|

市場調查報告書

商品編碼

1851507

亞太地區嬰幼兒食品包裝:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)APAC Baby Food Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

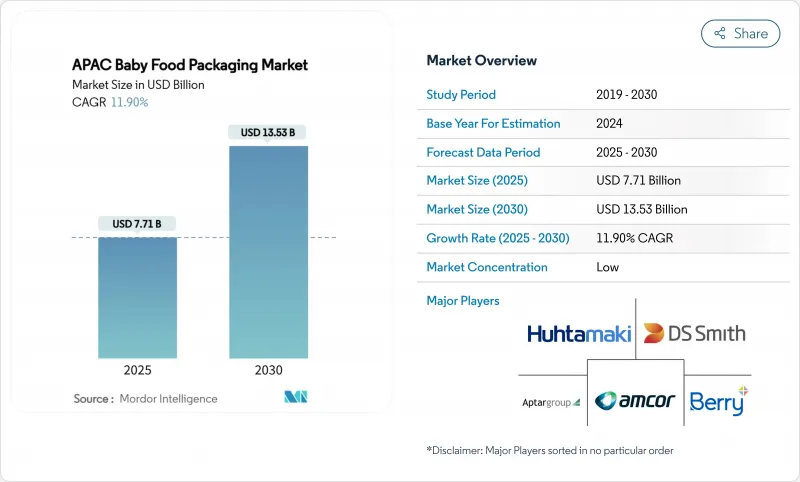

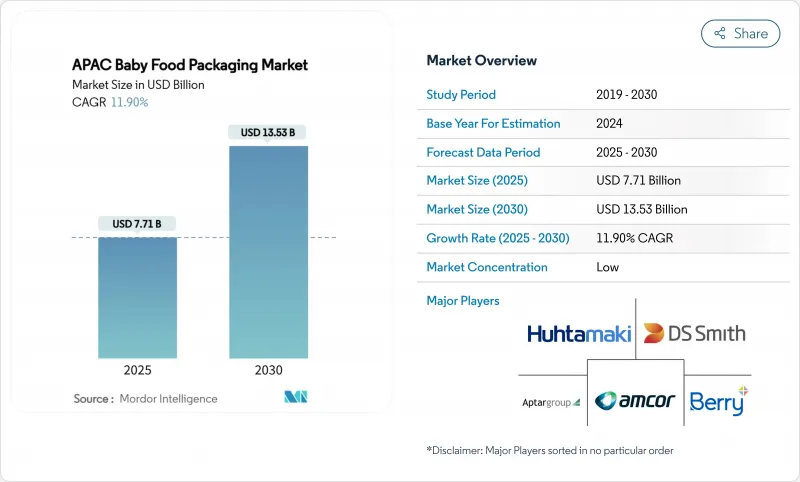

亞太地區嬰兒食品包裝市場規模預計在 2025 年達到 77.1 億美元,預計到 2030 年將達到 135.3 億美元,預測期(2025-2030 年)複合年成長率為 11.90%。

這一成長反映了該地區的人口成長勢頭、強勁的都市化以及消費者對高階嬰幼兒營養品日益成長的偏好。受中國龍年出生登記數量增加的推動,超高階嬰幼兒配方奶粉的銷售量增加了44.3%,使H&H集團在該價格分佈佔了15.6%的市場佔有率。材料創新也是推動成長的因素之一。預計到2024年,塑膠將維持46.7%的市場佔有率,其中生質塑膠的成長速度最快,年複合成長率達18.4%,這主要得益於NatureWorks公司位於泰國、投資6億美元的Ingeo PLA綜合體計畫(計畫於2025年投產)。便捷包裝袋目前已佔據33%的市場佔有率,並以15.9%的年複合成長率持續成長。地理集中度依然顯著,中國佔35%的市場佔有率,而印度預計到2030年將以14%的複合年成長率實現最快成長。嬰兒食品包裝的電子商務銷售額將以19.4%的複合年成長率加速成長,這將促使包裝形式轉向輕便、易於運輸,從而最大限度地減少破損和體積重量。

亞太地區嬰幼兒食品包裝市場趨勢及洞察

包裝嬰兒食品和嬰兒配方奶粉的需求不斷成長

2024年,中國嬰幼兒奶粉市場維持韌性,外資品牌銷售額成長8%,超高階市場佔37%的佔有率。亞太地區的都市區父母更傾向於選擇安全、保存期限長、營養豐富的產品,這推動了對多層阻隔膜和高階包裝的需求。代際財富轉移提升了千禧世代的購買力,他們更注重便利性和品質,而非自製替代品。儘管城鄉差距依然存在,但主要城市中心正成為人口密集的消費中心。

都市區雙薪家庭數量增加

雙薪家庭重視能滿足他們忙碌生活需求的包裝。吸嘴袋方便外出餵食,易於重新密封,減少灑漏,符合父母的期望。韓國和新加坡的富裕程度推動了高階定量包裝的普及,而隨著女性勞動參與率的提高,越南和印尼也開始出現這一趨勢。因此,品牌商們更加重視符合人體工學的形狀、柔軟的貼合加工以及單手快速開啟的設計。

嚴格禁止使用一次性塑膠製品

印度將在2025年前強制規定許多關鍵類別的產品中再生材料含量達到30%,這將迫使研發和認證週期加快。生產商將面臨更高的認證消費後再生樹脂成本,以及對遷移物和氣味更嚴格的要求。新加坡和印尼的類似措施將使跨國供應鏈更加複雜,因為它們需要應對不同的合規期限。

細分市場分析

至2024年,塑膠將佔亞太地區嬰幼兒食品包裝市場收入的46.7%。然而,在泰國投資促進政策和跨國品牌承諾實現碳中和的推動下,生質塑膠預計到2030年將以18.4%的複合年成長率成長。隨著NatureWorks和SKC等公司的產能縮小與石油基聚合物的成本差距,生質塑膠有望成為亞太地區嬰幼兒食品包裝市場規模成長最快的組成部分。泰國和越南的政府補貼降低了資本門檻,而生物基PLA和PBAT薄膜的加工性能得到提升,其耐熱性和密封性能可與傳統軟塑膠媲美。

在一些新興國家,價格敏感度仍然限制了可堆肥包裝的普及,但高階品牌和有機嬰幼兒食品品牌正將可堆肥包裝作為其品牌故事的一部分。玻璃罐常用於高階禮品包裝,但其重量和易碎性使其在電商領域競爭力下降。金屬罐的需求正逐漸被更輕的阻隔複合材料所取代。紙板,通常與生物阻隔塗層結合使用,在高階二次包裝領域仍佔有一席之地。

預計到2024年,袋裝產品將佔亞太地區嬰幼兒食品包裝市場的33%,複合年成長率將達到15.9%,主要得益於吸嘴式設計能夠幫助嬰兒自主進食。因此,在亞太地區嬰幼兒食品包裝領域,袋裝產品的成長速度超過了硬質包裝。雖然寶特瓶仍然是即飲配方奶粉的重要包裝選擇,但SIG和利樂等品牌的包裝系統如今面臨著來自碳足跡更低的單一材料軟包裝容器的競爭。由於重量問題,金屬罐的貨架吸引力正在下降,而倉儲式超市也擴大用具有類似阻隔性能的立式袋來替代金屬罐。

製造商看重包裝袋的物流優勢。零售商可以提高貨架陳列密度,提升銷售率,因為消費者更喜歡輕便的包裝形式。在印尼和菲律賓,小袋包裝仍然是一種經濟實惠的選擇,因為永續性的考慮。玻璃罐仍然是高階有機食物泥的理想包裝,但擴大採用輕質PET材料而非玻璃。

亞太地區嬰兒食品包裝市場報告按材料(塑膠、紙板、金屬、玻璃、生質塑膠)、包裝類型(瓶子、金屬罐、紙盒、其他)、產品類型(乾嬰兒食品、液態奶、奶粉、其他)、年齡層(0-6 個月、6-12 個月、1-2 歲、2-3 歲)、分銷通路(0-6 個月、6-12 個月、1-2 歲、2-3 歲)、分銷通路(超級市場/大賣場)、其他地區進行市場細分市場。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 包裝嬰兒食品和嬰兒奶粉的需求不斷成長

- 都市區雙薪家庭數量增加

- 有組織的零售和電子商務的擴張

- 轉向以品牌主導的便利商店小袋包裝形式

- 政府對生物基包裝生產線的補貼

- 投資於內部軟性加工能力的原始設備製造商

- 市場限制

- 嚴格禁止使用一次性塑膠製品

- 食品級樹脂價格波動

- 不同文化對自製嬰兒食品的偏好

- 東南亞新興經濟體的回收基礎設施缺口

- 永續發展趨勢

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 材料

- 塑膠

- 紙板

- 金屬

- 玻璃

- 生質塑膠

- 按包裝類型

- 瓶子

- 金屬罐

- 紙盒

- 瓶子

- 其他

- 依產品

- 嬰兒乾糧

- 液體配方

- 粉狀配方

- 零食和手指食品

- 其他

- 按年齡層

- 0-6個月

- 6-12個月

- 1-2歲

- 2-3歲

- 透過分銷管道

- 超級市場/大賣場

- 便利商店

- 藥房和藥品商店

- 線上零售

- 其他

- 按國家/地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 泰國

- 馬來西亞

- 亞太其他地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amcor PLC

- Huhtamaki Oyj

- Berry Global Inc.

- Aptar Group Inc.

- Winpak Ltd.

- Tetra Laval

- Constantia Flexibles

- Uflex Ltd.

- DS Smith Plc

- Ball Corporation

- Mondi Group

- SIG Combibloc

- Sealed Air Corp.

- Toyo Seikan Group

- Sonoco Products Co.

- Gualapack SpA

- ProAmpac LLC

- Takigawa Corporation

- Visy Industries

- Nihon Yamamura Glass Co.

- Shenzhen Beauty Star Co.

第7章 市場機會與未來展望

The APAC Baby Food Packaging Market size is estimated at USD 7.71 billion in 2025, and is expected to reach USD 13.53 billion by 2030, at a CAGR of 11.90% during the forecast period (2025-2030).

This expansion reflects the region's demographic momentum, strong urbanization and the growing preference for premium infant nutrition. Rising birth registrations during China's Year of the Dragon lifted super-premium infant formula sales by 44.3%, while H&H Group captured 15.6% share of that price tier. Material innovation is another growth catalyst. Plastic retained 46.7% revenue share in 2024, yet bioplastics are climbing fastest at 18.4% CAGR, supported by NatureWorks' USD 600 million Ingeo PLA complex in Thailand scheduled for 2025. Convenience-led pouches already hold 33% share and are growing at 15.9% CAGR, reshaping packaging line investments and retail shelf layouts. Geographic concentration remains evident as China commands 35% share, while India is registering the quickest 14% CAGR through 2030. E-commerce sales of baby food packaging accelerate at 19.4% CAGR, forcing a pivot toward shipping-robust, lighter formats that minimize breakage and dimensional weight.

APAC Baby Food Packaging Market Trends and Insights

Growing demand for packaged baby food and infant formula

China's infant formula segment stayed resilient in 2024 as foreign brands logged 8% sales growth, with the super-premium tier securing 37% share. Parents in urban APAC favor products that guarantee safety, extended shelf life and superior nutrition, prompting demand for multi-layer barrier films and premium finishes. Generational wealth transfer brings millennial purchasing power that privileges convenience and perceived quality over homemade alternatives. Urban-rural divides remain, yet metropolitan centers have become high-density demand clusters.

Rising dual-income urban households

Households with two earners value packaging that supports hectic routines. Spouted pouches enable on-the-go feeding, easy resealability and reduced mess, aligning with parental expectations. Affluence in South Korea and Singapore accelerates adoption of premium, portion-controlled packs, while Vietnam and Indonesia are beginning to mirror the trend as female labor participation rises. Brands are therefore prioritizing ergonomic shapes, soft-touch laminates and quick-open closures suitable for one-hand use.

Stringent bans on single-use plastics

India mandates 30% recycled content by 2025 in many rigid categories, forcing accelerated R&D and qualification cycles. Producers face added costs for certified PCR resin and tighter specifications on migration and odor. Parallel measures in Singapore and Indonesia add complexity for multinational supply chains that must juggle differing compliance deadlines.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of organised retail and e-commerce

- Brand-led shift toward convenience pouch formats

- Volatility in food-grade resin pricing

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Plastic dominated the APAC baby food packaging market in 2024 with 46.7% revenue share. Bioplastics, however, are charting an 18.4% CAGR to 2030, supported by Thailand's pro-investment regime and multinational brand pledges on carbon neutrality. The APAC baby food packaging market size for bioplastics is expected to grow the fastest as capacity from NatureWorks and SKC reduces cost differentials with petro-based polymers. Government subsidies in Thailand and Vietnam lower capital thresholds, while improved processability allows bio-based PLA and PBAT films to match heat resistance and sealing integrity of conventional flexibles.

Price sensitivity still limits uptake in several emerging economies, yet premium and organic baby food brands are using compostable packs as a brand story. Glass maintains relevance in luxury gifting, yet its weight and fragility reduce competitiveness in e-commerce. Metal can demand is retreating in favor of lighter barrier laminates. Paperboard, often coupled with bio-barrier coatings, retains a niche for premium secondary packs.

Pouches held 33% share of the APAC baby food packaging market in 2024. They are forecast to expand at 15.9% CAGR, propelled by spouted designs that support independent toddler feeding. The APAC baby food packaging market size for pouches is therefore widening more quickly than rigid formats. Bottles stay important for ready-to-drink formula, but SIG and Tetra systems now compete with mono-material flexibles that claim lower carbon footprints. Metal cans are losing shelf appeal due to weight penalties and are being displaced in club stores by stand-up pouches with fitments that offer similar barrier levels.

Manufacturers appreciate the logistics benefits of pouches, which reduce inbound freight volumes and warehouse space. Retailers gain faced-up shelf density and improved sell-through as consumers embrace the lighter format. Sachets remain a cost-effective option in Indonesia and the Philippines, where single-use affordability trumps sustainability concerns. Jars persist for premium organic purees but are trending toward lightweight PET rather than glass.

APAC Baby Food Packaging Market Report is Segmented by Material (Plastic, Paperboard, Metal, Glass, Bioplastics), Package Type (Bottles, Metal Cans, Cartons, and More), Product (Dried Baby Food, Liquid Milk Formula, Powder Milk Formula and More), Age Group (0-6 Months, 6-12 Months, 1-2 Years, 2-3 Years), Distribution Channel (Supermarkets/Hypermarkets, Convenience Stores and More), and Geography.

List of Companies Covered in this Report:

- Amcor PLC

- Huhtamaki Oyj

- Berry Global Inc.

- Aptar Group Inc.

- Winpak Ltd.

- Tetra Laval

- Constantia Flexibles

- Uflex Ltd.

- DS Smith Plc

- Ball Corporation

- Mondi Group

- SIG Combibloc

- Sealed Air Corp.

- Toyo Seikan Group

- Sonoco Products Co.

- Gualapack SpA

- ProAmpac LLC

- Takigawa Corporation

- Visy Industries

- Nihon Yamamura Glass Co.

- Shenzhen Beauty Star Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing demand for packaged baby food and infant formula

- 4.2.2 Rising dual-income urban households

- 4.2.3 Expansion of organised retail and e-commerce

- 4.2.4 Brand-led shift toward convenience pouch formats

- 4.2.5 Government subsidies for bio-based packaging lines

- 4.2.6 OEM investment in in-house flexible converting capacity

- 4.3 Market Restraints

- 4.3.1 Stringent bans on single-use plastics

- 4.3.2 Volatility in food-grade resin pricing

- 4.3.3 Cultural preference for home-cooked baby food

- 4.3.4 Recycling-infrastructure gaps across emerging SE-Asian economies

- 4.4 Sustainability Trends

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material

- 5.1.1 Plastic

- 5.1.2 Paperboard

- 5.1.3 Metal

- 5.1.4 Glass

- 5.1.5 Bioplastics

- 5.2 By Package Type

- 5.2.1 Bottles

- 5.2.2 Metal Cans

- 5.2.3 Cartons

- 5.2.4 Jars

- 5.2.5 Others

- 5.3 By Product

- 5.3.1 Dried Baby Food

- 5.3.2 Liquid Milk Formula

- 5.3.3 Powder Milk Formula

- 5.3.4 Snacks and Finger Foods

- 5.3.5 Others

- 5.4 By Age Group

- 5.4.1 0-6 Months

- 5.4.2 6-12 Months

- 5.4.3 1-2 Years

- 5.4.4 2-3 Years

- 5.5 By Distribution Channel

- 5.5.1 Supermarkets / Hypermarkets

- 5.5.2 Convenience Stores

- 5.5.3 Pharmacies and Drugstores

- 5.5.4 Online Retail

- 5.5.5 Others

- 5.6 By Country

- 5.6.1 China

- 5.6.2 India

- 5.6.3 Japan

- 5.6.4 South Korea

- 5.6.5 Indonesia

- 5.6.6 Thailand

- 5.6.7 Malaysia

- 5.6.8 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Amcor PLC

- 6.4.2 Huhtamaki Oyj

- 6.4.3 Berry Global Inc.

- 6.4.4 Aptar Group Inc.

- 6.4.5 Winpak Ltd.

- 6.4.6 Tetra Laval

- 6.4.7 Constantia Flexibles

- 6.4.8 Uflex Ltd.

- 6.4.9 DS Smith Plc

- 6.4.10 Ball Corporation

- 6.4.11 Mondi Group

- 6.4.12 SIG Combibloc

- 6.4.13 Sealed Air Corp.

- 6.4.14 Toyo Seikan Group

- 6.4.15 Sonoco Products Co.

- 6.4.16 Gualapack SpA

- 6.4.17 ProAmpac LLC

- 6.4.18 Takigawa Corporation

- 6.4.19 Visy Industries

- 6.4.20 Nihon Yamamura Glass Co.

- 6.4.21 Shenzhen Beauty Star Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment