|

市場調查報告書

商品編碼

1858799

熱管理領域相變材料市場機會、成長促進因素、產業趨勢分析及預測(2025-2034年)Phase Change Materials in Thermal Management Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

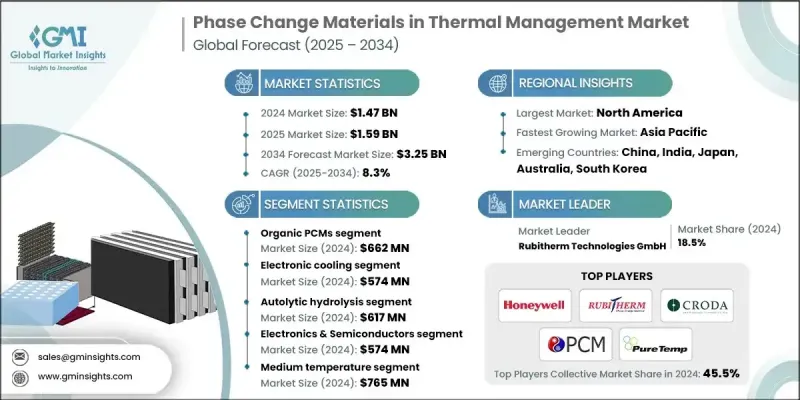

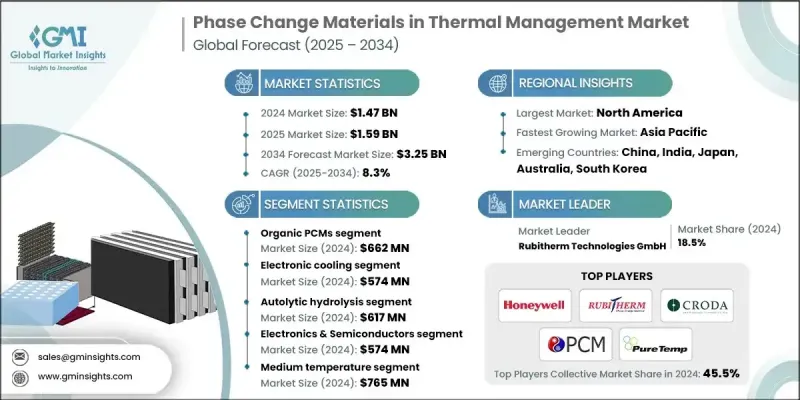

2024 年全球熱管理相變材料市場價值為 14.7 億美元,預計到 2034 年將以 8.3% 的複合年成長率成長至 32.5 億美元。

市場專注於開發和應用能夠在熔化或凝固等狀態變化過程中儲存、吸收和釋放熱能的材料。這些材料廣泛應用於電子、汽車和建築等領域,有助於調節溫度並提高能源效率。各行業對高效熱控制日益成長的需求是相變材料(PCM)技術的主要成長動力。全球對高性能熱調節系統的需求不斷成長,這些系統能夠支援更小巧、更強大的電子設備、永續建築和先進的汽車系統。奈米增強型PCM和微膠囊化等創新技術顯著提高了材料的耐久性、導熱性和整合潛力,從而改善了傳熱性能和生命週期性能。這些改進使PCM更具吸引力,可用於印刷電路板、電池、散熱器等設備的整合,從而在對熱要求極高的應用領域得到更廣泛的應用。市場成長反映了人們向更智慧的能源利用和更最佳化的熱管理邁進的趨勢。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 14.7億美元 |

| 預測值 | 32.5億美元 |

| 複合年成長率 | 8.3% |

2024年,有機相變材料(PCM)市場規模預計將達到6.62億美元。其強勁的市場地位源自於其可靠的熱性能、優異的潛熱儲存能力和長期的化學穩定性,這些特性對於電子元件冷卻和建築熱調節等領域至關重要。石蠟基相變材料因其熔點範圍寬廣而被廣泛應用,而脂肪酸和醇基相變材料則因其在汽車和電子應用中的循環穩定性而備受關注,這些應用需要反覆進行相變而不發生材料分解。

2024年,電子冷卻領域市場規模預計將達到5.74億美元,反映出控制緊湊型高密度設備產生的熱量的壓力日益增大。隨著設備尺寸縮小和功耗增加,控制熱峰值和維持安全的工作溫度變得至關重要。微封裝相變材料(PCM)專為電子組件應用而設計,可無縫整合到對熱敏感的系統中,而不會影響結構完整性或電氣性能。

2024年,美國相變材料(PCM)在熱管理領域的市場規模達到3.78億美元。這一領先地位歸功於美國強大的工業實力以及政府支持的旨在提高建築和製造業效率的能源計劃。鼓勵永續建築實踐和採用先進節能技術的政策,為PCM的市場發展奠定了堅實的基礎。此外,美國先進的汽車和電子產業也不斷尋求新的熱調節解決方案,進一步推動了PCM的應用。

全球相變材料熱管理市場主要的活躍企業包括:Cryopak Industries Inc.、Sonoco ThermoSafe、Climate Change Materials、AeroSafe Global、Pelican BioThermal、Rubitherm Technologies GmbH、Pluss Advanced Technologies Pvt. Ltd.、Cold Chain Technologies、Entropy Solutions Inc./PureTemp LLC、Cowabt. Ltd.、Cold Chain Technologies. Inc.、va-Q-tec、Salca BV、Outlast Technologies LLC、Datum Phase Change、PCM Energy Pvt. Ltd./Teappcm、Nanolope、Phase Change Material Products Limited (PlusICE)、Advanced Cooling Technologies Inc.、Mesa Laboratories Inc。 Plc。這些企業正採取一系列策略來擴大市場佔有率並保持競爭力。許多企業正投資研發奈米增強型或生物基相變材料等先進配方,以提高導熱性、減少環境影響並增強循環耐久性。與電子和汽車原始設備製造商 (OEM) 的策略合作,使得相變材料解決方案更容易整合到高性能系統中。此外,領先的製造商正在擴大產能並實現生產自動化,以滿足日益成長的全球需求。

目錄

第1章:方法論與範圍

第2章:執行概要

第3章:行業洞察

- 產業生態系分析

- 供應商格局

- 利潤率

- 每個階段的價值增加

- 影響價值鏈的因素

- 中斷

- 產業影響因素

- 成長促進因素

- 電子產品小型化所帶來的需求不斷成長

- 電動汽車熱管理領域的成長

- 技術進步提升了相變材料(PCM)的性能

- 專注於建築物的能源效率

- 產業陷阱與挑戰

- 高昂的生產和整合成本

- 材料穩定性與生命週期問題

- 市場機遇

- 電動汽車應用領域的擴展

- 融入再生能源系統

- 智慧建築材料的進步

- 成長潛力分析

- 監管環境

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL 分析

- 技術與創新格局

- 當前技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 依材料類型

- 未來市場趨勢

- 專利格局

- 貿易統計(HS編碼)(註:僅提供重點國家的貿易統計資料)

- 主要進口國

- 主要出口國

- 永續性和環境方面

- 永續實踐

- 減少廢棄物策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 按地區

- 公司矩陣分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 關鍵進展

- 併購

- 合作夥伴關係與合作

- 新產品發布

- 擴張計劃

第5章:市場估算與預測:依材料類型分類,2021-2034年

- 主要趨勢

- 有機相變材料

- 石蠟

- 脂肪酸

- 非石蠟有機物

- 無機相變材料

- 鹽水合物

- 金屬合金

- 共晶鹽

- 生物基相變材料

- 植物性化合物

- 天然脂肪酸

- 複合型和增強型相變材料

- 奈米增強型

- 石墨增強型

- 金屬泡沫複合材料

第6章:市場估算與預測:依應用領域分類,2021-2034年

- 主要趨勢

- 建築施工

- 暖通空調系統

- 牆板和石膏

- 混凝土及結構

- 隔熱與建築

- 電子冷卻

- 半導體熱學

- 資料中心冷卻

- 消費性電子產品

- 電力電子冷卻

- 電池熱

- 電動汽車電池

- 電網儲能

- 攜帶式設備電池

- 汽車

- 引擎熱

- 客艙舒適度

- 電動汽車熱管理

- 紡織品和穿戴式設備

- 冷鏈與物流

第7章:市場估計與預測:依外型尺寸分類,2021-2034年

- 主要趨勢

- 散裝及原料相變材料

- 微膠囊化

- 聚合物殼封裝

- 無機殼封裝

- 宏觀封裝

- 基於容器的

- 面板和管

- 形狀穩定

- 多孔支撐體

- 複合基體

第8章:市場估算與預測:依最終用途產業分類,2021-2034年

- 主要趨勢

- 建築材料

- 電子與半導體

- 汽車與運輸

- 能源與公用事業

- 航太與國防

- 醫療保健與製藥

第9章:市場估計與預測:依溫度範圍分類,2021-2034年

- 主要趨勢

- 低溫相變材料(-50°C 至 15°C)

- 舒適範圍相變材料(15°C 至 32°C)

- 中溫相變材料(32°C 至 100°C)

- 高溫相變材料(100°C 至 800°C)

第10章:市場估計與預測:依地區分類,2021-2034年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 歐洲其他地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 亞太其他地區

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地區

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

- 中東和非洲其他地區

第11章:公司簡介

- AeroSafe Global

- Advanced Cooling Technologies Inc.

- Axiotherm GmbH

- Climator Sweden AB

- Climate Change Materials

- Cold Chain Technologies

- Croda International Plc

- Cowa Thermal Solutions

- Datum Phase Change

- Entropy Solutions Inc./PureTemp LLC

- Honeywell International Inc.

- i-TES

- Microtek Laboratories Inc.

- Mesa Laboratories Inc.

- Nanolope

- Outlast Technologies LLC

- Pelican BioThermal

- Phase Change Energy Solutions

- Phase Change Material Products Limited (PlusICE)

- Pluss Advanced Technologies Pvt. Ltd.

- PCM Energy Pvt. Ltd./Teappcm

- Rubitherm Technologies GmbH

- Salca BV

- Sonoco ThermoSafe

- Sunamp

- Tetramer Technologies

- va-Q-tec

- Cryopak Industries Inc.

The Global Phase Change Materials in Thermal Management Market was valued at USD 1.47 billion in 2024 and is estimated to grow at a CAGR of 8.3% to reach USD 3.25 billion by 2034.

The market focuses on the development and deployment of materials capable of storing, absorbing, and releasing thermal energy during state changes such as melting or solidifying. These materials are widely applied in sectors like electronics, automotive, and buildings, helping regulate temperature while improving energy efficiency. The increasing need for efficient thermal control across industries is a major growth driver for PCM technologies. Global demand is rising for high-performance thermal regulation systems that support smaller, more powerful electronic devices, sustainable buildings, and advanced automotive systems. Innovations like nano-enhanced PCMs and microencapsulation have significantly boosted durability, thermal conductivity, and integration potential, improving heat transfer and lifecycle performance. These improvements have made PCMs more attractive for integration in printed circuit boards, batteries, heat sinks, and more, enabling wider adoption across thermal-critical applications. The market's growth reflects the broader push toward smarter energy use and optimized heat management.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $1.47 Billion |

| Forecast Value | $3.25 Billion |

| CAGR | 8.3% |

The organic PCMs segment generated USD 662 million in 2024. Their strong position comes from their reliable thermal characteristics, excellent latent heat storage capacity, and long-term chemical stability, all of which are essential in areas like electronic component cooling and thermal regulation in buildings. Paraffin-based PCMs are widely used due to their broad melting point range, while fatty acids and alcohol-based PCMs are gaining recognition for their cycling stability in automotive and electronics applications that demand repetitive phase transitions without material breakdown.

The electronics cooling segment generated USD 574 million in 2024, reflecting the increasing pressure to manage heat generated by compact, high-density devices. As devices shrink and power demands rise, managing heat spikes and maintaining safe operational temperatures becomes essential. Microencapsulated PCMs are tailored for use within electronic assemblies, offering seamless integration into heat-sensitive systems without compromising structural integrity or electrical performance.

US Phase Change Materials in Thermal Management Market generated USD 378 million in 2024. This leadership is attributed to strong industrial capabilities and government-backed energy initiatives aimed at improving efficiency in construction and manufacturing. Policies encouraging sustainable building practices and the adoption of advanced energy-saving technologies have given PCMs a significant foothold. Additionally, the country's advanced automotive and electronics sectors consistently seek out new solutions for thermal regulation, further driving PCM adoption.

Top companies active in the Global Phase Change Materials in Thermal Management Market are Cryopak Industries Inc., Sonoco ThermoSafe, Climate Change Materials, AeroSafe Global, Pelican BioThermal, Rubitherm Technologies GmbH, Pluss Advanced Technologies Pvt. Ltd., Cold Chain Technologies, Entropy Solutions Inc./PureTemp LLC, Cowa Thermal Solutions, Tetramer Technologies, Microtek Laboratories Inc., va-Q-tec, Salca BV, Outlast Technologies LLC, Datum Phase Change, PCM Energy Pvt. Ltd./Teappcm, Nanolope, Phase Change Material Products Limited (PlusICE), Advanced Cooling Technologies Inc., Mesa Laboratories Inc., Phase Change Energy Solutions, i-TES, Honeywell International Inc., Climator Sweden AB, Axiotherm GmbH, and Croda International Plc. Companies in the Phase Change Materials in Thermal Management Market are adopting a range of strategies to expand their market reach and stay competitive. Many are investing in advanced formulations such as nano-enhanced or bio-based PCMs to improve thermal conductivity, reduce environmental impact, and enhance cycling durability. Strategic collaborations with electronics and automotive OEMs are enabling easier integration of PCM solutions into high-performance systems. Additionally, leading manufacturers are expanding production capabilities and automating fabrication to meet growing global demand.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Material type

- 2.2.2 Application

- 2.2.3 Form factor

- 2.2.4 End Use Industry

- 2.2.5 Temperature Range

- 2.2.6 Regional

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Rising demand from electronics miniaturization

- 3.2.3 Growth in electric vehicle thermal management

- 3.2.4 Technological advancements boosting PCM performance

- 3.2.5 Focus on energy efficiency in buildings

- 3.3 Industry pitfalls and challenges

- 3.3.1 High production and integration costs

- 3.3.2 Material stability and lifecycle concerns

- 3.4 Market opportunities

- 3.4.1 Expansion in electric vehicle applications

- 3.4.2 Integration in renewable energy systems

- 3.4.3 Advancements in smart building materials

- 3.5 Growth potential analysis

- 3.6 Regulatory landscape

- 3.6.1 North America

- 3.6.2 Europe

- 3.6.3 Asia Pacific

- 3.6.4 Latin America

- 3.6.5 Middle East & Africa

- 3.7 Porter's analysis

- 3.8 PESTEL analysis

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Price trends

- 3.10.1 By region

- 3.10.2 By material type

- 3.11 Future market trends

- 3.12 Patent landscape

- 3.13 Trade statistics (HS code)( Note: the trade statistics will be provided for key countries only)

- 3.13.1 Major importing countries

- 3.13.2 Major exporting countries

- 3.14 Sustainability and environmental aspects

- 3.14.1 Sustainable practices

- 3.14.2 Waste reduction strategies

- 3.14.3 Energy efficiency in production

- 3.14.4 Eco-friendly initiatives

- 3.15 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Material Type, 2021-2034 (USD Million) (Kilo Tons)

- 5.1 Key trends

- 5.2 Organic PCMs

- 5.2.1 Paraffin waxes

- 5.2.2 Fatty acids

- 5.2.3 Non-paraffin organics

- 5.3 Inorganic PCMs

- 5.3.1 Salt hydrates

- 5.3.2 Metallic alloys

- 5.3.3 Eutectic salts

- 5.4 Bio-based PCMs

- 5.4.1 Vegetable-based compounds

- 5.4.2 Natural fatty acids

- 5.5 Composite & Enhanced PCMs

- 5.5.1 Nano-enhanced

- 5.5.2 Graphite-enhanced

- 5.5.3 Metal foam composites

Chapter 6 Market Estimates and Forecast, By Application, 2021-2034 (USD Million) (Kilo Tons)

- 6.1 Key trends

- 6.2 Building & construction

- 6.2.1 HVAC systems

- 6.2.2 Wallboard & gypsum

- 6.2.3 Concrete & structural

- 6.2.4 Insulation & building

- 6.3 Electronics cooling

- 6.3.1 Semiconductor thermal

- 6.3.2 Data center cooling

- 6.3.3 Consumer electronics

- 6.3.4 Power electronics cooling

- 6.4 Battery thermal

- 6.4.1 Electric vehicle battery

- 6.4.2 Grid energy storage

- 6.4.3 Portable device batteries

- 6.5 Automotive

- 6.5.1 Engine thermal

- 6.5.2 Cabin comfort

- 6.5.3 EV thermal

- 6.6 Textiles & wearables

- 6.7 Cold chain & logistics

Chapter 7 Market Estimates and Forecast, By Form Factor, 2021-2034 (USD Million) (Kilo Tons)

- 7.1 Key trends

- 7.2 Bulk & raw PCMs

- 7.3 Microencapsulated

- 7.3.1 Polymer-shell encapsulation

- 7.3.2 Inorganic shell encapsulation

- 7.4 Macroencapsulated

- 7.4.1 Container-based

- 7.4.2 Panel & tube

- 7.5 Shape-stabilized

- 7.5.1 Porous support

- 7.5.2 Composite matrix

Chapter 8 Market Estimates and Forecast, By End Use Industry, 2021-2034 (USD Million) (Kilo Tons)

- 8.1 Key trends

- 8.2 Construction & building materials

- 8.3 Electronics & semiconductors

- 8.4 Automotive & transportation

- 8.5 Energy & utilities

- 8.6 Aerospace & defense

- 8.7 Healthcare & pharmaceuticals

Chapter 9 Market Estimates and Forecast, By Temperature range, 2021-2034 (USD Million) (Kilo Tons)

- 9.1 Key trends

- 9.2 Low Temperature PCMs (-50°C to 15°C)

- 9.3 Comfort Range PCMs (15°C to 32°C)

- 9.4 Medium Temperature PCMs (32°C to 100°C)

- 9.5 High Temperature PCMs (100°C to 800°C)

Chapter 10 Market Estimates and Forecast, By Region, 2021-2034 (USD Million) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.2.3 Mexico

- 10.3 Europe

- 10.3.1 Germany

- 10.3.2 UK

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 Australia

- 10.4.5 South Korea

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 Saudi Arabia

- 10.6.2 South Africa

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 AeroSafe Global

- 11.2 Advanced Cooling Technologies Inc.

- 11.3 Axiotherm GmbH

- 11.4 Climator Sweden AB

- 11.5 Climate Change Materials

- 11.6 Cold Chain Technologies

- 11.7 Croda International Plc

- 11.8 Cowa Thermal Solutions

- 11.9 Datum Phase Change

- 11.10 Entropy Solutions Inc./PureTemp LLC

- 11.11 Honeywell International Inc.

- 11.12 i-TES

- 11.13 Microtek Laboratories Inc.

- 11.14 Mesa Laboratories Inc.

- 11.15 Nanolope

- 11.16 Outlast Technologies LLC

- 11.17 Pelican BioThermal

- 11.18 Phase Change Energy Solutions

- 11.19 Phase Change Material Products Limited (PlusICE)

- 11.20 Pluss Advanced Technologies Pvt. Ltd.

- 11.21 PCM Energy Pvt. Ltd./Teappcm

- 11.22 Rubitherm Technologies GmbH

- 11.23 Salca BV

- 11.24 Sonoco ThermoSafe

- 11.25 Sunamp

- 11.26 Tetramer Technologies

- 11.27 va-Q-tec

- 11.28 Cryopak Industries Inc.