|

市場調查報告書

商品編碼

1851546

環氧樹脂:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Epoxy Resins - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

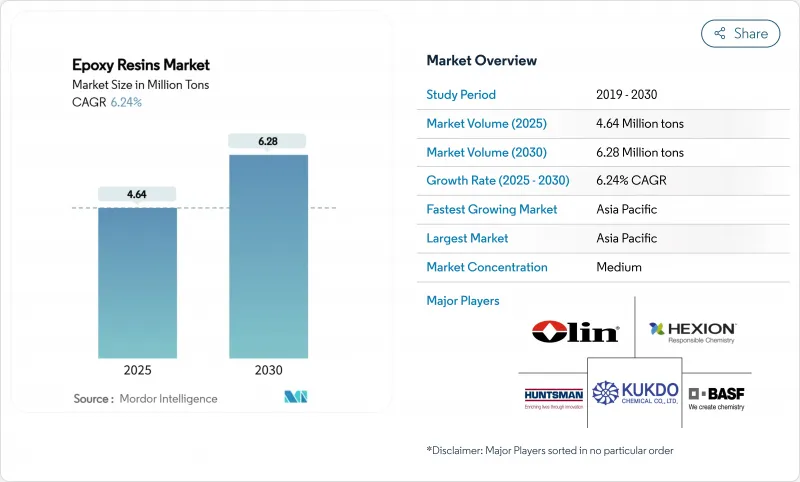

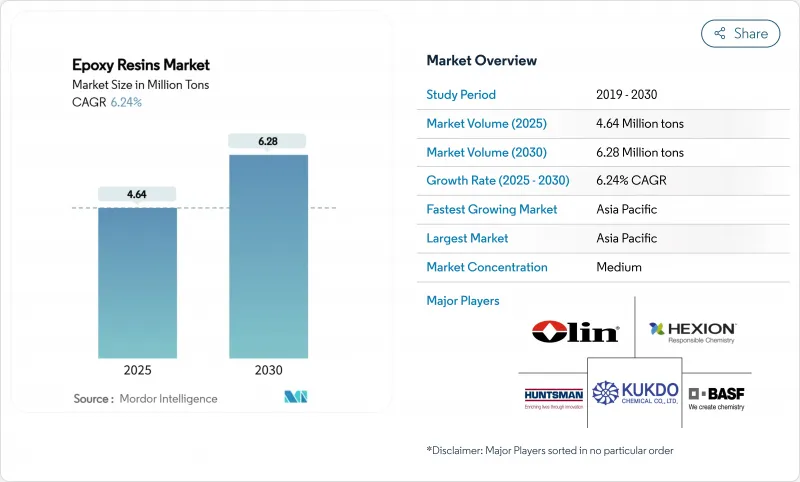

預計到 2025 年環氧樹脂市場規模為 464 萬噸,到 2030 年將達到 628 萬噸,預測期(2025-2030 年)複合年成長率為 6.22%。

持續的需求源於該材料無與倫比的機械、化學和熱性能,使其能夠支援從風力發電機葉片到半導體封裝等關鍵應用。隨著對雙酚A (BPA) 和揮發性有機化合物 (VOC) 的監管日益嚴格,以及水性、生物回收和低VOC化學品技術的進步,技術創新正在加速發展。新興國家可再生能源基礎設施的擴張、電氣化趨勢和基礎設施支出為銷售提供了積極的推動力,但不斷上漲的貿易關稅和植物來源價格的波動也為採購團隊帶來了短期不確定性。儘管環氧樹脂市場集中度仍然不高,但可回收和生物基配方方面的突破性進展正在為成熟企業和新興企業創造機會。

全球環氧樹脂市場趨勢與洞察

油漆和塗料需求不斷成長

塗料將繼續主導環氧樹脂市場,預計到2024年將佔60.15%的收入佔有率。東南亞和非洲的基礎設施項目,以及依賴高阻隔阻隔性耐腐蝕塗料的船舶和包裝等細分市場,將推動市場成長。 Westlake公司將於2025年推出EpoVIVE生物循環樹脂,顯示供應商正在努力平衡永續性和性能。量子點催化光化學技術將助力低VOC配方的普及,該技術無需使用昂貴的紫外線過濾劑即可提高樹脂的耐光穩定性。 Amerlock 400等船用級系統可延長船舶的乾船塢維修週期,並降低船隊業者的全生命週期成本。預計到2030年,塗料的複合年成長率將達到6.51%,並將成為整個環氧樹脂市場銷售和技術創新的驅動力。

複合材料在風力發電機葉片中的應用

離岸風力發電的興起、更大的轉子直徑以及碳-玻璃混合設計正在不斷提升環氧樹脂的性能閾值。全球風力發電理事會預測,新增產能將以每年8.8%的速度成長,以支撐樹脂的長期需求。 TPI Composites的客戶群將在2025年供應美國88%的陸上風力發電機葉片,這表明製程技術如何能夠整合採購。西門子歌美颯已將可在弱酸性條件下脫粘的可回收環氧樹脂葉片商業化,從而緩解了報廢難題。利用機器學習最佳化葉片固化工藝,可進一步減少廢棄物和能源消耗,鞏固環氧樹脂作為風力發電價值鏈首選基體材料的地位。

原物料價格波動

2024年上半年,中國雙酚A(BPA)產能成長12.31%,達到每年548萬噸,但運轉率下降,區域價格較上季下跌4.6%。國都化工廠爆炸等事件導致BPA價格一度翻倍,下游化合物生產商面臨利潤風險。極端天氣導致的不可抗力聲明進一步加劇了供應的不確定性。因此,多家環氧樹脂巨頭正在建造專屬式環氧氯丙烷和BPA裝置,以確保原料供應並避免價格波動風險。

細分市場分析

作為風力渦輪機葉片和汽車複合材料的首選樹脂,DGBEA樹脂預計在2024年仍將佔環氧樹脂市場37.02%的佔有率。 DGBEA樹脂以6.99%的複合年成長率持續成長,對市場擴張至關重要。然而,客戶審核要求生產商證明其雙酚A(BPA)來源可追溯且低碳。為此,歐洲、美國和日本的供應商正在試行物料平衡會計和生物回收原料,以維持DGBEA在環氧樹脂市場的地位。

特種樹脂填補了不同的性能空白。 DGBEF樹脂具有低黏度,適用於船舶維護塗料;酚醛樹脂則能抵抗爐襯中的熱衝擊。脂肪族環氧樹脂具有建築建築幕牆所需的紫外線穩定性。縮水甘油胺體系在電子機殼中具有優異的金屬黏合性。生物基樹脂和環脂族樹脂(歸類為其他原料)預計到2030年將佔據環氧樹脂市場相當大的佔有率,因為閉合迴路回收和碳核算正受到股東的關注。

環氧樹脂市場報告按原料(DGBEA(雙酚A和ECH)、DGBEF(雙酚F和ECH)、酚醛樹脂(甲醛和苯酚)、脂肪族(脂肪醇)、縮水甘油胺(芳香胺和ECH)、其他)、應用(油漆和塗料、黏合劑和密封劑、複合材料、電氣和ECH)以及其他地區(亞太)以及其他地區進行其他地區(亞太)

區域分析

亞太地區仍將是環氧樹脂市場的主導區域,預計到2024年將佔全球需求的48.19%,並有望在2030年前以6.44%的複合年成長率成長。中國樹脂出口面臨高達354.99%的美國反傾銷稅,迫使像DCM Shriram在印度投資1.25億美元的待開發區建廠這樣的企業,轉向服務於地域更加多元化的基本客群。泰國和越南正在購買新的印刷電路板和風力渦輪機葉片生產能力,而日本和韓國則在推廣用於半導體和離岸風電領域的高玻璃化轉變溫度(Tg)和可回收化學品。

北美將利用製造業回流、基礎設施投資和可再生能源稅額扣抵來緩解進口樹脂流量的波動。 1.01%至547.76%不等的反補貼稅將鼓勵國內製造商運作暫停中的核子反應爐,並投資新的原料資產。加拿大風電開發商指定使用北極級環氧樹脂體系,而墨西哥的汽車工業將推動對結構性黏著劑的需求。美國國家再生能源實驗室(NREL)的植物來源環氧樹脂研究凸顯了該地區在永續性的領先地位。

歐洲正努力在嚴格的雙酚A(BPA)法規與尖端研發之間尋求平衡。一家德國汽車零件製造商正與一家當地樹脂製造商合作開發一種導熱電磁相容(EMC)材料。英國離岸風力發電要求環氧底漆單樁的使用壽命達到25年,而法國核能產業則在推廣耐輻射等級的材料。斯科特·巴德公司斥資3000萬英鎊在英國擴建產能,凸顯了其在全球物流變化下對本地供應的承諾。在北歐,循環經濟政策已經到位,一項歐盟資助的計畫正在試驗閉合迴路環氧樹脂回收利用。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 油漆和塗料需求不斷成長

- 複合材料在風力發電機葉片中的應用

- 電氣和電子產業需求不斷成長

- 基礎設施建設驅動的黏合劑需求成長

- 3D列印環氧光敏聚合物

- 市場限制

- 原物料價格波動

- 更嚴格的VOC和BPA法規

- 反傾銷稅擾亂貿易流動

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模及成長預測(價值及數量)

- 按原料

- DGBEA(雙酚A和ECH)

- DGBEF(雙酚F和ECH)

- 酚醛樹脂(甲醛/苯酚)

- 脂肪族(脂肪醇)

- 縮水甘油胺(芳香胺和ECH)

- 其他原料(環脂族、生物基環氧樹脂)

- 依實體形態

- 液體

- 堅硬的

- 解決方案

- 水性分散體

- 透過使用

- 油漆和塗料

- 黏合劑和密封劑

- 合成的

- 電氣和電子

- 風力發電機

- 海洋

- 其他應用(建築、用於 3D 列印的光敏聚合物等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 卡達

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- Atul Ltd

- Bodo Moller Chemie GmbH

- Cardolite Corporation

- Chang Chun Group

- DIC Corporation

- Dow

- Grasim Industries Limited

- Hexion Inc.

- Huntsman International LLC

- Jiangsu Sanmu Group Co., Ltd.

- Kolon Industries

- Kukdo Chemical Co., Ltd

- Mitsui Chemicals, Inc.

- Nama

- Nan Ya Plastics Corporation

- Olin Corporation

- Robnor ResinLab Ltd,

- Sika AG

- Sinochem Holdings Corporation Ltd.

- Association for Chemical and Metallurgical Production(SPOLCHEMIE)

- Westlake Corporation

第7章 市場機會與未來展望

The Epoxy Resins Market size is estimated at 4.64 million tons in 2025, and is expected to reach 6.28 million tons by 2030, at a CAGR of 6.22% during the forecast period (2025-2030).

Sustained demand is rooted in the material's unmatched mechanical, chemical, and thermal performance that underpins critical uses ranging from wind-turbine blades to semiconductor packaging. Innovation is accelerating as stricter regulations on bisphenol A (BPA) and volatile organic compounds (VOCs) advance waterborne, bio-circular, and low-VOC chemistries. Expanding renewable-energy infrastructure, electrification trends, and infrastructure spending in emerging economies add positive volume momentum, while escalating trade duties and raw-material price swings present near-term uncertainties for procurement teams. The epoxy resins market remains moderately concentrated, yet breakthrough work on recyclable and plant-derived formulations is widening the opportunity set for both incumbents and specialist newcomers.

Global Epoxy Resins Market Trends and Insights

Increasing Demand from Paints and Coatings

Paints and coatings continued to dominate the epoxy resins market with a 60.15% revenue share in 2024. Growth is reinforced by infrastructure programs in Southeast Asia and Africa and by marine and packaging niches that depend on high-barrier, corrosion-resistant finishes. Westlake's 2025 launch of EpoVIVE bio-circular resins illustrates how suppliers are balancing sustainability with performance. The shift to low-VOC formulations is aided by quantum-dot-catalyzed photochemistry that improves sunlight stability without costly UV blockers Marine-grade systems such as Amerlock 400 lengthen dry-dock cycles, lowering total lifecycle cost for fleet operators.The resulting 6.51% CAGR to 2030 positions coatings as both volume and innovation anchors for the broader epoxy resins market.

Wind-Turbine Blade Composites Uptake

Growing offshore wind installations, larger rotor diameters, and hybrid carbon-glass designs are raising epoxy performance thresholds. The Global Wind Energy Council forecasts 8.8% annual growth in new capacity, which underpins long-run resin demand. TPI Composites' customer base supplied 88% of 2025 US onshore blades, underscoring how process know-how consolidates purchasing. Siemens Gamesa has already commercialized recyclable epoxy blades that de-bond under mild acidic conditions, easing end-of-life challenges. Machine-learning optimization of blade cure schedules further cuts waste and energy use, reinforcing epoxy's position as the matrix of choice in the wind energy value chain.

Raw-Material Price Volatility

China expanded BPA capacity by 12.31% in H1 2024 to 5.48 million t pa, yet utilization dipped and regional prices fell 4.6% quarter-on-quarter. Disruptions such as the Guodu Chemical plant explosion temporarily doubled BPA prices, exposing downstream formulators to margin risk. Force-majeure declarations following extreme weather events added further supply uncertainty. Several epoxy majors are therefore building captive epichlorohydrin and BPA units to secure feedstock and hedge volatility.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Demand from Electrical and Electronics

- Growing Infrastructure-Led Adhesive Demand

- Stricter VOC and BPA Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

DGBEA resins retained 37.02% epoxy resins market share in 2024 as the workhorse grade for wind-energy blades and automotive composites. At a 6.99% CAGR they remain integral to market expansion, yet customer audits are pushing producers to demonstrate traceable, lower-carbon BPA supply. In response, Western and Japanese suppliers are piloting mass-balance accounting and bio-circulating feedstocks to preserve DGBEA's position in the epoxy resins market.

Specialty resins fill clear performance gaps. DGBEF offers lower viscosity for marine maintenance coatings, while novolac chemistries withstand thermal shock inside furnace linings. Aliphatic epoxies deliver UV stability essential for architectural facades. Glycidylamine versions provide superior metal adhesion in electronics housings. Bio-based and cycloaliphatic chemistries, grouped under other raw materials, are projected to be the fastest movers and could capture a measurable slice of the epoxy resins market by 2030 as closed-loop recycling and carbon accounting gain shareholder focus.

The Epoxy Resins Market Report is Segmented by Raw Material (DGBEA (Bisphenol A and ECH), DGBEF (Bisphenol F and ECH), Novolac (Formaldehyde and Phenols), Aliphatic (Aliphatic Alcohols), Glycidylamine (Aromatic Amines and ECH), and More), Application (Paints and Coatings, Adhesives and Sealants, Composites, Electrical and Electronics, and More), and Geography (Asia-Pacific, North America, Europe, and More).

Geography Analysis

Asia-Pacific remained the epicenter of the epoxy resins market, securing 48.19% of 2024 demand and pointing to a 6.44% CAGR through 2030. China's resin exports face US anti-dumping duties as high as 354.99%, prompting ventures like DCM Shriram's USD 125 million Indian greenfield unit to serve a more regionally diversified customer base. Thailand and Vietnam capture fresh PCB and wind-blade capacity, while Japan and South Korea push ultra-high-Tg and recyclable chemistries for semiconductors and offshore wind applications.

North America leverages reshoring, infrastructure investment, and renewable-energy tax credits to buffer volatility in imported resin flows. Countervailing duties ranging from 1.01% to 547.76% spur domestic producers to reactivate idled reactors and invest in new feedstock assets. Canadian wind-farm developers specify Arctic-grade epoxy systems, and Mexico's automotive clusters accelerate demand for structural adhesives. NREL's plant-derived epoxy research underscores the region's sustainability leadership.

Europe balances stringent BPA rules with cutting-edge R&D. German automotive suppliers co-engineer thermally conductive EMCs with local resin formulators. The United Kingdom's offshore wind boom sustains 25-year service life requirements for epoxy-primed monopiles, and France's nuclear sector pushes radiation-resistant grades. Scott Bader's GBP 30 million UK capacity addition highlights commitments to local supply amid global logistics flux. The Nordic region, already well advanced in circular-economy policy, pilots closed-loop epoxy recycling trials under EU-funded programs.

- Atul Ltd

- Bodo Moller Chemie GmbH

- Cardolite Corporation

- Chang Chun Group

- DIC Corporation

- Dow

- Grasim Industries Limited

- Hexion Inc.

- Huntsman International LLC

- Jiangsu Sanmu Group Co., Ltd.

- Kolon Industries

- Kukdo Chemical Co., Ltd

- Mitsui Chemicals, Inc.

- Nama

- Nan Ya Plastics Corporation

- Olin Corporation

- Robnor ResinLab Ltd,

- Sika AG

- Sinochem Holdings Corporation Ltd.

- Association for Chemical and Metallurgical Production (SPOLCHEMIE)

- Westlake Corporation

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand from Paints and Coatings

- 4.2.2 Wind-Turbine Blade Composites Uptake

- 4.2.3 Increasing Demand from Electrical and Electronics

- 4.2.4 Growing Infrastructure-Led Adhesive Demand

- 4.2.5 3-D Printed Epoxy Photopolymers Adoption

- 4.3 Market Restraints

- 4.3.1 Raw-Material Price Volatility

- 4.3.2 Stricter VOC and BPA Regulations

- 4.3.3 Anti-Dumping Duties Disrupting Trade Flows

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Raw Material

- 5.1.1 DGBEA (Bisphenol A and ECH)

- 5.1.2 DGBEF (Bisphenol F and ECH)

- 5.1.3 Novolac (Formaldehyde and Phenol)

- 5.1.4 Aliphatic (Aliphatic Alcohols)

- 5.1.5 Glycidylamine (Aromatic Amines and ECH)

- 5.1.6 Other Raw Materials (Cycloaliphatic, Bio-based Epoxies)

- 5.2 By Physical Form

- 5.2.1 Liquid

- 5.2.2 Solid

- 5.2.3 Solution

- 5.2.4 Waterborne Dispersion

- 5.3 By Application

- 5.3.1 Paints and Coatings

- 5.3.2 Adhesives and Sealants

- 5.3.3 Composites

- 5.3.4 Electrical and Electronics

- 5.3.5 Wind Turbines

- 5.3.6 Marine

- 5.3.7 Other Applications (Construction, 3-D Printing Photopolymers, etc.)

- 5.4 By Geography

- 5.4.1 Asia-Pacific

- 5.4.1.1 China

- 5.4.1.2 India

- 5.4.1.3 Japan

- 5.4.1.4 South Korea

- 5.4.1.5 Malaysia

- 5.4.1.6 Thailand

- 5.4.1.7 Indonesia

- 5.4.1.8 Vietnam

- 5.4.1.9 Rest of Asia-Pacific

- 5.4.2 North America

- 5.4.2.1 United States

- 5.4.2.2 Canada

- 5.4.2.3 Mexico

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 France

- 5.4.3.4 Italy

- 5.4.3.5 Spain

- 5.4.3.6 Nordics

- 5.4.3.7 Turkey

- 5.4.3.8 Russia

- 5.4.3.9 Rest of Europe

- 5.4.4 South America

- 5.4.4.1 Brazil

- 5.4.4.2 Argentina

- 5.4.4.3 Colombia

- 5.4.4.4 Rest of South America

- 5.4.5 Middle-East and Africa

- 5.4.5.1 Saudi Arabia

- 5.4.5.2 Qatar

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 South Africa

- 5.4.5.7 Rest of Middle-East and Africa

- 5.4.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%(/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Atul Ltd

- 6.4.2 Bodo Moller Chemie GmbH

- 6.4.3 Cardolite Corporation

- 6.4.4 Chang Chun Group

- 6.4.5 DIC Corporation

- 6.4.6 Dow

- 6.4.7 Grasim Industries Limited

- 6.4.8 Hexion Inc.

- 6.4.9 Huntsman International LLC

- 6.4.10 Jiangsu Sanmu Group Co., Ltd.

- 6.4.11 Kolon Industries

- 6.4.12 Kukdo Chemical Co., Ltd

- 6.4.13 Mitsui Chemicals, Inc.

- 6.4.14 Nama

- 6.4.15 Nan Ya Plastics Corporation

- 6.4.16 Olin Corporation

- 6.4.17 Robnor ResinLab Ltd,

- 6.4.18 Sika AG

- 6.4.19 Sinochem Holdings Corporation Ltd.

- 6.4.20 Association for Chemical and Metallurgical Production (SPOLCHEMIE)

- 6.4.21 Westlake Corporation

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment