|

市場調查報告書

商品編碼

1851523

歐洲包裝自動化:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Europe Packaging Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

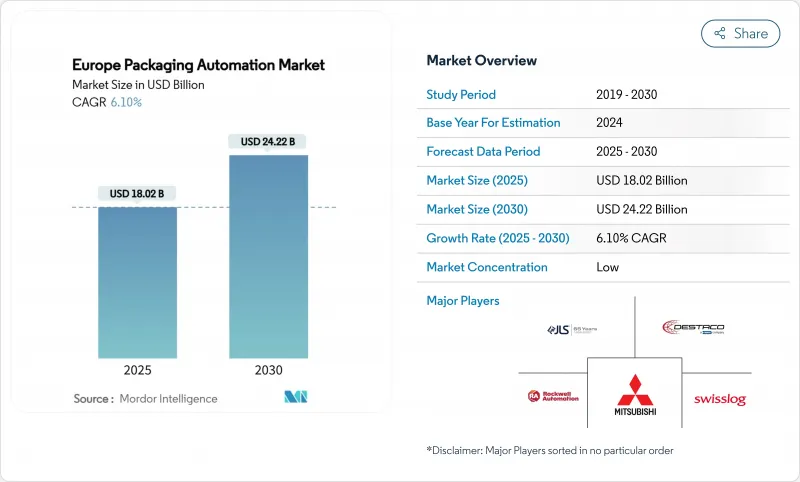

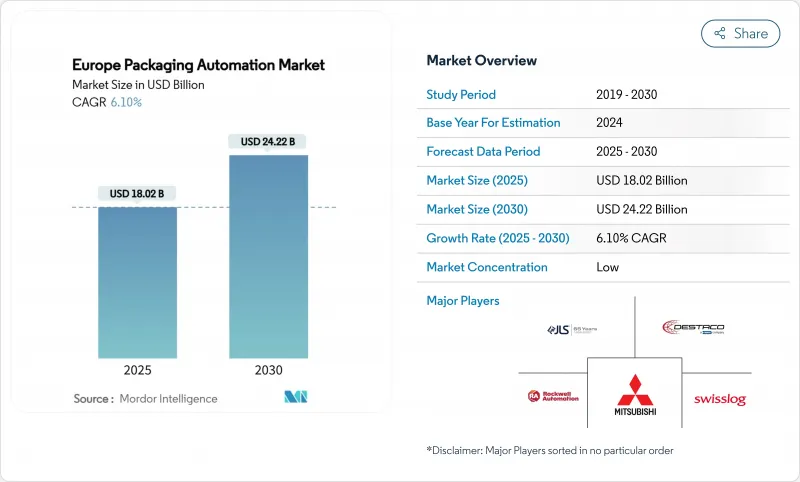

據估計,歐洲包裝自動化市場規模將在 2025 年達到 180.2 億美元,到 2030 年達到 242.2 億美元,在預測期(2025-2030 年)內複合年成長率為 6.10%。

日益嚴格的法規,尤其是歐盟的《包裝和包裝廢棄物法規》(PPWR),與不斷上漲的人事費用和技術的快速發展交織在一起,再形成歐洲製造業的資本支出重點。企業正轉向自動化,以確保符合可回收性要求、彌補勞動力缺口並保護利潤免受能源價格波動的影響。從人工智慧驅動的偵測到協作機器人輔助的碼垛,生產線數位化正在創造新的競爭標準。同時,終端用戶正在擴大供應商範圍,以降低原料價格波動和網路風險的影響,從而提高了對整合化、安全且可升級的自動化解決方案的期望。買家對整體擁有成本的日益關注,使得能夠將硬體、分析和生命週期服務整合到單一價值提案中的供應商更具優勢,加速了設備製造商和軟體專家之間的整合。

歐洲包裝自動化市場趨勢與洞察

降低營運成本的壓力

歐洲各地的包裝廠面臨持續的工資上漲和遠高於2022年水準的能源成本,因此自動化無疑是緩解營運壓力的最有效途徑。 ABB在Striebel & John公司實施多機器人包裝島後,生產率提高了25%,並將瓦楞紙板的SKU數量從15個減少到9個。儘管聚合物價格持續高企,但克朗斯(Krones)也憑藉類似的成果,實現了2024年10.1%的EBITDA獲利率,這表明先行者正在拉大與後進企業之間的成本差距。

技術工人數量減少

歐盟製造業就業人數預計在2024年將下降2.1%,其中包裝線技術員是最難招募的職位。博世力士樂的電池驅動移動協作機器人工作站允許一名操作員監督以往需要三人完成的任務,從而解放勞動力從事更高價值的工作。 ABB的OmniVance即插即用單元預先配置並自動校準,進一步降低了技術門檻,使中小企業無需內部程式設計人員即可部署機器人。

高初始投資

承包的機器人生產線造價可能在500萬至1000萬歐元之間,即使有補貼和稅收優惠,許多中型加工企業也難以承擔如此巨額的費用。供應商正在推出訂閱模式來應對這項挑戰,將支出從資本預算轉移到營運支出,但漫長的投資回收期仍然是家族企業面臨的一大障礙。

細分市場分析

製造商將自動化支出與全廠效率提升計畫掛鉤,在2024年佔據了歐洲包裝自動化市場41.5%的佔有率。他們的規模優勢支援多條生產線的部署,從而可以將軟體和維護成本分攤到更大的產量上。同時,全通路零售商將自動化裝袋系統與人工系統結合,以加快履約週期。 B2C電商營運商在2024年區域線上銷售額達到8,870億歐元的推動下,將在2030年之前實現13.0%的複合年成長率,成為該細分市場中成長最快的企業。他們將投資於智慧分類、自動化裝袋和尺寸測量模組,這些模組每小時可處理數千個小包裹。個人文件托運人和合約包裝商雖然仍屬於小眾市場,但他們正在穩步投資於可追蹤印表機和防篡改封口機。

越來越多的原始設備製造商正在重新思考「自製還是外購」的決策,他們將二級或三級包裝外包給代工包裝商,同時保留核心填充和封口工序的所有權。這種轉變擴大了模組化解決方案的潛在客戶群,這些解決方案可以根據訂單量的波動進行重新部署,使供應商能夠透過產品改造和生產線擴展獲得持續收入。

食品飲料產業總合佔歐洲包裝自動化市場44.0%的佔有率,其中以連續式灌裝機、旋轉式旋蓋機和環繞式裝箱機為主,這些設備均針對大批量SKU進行了最佳化。可口可樂公司位於根斯哈根和呂訥堡的工廠計畫於2025年進行升級改造,新增一條每小時可生產6萬個玻璃瓶的生產線,凸顯了其對高速系統的持續投入。同時,受對序列化和個人化藥物需求的推動,製藥業預計到2030年將以12.3%的複合年成長率成長。自動化組裝、偵測和符合低溫運輸的碼垛是重點投資領域,Systec和ABB正在試行一套多攝影機視覺系統,用於在產品放行前進行驗證。

為了在提升產品品質的同時兼顧不斷成長的SKU數量,化妝品和個人護理品牌正在採用軟性紙盒包裝機和按需印刷的套施用器。家用化學品和清潔劑製造商則專注於無洩漏劑量和節省空間的二級包裝,以滿足日益嚴格的運輸排放法規。糖果甜點和烘焙食品製造商正在部署Delta機器人和超音波封袋機,以快速保存易碎產品;而第三方物流供應商則在擴展自動化郵件處理機和標籤貼標施用器,以服務全通路客戶。

歐洲包裝自動化市場報告按業務類型(製造商、批發商、全通路零售商等)、最終用戶行業(食品、食品和飲料、製藥、化妝品、個人護理等)、包裝階段(初級包裝、二級包裝、生產線末端包裝、三級包裝和物流)、產品類型(灌裝機、貼標和編碼、成形充填密封等)以及地區進行細分。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 降低營運成本的壓力

- 技術純熟勞工數量減少

- 歐盟包裝廢棄物和可追溯性法規

- 大規模客製化和縮短SKU

- 人工智慧驅動的預測性維護

- 即插即用模組化協作機器人

- 市場限制

- 高額前期投資

- 網路安全漏洞

- 缺乏互通性標準

- 原料供應波動

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭的激烈程度

第5章 市場規模與成長預測

- 依業務類型

- 製造商

- 經銷商

- 全通路零售商

- B2B電子商務零售商

- B2C電子商務零售商

- 個人文件托運人

- 其他

- 按最終用戶行業分類

- 食物

- 飲料

- 製藥

- 化妝品和個人護理

- 家用清潔劑

- 化學

- 糖果甜點和烘焙

- 倉儲和第三方物流

- 其他

- 包裝階段

- 初級(填充和密封)

- 二次包裝(裝箱/裝箱)

- 生產線末端(托盤堆疊/拉伸包裝)

- 三級物流與物流

- 依產品類型

- 灌裝機

- 標籤和編碼

- 成形充填密封(H/VFFS)

- 裝袋和裝袋

- 碼垛和卸垛

- 其他

- 按地區

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ABB

- Siemens AG

- Rockwell Automation

- Mitsubishi Electric

- Schneider Electric

- JLS Automation

- ULMA Packaging

- Swisslog Holding AG

- Gerhard Schubert GmbH

- Destaco

- Emerson(Branson)

- ATS Automation

- Massman Automation

- Krones AG

- Fanuc Corporation

- KUKA AG

- Coesia SpA

- Syntegon Technology

- Sidel Group

- Yaskawa Electric

- Brenton Engineering

- Tetra Pak

第7章 市場機會與未來展望

The Europe Packaging Automation Market size is estimated at USD 18.02 billion in 2025, and is expected to reach USD 24.22 billion by 2030, at a CAGR of 6.10% during the forecast period (2025-2030).

Heightened regulatory demands, especially the EU Packaging and Packaging Waste Regulation (PPWR), converge with rising labor costs and rapid technological progress to re-shape capital-spending priorities across European manufacturing. Companies are automating to ensure recyclability compliance, close labor gaps and shield margins from energy-price swings. Line-side digitization, from AI-enabled inspection to cobot palletizing, is creating new competitive baselines. Simultaneously, end-users are widening supplier pools to mitigate raw-material volatility and cyber-risk exposure, thereby raising expectations for integrated, secure and upgradeable automation solutions. Intensifying buyer scrutiny around total cost of ownership favors vendors able to bundle hardware, analytics and life-cycle services into a single value proposition, accelerating consolidation among equipment makers and software specialists.

Europe Packaging Automation Market Trends and Insights

Pressure to Reduce Operating Costs

Packaging plants across Europe face sustained wage inflation and energy bills that remain well above 2022 levels, making automation the clearest path to offsetting operating pressure. ABB documented a 25% productivity gain at Striebel & John after deploying a multi-robot packaging island that also trimmed cardboard SKU counts from 15 to 9. Similar gains underpin Krones' 10.1% 2024 EBITDA margin, despite persistently high polymer prices, signalling that early adopters are widening their cost gap over late movers.

Shrinking Skilled-Labour Pool

Manufacturing employment in the EU fell 2.1% in 2024, with packaging-line technicians among the hardest roles to fill. Bosch Rexroth's battery-powered mobile cobot station lets one operator oversee tasks that previously needed a three-person team, freeing scarce labour for higher-value work. ABB's OmniVance plug-and-play cells further lower the expertise barrier by shipping pre-configured and self-calibrating, enabling SMEs to deploy robots without in-house programmers.

High Up-Front Capex

Turn-key robotic lines can demand EUR 5-10 million, a figure that still deters many mid-sized converters even after grants and tax incentives. Vendors are responding with subscription models that shift spend from capital budgets to OPEX, though long payback windows remain a hurdle for family-owned firms.

Other drivers and restraints analyzed in the detailed report include:

- EU Packaging-Waste and Traceability Mandates

- Mass-Customisation and Shorter SKUs

- Cyber-Security Vulnerabilities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturers captured 41.5% of Europe packaging automation market share in 2024 by tying automation spend to overall plant-wide efficiency programs. Their scale supports multi-line roll-outs that amortize software and maintenance across higher volumes. Wholesale distributors adopt automation chiefly for palletising and cross-docking, whereas omni-channel retailers blend goods-to-person systems with automated bagging to accelerate fulfillment cycles. B2C e-commerce operators, buoyed by EUR 887 billion in regional online sales during 2024, will log a 13.0% CAGR to 2030, the fastest within the segment hierarchy. Investments gravitate toward smart sortation, auto-bagging and dimensioning modules capable of processing thousands of individualized parcels per hour. Personal-document shippers and contract packers remain niche but show steady uptake in track-and-trace capable printers and tamper-evident sealers.

A growing share of original manufacturers is revisiting make-versus-buy decisions, outsourcing secondary or tertiary packaging to co-packers yet retaining ownership of core filling and closing operations. That shift widens the addressable base for modular solutions that can be redeployed as order books fluctuate, ensuring vendors maintain recurring revenue from retrofits and line extensions.

Food and beverage control a combined 44.0% stake in the Europe packaging automation market, anchored by continuous-motion fillers, rotary cappers and wrap-around case packers optimized for high-volume SKUs. Coca-Cola's 2025 upgrades in Genshagen and Luneburg feature 60,000-container-per-hour glass lines, underscoring ongoing appetite for high-speed systems. Meanwhile the pharmaceutical sector, spurred by serialization and demand for personalized medicines, is expanding at 12.3% CAGR through 2030. Automated aggregation, inspection and cold-chain compliant palletizing are top investment areas, with Systech and ABB piloting multi-camera vision suites that certify every bundle before release.

Cosmetics and personal care brands adopt flexible cartoners and print-on-demand sleeve applicators to balance premium aesthetics with rising SKU counts. Household-chem and detergent makers focus on leak-proof dosing and space-saving secondary packs to navigate tightening transport-emission rules. Confectionery and bakery outfits deploy gentle-handling delta robots and ultrasonic bag sealers to preserve fragile products at speed, while 3PL providers scale up automated mailers and label applicators for omnichannel clients.

Europe Packaging Automation Market Report is Segmented by Business Type (Manufacturers, Wholesale Distributors, Omni-Channel Retailers and More), End-User Vertical (Food, Beverages, Pharmaceuticals, Cosmetics and Personal Care and More), Packaging Stage (Primary, Secondary, End-Of-Line, Tertiary & Intralogistics), Product Type (Filling Machines, Labelling and Coding, Form-Fill-Seal and More), and Geography.

List of Companies Covered in this Report:

- ABB

- Siemens AG

- Rockwell Automation

- Mitsubishi Electric

- Schneider Electric

- JLS Automation

- ULMA Packaging

- Swisslog Holding AG

- Gerhard Schubert GmbH

- Destaco

- Emerson (Branson)

- ATS Automation

- Massman Automation

- Krones AG

- Fanuc Corporation

- KUKA AG

- Coesia S.p.A.

- Syntegon Technology

- Sidel Group

- Yaskawa Electric

- Brenton Engineering

- Tetra Pak

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Pressure to Reduce Operating Costs

- 4.2.2 Shrinking Skilled-Labour Pool

- 4.2.3 EU Packaging-Waste and Traceability Mandates

- 4.2.4 Mass-Customisation and Shorter SKUs

- 4.2.5 AI-Enabled Predictive Maintenance

- 4.2.6 Plug-and-Play Modular Cobots

- 4.3 Market Restraints

- 4.3.1 High Up-Front Capex

- 4.3.2 Cyber-Security Vulnerabilities

- 4.3.3 Lack of Interoperability Standards

- 4.3.4 Raw-Material Supply Volatility

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Business Type

- 5.1.1 Manufacturers

- 5.1.2 Wholesale Distributors

- 5.1.3 Omni-channel Retailers

- 5.1.4 B2B e-Commerce Retailers

- 5.1.5 B2C e-Commerce Retailers

- 5.1.6 Personal-Document Shippers

- 5.1.7 Others

- 5.2 By End-User Vertical

- 5.2.1 Food

- 5.2.2 Beverages

- 5.2.3 Pharmaceuticals

- 5.2.4 Cosmetics and Personal Care

- 5.2.5 Household and Detergents

- 5.2.6 Chemical

- 5.2.7 Confectionery and Bakery

- 5.2.8 Warehousing and 3PL

- 5.2.9 Others

- 5.3 By Packaging Stage

- 5.3.1 Primary (Filling/Sealing)

- 5.3.2 Secondary (Cartoning/Case-Packing)

- 5.3.3 End-of-Line (Palletising/Stretch-Wrap)

- 5.3.4 Tertiary and Intralogistics

- 5.4 By Product Type

- 5.4.1 Filling Machines

- 5.4.2 Labelling and Coding

- 5.4.3 Form-Fill-Seal (H/VFFS)

- 5.4.4 Bagging and Pouching

- 5.4.5 Palletising and Depalletising

- 5.4.6 Others

- 5.5 By Geography

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 France

- 5.5.4 Italy

- 5.5.5 Spain

- 5.5.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ABB

- 6.4.2 Siemens AG

- 6.4.3 Rockwell Automation

- 6.4.4 Mitsubishi Electric

- 6.4.5 Schneider Electric

- 6.4.6 JLS Automation

- 6.4.7 ULMA Packaging

- 6.4.8 Swisslog Holding AG

- 6.4.9 Gerhard Schubert GmbH

- 6.4.10 Destaco

- 6.4.11 Emerson (Branson)

- 6.4.12 ATS Automation

- 6.4.13 Massman Automation

- 6.4.14 Krones AG

- 6.4.15 Fanuc Corporation

- 6.4.16 KUKA AG

- 6.4.17 Coesia S.p.A.

- 6.4.18 Syntegon Technology

- 6.4.19 Sidel Group

- 6.4.20 Yaskawa Electric

- 6.4.21 Brenton Engineering

- 6.4.22 Tetra Pak

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment