|

市場調查報告書

商品編碼

1851429

指紋感測器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Fingerprint Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

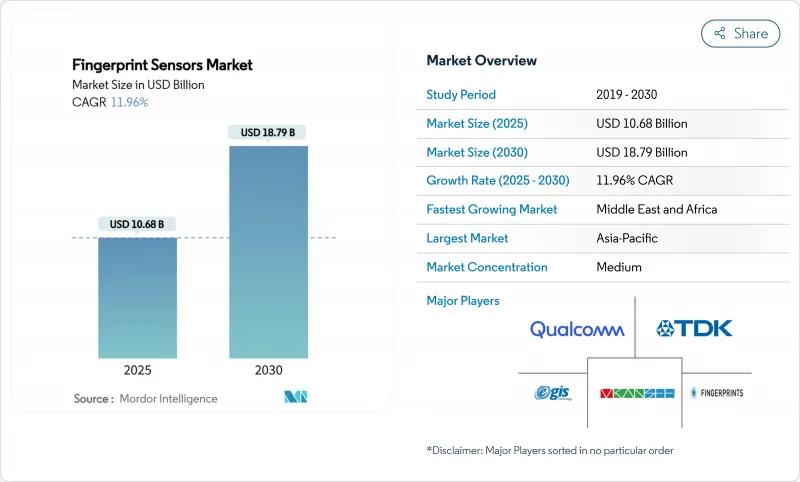

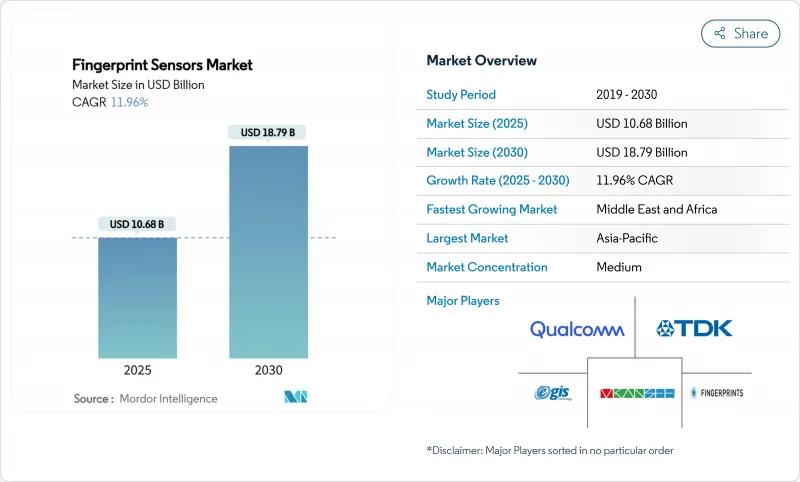

預計到 2025 年,指紋感測器市場規模將達到 106.8 億美元,到 2030 年將達到 187.9 億美元,複合年成長率為 11.96%。

消費性電子、行動旅行、支付和政府識別等領域的生物識別要求不斷擴展,應用範圍也日益擴大。智慧型手機品牌正採用超音波下指紋辨識技術,在不影響防偽性能的前提下實現無邊框設計;支付級生物辨識卡則支援符合PSD3和EMV標準的刷卡交易。汽車製造商正努力使指紋辨識晶片獲得AEC-Q100認證,用於免鑰匙進入和車內個性化設定;同時,PMUT(光電感測器單元)製造成本的下降也緩解了組件成本的壓力。基於人工智慧的活體偵測和邊緣處理技術的同步進步,進一步提升了指紋辨識的可靠性,並鞏固了其在更廣泛的多模態安全體系中的地位。

全球指紋感應器市場趨勢與洞察

智慧型手機廠商轉向屏下超音波感測器

屏下超音波感測器設計使行動電話製造商能夠在保持全面屏OLED螢幕的同時,確保可靠的生物識別安全性。高通最新的3D Sonic Max感測器可在250毫秒內擷取600平方毫米的影像,即使在潮濕或油膩的皮膚上也能保證解鎖功能。三星、Google和小米已承諾在其2025年的產品藍圖中,在其旗艦產品線中採用超音波,這與Android 16生物識別API相一致,後者提高了FAR/FRR認證的門檻。由此產生的規模經濟將降低二線OEM廠商的平均售價,加速各價格分佈的銷售成長,並推動指紋感應器市場邁入下一個設備週期。

政府推廣電子身分證和電子護照將推動需求成長。

從阿拉伯聯合大公國到南非,數位身分識別計畫如今都採用了多因素生物辨識技術,包括儲存在安全元件中的指紋模板。毛里求斯將於2024年2月發行MNIC 3.0卡,該卡整合了卡片指紋匹配認證功能,可實現基於錢包的跨國身份驗證。巴布亞新幾內亞的SevisPass試點計畫凸顯了小型經濟體如何在沒有傳統基礎設施的情況下快速過渡到生物辨識辨識。此類方案引發了一波多年期可信感測器模組採購浪潮,並將指紋感測器市場納入公共部門預算週期。

高階設備上人臉部認證的快速普及

蘋果的 iPhone 17 系列和三星的 Galaxy Z7 Fold Pro 都預設採用 3D 人臉解鎖,這使得生物識別技術的顧客購買傾向率轉向了基於相機的解鎖方式。然而,到 2025 年,93% 的手機仍將配備指紋辨識器,而且一旦屏下指紋辨識技術達到蘋果設定的 0.002% 的識別率目標,預計 iPhone 產品線中也將重新採用屏下指紋識別。由於在潮濕環境、戴手套操作以及需要將指紋識別模板存儲在設備上的銀行應用程式等對隱私要求較高的應用場景中,指紋識別仍然是首選方式,因此,屏下指紋識別技術的市場蠶食主要影響的是高階指紋識別市場,而非主流市場。

細分市場分析

至2024年,由於電容式指紋感應器成本曲線成熟且應用範圍廣泛,其仍將佔據51%的指紋感應器市場佔有率。然而,超音波晶片預計將以15.42%的複合年成長率成長,到2030年,隨著OEM廠商將高階行動電話和汽車主機等設備轉向體成像技術,超音波晶片的市場佔有率將逐漸縮小。超音波指紋感測器市場預計在2030年突破40億美元,主要得益於其高階的平均售價和汽車認證帶來的利潤空間。根據柏克萊感測器與致動器中心的研究,基於KNN的PMUT陣列可產生105.5 dB/V的輸出訊號,足以穿透厚厚的蓋玻片和手套。

性能優勢也帶來了認證上的成功:高通的 3D Sonic Max 於 2025 年獲得了 FIDO Level-3 和 BSI CC EAL 6+ 認證,符合德國電子識別 (eID) 標準。光學感測器繼續服務於對成本敏感的細分市場和自助服務終端,而熱感感測器仍然是適用於惡劣環境和屍檢取證的小眾產品。總體而言,技術多樣性支持更廣泛的市場細分,即使超音波技術在超音波市場鞏固了其領先地位。

後置/前置指紋辨識技術,得益於傳統手機設計和堅固型手持裝置的普及,預計到2024年將貢獻42%的市場佔有率。然而,屏下超音波模組憑藉著更薄的OLED基板和局部聲音耦合層,將以16.28%的複合年成長率成為成長最快的技術。隨著無邊框設計在400美元以下的設備中日益普及,屏下指紋感應器的市佔率預計到2030年將達到38%。蘋果、三星和OPPO已訂購超過2.5億顆屏下感測器晶片,用於2024年下半年的生產,顯示螢幕下指紋辨識技術晶粒被大規模採用。

雖然側邊電容式觸控條在折疊式行動電話和遊戲行動電話中仍然很受歡迎,因為快速點擊檢測是其首要考慮因素,但電源鍵/主頁鍵設計在企業級筆記型電腦中仍然很流行,因為筆記型電腦的鍵盤更換週期比智慧型手機慢兩到三年。京東方和維信諾正在測試的OLED感測器原型整合了指紋識別和心率光電感測器,預示著多功能面板的出現,它可能會重新定義指紋感測器市場的未來。

指紋感應器市場按感測器類型(光學式、電容式及其他)、外形規格(後置/前置、側置及其他)、應用領域(智慧型手機和平板電腦、筆記型電腦/PC及其他)、終端用戶產業(消費性電子產品OEM廠商、銀行、金融服務和金融科技公司及其他)以及地區進行細分。市場預測以美元計價。

區域分析

亞太地區46%的營收佔有率反映了其供應鏈深度與終端市場需求的獨特整合。中國垂直整合的行動電話生態系統、韓國的AMOLED創新以及日本在壓電陶瓷領域的領先地位,共同鞏固了該地區的價值鏈。印度的Aadhaar 2.0藍圖和印尼的e-KTP升級計畫將進一步支撐未來多年的國內需求。此外,各國政府正在鼓勵本地矽晶片製造,降低落地成本,並鞏固亞太地區作為指紋感測器市場中心的地位。

預計中東和非洲將成為全球成長最快的地區,複合年成長率將達到15.4%。阿拉伯聯合大公國的國家生物辨識錢包和沙烏地阿拉伯的Nafath平台都需要使用指紋認證模組進行公民註冊,這引發了對卡片和自助服務終端的大量訂單。南非斥資250萬美元啟動智慧ID卡競標,旨在2029年大選前大規模發行,這標誌著非洲在數位身分基礎設施建設方面邁出了重要一步。隨著Made和e-Fawateer等區域支付網路向標記化轉型,感測器供應商通路日益緊張,凸顯了新興經濟體指紋感測器市場的巨大成長潛力。

北美和歐洲市場保持著中等個位數的成長勢頭,這主要得益於汽車生物辨識技術、企業安全升級以及嚴格的資料隱私合規要求。歐洲的數位身分框架要求到2026年普及電子錢包,這意味著屆時將有4.5億居民需要使用基於設備或卡片的指紋認證。台積電投資400億美元在亞利桑那州建設的第二條生產線計畫於2026年投產,將為美國主要行動電話營運商生產超音波PMUT晶圓,從而增強美國本土的供應韌性,並平衡全球指紋感測器市場的分佈格局。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 智慧型手機廠商轉向屏下超音波感測器

- 政府推行電子身分證和電子護照將加速需求成長。

- 用於支付的生物識別智慧卡開始商業銷售

- 車內生物識別將成為免鑰匙進入的強制性要求

- 基於人工智慧的欺騙檢測可提高安全認證效率

- 降低薄膜壓電PMUT陣列的成本/面積。

- 市場限制

- 高階設備臉部辨識的快速普及

- 限制生物辨識資料保留的資料隱私法

- 供應鏈對高階8吋CIS鑄件的依賴

- 戶外潮濕手指環境下的錯誤感知焦慮

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭的激烈程度

第5章 市場規模與成長預測

- 依感測器類型

- 光學

- 電容式

- 熱感的

- 超音波

- 外形規格/安裝方式

- 後/前安裝

- 側裝

- 螢幕下(光學)

- 螢幕下(超音波)

- 按鈕/主鍵

- 透過使用

- 智慧型手機和平板電腦

- 筆記型電腦/桌上型電腦

- 智慧卡和支付令牌

- 物聯網/智慧門鎖和穿戴式設備

- 按最終用戶行業分類

- 消費性電子產品OEM廠商

- 銀行、金融服務與金融科技

- 政府/執法部門

- 軍事/國防

- 汽車與出行

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東

- 以色列

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Apple Inc.

- AU Optronics Corp.

- CrucialTec Co., Ltd.

- Egis Technology Inc.

- Fingerprint Cards AB

- Goodix Technology Co., Ltd.

- HID Global Corporation

- IDEX Biometrics ASA

- Infineon Technologies AG

- NEC Corporation

- Next Biometrics ASA

- Qualcomm Technologies Inc.

- Samsung System LSI Business

- Shenzhen Chipone/Novatek(Biometric BU)

- Sonavation Inc.

- STMicroelectronics NV

- Synaptics Incorporated

- TDK Corporation(InvenSense)

- Thales Group

- TKH Group(Nedap)

- VKANSEE Technology Inc.

第7章 市場機會與未來展望

The fingerprint sensors market stands at USD 10.68 billion in 2025 and is forecast to reach USD 18.79 billion by 2030, reflecting an 11.96% CAGR.

Expanding biometric mandates in consumer electronics, mobility, payments and government identity programs continue to widen the addressable base. Smartphone brands have turned to ultrasonic under-display solutions to deliver bezel-free designs without compromising spoof resistance, while payment-grade biometric cards enable card-present transactions that meet PSD3 and EMV requirements. Automotive suppliers are qualifying AEC-Q100 fingerprint ICs for keyless entry and in-cabin personalization and falling PMUT production costs are easing bill-of-materials pressures. Parallel improvements in AI-based liveness detection and edge processing further lift the reliability of fingerprint authentication, reinforcing its position in the wider multimodal security stack.

Global Fingerprint Sensors Market Trends and Insights

Smartphone OEM Shift to Under-Display Ultrasonic Sensors

Ultrasonic under-display designs let handset makers preserve edge-to-edge OLED screens while retaining high-confidence biometric security. Qualcomm's latest 3D Sonic Max transducer captures a 600 mm2 image in 250 ms and sustains unlock even with damp or oily skin, outperforming optical modules in spoof testing. Samsung, Google and Xiaomi have committed flagship lines to ultrasonic implementations in 2025 product roadmaps, aligning with Android 16 biometric APIs that raise FAR/FRR certification thresholds. The resulting scale economies lower ASPs for tier-2 OEMs, accelerating volume growth across price bands and propelling the fingerprint sensors market into its next device cycle.

Government e-ID & e-Passport Rollouts Accelerating Demand

Digital identity programs from the UAE to South Africa now specify multi-factor biometrics, typically including fingerprint templates stored in secure elements. Mauritius issued its MNIC 3.0 card in February 2024, embedding match-on-card fingerprint authentication that enables wallet-based cross-border recognition. Papua New Guinea's SevisPass pilot underscores how small economies leapfrog to biometric IDs without legacy infrastructure. Such schemes create multi-year procurement waves for trusted sensor modules, anchoring the fingerprint sensors market in the public-sector budget cycle.

Rapid Adoption of Facial Recognition in Premium Devices

Apple's iPhone 17 range and Samsung's Galaxy Z7 Fold Pro both default to 3-D facial unlock, shifting biometric mindshare toward camera-based modalities. Yet 93% of handsets shipping in 2025 still carry a fingerprint reader, and under-display sensors are expected to return to the iPhone portfolio when technology meets Apple's 0.002 % FAR target. Fingerprint methods remain preferred for wet environments, gloved usage and privacy-sensitive workflows such as banking apps that require on-device template storage, so cannibalization largely affects the premium tail rather than the bulk of the fingerprint sensors market.

Other drivers and restraints analyzed in the detailed report include:

- Payment-Grade Biometric Smartcard Commercial Launches

- Automotive In-Cabin Biometrics Mandated for Keyless Access

- Data-Privacy Legislation Limiting Biometric Data Retention

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Capacitive units retained a 51% share of the fingerprint sensors market in 2024 owing to mature cost curves and broad application reach. Ultrasonic chips, however, are set to climb at 15.42% CAGR and are projected to narrow the revenue gap by 2030 as OEMs migrate high-tier phones and automotive consoles toward volumetric imaging. The fingerprint sensors market size for ultrasonic devices is on track to surpass USD 4 billion by 2030, reflecting premium ASPs and automotive qualification margins. Research from Berkeley's Sensor & Actuator Center shows KNN-based PMUT arrays generating 105.5 dB/V output, enhancing penetration through thick cover glass and gloves.

Performance advantages are translating into certification wins. Qualcomm's 3D Sonic Max achieved FIDO Level-3 and BSI CC EAL 6+ in 2025, enabling German eID compliance. Optical sensors continue servicing cost-sensitive tiers and kiosk terminals, while thermal variants remain niche for harsh-environment and postmortem forensics. Altogether, technology diversity sustains the broader fingerprint sensors market even as ultrasonic leadership cements in premium segments.

Rear/front mounts generated 42% of 2024 revenue, helped by legacy handset designs and rugged handhelds. Yet under-display ultrasonic modules will post the fastest 16.28% CAGR, taking advantage of OLED substrate thinning and localized acoustic coupling layers. The fingerprint sensors market share for under-display formats is expected to reach 38% by 2030 as bezel-less design becomes ubiquitous among sub-USD 400 devices. Apple, Samsung and Oppo collectively placed orders exceeding 250 million under-display sensors die in H2 2024 production slots, signalling scale adoption.

Side-mounted capacitive strips remain popular in foldables and gaming phones that prioritize rapid tap detection, while on-button/home-key designs linger in enterprise notebooks where keyboard replacement cycles lag smartphones by 2-3 years. Sensor-in-OLED prototypes under test at BOE and Visionox merge fingerprint capture with heart rate photoplethysmography, hinting at multifunctional panels that could redefine the next chapter of the fingerprint sensors market.

Fingerprint Sensors Market Segmented by Sensor Type (Optical, Capacitive, and More), Form Factor (Rear/Front Mount, Side-Mounted, and More), Application (Smartphones & Tablets, Laptops/PCs, and More), End-User Industry (Consumer Electronics OEM, BFSI & FinTech, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific's 46% revenue share reflects a unique integration of supply chain depth and end-market demand. China's vertically aligned handset ecosystem, Korea's AMOLED innovation and Japan's piezo ceramics leadership collectively anchor a resilient regional value chain. India's Aadhaar 2.0 roadmap and Indonesia's e-KTP upgrade pipeline further underwrite multi-year domestic demand. Regional governments also sponsor local silicon fabrication incentives, lowering landed costs and reinforcing Asia-Pacific as the gravitational center of the fingerprint sensors market.

Middle East & Africa is projected to expand at 15.4% CAGR, the fastest worldwide. The UAE's national biometric wallet and Saudi Arabia's Nafath platform both require certified fingerprint modules for citizen onboarding, catalysing bulk card and kiosk orders. South Africa's USD 2.5 million smart ID card tender aims for mass issuance before the 2029 elections, illustrating Africa's leapfrogging toward digital identity infrastructures. With regional payment networks such as made and e-Fawateer shifting to biometric tokenization, supplier pipelines for sensors are tightening, underscoring the growth potential of the fingerprint sensors market in emerging economies.

North America and Europe sustain mid-single-digit trajectories underpinned by automotive biometrics, enterprise security upgrades and stringent data-privacy compliance. The European Digital Identity Framework mandates wallet rollout by 2026, translating into 450 million residents requiring device or card-based fingerprint authentication. TSMC's USD 40 billion Arizona fabs, due to open Phase 2 lines in 2026, will localize ultrasonic PMUT wafer starts for key U.S. handset accounts, strengthening onshore supply resilience and balancing the global distribution of the fingerprint sensors market.

- Apple Inc.

- AU Optronics Corp.

- CrucialTec Co., Ltd.

- Egis Technology Inc.

- Fingerprint Cards AB

- Goodix Technology Co., Ltd.

- HID Global Corporation

- IDEX Biometrics ASA

- Infineon Technologies AG

- NEC Corporation

- Next Biometrics ASA

- Qualcomm Technologies Inc.

- Samsung System LSI Business

- Shenzhen Chipone / Novatek (Biometric BU)

- Sonavation Inc.

- STMicroelectronics N.V.

- Synaptics Incorporated

- TDK Corporation (InvenSense)

- Thales Group

- TKH Group (Nedap)

- VKANSEE Technology Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Smartphone OEM shift to under-display ultrasonic sensors

- 4.2.2 Government e-ID and e-Passport roll-outs accelerating demand

- 4.2.3 Payment-grade biometric smart-card commercial launches

- 4.2.4 Automotive in-cabin biometrics mandated for key-less access

- 4.2.5 AI-driven spoof-detection improving security certification

- 4.2.6 Falling cost/area of thin-film piezoelectric PMUT arrays

- 4.3 Market Restraints

- 4.3.1 Rapid adoption of facial recognition in premium devices

- 4.3.2 Data-privacy legislation limiting biometric data retention

- 4.3.3 Supply-chain reliance on high-end 8-inch CIS foundries

- 4.3.4 False-accept anxiety in wet-finger outdoor conditions

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Sensor Type

- 5.1.1 Optical

- 5.1.2 Capacitive

- 5.1.3 Thermal

- 5.1.4 Ultrasonic

- 5.2 By Form Factor / Placement

- 5.2.1 Rear/Front Mount

- 5.2.2 Side-mounted

- 5.2.3 Under-display (Optical)

- 5.2.4 Under-display (Ultrasonic)

- 5.2.5 On-button / Home-key

- 5.3 By Application

- 5.3.1 Smartphones and Tablets

- 5.3.2 Laptops / PCs

- 5.3.3 Smart-Cards and Payment Tokens

- 5.3.4 IoT / Smart Locks and Wearables

- 5.4 By End-user Industry

- 5.4.1 Consumer Electronics OEM

- 5.4.2 BFSI and FinTech

- 5.4.3 Government and Law-Enforcement

- 5.4.4 Military and Defense

- 5.4.5 Automotive and Mobility

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 United Kingdom

- 5.5.2.2 Germany

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Rest of Asia-Pacific

- 5.5.4 Middle East

- 5.5.4.1 Israel

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 United Arab Emirates

- 5.5.4.4 Turkey

- 5.5.4.5 Rest of Middle East

- 5.5.5 Africa

- 5.5.5.1 South Africa

- 5.5.5.2 Egypt

- 5.5.5.3 Rest of Africa

- 5.5.6 South America

- 5.5.6.1 Brazil

- 5.5.6.2 Argentina

- 5.5.6.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Apple Inc.

- 6.4.2 AU Optronics Corp.

- 6.4.3 CrucialTec Co., Ltd.

- 6.4.4 Egis Technology Inc.

- 6.4.5 Fingerprint Cards AB

- 6.4.6 Goodix Technology Co., Ltd.

- 6.4.7 HID Global Corporation

- 6.4.8 IDEX Biometrics ASA

- 6.4.9 Infineon Technologies AG

- 6.4.10 NEC Corporation

- 6.4.11 Next Biometrics ASA

- 6.4.12 Qualcomm Technologies Inc.

- 6.4.13 Samsung System LSI Business

- 6.4.14 Shenzhen Chipone / Novatek (Biometric BU)

- 6.4.15 Sonavation Inc.

- 6.4.16 STMicroelectronics N.V.

- 6.4.17 Synaptics Incorporated

- 6.4.18 TDK Corporation (InvenSense)

- 6.4.19 Thales Group

- 6.4.20 TKH Group (Nedap)

- 6.4.21 VKANSEE Technology Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment