|

市場調查報告書

商品編碼

1851263

北美積體電路市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030 年)NA ICS - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

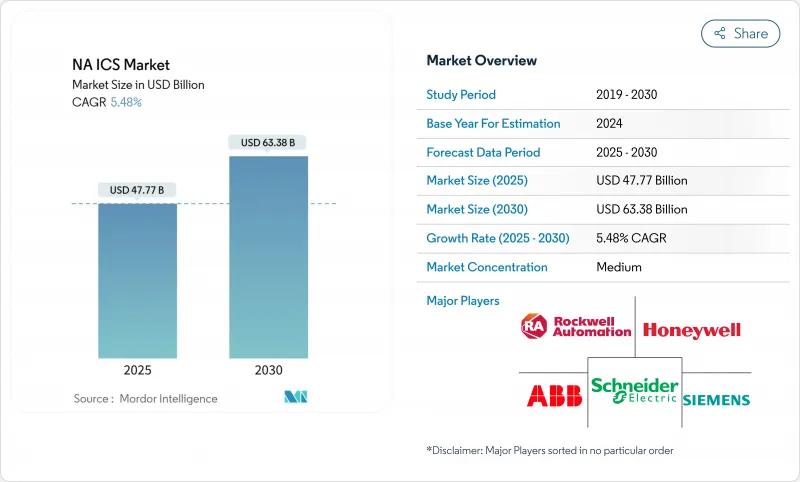

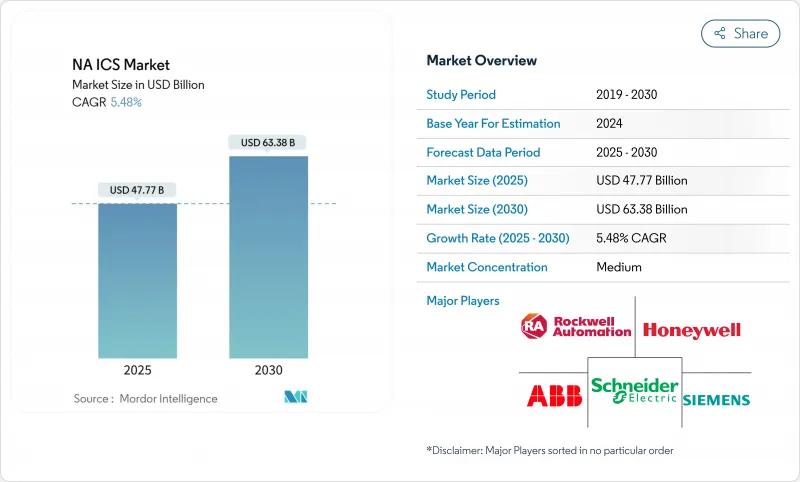

預計到 2025 年,北美工業控制系統市場規模將達到 477.7 億美元,到 2030 年將達到 633.8 億美元,複合年成長率為 5.48%。

2024年,硬體仍將維持最大的收入佔有率,達到57.2%,這主要得益於對PLC、分散式控制硬體和I/O模組的持續投資。美國《晶片與積體電路法案》(CHIPS Act)宣布投資4,500億美元用於半導體產能建設,以緩解元件短缺並促進新的自動化部署。工業乙太網在2024年佔已安裝通訊設備的48.9%,但隨著工廠尋求靈活的連接方式,無線通訊協定以10.4%的複合年成長率(CAGR)快速發展。雲端採用率以9.31%的複合年成長率成長,但由於對延遲敏感的控制迴路和嚴格的安全策略,81%的雲端部署仍保留在本地。汽車製造商佔了18.6%的需求佔有率,但製藥業是成長最快的終端用戶,複合年成長率達到9.1%,這主要得益於對高品質設計要求的不斷提高。

北美ICS - 市場趨勢與洞察

美國汽車工廠的棕地現代化改造正在加速進行

汽車製造商正以統一架構取代分散的控制層,以提高靈活性和運轉率。奧迪美國車身車間採用了西門子Simatic S7-1500V虛擬控制器,並將其連接到私有雲端,以整合IT和OT工作流程,從而縮短換車時間。美國僅有31%的工廠實現了全自動化功能,凸顯了現代化改造的巨大空間。金佰利公司逐步將PLC系統遷移到DCS系統,採取了謹慎的策略——在10年內每年遷移一條生產線——以最大限度地減少停機時間,同時建立一個具備網路安全功能的平台。

網實整合安全標準的採用率不斷提高

在過去12個月中,93%的OT設施報告了入侵事件,這推動了ISA/IEC 62443框架的快速普及。此框架定義了區域、通道和連續監控。 2025年2月發布的ANSI/ISA-62443-2-1更新引入了成熟度模型,使資產所有者能夠根據自身風險狀況客製化控制措施。公用事業公司和離散製造企業都在建立縱深防禦體系,以減少非計劃性停機和保險成本。

遺留的棕地系統被鎖定在專有通訊協定中

90年代建造的工廠仍依賴特定廠商的匯流排,這使得資料擷取和雲端連接變得複雜。菲尼克斯電氣建議逐步遷移I/O以最大程度地減少停機時間,但整合商必須將數千個傳統暫存器對應到現代物件模型。伍德PLC指出,考慮到製程的生命週期長達30年,一次性全部更換並不現實,業主需要在未來幾年內分期投資建造雙棧架構。

細分市場分析

硬體業務佔2024年營收的57.2%,主要得益於PLC機架、DCS節點和馬達驅動器訂單的持續成長。 ABB製程自動化部門預測2024年營收將達到68億美元,顯示市場對資本設備的需求仍強勁。將邊緣分析技術整合到控制器中,例如Honeywell的ControlEdge PLC,其內建OPC UA和MQTT功能,正在推動高階產品的銷售。

生命週期支援外包雖然目前規模較小,但正以8.9%的複合年成長率快速成長。截至2024年9月,羅克韋爾自動化公司的生命週期服務訂單已達17億美元,這反映出市場對以結果為導向、將費用與可用性提升掛鉤的合約的需求。技能短缺問題,尤其是到2025年網路安全負責人缺口將達到350萬人,將推動維護合約和遠端監控合約的成長,進而提升北美工業控制系統產業的經常性收入。

預計到2024年,PLC將佔據北美工業控制系統市場31.4%的佔有率,主要得益於其確定性控制和久經考驗的可靠性。羅克韋爾自動化的Logix控制器系列為該地區的汽車和食品生產線提供動力。目前,供應商提供的PLC產品均具備原生CIP安全功能和TLS加密功能,從而減少了對閘道器的依賴。

隨著製造商尋求批次級溯源和訂單到批次的同步,MES平台正以7.6%的複合年成長率快速成長。隨著工業4.0的普及,到2024年,全球互聯設備數量將加倍,達到170億台,由此產生的資料集可被MES轉化為可執行的生產KPI。汽車OEM廠商正在利用MES協調機器人噴塗、電池組裝和最終檢驗,縮短產品上市週期,並整合企業資源計畫(ERP)。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加速美國汽車工廠棕地現代化改造

- 網實整合安全標準(ISA/IEC 62443)正變得越來越普及。

- 美國《晶片法案》提升半導體產能

- 加拿大的淨零電網指令促使公用事業公司自動化

- 墨西哥灣沿岸中游液化天然氣投資不斷成長

- 墨西哥原始設備製造商推出邊緣運算預測性維護

- 市場限制

- 遺留的棕地系統被鎖定在專有通訊協定中

- OSHA功能安全改造的資本維修成本

- ISA認證的OT網路安全人才短缺

- 北美供應鏈對稀土磁鐵進口的風險敞口

- 價值/供應鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 按組件

- 硬體

- 軟體

- 服務

- 依系統類型

- SCADA(監控與資料收集)

- DCS(分散式控制系統)

- PLC(可程式邏輯控制器)

- MES(製造執行系統)

- 產品生命週期管理 (PLM)

- ERP(企業資源計畫)

- 人機介面 (HMI)

- 其他(OTS、機器安全)

- 透過通訊協定

- 現場匯流排

- 工業乙太網

- 無線的

- 透過部署模式

- 本地部署

- 雲

- 混合

- 按最終用戶行業分類

- 車

- 化工/石油化工

- 公共產業(電力/水)

- 製藥

- 飲食

- 石油和天然氣

- 採礦和金屬

- 紙漿和造紙

- 其他

- 按國家/地區

- 美國

- 加拿大

- 墨西哥

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ABB Ltd.

- Emerson Electric Co.

- General Electric Co.

- Honeywell International Inc.

- Johnson Controls International plc

- Mitsubishi Electric Corp.

- Omron Corp.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corp.

- Bosch Rexroth AG

- Phoenix Contact GmbH

- Advantech Co. Ltd.

- Eaton Corp. plc

- BandR Industrial Automation GmbH

- Beckhoff Automation GmbH

- FANUC Corp.

- Delta Electronics Inc.

- Hitachi Ltd.

- IDEC Corp.

第7章 市場機會與未來展望

The North American industrial control systems market size stands at USD 47.77 billion in 2025 and is projected to reach USD 63.38 billion by 2030, reflecting a 5.48% CAGR.

Hardware retains the largest revenue share at 57.2% in 2024, underpinned by steady investment in PLCs, distributed control hardware, and I/O modules. Demand is reinforced by the U.S. CHIPS Act, which has mobilized USD 450 billion of announced semiconductor capacity investments, easing component shortages and spurring new automation roll-outs. Industrial Ethernet accounted for 48.9% of installed communications in 2024, while wireless protocols advanced at a 10.4% CAGR as plants sought flexible connectivity. Although cloud deployments are expanding at 9.31% CAGR, 81% of installations remain on-premise because of latency-sensitive control loops and strict security policies. Automotive producers captured 18.6% of demand, yet pharmaceuticals are the fastest-growing end user at 9.1% CAGR as quality-by-design mandates intensify.

NA ICS Market Trends and Insights

Accelerated brown-field modernization across U.S. automotive plants

Automotive manufacturers are replacing fragmented control layers with unified architectures to boost flexibility and uptime. Audi's U.S. body shop adopted Siemens Simatic S7-1500V virtual controllers connected to its private cloud, merging IT and OT workflows and shortening change-over times. Only 31% of domestic factories have fully automated a function, highlighting large headroom for modernization. Kimberly-Clark's phased PLC-to-DCS migration illustrates the cautious pace: one line per year over a decade to limit downtime while embedding cybersecurity-ready platforms.

Growing cyber-physical safety standards adoption

Ninety-three percent of OT facilities reported an intrusion in the past 12 months, prompting rapid uptake of ISA/IEC 62443 frameworks that define zones, conduits, and continuous monitoring. The February 2025 ANSI/ISA-62443-2-1 update introduced a maturity model, allowing asset owners to tailor controls to risk profiles. Utilities and discrete manufacturers alike are structuring multi-layer defenses, reducing unplanned outages and insurance premiums.

Legacy brown-field systems with proprietary protocol lock-in

Plants built in the 1990s still rely on vendor-specific buses that complicate data acquisition and cloud connectivity. Phoenix Contact advises staged I/O migration to minimise shutdowns, yet integration crews must map thousands of legacy registers to modern object models-an effort that prolongs project timelines and inflates labor costs. Wood PLC notes that process-site lifecycles of 30 years make wholesale replacement impractical, obliging owners to fund dual-stack architectures for years.

Other drivers and restraints analyzed in the detailed report include:

- U.S. CHIPS Act-fuelled semiconductor capacity build-out

- Canada's net-zero grid mandate driving utility automation

- Capital-intensive retrofit costs for OSHA functional-safety

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hardware contributed 57.2% of 2024 revenue, led by sustained orders for PLC racks, DCS nodes, and motor drives. ABB's Process Automation unit posted USD 6.8 billion of 2024 sales, showing continued appetite for capital equipment. Integration of edge analytics into controllers, such as Honeywell's ControlEdge PLC with embedded OPC UA and MQTT, is boosting sell-through of premium SKUs.

Services, though smaller, are scaling rapidly at 8.9% CAGR as owners outsource lifecycle support. Rockwell Automation's Lifecycle Services backlog reached USD 1.70 billion in September 2024, reflecting demand for outcome-based contracts that tie fees to availability gains. Skills shortages-3.5 million cybersecurity roles lacking by 2025-push maintenance and remote-monitoring agreements higher, elevating recurring revenue in the North American industrial control systems industry.

PLCs held 31.4% of the North American industrial control systems market size in 2024, valued for deterministic control and proven reliability. Rockwell's Logix controller family anchors automotive and food lines across the region. Vendors now ship PLCs with native CIP-Security and TLS encryption, reducing gateway dependencies.

MES platforms are expanding at 7.6% CAGR as manufacturers seek lot-level genealogy and order-to-batch synchronisation. Industry 4.0 roll-outs nearly doubled connected devices to 17 billion globally in 2024, creating data sets that MES converts into actionable production KPIs. Automotive OEMs use MES to coordinate robotic paint, battery assembly, and final inspection, shortening launch cycles and connecting enterprise resource planning.

The North American Industrial Control Systems Market Report is Segmented by Component (Hardware, Software, Services), Type of System (Supervisory Control & Data Acquisition, Distributed Control Systems, and More), Communication Protocol (Fieldbus, Industrial Ethernet, Wireless), Deployment Mode (On-Premise, Cloud, Hybrid), End-User Industry, and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ABB Ltd.

- Emerson Electric Co.

- General Electric Co.

- Honeywell International Inc.

- Johnson Controls International plc

- Mitsubishi Electric Corp.

- Omron Corp.

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- Yokogawa Electric Corp.

- Bosch Rexroth AG

- Phoenix Contact GmbH

- Advantech Co. Ltd.

- Eaton Corp. plc

- BandR Industrial Automation GmbH

- Beckhoff Automation GmbH

- FANUC Corp.

- Delta Electronics Inc.

- Hitachi Ltd.

- IDEC Corp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Brown-Field Modernization across U.S. Automotive Plants

- 4.2.2 Growing Cyber-physical Safety Standards (ISA/IEC 62443) Adoption

- 4.2.3 U.S. CHIPS Act-fuelled Semiconductor Capacity Build-out

- 4.2.4 Canada's Net-Zero Grid Mandate Driving Utility Automation

- 4.2.5 Rising Mid-stream LNG Investments in Gulf Coast

- 4.2.6 Edge-enabled Predictive Maintenance Roll-outs in Mexican OEMs

- 4.3 Market Restraints

- 4.3.1 Legacy Brown-field Systems with Proprietary Protocol Lock-in

- 4.3.2 Capital-intensive Retrofit Costs for OSHA Functional-Safety

- 4.3.3 Shortage of ISA-Certified OT-Cybersecurity Workforce

- 4.3.4 North American Supply-Chain Exposure to Rare-earth Magnet Imports

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Type of System

- 5.2.1 SCADA (Supervisory Control and Data Acquisition)

- 5.2.2 DCS (Distributed Control Systems)

- 5.2.3 PLC (Programmable Logic Controller)

- 5.2.4 MES (Manufacturing Execution Systems)

- 5.2.5 PLM (Product Lifecycle Management)

- 5.2.6 ERP (Enterprise Resource Planning)

- 5.2.7 HMI (Human Machine Interface)

- 5.2.8 Others (OTS, Machine-safety)

- 5.3 By Communication Protocol

- 5.3.1 Fieldbus

- 5.3.2 Industrial Ethernet

- 5.3.3 Wireless

- 5.4 By Deployment Mode

- 5.4.1 On-premise

- 5.4.2 Cloud

- 5.4.3 Hybrid

- 5.5 By End-user Industry

- 5.5.1 Automotive

- 5.5.2 Chemical and Petrochemical

- 5.5.3 Utilities (Power and Water)

- 5.5.4 Pharmaceutical

- 5.5.5 Food and Beverage

- 5.5.6 Oil and Gas

- 5.5.7 Mining and Metals

- 5.5.8 Pulp and Paper

- 5.5.9 Others

- 5.6 By Country

- 5.6.1 United States

- 5.6.2 Canada

- 5.6.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Emerson Electric Co.

- 6.4.3 General Electric Co.

- 6.4.4 Honeywell International Inc.

- 6.4.5 Johnson Controls International plc

- 6.4.6 Mitsubishi Electric Corp.

- 6.4.7 Omron Corp.

- 6.4.8 Rockwell Automation Inc.

- 6.4.9 Schneider Electric SE

- 6.4.10 Siemens AG

- 6.4.11 Yokogawa Electric Corp.

- 6.4.12 Bosch Rexroth AG

- 6.4.13 Phoenix Contact GmbH

- 6.4.14 Advantech Co. Ltd.

- 6.4.15 Eaton Corp. plc

- 6.4.16 BandR Industrial Automation GmbH

- 6.4.17 Beckhoff Automation GmbH

- 6.4.18 FANUC Corp.

- 6.4.19 Delta Electronics Inc.

- 6.4.20 Hitachi Ltd.

- 6.4.21 IDEC Corp.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment