|

市場調查報告書

商品編碼

1851369

工業控制系統:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Industrial Control Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

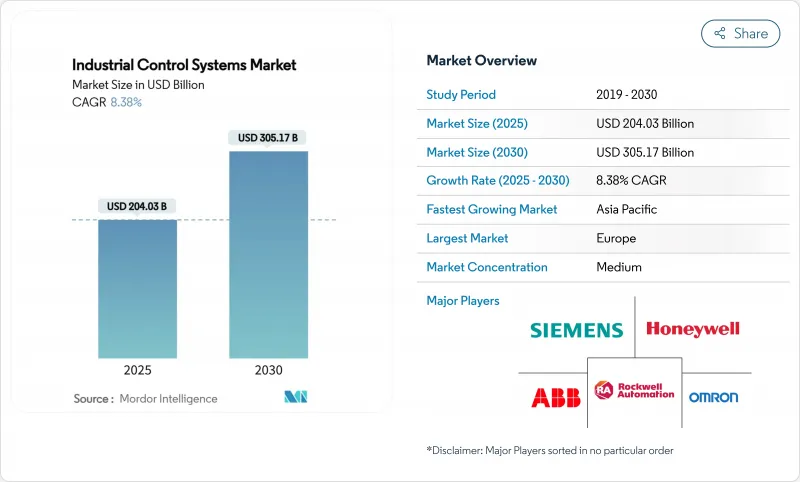

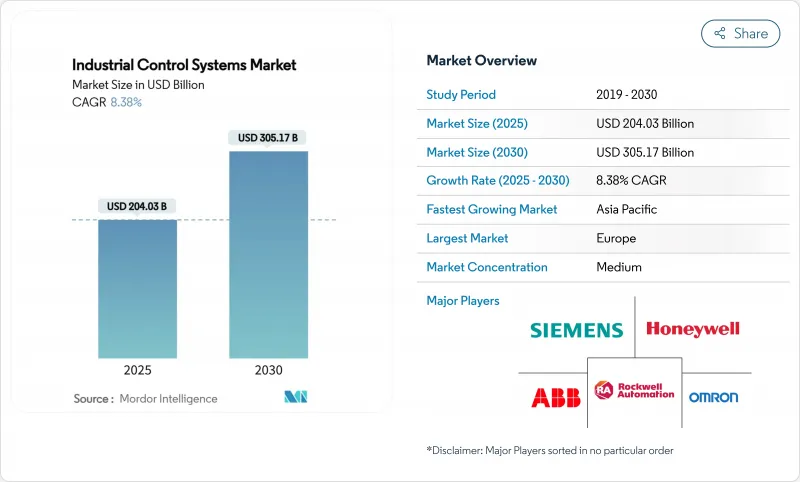

預計到 2025 年,工業控制系統市場規模將達到 2,040.3 億美元,到 2030 年將達到 3,051.7 億美元,年複合成長率為 8.38%。

工業4.0加速數位化、網路安全要求以及開放式、廠商中立架構日益成長的吸引力,正將自動化從提升效率的附加附加元件轉變為營運的基石。 2024年半導體產業的低迷加劇了供應鏈風險,凸顯了軟體定義控制平台(將功能與專用硬體分離)的價值;同時,歐洲和北美政府的激勵措施擴大了維修計劃的資金池。隨著製造商在不放棄低延遲製程控制的前提下尋求大規模分析,雲端、邊緣和本地部署正在並存。尤其是在電子和生命科學等高精度領域,能夠將可互通的硬體與人工智慧軟體和整合安全功能相結合的供應商正在獲得競爭優勢。

全球工業控制系統市場趨勢與洞察

利用工業4.0加速工廠整體自動化

製造商正將自動化從孤立的生產線擴展到整合營運、工程和業務數據的企業級網路。諸如西門子 SINUMERIK ONE 等支援人工智慧的邊緣節點,現在可以直接在工具機現場執行預測性維護和自適應進給速度控制,從而縮短決策延遲。更廣泛的連接性創造了複合價值,這也解釋了為什麼儘管面臨宏觀經濟逆風,到 2025 年營運技術 (OT) 預算平均仍將成長 30%。因此,可互通的產品正在超越專有單點產品,重塑市場競爭動態。

更加重視工業安全和功能安全合規性

工業法規正朝著安全完整性(IEC 61508/61511)和網路安全韌性(IEC 62443)的雙重目標靠攏。經過認證的安全PLC和安全通訊協定至關重要,因為像西門子SIBERprotect這樣的工具可以在幾毫秒內隔離風險資產,同時保持安全迴路的完整性。隨著CISA針對2024年OT漏洞發布了24項建議,買家現在將網路安全資質納入資本規劃,這推動工業控制系統市場向提供原生整合功能的供應商靠攏。

熟練的OT/ICS工程師短缺

德勤預測,到2033年,美國製造業將有190萬個工作失業,其中許多人需要具備IT和OT混合技能。因此,供應商正尋求透過將託管服務與低程式碼配置捆綁在一起來降低部署難度。

細分市場分析

儘管SCADA平台在2024年將佔據工業控制系統市場28.7%的佔有率,但其集中式控制方式正受到邊緣PLC的挑戰,後者預計到2030年將以11.46%的複合年成長率成長。微型AI晶片的湧現使得PLC能夠在本地處理狀態監測和品質檢測工作負載,從而減少資料回程傳輸和網路擁塞。在石油天然氣和化學工業,分散式控制系統仍用於管理連續流程,但客戶正在傳統DCS之上疊加預測演算法,以延長資產壽命。人機介面正在演變為決策支援主機,並整合AR擴增實境技術以進行現場故障排除。隨著電網營運商尋求更快的故障隔離,智慧電子設備在公用事業領域越來越受歡迎。對於這些應用場景,提供開放API的供應商在工業控制系統市場備受青睞,這使得工廠管理人員能夠在不被特定供應商鎖定的情況下組合使用最佳組件。

預計到2025年,SCADA仍將為工業控制系統市場貢獻585億美元,屆時,能夠融合分析功能並維持監控層完整性的容器化微服務將主導升級週期。同時,一項離散製造業的試點計畫表明,邊緣PLC集群可將計劃外停機時間減少高達20%,從而加快投資回報率。能夠協調集中式和分散式架構生命週期服務的供應商預計將獲得不成比例的市場佔有率。

隨著工廠追求整體設備效率 (OEE) 和無需計劃維護,資產性能管理將在 2024 年貢獻 23.6% 的收入。展望未來,受勒索軟體攻擊 OT 資產日益猖獗的推動,網路安全套件預計將以 12.75% 的複合年成長率 (CAGR) 超越所有其他類別。整合漏洞掃描、零信任分段和安全 PLC 加固功能的產品在製藥公司等風險規避型產業中越來越受歡迎。製造執行系統 (MES) 現在將品質分析與電子批次記錄 (EBR) 結合,產品生命週期管理 (PLM) 工具與數位孿生技術連接,從而連接設計和製造。 ERP 供應商正在透過 REST API 公開 OT 資料模型,以支援需求主導的計畫演算法。因此,工業控制系統市場正傾向於編配跨域資料的平台,而不是單一模組。

預計到2030年,工業控制系統市場規模將超過140億美元,工業網路平台正吸引創業投資資金,並促使現有供應商收購特定領域的專業公司。擅長協調應用效能管理(APM)、製造執行系統(MES)和網路層的供應商,正將自身定位為數位轉型藍圖的端到端推動者。

區域分析

2024年,歐洲將佔全球銷售額的28.5%,嚴格的功能安全法規和永續性要求推動了對高效自動化技術的重視。諸如Manufacturing-X之類的資金籌措計劃正在撥款1.5億歐元(1.61億美元)用於優先考慮數據主權的計劃,這使本土供應商獲得了先發優勢。資本計劃擴大將碳足跡儀錶板與歐盟綠色新政的報告要求捆綁在一起。東歐產業叢集為西方原始設備製造商提供了近岸產能,刺激了對中階控制設備的需求成長。

亞太地區將以10.24%的複合年成長率成長,受益於電子產品、電動車電池和可再生組件的大規模產能擴張。中國的人口結構變化和薪資上漲將加速工廠自動化進程,而東南亞國家將利用稅收優惠吸引回流計劃。國內PLC和機器人供應商正在擴大市場佔有率,而跨國巨頭則繼續在高階安全和運動解決方案領域保持主導地位。以中國《關鍵資訊基礎設施法》為首的政府網路安全法規,正促使買家轉向檢驗的安全相關產品,並影響採購候選名單的發展。

北美將透過製造業舉措和《CHIPS法案》2億美元的數位雙胞胎孿生計畫維持成長動能。美國墨西哥灣沿岸的能源轉型支出正在催生開放式製程自動化的需求,以用於維修天然氣、氫氣和碳捕獲與封存(CCS)設施。加拿大NGen的3500萬美元永續製造挑戰計畫正在推動中小企業採用模組化控制套件。美國網路安全和基礎設施安全局(CISA)加強的網路安全要求正在改善採購規範,優先考慮擁有IEC 62443認證的供應商。總而言之,這些趨勢正在推動工業控制系統市場持續實現區域多元化成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 工業4.0的部署將加速工廠範圍內的自動化進程。

- 更加重視工業安全和功能安全合規性

- 對即時、數據主導的大規模客製化的需求激增

- 政府對智慧工廠維修的獎勵

- 開放式流程自動化(O-PAS)架構尚未引起廣泛關注

- 轉型為「OT即服務」邊緣平台(鮮為人知)

- 市場限制

- 熟練的OT/ICS工程師短缺

- 高額資本投入和較長的投資回收期

- 半導體前置作業時間波動(在不為人知的情況下)擾亂了控制器供應。

- 舊有系統整合複雜性(鮮為人知)

- 價值鏈分析

- 監管環境

- 技術展望

- 主要宏觀經濟趨勢的影響

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 評估市場宏觀經濟趨勢

第5章 市場規模與成長預測

- 透過營運技術

- 監控與數據採集(SCADA)

- 分散式控制系統(DCS)

- 可程式邏輯控制器(PLC)

- 智慧電子設備(IED)

- 人機介面(HMI)

- 其他系統

- 透過軟體

- 資產績效管理(APM)

- 產品生命週期管理(PLM)

- 製造執行系統(MES)

- 企業資源規劃(ERP)

- 工業網路安全平台

- 其他軟體

- 透過部署模式

- 本地部署

- 雲端基礎的

- 邊緣/混合

- 按最終用戶行業分類

- 石油和天然氣

- 化工/石油化工

- 電力與公用事業

- 飲食

- 汽車和運輸設備

- 生命科學

- 用水和污水

- 金屬和採礦

- 紙漿和造紙

- 電子和半導體

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Siemens AG

- ABB Ltd.

- Rockwell Automation Inc.

- Schneider Electric SE

- Honeywell International Inc.

- Emerson Electric Co.

- Yokogawa Electric Corporation

- Mitsubishi Electric Corporation

- Omron Corporation

- GE Digital(General Electric Co.)

- Bosch Rexroth AG

- Phoenix Contact GmbH

- Beckhoff Automation GmbH

- Hitachi Ltd.

- Delta Electronics Inc.

- Advantech Co., Ltd.

- Johnson Controls International plc

- Fortinet Inc.(ICS-cybersecurity)

- Palo Alto Networks Inc.(ICS-cybersecurity)

- ICS-Secure LLC

第7章 市場機會與未來展望

The industrial control systems market size stood at USD 204.03 billion in 2025 and is projected to reach USD 305.17 billion by 2030, advancing at an 8.38% CAGR.

Accelerated digitalization under Industry 4.0, mounting cybersecurity obligations, and the growing appeal of open, vendor-neutral architectures are reinforcing automation as an operational cornerstone rather than an efficiency add-on. Heightened supply-chain risk during the 2024 semiconductor squeeze underscored the value of software-defined control platforms that detach functionality from dedicated hardware, while government incentives in Europe and North America widened the capital pool for retrofit projects. Cloud, edge, and on-premise deployments now coexist as manufacturers seek analytics at scale without surrendering low-latency process control. Competitive positioning increasingly favors vendors that combine interoperable hardware with AI-enabled software and integrated security, especially in high-precision sectors such as electronics and life sciences.

Global Industrial Control Systems Market Trends and Insights

Industry 4.0 Roll-outs Accelerating Plant-wide Automation

Manufacturers are extending automation from isolated lines to enterprise-wide networks that merge operational, engineering, and business data. AI-ready edge nodes such as Siemens SINUMERIK ONE now execute predictive maintenance and adaptive feed-rate control directly on the machine floor, shrinking decision latency. Broader connectivity generates compound value, which explains why average OT budgets grew 30% in 2025 despite macro headwinds. As a result, interoperable offerings are edging out proprietary point products, reshaping competitive dynamics across the industrial control systems market.

Growing Emphasis on Industrial Safety and Functional-Safety Compliance

Industrial regulations are converging around dual mandates of safety integrity (IEC 61508/61511) and cybersecurity resilience (IEC 62443). Tools such as Siemens SIBERprotect isolate compromised assets within milliseconds while keeping safety loops intact, making certified safety PLCs and secure communication protocols indispensable. With CISA releasing 24 advisories on OT vulnerabilities in 2024, buyers now factor cyber-safety credentials into capital planning, nudging the industrial control systems market toward vendors that offer natively integrated capabilities.

Shortage of Skilled OT/ICS Engineers

Deloitte estimates 1.9 million US manufacturing roles may go unfilled by 2033, many requiring hybrid IT-OT skills. Scarcity inflates labor costs and prolongs commissioning cycles, prompting vendors to bundle managed services and low-code configuration to soften onboarding friction.

Other drivers and restraints analyzed in the detailed report include:

- Surge in Demand for Real-time Data-driven Mass-customisation

- Government Incentives for Smart-factory Retrofits

- High Capex and Long Pay-back Periods

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SCADA platforms retained a 28.7% slice of the industrial control systems market in 2024, yet their centralized approach is being contested by edge-enabled PLCs that are posting 11.46% CAGR through 2030. The influx of micro-AI chips allows PLCs to process condition-monitoring and quality-inspection workloads locally, reducing data backhaul and network congestion. In oil & gas and chemicals, Distributed Control Systems still govern continuous processes, but customers are layering predictive algorithms over legacy DCS to extend asset life. Human-Machine Interfaces have evolved into decision-support consoles incorporating AR overlays for on-the-spot troubleshooting. Intelligent Electronic Devices are gaining traction in utilities as grid operators pursue faster fault isolation. Across these use cases, the industrial control systems market rewards suppliers that embed open APIs, enabling plant managers to mix best-of-breed components without vendor lock-in.

With SCADA still contributing USD 58.5 billion to industrial control systems market size in 2025, upgrade cycles center on container-based micro-services that keep supervisory layers intact while injecting analytics. Meanwhile, pilot programs in discrete manufacturing show edge PLC clusters trimming unplanned downtime by up to 20%, accelerating payback. Vendors able to harmonize lifecycle services for both centralized and distributed architectures are expected to capture disproportionate share.

Asset Performance Management generated 23.6% of 2024 revenue as plants chase overall equipment effectiveness and schedule-free maintenance. Looking ahead, cybersecurity suites are set to outpace all other categories at 12.75% CAGR, a reaction to increased ransomware targeting OT assets. Integrated offerings that fuse vulnerability scanning, zero-trust segmentation, and safety-PLC hardening resonate with risk-averse sectors such as pharmaceuticals. Manufacturing Execution Systems now bundle quality analytics and electronic batch records, while Product Lifecycle Management tools couple with digital twins to bridge design and production. ERP vendors are exposing OT data models via REST APIs, feeding demand-driven planning algorithms. The industrial control systems market is therefore tilting toward platforms that orchestrate cross-domain data rather than discrete modules.

Industrial cyber platforms, forecast to exceed USD 14 billion in industrial control systems market size by 2030, are attracting venture funding and prompting established vendors to buy niche specialists. Suppliers competent in synchronizing APM, MES, and cyber layers position themselves as single-throat-to-choke partners for digital transformation roadmaps.

The Global Industrial Control Systems Market Report is Segmented by Operational Technology (SCADA, DCS, PLC, and More), Software (APM, PLM, MES, ERP, and More), Deployment Mode (On-Premise, Cloud-Based, Edge/Hybrid), End-User Industry (Oil and Gas, Chemical and Petrochemical, Power and Utilities, Food and Beverages, Automotive and Transportation, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe steers 28.5% of 2024 revenue, driven by rigorous functional-safety statutes and sustainability mandates that reward high-efficiency automation. Funding schemes such as Manufacturing-X distribute EUR 150 million (USD 161 million) to projects that emphasize data sovereignty, giving domestic vendors an early-mover edge. Capital projects increasingly bundle carbon-footprint dashboards, aligning with the EU's Green Deal reporting. Eastern European clusters act as near-shore capacity for Western OEMs, stimulating incremental demand for mid-tier control gear.

Asia-Pacific, advancing at 10.24% CAGR, benefits from large-scale capacity expansions in electronics, EV batteries, and renewable components. China's demographic headwinds and wage inflation accelerate factory automation, while Southeast Asian nations leverage tax incentives to lure reshoring projects. Domestic PLC and robot suppliers are gaining share, but multinational incumbents retain dominance in high-end safety and motion solutions. Government cyber rules, notably China's Critical Information Infrastructure law, push buyers toward products with verifiable security lineage, shaping procurement shortlists.

North America sustains momentum through reshoring initiatives and the CHIPS Act's USD 200 million digital-twin program. Energy transition spending in the US Gulf Coast is spawning demand for open-process automation to retrofit LNG, hydrogen, and CCS facilities. Canada's NGen USD 35 million sustainable manufacturing challenge propels SME adoption of modular control kits. Heightened cyber directives from CISA elevate procurement specifications, giving advantage to suppliers with IEC 62443 certifications. Collectively, these trends keep the industrial control systems market on a diversified regional growth footing.

- Siemens AG

- ABB Ltd.

- Rockwell Automation Inc.

- Schneider Electric SE

- Honeywell International Inc.

- Emerson Electric Co.

- Yokogawa Electric Corporation

- Mitsubishi Electric Corporation

- Omron Corporation

- GE Digital (General Electric Co.)

- Bosch Rexroth AG

- Phoenix Contact GmbH

- Beckhoff Automation GmbH

- Hitachi Ltd.

- Delta Electronics Inc.

- Advantech Co., Ltd.

- Johnson Controls International plc

- Fortinet Inc. (ICS-cybersecurity)

- Palo Alto Networks Inc. (ICS-cybersecurity)

- ICS-Secure LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Industry 4.0 roll-outs accelerating plant-wide automation

- 4.2.2 Growing emphasis on industrial safety and functional-safety compliance

- 4.2.3 Surge in demand for real-time data-driven mass-customisation

- 4.2.4 Government incentives for smart-factory retrofits

- 4.2.5 Open Process Automation (O-PAS) architecture gaining traction (under-the-radar)

- 4.2.6 Shift to "OT-as-a-Service" edge platforms (under-the-radar)

- 4.3 Market Restraints

- 4.3.1 Shortage of skilled OT/ICS engineers

- 4.3.2 High capex and long pay-back periods

- 4.3.3 Semiconductor lead-time volatility disrupting controller supply (under-the-radar)

- 4.3.4 Legacy-system integration complexity (under-the-radar)

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Key Macroeconomic Trends

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Assessment of Macro Economic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Operational Technology

- 5.1.1 Supervisory Control and Data Acquisition (SCADA)

- 5.1.2 Distributed Control System (DCS)

- 5.1.3 Programmable Logic Controller (PLC)

- 5.1.4 Intelligent Electronic Devices (IED)

- 5.1.5 Human-Machine Interface (HMI)

- 5.1.6 Other Systems

- 5.2 By Software

- 5.2.1 Asset Performance Management (APM)

- 5.2.2 Product Lifecycle Management (PLM)

- 5.2.3 Manufacturing Execution System (MES)

- 5.2.4 Enterprise Resource Planning (ERP)

- 5.2.5 Industrial Cyber-security Platforms

- 5.2.6 Other Software

- 5.3 By Deployment Mode

- 5.3.1 On-premise

- 5.3.2 Cloud-based

- 5.3.3 Edge / Hybrid

- 5.4 By End-user Industry

- 5.4.1 Oil and Gas

- 5.4.2 Chemical and Petrochemical

- 5.4.3 Power and Utilities

- 5.4.4 Food and Beverages

- 5.4.5 Automotive and Transportation

- 5.4.6 Life Sciences

- 5.4.7 Water and Wastewater

- 5.4.8 Metal and Mining

- 5.4.9 Pulp and Paper

- 5.4.10 Electronics and Semiconductor

- 5.4.11 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Japan

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Siemens AG

- 6.4.2 ABB Ltd.

- 6.4.3 Rockwell Automation Inc.

- 6.4.4 Schneider Electric SE

- 6.4.5 Honeywell International Inc.

- 6.4.6 Emerson Electric Co.

- 6.4.7 Yokogawa Electric Corporation

- 6.4.8 Mitsubishi Electric Corporation

- 6.4.9 Omron Corporation

- 6.4.10 GE Digital (General Electric Co.)

- 6.4.11 Bosch Rexroth AG

- 6.4.12 Phoenix Contact GmbH

- 6.4.13 Beckhoff Automation GmbH

- 6.4.14 Hitachi Ltd.

- 6.4.15 Delta Electronics Inc.

- 6.4.16 Advantech Co., Ltd.

- 6.4.17 Johnson Controls International plc

- 6.4.18 Fortinet Inc. (ICS-cybersecurity)

- 6.4.19 Palo Alto Networks Inc. (ICS-cybersecurity)

- 6.4.20 ICS-Secure LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment