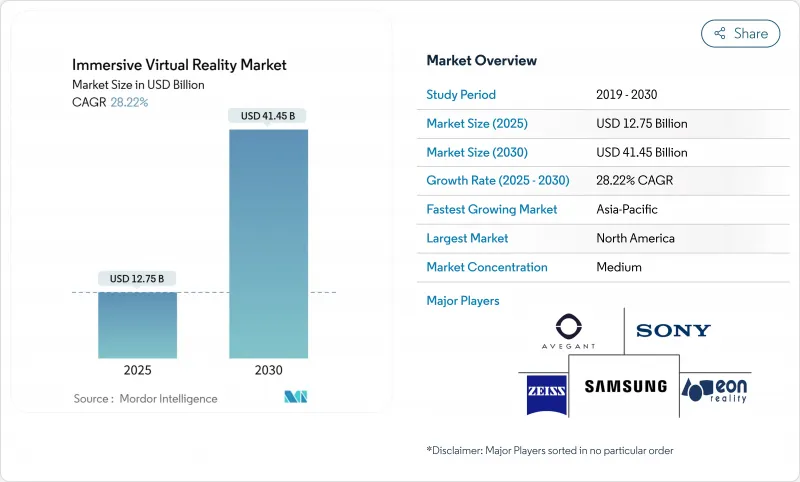

2025 年身臨其境型虛擬實境市場規模估計為 127.5 億美元,預計到 2030 年將達到 414.5 億美元,預測期(2025-2030 年)複合年成長率為 28.22%。

隨著企業從試驗計畫轉向大規模部署,商業需求正在不斷成長,尤其是在航太飛行模擬、國防飛行員訓練和受監管的醫療保健領域。雖然頭戴式顯示器仍然是主流設備外形規格,但獨立式顯示器的發展速度最快,因為許多買家看重無需連接電腦或主機的有線設定。北美地區仍維持支出主導,但亞太地區成長更為迅猛,這主要得益於中國政府的標準化舉措,預計到2024年將有超過100個大型VR裝置投入使用。企業的投資報酬率指標也反映了這一成長勢頭,例如沃爾瑪將培訓時間縮短了96%,波音公司將佈線流程指導時間縮短了75%。軟體交付技術的進步,例如雲端串流媒體和人工智慧主導的自我調整內容,有助於緩解硬體價格波動,但半導體和高純度石英的供應波動正在推高組件成本。

全球身臨其境型虛擬實境市場趨勢與洞察

虛擬實境技術在航太和國防訓練的應用

國防機構正將身臨其境型模擬器納入核心課程。美國在其「飛行員訓練轉型舉措」下部署了225台虛擬實境設備,Mass Virtual公司也因此獲得了價值6,700萬美元的相關合約。洛克希德馬丁公司和Red 6公司將擴增實境技術整合到TF-50教練機中,Vrgineers公司則參與了一項捷克協議,旨在擴展F-35的模擬能力。美國聯邦航空管理局正與Vertex Solutions和Varjo公司合作,更新民用飛行模擬器標準。這些舉措將縮短訓練週期,降低實際飛行燃油成本,並支持身臨其境型虛擬實境市場的持續成長。歐洲和亞洲持續不斷的採購項目也增強了中期前景。

透過遊戲頭戴式顯示器實現消費者普及

預計到2024年,全球VR頭戴裝置貨量將成長至960萬台,其中Meta將佔據73%的市場佔有率,而蘋果的Vision Pro儘管售價高達3,499美元,仍能佔據5%的高階市場。獨立式頭戴裝置的複合年成長率(CAGR)高達33.20%,主要得益於消費者對無線使用方式的偏好。然而,像Quest 3S這樣價格較低的新品發布並不能完全彌補假期季節的銷售疲軟,這表明內容的豐富程度與價格同樣重要。中國對海外硬體徵收105%的關稅以及區域性GPU短缺可能會導致零售價格上漲,但由地方政府資助的大規模線下VR體驗計畫將持續吸引新用戶,並支撐近期出貨量的成長。 5G和雲端渲染技術的加速普及將進一步降低效能門檻,從而保持身臨其境型虛擬實境市場的成長動能。

多感測器鑽機的總體擁有成本高

蘋果 Vision Pro 的材料清單為 1542 美元,其中僅 micro-OLED 顯示器就佔了 35% 的成本。颶風海倫 (Helene) 損毀了北卡羅來納州的一座石英礦,該礦供應半導體微影術所需的高純度石英,佔全球總量的 90%,導致零件價格上漲。中國製造的頭戴式設備被徵收超過 100% 的關稅,加上台積電地震災害後 GPU 的短缺,都推高了消費者和企業的購買成本。美國半導體工廠的營運成本比亞洲同業高出 35%,這限制了國內價格的上漲。然而,短期內的價格衝擊可能會抑制價格敏感地區的市場接受度,並減緩身臨其境型虛擬實境市場的發展速度。

細分市場分析

預計頭戴式顯示器將主導身臨其境型虛擬實境市場,到2024年將佔據86%的市場。獨立式顯示器預計將成長最快,到2030年複合年成長率將達到33.20%。 Meta公司的Quest系列產品持續佔73%的出貨量,但售價299美元的Quest 3S未能激發假日季的需求。隨著無線串流媒體延遲的降低,有線連接方式正逐漸失去市場,而隨著專用硬體變得更加經濟實惠且功能強大,智慧型手機外接式虛擬實境設備也正在減少。

手勢追蹤配件和觸覺手套在需要精準手部動作的企業培訓計畫中越來越受歡迎。 Meta、SONY和微軟已申請了觸覺回饋專利,旨在增強用戶沉浸感。 VR攝影機正被銷售給中國的線下娛樂營運商,這些營運商在2024年開設了超過100家場所,從而提升了本地內容的採集能力。儘管石英礦開採中斷導致的零件短缺可能會推高所有類型設備的零件成本,但顯示螢幕產量比率和電池密度的提升預計將從2026年起緩解成本上漲,從而推動身臨其境型虛擬實境設備在市場上的廣泛普及。

到2024年,娛樂和遊戲領域仍將佔據身臨其境型虛擬實境市場46%的佔有率。然而,醫療保健領域預計將成為成長最快的細分市場,到2030年將以29.42%的複合年成長率成長,這主要得益於FDA和CE的核准為醫保報銷鋪平了道路。 RelieVRx和DeepWell DTx的核准將把治療內容引入疼痛管理和心理健康領域,推動該領域從實驗階段走向處方階段。

國防和航太持續採購大型模擬器,美國空軍已部署的225套訓練設備是最好的證明。漢莎航空和CAE等汽車公司正在將混合實境技術應用於機組人員指導和駕駛座熟悉訓練,而建築設計工作室則利用全像來及早發現設計缺陷。零售業仍在試驗,因為擔心內容成本和頭戴式設備的衛生問題。像BP這樣的製造和能源巨頭正在部署安全模組,這表明醫療保健領域的檢驗優勢正在逐步惠及相關產業。

身臨其境型虛擬實境市場報告按設備(頭戴式顯示器 [HMD]、手勢追蹤設備、觸覺回饋設備、VR 攝影機)、最終用戶產業(娛樂和遊戲、航太和國防、醫療保健、教育和培訓、其他)、組件(硬體、軟體、服務)、身臨其境型(完全身臨其境型、半身臨其境型、非身臨其境型)和地區進行細分。

區域分析

北美將持續引領身臨其境型虛擬實境市場,預計2024年將佔據38%的市場。美國公司受益於龐大的試點培訓預算和醫療報銷管道,但不斷上漲的半導體製造成本推高了硬體價格,使其高於亞洲競爭對手。該地區正利用雲端基礎設施和5G部署試點遠端渲染解決方案,以抵消設備成本方面的障礙。沃爾瑪、波音和美國銀行等公司的企業培訓計畫在北美取得了顯著成效,供應商也優先考慮北美客戶。

亞太地區複合年成長率最高,達32.60%,這主要得益於中國結構化的元宇宙政策框架以及2024年超過100家大型VR設施的投產。工業和資訊化部成立了標準化委員會來協調設備通訊協定,國家電影局也鼓勵VR影院的部署。 IDC預測,到2029年,亞太地區AR/VR支出將超過105億美元,佔全球支出的26.5%。日本和韓國正透過政府對教育和智慧製造試點計畫的補貼而加速發展,而印度具成本效益的開發者群體將加速在地化內容的製作。儘管地震和颱風等自然災害對台積電石英晶體造成的損害仍然是營運方面的擔憂,但接近性零件供應鏈的優勢有助於減少運輸延誤。

歐洲在這方面擁有得天獨厚的戰略地位,這得益於歐盟委員會的《虛擬世界藍圖》和德國XR互動網路(一個由60家公司組成的網路,這些公司都獲得多年國家資助)。虛擬與擴增擴增實境產業聯盟預測,到2025年,歐洲將新增86萬個就業崗位,展現了歐洲與美國和中國生態系統競爭的政治意願。倫敦政經學院提出了「元元宇宙空中巴士」計劃,旨在匯集產業專長;寶馬、IKEA和博世等公司正在試驗可互通的數位孿生技術。儘管外匯波動和更嚴格的隱私法規可能會減緩消費者接受度,但跨國在標準和倫理方面的合作將增強區域長期競爭力,並維持歐洲在身臨其境型虛擬實境市場中的貢獻。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場促進因素

- 虛擬實境技術在航太和國防訓練的應用

- 透過遊戲頭戴式顯示器實現消費者普及

- 政府資助的虛擬實境醫療保健初步試驗

- 用於遠端協作的企業元宇宙平台

- 基於人工智慧的虛擬實境教育自適應學習

- 雲端渲染VR串流媒體降低了硬體門檻

- 市場限制

- 多感測器鑽機的總體擁有成本高

- 內容匱乏與生態系破碎化

- 等待時間導致的暈動症限制了會話長度

- 生物辨識和注視分析引發的隱私擔憂

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 透過裝置

- 頭戴式顯示器(HMD)

- 獨立式頭戴式顯示器

- 繫繩式頭戴顯示器

- 基於智慧型手機的頭戴式顯示器

- 手勢追蹤設備

- 觸覺手套

- 運動控制器

- 全身服

- 觸覺回饋裝置

- VR相機

- 頭戴式顯示器(HMD)

- 按最終用戶行業分類

- 娛樂和遊戲

- 航太/國防

- 衛生保健

- 外科和醫學培訓

- 復健治療

- 心理健康和疼痛管理

- 教育和培訓

- 汽車與運輸

- 建築、工程和施工 (AEC)

- 零售與電子商務

- 其他行業

- 按組件

- 硬體

- 軟體

- 服務

- 按浸入式類型

- 完全身臨其境型

- 半身臨其境型

- 非身臨其境型

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 亞太其他地區

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 肯亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 策略趨勢

- 市佔率分析

- 公司簡介

- Meta Platforms Inc.(Oculus)

- Sony Corporation

- HTC Corporation

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Microsoft Corporation

- Pico Interactive(ByteDance Ltd.)

- Valve Corporation

- Varjo Technologies Oy

- HP Inc.

- Carl Zeiss AG

- Avegant Corporation

- Varjo Technologies

- Vrgineers

- Magic Leap, Inc.

- Google LLC

- Eon Reality, Inc.

- CyberGlove Systems LLC

- Ultraleap Ltd.(Leap Motion)

- Sixense Enterprises Inc.

- Vuzix Corporation

- Lenovo Group Ltd.

- Ultraleap Ltd.

第7章 市場機會與未來展望

The Immersive Virtual Reality Market size is estimated at USD 12.75 billion in 2025, and is expected to reach USD 41.45 billion by 2030, at a CAGR of 28.22% during the forecast period (2025-2030).

Commercial demand is expanding as enterprises shift from pilot programs to scaled roll-outs, particularly in aerospace flight simulation, defense pilot training, and regulated healthcare therapies. Head-mounted displays remain the dominant device form factor, yet stand-alone models are accelerating fastest as buyers value untethered set-ups that remove PC or console requirements. North America retains spending leadership, but Asia Pacific is growing more quickly on the back of Chinese government standardization initiatives and more than 100 large-scale VR installations launched in 2024. Momentum is also evident in enterprise ROI metrics, Walmart compressed training times by 96% and Boeing trimmed wiring-process instruction by 75% confirming cost savings that extend well beyond entertainment. Supply-side turbulence in semiconductors and high-purity quartz is lifting component costs, though software-delivered advances such as cloud streaming and AI-driven adaptive content help mitigate hardware price friction.

Global Immersive Virtual Reality Market Trends and Insights

Use of VR in Aerospace and Defence Training

Defense agencies are embedding immersive simulators into core curricula. The U.S. Air Force deployed 225 VR devices under its Pilot Training Transformation initiative, while Mass Virtual secured USD 67 million in related contracts. Lockheed Martin and Red 6 integrated augmented overlays for the TF-50 trainer, and Vrgineers joined a Czech agreement to extend F-35 simulation capability. Regulatory alignment is advancing as the Federal Aviation Administration collaborates with Vertex Solutions and Varjo to update standards for civilian flight simulators. These moves shorten skill-acquisition cycles, reduce live-flight fuel spending, and underpin sustained growth for the immersive virtual reality market. Continued procurement pipelines in Europe and Asia reinforce the medium-term outlook.

Consumer Adoption via Gaming HMDs

Global VR headset shipments rose to 9.6 million units in 2024, with Meta holding 73% share and Apple's Vision Pro securing a 5% premium niche despite a USD 3,499 price tag. Stand-alone HMDs are expanding at 33.20% CAGR as buyers favor cable-free use, yet lower-priced launches such as the Quest 3S did not fully offset holiday-season softness, suggesting that content breadth is as vital as price. China's 105% tariffs on overseas hardware and regional GPU shortages risk lifting retail prices, but large-scale location-based VR experiences funded by local authorities continue to attract first-time users, supporting near-term unit growth. Accelerated 5G roll-out and cloud rendering will further lower performance barriers, sustaining momentum for the immersive virtual reality market.

High Total Cost of Ownership of Multi-Sensory Rigs

Apple Vision Pro's bill of materials stands at USD 1,542, with micro-OLED displays alone forming 35% of the cost, underscoring how sophisticated optics inflate retail pricing. Hurricane Helene damaged North Carolina quartz mines that supply up to 90% of global high-purity quartz, vital for semiconductor photolithography, pushing component prices higher. Tariffs exceeding 100% on China-built headsets, plus GPU shortages after TSMC earthquake disruptions, elevate consumer and enterprise acquisition expenses. U.S. fabs operate at operating costs 35% above Asian peers, curbing domestic price relief. Enterprises respond with bulk pre-purchase contracts to lock in supply, yet near-term sticker shock trims adoption in price-sensitive regions and tempers the immersive virtual reality market trajectory.

Other drivers and restraints analyzed in the detailed report include:

- Government-Funded VR Healthcare Therapy Pilots

- Enterprise Metaverse Platforms for Remote Collaboration

- Content Scarcity and Ecosystem Fragmentation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The immersive virtual reality market size for head-mounted displays stood dominant in 2024 as the form factor secured 86% revenue share. Stand-alone variants are poised for the fastest climb, advancing at a projected 33.20% CAGR to 2030 as buyers gravitate toward wire-free operation that speeds initial set-up. Meta's Quest line continues to hold 73% share of shipments, yet the USD 299 Quest 3S failed to ignite holiday demand, underscoring content rather than price as the limiting factor. Tethered rigs are losing favor as wireless streaming narrows latency, while smartphone-shell viewers retreat because dedicated hardware is more affordable and performant.

Gesture-tracking accessories and haptic gloves are gaining traction within enterprise training programs that need precise hand articulation. Patent filings from Meta, Sony, and Microsoft around tactile feedback elevate user immersion, though full-body suits remain niche given higher cost and cleaning complexity. VR cameras are selling into China's location-based entertainment operators that launched over 100 venues in 2024, enriching local content capture. Component shortages tied to quartz mine disruptions can raise the bill of materials across all device classes yet advances in display yield and battery density are expected to moderate cost escalation after 2026, supporting broader device penetration into the immersive virtual reality market.

Entertainment and gaming retained a 46% share of the immersive virtual reality market size during 2024 as blockbuster titles and esports events anchored consumer spend. Healthcare, however, is tracking the steepest ascent, estimated to deliver a 29.42% CAGR through 2030 on the back of FDA and CE approvals that open reimbursement lanes. RelieVRx and DeepWell DTx clearances usher therapeutic content into pain management and mental health, shifting the segment from experimental to prescription territory.

Defense and aerospace continue to procure large simulator fleets, evidenced by 225 USAF training units already fielded, while education providers join the vanguard as Walmart, Boeing, and Bank of America quantify double-digit productivity lifts. Automotive firms like Lufthansa and CAE apply mixed reality to crew guidance and cockpit familiarization, and architecture studios leverage holographic walkthroughs to identify design flaws early. Retail engagement remains exploratory, held back by content costs and headset hygiene concerns. Manufacturing and energy majors such as BP roll out safety modules, demonstrating how healthcare's validation effect is permeating adjacent sectors, which amplifies growth momentum for the immersive virtual reality market.

The Immersive Virtual Reality Market Report is Segmented by Device (Head-Mounted Displays [HMDs], Gesture Tracking Devices, Haptic Feedback Devices, and VR Cameras), End-User Industry (Entertainment and Gaming, Aerospace and Defense, Healthcare, Education and Training, and More), Component (Hardware, Software, and Services), Immersion Type (Fully-Immersive, Semi-Immersive, and Non-Immersive), and Geography.

Geography Analysis

North America continued to lead the immersive virtual reality market with 38% revenue share in 2024, buoyed by substantial defense spending and early enterprise adoption. U.S. companies benefit from large pilot training budgets and healthcare reimbursement pipelines, although higher semiconductor fabrication costs raise hardware prices relative to Asian competitors. The region is leveraging cloud infrastructure and 5G roll-out to pilot remote rendering solutions that could offset device cost barriers. Corporate training programs at Walmart, Boeing, and Bank of America supply domestic proof points, reinforcing vendor focus on North American clients.

Asia Pacific registered the highest regional CAGR at 32.60%, propelled by China's structured metaverse policy framework and more than 100 large-scale VR installations commissioned in 2024. The Ministry of Industry and Information Technology formed a standards committee that aligns device protocols, while the National Film Administration encouraged VR cinema roll-outs. IDC projects regional AR/VR spending to surpass USD 10.5 billion by 2029, equal to 26.5% of global outlays. Japan and South Korea add momentum through government grants for education and smart-manufacturing pilots, and India's cost-efficient developer pool accelerates localized content creation. Proximity to component supply chains helps mitigate freight delays, though natural disaster risks such as TSMC's earthquake and typhoon-driven quartz disruptions remain operational concerns.

Europe holds a strategic middle position, supported by the European Commission's virtual worlds roadmap and Germany's XR-Interaction network of 60 firms receiving multi-year state funding. The Virtual and Augmented Reality Industrial Coalition forecasts 860,000 new European jobs by 2025, signaling political will to compete with U.S. and Chinese ecosystems. The London School of Economics champions an "Airbus for the metaverse" to pool industrial expertise, while companies such as BMW, IKEA, and Bosch experiment with interoperable digital twins. Currency fluctuations and stricter privacy rules can slow consumer uptake, yet cross-border collaboration on standards and ethics enhances long-term regional competitiveness, sustaining European contribution to the immersive virtual reality market.

- Meta Platforms Inc. (Oculus)

- Sony Corporation

- HTC Corporation

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Microsoft Corporation

- Pico Interactive (ByteDance Ltd.)

- Valve Corporation

- Varjo Technologies Oy

- HP Inc.

- Carl Zeiss AG

- Avegant Corporation

- Varjo Technologies

- Vrgineers

- Magic Leap, Inc.

- Google LLC

- Eon Reality, Inc.

- CyberGlove Systems LLC

- Ultraleap Ltd. (Leap Motion)

- Sixense Enterprises Inc.

- Vuzix Corporation

- Lenovo Group Ltd.

- Ultraleap Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Drivers

- 4.1.1 Use of VR in aerospace and defence training

- 4.1.2 Consumer adoption via gaming HMDs

- 4.1.3 Government-funded VR healthcare therapy pilots

- 4.1.4 Enterprise metaverse platforms for remote collaboration

- 4.1.5 AI-powered adaptive learning in VR education

- 4.1.6 Cloud-rendered VR streaming lowers hardware barrier

- 4.2 Market Restraints

- 4.2.1 High total cost of ownership of multi-sensory rigs

- 4.2.2 Content scarcity and ecosystem fragmentation

- 4.2.3 Latency-driven motion-sickness limits session length

- 4.2.4 Privacy concerns over biometric and gaze analytics

- 4.3 Value/Supply-Chain Analysis

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Device

- 5.1.1 Head-Mounted Displays (HMDs)

- 5.1.1.1 Stand-alone HMDs

- 5.1.1.2 Tethered HMDs

- 5.1.1.3 Smartphone-based HMDs

- 5.1.2 Gesture Tracking Devices

- 5.1.2.1 Haptic Gloves

- 5.1.2.2 Motion Controllers

- 5.1.2.3 Full-Body Suits

- 5.1.3 Haptic Feedback Devices

- 5.1.4 VR Cameras

- 5.1.1 Head-Mounted Displays (HMDs)

- 5.2 By End-user Industry

- 5.2.1 Entertainment and Gaming

- 5.2.2 Aerospace and Defence

- 5.2.3 Healthcare

- 5.2.3.1 Surgery and Medical Training

- 5.2.3.2 Rehabilitation Therapy

- 5.2.3.3 Mental Health and Pain Management

- 5.2.4 Education and Training

- 5.2.5 Automotive and Transportation

- 5.2.6 Architecture, Engineering and Construction (AEC)

- 5.2.7 Retail and E-commerce

- 5.2.8 Other Industries

- 5.3 By Component

- 5.3.1 Hardware

- 5.3.2 Software

- 5.3.3 Services

- 5.4 By Immersion Type

- 5.4.1 Fully-Immersive

- 5.4.2 Semi-Immersive

- 5.4.3 Non-Immersive

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Kenya

- 5.5.6.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.3.1 Meta Platforms Inc. (Oculus)

- 6.3.2 Sony Corporation

- 6.3.3 HTC Corporation

- 6.3.4 Apple Inc.

- 6.3.5 Samsung Electronics Co., Ltd.

- 6.3.6 Microsoft Corporation

- 6.3.7 Pico Interactive (ByteDance Ltd.)

- 6.3.8 Valve Corporation

- 6.3.9 Varjo Technologies Oy

- 6.3.10 HP Inc.

- 6.3.11 Carl Zeiss AG

- 6.3.12 Avegant Corporation

- 6.3.13 Varjo Technologies

- 6.3.14 Vrgineers

- 6.3.15 Magic Leap, Inc.

- 6.3.16 Google LLC

- 6.3.17 Eon Reality, Inc.

- 6.3.18 CyberGlove Systems LLC

- 6.3.19 Ultraleap Ltd. (Leap Motion)

- 6.3.20 Sixense Enterprises Inc.

- 6.3.21 Vuzix Corporation

- 6.3.22 Lenovo Group Ltd.

- 6.3.23 Ultraleap Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment