|

市場調查報告書

商品編碼

1851416

美國溫度感測器:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)US Temperature Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

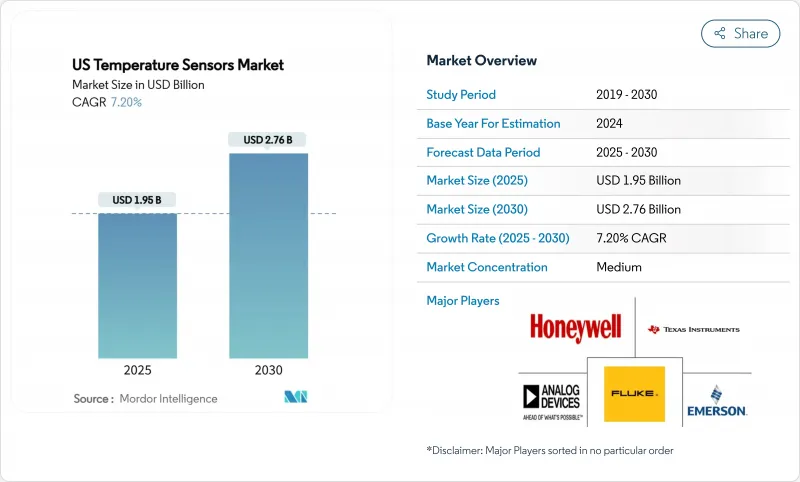

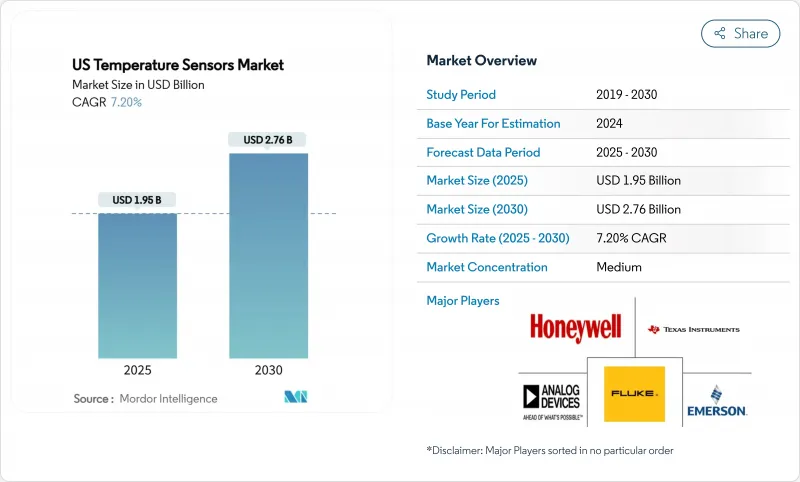

據估計,2025 年美國溫度感測器市場規模為 19.5 億美元,預計到 2030 年將達到 27.6 億美元,預測期(2025-2030 年)複合年成長率為 7.20%。

對亞攝氏度級精度的需求、聯邦政府為促進本土半導體生產而提供的獎勵,以及電動車價值鍊和資料中心冷卻系統中即時監控的普及,持續推動著半導體產業的成長。私人半導體投資的流動性已超過4000億美元,這為依賴製程熱診斷的新型工廠提供了可能;同時,自動化工廠和預測性維護計畫也在推動感測器的持續維修。分散式光纖解決方案、先進的紅外線陣列和人工智慧賦能的邊緣設備,正在為能夠將測量精度與整合分析相結合的供應商拓寬競爭優勢。同時,醫療保健、儲能和石化產業日益嚴格的安全法規,也促使傳統有線設備進入積極的更新換代週期。

美國溫度感測器市場趨勢與洞察

工業4.0和智慧工廠的廣泛應用

工業數位化正在透過融合人工智慧、機器人和互聯儀器重塑工廠車間,而溫度感測正是這一融合的核心。過去僅對少數關鍵設備進行採樣的預測性維護程序,如今已覆蓋整個生產線,數百個節點可在機器故障發生前數小時發出溫度偏差警報。德克薩斯(TI) 新型感測器中嵌入的邊緣人工智慧晶片組可處理本地資料流,實現毫秒級警報,從而觸發自動化響應,且無雲延遲。 FOUNDATION 現場匯流排和 PROFINET 等互通通訊協定簡化了系統整合,而堅固耐用的外殼和更寬的溫度範圍則確保了在多塵、高振動環境下的可靠運作。因此,美國溫度感測器市場持續受益於傳統 PLC 網路的替換銷售以及來自待開發區智慧工廠的新增需求。

穿戴式裝置推動了對溫度感測技術的需求。

小型化、低功耗晶粒將臨床級溫度精度帶入日常設備,使消費者能夠以±0.1°C的精度追蹤體溫,從而實現疾病的早期檢測。可拉伸基板如今能夠貼合皮膚數日而不會引起刺激,雙感測器耳道式設計可提供連續讀數,完美契合遠距遠端醫療。對於感測器製造商而言,這些設計上的突破使他們不僅能夠在大批量消費通路中應用其技術,還能在同樣對功耗要求嚴格的工業IoT領域中加以利用。因此,美國溫度感測器市場正處於快速創新階段。

半導體和鉑族金屬價格波動;

鎵、鍺和鉑金價格的波動正在擾亂熱電阻(RTD)和精密晶片式探頭的成本結構。由於中國在鎵和鍺提煉主導,美國買家容易受到出口限制的影響。同時,隨著燃料電池和觸媒轉換器觸媒轉換器需求的激增,鉑金薄膜面臨供不應求。預算的供不應求導致升級計劃延期,這可能會在短期內降低美國溫度感測器市場的銷售量。

細分市場分析

由於有線設備在安全關鍵硬佈線和現有資料中心控制系統 (DCS) 佈線中的可靠性,預計到 2024 年,有線設備仍將佔據 69.20% 的收入佔有率;而無線節點預計將以 10.90% 的複合年成長率成長,這主要得益於其易於改裝和安裝成本更低。美國無線溫度感測器市場預計到 2030 年將達到 8.6 億美元,反映出資料中心和食品工廠對無線溫度感測器的強勁需求。麻省理工學院 (MIT) 開發的自供電能量採集器消除了電池維護的障礙,拓展了其在泵浦、窯爐和旋轉設備等領域的應用場景。在大型工廠中,LoRaWAN 和 5G NB-IoT 技術能夠以毫瓦級的功率預算實現公里級的覆蓋範圍,使工廠管理人員無需挖掘電纜溝即可獲得精細的溫度分佈圖。

隨著跳頻和AES-128加密技術的普及,曾經令無線技術備受關注的可靠性問題逐漸消退。邊緣微控制器現在能夠預處理資料以減少資料包有效載荷,從而緩解工廠骨幹網路的擁塞。同時,在核能、製藥和航太等產業,有線連接仍然不可或缺,因為這些產業的管治通訊協定要求使用固定電纜和類比輸出。供應商若能將混合模式閘道與Wi-Fi或sub-GHz無線電模組結合,從而橋接4-20mA環路,將可充分利用混合部署模式,並提升其在美國溫度感測器市場的佔有率。

熱電偶可覆蓋高達 2300 度C 的極端溫度,預計到 2024 年將貢獻 32.30% 的收入。同時,分散式光纖系統正以 11.90% 的複合年成長率快速成長,因為產業對空間解析度的需求遠高於點檢測。 DTS 預測,到 2030 年,美國溫度感測器市場規模將超過 4.7 億美元。無電磁干擾的光纖線路可穿過高壓艙和感應爐等電子設備容易故障的場所。 Luna Innovations 的高解析度裝置可實現亞毫米級的精度,用於繪製電池模組和低溫管道的分佈圖。

在製藥無塵室和計量實驗室等需要±0.1 度C精度的場所,電阻式溫度檢測器仍佔據主導地位。熱敏電阻器用於檢測對成本敏感的設備,而紅外線陣列則為預測性釋放提供了熱成像技術。支援HART、Modbus和乙太網路通訊協定的混合型變送器簡化了與數位孿生的整合。能夠提供全套感測元件、頭戴式傳送器和分析韌體的供應商將增強其經常性收入,並鞏固其在美國溫度感測器市場的地位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 工業4.0和智慧工廠的廣泛應用

- 穿戴式裝置對溫度感測的需求日益成長

- 汽車電子產品和電動車對溫度控管的要求日益提高

- 用於mRNA疫苗分發的低溫運輸聯網感測器

- 資料中心液冷技術的快速發展需要分散式感測技術。

- 聯邦政府的回流激勵措施促進了工廠內部熱過程感測器的發展

- 市場限制

- 半導體和鉑族金屬價格波動

- 較長的設計週期會延遲受監管區域的感測器更換。

- 關鍵基礎設施中無線感測器的網路安全問題

- 光纖安裝人員短缺限制了分散式感測技術的應用。

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 有線

- 無線的

- 透過技術

- 紅外線的

- 熱電偶

- 電阻溫度檢測器(RTD)

- 熱敏電阻器

- 溫度變送器

- 光纖

- 其他

- 按最終用戶行業分類

- 化工/石油化工

- 石油和天然氣

- 金屬和採礦

- 發電

- 飲食

- 車

- 醫療的

- 航太/軍事

- 消費性電子產品

- 其他終端用戶產業

- 連結性別

- 接觸

- 非接觸式

- 透過應用環境

- 工業製程監控

- 暖通空調和建築自動化

- 醫療保健和穿戴式設備

- 電動汽車電池管理

- 資料中心和電訊

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Texas Instruments Inc.

- Honeywell International Inc.

- TE Connectivity Ltd

- Analog Devices Inc.

- Siemens AG

- Panasonic Corp.

- ABB Ltd

- Emerson Electric Co.

- STMicroelectronics

- Microchip Technology Inc.

- NXP Semiconductors NV

- Robert Bosch GmbH

- DENSO Corp.

- FLIR Systems(Teledyne)

- Omron Corp.

- Maxim Integrated(ADI)

- Fluke Process Instruments

- Sensirion AG

- Amphenol Advanced Sensors

- Silixa Ltd

- AP Sensing GmbH

第7章 市場機會與未來展望

The US Temperature Sensors Market size is estimated at USD 1.95 billion in 2025, and is expected to reach USD 2.76 billion by 2030, at a CAGR of 7.20% during the forecast period (2025-2030).

Sub-degree accuracy demands, federal incentives that strengthen on-shore semiconductor production, and the diffusion of real-time monitoring across electric-vehicle (EV) value chains and data-center cooling systems keep the growth engine running. Liquidity in private semiconductor investments already past USD 400 billion has unlocked new fabs that rely on in-process thermal diagnostics, while autonomous factories and predictive maintenance programs drive continuous sensor retrofits. Distributed fiber-optic solutions, advanced infrared arrays, and AI-enabled edge devices are widening the competitive moat for suppliers able to pair measurement precision with integrated analytics. At the same time, tighter safety regulations in healthcare, energy storage, and petrochemical sites ensure that replacement cycles remain brisk even in legacy wired installations.

US Temperature Sensors Market Trends and Insights

Expansion of Industry 4.0 and smart-factory adoption

Industrial digitalization reshapes factory floors by fusing AI, robotics, and connected instrumentation, and temperature sensing sits at the heart of that convergence. Predictive maintenance programs that once sampled a few key assets now blanket entire production lines with hundreds of nodes that flag thermal deviations hours before mechanical breakdowns. Edge AI chipsets embedded in new sensors from Texas Instruments crunch local data streams so millisecond-level alerts can trigger automated responses without cloud latency. Interoperable protocols such as FOUNDATION Fieldbus and PROFINET simplify system integration, while ruggedized housings and extended temperature ranges ensure reliable service in dusty, high-vibration zones. As a result, the US temperature sensors market keeps enjoying replacement sales into heritage PLC networks and fresh demand from green-field smart factories.

Growing demand for temperature sensing in wearable consumer electronics

Miniaturized, low-power die have brought clinical-grade temperature accuracy into everyday devices, letting consumers track core body temperature within +-0.1 °C for early illness detection. Stretchable substrates now conform to skin for days without irritation, and dual-sensor ear-canal designs deliver continuous readings that fit into telehealth workflows. Fifth-generation cellular links and edge computing chips send encrypted streams to healthcare dashboards so clinicians can intervene remotely, a capability valued by aging-in-place programs. For sensor makers, these design wins offer high-volume consumer channels plus technology leverage across industrial IoT where power budgets are equally tight. The resulting pull keeps the US temperature sensors market on a steep innovation curve.

Volatility in semiconductor and platinum-group metal prices

Price swings in gallium, germanium, and platinum upset cost structures for RTDs and high-precision chip-based probes. China's command of gallium and germanium refining keeps US buyers vulnerable to export restrictions, while platinum thin films face supply tightness amid intensified fuel-cell and catalytic-converter demand. Budget uncertainty can delay upgrade projects, trimming near-term volumes inside the US temperature sensors market.

Other drivers and restraints analyzed in the detailed report include:

- Rising automotive electronics and EV thermal-management requirements

- Adoption of cold-chain IoT sensors for mRNA-vaccine logistics

- Cyber-security concerns over wireless sensors in critical infrastructure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wired devices retained 69.20% of 2024 revenue thanks to hard-wired reliability in safety-critical loops and existing DCS cabling, yet wireless nodes are scaling 10.90% CAGR on retrofit ease and lower installation costs. The US temperature sensors market size for wireless products is forecast to reach USD 0.86 billion by 2030, reflecting robust adoption in data centers and food plants. Self-powered harvesters developed at MIT remove battery maintenance barriers and widen use cases in pumps, kilns, and rotating equipment. In sprawling factories, LoRaWAN and 5G NB-IoT enable kilometer-scale reach with milliwatt power budgets, giving plant managers granular heat maps without trenching cable.

Reliability fears that once shadowed wireless have faded as frequency-hopping and AES-128 encryption become standard. Edge microcontrollers now pre-process readings to slash packet payloads, reducing congestion on factory backbones. Meanwhile, wired incumbency endures in nuclear, pharma, and aerospace lines where governance protocols require fixed cabling and analog outputs. Suppliers that bundle mixed-mode gateways bridging 4-20 mA loops with Wi-Fi or Sub-GHz radios capitalize on hybrid roll-outs and expand their stake in the US temperature sensors market.

Thermocouples brought in 32.30% of 2024 turnover by covering extreme heat up to 2,300 °C, but distributed fiber-optic systems are rocketing at 11.90% CAGR as industries crave spatial resolution over point checks. The US temperature sensors market size for DTS is projected to exceed USD 470 million by 2030. Immune to EMI, fiber lines navigate high-voltage bays and induction furnaces where electronics fail. High-definition units from Luna Innovations achieve sub-millimeter granularity, mapping battery modules and cryogenic pipelines alike.

Resistance Temperature Detectors still dominate pharma cleanrooms and metrology labs that stipulate +-0.1 °C accuracy. Thermistors capture cost-sensitive appliances, while infrared arrays unlock thermal imaging for predictive maintenance. Hybrid transmitters delivering HART, Modbus, or Ethernet protocols simplify integration into digital twins. Vendors that supply full stacks sensing element, head-mount transmitter, and analytics firmware bolster recurring revenue and deepen their position inside the US temperature sensors market.

US Temperature Sensors Market Report is Segmented by Type (Wired, Wireless), Technology (Infrared, Thermocouple, RTD, Thermistor and More), End-User Industry (Chemical and Petrochemical, Oil and Gas, Metal and Mining and More), Connectivity (Contact, Non-Contact), Application Environment (Industrial Process Monitoring, HVAC and Building Automation and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Texas Instruments Inc.

- Honeywell International Inc.

- TE Connectivity Ltd

- Analog Devices Inc.

- Siemens AG

- Panasonic Corp.

- ABB Ltd

- Emerson Electric Co.

- STMicroelectronics

- Microchip Technology Inc.

- NXP Semiconductors NV

- Robert Bosch GmbH

- DENSO Corp.

- FLIR Systems (Teledyne)

- Omron Corp.

- Maxim Integrated (ADI)

- Fluke Process Instruments

- Sensirion AG

- Amphenol Advanced Sensors

- Silixa Ltd

- AP Sensing GmbH

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Expansion of Industry 4.0 and smart-factory adoption

- 4.2.2 Growing demand for temperature sensing in wearable consumer electronics

- 4.2.3 Rising automotive electronics and EV thermal-management requirements

- 4.2.4 Adoption of cold-chain IoT sensors for mRNA-vaccine logistics

- 4.2.5 Rapid growth of data-center liquid-cooling needs distributed sensing

- 4.2.6 Federal on-shoring incentives boosting in-fab thermal-process sensors

- 4.3 Market Restraints

- 4.3.1 Volatility in semiconductor and platinum-group metal prices

- 4.3.2 Lengthy design-in cycles slow sensor replacement in regulated sectors

- 4.3.3 Cyber-security concerns over wireless sensors in critical infrastructure

- 4.3.4 Shortage of fiber-optic installers curbs distributed sensing roll-out

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry Intensity

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Wired

- 5.1.2 Wireless

- 5.2 By Technology

- 5.2.1 Infrared

- 5.2.2 Thermocouple

- 5.2.3 Resistance Temperature Detector (RTD)

- 5.2.4 Thermistor

- 5.2.5 Temperature Transmitter

- 5.2.6 Fiber Optic

- 5.2.7 Others

- 5.3 By End-user Industry

- 5.3.1 Chemical and Petrochemical

- 5.3.2 Oil and Gas

- 5.3.3 Metal and Mining

- 5.3.4 Power Generation

- 5.3.5 Food and Beverage

- 5.3.6 Automotive

- 5.3.7 Medical

- 5.3.8 Aerospace and Military

- 5.3.9 Consumer Electronics

- 5.3.10 Other End-user Industries

- 5.4 By Connectivity

- 5.4.1 Contact

- 5.4.2 Non-Contact

- 5.5 By Application Environment

- 5.5.1 Industrial Process Monitoring

- 5.5.2 HVAC and Building Automation

- 5.5.3 Healthcare and Wearables

- 5.5.4 Electric-Vehicle Battery Management

- 5.5.5 Data Centers and Telecom

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Texas Instruments Inc.

- 6.4.2 Honeywell International Inc.

- 6.4.3 TE Connectivity Ltd

- 6.4.4 Analog Devices Inc.

- 6.4.5 Siemens AG

- 6.4.6 Panasonic Corp.

- 6.4.7 ABB Ltd

- 6.4.8 Emerson Electric Co.

- 6.4.9 STMicroelectronics

- 6.4.10 Microchip Technology Inc.

- 6.4.11 NXP Semiconductors NV

- 6.4.12 Robert Bosch GmbH

- 6.4.13 DENSO Corp.

- 6.4.14 FLIR Systems (Teledyne)

- 6.4.15 Omron Corp.

- 6.4.16 Maxim Integrated (ADI)

- 6.4.17 Fluke Process Instruments

- 6.4.18 Sensirion AG

- 6.4.19 Amphenol Advanced Sensors

- 6.4.20 Silixa Ltd

- 6.4.21 AP Sensing GmbH

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment