|

市場調查報告書

商品編碼

1851514

燃料電池:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Fuel Cell - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

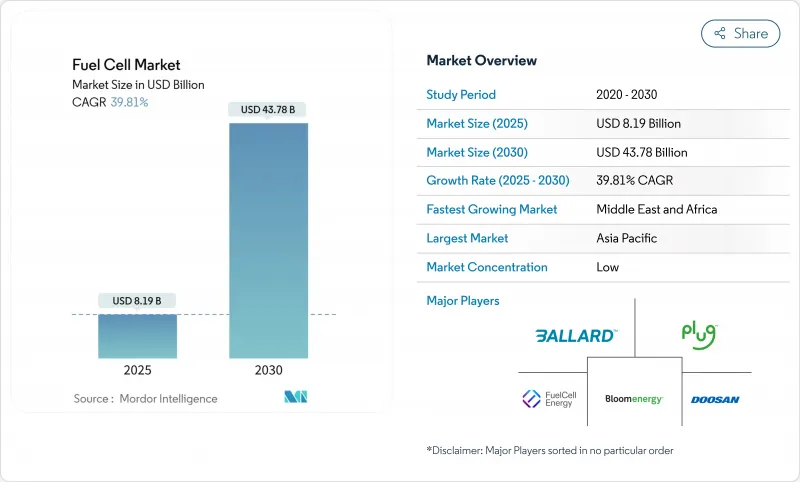

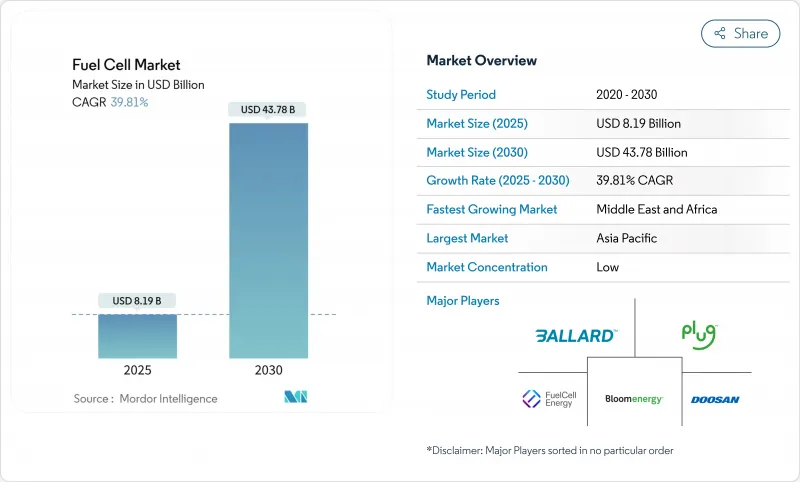

預計到 2025 年,燃料電池市場規模將達到 81.9 億美元,到 2030 年將達到 437.8 億美元,預測期(2025-2030 年)複合年成長率為 39.81%。

燃料電池市場的擴張主要得益於交通運輸、資料中心和公用事業規模應用領域需求的激增,而這些領域都受惠於清潔能源政策的推動。綠氫和藍氫的成本下降、亞太地區加氫走廊的快速建設以及重型卡車製造商加速投資,都拓寬了燃料電池的商業性路徑。創新勢頭正轉向用於固定負載的固體氧化物燃料電池,而固體電解質膜燃料電池在汽車、巴士和堆高機領域仍佔據主導地位。鉑族金屬供應鏈風險和氫基礎設施的不足限制了近期成長,而航運營運商和公共產業日益成長的興趣則進一步擴大了燃料電池市場的潛在用戶群。

全球燃料電池市場趨勢與洞察

綠色和藍氫生產成本下降

美國清潔氫氣生產稅額扣抵(最高可達3美元/公斤)和歐盟可再生能源指令中針對工業領域42%可再生氫氣配額等政策獎勵,正在推動投資項目的發展。 2020年至2024年間,最終做出投資決策的計劃數量激增七倍,反映出資本流動的不斷深化。由於氫燃料通常佔燃料電池總擁有成本的近一半,因此價格較低的氫分子將直接促進其更廣泛的應用。燃料電池市場的先驅者預測,價格低於2美元/公斤的氫氣將成為推動遠距運輸車輛實現與柴油價格持平的關鍵因素。

亞太地區汽車製造商對燃料電池電動車的承諾

豐田、現代和本田已承諾投入數十億美元用於氫能藍圖,其中包括未來兩年內供應4.5萬輛燃料電池電動車(FCEV)的協議。中國的目標是到2035年實現100萬輛燃料電池汽車和2000座加氫站,而韓國則將氫燃料電池卡車納入其國家智慧電網計畫。汽車製造商正透過調整生產計畫、與能源公司成立合資企業以及共同投資建造加氫站來縮短規模化生產的時間。這些需求訊號會透過電堆供應商、壓縮機製造商和加氫站整合商傳遞到燃料電池市場。

日本和韓國以外地區氫氣加註基礎設施的匱乏

除日本和韓國的成熟走廊外,其他地區的加氫網路密度仍不足。德國擁有約170座公共加氫站,在歐洲處於領先地位,但其覆蓋範圍仍無法滿足區域貨運路線的需求。在美國,只有加州開展了大規模的加氫建設計畫,而每公斤12-15美元的加氫價格阻礙了車隊的全面部署。基礎建設的不足減緩了車隊的轉型速度,延長了早期用戶的投資回收期,並降低了燃料電池市場的整體規模。

細分市場分析

預計車輛領域將在燃料電池市場中扮演核心角色,到2024年將佔全球銷售量的80.9%。商用卡車、城市公車和輕型車輛均依賴PEMFC架構來實現快速加氫和遠距。近期235輛氫燃料電池卡車的批發銷售,以及歐洲燃料電池公車的大訂單,顯示市場需求曲線正趨於成熟。隨著氫氣價格的下降和維護成本的降低,燃料電池與柴油車的總成本差距正在縮小。

資料中心、通訊塔和醫院等固定式應用佔據剩餘的19.1%市場佔有率,並且成長迅速。超大規模業者正在試驗建造兆瓦級燃料電池系統,以取代柴油發電機。這些早期成功案例表明,隨著運作時間和排放法規的逐步完善,燃料電池市場在2030年後行動應用和固定式應用之間的佔有率將更加均衡。

預計2024年,PEMFC(質子交換膜燃料電池)將維持70.4%的市場佔有率,主要得益於乘用車和物料輸送車隊的應用。其較低的工作溫度允許頻繁啟停,從而提高了在都市區的運轉率。此外,電堆壽命的延長和膜回收計畫的實施將進一步提升PEMFC的經濟效益。

然而,固態氧化物燃料電池(SOFC)預計將以最快的速度成長,到2030年複合年成長率(CAGR)將達到51.1%。其接近60%的電力效率和靈活的燃料配置將使公共產業和資料中心客戶能夠今天運作管道天然氣,明天使用氫氣。 Bloom Energy的多兆瓦訂單凸顯了這項轉變。因此,預計到2035年,SOFC系統的燃料電池市場規模將超過200億美元,這反映了其在基本負載替代和微電網應用的多元化需求。鹼性燃料電池、磷酸燃料電池和熔融碳酸鹽燃料電池則滿足特定的工業需求,並完善了燃料電池的技術頻譜。

燃料電池市場報告按應用(車輛、非車輛)、技術(聚合物電解質膜燃料電池、固體氧化物燃料電池、鹼性燃料電池、其他)、燃料類型(氫氣、天然氣、氨氣、其他)、終端用戶行業(運輸、公共產業、商業和工業、其他)以及地區(北美、歐洲、亞太地區、南美、中東和非洲)進行細分。

區域分析

到2024年,亞太地區將佔據全球燃料電池市場57.8%的佔有率。日本的戰略藍圖對燃料電池汽車和家用微型熱電聯產裝置提供補貼,而韓國則將氫能與智慧城市計畫捆綁在一起。中國設定了2035年擁有100萬輛燃料電池電動車和2000座加氫站的目標,這一規模在其他國家都無法比擬。地方政府正在資助電解槽建設並免除通行費,以降低車輛營運成本。成熟的汽車集團正在將燃料電池整合到卡車、SUV和堆高機中,從而鎖定區域供應商的零件需求。

北美位居第二,這主要得益於美國的政策利好。清潔氫氣生產扣除額和七個區域氫能中心將調動數十億美元資金用於電解、儲存和下游計劃。加州的先進清潔卡車法規正在推動中型和重型車隊的早期需求,而加拿大各省則在支持氫燃料電池公車的發展。德克薩斯州、伊利諾伊州和維吉尼亞的資料中心營運商已簽署契約,建造兆瓦級固體氧化物燃料電池(SOFC)電站,以提高電網可靠性,進一步深化了該地區的燃料電池市場。

歐洲將利用其「Fit-for-55」氣候方案,推動燃料電池在卡車、鐵路和海運領域的應用。最新的二氧化碳排放標準要求在2040年將重型車輛排放氣體減少90%,這使得氫動力成為一條切實可行的途徑。德國擁有超過170座公共站,在歐洲大陸處於領先地位。歐洲氫能銀行和創新基金為競標提供津貼,以降低電解槽和燃料電池堆工廠規模化建設的風險。從西班牙到法國的跨境管線升級改造將為未來的綠色氫氣輸送奠定基礎設施基礎。

預計中東和非洲將成為成長最快的地區,年複合成長率預計達到41.2%。豐富的太陽能和風能資源將打造一個具有競爭力的綠氫能出口中心。埃及、阿拉伯聯合大公國和沙烏地阿拉伯都計劃建造數吉瓦級電解槽園區,並與氨生產系統相連,為航運客戶提供服務。現有的天然氣管道和港口基礎設施為向氫燃料轉型提供了平台。非洲各國正在轉向本地燃料電池微電網,以穩定脆弱的電網並取代柴油發電機,預示著新一輪需求的到來。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 最新進展

- 市場促進因素

- 綠色和藍氫發電成本下降

- 亞太地區汽車製造商對燃料電池電動車的承諾

- 政府對重型車輛運輸的零排放強制規定(北美和歐盟)

- 資料中心對長期備用電源的需求

- 海洋脫碳目標推動燃料電池發展

- 企業現場分散式發電的淨零投資

- 市場限制

- 日本和韓國以外地區氫氣加註基礎設施的匱乏

- 鉑族金屬和鎳價格波動推高了累積成本。

- 在近海高硫環境中,固態氧化物燃料電池(SOFC)的性能劣化

- 美國建築規範認證的漏洞延緩了固定設施的安裝。

- 供應鏈分析

- 監理展望

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過使用

- 車輛(轎車、巴士和長途客車、卡車、物料輸送設備、鐵路、船舶)

- 非車輛用電(固定式電源、可攜式電源、微型熱電聯產)

- 透過技術

- 聚合物電解質膜燃料電池(PEMFC)

- 固體氧化物燃料電池(SOFC)

- 鹼性燃料電池(AFC)

- 其他[磷酸燃料電池(PAFC)、熔融碳酸鹽燃料電池(MCFC)、直接甲醇燃料電池(DMFC)]。

- 按燃料類型

- 氫

- 天然氣/甲烷

- 氨

- 其他(甲醇、沼氣)

- 按最終用戶行業分類

- 運輸

- 公用事業

- 商業和工業

- 其他(國防、住房)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 北歐國家

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 馬來西亞

- 泰國

- 印尼

- 越南

- 澳洲

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 南美洲其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、夥伴關係、購電協議)

- 市場佔有率分析(主要企業的市場排名/佔有率)

- 公司簡介

- Ballard Power Systems Inc.

- Plug Power Inc.

- FuelCell Energy Inc.

- Bloom Energy Corporation

- Doosan Fuel Cell Co., Ltd.

- Cummins Inc.(Hydrogenics)

- Toshiba Energy Systems & Solutions Corp.

- Panasonic Corporation

- Horizon Fuel Cell Technologies Pte. Ltd.

- Intelligent Energy Ltd.

- Nuvera Fuel Cells, LLC

- SFC Energy AG

- Mitsubishi Power Ltd.

- Hyundai Mobis Co., Ltd.

- Toyota Motor Corporation

- Nikola Corporation

- Ceres Power Holdings plc

- Ballard Motive Solutions Ltd.

- PowerCell Sweden AB

- AFC Energy plc

- Advent Technologies Holdings Inc.

- Gencell Ltd.

- Proton Motor Power Systems plc

第7章 市場機會與未來展望

The Fuel Cell Market size is estimated at USD 8.19 billion in 2025, and is expected to reach USD 43.78 billion by 2030, at a CAGR of 39.81% during the forecast period (2025-2030).

Expansion is rooted in surging demand from transportation, data centers, and utility-scale applications, each benefiting from cleaner-energy policy mandates. Falling costs of green and blue hydrogen, rapid roll-outs of hydrogen refueling corridors in Asia-Pacific, and accelerating investment from heavy-duty truck makers together widen commercial pathways. Innovation momentum is shifting toward solid oxide fuel cells that serve stationary loads, while polymer electrolyte membrane fuel cells continue to dominate cars, buses, and forklifts. Growing interest from maritime operators and utilities further broadens the addressable base of the fuel cell market, even as supply-chain risks around platinum group metals and hydrogen infrastructure gaps temper near-term growth.

Global Fuel Cell Market Trends and Insights

Falling Costs of Green & Blue Hydrogen Generation

Green hydrogen production costs are set to decline by up to 60% by 2030 as electrolyzer manufacturing scales and renewable power prices fall.Policy incentives such as the U.S. Clean Hydrogen Production Tax Credit of up to USD 3.00/kg and the EU Renewable Energy Directive's 42% renewable-hydrogen quota for industry underpin investment pipelines. A seven-fold jump in projects reaching final investment decision between 2020 and 2024 reflects deepening capital flows. As hydrogen fuel typically represents nearly half of a fuel cell's total cost of ownership, cheaper molecules directly widen adoption. Developers in the fuel cell market anticipate that sub-USD 2/kg hydrogen will trigger parity with diesel in long-haul fleets.

Automaker Commitments to FCEVs in Asia-Pacific

Toyota, Hyundai, and Honda have collectively pledged multi-billion-dollar roadmaps for hydrogen mobility, including supply contracts for 45,000 FCEVs over the next two years. China targets 1 million fuel-cell vehicles and 2,000 stations by 2035, while South Korea links hydrogen trucks to its national smart-grid plan. Automakers' aligned production schedules, joint ventures with energy firms, and station co-investment compress scale-up timelines. Their demand signals cascade along the fuel cell market through stack suppliers, compressor makers, and refueling integrators.

Scarcity of Hydrogen Refueling Infrastructure Outside JP & KR

Network density remains insufficient outside the mature corridors of Japan and South Korea. Germany leads Europe with about 170 public hydrogen stations, yet coverage still trails the needs of regional trucking routes. In the U.S., only California offers a cohesive buildout plan, and pump prices of USD 12-15/kg deter fleet wide roll-outs. Infrastructure delays slow fleet conversion, stretching payback periods for early adopters and reducing overall volumes in the fuel cell market.

Other drivers and restraints analyzed in the detailed report include:

- Government Zero-Emission Mandates in Heavy-Duty Transport (NA & EU)

- Demand for Long-Duration Backup Power in Data Centers

- PGM & Nickel Price Volatility Inflating Stack Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The vehicular segment generated 80.9% of global revenue in 2024, confirming its central role within the fuel cell market. Commercial trucks, city buses, and light-duty cars rely on PEMFC architecture that delivers fast refueling and long range. Recent wholesale of 235 hydrogen trucks, coupled with bulk orders for European fuel-cell buses, signals maturing demand curves. The total cost gap versus diesel narrows as hydrogen prices fall and maintenance savings accrue.

Stationary deployments for data centers, telecom towers, and hospitals capture the remaining 19.1% share, yet post sharp growth. Hyperscale operators trial multi-megawatt installations that displace diesel gensets. These early wins suggest that the fuel cell market will balance more evenly between mobile and stationary uses after 2030 as uptime and emission credentials prove out.

PEMFC retained a 70.4% share in 2024, underpinned by passenger cars and material-handling fleets. Its low operating temperature suits frequent starts and stops, which lifts utilization rates in urban duty cycles. Stack lifetime improvements and membrane recycling programs further cement PEMFC economics.

SOFC, however, is the fastest climber with a forecast 51.1% CAGR to 2030. Electrical efficiencies near 60% and flexible fuel inputs empower utilities and data-center customers to run on pipeline gas today and hydrogen tomorrow. Bloom Energy's multi-megawatt orders underscore this inflection. As a result, the fuel cell market size for SOFC systems is expected to pass USD 20 billion by 2035, reflecting a mix of base-load replacements and microgrid applications. Alkaline, phosphoric acid, and molten carbonate fuel cells address specific industrial niches, completing the technology spectrum.

The Fuel Cell Market Report is Segmented by Application (Vehicular and Non-Vehicular), Technology (Polymer Electrolyte Membrane Fuel Cell, Solid Oxide Fuel Cell, Alkaline Fuel Cell, and Others), Fuel Type (Hydrogen, Natural Gas, Ammonia, and Others), End-User Industry (Transportation, Utilities, Commercial and Industrial, and Others), and Geography (North America, Europe, Asia-Pacific, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific held a 57.8% share of the fuel cell market in 2024. Japan's strategic roadmap subsidizes fuel-cell cars and residential micro-CHP units, while South Korea bundles hydrogen with smart-city initiatives. China's target of 1 million FCEVs and 2,000 stations by 2035 signals a scale unmatched elsewhere. Local governments fund electrolyzers and provide toll exemptions that cut fleet operating costs. Established automotive groups embed fuel cells across trucks, SUVs, and forklifts, locking in component demand for regional suppliers.

North America ranked second, propelled by policy tailwinds in the United States. The Clean Hydrogen Production Tax Credit and seven Regional Hydrogen Hubs mobilize billions toward electrolysis, storage, and downstream projects. California's Advanced Clean Trucks rule anchors early demand in medium- and heavy-duty fleets, while Canadian provinces support hydrogen buses. Data-center operators in Texas, Illinois, and Virginia are contracting multi-megawatt SOFC plants to bolster grid reliability, adding depth to the regional fuel cell market.

Europe leverages its Fit-for-55 climate package to stimulate fuel-cell adoption in trucks, rail, and maritime. Updated CO2 standards require a 90% cut in heavy-duty vehicle emissions by 2040, making hydrogen propulsion a credible path. Germany's 170-plus public stations lead continental coverage. The European Hydrogen Bank and Innovation Fund align bidders with grant finance, derisking scale-up for electrolyzer and stack plants. Cross-border pipeline upgrades from Spain to France pave the infrastructure for future green-hydrogen flows.

The Middle East & Africa offers the fastest growth outlook at a forecast 41.2% CAGR. Ample solar and wind resources enable competitive green-hydrogen export hubs. Egypt, the United Arab Emirates, and Saudi Arabia each map multi-gigawatt electrolyzer parks tied to ammonia production for shipping customers. Existing natural-gas pipelines and port infrastructure provide a ready platform for conversion to hydrogen blends. African economies eye local fuel-cell microgrids that stabilize weak grids and displace diesel gensets, signalling a fresh demand wave.

- Ballard Power Systems Inc.

- Plug Power Inc.

- FuelCell Energy Inc.

- Bloom Energy Corporation

- Doosan Fuel Cell Co., Ltd.

- Cummins Inc. (Hydrogenics)

- Toshiba Energy Systems & Solutions Corp.

- Panasonic Corporation

- Horizon Fuel Cell Technologies Pte. Ltd.

- Intelligent Energy Ltd.

- Nuvera Fuel Cells, LLC

- SFC Energy AG

- Mitsubishi Power Ltd.

- Hyundai Mobis Co., Ltd.

- Toyota Motor Corporation

- Nikola Corporation

- Ceres Power Holdings plc

- Ballard Motive Solutions Ltd.

- PowerCell Sweden AB

- AFC Energy plc

- Advent Technologies Holdings Inc.

- Gencell Ltd.

- Proton Motor Power Systems plc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Recent Trends & Developments

- 4.3 Market Drivers

- 4.3.1 Falling Costs of Green & Blue Hydrogen Generation

- 4.3.2 Automaker Commitments to FCEVs in Asia-Pacific

- 4.3.3 Government Zero-Emission Mandates in Heavy-Duty Transport (NA & EU)

- 4.3.4 Demand for Long-Duration Backup Power in Data Centers

- 4.3.5 Maritime Decarbonization Targets Accelerating Fuel Cell Adoption

- 4.3.6 Corporate Net-Zero Investment into On-Site Distributed Generation

- 4.4 Market Restraints

- 4.4.1 Scarcity of Hydrogen Refueling Infrastructure Outside JP & KR

- 4.4.2 PGM & Nickel Price Volatility Inflating Stack Costs

- 4.4.3 SOFC Performance Degradation in Maritime High-Sulfur Environments

- 4.4.4 Certification Gaps in US Building Codes Slowing Stationary Installations

- 4.5 Supply-Chain Analysis

- 4.6 Regulatory Outlook

- 4.7 Technological Outlook

- 4.8 Porte's Five Forces

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Consumers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products & Services

- 4.8.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts

- 5.1 By Application

- 5.1.1 Vehicular (Passenger Cars, Buses & Coaches, Trucks, Material Handling Equipment, Rail, Marine Vessels)

- 5.1.2 Non-Vehicular (Stationary Power, Portable Power, Micro-Combined Heat & Power)

- 5.2 By Technology

- 5.2.1 Polymer Electrolyte Membrane Fuel Cell (PEMFC)

- 5.2.2 Solid Oxide Fuel Cell (SOFC)

- 5.2.3 Alkaline Fuel Cell (AFC)

- 5.2.4 Others [Phosphoric Acid Fuel Cell (PAFC), Molten Carbonate Fuel Cell (MCFC), Direct Methanol Fuel Cell (DMFC)]

- 5.3 By Fuel Type

- 5.3.1 Hydrogen

- 5.3.2 Natural Gas/Methane

- 5.3.3 Ammonia

- 5.3.4 Others (Methanol, Biogas)

- 5.4 By End-User Industry

- 5.4.1 Transportation

- 5.4.2 Utilities

- 5.4.3 Commercial and Industrial

- 5.4.4 Others (Defense, Residential)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Spain

- 5.5.2.5 Nordic Countries

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 South Korea

- 5.5.3.5 Malaysia

- 5.5.3.6 Thailand

- 5.5.3.7 Indonesia

- 5.5.3.8 Vietnam

- 5.5.3.9 Australia

- 5.5.3.10 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Colombia

- 5.5.4.4 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Ballard Power Systems Inc.

- 6.4.2 Plug Power Inc.

- 6.4.3 FuelCell Energy Inc.

- 6.4.4 Bloom Energy Corporation

- 6.4.5 Doosan Fuel Cell Co., Ltd.

- 6.4.6 Cummins Inc. (Hydrogenics)

- 6.4.7 Toshiba Energy Systems & Solutions Corp.

- 6.4.8 Panasonic Corporation

- 6.4.9 Horizon Fuel Cell Technologies Pte. Ltd.

- 6.4.10 Intelligent Energy Ltd.

- 6.4.11 Nuvera Fuel Cells, LLC

- 6.4.12 SFC Energy AG

- 6.4.13 Mitsubishi Power Ltd.

- 6.4.14 Hyundai Mobis Co., Ltd.

- 6.4.15 Toyota Motor Corporation

- 6.4.16 Nikola Corporation

- 6.4.17 Ceres Power Holdings plc

- 6.4.18 Ballard Motive Solutions Ltd.

- 6.4.19 PowerCell Sweden AB

- 6.4.20 AFC Energy plc

- 6.4.21 Advent Technologies Holdings Inc.

- 6.4.22 Gencell Ltd.

- 6.4.23 Proton Motor Power Systems plc

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment