|

市場調查報告書

商品編碼

1851368

超級電容:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Supercapacitors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

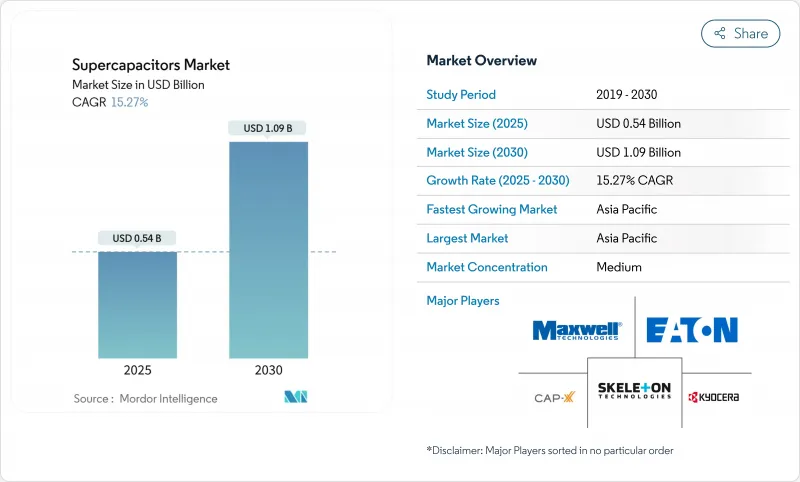

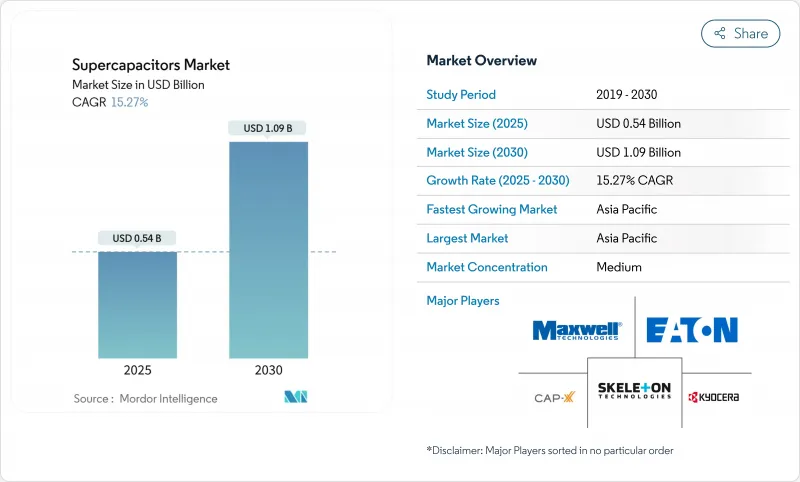

全球超級電容市場預計到 2025 年將達到 5.4 億美元,到 2030 年將達到 10.9 億美元,年複合成長率為 15.27%。

推動成長的因素包括:歐盟48V輕混動力系統強制令等電氣化法規、人工智慧(AI)突波期間資料中心對不斷電系統的需求,以及將電池和超級電容相結合以實現快速頻率響應的電網現代化計劃。中國仍然是生產和研發的核心,隨著鋰離子電池市場佔有率的下降,韓國製造商正將重心轉向儲能系統。產品創新主要集中在將能量密度提升至電池水平的混合動力設計以及可實現超薄穿戴裝置的石墨烯電極。活性碳價格和離子液體電解質等供應鏈風險將在短期內壓縮淨利率,但會促進區域多元化發展。

全球超級電容市場趨勢與洞察

電子公車隊快速採用超級電容模組進行再生煞車

城市交通擴大採用再生煞車系統,該系統結合了電池和超級電容,與純電池系統相比,可回收高達 85% 的動能。梅賽德斯-奔馳的 Intouro 混合動力公車採用 48 伏特超級電容器組,可承受數百萬次的充電循環而不會劣化,從而降低了 5% 的燃油消耗。中國城市走在前列,目前已將混合動力公車場站接入電網,用於車輛充電和電網穩定服務。系統供應商正在整合演算法,根據路線地形在超級電容和電池之間自動切換功率,從而降低整體擁有成本。隨著電動公車採購量的成長,這項技術增強了超級電容在公共運輸電氣化領域的競爭力。

電網級電池和超級電容器混合儲能

電力公司公共產業超級電容的即時頻率調節能力。示範測試表明,與獨立鋰離子電池組相比,超級電容器可將頻率下降降低17.43%,與純電池方案相比,其經濟效益是後者的3.2倍。美國能源局預測,隨著自動化電池生產的擴展,到2030年,儲能的平準化成本將達到每度電0.337美元。此外,超級電容還具有環境優勢,因為它們不使用鈷或鎳。這些因素使得超級電容市場成為高可再生能源場景下,與長壽命電池互補的重要電網組成部分。

認證差距(IEC 62391)限制了住宅部署

IEC 62391 測試程序延長了認證週期並增加了成本,尤其對中小企業而言更是如此。對比研究表明,該標準比 Maxwell 和 QC/T 741-2014通訊協定耗時更長,導致產品上市延遲長達 12 個月。其對高電流測試的重視與典型家庭的用電需求不符。這一行政障礙導致了市場分割,並減緩了住宅儲能領域的准入,而簡化合規流程本可以釋放該領域的新需求。

細分市場分析

由於其成熟的生產線和在工業功率緩衝領域久經考驗的耐用性,電雙層電容器預計在2024年將維持55.2%的超級電容市場佔有率。混合型超級電容融合了類似電池的儲能特性和傳統電容器的功率輸出特性,預計到2030年將以18.1%的複合年成長率成長。這種混合型方案滿足了原始設備製造商(OEM)對能夠承受數秒電壓驟降並保持更長放電週期的設備的需求。

包括鋰離子電容器在內的多種新型鋰離子電容器的研發進展,正在縮小能量密度差距並提高動作溫度。在汽車逆變器和併網系統中的先導計畫已證明其循環壽命超過一百萬次。這些特性意味著混合型超級電容器將成為超級電容行業的下一個性能標竿。

2024年,模組化組件將佔據超級電容市場57.8%的佔有率,這主要得益於整合的平衡電路以及與公車、起重機和風力發電機的即插即用相容性。同時,隨著電網營運商和電動車製造商選擇800V以上的高壓電池組,電池組預計將以每年17.4%的速度成長。到2030年,隨著公用事業公司部署超級電容電容器的市場規模可能會翻倍。

電池產品在穿戴式裝置和工業控制器領域仍然至關重要,因為在這些領域,板級整合和成本敏感度仍然是關鍵因素。供應商目前提供的模組化架構允許客戶以 50 伏特為增量擴展能量,從而縮短計劃設計週期。先進的溫度控管功能也進一步推動了電池產品在嚴苛環境下的應用。

區域分析

中國擁有龐大的活性碳加工規模和深厚的研究基礎,發表了65.4%的高影響力論文,預計到2024年將佔全球收入的28.2%。國內電動車製造商和國家支持的電網計劃推動了市場需求的成長,也支撐了銷售量的成長。國家優先發展本地儲能技術的政策進一步強化了超級電容市場的供應鏈生態系統。

到2030年,韓國及整個亞洲地區的複合年成長率將達到16.3%,將推動LG能源解決方案、三星SDI和SK安等公司投資超過200億美元用於新增產能。韓國企業將憑藉其電極塗層技術,為北美公用事業公司的儲能系統提供組件級解決方案。日本將貢獻高精度、高可靠性的汽車模組製造,東南亞國家將吸引尋求多元化供應鏈的組裝廠。

美國正利用《通膨降低法案》的激勵措施,在超大型資料中心實現超級電容UPS設備的在地化生產和部署。歐洲仍然以監管為主導,歐VII排放標準刺激了汽車需求,電網現代化資金則支持混合儲能試點計畫。拉丁美洲和中東等新興地區正在測試超級電容組,以確保微電網的穩定性,這表明超級電容市場具有長期成長潛力。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電動公車隊快速採用再生煞車超級電容模組

- 電網級電池和超級電容器混合儲能

- 用於超薄穿戴裝置的石墨烯電極取得突破性進展

- 歐盟的48V輕混動力系統強制令將加速12-48V模組的需求

- 資料中心超大規模資料中心業者部署基於超級電容的UPS以滿足ESG目標

- 市場限制

- 活性碳前驅物價格波動會影響物料清單成本。

- 認證差距(IEC 62391)限制了住宅應用

- 能量密度平台期(最高10Wh/kg)限制了遠距電動車的普及。

- 離子液體電解質供應鏈瓶頸導致前置作業時間延長

- 監管與技術視角(電極材料、亞太地區額定值、電解、電壓範圍)

- 宏觀經濟因素和貿易價格的影響

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資與資金籌措分析

第5章 市場規模與成長預測

- 依成分(類型)

- 雙電層電容器(EDLC)

- 贗電容器

- 混合型超級電容

- 按外形規格

- 細胞

- 模組

- 盒

- 依安裝類型(分立元件)

- 表面黏著技術

- 徑向引線

- 卡扣式

- 螺絲終端

- 按最終用戶行業分類

- 消費性電子產品

- 穿戴式裝置

- 智慧型手機和平板電腦

- SSD 和記憶體備份

- 能源與公共產業

- 電網頻率調節

- 可再生能源併網(風能、太陽能)

- 微電網和UPS

- 工業設備

- 機器人與自動化

- 電動工具

- 重型機械和起重機

- 汽車與運輸

- 搭乘用車

- 48V輕混

- 啟停式微混合動力

- 商用車輛

- 公車

- 追蹤

- 鐵路和路面電車

- 航空航太

- 資料中心和電信

- 國防與航太

- 其他(醫療設備、農業無人機)

- 消費性電子產品

- 按地區

- 美國

- 歐洲

- 中國

- 日本

- 韓國及其他亞太地區

- 世界其他地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Maxwell Technologies Inc.(Tesla)

- Skeleton Technologies SA

- CAP-XX Ltd.

- Eaton Corporation plc

- Panasonic Holdings Corp.

- LS Mtron Ltd.

- Kyocera Corp.

- Nippon Chemi-Con Corp.

- Supreme Power Solutions Co.

- Shanghai Aowei Technology Development Co.

- Samwha capacitor Group

- Nanoramic Laboratories(FastCAP)

- Nawa Technologies SAS

- Cornell Dubilier Electronics Inc.

- Toyo capacitor Co.

- Shenzhen Topmay Electronic Co.

- Liaoning Brother Electronics Technology Co.

- Chengdu ZT-Energy Tech Co.

- Loxus Inc.

- Nantong Jianghai capacitor Co. Ltd

- Beijing HCC Energy

- Jinzhou Kaimei Power Co. Ltd(KAM)

- Shanghai Green Tech Co. Ltd(GTCAP)

- Shenzhen Topmay Electronic Co. Ltd

- SEMG(Seattle Electronics Manufacturing Group(HK)Co. Ltd)

- Shanghai Pluspark Electronics Co. Ltd

第7章 市場機會與未來展望

The global supercapacitors market stood at USD 0.54 billion in 2025 and is forecast to reach USD 1.09 billion by 2030, advancing at a 15.27% CAGR.

Growth is supported by electrification rules such as the European Union's 48-volt mild-hybrid mandate, datacenter demand for uninterruptible power during artificial-intelligence (AI) surges, and grid-modernization projects that blend batteries with supercapacitors for rapid frequency response. China continues to anchor production and research, while Korean manufacturers pivot toward energy-storage systems as their lithium-ion share slips. Product innovation centres on hybrid designs that lift energy density toward battery-like levels and graphene electrodes that enable ultra-thin wearables. Supply-chain risks around activated-carbon prices and ionic-liquid electrolytes temper near-term margins but also encourage regional diversification.

Global Supercapacitors Market Trends and Insights

Rapid adoption of regenerative-braking supercapacitor modules in e-bus fleets

Urban transit agencies are scaling regenerative-braking systems that pair batteries with supercapacitors, recovering up to 85% more kinetic energy than battery-only setups. Mercedes-Benz's Intouro hybrid bus cut fuel use by 5% using a 48-volt supercapacitor pack that endures millions of charge cycles without degradation. Chinese cities were first movers and now link hybrid depots to the grid for both vehicle charging and grid-stability services. System suppliers integrate algorithms that shift power between supercapacitors and batteries to match route topography, which lowers total cost of ownership. As electric-bus procurements rise, this capability strengthens the competitive position of the supercapacitors market in mass-transit electrification.

Grid-scale battery-supercapacitor hybrid storage

Utilities value supercapacitors for instant frequency regulation. Demonstrations showed a 17.43% reduction in frequency-drop rates versus standalone lithium-ion arrays, delivering economic benefits 3.2-times greater than battery-only solutions. The U.S. Department of Energy projects levelized storage costs of USD 0.337 per kWh by 2030 as automated cell production scales. Operators also cite environmental advantages because supercapacitors avoid cobalt and nickel. These factors position the supercapacitors market as an essential grid-forming resource that complements long-duration batteries under high-renewable penetration scenarios.

Certification gaps (IEC 62391) limiting residential adoption

IEC 62391 testing procedures prolong qualification timelines and raise costs, especially for smaller firms. Comparative studies show the standard takes longer than Maxwell and QC/T 741-2014 protocols, stretching product launches by up to 12 months. The heavy focus on high-current testing is mismatched with typical household power profiles. This administrative hurdle slows the supercapacitors market from penetrating residential energy-storage segments where simplified compliance would unlock new demand.

Other drivers and restraints analyzed in the detailed report include:

- Graphene-based electrode breakthroughs enabling ultra-thin wearables

- EU 48 V mild-hybrid mandate accelerating demand for 12-48 V modules

- Energy-density plateau (~10 Wh/kg) restricting long-range EV penetration

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Electric Double-Layer Capacitors maintained a 55.2% share of the supercapacitors market in 2024, reflecting established production lines and proven durability in industrial power buffering. Hybrid Supercapacitors are on track for an 18.1% CAGR to 2030 as they merge battery-like energy storage with classic capacitor power delivery. The hybrid approach answers OEM calls for devices that can ride through seconds-long voltage dips and also sustain longer discharge profiles.

Rapid R&D advances, including lithium-ion capacitor variants, narrow the energy-density gap and extend operating temperatures. Pilot projects in automotive inverters and grid-forming systems showcase cycle lifetimes beyond one million cycles. These traits position hybrids as the next performance benchmark within the supercapacitors industry.

Module assemblies captured 57.8% of the supercapacitors market in 2024 thanks to integrated balancing circuitry and drop-in compatibility for buses, cranes, and wind turbines. Pack configurations, however, are projected to grow 17.4% annually as grid operators and EV makers opt for higher-voltage stacks that exceed 800 V. The supercapacitors market size for pack-level products could double by 2030 as utilities deploy them for sub-second frequency response.

Cell products retain relevance in wearables and industrial controllers where board-level integration and cost sensitivity remain critical. Vendors now offer modular architectures that let customers scale energy in 50-volt increments, shortening project design cycles. Advanced thermal-management features further widen adoption across harsh-duty environments.

The Supercapacitors Market Report is Segmented by Configuration (Type) (Electric Double-Layer Capacitors (EDLC), Pseudo Capacitors, and Hybrid Supercapacitors), Form Factor (Cell, Module, and Pack), Mounting Type (Discrete Components) (Surface-Mount, Radial Leaded, Snap-In, and More), End-User Industry (Consumer Electronics, Energy and Utilities, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

China controlled 28.2% of global revenue in 2024 due to scale in activated-carbon processing and a deep research base that publishes 65.4% of high-impact papers. Domestic demand from electric-vehicle makers and state-backed grid projects underpins volume growth. State policies that prioritise local energy-storage content further entrench supply-chain ecosystems for the supercapacitors market.

Korea and the broader Asia region are set for a 16.3% CAGR through 2030, propelled by LG Energy Solution, Samsung SDI, and SK On investments that exceed USD 20 billion in new capacity. Korean firms channel expertise in electrode coatings toward pack-level storage systems aimed at North American utilities. Japan contributes precision manufacturing for high-reliability automotive modules, while Southeast Asian nations attract assembly plants seeking diversified supply bases.

The United States leverages Inflation Reduction Act incentives to localise production and deploy supercapacitor-based UPS units in hyperscale datacenters. Europe remains regulation-driven, with the Euro 7 framework spurring automotive demand and grid-modernization funds supporting hybrid storage pilot plants. Emerging regions in Latin America and the Middle East trial supercapacitor packs for microgrid stability, signalling long-term addressable growth for the supercapacitors market.

List of Companies Covered in this Report:

- Maxwell Technologies Inc. (Tesla)

- Skeleton Technologies SA

- CAP-XX Ltd.

- Eaton Corporation plc

- Panasonic Holdings Corp.

- LS Mtron Ltd.

- Kyocera Corp.

- Nippon Chemi-Con Corp.

- Supreme Power Solutions Co.

- Shanghai Aowei Technology Development Co.

- Samwha capacitor Group

- Nanoramic Laboratories (FastCAP)

- Nawa Technologies SAS

- Cornell Dubilier Electronics Inc.

- Toyo capacitor Co.

- Shenzhen Topmay Electronic Co.

- Liaoning Brother Electronics Technology Co.

- Chengdu ZT-Energy Tech Co.

- Loxus Inc.

- Nantong Jianghai capacitor Co. Ltd

- Beijing HCC Energy

- Jinzhou Kaimei Power Co. Ltd (KAM)

- Shanghai Green Tech Co. Ltd (GTCAP)

- Shenzhen Topmay Electronic Co. Ltd

- SEMG (Seattle Electronics Manufacturing Group (HK) Co. Ltd)

- Shanghai Pluspark Electronics Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid adoption of regenerative-braking supercapacitor modules in e-bus fleets

- 4.2.2 Grid-scale battery-supercapacitor hybrid storage

- 4.2.3 Graphene-based electrode breakthroughs enabling ultra-thin wearables

- 4.2.4 EU 48 V mild-hybrid mandate accelerating demand for 12-48 V modules

- 4.2.5 Supercapacitor-based UPS deployment by Datacenter hyperscalers to meet ESG targets

- 4.3 Market Restraints

- 4.3.1 Activated-carbon precursor price volatility inflating BOM costs

- 4.3.2 Certification gaps (IEC 62391) limiting the residential adoption

- 4.3.3 Energy-density plateau (~10 Wh/kg) restricting long-range EV penetration

- 4.3.4 Ionic-liquid electrolyte supply-chain bottlenecks elongating lead-times

- 4.4 Regulatory and Technological Outlook (Electrode Material, CAsia-Pacificitance Ratings, Electrolyte, Voltage Range)

- 4.5 Impact of Macroeconomic Factors and Trade Tarrifs

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Configuration (Type)

- 5.1.1 Electric Double-Layer Capacitors (EDLC)

- 5.1.2 Pseudocapacitors

- 5.1.3 Hybrid Supercapacitors

- 5.2 By Form Factor

- 5.2.1 Cell

- 5.2.2 Module

- 5.2.3 Pack

- 5.3 By Mounting Type (Discrete Components)

- 5.3.1 Surface-Mount

- 5.3.2 Radial Leaded

- 5.3.3 Snap-in

- 5.3.4 Screw Terminal

- 5.4 By End-User Industry

- 5.4.1 Consumer Electronics

- 5.4.1.1 Wearables

- 5.4.1.2 Smartphones and Tablets

- 5.4.1.3 SSD and Memory Backup

- 5.4.2 Energy and Utilities

- 5.4.2.1 Grid Frequency Regulation

- 5.4.2.2 Renewable Integration (Wind, Solar)

- 5.4.2.3 Microgrid and UPS

- 5.4.3 Industrial Equipment

- 5.4.3.1 Robotics and Automation

- 5.4.3.2 Power Tools

- 5.4.3.3 Heavy Machinery and Cranes

- 5.4.4 Automotive and Transportation

- 5.4.4.1 Passenger Cars

- 5.4.4.1.1 48 V Mild Hybrid

- 5.4.4.1.2 Start-Stop Micro Hybrid

- 5.4.4.2 Commercial Vehicles

- 5.4.4.2.1 Buses

- 5.4.4.2.2 Trucks

- 5.4.4.3 Rail and Tram

- 5.4.4.4 Aviation and Aerospace

- 5.4.5 Data Centers and Telecom

- 5.4.6 Defense and Space

- 5.4.7 Others (Medical Devices, Agri-drones)

- 5.4.1 Consumer Electronics

- 5.5 By Geography

- 5.5.1 United States

- 5.5.2 Europe

- 5.5.3 China

- 5.5.4 Japan

- 5.5.5 Korea and Rest of Asia-Pacific

- 5.5.6 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Maxwell Technologies Inc. (Tesla)

- 6.4.2 Skeleton Technologies SA

- 6.4.3 CAP-XX Ltd.

- 6.4.4 Eaton Corporation plc

- 6.4.5 Panasonic Holdings Corp.

- 6.4.6 LS Mtron Ltd.

- 6.4.7 Kyocera Corp.

- 6.4.8 Nippon Chemi-Con Corp.

- 6.4.9 Supreme Power Solutions Co.

- 6.4.10 Shanghai Aowei Technology Development Co.

- 6.4.11 Samwha capacitor Group

- 6.4.12 Nanoramic Laboratories (FastCAP)

- 6.4.13 Nawa Technologies SAS

- 6.4.14 Cornell Dubilier Electronics Inc.

- 6.4.15 Toyo capacitor Co.

- 6.4.16 Shenzhen Topmay Electronic Co.

- 6.4.17 Liaoning Brother Electronics Technology Co.

- 6.4.18 Chengdu ZT-Energy Tech Co.

- 6.4.19 Loxus Inc.

- 6.4.20 Nantong Jianghai capacitor Co. Ltd

- 6.4.21 Beijing HCC Energy

- 6.4.22 Jinzhou Kaimei Power Co. Ltd (KAM)

- 6.4.23 Shanghai Green Tech Co. Ltd (GTCAP)

- 6.4.24 Shenzhen Topmay Electronic Co. Ltd

- 6.4.25 SEMG (Seattle Electronics Manufacturing Group (HK) Co. Ltd)

- 6.4.26 Shanghai Pluspark Electronics Co. Ltd

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment