|

市場調查報告書

商品編碼

1773400

先進汽車照明市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Advanced Vehicle Lighting Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

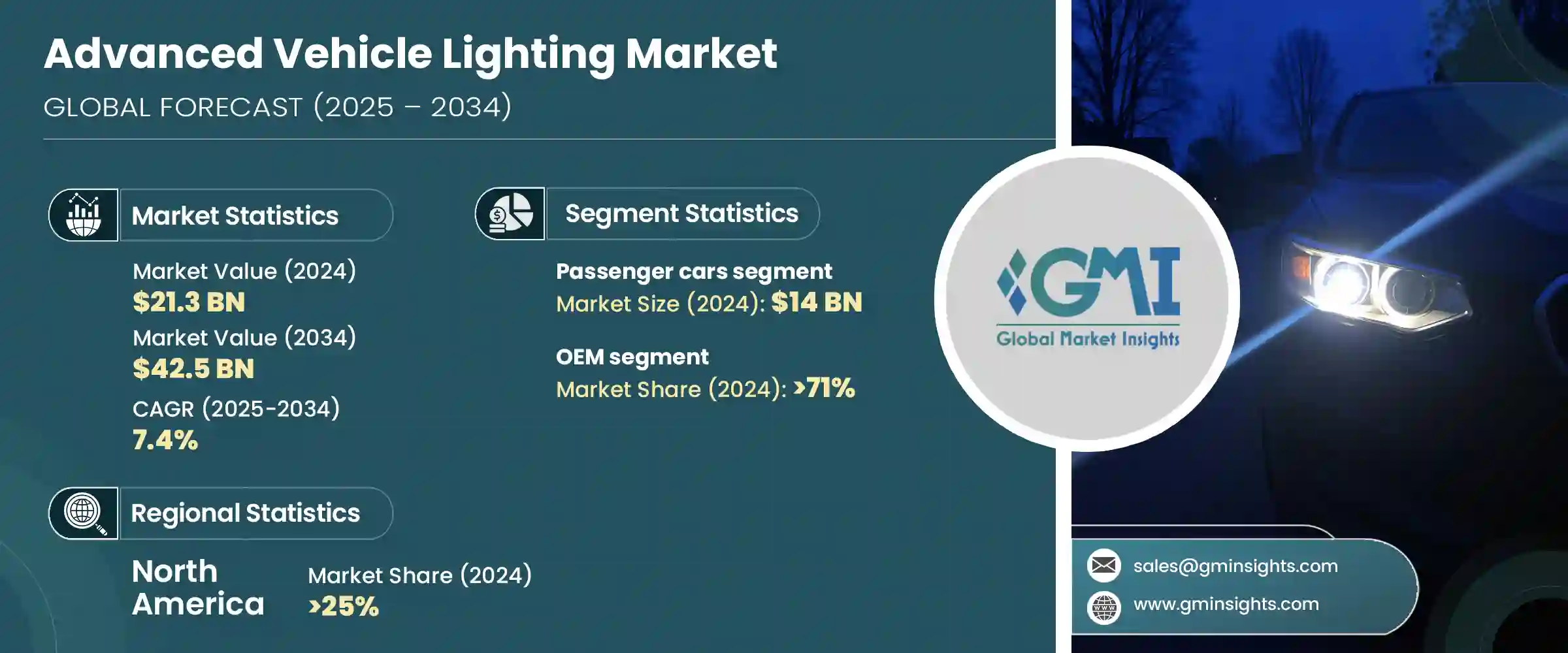

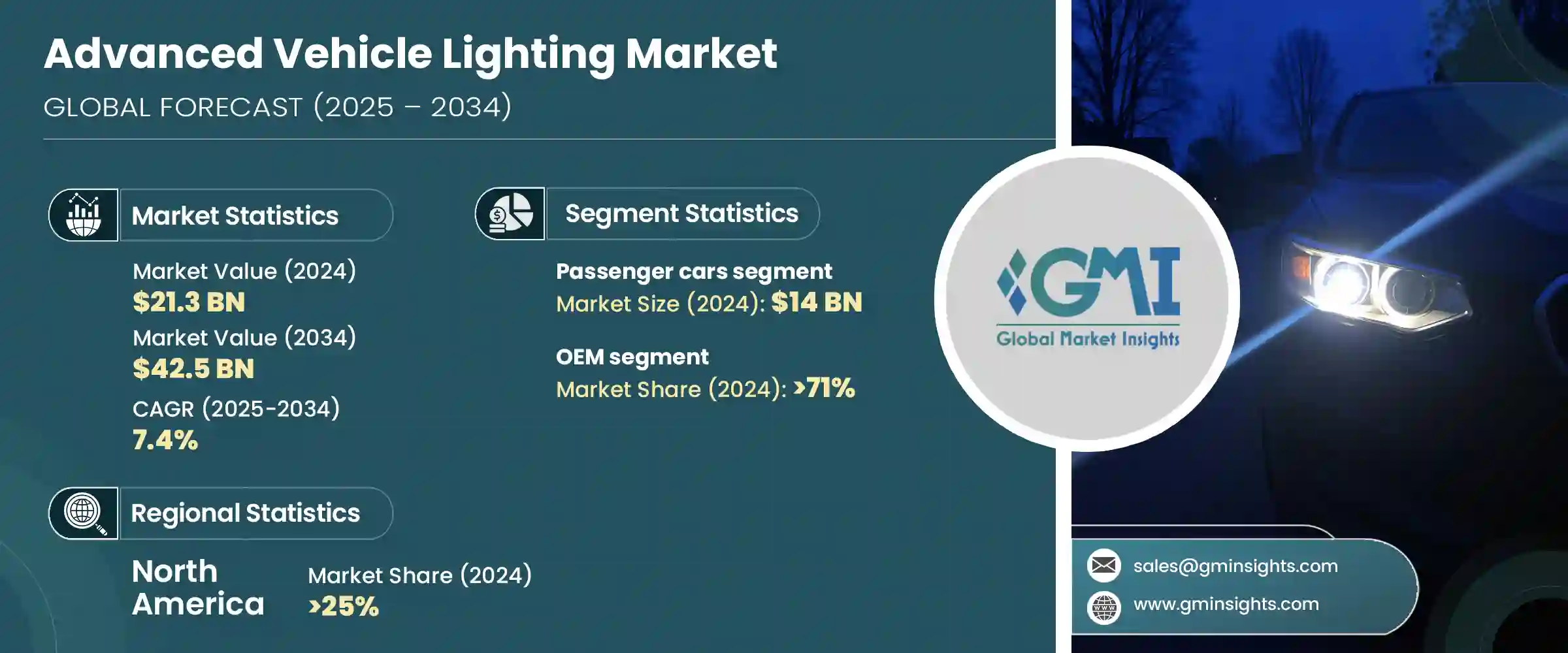

2024年,全球先進汽車照明市場規模達213億美元,預計2034年將以7.4%的複合年成長率成長,達到425億美元。這一成長主要得益於先進駕駛輔助系統(ADAS) 和自動駕駛技術的日益融合,這些技術正在徹底改變現代汽車的照明需求。矩陣LED和雷射頭燈等智慧照明解決方案的需求日益成長,因為它們可以即時調整光束模式,以支援感測器功能並減少眩光。

汽車製造商正在大力投資動態照明系統,該系統能夠與行人和其他車輛進行通訊,尤其是在能見度有限的條件下。隨著汽車產業競爭的加劇,製造商們正在利用複雜的照明設計來創造獨特的品牌標誌。動態方向燈、3D尾燈和車內氛圍燈等功能如今已成為必備的造型元素,尤其是在電動車和豪華車領域。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 213億美元 |

| 預測值 | 425億美元 |

| 複合年成長率 | 7.4% |

靈活的 LED 和 OLED 技術使汽車製造商能夠打造高度可自訂的動態照明效果,從而顯著提升車輛的辨識度和視覺吸引力。這些自適應照明解決方案可以客製化形狀並整合到車輛的各個部件,讓設計師能夠自由地開發獨特的標誌性設計,使每款車型在競爭激烈的市場中脫穎而出。動態動畫程式功能(例如順序方向燈、迎賓燈光秀或營造氛圍的車內照明)更增添了精緻感,能夠與追求未來感和個人化功能的消費者產生強烈共鳴。

2024年,乘用車市場規模達140億美元。全球範圍內的監管規定,例如日間行車燈 (DRL) 和自適應遠光燈 (ADB) 系統的採用,正迫使原始設備製造商 (OEM) 整合先進的照明技術。這些功能不僅提高了日間和夜間的可視性,還能確保符合國際安全標準。隨著各國政府實施更嚴格的照明法規,主流乘用車擴大配備此類系統,推動了對先進汽車照明的需求。此外,消費者對高階沉浸式內裝的興趣促使汽車製造商安裝多色LED燈帶、同步情緒照明和可自訂的燈光主題,以打造精緻的車內體驗。

2024年,原始設備OEM)佔據了71%的市場。先進的照明系統已成為定義車輛設計和強化製造商品牌形象的關鍵。標誌性的LED日行燈、動態迎賓燈和可配置的尾燈設計,有助於提升車輛的辨識度,同時支援以創新和奢華為重點的行銷活動。為了在競爭激烈的市場中脫穎而出,OEM廠商投入大量資源進行照明研發,旨在打造引人注目、獨特的設計,吸引消費者,並使其產品脫穎而出。

2024年,北美先進汽車照明市場佔據25%的市場。美國國家公路交通安全管理局(NHTSA)正逐步支持允許使用自適應遠光燈(ADB)和其他智慧照明技術的法規。這些政策轉變鼓勵汽車製造商採用先進的照明系統,以提高道路安全性、減少眩光並符合不斷發展的聯邦安全標準,為高品質照明解決方案創造了更大的市場機會。此外,在政府激勵措施和消費者濃厚興趣的推動下,美國電動車(EV)和自動駕駛汽車的快速成長,刺激了對LED矩陣、整合式雷射雷達的頭燈和以通訊為中心的照明功能等先進照明技術的需求,這些技術對於下一代汽車的安全性和性能至關重要。

全球先進汽車照明市場的領導者包括歐司朗 (OSRAM)、ZKW、小糸 (Koito)、Lumileds、Forvia、史丹利 (STANLEY) 和法雷奧 (Valeo)。這些公司佔據了全球相當一部分市場佔有率,透過創新和策略定位展開激烈競爭。為了鞏固市場地位,先進汽車照明領域的公司正專注於照明技術的持續創新,例如開發符合自動駕駛和電動車趨勢的自適應、智慧和連網照明系統。他們正大力投資研發,以推出功能增強、能源效率更高、設計獨特的新產品。與汽車原始設備製造商 (OEM) 建立策略合作夥伴關係和合作關係,使這些公司能夠將其照明解決方案無縫整合到汽車平台中,從而確保早期採用和簽訂長期合約。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商概況

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業衝擊力

- 成長動力

- 車輛中自適應照明的採用日益增多

- 汽車電氣化和電動車生產率不斷提高

- 更重視道路和乘客安全

- 政府強制推行高效照明系統

- 產業陷阱與挑戰

- 先進照明元件成本高

- 與車輛電子設備的系統整合的複雜性

- 市場機會

- 自動駕駛智慧照明的開發

- 電動車和豪華車領域的成長

- 新興汽車製造市場的擴張

- 照明與車輛通訊系統的整合

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 價格趨勢

- 按地區

- 按產品

- 生產統計

- 生產中心

- 消費中心

- 匯出和匯入

- 成本細分分析

- 專利分析

- 永續性和環境方面

- 永續實踐

- 減少廢棄物的策略

- 生產中的能源效率

- 環保舉措

- 碳足跡考量

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- MEA

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 戰略展望矩陣

- 關鍵進展

- 併購

- 夥伴關係與合作

- 新產品發布

- 擴張計劃和資金

第5章:市場估計與預測:按產品,2021 - 2034 年

- 主要趨勢

- 鹵素

- 氙氣/HID

- 引領

- 雷射

- OLED

- 矩陣LED

第6章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 頭燈

- 後部照明

- 室內照明

- 側面和角落照明

- 霧燈和輔助燈

- 通訊照明

第7章:市場估計與預測:依車型,2021 - 2034 年

- 主要趨勢

- 搭乘用車

- 掀背車

- 轎車

- 越野車

- 商用車

- 輕型

- 中型

- 重負

第8章:市場估計與預測:依銷售管道,2021 - 2034 年

- 主要趨勢

- OEM

- 售後市場

第9章:市場估計與預測:按推進方式,2021 - 2034 年

- 主要趨勢

- 冰

- 純電動車

- 油電混合車

- 插電式混合動力

- 燃料電池電動車

第10章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 北歐人

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 東南亞

- 拉丁美洲

- 巴西

- 阿根廷

- 墨西哥

- MEA

- 阿拉伯聯合大公國

- 南非

- 沙烏地阿拉伯

第 11 章:公司簡介

- Koito Manufacturing Co., Ltd.

- Valeo SA

- Hella GmbH & Co. KGaA (FORVIA Group)

- Marelli Automotive Lighting

- Stanley Electric Co., Ltd.

- ZKW Group GmbH

- OSRAM Continental GmbH

- Hyundai Mobis Co., Ltd.

- Lumileds Holding BV

- Nichia Corporation

- Bosch Mobility Solutions

- TYC Brother Industrial Co., Ltd.

- Texas Instruments

- Denso Corporation

- GE Lighting (Savant Systems Inc.)

- Varroc Engineering Ltd.

- Bosla Lighting

- SL Corporation

- Ichikoh Industries, Ltd.

- JW Speaker Corporation

The Global Advanced Vehicle Lighting Market was valued at USD 21.3 billion in 2024 and is estimated to grow at a CAGR of 7.4% to reach USD 42.5 billion by 2034. This growth is driven largely by the rising integration of advanced driver assistance systems (ADAS) and autonomous driving technologies, which are transforming the lighting requirements of modern vehicles. Intelligent lighting solutions, such as matrix LED and laser headlamps, are increasingly in demand because they can adjust beam patterns in real-time to support sensor functions and reduce glare.

Automakers are heavily investing in dynamic lighting systems that can communicate with pedestrians and other vehicles, especially in conditions with limited visibility. As competition intensifies in the automotive sector, manufacturers are leveraging complex lighting designs as a distinctive brand signature. Features like dynamic turn signals, 3D taillights, and interior ambient lighting are now essential styling elements, particularly in electric and luxury vehicles.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $21.3 Billion |

| Forecast Value | $42.5 Billion |

| CAGR | 7.4% |

Flexible LED and OLED technologies allow automakers to create highly customizable and animated lighting effects that significantly boost a vehicle's identity and visual appeal. These adaptable lighting solutions can be shaped and integrated into various parts of the vehicle, offering designers the freedom to develop unique signatures that set each model apart in a competitive market. The ability to program dynamic animations-such as sequential turn signals, welcoming light shows, or mood-enhancing interior lighting-adds a layer of sophistication that resonates strongly with consumers seeking futuristic and personalized features.

In 2024, the passenger cars segment held USD 14 billion. Regulatory mandates worldwide, such as the adoption of daytime running lights (DRLs) and adaptive driving beam (ADB) systems, are compelling original equipment manufacturers (OEMs) to integrate advanced lighting technologies. These features not only improve visibility during both day and night but also ensure compliance with international safety standards. As governments enforce stricter lighting regulations, mainstream passenger cars are increasingly outfitted with such systems, pushing demand for advanced vehicle lighting higher. Furthermore, consumer interest in premium, immersive interiors is driving automakers to install multi-color LED strips, synchronized mood lighting, and customizable light themes to create a sophisticated in-car experience.

The OEM segment held a 71% share in 2024. Advanced lighting systems have become crucial in defining vehicle design and reinforcing brand identity for manufacturers. Signature LED DRLs, animated welcome lights, and configurable taillight designs contribute to making vehicles instantly recognizable while supporting marketing campaigns focused on innovation and luxury. To stand out in a crowded marketplace, OEMs are dedicating significant resources to lighting research and development, aiming to create striking, distinctive designs that attract consumers and differentiate their offerings.

North America Advanced Vehicle Lighting Market held a 25% share in 2024. The U.S. National Highway Traffic Safety Administration (NHTSA) is increasingly supporting regulations that permit adaptive driving beam (ADB) headlights and other intelligent lighting technologies. These policy shifts encourage automakers to adopt advanced lighting systems that enhance on-road safety, reduce glare, and comply with evolving federal safety standards, generating greater market opportunities for high-quality lighting solutions. Additionally, the rapid growth of electric vehicles (EVs) and autonomous cars in the U.S., spurred by government incentives and strong consumer interest, fuels demand for sophisticated lighting technologies such as LED matrices, LiDAR-integrated headlamps, and communication-focused lighting features that are critical for next-generation vehicle safety and performance.

Leading players in the Global Advanced Vehicle Lighting Market include OSRAM, ZKW, Koito, Lumileds, Forvia, STANLEY, and Valeo. Together, these companies hold a significant portion of the global market share, competing vigorously through innovation and strategic positioning. To solidify their presence and strengthen market positions, companies in the advanced vehicle lighting space are focusing on continuous innovation in lighting technologies, such as the development of adaptive, smart, and connected lighting systems that align with autonomous and electric vehicle trends. They are investing heavily in research and development to introduce new products that offer enhanced functionality, energy efficiency, and distinctive design features. Strategic partnerships and collaborations with automotive OEMs allow these companies to integrate their lighting solutions seamlessly into vehicle platforms, ensuring early adoption and long-term contracts.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Product

- 2.2.3 Vehicle

- 2.2.4 Propulsion

- 2.2.5 Sales Channel

- 2.2.6 Application

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Key decision points for industry executives

- 2.4.2 Critical success factors for market players

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier Landscape

- 3.1.2 Profit Margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Growing adoption of adaptive lighting in vehicles

- 3.2.1.2 Rising vehicle electrification and EV production rates

- 3.2.1.3 Increasing emphasis on road and passenger safety

- 3.2.1.4 Government mandates for efficient lighting systems

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 High cost of advanced lighting components

- 3.2.2.2 Complexity in system integration with vehicle electronics

- 3.2.3 Market opportunities

- 3.2.3.1 Development of smart lighting for autonomous driving

- 3.2.3.2 Growth in EV and luxury vehicle segments

- 3.2.3.3 Expansion in emerging automotive manufacturing markets

- 3.2.3.4 Integration of lighting with vehicle communication systems

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By product

- 3.9 Production statistics

- 3.9.1 Production hubs

- 3.9.2 Consumption hubs

- 3.9.3 Export and import

- 3.10 Cost breakdown analysis

- 3.11 Patent analysis

- 3.12 Sustainability and Environmental Aspects

- 3.12.1 Sustainable Practices

- 3.12.2 Waste Reduction Strategies

- 3.12.3 Energy Efficiency in Production

- 3.12.4 Eco-friendly Initiatives

- 3.12.5 Carbon Footprint Considerations

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 LATAM

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Product, 2021 - 2034 ($Mn & Units)

- 5.1 Key trends

- 5.2 Halogen

- 5.3 Xenon/HID

- 5.4 LED

- 5.5 Laser

- 5.6 OLED

- 5.7 Matrix LED

Chapter 6 Market Estimates & Forecast, By Application, 2021 - 2034 ($Mn & Units)

- 6.1 Key trends

- 6.2 Front Lighting

- 6.3 Rear Lighting

- 6.4 Interior Lighting

- 6.5 Side & Corner Lighting

- 6.6 Fog and Auxiliary Lights

- 6.7 Communication Lighting

Chapter 7 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Mn & Units)

- 7.1 Key trends

- 7.2 Passenger Car

- 7.2.1 Hatchback

- 7.2.2 Sedan

- 7.2.3 SUV

- 7.3 Commercial Vehicle

- 7.3.1 Light-duty

- 7.3.2 Medium-duty

- 7.3.3 Heavy-duty

Chapter 8 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Mn & Units)

- 8.1 Key trends

- 8.2 OEM

- 8.3 Aftermarket

Chapter 9 Market Estimates & Forecast, By Propulsion, 2021 - 2034 ($Mn & Units)

- 9.1 Key trends

- 9.2 ICE

- 9.3 BEV

- 9.4 HEV

- 9.5 PHEV

- 9.6 FCEV

Chapter 10 Market Estimates & Forecast, By Region, 2021 - 2034 ($Mn & Units)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Spain

- 10.3.5 Italy

- 10.3.6 Russia

- 10.3.7 Nordics

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Southeast Asia

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Argentina

- 10.5.3 Mexico

- 10.6 MEA

- 10.6.1 UAE

- 10.6.2 South Africa

- 10.6.3 Saudi Arabia

Chapter 11 Company Profiles

- 11.1 Koito Manufacturing Co., Ltd.

- 11.2 Valeo S.A.

- 11.3 Hella GmbH & Co. KGaA (FORVIA Group)

- 11.4 Marelli Automotive Lighting

- 11.5 Stanley Electric Co., Ltd.

- 11.6 ZKW Group GmbH

- 11.7 OSRAM Continental GmbH

- 11.8 Hyundai Mobis Co., Ltd.

- 11.9 Lumileds Holding B.V.

- 11.10 Nichia Corporation

- 11.11 Bosch Mobility Solutions

- 11.12 TYC Brother Industrial Co., Ltd.

- 11.13 Texas Instruments

- 11.14 Denso Corporation

- 11.15 GE Lighting (Savant Systems Inc.)

- 11.16 Varroc Engineering Ltd.

- 11.17 Bosla Lighting

- 11.18 SL Corporation

- 11.19 Ichikoh Industries, Ltd.

- 11.20 J.W. Speaker Corporation