|

市場調查報告書

商品編碼

1851431

汽車電動液壓動力方向盤:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Automotive Electro-Hydraulic Power Steering - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

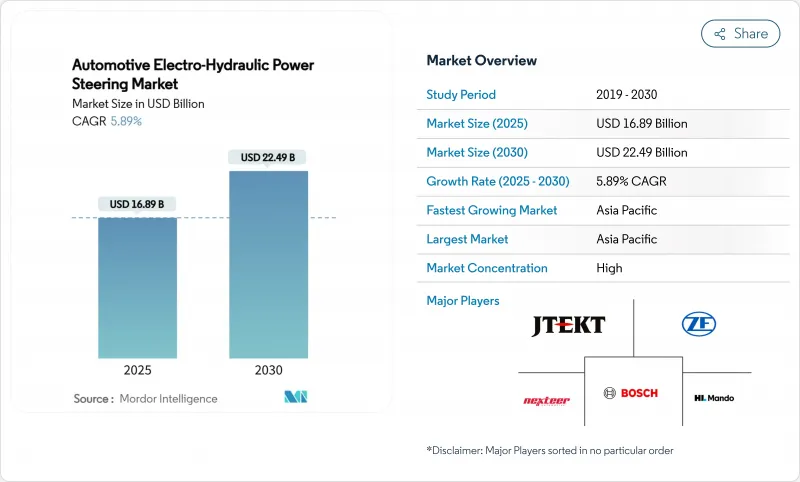

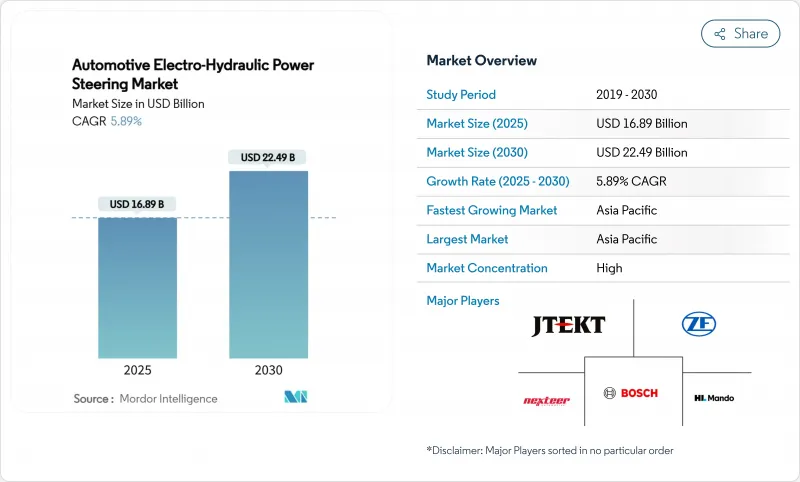

2025 年汽車電動液壓動力方向盤市場價值為 168.9 億美元,預計到 2030 年將達到 224.9 億美元,預測期(2025-2030 年)複合年成長率為 5.89%。

這一前景主要受電動車產量成長、全球排放氣體法規日益嚴格以及對線傳技術(旨在提高轉向能源效率)的需求不斷成長所驅動。乘用車和輕型商用車的電氣化推動了12V輔助負載的增加,與皮帶驅動液壓系統相比,按需式電動輔助轉向幫浦(EHPS)的相對能耗性能得到提升。自動駕駛程式需要故障後仍能正常運作的轉向系統架構,這進一步推動了EHPS的普及。儘管稀土材料的供應限制構成了一項關鍵風險,但全電動方向盤在輕型車領域帶來了激烈的競爭。然而,EHPS是一項融合了液壓動力和電子控制靈活性的橋樑技術,使供應商能夠在內燃機、混合動力和純電動平台上都受益。

全球汽車液壓動力方向盤市場趨勢及洞察

電動車產量增加和12V輔助電源負載增加

純電動車和插電式混合動力車產量的不斷成長,導致空調、資訊娛樂和安全功能等輔助負載增加,從而擴大了按需驅動式電液動力轉向泵(EHPS)與連續驅動式液壓泵之間的效率差距。預計到2024年,全球電動車銷量將達到1,400萬輛,其中純電動車將佔總銷量的73%,為EHPS系統奠定了堅實的基礎。商用車領域也呈現類似的趨勢,預計2024年電動巴士的出貨量將成長30%,進而推動節能轉向解決方案的應用。目前,工程研發的重點是開發與車輛能量管理系統協同工作的泵浦控制演算法,以最大限度地降低車輛在勻速行駛時的電流消耗。

OEM廠商對L3+ ADAS轉向冗餘的需求

對於3級以上安全等級,ISO 26262標準規定了故障運作轉向系統的要求,並明確了轉向控制的ASIL-D完整性等級。採用雙馬達和液壓輔助路徑的EHPS架構提供了必要的冗餘和容錯能力,即使在斷電或致動器故障的情況下也能保持轉向能力。近期推出的產品,例如蔚來ET9上的線控轉向解決方案,凸顯了EHPS模組如何與電子執行器配合,實現可變轉向比和緊急干預。因此,供應商必須對診斷、感測器融合和故障回退策略進行研發,以滿足功能安全審核的要求。

稀土永磁馬達供應鏈不穩定

釹、鏑和鋱的供應仍集中在小型礦山,其中中國佔精煉產量的60%以上。 2024年出口許可證政策的調整推高了現貨價格,並導致庫存趨緊,促使汽車製造商重新考慮無磁同步磁阻馬達和雙源泵浦組件。轉向系統製造商正在增加安全庫存,並與礦商簽訂直接承購協議,以穩定前置作業時間。

細分市場分析

到2024年,乘用車將佔據電動液壓動力方向盤)市場64.31%的佔有率,EHPS將在緊湊型、中型和豪華車型平台上廣泛應用。汽車製造商正在整合EHPS以實現自動啟動/停止功能、輕度混合動力系統以及擴展高級駕駛輔助系統(ADAS)的配置。輕型商用車的電動液壓動力方向盤市場規模預計將以7.27%的複合年成長率成長。

乘用車共享體現了高效的規模效應、車型更新周期以及高配置量,這些優勢足以抵消電動幫浦的額外成本。由於中國、歐洲和美國部分州收緊了最後一公里配送法規,商用車計畫正經歷加速成長。重型卡車和客車的成長相對滯後,但隨著電池組經濟性和高壓轉向驅動技術的融合,未來有望崛起。

到2024年,轉向馬達將佔電液壓動力方向盤市場佔有率的36.53%。其高材料價值和關鍵性能作用將支撐整個組件組合。感測器和扭力模組到2030年將以7.73%的複合年成長率成長,因為ISO 26262冗餘目標將使每個系統的位置和扭力感測通道數量翻倍。

永磁無刷馬達因其高功率密度和快速響應能力,仍然是行業標準。供應商正投資研發基於鐵氧體或磁阻式設計的電機,以避免使用稀土元素。隨著線控轉向軟體層的擴展,控制ECU正向更高頻寬的微控制器遷移,而密封泵殼現在也整合了冷卻套,以延長工作週期。

區域分析

亞太地區仍是需求中心。該地區在2024年佔據了電動液壓動力方向盤47.57%的市場佔有率,預計到2030年將以8.75%的複合年成長率成長,成為規模最大、成長最快的地區。中國純電動車和插電式混合動力車的產能推動了泵浦的大量需求。印度的FAME-II和PLI計劃鼓勵國內線控轉向系統和泵浦設備的在地採購。日本為出口車型提供符合ISO 26262標準的高可靠性感測器和馬達控制器。區域供應商受益於政府激勵措施,這些措施降低了到岸成本,並縮短了集中在上海、廣州、清奈和名古屋的OEM工廠的供應鏈。

隨著排放氣體法規日益嚴格,北美市場持續穩定擴張。美國)的多污染物排放標準和加州的「先進清潔汽車II」(Advanced Clean Car II)計畫要求汽車製造商對包括轉向系統在內的輔助系統進行電氣化改造,以達到車輛排放目標。預計從2024年起,純電動貨車的普及率將加倍,而電動液壓輔助轉向系統(EHPS)的應用也日益廣泛,尤其是在小包裹和雜貨運輸車隊中。此外,美國本土汽車製造商也透過資助鐵氧體和磁阻馬達的研究來規避稀土風險,從而支撐了該地區液壓動力方向盤的市場規模,使其成為抵禦市場衝擊的韌性力量。加拿大的清潔交通訊貸計畫與美國的政策相呼應,進一步加強了跨國生產協同效應。

歐洲正引領高階汽車領域的創新。德國、瑞典和法國的汽車品牌正在推出線傳轉向平台,這些平台整合了EHPS(電子高壓幫浦)作為安全冗餘的致動器。採埃孚(ZF)計畫於2025年初開始為一家中國高階汽車製造商量產相關產品。歐盟到2030年將整車二氧化碳排放量減少55%的目標,持續推動供應商在零件層面提升效率。隨著豪華車和高性能車市場向800V架構轉型,配備智慧能源回收演算法的EHPS模組將與線控刹車和主動懸吊系統相輔相成。東歐和中東地區擁有新興的組裝基地,但基礎設施的不足和價格敏感度將阻礙短期內的普及,因此亞太地區將成為未來十年關鍵的成長引擎。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- OEM廠商對L3+ ADAS轉向冗餘的需求

- 電動車產量增加,12V輔助電源負載增加

- 輕型商用車快速電氣化

- 更嚴格的二氧化碳/CAFE法規提高了轉向效率

- 線控轉向模組和EHPS幫浦整合

- 中國和印度的在地採購獎勵(PLI、MIIT、FAME-II)

- 市場限制

- 稀土永磁電機供應鏈波動性

- 與傳統HPS相比,前期成本較高

- 高溫工作循環期間的可靠性問題

- 在B/C級車型中,全電動方向盤(EPS)車型與競爭對手競爭

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 大型商用車輛

- 公車和長途客車

- 非公路及特種車輛

- 依組件類型

- 轉向電機

- 液壓泵浦

- 感測器和扭矩模組

- ECU/控制器

- 水箱、軟管等。

- 依推進類型

- 內燃機(ICE)

- 混合動力電動車(HEV)

- 電池電動車(BEV)

- 插電式混合動力電動車

- 燃料電池電動車(FCEV)

- 按銷售管道

- 目的地設備製造商 (OEM)

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 印尼

- 越南

- 菲律賓

- 澳洲

- 紐西蘭

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- JTEKT Corporation

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Nexteer Automotive Corporation

- Mando Corporation

- NSK Ltd.

- Continental AG

- Thyssenkrupp Presta AG

- Hitachi Astemo

- Showa Corporation

- Knorr-Bremse Commercial Vehicle Systems GmbH

- Shanghai OE Industrial Co., Ltd.(Brogen EV Solutions)

第7章 市場機會與未來展望

The automotive electro-hydraulic power steering market was valued at USD 16.89 billion in 2025 and is projected to reach USD 22.49 billion by 2030, equal to a 5.89% CAGR during the forecast period (2025-2030).

This outlook stems from rising electric vehicle production, stricter global emissions rules, and growing requirements for steer-by-wire readiness that demand higher steering energy efficiency. Passenger car and light commercial vehicle electrification is lifting auxiliary 12 V loads, which improves the relative energy profile of on-demand EHPS pumps compared with belt-driven hydraulic systems. Autonomous driving programs call for fail-operational steering architectures, further reinforcing EHPS adoption. Rare-earth material constraints represent the main supply risk, while full electric power steering creates competitive pressure in smaller vehicle segments. Yet EHPS remains the bridge technology that pairs hydraulic force capability with electronic control flexibility, positioning suppliers to benefit across internal combustion, hybrid, and battery-electric platforms.

Global Automotive Electro-Hydraulic Power Steering Market Trends and Insights

Growing EV Production and Higher Auxiliary-12 V Loads

Escalating battery electric and plug-in hybrid volumes raise auxiliary loads for climate, infotainment, and safety functions, which amplifies the efficiency gap between on-demand EHPS pumps and continuously driven hydraulic pumps. Global EV sales reached 14 million units in 2024, with battery electric vehicles taking 73% of deliveries, creating a sizeable addressable base for EHPS systems. Commercial segments follow a similar path as electric buses logged 30% shipment growth in 2024, encouraging the adoption of energy-saving steering solutions. The engineering priority now focuses on pump control algorithms coordinating with vehicle energy management to minimize current draw during steady-state cruising.

OEM Demand for Steering Redundancy for L3+ ADAS

Level 3 and above automated driving creates fail-operational steering requirements under ISO 26262, stipulating ASIL-D integrity for steering control. EHPS architecture, with its dual electric motor and hydraulic assist paths, delivers the redundancy and fault tolerance needed to maintain steerability during power interruptions or actuator faults. Recent production launches such as the steer-by-wire solution in NIO's ET9 highlight how EHPS modules pair with electronic actuation to achieve variable steering ratios and emergency intervention. Suppliers, therefore, align R&D toward diagnostics, sensor fusion, and fallback strategies that satisfy functional safety audits

Supply Chain Volatility of Rare-Earth Permanent Magnet Motors

Neodymium, dysprosium, and terbium supply remains concentrated in small mines, with China accounting for more than 60% of refined output. Export licensing changes in 2024 raised spot prices and strained inventory, prompting automakers to review magnet-free synchronous reluctance motors and to dual-source pump assemblies. Steering suppliers are lengthening safety stocks and entering direct offtake agreements with miners to stabilize lead times.

Other drivers and restraints analyzed in the detailed report include:

- Rapid Electrification of Light Commercial Vehicles

- Integration of Steer-By-Wire Modules With EHPS Pumps

- Up-Front Cost Premium vs Conventional HPS

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Passenger cars commanded 64.31% of the electric hydraulic power steering market in 2024 on the strength of widespread adoption across compact, mid-size, and luxury platforms. Carmakers integrate EHPS to unlock stop-start compatibility, mild hybrid gains, and growing ADAS content. Electric hydraulic power steering market size for light commercial vehicles is projected to expand at a 7.27% CAGR because parcel fleets favor energy savings during urban duty cycles.

The passenger car share reflects efficient scale, model refresh cadence, and high configuration volumes that absorb the added cost of electronic pumps. Commercial vehicle programs show faster unit growth as final mile delivery regulations tighten in China, Europe, and several United States states. Heavy trucks and buses trail but represent future upside once battery pack economics and high voltage steering actuation converge.

Steering motors held 36.53% electric hydraulic power steering market share in 2024. Their high material value and critical performance role anchor the component mix. Sensors and torque modules will record a 7.73% CAGR through 2030, driven by ISO 26262 redundancy targets that double the number of position and torque sensing channels per system.

Permanent magnet brushless motors remain the industry standard because they deliver high power density and rapid response. Suppliers are investing in ferrite-based or reluctance designs to sidestep rare-earth exposure. Control ECUs migrate toward higher bandwidth microcontrollers as steer-by-wire software layers expand, while sealed pump housings incorporate integrated cooling jackets to extend duty cycles.

The Automotive Electro-Hydraulic Power Steering Market is Segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Component Type (Steering Motors, Hydraulic Pumps, and More ), Propulsion ( Internal Combustion Engine, and More), Sales Channel (Original Equipment Manufacturer (OEM), Aftermarket), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific remains the clear demand center. The region accounted for 47.57% electric hydraulic power steering market share in 2024 and is projected to expand at an 8.75% CAGR through 2030, making it the largest and fastest-growing territory. China's battery-electric and plug-in hybrid production scale drives high pump volumes. India's FAME-II and PLI schemes channel local sourcing toward domestic steer-by-wire and pump facilities. Japan contributes high-reliability sensors and motor controls that meet ISO 26262 targets for export models. Regional suppliers benefit from government incentives that lower landed costs and shorten supply chains for OEM plants clustered in Shanghai, Guangzhou, Chennai, and Nagoya.

North America follows with steady expansion as emissions rules tighten. The EPA's Multi-Pollutant Standards and California's Advanced Clean Cars II program compel automakers to electrify auxiliaries, including steering, to meet fleet targets. Battery-electric delivery van adoption has doubled since 2024, pulling EHPS content into parcel and grocery fleets. Domestic automakers also hedge rare-earth risk by funding ferrite and reluctance motor research, which supports regional electric hydraulic power steering market size resilience against supply shocks. Canada's clean-transport credits mirror United States policy and reinforce cross-border production synergies.

Europe anchors premium vehicle innovation. German, Swedish, and French brands are rolling out steer-by-wire platforms that integrate EHPS pumps as safety-redundant actuators, and ZF began series production for a Chinese luxury marque in early 2025. The European Union target of a 55% fleet-wide CO2 cut by 2030 keeps pressure on suppliers to deliver efficiency gains at component level. As luxury and performance segments migrate to 800 V architectures, EHPS modules with smart energy-recovery algorithms complement brake-by-wire and active suspension systems. Eastern Europe and the Middle East provide emerging assembly bases, but infrastructure gaps and price sensitivity temper near-term penetration, positioning Asia-Pacific as the principal growth engine through the decade.

- JTEKT Corporation

- Robert Bosch GmbH

- ZF Friedrichshafen AG

- Nexteer Automotive Corporation

- Mando Corporation

- NSK Ltd.

- Continental AG

- Thyssenkrupp Presta AG

- Hitachi Astemo

- Showa Corporation

- Knorr-Bremse Commercial Vehicle Systems GmbH

- Shanghai OE Industrial Co., Ltd. (Brogen EV Solutions)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 OEM Demand For Steering Redundancy For L3+ ADAS

- 4.2.2 Growing EV Production and Higher Auxiliary-12 V Loads

- 4.2.3 Rapid Electrification Of Light Commercial Vehicles (Elcv)

- 4.2.4 Tightening CO2 / CAFE Regulations Pushing Steering Efficiency

- 4.2.5 Integration Of Steer-By-Wire Modules With EHPS Pumps

- 4.2.6 Local Sourcing Incentives In China and India (PLI, MIIT, FAME-II)

- 4.3 Market Restraints

- 4.3.1 Supply-Chain Volatility Of Rare-Earth PM Motors

- 4.3.2 Up-Front Cost Premium Vs. Conventional HPS

- 4.3.3 Reliability Concerns In High-Temperature Duty Cycles

- 4.3.4 Competition From Full-Electric Power Steering (EPS) In B-/C-Segment Cars

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicles

- 5.1.3 Heavy Commercial Vehicles

- 5.1.4 Buses and Coaches

- 5.1.5 Off-highway and Specialty Vehicles

- 5.2 By Component Type

- 5.2.1 Steering Motors

- 5.2.2 Hydraulic Pumps

- 5.2.3 Sensors and Torque Modules

- 5.2.4 ECU / Controllers

- 5.2.5 Reservoirs, Hoses and Others

- 5.3 By Propulsion Type

- 5.3.1 Internal-Combustion Engine (ICE)

- 5.3.2 Hybrid Electric Vehicle (HEV)

- 5.3.3 Battery Electric Vehicle (BEV)

- 5.3.4 Plug-in Hybrid Electric Vehicles

- 5.3.5 Fuel-Cell Electric Vehicle (FCEV)

- 5.4 By Sales Channel

- 5.4.1 Original Equipment Manufacturer (OEM)

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Indonesia

- 5.5.4.6 Vietnam

- 5.5.4.7 Philippines

- 5.5.4.8 Australia

- 5.5.4.9 New Zealand

- 5.5.4.10 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 JTEKT Corporation

- 6.4.2 Robert Bosch GmbH

- 6.4.3 ZF Friedrichshafen AG

- 6.4.4 Nexteer Automotive Corporation

- 6.4.5 Mando Corporation

- 6.4.6 NSK Ltd.

- 6.4.7 Continental AG

- 6.4.8 Thyssenkrupp Presta AG

- 6.4.9 Hitachi Astemo

- 6.4.10 Showa Corporation

- 6.4.11 Knorr-Bremse Commercial Vehicle Systems GmbH

- 6.4.12 Shanghai OE Industrial Co., Ltd. (Brogen EV Solutions)