|

市場調查報告書

商品編碼

1773217

自動儲存與檢索系統 (ASR) 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Automated Storage and Retrieval System Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

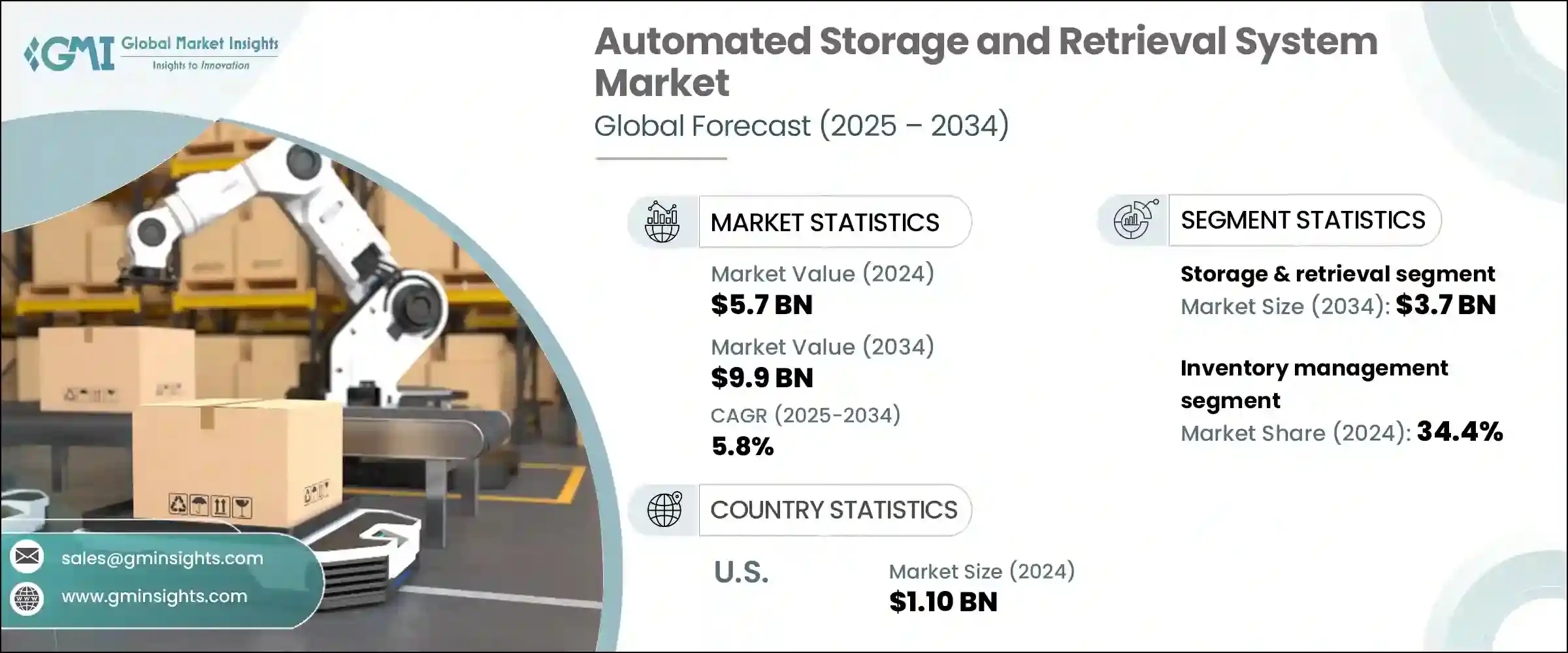

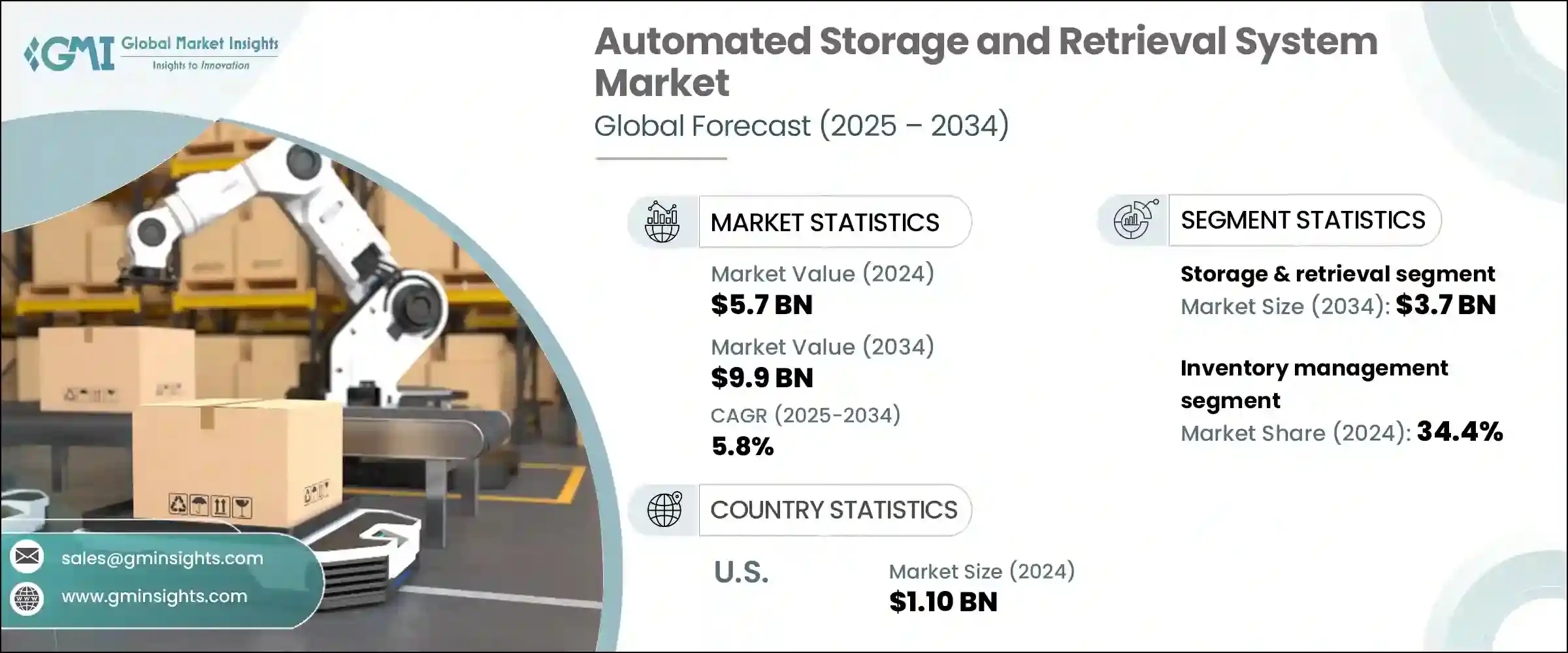

2024年,全球自動倉儲與檢索系統 (ASRS) 市場規模達57億美元,預計到2034年將以5.8%的複合年成長率成長,達到99億美元。電子商務的快速發展給倉庫帶來了越來越大的壓力,要求它們以更快、更準確、更低成本地交付貨物。 ASRS系統促進了「貨到人」模式,從而縮短了運輸時間並提高了揀選準確性。透過使用垂直儲存來最大化空間,這些系統降低了營運成本,並釋放了地面空間用於輕型製造和專業搬運等增值活動。勞動力短缺和薪資上漲也推動配送中心走向自動化。由於ASRS能夠取代多達三分之二的勞力密集揀選任務,企業可以將員工重新分配到監督和維護職位,從而提高效率並解決勞動力短缺的問題。

對倉庫效率的日益重視,加速了高密度自動化倉儲和檢索系統的轉變。各行各業的公司都面臨著充分利用每一平方英尺空間的壓力,尤其是在城市和高租金地區,這推動了對垂直和模組化 ASRS 配置的強勁需求。這些系統使企業能夠最大限度地利用倉庫空間,同時保持快速且準確的庫存存取。此外,ASRS 技術的設計擴大適應不同的樓層平面圖和天花板高度,使其適用於舊設施的改造以及與新建的智慧倉庫的整合。無需擴大實體佔地面積即可擴展儲存能力,不僅可以降低房地產成本,還可以支援更精簡的營運,使企業在空間受限的環境中佔據戰略優勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 57億美元 |

| 預測值 | 99億美元 |

| 複合年成長率 | 5.8% |

倉儲和檢索功能領域在2024年創造了22億美元的市場規模,預計到2034年將達到37億美元。該功能是ASRS系統的核心,可實現高密度庫存管理和快速SKU訪問,使其成為零售、製藥、電子和汽車等行業不可或缺的必備系統。隨著倉庫空間日益緊張,這些系統能夠利用垂直存儲,並結合即時庫存同步,有助於減少損耗和人為錯誤。

庫存管理領域在2024年創造了20億美元的收入,佔34.4%。即時庫存視覺性、自動庫存週轉(先進先出/後進先出)以及預防庫存過剩或缺貨,使庫存管理成為自動化自動化倉儲系統(ASRS)應用的關鍵組成部分。透過RFID和條碼掃描等技術與ERP/WMS平台整合,有助於確保整個供應鏈的資料準確性和營運效率。

2024年,美國自動化倉儲與檢索系統(ASRS)市場規模達11億美元,預計2034年將以5.8%的複合年成長率成長。由於強大的製造業、零售業和物流業,美國在倉庫自動化領域處於領先地位。隨著產業領導者為供應鏈數位化樹立標桿,對可擴展、高效的儲存解決方案的需求日益旺盛。 ASRS技術在降低人工成本、提高準確性和增加吞吐量方面發揮關鍵作用,尤其是在大型配送中心。

該行業的主要參與者包括 Symbotic LLC、大福株式會社、TGW 物流集團、卡迪斯集團和凱傲集團,它們合計佔據約 15% 的市場佔有率。行業領導者正在透過一系列策略舉措鞏固其市場地位。他們正在投資模組化自動化倉庫 (ASRS) 設計和可擴展的軟體平台,以支援靈活配置以及與機器人、人工智慧和物聯網系統的整合。

與倉庫營運商、電商公司和物流整合商的合作,幫助他們提供客製化解決方案。透過本地製造和服務中心拓展全球業務,可以更快地部署和支援。企業也推出了基於訂閱或託管的服務模式,以降低企業進入門檻。透過提供即時分析、預測性維護和遠端系統監控,他們憑藉卓越的性能和可靠性脫穎而出。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 每個階段的增值

- 影響價值鏈的因素

- 產業影響力量

- 成長動力

- 產業陷阱與挑戰

- 機會

- 成長潛力分析

- 未來市場趨勢

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 監管格局

- 標準和合規性要求

- 區域監理框架

- 認證標準

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估計與預測:按系統類型,2021 - 2034 年

- 主要趨勢

- 單元起重機

- 小型起重機

- 垂直升降模組

- 基於機器人穿梭車

- 基於機器人立方體

- 基於輪播

- 垂直旋轉式倉儲系統

- 水平旋轉式倉儲系統

- 其他

第6章:市場估計與預測:依功能,2021 - 2034 年

- 主要趨勢

- 儲存與檢索

- 訂單揀選和整合

- 緩衝和排序

- 配套和組裝支持

- 補貨

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 冷鏈儲存

- 庫存管理

- 訂單履行

- 生產支援

- 逆向物流

第8章:市場估計與預測:按最終用途產業,2021 - 2034 年

- 主要趨勢

- 航太與國防

- 汽車

- 電子和半導體

- 衛生保健

- 金屬和重型機械

- 零售與電子商務

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 拉丁美洲

- 巴西

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

第10章:公司簡介

- Automation Logistics Corporation

- Bastian Solutions

- Beumer Group

- Daifuku Co., Ltd.

- Dematic

- Egemin Automation

- Kardex Group

- Kion Group AG

- Knapp AG

- Mecalux, SA

- Murata Machinery, Ltd.

- Schaefer Systems International, Inc.

- Swisslog Holding AG

- Symbotic LLC

- System Logistics Corporation

- TGW Logistics Group

- Vanderlande Industries

- Westfalia Technologies, Inc.

- Witron Logistik + Informatik GmbH

The Global Automated Storage and Retrieval System Market was valued at USD 5.7 billion in 2024 and is estimated to grow at a CAGR of 5.8% to reach USD 9.9 billion by 2034. The rapid growth of e-commerce is putting mounting pressure on warehouses to deliver faster, more accurately, and at a lower cost. ASRS systems facilitate a "goods-to-person" model that slashes travel time and boosts picking accuracy. By using vertical storage to maximize cubic space, these systems lower overheads and free up ground-level space for value-added activities like light manufacturing and specialized handling. Labor shortages and rising wages are also pushing distribution centers toward automation. With ASRS capable of replacing up to two-thirds of labor-intensive picking tasks, companies can redirect staff to supervisory and maintenance roles, enhancing efficiency and addressing workforce constraints.

The rising emphasis on warehouse efficiency is accelerating the shift toward high-density automated storage and retrieval systems. Companies across industries are under pressure to make the most of every square foot-particularly in urban and high-rent areas-driving strong demand for vertical and modular ASRS configurations. These systems allow businesses to maximize cubic volume while maintaining quick and accurate access to inventory. Additionally, ASRS technologies are increasingly being designed to adapt to varied floor plans and ceiling heights, making them suitable for retrofitting in older facilities and integration into newly constructed smart warehouses. The ability to scale storage without expanding physical footprints not only cuts real estate costs but also supports leaner operations, giving businesses a strategic edge in space-constrained environments.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $9.9 Billion |

| CAGR | 5.8% |

The storage & retrieval functionality segment generated USD 2.2 billion in 2024 and is expected to reach USD 3.7 billion by 2034. This capability lies at the heart of ASRS systems, enabling high-density inventory management and rapid SKU access, making it indispensable across sectors from retail and pharmaceuticals to electronics and automotive. As warehouse space becomes more constrained, these systems' ability to leverage vertical storage, paired with real-time inventory synchronization, helps reduce shrinkage and human error.

The inventory management segment generated USD 2 billion in 2024 and accounted for a 34.4% share. Real-time stock visibility, automated stock rotation (FIFO/LIFO), and prevention of overstocking or stockouts make inventory management a critical component of ASRS adoption. Integration with ERP/WMS platforms, using technologies like RFID and barcode scanning, helps ensure data accuracy and operational efficiency throughout the supply chain.

United States Automated Storage and Retrieval System Market was valued at USD 1.1 billion in 2024 and is forecasted to grow at a CAGR of 5.8% through 2034. The country leads in warehouse automation, supported by strong manufacturing, retail, and logistics sectors. With industry leaders setting benchmarks for supply chain digitization, there's a strong demand for scalable, efficient storage solutions. ASRS technology plays a key role in reducing labor costs, improving accuracy, and increasing throughput, especially in large distribution centers.

Among the major players in this industry are Symbotic LLC, Daifuku Co., Ltd., TGW Logistics Group, Kardex Group, and Kion Group AG, which collectively hold approximately 15% of the market. Industry leaders are strengthening their market positions through a series of strategic initiatives. They are investing in modular ASRS designs and scalable software platforms that support flexible configuration and integration with robotics, AI, and IoT systems.

Partnerships with warehouse operators, e-commerce firms, and logistics integrators are helping them deliver tailored solutions. Expanding global footprints via local manufacturing and service centers allows quicker deployment and support. Companies are also launching subscription-based or managed service models to lower entry barriers for businesses. By offering real-time analytics, predictive maintenance, and remote system monitoring, they differentiate themselves through performance and reliability.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 End Use

- 2.3 CXO perspectives: Strategic imperatives

- 2.3.1 Key decision points for industry executives

- 2.3.2 Critical success factors for market players

- 2.4 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.2 Industry Impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls & challenges

- 3.2.3 Opportunities

- 3.3 Growth potential analysis

- 3.4 Future market trends

- 3.5 Technology and innovation landscape

- 3.5.1 Current technological trends

- 3.5.2 Emerging technologies

- 3.6 Price trends

- 3.6.1 By region

- 3.6.2 By product

- 3.7 Regulatory landscape

- 3.7.1 Standards and compliance requirements

- 3.7.2 Regional regulatory frameworks

- 3.7.3 Certification standards

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates & Forecast, By System Type, 2021 - 2034 (USD Billion) (Units)

- 5.1 Key trends

- 5.2 Unit load cranes

- 5.3 Mini load cranes

- 5.4 Vertical lift module

- 5.5 Robotic shuttle-based

- 5.6 Robotic cube-based

- 5.7 Carousel-based

- 5.7.1 Vertical carousel

- 5.7.2 Horizontal carousel

- 5.8 Others

Chapter 6 Market Estimates & Forecast, By Function, 2021 - 2034 (USD Billion) (Units)

- 6.1 Key trends

- 6.2 Storage & retrieval

- 6.3 Order picking & consolidation

- 6.4 Buffering & sequencing

- 6.5 Kitting & assembly support

- 6.6 Replenishment

Chapter 7 Market Estimates & Forecast, By Application, 2021 - 2034 (USD Billion) (Units)

- 7.1 Key trends

- 7.2 Cold chain storage

- 7.3 Inventory management

- 7.4 Order fulfillment

- 7.5 Production support

- 7.6 Reverse logistics

Chapter 8 Market Estimates & Forecast, By End Use Industry, 2021 - 2034, (USD Billion) (Units)

- 8.1 Key trends

- 8.2 Aerospace & defense

- 8.3 Automotive

- 8.4 Electronics & semiconductors

- 8.5 Healthcare

- 8.6 Metals & heavy machinery

- 8.7 Retail & e-commerce

- 8.8 Others

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034, (USD Billion) (Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 U.K.

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 South Korea

- 9.4.5 Australia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 Saudi Arabia

- 9.6.3 South Africa

Chapter 10 Company Profiles (Business Overview, Financial Data, Product Landscape, Strategic Outlook, SWOT Analysis)

- 10.1 Automation Logistics Corporation

- 10.2 Bastian Solutions

- 10.3 Beumer Group

- 10.4 Daifuku Co., Ltd.

- 10.5 Dematic

- 10.6 Egemin Automation

- 10.7 Kardex Group

- 10.8 Kion Group AG

- 10.9 Knapp AG

- 10.10 Mecalux, S.A.

- 10.11 Murata Machinery, Ltd.

- 10.12 Schaefer Systems International, Inc.

- 10.13 Swisslog Holding AG

- 10.14 Symbotic LLC

- 10.15 System Logistics Corporation

- 10.16 TGW Logistics Group

- 10.17 Vanderlande Industries

- 10.18 Westfalia Technologies, Inc.

- 10.19 Witron Logistik + Informatik GmbH