|

市場調查報告書

商品編碼

1851535

自動化儲存和搜尋系統(ASRS):市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automated Storage And Retrieval System (ASRS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

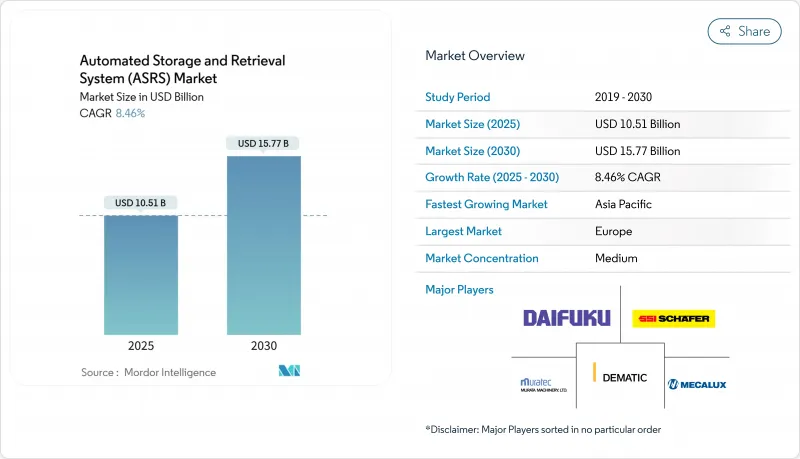

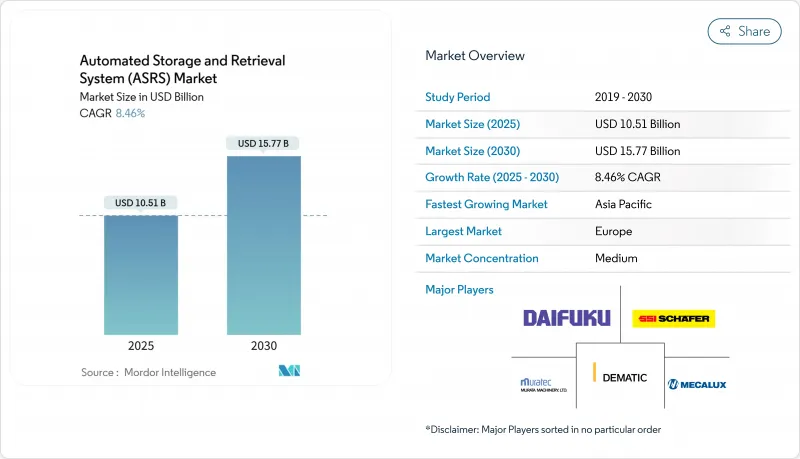

預計到 2025 年,自動化儲存和搜尋系統市場價值將達到 105.1 億美元,到 2030 年將達到 157.7 億美元。

這反映了強勁的複合年成長率,凸顯了智慧自動化從倉庫營運商的可選升級轉變為策略必需品的轉變。

電子商務交易量激增、勞動力長期短缺以及房地產成本不斷上漲,共同促成了自動化儲存和搜尋系統市場的一個轉折點,使得部署這些系統能夠顯著提升吞吐量、準確性和空間利用率。面對物流營運中每年 5-7% 的薪資成長,企業正將資本密集的自動化計劃視為應對營運成本上漲的保障,而節能的立方體和穿梭車解決方案也符合企業永續性的要求。多種技術的融合正在重塑解決方案的設計。現代平台整合了機器人技術、人工智慧路徑規劃演算法和預測性維護分析,可將非計劃性停機時間減少高達 30%。早期採用者報告稱,高混合訂單的周期時間縮短了 40%,這使得自動化儲存和搜尋系統投資成為全通路履約策略的基礎。

全球自動化儲存與搜尋系統(ASRS)市場趨勢與洞察

履約壓力

到2025年中期,亞馬遜部署一百萬台機器人的計畫已充分證明,人工揀貨無法應付每小時接近300行的訂單處理量。其他零售商迅速做出回應,加快推進其「立方體穿梭車」(Cube Shuttle)計劃,將訂單處理週期從數小時縮短至數分鐘,從而加速了自動化儲存和搜尋系統市場的發展。服裝和電子產品退貨率的上升使得準確性變得至關重要。人工智慧增強型機械手的商品識別準確率現已超過99%,有效減少了成本高昂的重新出貨。履約業者也發現,機器人技術能夠減少堆高機作業次數和照明需求,進而降低每筆訂單8%的能源成本。

人事費用上升和安全義務

2024年,堆高機事故佔倉庫死亡事故的大多數,每週造成美國8,400萬美元的工傷賠償。 2025年發布的新版美國職業安全與健康管理局(OSHA)指南轉移了雇主的責任,並加速了向「物料到人」單元的轉變,這種模式將人員從人流密集的通道中移除。預計到2028年,汽車修理廠將面臨20%的技工缺口,因此它們採用了小型裝載系統,將稀缺的勞動力從搜尋崗位轉移到診斷崗位。總而言之,這些動態共同推動了自動化儲存和搜尋系統市場在中期內成長,增幅超過兩個百分點。

前期資本支出高,投資回收期長

儘管承包計劃已被證實具有顯著的成本節約潛力,但其金額從7萬美元到300萬美元不等,對許多小型經銷商而言仍然是一大障礙。總擁有成本 (TCO) 模式通常會在基礎價格的基礎上增加40%的軟體、試運行和培訓費用,這意味著在宏觀經濟不確定時期,投資回報期將超出財務長的負擔範圍。基於訂閱的「按次付費」模式旨在降低領先成本,但目前僅適用於部分大批量使用情境。

細分市場分析

到2024年,固定巷道起重機系統仍將佔全球銷售額的38.2%,這主要得益於汽車和大眾消費品工廠的需求,這些工廠可預測的物流流程使得高性能貨架成為必要。這些工廠歷來是自動化儲存和搜尋系統市場的設計模板,限制了使用者對特定巷道寬度和吞吐量上限的依賴。基於立方體的網格系統和機器人儲存線透過將儲存密度提高60%並將搜尋時間縮短至70秒以內而迅速發展,預計到本十年末將實現12.1%的複合年成長率,從而改變了綜合收益。像AutoStore和DSV這樣的知名第三方物流公司已在九個國家/地區擴展了立方體系統的部署,凸顯了其多功能性和適應性。穿梭車系統則介於兩者之間。模組化的穿梭車通道使企業能夠在不進行大規模建築維修的情況下逐步擴展。這種靈活性對那些希望根據年度需求波動調整其自動化儲存和搜尋系統投資的快速成長型零售商極具吸引力。

儘管垂直升降模組 (VLM) 和旋轉貨架解決方案仍屬於小眾市場,收入佔不到 10%,但在占地面積有限且零件完整性至關重要的場所,它們卻能創造顯著價值。例如,醫療設備組裝使用 VLM 來保護微機械零件免受污染,同時實現超過 99.9% 的揀選精度。混合型倉庫擴大採用起重機、穿梭車和立方體貨架的組合。這種架構表明,自動化儲存和搜尋系統市場已從單一技術轉向客製化生態系統。 Kardex 與 Berkshire Grey 的合作將 AI 視覺揀選單元整合到其 VLM 產品線中,實現了 99.99% 的準確率,進一步強化了塑造現代倉庫設計的跨領域融合趨勢。

到2024年,單元貨載托盤系統將佔總收入的42.5%,這主要得益於汽車零件組裝、飲料托盤化以及其他以同質商品為主要儲存物件的散裝物流領域的成長。然而,電子商務中SKU的爆炸性成長導致周轉箱層級的搜尋速度大幅提升,而單元貨載起重機無法以經濟高效的方式滿足這一需求,因此對小型裝載系統的需求正以11.3%的複合年成長率成長。預計在全通路生鮮領域,小型裝載週轉箱解決方案的自動化儲存和搜尋市場規模將成長得更快,因為該領域平均每個購物籃包含35個線上訂單。單一小型裝載通道每小時可處理多達1200個週轉箱循環,從而在有限的空間內實現門市補貨和線上訂購線下取貨的履約履行。

托盤穿梭車子系統彌合了高吞吐量托盤儲存和選擇性存取需求之間的差距,可配置深度,從而平衡儲存密度和速度。中型負載應用可處理小批量物品以及電子產品和汽車售後零件中較為笨重的中型組件。隨著倉庫管理系統 (WMS) 基於即時單次移動成本而非僵化的孤立區域來指導揀貨,營運商擴大在統一的軟體平台上混合使用不同類型的貨物,這標誌著自動化存儲和搜尋系統市場正悄然走向成熟。

ASRS 市場報告按產品類型(固定巷道起重機系統、穿梭車系統、垂直升降模組 (VLM) 等)、負載類型(單元貨載、托盤負載穿梭車、小型負載、中型負載、週轉箱/紙箱等)、應用(存儲和緩衝、貨到人揀貨、套件組裝和地區排序等)、最終用戶行業(製造業、非製造業)和地區對行業排序。

區域分析

歐洲仍將是最大的區域貢獻者,預計2024年將佔全球銷售額的33.8%。每小時超過28美元的高昂人事費用以及嚴格的工人安全法規使得自動化在經濟上極具吸引力,而歐盟的永續性法規也認可高密度立方體網格是降低建築能耗的有效途徑。德國的《2025年高科技戰略》累計3.692億美元用於機器人研發,並加強了有利於解決方案提供者的商業生態系統。一家斯堪地那維亞零售商將六個傳統倉庫合併為一個自動化倉庫,使每筆訂單的二氧化碳排放量減少了35%。

亞太地區成長最快,複合年成長率達11.9%。中國耗資兆元人民幣的大型企劃標誌著國家對工廠自動化的堅定承諾;日本提案連接大阪和東京的500公里輸送機網路,從而催生了對高吞吐量分類節點的需求。韓國的政策誘因為智慧工廠部署提供了1.28億美元的補貼;大福公司在DAIFUKU CO. LTD.的工廠於2025年投產後,印度也成為了其生產基地,縮短了區域客戶的前置作業時間。因此,亞太地區的自動化儲存和搜尋系統市場正受益於國內需求和在地化生產能力的雙重推動。

北美仍然是創新中心,擁有許多超大規模電子商務試驗場,為全球樹立了標竿。亞馬遜部署了以人工智慧為基礎的模式來重新規劃其機器人車隊的路線,在提高每小時揀貨量的同時,也提升了能源效率。 AutoStore位於新罕布夏州的新總部設有一所培訓學院,旨在解決技能缺口問題,並支持該公司關於在2026年底在該地區安裝車輛數量將超過300輛的預測。沙烏地阿拉伯的一家藥品分銷商將於2024年試行半自動化履約,而巴西的一家第三方物流公司將受惠於資本財稅收優惠,這將使這兩個地區在未來五年內成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 履約壓力

- 人事費用上升和職場安全法規要求

- 轉型為微型履約與都市配送中心(悄無聲息地)

- 低溫運輸自動化(鮮為人知的領域)

- 低調的預測性維護分析可提高投資報酬率

- 亞太地區和歐洲產業政策獎勵

- 市場限制

- 初始投資額高,投資回收期長

- ASRS技術熟練人員短缺

- 與傳統倉庫管理系統整合的複雜性

- 互聯自動化儲存與檢索系統 (ASRS) 中的網路安全漏洞(鮮為人知)

- 關鍵法規結構評估

- 價值鏈分析

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 關鍵相關人員影響評估

- 主要用例和案例研究

- 宏觀經濟因素對市場的影響

- 投資分析

第5章 市場區隔

- 依產品類型

- 固定巷道起重機系統

- 太空梭系統

- 垂直升降模組(VLM)

- 輪播模組(垂直、水平)

- 立方體型/機器人型立方體存儲

- 按載荷類型

- 單元貨載

- 托盤公路穿梭車

- 迷你公路

- 中載

- 手提袋/紙箱等

- 透過使用

- 儲存和緩衝

- 現場揀貨

- 試劑盒和定序

- 組裝/生產支持

- 冷藏和冷凍處理

- 按最終用戶行業分類

- 製造業

- 車

- 飲食

- 製藥和生命科學

- 電子和半導體

- 金屬和機械

- 非製造業

- 電子商務與零售

- 第三方物流(3PL)和倉儲業

- 機場和行李處理

- 國防和政府商店

- 製造業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- ASEAN

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Daifuku Co., Ltd.

- Schaefer Systems International GmbH(SSI SCHAEFER)

- Dematic Corp.(KION Group AG)

- Murata Machinery, Ltd.

- Mecalux, SA

- Honeywell Intelligrated, Inc.

- KUKA AG

- KNAPP AG

- Kardex Holding AG

- Toyota Industries Corporation

- Viastore Systems GmbH

- AutoStore Holdings Ltd.

- Swisslog Holding AG

- Vanderlande Industries BV

- Bastian Solutions LLC

- System Logistics SpA

- Hanel Storage Systems

- Modula SpA

- TGW Logistics Group GmbH

- BEUMER Group GmbH & Co. KG

- Stocklin Logistik AG

- Godrej Korber Supply Chain Ltd.

- Westfalia Technologies, Inc.

- Shanghai Jingxing Logistics Equipment Engineering Co., Ltd.

- Unitechnik Systems GmbH

第7章 市場機會與未來展望

The automated storage and retrieval system market size was valued at USD 10.51billion in 2025 and is forecast to reach USD 15.77 billion by 2030, reflecting a robust 8.46% CAGR that underscores how intelligent automation has shifted from optional upgrade to strategic necessity for warehouse operators.

Growing e-commerce volumes, chronic labor shortages, and escalating real-estate costs have combined to create a tipping point at which automated storage and retrieval system market deployments deliver measurable gains in throughput, accuracy, and space utilization. Companies facing 5%-7% annual wage inflation in logistics roles have treated capital-intensive automation projects as a hedge against rising operating expenses, while energy-efficient cube and shuttle solutions align with corporate sustainability mandates. Technology convergence is reshaping solution design; modern platforms integrate robotics, AI routing algorithms, and predictive maintenance analytics that cut unplanned downtime by up to 30%. Early adopters report cycle-time reductions of 40% for high-mix order profiles, positioning automated storage and retrieval system market investments as a foundation for omnichannel fulfillment strategies.

Global Automated Storage And Retrieval System (ASRS) Market Trends and Insights

E-commerce fulfillment pressure

By mid-2025, Amazon's deployment of 1 million robots served as visible proof that manual picking cannot sustain order profiles approaching 300 lines per hour. Peer retailers responded by fast-tracking cube and shuttle projects that shrink order cycle times from hours to minutes, driving accelerated bookings for the automated storage and retrieval system market. Higher return rates in apparel and electronics sharpened the focus on accuracy; AI-enhanced grippers now achieve item recognition accuracy above 99%, cutting costly reships. Fulfillment operators also discovered that robotics lowered energy cost per order by 8% by limiting forklift movements and lighting requirements.

Rising labor costs and safety mandates

Forklift incidents accounted for most fatal warehouse accidents in 2024, costing USD 84 million in weekly injury claims across the United States. New OSHA guidelines issued in 2025 shifted employer liability, prompting accelerated conversion to goods-to-person cells that remove humans from high-traffic aisles. Automotive maintenance depots suffering a projected 20% technician shortfall by 2028 adopted mini-load systems to reassign scarce labor from retrieval to diagnostic roles. Collectively, these dynamics add more than two percentage points to automated storage and retrieval system market growth over the mid-term.

High initial CAPEX and extended payback periods

Turnkey projects ranging from USD 70,000 to USD 3 million deterred many small distributors despite demonstrable cost-out potential. TCO models reveal software, commissioning, and training often add another 40% to sticker price, stretching payback beyond CFO comfort zones during periods of macro uncertainty. Subscription-based "pay-per-pick" models started to mitigate upfront expense, though current availability is limited to select high-volume use cases.

Other drivers and restraints analyzed in the detailed report include:

- Shift toward micro-fulfillment centers

- Deep-freeze warehouse automation

- Cyber-security vulnerabilities threaten connected ASRS operations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fixed-aisle crane installations still delivered 38.2% of global revenue in 2024, anchored in automotive and bulk consumer-goods plants where predictable flows justify tall rack structures. These installations historically set the design template for the automated storage and retrieval system market, yet they lock users into specific aisle widths and throughput ceilings. Cube-based grids and robotic storage lines gained momentum by raising storage density 60% and slashing retrieval times to under 70 seconds, driving a 12.1% CAGR that will shift the revenue mix before decade-end. AutoStore and populous 3PLs such as DSV scaled cube deployments across nine countries, underscoring multipurpose adaptability. Shuttle-based systems occupy a middle ground; modular shuttle lanes allow firms to expand incrementally without major building retrofits. That flexibility appeals to fast-growing retailers who want automated storage and retrieval system market investments aligned with year-to-year demand swings.

Vertical lift modules (VLMs) and carousel solutions remain niche at under 10% revenue share, yet they add critical value where floor area is scarce and parts integrity is paramount. Medical-device assemblers, for example, use VLMs to protect micro-mechanical parts from contamination while achieving pick accuracies above 99.9%. Hybrid facilities increasingly mix cranes, shuttles, and cubes, an architecture that exemplifies how the automated storage and retrieval system market evolved toward tailored ecosystems rather than single-technology bets. Kardex's collaboration with Berkshire Grey incorporated AI vision pick cells into VLM lines, attaining 99.99% accuracy and reinforcing the cross-pollination trend shaping modern warehouse design.

Unit-load pallet systems captured 42.5% of 2024 revenue, powered by automotive subassemblies, beverage palletizing, and other bulk flows where each storage location houses homogenous items. Yet the SKU explosion in e-commerce drove tote-level retrieval rates that unit-load cranes cannot satisfy cost-effectively, opening demand for mini-load systems advancing at 11.3% CAGR. The automated storage and retrieval system market size for mini-load tote solutions is projected to expand even faster in omnichannel grocery, where online order lines per basket average 35. A single mini-load aisle can process up to 1,200 tote cycles per hour, enabling store replenishment and click-and-collect fulfillment from one footprint.

Pallet shuttle subsystems bridge high-throughput pallet storage with selective access demands, permitting configurable depth that balances density and speed. Mid-load applications, though smaller in headline numbers, handle awkward medium-sized components in electronics and aftermarket auto parts, functions often overlooked in project scoping yet critical to end-to-end flow. Operators increasingly blend load types inside unified software platforms so that WMS directs picks based on real-time cost per move, rather than rigid siloed zones, signaling a nuanced maturity within the automated storage and retrieval system market.

The ASRS Market Report Segments the Industry Into by Product Type (Fixed-Aisle Crane Systems, Shuttle-Based Systems, Vertical Lift Modules (VLM), and More), Load Type (Unit Load, Pallet Load Shuttle, Mini Load, Mid Load, and Tote / Carton and Others), Application (Storage and Buffering, Goods-To-Person Order Picking, Kitting and Sequencing, and More), End-User Industry (Manufacturing, and Non-Manufacturing), and Geography.

Geography Analysis

Europe retained the largest regional contribution at 33.8% of 2024 global revenue. High labor costs exceeding USD 28 per hour and stringent worker-safety legislation made automation financially compelling, while EU sustainability rules recognized high-density cube grids as a path to lower building energy footprint. Germany's High-Tech Strategy 2025 earmarked USD 369.2 million for robotics R&D, reinforcing commercial ecosystems that nurture solution providers. Scandinavian retailers compressed six conventional warehouses into a single automated facility and cut CO2 per shipped order by 35%.

Asia-Pacific delivered the fastest growth at 11.9% CAGR. China's trillion-yuan robotics megaproject signaled state-level commitment to factory automation, while Japan proposed a 500-kilometer conveyor belt network linking Osaka and Tokyo, creating demand for high-throughput sortation nodes. Korean policy incentives added USD 128 million in grants for smart-factory deployments, and India became a production hub following Daifuku's 2025 plant opening that lowers lead times for regional customers. The automated storage and retrieval system market in Asia-Pacific therefore benefits from both domestic demand and localized manufacturing capacity.

North America remains innovation center, with hyperscale e-commerce proving grounds that set global benchmarks. Amazon introduced AI foundation models to re-route swarm robots, improving energy efficiency while increasing picks per hour, which directly influences design specifications adopted by peers. AutoStore's new headquarters in New Hampshire houses an academy that trains technicians, addressing the skill-gap restraint and underscoring the company's forecast to surpass 300 regional installations by late-2026. Latin America and Middle East and Africa are emerging corridors; Saudi pharmaceutical distributors piloted semi-automated fulfillment in 2024, and Brazilian 3PLs benefitted from tax breaks on capital goods, positioning both regions as growth white space over the next five years.

- Daifuku Co., Ltd.

- Schaefer Systems International GmbH (SSI SCHAEFER)

- Dematic Corp. (KION Group AG)

- Murata Machinery, Ltd.

- Mecalux, S.A.

- Honeywell Intelligrated, Inc.

- KUKA AG

- KNAPP AG

- Kardex Holding AG

- Toyota Industries Corporation

- Viastore Systems GmbH

- AutoStore Holdings Ltd.

- Swisslog Holding AG

- Vanderlande Industries B.V.

- Bastian Solutions LLC

- System Logistics S.p.A.

- Hanel Storage Systems

- Modula S.p.A.

- TGW Logistics Group GmbH

- BEUMER Group GmbH & Co. KG

- Stocklin Logistik AG

- Godrej Korber Supply Chain Ltd.

- Westfalia Technologies, Inc.

- Shanghai Jingxing Logistics Equipment Engineering Co., Ltd.

- Unitechnik Systems GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce fulfillment pressure

- 4.2.2 Rising labor-cost and workplace-safety mandates

- 4.2.3 Shift toward micro-fulfillment / urban DCs (under-the-radar)

- 4.2.4 Deep-freeze warehouse automation for cold-chain (under-the-radar)

- 4.2.5 Predictive-maintenance analytics boosting ROI (under-the-radar)

- 4.2.6 Industrial-policy incentives in APAC and Europe

- 4.3 Market Restraints

- 4.3.1 High initial CAPEX and long pay-back

- 4.3.2 Scarcity of ASRS-skilled technicians

- 4.3.3 Integration complexity with legacy WMS

- 4.3.4 Cyber-security vulnerabilities in connected ASRS (under-the-radar)

- 4.4 Evaluation of Critical Regulatory Framework

- 4.5 Value Chain Analysis

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Impact Assessment of Key Stakeholders

- 4.9 Key Use Cases and Case Studies

- 4.10 Impact on Macroeconomic Factors of the Market

- 4.11 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Fixed-Aisle Crane Systems

- 5.1.2 Shuttle-Based Systems

- 5.1.3 Vertical Lift Modules (VLM)

- 5.1.4 Carousel Modules (Vertical and Horizontal)

- 5.1.5 Cube-Based / Robotic Cube Storage

- 5.2 By Load Type

- 5.2.1 Unit Load

- 5.2.2 Pallet Load Shuttle

- 5.2.3 Mini Load

- 5.2.4 Mid Load

- 5.2.5 Tote / Carton and Others

- 5.3 By Application

- 5.3.1 Storage and Buffering

- 5.3.2 Goods-to-Person Order Picking

- 5.3.3 Kitting and Sequencing

- 5.3.4 Assembly / Production Support

- 5.3.5 Cold-Storage and Deep-Freeze Handling

- 5.4 By End-user Industry

- 5.4.1 Manufacturing

- 5.4.1.1 Automotive

- 5.4.1.2 Food and Beverages

- 5.4.1.3 Pharmaceuticals and Life Sciences

- 5.4.1.4 Electronics and Semiconductor

- 5.4.1.5 Metals and Machinery

- 5.4.2 Non-manufacturing

- 5.4.2.1 E-commerce and Retail

- 5.4.2.2 Third-Party Logistics (3PL) and Warehousing

- 5.4.2.3 Airports and Baggage Handling

- 5.4.2.4 Defense and Government Stores

- 5.4.1 Manufacturing

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Russia

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 ASEAN

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Daifuku Co., Ltd.

- 6.4.2 Schaefer Systems International GmbH (SSI SCHAEFER)

- 6.4.3 Dematic Corp. (KION Group AG)

- 6.4.4 Murata Machinery, Ltd.

- 6.4.5 Mecalux, S.A.

- 6.4.6 Honeywell Intelligrated, Inc.

- 6.4.7 KUKA AG

- 6.4.8 KNAPP AG

- 6.4.9 Kardex Holding AG

- 6.4.10 Toyota Industries Corporation

- 6.4.11 Viastore Systems GmbH

- 6.4.12 AutoStore Holdings Ltd.

- 6.4.13 Swisslog Holding AG

- 6.4.14 Vanderlande Industries B.V.

- 6.4.15 Bastian Solutions LLC

- 6.4.16 System Logistics S.p.A.

- 6.4.17 Hanel Storage Systems

- 6.4.18 Modula S.p.A.

- 6.4.19 TGW Logistics Group GmbH

- 6.4.20 BEUMER Group GmbH & Co. KG

- 6.4.21 Stocklin Logistik AG

- 6.4.22 Godrej Korber Supply Chain Ltd.

- 6.4.23 Westfalia Technologies, Inc.

- 6.4.24 Shanghai Jingxing Logistics Equipment Engineering Co., Ltd.

- 6.4.25 Unitechnik Systems GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment