|

市場調查報告書

商品編碼

1851469

相變材料:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Phase Change Materials - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

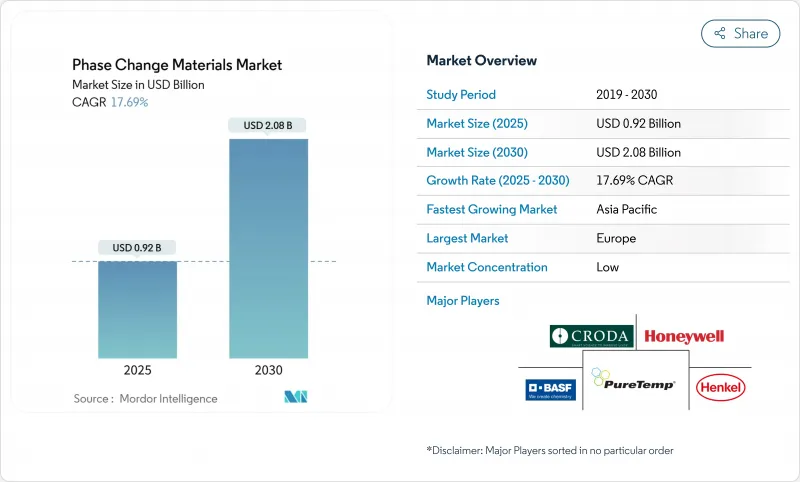

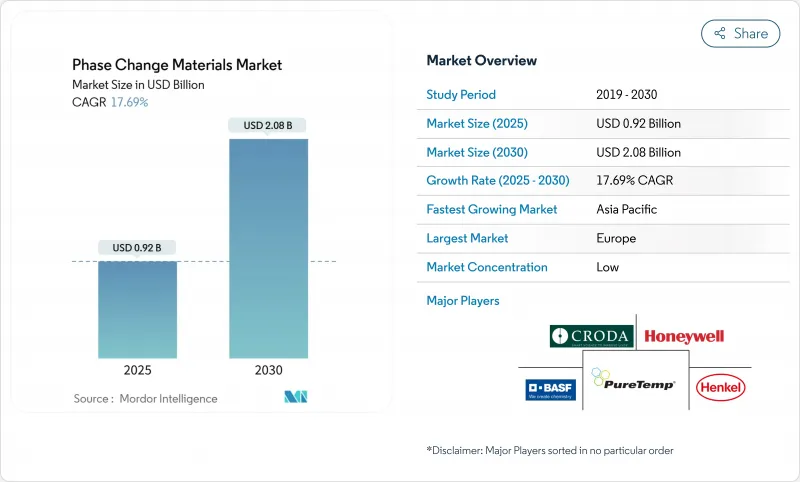

相變材料市場規模預計到 2025 年將達到 9.2 億美元,預計到 2030 年將達到 20.8 億美元,在預測期(2025-2030 年)內複合年成長率為 17.69%。

持續高溫、淨零排放建築目標以及交通運輸的快速電氣化,使得潛熱儲存成為商業能源策略的核心。低溫運輸物流和電動車電池組也正在拓展這項技術的應用範圍,涵蓋交通運輸、製藥和資料中心冷卻等領域。鹽水合物長期以來受限於相分離和過冷問題,但隨著近期導電性能的突破,其應用前景日益廣闊。同時,源自農業廢棄物的生物基相變材料在不犧牲熱容量的前提下,解決了防火安全和永續性問題,正從實驗室研究走向可規模化商業化產品。在亞太地區,高純度鹽水合物正成為產能擴張的關鍵,製造商紛紛增設本地生產線以規避相關的供應鏈風險。

全球相變材料市場趨勢與洞察

強制性建築節能規範加速了相變材料(PCM)的整合

基於性能的合規標準允許建築師以潛熱儲存層替代剛性隔熱材料,從而將輕質牆體的峰值冷卻負荷降低35%至45%。明尼蘇達州的測量結果顯示,室內高峰溫度降低了攝氏5.49度,並且77.8%的負荷轉移到了非尖峰時段,這為監管機構提供了暖通空調系統節能的實際證據。預計為實現歐盟2027年維修目標,更高的合規基準值將更加重視相變材料填充的石膏板和混凝土塊,從而增加整個相變材料市場的採購量。

低溫運輸物流基礎設施快速發展

疫苗、先進生技藥品和精準肉類通常需要溫度範圍在三天內僅能承受±0.5°C偏差的溫度區域。相變材料(PCM)無需外部電源即可將這種耐受性延長至72小時,從而減少機場和海關延誤期間對柴油發電機的依賴。與主動冷卻相比,甘油-水-氯化鈉混合物可減少30-40%的碳排放,並將藥品保存期限延長15-25%,推動相變材料市場出現兩位數成長。

相變材料的危險特性

石蠟的燃點約為170 度C,需要使用溴化阻燃劑,這會增加成本,並可能引發健康標籤法規的限制。無機阻燃劑,例如硝酸鋰(LiNO3),則有毒性風險。近年來,原位聚合的固體-固體材料(PCM)無需鹵素即可消除洩漏並達到UL94 V-0阻燃標準。其更廣泛的應用取決於封裝技術的進步以及全球化學品安全標準的統一。

細分市場分析

有機石蠟仍將是相變材料市場的主要收入來源,預計2024年將佔全球收入的44.19%。其市場主導地位源自於其成熟的供應鏈、寬廣的溫度範圍以及與建築板材中使用的大分子膠囊化板材的兼容性。然而,隨著相關人員尋求減少生命週期排放,相變材料市場正迅速轉向生物基油、牛油和脂肪酸混合物。在LEED認證積分和政府綠色採購政策的推動下,這個新興細分市場預計將以19.21%的複合年成長率成長,到2030年將超越競爭對手,這些政策明確支持生物來源材料。

由於石蠟基配方具有穩定的結晶性和易於調節的0-90°C熔點範圍,預計到2024年將佔據相變材料市場收入的41.49%。然而,鹽水合物有望崩壞這一格局,預計到2030年將以18.04%的複合年成長率成長。鹽水合物具有高體積比熱容(高達350 kJ/L)以及碳添加劑帶來的導熱性提升,因此能夠減少組件的尺寸和重量。由此帶來的密度優勢對於電動車電池套管和空間有限的緊湊型資料中心機架尤為重要。

區域分析

2024年,歐洲將佔全球銷售額的32.86%,這主要得益於歐盟《建築能源性能指令》(EPBD),該指令強制要求新建建築和大型維修均達到接近淨零能耗的目標。德國和斯堪的納維亞半島的先驅已證明,將相變材料(PCM)應用於外牆隔熱系統後,暖通空調(HVAC)的能耗可降低20%至35%。碳排放交易和綠色債券合格的監管政策日益明朗,持續吸引資金流入富含相變材料的建築材料領域,鞏固了歐洲在相變材料市場的主導地位。

亞太地區是成長最快的地區,預計到 2030 年將以每年 18.98% 的速度成長。中國積極部署熱泵,透過節約用電高峰期的電力需求,與 PCM 儲熱技術相輔相成,並在「熱泵的未來」藍圖的指導下,鼓勵協同效應。

在北美,嚴格的能源監管更新和電動汽車行業的蓬勃發展,促使美國資料中心營運商試行基於 PCM 的熱感緩衝器,以吸收伺服器中的熱峰值並推遲冷卻器啟動,從而利用現場儲能的稅額扣抵抵免。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐洲和美國強制性的建築節能標準將加速相變材料(PCM)的整合。

- 低溫運輸物流基礎設施快速發展

- 車輛電氣化需要採用鹽水合物相變材料的先進熱電池組。

- 政府對淨零排放建築的獎勵措施,以鼓勵採用生物基相變材料

- 全球日益成長的節能和永續發展趨勢

- 市場限制

- 相變材料的危險性

- 高純度水合鹽供應鏈的變異性

- 認知和理解有限

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

- 原料分析

- 專利分析

第5章 市場規模與成長預測

- 依產品類型

- 有機的

- 無機物

- 生物基

- 按化學成分

- 石蠟

- 非烷烴

- 鹽水合物

- 共晶體

- 透過封裝技術

- 大分子膠囊化

- 微膠囊化

- 分子封裝

- 按最終用戶行業分類

- 建築/施工

- 包裹

- 紡織品

- 電子學

- 運輸

- 其他產業(醫療保健、國防)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、合資、聯盟、資金籌措)

- 市佔率(%)/排名分析

- 公司簡介

- BASF

- Appvion, LLC.

- Climator

- Croda International Plc

- Cryopak

- DuPont

- Henkel AG & Co. KGaA

- Honeywell International Inc.

- Laird Technologies, Inc.

- Microtek

- National Gypsum Services Company

- Outlast Technologies GmbH

- Parker Hannifin Corp

- Phase Change Solutions

- Pluss Advanced Technologies

- PureTemp LLC

- Rubitherm Technologies GmbH

- Shenzhen Aochuan Technology Co.,Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Sonoco Products Company

第7章 市場機會與未來展望

The Phase Change Materials Market size is estimated at USD 0.92 billion in 2025, and is expected to reach USD 2.08 billion by 2030, at a CAGR of 17.69% during the forecast period (2025-2030).

Lengthening heat waves, net-zero construction goals, and rapid electrification in transport now place latent-heat storage at the center of commercial energy strategies. Mandatory building-energy codes in Europe and North America are accelerating integration, while cold-chain logistics and electric-vehicle battery packs expand the technology's reach into transportation, pharmaceuticals, and data-center cooling. Longly constrained by phase-separation and supercooling issues, salt hydrates are gaining traction after recent conductivity breakthroughs. At the same time, bio-based PCMs derived from agricultural residues have moved from laboratory curiosity to scalable commercial products, addressing fire safety and sustainability concerns without sacrificing thermal capacity. Regionally, Asia-Pacific is evolving into the fulcrum for capacity additions as manufacturers add local production lines to hedge supply-chain risk linked to high-purity salt hydrates.

Global Phase Change Materials Market Trends and Insights

Mandatory Building-Energy Codes Accelerating PCM Integration

Performance-based compliance criteria now allow architects to substitute rigid insulation with latent-heat storage layers, unlocking a 35-45% reduction in peak cooling loads within lightweight walls. Measured field results in Minnesota reported a 5.49 °C drop in peak indoor temperature plus a 77.8% load shift toward off-peak hours, providing regulators with real-world evidence of HVAC savings. Rising compliance thresholds for 2027 EU renovation targets are expected to place additional emphasis on PCM-infused gypsum boards and concrete blocks, thereby lifting procurement volumes across the Phase Change Material market.

Rapid Deployment of Cold-Chain Logistics Infrastructure

Vaccines, advanced biologics, and precision meats require temperature bands that often tolerate a +-0.5 °C deviation for less than three days. PCMs extend that holdover to 72 hours without external power, cutting diesel-generator reliance during airport or customs delays. Glycerol-water-NaCl blends slash carbon footprints 30-40% versus active cooling and lift pharmaceutical shelf life by 15-25%, feeding double-digit demand across the Phase Change Material market.

Hazardous Nature of Phase Change Materials

Paraffin waxes ignite at roughly 170 °C and require brominated flame retardants that add cost and can trigger health-labeling restrictions. Inorganic candidates such as LiNO3 present toxicity risks. Recent in-situ polymerized solid-solid PCMs eliminate leakage, passing UL94 V-0 flammability without halogens. Broader adoption hinges on scaling these encapsulation advances and harmonizing global chemical safety standards.

Other drivers and restraints analyzed in the detailed report include:

- Electrification of Vehicles Necessitating Advanced Thermal Battery Packs

- Government Incentives for Net-Zero Buildings Propelling Bio-Based PCM Adoption

- Supply-Chain Volatility of High-Purity Salt Hydrates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Organic paraffin waxes remain the revenue anchor for the Phase Change Material market, accounting for 44.19% of global sales in 2024. Their dominance reflects mature supply chains, broad temperature coverage, and compatibility with macro-encapsulation slabs used in building panels. Yet the Phase Change Material market is witnessing a sharp pivot toward bio-derived oils, tallow, and fatty-acid blends as stakeholders chase lower life-cycle emissions. The emergent sub-segment is forecast to outpace all others at 19.21% CAGR to 2030, buoyed by LEED credits and municipal green-procurement mandates that explicitly endorse biogenic materials.

Paraffin-based formulations captured 41.49% of the Phase Change Material market revenue in 2024 due to their stable crystallization and ease of tailoring melting points across the 0-90 °C spectrum. Even so, salt hydrates are on course to disrupt that hierarchy, expanding at an 18.04% CAGR through 2030. High volumetric heat capacity (up to 350 kJ/L) and thermal conductivity improvements via carbon additives are allowing salt hydrates to shrink component size and weight. The resulting density advantage is especially attractive for electric-vehicle battery sleeves and compact data-center racks, where available footprint is constrained.

The Phase Change Material Market Report Segments the Industry by Product Type (Organic, Inorganic, and Bio-Based), Chemical Composition (Paraffin, Non-Paraffin Hydrocarbons, and More), Encapsulation Technology (Macro-Encapsulation, and More), End-User Industry (Building and Construction, Packaging, Textiles, Electronics, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle-East and Africa).

Geography Analysis

Europe held 32.86% of global sales in 2024, underpinned by the EU's Energy Performance of Buildings Directive, which compels both new construction and deep-renovation projects to hit quasi-net-zero targets. Early adopters in Germany and the Nordics have shown 20-35% HVAC energy savings after embedding PCMs into external wall insulation systems. Regulatory clarity around carbon trading and green-bond eligibility continues to draw capital toward PCM-rich building materials, consolidating Europe's leadership position in the Phase Change Material market.

Asia-Pacific is the fastest-growing region, anticipated to expand 18.98% annually through 2030. China's aggressive heat-pump rollout complements PCM thermal storage by shaving peak electricity demand, a synergy encouraged under the "Future of Heat Pumps" roadmap.

North America combines stringent energy-code updates with an exploding electric-vehicle sector. Data-center operators in the United States, drawn by tax credits for on-site energy storage, pilot PCM-based thermal buffers to absorb server heat spikes and postpone chiller start-up.

- BASF

- Appvion, LLC.

- Climator

- Croda International Plc

- Cryopak

- DuPont

- Henkel AG & Co. KGaA

- Honeywell International Inc.

- Laird Technologies, Inc.

- Microtek

- National Gypsum Services Company

- Outlast Technologies GmbH

- Parker Hannifin Corp

- Phase Change Solutions

- Pluss Advanced Technologies

- PureTemp LLC

- Rubitherm Technologies GmbH

- Shenzhen Aochuan Technology Co.,Ltd.

- Shin-Etsu Chemical Co., Ltd.

- Sonoco Products Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Mandatory Building-Energy Codes in Europe and North America Accelerating PCM Integration

- 4.2.2 Rapid Deployment of Cold-Chain Logistics Infrastructure

- 4.2.3 Electrification of Vehicles Necessitating Advanced Thermal Battery Packs Using Salt-Hydrate PCMs

- 4.2.4 Government Incentives for Net-Zero Buildings Propelling Bio-based PCM Adoption

- 4.2.5 Expanding Global Trend Towards Energy Conservation and Sustainable Development

- 4.3 Market Restraints

- 4.3.1 Hazardous Nature of Phase Change Materials

- 4.3.2 Supply-Chain Volatility of High-Purity Salt Hydrates

- 4.3.3 Limited Awareness and Understanding

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

- 4.6 Raw-Material Analysis

- 4.7 Patent Analysis

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Organic

- 5.1.2 Inorganic

- 5.1.3 Bio-based

- 5.2 By Chemical Composition

- 5.2.1 Paraffin

- 5.2.2 Non-Paraffin Hydrocarbons

- 5.2.3 Salt Hydrates

- 5.2.4 Eutectics

- 5.3 By Encapsulation Technology

- 5.3.1 Macro-encapsulation

- 5.3.2 Micro-encapsulation

- 5.3.3 Molecular Encapsulation

- 5.4 By End-user Industry

- 5.4.1 Building and Construction

- 5.4.2 Packaging

- 5.4.3 Textiles

- 5.4.4 Electronics

- 5.4.5 Transportation

- 5.4.6 Other Industries (Healthcare, Defense)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle-East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (Mergers and Acquistions, JV, Collaboration, Funding)

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, and Recent Developments)}

- 6.4.1 BASF

- 6.4.2 Appvion, LLC.

- 6.4.3 Climator

- 6.4.4 Croda International Plc

- 6.4.5 Cryopak

- 6.4.6 DuPont

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 Honeywell International Inc.

- 6.4.9 Laird Technologies, Inc.

- 6.4.10 Microtek

- 6.4.11 National Gypsum Services Company

- 6.4.12 Outlast Technologies GmbH

- 6.4.13 Parker Hannifin Corp

- 6.4.14 Phase Change Solutions

- 6.4.15 Pluss Advanced Technologies

- 6.4.16 PureTemp LLC

- 6.4.17 Rubitherm Technologies GmbH

- 6.4.18 Shenzhen Aochuan Technology Co.,Ltd.

- 6.4.19 Shin-Etsu Chemical Co., Ltd.

- 6.4.20 Sonoco Products Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Development of Phase Change Thermal Interface Material