|

市場調查報告書

商品編碼

1851398

汽車照明:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Automotive Lighting - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

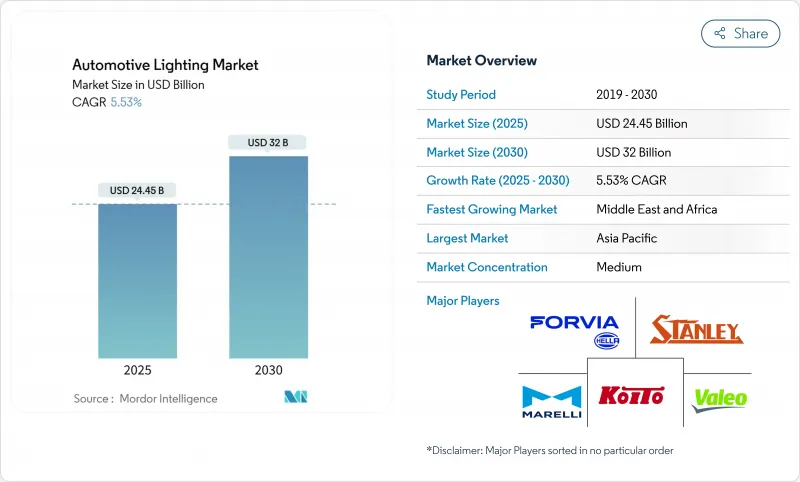

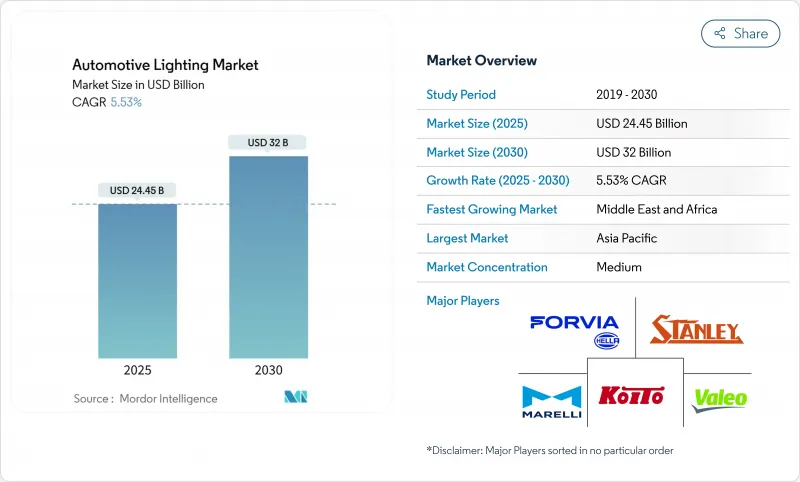

預計到 2025 年,汽車照明市場規模將達到 244.5 億美元,到 2030 年將達到 320 億美元,年複合成長率為 5.53%。

市場成長主要與全球範圍內不斷加強的能源效率政策、LED的快速普及以及對更智慧、更個人化照明模組日益成長的需求密切相關。汽車製造商正持續從電力消耗的鹵素燈解決方案轉向高度整合的LED、OLED和雷射平台,這些平台能夠提供更低的電力負載和更豐富的功能。此外,自我調整遠光燈在關鍵地區的核准也加速了高階功能的普及。在供應方面,照明專家與半導體供應商之間的策略聯盟正在縮短開發週期,並為支援ADAS(高級駕駛輔助系統)通訊的數位投影技術帶來機會。儘管亞太地區仍然是製造中心,但隨著政策制定者協調安全法規並建造充電基礎設施,中東和非洲有望實現最快的銷售成長。

全球汽車照明市場趨勢與洞察

強制推廣LED

為實現二氧化碳減排目標,政策制定者正在逐步淘汰高密集型燈具,並在所有車輛領域推廣使用LED燈。歐洲車隊估算顯示,如果全面採用LED燈,每年可節省1.48太瓦時(TWh)的能源。在美國,2024年修訂的FMVSS 108標準將使自我調整遠光燈合法化,進一步鼓勵採用LED頭燈。聯合國第148號法規將統一核准代碼,並促進下一代設備的全球認證。

智慧駕駛座和沈浸式環境的需求

內裝模組融合了數千個 RGB LED 燈,打造出以健康為中心的座艙環境,並與資訊娛樂系統同步運作。梅賽德斯-奔馳數位照明系統擁有超過 200 萬像素,可在路面上投射符號,增強駕駛員的感知能力。先進的校準技術經過實驗室測試,可提高直射光導光條的色彩準確度和均勻性,並消除高級儀表板上的光斑。

先進模組的初始成本較高

AudiQ5等豪華車型上的數位OLED尾燈採用18個可獨立尋址的燈段,導致元件和模具成本高。串聯堆疊式OLED原型燈已實現77%的外部量子效率和46,000小時的使用壽命,但製造程序的複雜性限制了其向大眾市場的推廣。 MicroLED替代方案可為頭燈組件減重30瓦和1公斤,但設備成本仍然很高。

細分市場分析

到2024年,乘用車將以69.36%的收入佔有率主導汽車照明市場。同時,摩托車預計將以7.45%的複合年成長率成為成長最快的細分市場。隨著電動Scooter優先採用低功耗LED以延長電池組裝時間,摩托車汽車照明市場規模將進一步擴大。 Fiem Industries透露,該公司計劃在未來三年內運作超過80個摩托車LED照明計劃。輕型商用車正傾向於採用自我調整頭燈,以提升密集都市區路段的「最後一公里」行駛安全性。雖然中型和重型卡車的升級速度相對較慢,但強制性的高能見度反光膠帶和行車燈法規仍在推動穩定的改裝需求。

採用多感測器融合技術的自我調整LED頭燈將於2025年率先應用於幾款國產轎車,並逐漸被摩托車廣泛採用,以解決彎曲路面照明造成的盲點問題。高階乘用車車型已經開始使用數位投影和獨特的日間行車燈圖案來強化品牌形象。未來,更小的LED燈珠和無需散熱器的光學元件有望使經濟型Scooter也能配備先前僅供豪華車型使用的自適應駕駛輔助系統(ADB)。

到2024年,外部模組將佔據汽車照明市場的主導地位,在全球營收中佔比高達78.54%,而內裝解決方案預計將以8.20%的複合年成長率(CAGR)表現更佳。可尋址RGB陣列安裝在車頂和腳部空間,並與空調和資訊娛樂系統連結。研究表明,協調色溫可以減輕駕駛員夜間通勤的疲勞感。

頭燈仍然是技術試驗場:FMVSS(聯邦機動車輛安全標準)的更新允許使用自我調整遠光燈,使LED能夠動態地遮罩迎面而來的車輛眩光。高階SUV上的OLED尾燈即使在形狀複雜的情況下也能實現均勻的亮度。投射ADAS(高級駕駛輔助系統)警告的車內照明條現在與L3級自動駕駛套件捆綁在一起,將環境訊號與外部燈光行為關聯起來。

區域分析

亞太地區將主導汽車照明市場,2024年將佔全球收入的32.64%,鞏固其作為全球汽車製造商生產基地的地位。中國領先的供應商目前正出口符合聯合國第148號規則的自適應LED模組,從而拓展了市場選擇,使其不再局限於傳統的日本和歐洲廠商。廣東省一家本土龍頭企業報告稱,智慧照明合約將佔2024年收入的41.5%。 Apan公司改進了多感測器頭燈融合技術,而印度摩托車市場的蓬勃發展將推動通勤摩托車對LED的需求。

預計中東和非洲將以7.14%的複合年成長率實現最快增速,海灣國家正在建造電動車充電走廊並推出與歐盟眩光閾值相符的國家安全標準。沙烏地阿拉伯的目標是到2025年實現輕型車銷量超過500萬輛,而阿拉伯聯合大公國的目標是到2050年實現50%的電動車普及率。各國政府也正在進行光生物安全審核,要求汽車製造商在進入市場前檢驗藍光比例。

預計歐洲將以4.90%的速度成長,北美將以5.60%的速度成長,這主要得益於節能指令和高階車型的普及。歐盟的二氧化碳排放標準鼓勵汽車製造商降低用電量,使得LED照明系統快速普及。美國在FMVSS自我調整光束系統核准後,市場活動將更加活躍,國內卡車平台也計劃在其2026年的生產週期內進行數位化照明昇級。美國將以6.80%的複合年成長率成長,因為該地區的組裝商正在採用整合平台架構,整合全球規格的照明模組,從而降低單位成本並促進售後市場認證。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 推廣LED的義務

- 智慧駕駛座和沈浸式環境的需求

- 電動車能源效率要求

- 用於ADAS/V2X的數位光投影

- 支持OTA的照明個性化

- 安全可見性規定

- 市場限制

- 先進模組的初始成本較高

- 半導體和原物料價格波動

- 增強型防眩光/光生物安全帽

- 消費後回收責任

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按車輛類型

- 搭乘用車

- 輕型商用車

- 中型和大型商用車輛

- 摩托車

- 透過使用

- 外部的

- 頭燈

- 尾燈

- 日間行車燈(DRL)

- 霧燈

- 內部的

- 環境/腳部空間

- 屋頂/穹頂

- 外部的

- 透過技術

- 鹵素

- 氙氣燈/HID燈

- LED

- 雷射

- 有機發光二極體

- 按銷售管道

- OEM

- 售後市場

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Koito Manufacturing Co. Ltd

- Stanley Electric Co. Ltd

- Valeo SE

- Forvia-HELLA GmbH & Co. KGaA

- Marelli Holdings Co. Ltd

- Tungsram Group

- Hyundai Mobis Co.

- Lumax Industries Ltd

- ams-OSRAM AG

- ZKW Group GmbH

- SL Corporation

- Nichia Corporation

- Continental AG

- DENSO Corporation

- Lear Corporation

- Bosch Mobility Lighting Modules

- LG Innotek Co.

- Panasonic Automotive Lighting

- Seoul Semiconductor Co.

第7章 市場機會與未來展望

The automotive lighting market stands at USD 24.45 billion in 2025 and is set to reach USD 32 billion by 2030, advancing at a 5.53% CAGR.

The market's growth is primarily linked to stricter global energy-efficiency policies, rapid LED penetration, and rising demand for smarter, personalization-ready lighting modules. Automakers continue to shift away from power-hungry halogen solutions toward highly integrated LED, OLED, and laser platforms that deliver lower electrical loads and richer functionality. Intensifying electric-vehicle production magnifies the importance of every watt saved, while adaptive driving beam approvals in key regions accelerate premium feature uptake. On the supply side, strategic partnerships between lighting specialists and semiconductor suppliers are shortening development cycles and unlocking digital-light projection opportunities that support advanced driver-assistance systems (ADAS) communication. Asia-Pacific remains the manufacturing hub, yet the Middle East and Africa promise the fastest volume gains as policymakers harmonize safety rules and build charging infrastructure.

Global Automotive Lighting Market Trends and Insights

LED-penetration mandates

Policymakers are phasing out energy-intensive lamps to meet CO2-reduction targets, pushing LEDs into every vehicle segment. European fleet calculations show potential savings of 1.48 TWh per year when full LED deployment is achieved. The United States amended FMVSS 108 in 2024, legalising adaptive driving beams and further incentivising LED headlamp adoption. UN Regulation 148 unifies approval codes, easing global homologation for next-generation devices.

Smart-cockpit and ambient-experience demand

Interior modules now blend thousands of RGB LEDs to create wellness-centric cabins that synchronise with infotainment cues. Mercedes-Benz DIGITAL LIGHT packs over 2 million pixels and projects road symbols to augment driver awareness. Laboratory studies confirm that advanced calibration improves colour accuracy and uniformity in direct-lit guides, removing hotspot artefacts in premium dashboards.

High upfront cost of advanced modules

Digital OLED tail-lamps in luxury models such as the Audi Q5 use 18 individually addressable segments that raise BOM and tooling costs. Tandem-stack OLED prototypes achieve 77% external quantum efficiency at 46,000-hour lifetimes, yet manufacturing complexity limits mass-market migration. Micro-LED replacements can shave 30 W and 1 kg from a headlamp assembly, but capital equipment costs remain significant.

Other drivers and restraints analyzed in the detailed report include:

- EV energy-efficiency requirements

- Digital-light projection for ADAS/V2X

- Semiconductor and raw-material volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The passenger cars segment dominated the Automotive Lighting Market with a 69.36% Share in 2024 revenues. Meanwhile, Two-wheelers are expected to register the fastest 7.45% CAGR. The automotive lighting market size within Two-wheelers will climb as e-scooters prioritize low-draw LEDs to preserve battery autonomy. Fiem Industries disclosed more than 80 active LED projects for bikes scheduled to hit assembly lines within three years. Light commercial fleets lean on adaptive headlamps to increase last-mile safety in dense urban corridors. Medium and heavy trucks upgrade more slowly, but mandatory conspicuity tape and running-light laws still feed a steady retrofit pipeline.

Adaptive LED headlamps using multi-sensor fusion debuted on several 2025 domestic Chinese sedans and cascaded to motorcycle variants to counter bend-lighting blind spots. Passenger-car premium trims already bake in digital-light projection and signature DRL patterns to reinforce brand identity, whereas fleet operators concentrate on durability and cost per lumen. Over the forecast horizon, small-format LEDs and heatsink-free optics will let low-cost scooters adopt ADB features previously limited to luxury cars.

Exterior modules segment dominated the Automotive Lighting Market with a 78.54% share in global revenues in 2024, but Interior solutions are set to outpace with an 8.20% CAGR. Roof and foot-well zones now host addressable RGB arrays that coordinate with climate controls and infotainment events. Studies confirm that harmonized color temperature can cut driver fatigue during night-time commutes.

Headlamps remain technology testbeds: FMVSS updates permit adaptive driving beams, letting LEDs dynamically mask glare for oncoming traffic. OLED tail lights in premium SUVs deliver uniform luminance across complex shapes, which is impossible with discrete LEDs. Interior light bars that mirror ADAS warnings are now bundled with Level-3 autonomy packages, linking ambient cues to external lamp behavior.

The Automotive Lighting Market Report is Segmented by Vehicle Type (Passenger Cars, Light Commercial Vehicles, and More), Application (Exterior (Headlamps, Taillights, Fog Lamps, and More) and Interior (Ambient/Footwell and Roof/Dome)), Technology (Halogen, Xenon / HID, LED, Laser and More), Sales Channel (OEM and Aftermarket), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

Geography Analysis

Asia-Pacific dominated the Automotive Lighting Market and holds 32.64% of 2024 revenues, cementing its role as a production center for global carmakers. Chinese tier-one suppliers now export adaptive LED modules compliant with UN Regulation 148, widening market options beyond traditional Japanese and European incumbents. Local champions in Guangdong reported that smart-lighting contracts accounted for 41.5% of 2024 revenue. Apan refines multi-sensor headlamp fusion, while India's two-wheeler boom accelerates LED demand across commuter bikes.

The Middle East and Africa are expected to log the fastest 7.14% CAGR as Gulf states build EV charging corridors and roll out national safety codes that mirror EU glare thresholds. Saudi Arabia targets more than 5 million light-vehicle sales by 2025, and the UAE aims for 50% EV penetration by 2050, both policies fuelling the need for energy-efficient lamps. Governments also pursue photobiological safety audits, prompting OEMs to validate blue-light ratios before market entry.

Europe and North America are expected to expand at 4.90% and 5.60%, respectively, sustained by energy-conservation directives and premium-vehicle density. EU CO2 standards reward automakers who cut electrical loads, positioning LEDs as low-hanging fruit. The United States sees heightened activity after FMVSS adaptive-beam approval, with domestic truck platforms planning digital-light updates in 2026 production cycles. South America advances at 6.80% CAGR as regional assemblers adopt consolidated platform architectures that integrate global-spec lighting modules, reducing cost per unit and easing aftermarket certification.

- Koito Manufacturing Co. Ltd

- Stanley Electric Co. Ltd

- Valeo SE

- Forvia-HELLA GmbH & Co. KGaA

- Marelli Holdings Co. Ltd

- Tungsram Group

- Hyundai Mobis Co.

- Lumax Industries Ltd

- ams-OSRAM AG

- ZKW Group GmbH

- SL Corporation

- Nichia Corporation

- Continental AG

- DENSO Corporation

- Lear Corporation

- Bosch Mobility Lighting Modules

- LG Innotek Co.

- Panasonic Automotive Lighting

- Seoul Semiconductor Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 LED-penetration mandates

- 4.2.2 Smart-cockpit & ambient-experience demand

- 4.2.3 EV energy-efficiency requirements

- 4.2.4 Digital-light projection for ADAS/V2X

- 4.2.5 OTA-enabled lighting personalisation

- 4.2.6 Safety-visibility regulations

- 4.3 Market Restraints

- 4.3.1 High upfront cost of advanced modules

- 4.3.2 Semiconductor & raw-material volatility

- 4.3.3 Stricter glare/photobiological safety caps

- 4.3.4 End-of-life recycling liabilities

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value)

- 5.1 By Vehicle Type

- 5.1.1 Passenger Cars

- 5.1.2 Light Commercial Vehicles

- 5.1.3 Medium & Heavy Commercial Vehicles

- 5.1.4 Two-Wheelers

- 5.2 By Application

- 5.2.1 Exterior

- 5.2.1.1 Headlamps

- 5.2.1.2 Taillights

- 5.2.1.3 Daytime Running Lights (DRLs)

- 5.2.1.4 Fog Lamps

- 5.2.2 Interior

- 5.2.2.1 Ambient / Footwell

- 5.2.2.2 Roof / Dome

- 5.2.1 Exterior

- 5.3 By Technology

- 5.3.1 Halogen

- 5.3.2 Xenon / HID

- 5.3.3 LED

- 5.3.4 Laser

- 5.3.5 OLED

- 5.4 By Sales Channel

- 5.4.1 OEM

- 5.4.2 Aftermarket

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 South Korea

- 5.5.4.5 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 South Africa

- 5.5.5.4 Rest of Middle East and Africa

- 5.5.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.4.1 Koito Manufacturing Co. Ltd

- 6.4.2 Stanley Electric Co. Ltd

- 6.4.3 Valeo SE

- 6.4.4 Forvia-HELLA GmbH & Co. KGaA

- 6.4.5 Marelli Holdings Co. Ltd

- 6.4.6 Tungsram Group

- 6.4.7 Hyundai Mobis Co.

- 6.4.8 Lumax Industries Ltd

- 6.4.9 ams-OSRAM AG

- 6.4.10 ZKW Group GmbH

- 6.4.11 SL Corporation

- 6.4.12 Nichia Corporation

- 6.4.13 Continental AG

- 6.4.14 DENSO Corporation

- 6.4.15 Lear Corporation

- 6.4.16 Bosch Mobility Lighting Modules

- 6.4.17 LG Innotek Co.

- 6.4.18 Panasonic Automotive Lighting

- 6.4.19 Seoul Semiconductor Co.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment