|

市場調查報告書

商品編碼

1851449

汽車潤滑油:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Automotive Lubricants - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

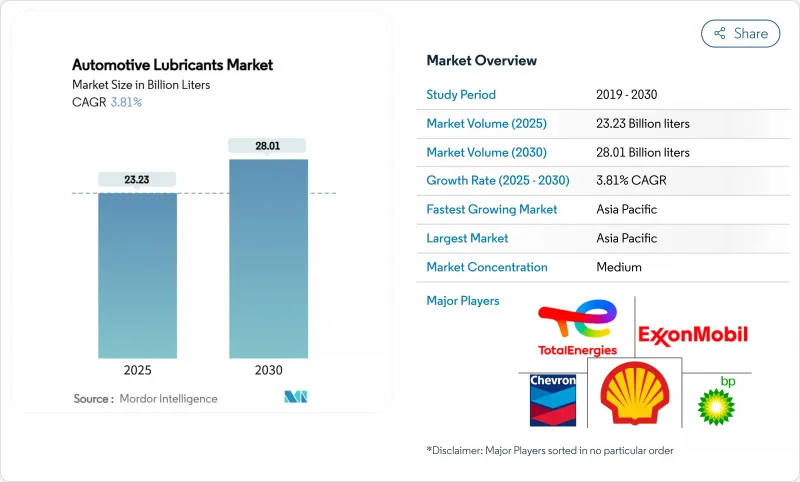

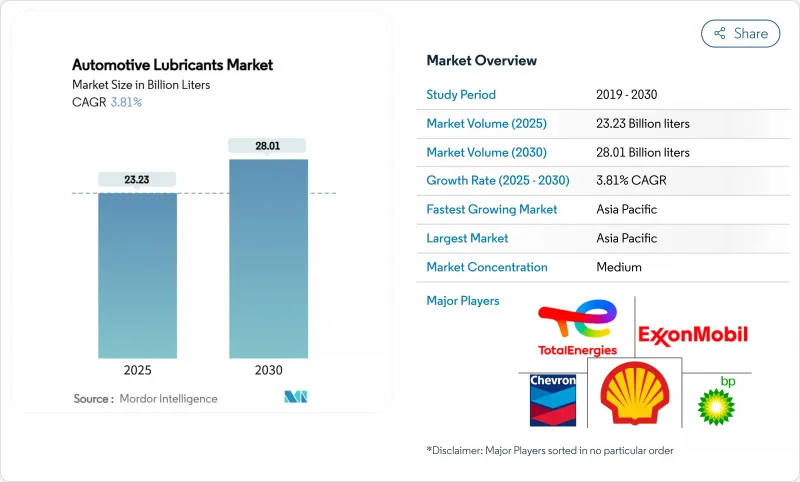

預計到 2025 年,汽車潤滑油市場規模將達到 232.3 億公升,到 2030 年將達到 280.1 億公升,在預測期(2025-2030 年)內,複合年成長率將達到 3.81%。

成長的促進因素包括已開發地區全球車輛保有量的老化、新興經濟體摩托車和商用車的持續湧入,以及該行業對能夠提高燃油經濟性並延長排放的優質合成油的重視。亞太地區憑藉著不斷成長的車輛保有量和對本地製造業的投資,仍然是需求中心;而北美和歐洲則依靠車輛的使用壽命來維持售後市場銷售。競爭強度適中:殼牌將在2024年連續第18年保持領先地位,但區域調配商將透過提高本地產能和專有配方來擴大市場佔有率。預計到2024年,中國道路上的電動車數量將達到3,140萬輛,這將帶來一些不利因素,例如整車製造商強制規定的較長換油週期,但低黏度合成油(類似於API SQ)的高單價可以緩解這些不利影響。

全球汽車潤滑油市場趨勢與洞察

主要經濟體平均車齡成長

車輛使用壽命的延長正在重塑潤滑油的需求格局。在美國,半導體短缺和通貨膨脹導致車輛更換速度放緩,促使車主增加換油頻率並投資購買更高品質的合成機油。歐洲車輛的車齡也不斷成長,西歐為18.1年,東歐為28.4年。老舊引擎容易出現密封件劣化、熱應力和污染等問題,這些都會加速機油劣化,從而刺激對優質基礎油的需求。車齡6至15車齡的車輛維修成本在短短一年內從514美元增加到537美元,凸顯了車齡與成本之間的關聯。報廢率已降至20年來的最低點4.20%,從而擴大了售後市場的收入來源。隨著車主尋求更佳的保護和更低的整體擁有成本,高價值合成機油如今已成為維修車間的主流選擇。

新興市場的全球汽車保有量成長

新興市場抵消了成熟市場電動車相關需求的下滑。預計到2024年,中國汽車保有量將達到4.53億輛,新增註冊量為3,583萬輛。在印度和東南亞,受都市區擁塞緩解和出行成本降低的推動,二輪車保有量持續成長。營運於電商和最後一公里配送路線的商用車輛行駛里程更長,排放頻率也更高。這些地區的本土汽車製造商正與當地潤滑油調配商合作,靈活開發適用於各種燃油品質和極端氣候條件的低成本潤滑油。因此,儘管全球經濟成長放緩,汽車潤滑油市場仍維持成長動能。

加速電動車的普及

電動車將使曲軸箱機油和許多傳動系統油液從保養項目中移除。到2024年底,中國將有3,140萬輛新能源汽車上路,較去年同期成長51.49%。國際能源總署(IEA)預測,到2030年,全球電動車保有量將超過2.5億輛,屆時石油需求將減少高達每日430萬桶。然而,電動車也將催生新的市場需求:用於馬達軸承的酯類潤滑脂、介電冷卻液以及針對高轉速和電磁相容性最佳化的齒輪潤滑脂。對於供應商而言,挑戰將從追求銷售轉向追求價值,因為專用油液的價格是傳統機油的兩到三倍。

細分市場分析

機油廣泛應用於火星點火式和壓燃式引擎,支撐著汽車潤滑油市場,預計到2024年將銷售量的58.61%。輕型卡車和非公路用機械由於其油底殼容量較大,市佔率也不斷成長。變速箱油、液壓油和齒輪油對於專用於特定用途的手排變速箱、濕式煞車和動力方向盤系統至關重要。潤滑脂雖然目前僅佔汽車潤滑油市場的一小部分,但預計將以4.28%的複合年成長率快速成長,因為電動車需要專用的軸承潤滑脂來應對高轉速和電解腐蝕。供應商正在將合成酯與聚脲增稠劑混合,以實現導電性和熱穩定性控制,從而提升產品價值。

隨著符合API SQ標準的潤滑油的廣泛應用,該細分市場的銷售正向合成潤滑油轉移。 0W-16和0W-12等超低黏度配方使汽車製造商能夠滿足車輛平均二氧化碳排放目標,尤其是在日本和歐洲。即使在重負荷潤滑油領域,從15W-40到5W-30的轉變也顯示市場對黏度更低、高溫高剪切黏度(HTHS)更高的潤滑油的需求,以降低燃油成本。隨著黏度等級的收窄,添加劑配方也在多樣化,硼酯、二硫化鉬和無灰清潔劑成為新一代產品的核心成分。因此,汽車潤滑油市場正在努力平衡銷售下滑和單位利潤率高這兩方面的挑戰。

汽車潤滑油市場報告按產品類型(引擎油、變速箱油和齒輪油、液壓油、潤滑脂)、車輛類型(乘用車、商用車、摩托車)和地區(亞太地區、北美、歐洲、南美、中東和非洲)進行細分。

區域分析

到2024年,亞太地區將佔全球汽車潤滑油市場佔有率的42.25%,預計到2030年將以4.16%的年均複合成長率成長。光是中國就擁有4.53億輛汽車,預計到2024年將新增註冊3,583萬輛,將帶來龐大的工廠裝機需求和龐大的服務市場。東協各國政府正大力發展電動車組裝中心。泰國的東部經濟走廊計畫促使殼牌公司將其在泰國的潤滑脂產能提高三倍,從而確保區域供應的穩定性。在越南和印尼,摩托車擁有率超過70%,帶動了摩托車潤滑油銷售量的成長。

北美將貢獻緩慢但穩定的成長,電動車年銷量將超過140萬輛,但僅佔二手車的不到8%,到2030年,內燃機車保有量仍將保持龐大。汽車製造商正在大力推廣API SQ合成油,換油週期超過1萬英里,促使快修連鎖店升級庫存,採用黏度更低的配方。

在歐洲,車齡在18至28年之間的車輛對潤滑油的需求持續成長,即便新車註冊量保持穩定。歐洲大陸在二氧化碳排放法規方面處於領先地位,推動了0W-20和0W-16機油的普及,這些機油符合PSA、VW 508/509和ACEA C6等相關規範。保養週期延長至3萬公里也促進了高階機油的銷售,部分抵消了銷售量下滑的影響。

中東/非洲和南美洲目前在全球銷售量中所佔比例雖小,但預計將實現顯著成長。 Vivo Energy品牌潤滑油在23個非洲國家的擴張以及殼牌收購印度Raj Petro公司,凸顯了南南競爭的趨勢。基礎設施建設、農業機械化和採礦計劃催生了對耐粉塵、耐高溫液壓油和重型機油的需求。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 主要國家車輛平均車齡增加

- 新興市場全球汽車保有量成長

- 疫情後OEM工廠灌裝量的恢復情形

- 快速轉向低黏度合成油

- 在非洲和東南亞的本地配方投資

- 市場限制

- 電動車加速普及

- 仿冒劣質機油

- OEM長換油週期規格

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 依產品類型

- 機油

- 變速箱/齒輪油

- 油壓

- 潤滑脂

- 按車輛類型

- 搭乘用車

- 商用車輛

- 摩托車

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 印尼

- 泰國

- 馬來西亞

- 越南

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 土耳其

- 俄羅斯

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 卡達

- 埃及

- 奈及利亞

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- AMSOIL Inc.

- Bharat Petroleum Corporation Limited

- BP plc(Castrol)

- Chevron Corporation

- China National Petroleum Corporation(CNPC)

- China Petroleum & Chemical Corporation

- ENEOS

- Exxon Mobil Corporation

- FUCHS

- Gazprom Neft PJSC

- Gulf Oil International Ltd

- Hindustan Petroleum Corporation Limited

- Idemitsu Kosan Co.,Ltd.

- Indian Oil Corporation Ltd

- Lukoil

- Motul

- Petrobras

- PETRONAS Lubricants International

- Phillips 66 Company

- PT Pertamina Lubricants

- Repsol

- Saudi Arabian Oil Co.

- Shell plc

- SK Lubricants Co. Ltd.

- TotalEnergies

- Veedol International

第7章 市場機會與未來展望

The Automotive Lubricants Market size is estimated at 23.23 billion liters in 2025, and is expected to reach 28.01 billion liters by 2030, at a CAGR of 3.81% during the forecast period (2025-2030).

Growth is anchored by an aging global vehicle parc in developed regions, a steady influx of two-wheelers and commercial vehicles in emerging economies, and the sector's pivot toward premium synthetics that improve fuel economy and extend drain intervals. Asia-Pacific remains the core demand center thanks to rising ownership levels and local manufacturing investments, while North America and Europe rely on vehicle longevity to sustain aftermarket sales. Competitive intensity stays moderate: Shell led for the 18th straight year in 2024, but regional blenders gain ground through local capacity additions and tailored formulations. Headwinds such as accelerating electric-vehicle (EV) penetration-31.4 million units on Chinese roads in 2024-and OEM-specified long-drain intervals are mitigated by the higher unit values of API SQ and similar low-viscosity synthetics.

Global Automotive Lubricants Market Trends and Insights

Growing Average Vehicle Age in Major Economies

Vehicle longevity is reshaping lubricant demand profiles. Semiconductor shortages and inflation have slowed vehicle replacement rates in the US, prompting owners to increase oil-change frequency and invest in higher-quality synthetic oils. Europe's fleet is even older-18.1 years in the West and 28.4 years in the East-driving more workshop visits and raising per-vehicle lubricant consumption. Older engines suffer seal degradation, thermal stress, and contamination, all of which accelerate oil degradation and spur demand for premium base stocks. Maintenance outlays for vehicles aged 6-15 years rose from USD 514 to USD 537 in just one year, underscoring the link between age and spend. Scrappage has fallen to 4.20%, the lowest in two decades, prolonging aftermarket revenue streams. Higher-value synthetics now dominate service bays as owners seek extended protection and lower total cost of ownership.

Rising Global Vehicle Parc in Emerging Markets

Emerging economies offset EV-related volume erosion in mature markets. China's motor-vehicle stock reached 453 million units, supported by 35.83 million new registrations in 2024. Two-wheeler ownership continues to surge in India and Southeast Asia, propelled by urban congestion relief and affordable mobility. Commercial fleets running e-commerce and last-mile delivery routes accumulate higher mileage, boosting drain-frequency multiples. Domestic automakers in these regions collaborate with local blenders, allowing agile development of cost-effective oils tailored to varied fuel quality and climate extremes. As a result, the automotive lubricants market keeps expanding even amid global moderation.

Accelerating EV Penetration

EVs remove crankcase oils and many driveline fluids from service menus. China logged 31.4 million new-energy vehicles on its roads by end-2024, up 51.49% year-on-year. The IEA projects global stock could eclipse 250 million by 2030, cutting oil demand by up to 4.3 million bbl/d. Nonetheless, EVs introduce new niches: esters for e-motor bearings, dielectric coolants, and gear greases optimized for high RPM and electromagnetic compatibility. For suppliers, the challenge shifts from volume to value as specialized fluids command two-to-three-fold price premiums over conventional engine oil.

Other drivers and restraints analyzed in the detailed report include:

- OEM Factory-Fill Volume Recovery Post-Pandemic

- Local Blending Investments in Africa and SE Asia

- OEM Long-Drain Interval Specifications

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Engine oil held 58.61% of 2024 volumes, anchoring the automotive lubricants market through ubiquitous use in spark-ignition and compression-ignition engines. Larger sump capacities in light trucks and off-highway machinery amplify its share. Transmission fluids, hydraulic oils, and gear oils serve narrower applications yet remain vital for manual boxes, wet brakes, and power-steering circuits. Greases, though just a fraction of the automotive lubricants market size, are the fastest riser at a 4.28% CAGR as EVs require dedicated bearing greases that handle high RPM and electrical pitting. Suppliers blend synthetic esters and polyurea thickeners to deliver conductivity control and thermal stability, elevating product mix value.

The segment's revenue mix swings toward synthetics as API SQ-compliant oils gain traction. Ultra-low viscosity formulations such as 0W-16 and 0W-12 enable OEMs to meet fleet-average CO2 targets, especially in Japan and Europe. Even within heavy-duty oils, the shift from 15W-40 to 5W-30 illustrates demand for thinner, high-HTHS blends that cut fuel costs. As viscosity grades narrow, additive packages diversify-boron esters, molybdenum disulfide, and ashless detergents become cornerstones in next-generation SKUs. The automotive lubricants market therefore balances declining unit volumes against richer per-unit margins.

The Automotive Lubricants Market Report is Segmented by Product Type (Engine Oil, Transmission and Gear Oil, Hydraulic Fluids, Greases), Vehicle Type (Passenger Vehicles, Commercial Vehicles, Motorcycles), and Geography (Asia-Pacific, North America, Europe, South America, Middle East and Africa).

Geography Analysis

Asia-Pacific dominated the automotive lubricants market with a 42.25% share in 2024 and is forecast to grow 4.16% per year through 2030. China alone hosts 453 million vehicles and recorded 35.83 million new registrations in 2024, pairing vast factory-fill demand with a colossal service marketplace. ASEAN governments nurture EV assembly hubs; Thailand's Eastern Economic Corridor plans drove Shell to triple Thai grease capacity, ensuring regional supply resilience. Two-wheeler penetration surpasses 70% of households in Vietnam and Indonesia, bolstering motorcycle-oil volumes.

North America contributes to stable if modest growth. EV sales exceed 1.40 million units annually yet remain below 8% of in-service vehicles, preserving a sizeable internal-combustion fleet through 2030. OEMs emphasize API SQ synthetics with drain intervals topping 10,000 miles, prompting quick-lube chains to upgrade inventories to low-viscosity formulations.

Europe's 18-28 year car fleet sustains lubricant demand despite flat new-car registrations. The continent pioneers CO2 cap compliance, spurring adoption of 0W-20 and 0W-16 oils backed by PSA, VW 508/509, and ACEA C6 specifications. Extended-service intervals of up to 30,000 km partially offset volume loss by encouraging premium-grade purchases.

The Middle East & Africa and South America jointly contribute a smaller share of the global volume today but deliver outsized upside. Vivo Energy's branded-lube expansion across 23 African nations and Shell's Raj Petro acquisition in India highlight a south-south competitive trend. Infrastructure build-out, agricultural mechanization, and mining projects generate demand for hydraulic fluids and heavy-duty engine oils resilient to dust and high ambient temperatures.

- AMSOIL Inc.

- Bharat Petroleum Corporation Limited

- BP p.l.c. (Castrol)

- Chevron Corporation

- China National Petroleum Corporation (CNPC)

- China Petroleum & Chemical Corporation

- ENEOS

- Exxon Mobil Corporation

- FUCHS

- Gazprom Neft PJSC

- Gulf Oil International Ltd

- Hindustan Petroleum Corporation Limited

- Idemitsu Kosan Co.,Ltd.

- Indian Oil Corporation Ltd

- Lukoil

- Motul

- Petrobras

- PETRONAS Lubricants International

- Phillips 66 Company

- PT Pertamina Lubricants

- Repsol

- Saudi Arabian Oil Co.

- Shell plc

- SK Lubricants Co. Ltd.

- TotalEnergies

- Veedol International

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing average vehicle age in major economies

- 4.2.2 Rising global vehicle parc in emerging markets

- 4.2.3 OEM factory-fill volume recovery post-pandemic

- 4.2.4 Rapid shift toward lower-viscosity synthetics

- 4.2.5 Local blending investments in Africa and SE Asia

- 4.3 Market Restraints

- 4.3.1 Accelerating EV penetration

- 4.3.2 Counterfeit and adulterated engine oils

- 4.3.3 OEM long-drain interval specifications

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Product Type

- 5.1.1 Engine Oil

- 5.1.2 Transmission and Gear Oil

- 5.1.3 Hydraulic Fluids

- 5.1.4 Greases

- 5.2 By Vehicle Type

- 5.2.1 Passenger Vehicles

- 5.2.2 Commercial Vehicles

- 5.2.3 Motorcycles

- 5.3 By Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Indonesia

- 5.3.1.6 Thailand

- 5.3.1.7 Malaysia

- 5.3.1.8 Vietnam

- 5.3.1.9 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 France

- 5.3.3.4 Italy

- 5.3.3.5 Spain

- 5.3.3.6 Nordic Countries

- 5.3.3.7 Turkey

- 5.3.3.8 Russia

- 5.3.3.9 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Colombia

- 5.3.4.4 Rest of South America

- 5.3.5 Middle East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Qatar

- 5.3.5.4 Egypt

- 5.3.5.5 Nigeria

- 5.3.5.6 South Africa

- 5.3.5.7 Rest of Middle East and Africa

- 5.3.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 AMSOIL Inc.

- 6.4.2 Bharat Petroleum Corporation Limited

- 6.4.3 BP p.l.c. (Castrol)

- 6.4.4 Chevron Corporation

- 6.4.5 China National Petroleum Corporation (CNPC)

- 6.4.6 China Petroleum & Chemical Corporation

- 6.4.7 ENEOS

- 6.4.8 Exxon Mobil Corporation

- 6.4.9 FUCHS

- 6.4.10 Gazprom Neft PJSC

- 6.4.11 Gulf Oil International Ltd

- 6.4.12 Hindustan Petroleum Corporation Limited

- 6.4.13 Idemitsu Kosan Co.,Ltd.

- 6.4.14 Indian Oil Corporation Ltd

- 6.4.15 Lukoil

- 6.4.16 Motul

- 6.4.17 Petrobras

- 6.4.18 PETRONAS Lubricants International

- 6.4.19 Phillips 66 Company

- 6.4.20 PT Pertamina Lubricants

- 6.4.21 Repsol

- 6.4.22 Saudi Arabian Oil Co.

- 6.4.23 Shell plc

- 6.4.24 SK Lubricants Co. Ltd.

- 6.4.25 TotalEnergies

- 6.4.26 Veedol International

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment