|

市場調查報告書

商品編碼

1859024

運輸燃料電池市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Transport Fuel Cell Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

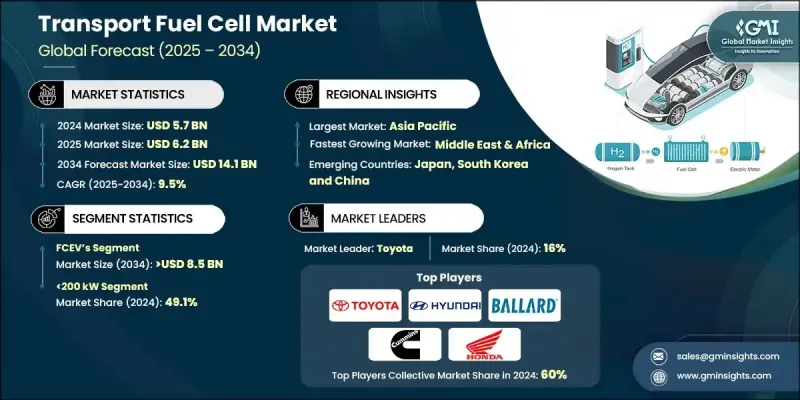

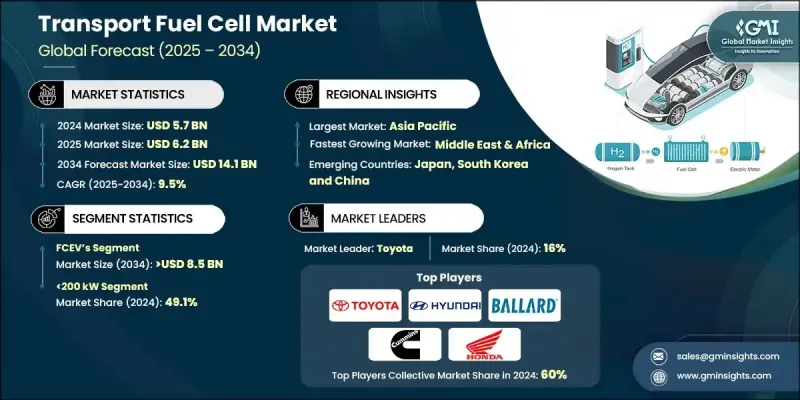

2024 年全球運輸燃料電池市場價值為 57 億美元,預計到 2034 年將以 9.5% 的複合年成長率成長至 141 億美元。

全球交通網路對脫碳和清潔能源的日益重視推動了燃料電池技術的成長。現代燃料電池系統性能指標的提升,例如更高的耐久性、更最佳化的成本和更高的效率,使其成為各種交通應用領域的首選解決方案。隨著氫能基礎設施的不斷改進以及主要經濟體陸續推出國家氫能目標,燃料電池的可行性正在迅速擴大。各國政府致力於削減交通運輸領域排放的政策,正促使人們大規模轉向零排放解決方案,而燃料電池為之提供了強力的替代方案,尤其適用於重型、長途和離網應用。這些系統發電驅動電動機,消除了廢氣排放,同時也能像內燃機一樣提供穩定的輸出性能。儘管發展勢頭強勁,但市場仍面臨著前期資本成本高、極端條件下運作可靠性問題以及氫能物流發展不足等挑戰,尤其是在氫能發展相對低度開發的地區。然而,持續的投資和公私合作正在努力緩解這些限制,並提高全球氫能的普及程度。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 57億美元 |

| 預測值 | 141億美元 |

| 複合年成長率 | 9.5% |

到2034年,鐵路業將以9.5%的複合年成長率成長,這主要得益於燃料電池在客運和貨運領域日益廣泛的應用。這些燃料電池列車能夠在尚未電氣化的鐵路網路上實現零排放運行,從而最大限度地降低基礎設施成本,並提供更低的維護成本和更安靜的運行環境。對於擁有龐大鐵路網且亟需進行永續改造的國家而言,這項技術尤其具有吸引力。

2024年,功率範圍在200千瓦至1兆瓦的燃料電池市佔率為34.7%,預計到2034年將以8.5%的複合年成長率成長。此功率範圍非常適合中型商用車隊、貨運機車和中型船舶。它在能量輸出、系統複雜性和成本之間取得了平衡,使其成為許多實際交通運輸應用的理想選擇。

受歐洲綠色協議和氫能基礎設施巨額投資的推動,預計到2034年,歐洲交通燃料電池市場規模將達到30億美元。該地區鐵路應用領域正蓬勃發展,船舶系統的應用也不斷成長。德國、挪威和荷蘭等國正積極推動燃料電池交通運輸領域的創新,進而提升整體產品需求和基礎建設支援。

全球運輸燃料電池市場的主要企業包括豐田汽車公司、巴拉德動力系統公司、現代汽車公司、本田汽車公司、博格華納公司、斗山燃料電池公司、智慧能源有限公司、採埃孚股份公司、弗羅伊登貝格公司、瑞典PowerCel l公司、埃爾林克林格公司、愛信株式會社、Symbio公司、Nuvera燃料電池公司、Oorja燃料電池公司、AFC能源公司、康明斯公司、武漢虎牌燃料電池公司、東芝公司和Nedstack燃料電池技術公司。為了鞏固在運輸燃料電池產業的地位,主要企業正大力投資研發,以提高燃料電池系統的效率和使用壽命。許多公司正與汽車和軌道運輸製造商建立合作關係,將其技術整合到商用車和車隊中。一些公司正在擴大產能和區域製造中心,以滿足全球需求並減少供應鏈摩擦。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系統

- 監管環境

- 產業影響因素

- 成長促進因素

- 產業陷阱與挑戰

- 成長潛力分析

- 價格趨勢分析,2021-2034年

- 按最終用途

- 按地區

- 波特的分析

- PESTEL 分析

第4章:競爭格局

- 介紹

- 按地區分類的公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 中東和非洲

- 拉丁美洲

- 戰略儀錶板

- 策略舉措

- 公司標竿分析

- 創新與技術格局

第5章:市場規模及預測:依產品分類,2021-2034年

- 主要趨勢

- PEMFC

- 固態氧化物燃料電池

- 直接甲醇燃料電池

- 巴基斯坦足球俱樂部和亞足聯

- 曼城足球俱樂部

第6章:市場規模及預測:依產能分類,2021-2034年

- 主要趨勢

- 小於200千瓦

- 200千瓦 - 1兆瓦

- ≥ 1 兆瓦

第7章:市場規模及預測:依最終用途分類,2021-2034年

- 主要趨勢

- 海洋

- 鐵路

- 燃料電池電動車

- 其他

第8章:市場規模及預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 奧地利

- 亞太地區

- 日本

- 韓國

- 中國

- 印度

- 菲律賓

- 越南

- 中東和非洲

- 南非

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 拉丁美洲

- 巴西

- 秘魯

- 墨西哥

第9章:公司簡介

- AISIN Corporation

- AFC Energy PLC

- BorgWarner Inc

- Ballard Power Systems

- Cummins

- Doosan Fuel Cell

- ElringKlinger

- Freudenberg

- Hyundai Motor Company

- Honda Motor

- Intelligent Energy Limited

- Nuvera Fuel Cells

- Nedstack Fuel Cell Technology

- PowerCell Sweden

- Oorja Fuel Cells

- Symbio

- Toyota Motor Corporation

- Toshiba Corporation

- Wuhan Tiger Fuel Cell

- ZF Friedrichshafen AG

The Global Transport Fuel Cell Market was valued at USD 5.7 billion in 2024 and is estimated to grow at a CAGR of 9.5% to reach USD 14.1 billion by 2034.

This growth trajectory is fueled by the rising push for decarbonization and clean energy adoption across global transportation networks. Enhanced performance metrics in modern fuel cell systems, such as improved durability, cost optimization, and better efficiency, are making them a preferred solution in various transport applications. As hydrogen infrastructure continues to mature and national hydrogen targets are being rolled out by leading economies, the viability of fuel cells is expanding rapidly. Government mandates focused on slashing emissions across the mobility sector are prompting a large-scale shift toward zero-emission solutions, where fuel cells offer a strong alternative, particularly for heavy-duty, long-haul, and off-grid applications. These systems generate electricity to power electric motors, eliminating tailpipe emissions while delivering consistent output performance like combustion engines. Despite clear momentum, the market still contends with high upfront capital costs, operational reliability issues in extreme conditions, and underdeveloped hydrogen logistics, particularly in less mature regions. However, ongoing investment and public-private partnerships are working to mitigate these constraints and enhance global accessibility.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $5.7 Billion |

| Forecast Value | $14.1 Billion |

| CAGR | 9.5% |

The railway segment will grow at a CAGR of 9.5% through 2034, driven by the increasing use of fuel cells in both passenger and freight transport. These fuel cell-powered trains enable emission-free operations on rail networks lacking electrification, minimizing infrastructure costs and offering lower maintenance and quieter service. The technology is proving especially attractive in countries with vast rail networks needing sustainable retrofitting.

The fuel cells in the 200 kW to 1 MW capacity segment held a 34.7% share in 2024 and are projected to grow at an 8.5% CAGR through 2034. This power band is ideally suited for medium-duty commercial fleets, freight locomotives, and mid-sized marine vessels. It strikes a balance between energy output, system complexity, and cost, making it optimal for many real-world transport applications.

Europe Transport Fuel Cell Market is expected to reach USD 3 billion by 2034, influenced by the European Green Deal and heavy investment in hydrogen infrastructure. The region is witnessing strong deployment in rail applications and growing uptake in marine systems. Countries including Germany, Norway, and the Netherlands are actively shaping fuel cell transportation innovation, boosting overall product demand and infrastructure support.

Leading companies in the Global Transport Fuel Cell Market include Toyota Motor Corporation, Ballard Power Systems, Hyundai Motor Company, Honda Motor, BorgWarner Inc., Doosan Fuel Cell, Intelligent Energy Limited, ZF Friedrichshafen AG, Freudenberg, PowerCell Sweden, ElringKlinger, AISIN Corporation, Symbio, Nuvera Fuel Cells, Oorja Fuel Cells, AFC Energy PLC, Cummins, Wuhan Tiger Fuel Cell, Toshiba Corporation, and Nedstack Fuel Cell Technology. To strengthen their position in the transport fuel cell industry, key players are heavily investing in research and development to enhance the efficiency and lifecycle of their fuel cell systems. Many companies are forming partnerships with automotive and rail manufacturers to integrate their technologies into commercial vehicles and fleets. Several firms are scaling up production capacity and regional manufacturing hubs to support global demand and reduce supply chain friction.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.1.3 Base estimates and calculations

- 1.1.4 Base year calculation

- 1.1.5 Key trends for market estimates

- 1.2 Forecast model

- 1.3 Primary research & validation

- 1.3.1 Primary sources

- 1.4 Data mining sources

- 1.5 Market definitions

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

- 2.2 Business trends

- 2.3 Product trends

- 2.4 Capacity trends

- 2.5 End use trends

- 2.6 Regional trends

Chapter 3 Industry Insights

- 3.1 Industry ecosystem

- 3.2 Regulatory landscape

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.2 Industry pitfalls & challenges

- 3.4 Growth potential analysis

- 3.5 Price trend analysis, 2021-2034

- 3.5.1 By end use

- 3.5.2 By region

- 3.6 Porter's analysis

- 3.6.1 Bargaining power of suppliers

- 3.6.2 Bargaining power of buyers

- 3.6.3 Threat of new entrants

- 3.6.4 Threat of substitutes

- 3.7 PESTEL analysis

Chapter 4 Competitive landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis, by region, 2024

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Middle East & Africa

- 4.2.5 Latin America

- 4.3 Strategic dashboard

- 4.4 Strategic initiatives

- 4.5 Company benchmarking

- 4.6 Innovation & technology landscape

Chapter 5 Market Size and Forecast, By Product, 2021 - 2034 (USD Million & MW)

- 5.1 Key trends

- 5.2 PEMFC

- 5.3 SOFC

- 5.4 DMFC

- 5.5 PAFC & AFC

- 5.6 MCFC

Chapter 6 Market Size and Forecast, By Capacity, 2021 - 2034 (USD Million & MW)

- 6.1 Key trends

- 6.2 <200 kW

- 6.3 200 kW - 1 MW

- 6.4 ≥ 1 MW

Chapter 7 Market Size and Forecast, By End Use, 2021 - 2034 (USD Million & MW)

- 7.1 Key trends

- 7.2 Marine

- 7.3 Railways

- 7.4 FCEVs

- 7.5 Others

Chapter 8 Market Size and Forecast, By Region, 2021 - 2034 (USD Million & MW)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Italy

- 8.3.5 Spain

- 8.3.6 Austria

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 South Korea

- 8.4.3 China

- 8.4.4 India

- 8.4.5 Philippines

- 8.4.6 Vietnam

- 8.5 Middle East & Africa

- 8.5.1 South Africa

- 8.5.2 UAE

- 8.5.3 Saudi Arabia

- 8.6 Latin America

- 8.6.1 Brazil

- 8.6.2 Peru

- 8.6.3 Mexico

Chapter 9 Company Profiles

- 9.1 AISIN Corporation

- 9.2 AFC Energy PLC

- 9.3 BorgWarner Inc

- 9.4 Ballard Power Systems

- 9.5 Cummins

- 9.6 Doosan Fuel Cell

- 9.7 ElringKlinger

- 9.8 Freudenberg

- 9.9 Hyundai Motor Company

- 9.10 Honda Motor

- 9.11 Intelligent Energy Limited

- 9.12 Nuvera Fuel Cells

- 9.13 Nedstack Fuel Cell Technology

- 9.14 PowerCell Sweden

- 9.15 Oorja Fuel Cells

- 9.16 Symbio

- 9.17 Toyota Motor Corporation

- 9.18 Toshiba Corporation

- 9.19 Wuhan Tiger Fuel Cell

- 9.20 ZF Friedrichshafen AG