|

市場調查報告書

商品編碼

1851417

託管服務:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Managed Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

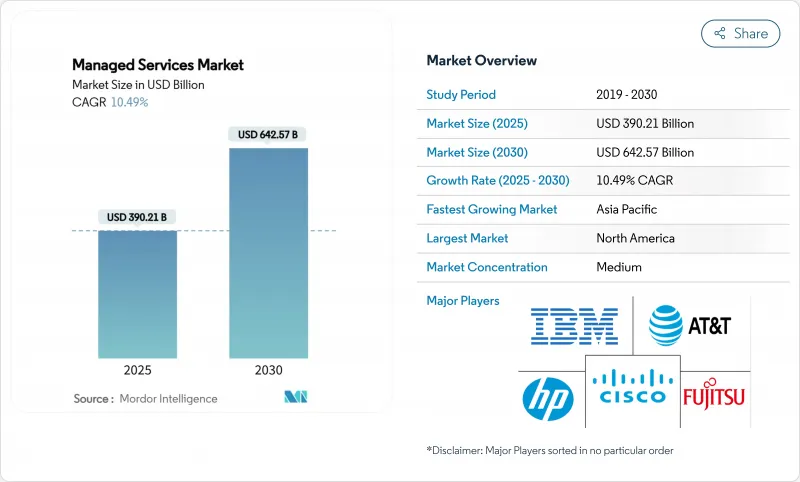

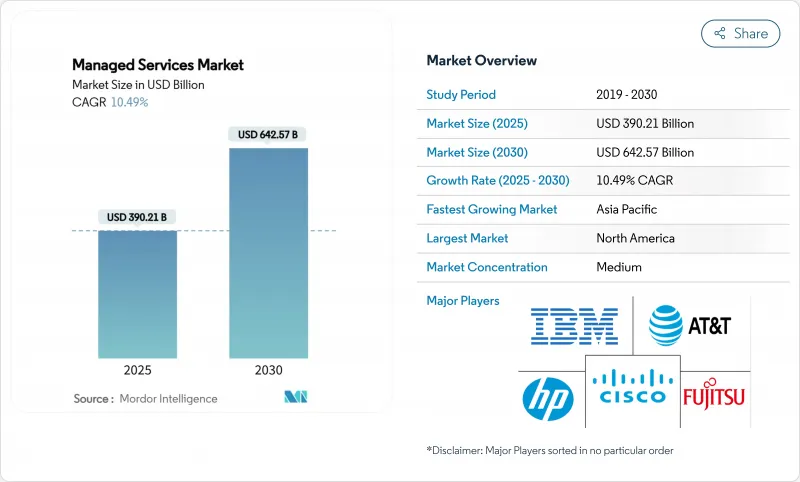

預計到 2025 年,託管服務市場規模將達到 3,902.1 億美元,到 2030 年將擴大到 6,425.7 億美元,複合年成長率為 10.49%。

強勁的成長反映了企業在應對混合雲端複雜性、日益嚴峻的網路威脅和持續的預算審查時,紛紛轉向外包IT營運。以雲端為中心的交付模式、人工智慧的日益普及以及監管壓力正在重塑服務提供者的產品和服務,而智慧自動化和垂直行業專業知識則是實現差異化競爭的關鍵。策略外包已從單純的成本節約轉變為數位轉型的核心支柱,服務供應商正在加速投資安全營運中心、多重雲端編配工具和邊緣管理平台。併購活動凸顯了規模經濟的吸引力,服務提供者正尋求透過非內生成長來彌補技術差距並擴大地域覆蓋範圍。

全球託管服務市場趨勢與洞察

混合雲端的複雜性推動了託管服務的採用

混合雲端架構融合了本地部署、私有雲端和多個公共雲端,增加了維運的複雜性,讓內部團隊難以應付。諸如微軟歐盟資料邊界之類的管理方案要求在地化資料處理,迫使企業選擇能夠保證合規性、可攜性和統一安全策略的供應商。

成本最佳化壓力推動外包決策

持續的利潤壓力正將固定IT成本轉化為變動成本項目,例如託管服務。埃森哲與美國簽訂的價值16億美元的「雲一號」(Cloud One)合約等大規模轉型交易表明,企業正將外包視為戰略性而非戰術性的舉措。服務提供者將Accenture、人工智慧工具和認證人才庫打包出售,使買家能夠在避免前期投資投入的同時獲得新的能力。

資料主權法規限制了服務交付模式。

要求本地化處理的法規迫使服務提供者在每個司法管轄區複製基礎設施,從而降低了規模經濟效益,並使全球交付更加複雜。微軟的歐盟資料邊界意味著服務提供者必須承擔額外的資本和營運成本,才能為多個地區的客戶提供服務。

細分市場分析

到2024年,雲端運算將佔據託管服務市場52.7%的佔有率,隨著混合雲端在2030年前以12.1%的複合年成長率成長,其領先優勢將進一步擴大。按需啟動資源、遵守資料法規以及整合邊緣工作負載的能力,正推動企業從本地部署模式遷移到雲端運算。Accenture的「雲端一體化」(Cloud One)計畫等超大規模雲端服務聯盟,展現了協作創新如何促成多年期大型合約。

託管服務市場將受益於雲端運算的普及,因為它允許服務供應商集中基礎設施、自動修補漏洞並大規模部署人工智慧主導的成本最佳化。私有雲端在資料敏感領域仍將保持可行性,但對於難以重構的傳統工作負載,本地部署服務仍將持續存在。多重雲端編配和財務營運彙報的服務提供者將最有優勢贏得新的支出。

到2024年,託管基礎設施服務收入將成長38.9%,這反映了維持異質設施運作的根本需求。然而,託管安全服務將引領成長,複合年成長率將達到11.9%,這反映了董事會對勒索軟體和合規罰款的擔憂。人工智慧驅動的威脅搜尋、零信任部署和自動化事件遏制是區分市場贏家的關鍵。

隨著網路保險公司收緊承保標準,託管保全服務服務市場規模預計將加速成長。服務提供者正將安全營運中心即服務 (SOCaaS) 與合規報告和桌面演練捆綁銷售,從而創造高利潤的經常性收入。網路和通訊服務將受益於 5G 的推廣,而資料中心能源管理產品也將受益於永續性要求。

託管服務市場按配置(本地部署、雲端部署)、服務類型(託管資料中心、託管安全、託管通訊等)、公司規模(中小企業、大型企業)、最終用戶行業(銀行、金融服務和保險 (BFSI)、IT 和通訊、製造業等)以及地區進行細分。市場預測以美元計價。

區域分析

北美地區預計在2024年將維持32.7%的收入佔有率,這主要得益於早期雲端遷移、網路安全法規以及高額的IT支出。聯邦政府項目,例如美國的「雲端一號」(Cloud One)計劃,正在提升大型託管服務合約的透明度。銀行、金融服務和保險(BFSI)以及醫療保健行業的客戶持續支撐著市場需求,而服務提供者正將該地區作為人工智慧和邊緣運算試點計畫的啟動平台。

亞太地區是成長最快的地區,預計到2030年複合年成長率將達到11.5%。中國製造業的升級、印度數位化公共基礎設施的建設以及日本老舊工廠的現代化改造,都在推動對能夠連接傳統工作負載和雲端工作負載的服務提供者的投資。超大規模資料中心營運商正與本地主機服務供應商 (MSP) 合作,以滿足各國自主的雲端需求,而東協各國政府也在強制推行雲端優先政策並縮短銷售週期。

隨著GDPR、數位營運彈性法規和永續性規則的實施,合規難度日益增加,歐洲正穩步擴張。德國大力推動工業4.0,英國利用託管服務供應商(MSP)應對脫歐後的金融監管,法國則著重發展其主權雲端框架。服務提供者正透過區域性資料中心和綠色能源採購來實現差異化競爭,以達成環保目標。中東和非洲仍在發展中,但智慧城市和電子政府計劃正經歷快速成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 向混合雲營運模式轉型

- 企業IT預算面臨成本最佳化壓力

- 網路威脅數量不斷增加,合規要求日益嚴格

- 遠端邊緣運算部署管理服務

- 網路保險對全天候託管式偵測和回應的先決條件

- 永續性和綠色IT法規推動了電力/冷卻管理

- 市場限制

- 根深蒂固的資料主權和隱私法規

- 多廠商整合和傳統系統互通性挑戰

- 長期MSP合約帶來的供應商鎖定風險和高昂的退出成本

- MSP(託管服務提供者)內部人才短缺限制了服務品質的擴充性。

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 評估市場的宏觀經濟因素

第5章 市場規模與成長預測

- 透過部署

- 本地部署

- 雲

- 公有雲

- 私有雲端

- 混合雲

- 按服務類型

- 託管資料中心

- 託管安全

- 管理溝通

- 主機網路

- 託管基礎設施

- 行動管理

- 其他

- 按公司規模

- 中小企業

- 主要企業

- 按最終用戶行業分類

- BFSI

- 資訊科技/通訊

- 醫療保健和生命科學

- 製造業

- 零售與電子商務

- 政府/公共部門

- 能源與公共產業

- 媒體與娛樂

- 其他(教育、非營利組織)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- IBM Corporation

- Cisco Systems Inc.

- Fujitsu Ltd

- ATandT Inc.

- Hewlett Packard Enterprise(HPE)

- Microsoft Corporation

- Verizon Communications Inc.

- Dell Technologies Inc.

- Nokia Corporation

- Deutsche Telekom AG(T-Systems)

- Rackspace Technology Inc.

- Tata Consultancy Services Ltd

- Wipro Ltd

- Accenture plc

- Capgemini SE

- HCL Technologies Ltd

- Cognizant Technology Solutions

- NTT Data Corp.

- DXC Technology Co.

- Lumen Technologies Inc.

- Orange Business Services

第7章 市場機會與未來展望

The managed services market stands at USD 390.21 billion in 2025 and is forecast to expand to USD 642.57 billion by 2030 at a 10.49% CAGR.

The strong growth reflects enterprises' pivot toward outsourced IT operations as they juggle hybrid-cloud complexity, rising cyber threats, and ongoing budget scrutiny. Cloud-centric delivery models, wider AI adoption, and regulatory pressures are reshaping provider offerings, while competitive differentiation now hinges on intelligent automation and vertical expertise. Strategic outsourcing has shifted from pure cost reduction to a core pillar of digital transformation, accelerating provider investments in security operations centers, multi-cloud orchestration tools, and edge management platforms. M&A activity underscores the appeal of scale, with providers pursuing inorganic growth to fill technology gaps and expand geographic reach.

Global Managed Services Market Trends and Insights

Hybrid-cloud complexity drives managed services adoption

Hybrid-cloud architectures combine on-premises, private, and multiple public clouds, elevating operational complexity that internal teams struggle to master. Regulatory initiatives such as the Microsoft EU Data Boundary require localized data handling, pushing enterprises toward providers that can guarantee compliance, portability, and unified security policies.Seamless workload portability and real-time policy enforcement across distributed environments cement long-term demand for managed infrastructure and security offerings.

Cost optimization pressures accelerate outsourcing decisions

Persistent margin pressure turns fixed IT overhead into a variable line item through managed services. Large transformation deals such as Accenture's USD 1.6 billion Cloud One contract with the U.S. Air Force illustrate how enterprises view outsourcing as strategic, not merely tactical. Providers bundle automation, AI tooling, and certified talent pools, allowing buyers to avoid up-front capital outlays while still accessing emerging capabilities.

Data-sovereignty regulations constrain service delivery models

Mandates requiring localized processing force providers to duplicate infrastructure in each jurisdiction, reducing economies of scale and complicating global delivery. Microsoft's EU Data Boundary illustrates the additional capital and operational overhead that providers must absorb to serve multi-region clients.

Other drivers and restraints analyzed in the detailed report include:

- Cybersecurity threat evolution demands specialized response capabilities

- Edge computing expansion creates remote management requirements

- Vendor lock-in concerns limit long-term commitments

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud deployment held 52.7% share of the managed services market in 2024 and is widening its lead as hybrid cloud posts a 12.1% CAGR through 2030. The ability to spin up resources on demand, comply with data regulations, and integrate edge workloads explains why enterprises migrate from on-premises models. Hyperscaler alliances, like Accenture's engagement on Cloud One, show how co-innovation can unlock large multiyear deals.

The managed services market benefits as cloud deployment allows providers to pool infrastructure, automate patches, and roll out AI-driven cost-optimization at scale. Private cloud remains relevant for data-sensitive sectors, while on-premises services persist for legacy workloads that cannot be refactored easily. Providers that master multi-cloud orchestration and FinOps reporting are best positioned to capture new spend.

Managed infrastructure services owned 38.9% revenue in 2024, reflecting the baseline need to keep heterogeneous estates running. Yet managed security services lead growth with an 11.9% CAGR, mirroring board-level concern over ransomware and compliance fines. AI-enabled threat hunting, zero-trust rollouts, and automated incident containment set market winners apart.

The managed services market size for security offerings is expected to accelerate as cyber-insurance carriers tighten underwriting criteria. Providers are bundling SOC-as-a-service with compliance reporting and tabletop exercises, creating high-margin recurring revenue. Network and communication services gain from 5G roll-outs, while data-center energy management products ride sustainability mandates.

Managed Services Market is Segmented by Deployment (On-Premises, Cloud), Service Type (Managed Data Center, Managed Security, Managed Communications, and More), Enterprise Size (Small and Medium Enterprises, Large Enterprises), End-User Vertical (BFSI, IT and Telecommunication, Manufacturing, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America retained 32.7% revenue share in 2024, buoyed by early cloud migration, cyber regulations, and high IT spend. Federal programs such as the U.S. Air Force Cloud One create visibility for large managed services contracts. BFSI and healthcare customers continue to anchor demand, and providers use the region as a launchpad for AI and edge pilots.

Asia-Pacific is the fastest-growing region at 11.5% CAGR to 2030. China's manufacturing upgrades, India's digital-public-infrastructure push, and Japan's aging plant modernization funnel spend toward providers capable of bridging legacy and cloud workloads. Hyperscalers team with local MSPs to address sovereign-cloud requirements, while ASEAN governments adopt cloud-first mandates that shorten sales cycles.

Europe shows steady expansion as GDPR, Digital Operational Resilience Act, and sustainability rules heighten compliance complexity. Germany drives Industry 4.0 managed services, the United Kingdom leans on MSPs for post-Brexit financial regulation, and France emphasizes sovereign-cloud frameworks. Providers differentiate through localized data centers and green-energy sourcing to meet environmental targets. The Middle East and Africa remain nascent but grow quickly on smart-city and e-government projects.

- IBM Corporation

- Cisco Systems Inc.

- Fujitsu Ltd

- ATandT Inc.

- Hewlett Packard Enterprise (HPE)

- Microsoft Corporation

- Verizon Communications Inc.

- Dell Technologies Inc.

- Nokia Corporation

- Deutsche Telekom AG (T-Systems)

- Rackspace Technology Inc.

- Tata Consultancy Services Ltd

- Wipro Ltd

- Accenture plc

- Capgemini SE

- HCL Technologies Ltd

- Cognizant Technology Solutions

- NTT Data Corp.

- DXC Technology Co.

- Lumen Technologies Inc.

- Orange Business Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shift to hybrid-cloud operating models

- 4.2.2 Cost-optimization pressure on enterprise IT budgets

- 4.2.3 Rising cyber-threat volume and compliance mandates

- 4.2.4 Edge-computing roll-outs demanding remote managed services

- 4.2.5 Cyber-insurance prerequisites for 24/7 managed detection and response

- 4.2.6 Sustainability and green-IT regulations driving managed power/cooling

- 4.3 Market Restraints

- 4.3.1 Persistent data-sovereignty and privacy regulations

- 4.3.2 Multi-vendor integration and legacy interoperability challenges

- 4.3.3 Vendor lock-in risk and high exit costs of long-term MSP contracts

- 4.3.4 Talent shortages within MSPs limiting service-quality scalability

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Assesment of Macroeconomic Factors on the market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.1.2.1 Public Cloud

- 5.1.2.2 Private Cloud

- 5.1.2.3 Hybrid Cloud

- 5.2 By Service Type

- 5.2.1 Managed Data Center

- 5.2.2 Managed Security

- 5.2.3 Managed Communications

- 5.2.4 Managed Network

- 5.2.5 Managed Infrastructure

- 5.2.6 Managed Mobility

- 5.2.7 Others

- 5.3 By Enterprise Size

- 5.3.1 Small and Medium Enterprises (SMEs)

- 5.3.2 Large Enterprises

- 5.4 By End-user Vertical

- 5.4.1 BFSI

- 5.4.2 IT and Telecommunication

- 5.4.3 Healthcare and Life Sciences

- 5.4.4 Manufacturing

- 5.4.5 Retail and E-commerce

- 5.4.6 Government and Public Sector

- 5.4.7 Energy and Utilities

- 5.4.8 Media and Entertainment

- 5.4.9 Others (Education, Non-Profit)

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Southeast Asia

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 IBM Corporation

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Fujitsu Ltd

- 6.4.4 ATandT Inc.

- 6.4.5 Hewlett Packard Enterprise (HPE)

- 6.4.6 Microsoft Corporation

- 6.4.7 Verizon Communications Inc.

- 6.4.8 Dell Technologies Inc.

- 6.4.9 Nokia Corporation

- 6.4.10 Deutsche Telekom AG (T-Systems)

- 6.4.11 Rackspace Technology Inc.

- 6.4.12 Tata Consultancy Services Ltd

- 6.4.13 Wipro Ltd

- 6.4.14 Accenture plc

- 6.4.15 Capgemini SE

- 6.4.16 HCL Technologies Ltd

- 6.4.17 Cognizant Technology Solutions

- 6.4.18 NTT Data Corp.

- 6.4.19 DXC Technology Co.

- 6.4.20 Lumen Technologies Inc.

- 6.4.21 Orange Business Services

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment