|

市場調查報告書

商品編碼

1851304

德國太陽能市場:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Germany Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

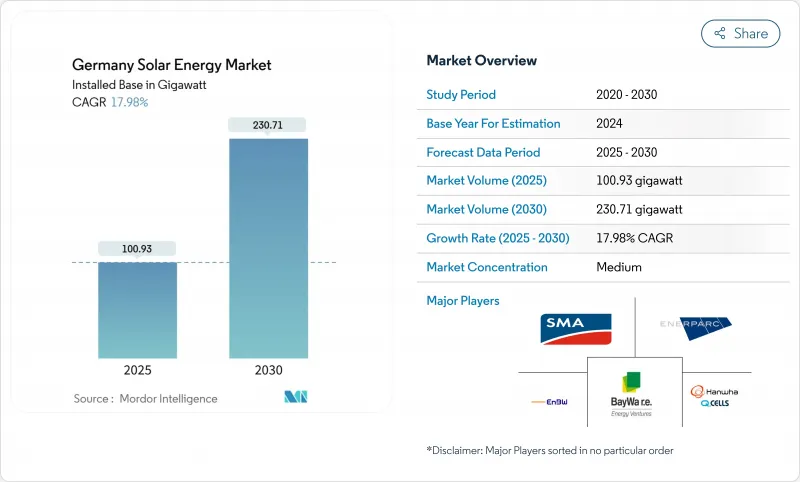

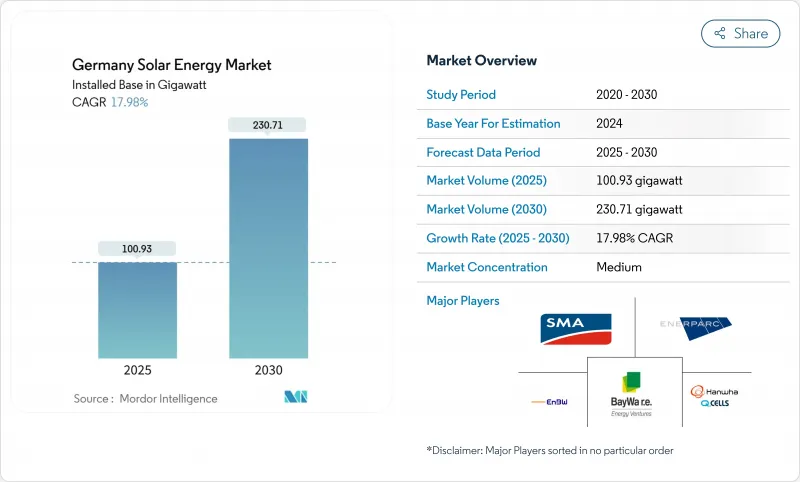

德國太陽能發電市場規模預計將從 2025 年的 100.93 吉瓦成長到 2030 年的 230.71 吉瓦,預測期(2025-2030 年)的複合年成長率為 17.98%。

該國在2030年實現80%再生能源的目標以及太陽能光電裝置容量在2025年初突破100吉瓦的里程碑,都推動了這一擴張。太陽能第一期計畫簡化了授權,組件價格暴跌87%,以及企業購電協議的簽訂,都在加速各個規模系統的計劃建設。屋頂強制安裝、陽台插電式光伏系統以及電網電價上漲,使得家庭和小型企業成為重要的投資者,而聚光太陽能發電(CSP)等發電配電技術也開始獲得試點資金,用於夜間高峰時段的電力支持。儘管機構資本湧入,競爭加劇,電網擁塞和技術純熟勞工短缺仍然限制新增併網項目的速度。

德國太陽能市場趨勢與洞察

太陽能套餐一和強制性屋頂安裝可加快核准

第一階段太陽能方案將住宅太陽能安裝的核准時間縮短了70%,商業太陽能安裝的核准時間縮短了45%。針對特定系統類型的上網電價補貼增加,以及各州對新建屋頂太陽能系統的強制性規定,共同推動了到2026年每年新增裝置容量4-5吉瓦的規模。簡化的立法拓寬了安裝商管道,降低了軟成本,並增強了投資者對都市區維修項目的信心。

企業購電協議熱潮推動無補貼電力計劃

上網電價補貼的下降促使電力公司轉向長期企業購電協議(PPA)。到2024年,德國將成為歐洲第二大PPA市場,合約量將實現三位數成長。亞馬遜和賓士等購電方正利用PPA來確保價格穩定並實現其範圍2脫碳目標,從而鼓勵在不依賴補貼的情況下進行開發。這一趨勢正在推動在掩埋工業用地上建設100兆瓦以上的計劃,這些項目資金籌措迅速完成,並實現了傳統競標之外的收入來源多元化。

電網擁塞和長達24個月的等待時間

2024年,光電發電量的棄光率將比2023年增加97%,將損害投資人的回報。快速的裝置容量擴張與電網升級滯後之間的不匹配將導致超過40億歐元的平衡成本,這些成本最終將反映在零售電價中。動態線路額定值和混合發電廠設計可以部分緩解這一問題,而《太陽能高峰法案》則在負電價時段引入了上網電價上限。儘管這些措施有所幫助,但它們無法取代導線延長和數位化變電站的部署。

細分市場分析

到2024年,光伏發電將佔德國太陽能市場總容量的100%,這主要得益於每瓦峰值功率(W-p)6-13歐分的低組件價格和接近每千瓦時3.7歐分的平準化度電成本(LCOE)。住宅、商業和公用事業相關人員都青睞高效的單面PERC組件,以及日益普及的雙面組件,這些組件能夠在不增加佔地面積的情況下提高發電量。弗勞恩霍夫太陽能系統研究所(Fraunhofer ISE)的研究表明,鈣鈦礦-矽串聯電池的效率已超過33%,這預示著未來效率的提升將有助於進一步降低價格。

目前聚光型太陽光電的市佔率為零,但預計到2030年將以18.5%的複合年成長率成長。其整合的熱能儲存可提供夜間高峰電力和製程熱,從而解決間歇性問題——隨著太陽能滲透率的提高,間歇性問題日益受到關注。歐盟委員會的藍圖指出,應將聚光太陽能發電與現有的區域供熱網路和工業蒸氣循環系統結合,並建議為示範試驗提供資金。如果目前的試點工廠能夠達到其發電和輸電能力以及成本目標,那麼在未來十年內,該領域有望發展成為德國太陽能市場的重要支柱。

德國太陽能市場報告按技術(光伏、聚光型太陽光電)、組件(光伏組件、逆變器、系統平衡裝置、電池儲能系統及其他)和應用(公用事業規模太陽能電站、商業和工業屋頂、住宅屋頂及其他)進行細分。市場規模和預測以裝置容量(吉瓦)為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 太陽能套餐 i 和屋頂安裝強制令,加速核准

- 企業購電協議熱潮推動無補貼電力計劃

- 電網收費上漲促進了用戶側太陽能發電和儲能的發展。

- 在出租房屋中大規模推廣陽台式太陽能發電系統

- 模組價格暴跌87%,使其成本與批發價持平。

- 新建築標準(2026 年及以後)中的 BIPV 整合要求

- 市場限制

- 電網擁塞和長達24個月的等待時間

- 熟練電工和安裝工短缺

- 歐盟和中國組件之間60%的成本差異造成了供應風險。

- 上網電價補貼減少和補貼突然調整會降低房屋投資報酬率

- 供應鏈分析

- 監理展望(EEG 2023、Solar Packet i、各州屋頂光電強制令)

- 技術展望(鈣鈦礦串聯太陽能電池、農業光伏、汽車光伏)

- 波特五力模型

- 競爭對手之間的競爭

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅(風能、熱泵、需量反應)

- PESTEL 分析

第5章 市場規模與成長預測

- 透過技術

- 光伏(PV)

- 聚光太陽能發電(CSP)

- 按組件

- 光電模組

- 逆變器(組串式、集中式、微型/功率最佳化器)

- 系統平衡(安裝、線)

- 電池儲能系統

- 監控和SCADA軟體

- EPC和O&M服務

- 透過使用

- 大型太陽能發電廠

- 商業和工業屋頂(30kW 至 1MW)

- 住宅屋頂光電發電(小於30kW,包括陽台光電)

- 其他(農業/農光互補)

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、夥伴關係、購電協議)

- 市場佔有率分析(主要企業的市場排名/佔有率)

- 公司簡介

- BayWa re AG

- SMA Solar Technology AG

- EnBW Energie Baden-Wurttemberg AG

- Hanwha Q CELLS GmbH

- IBC Solar AG

- Enerparc AG

- RWE Renewables GmbH

- Encavis AG

- juwi GmbH

- ABO Wind AG

- Vattenfall GmbH

- BayWa re Power Solutions GmbH

- Next2Sun GmbH

- Solnet Green Energy OY

- Axitec Energy GmbH & Co. KG

- Solarwatt GmbH

- Meyer Burger Technology AG(Freiberg)

- Tesla Germany GmbH(Powerwall & Roof)

- 1KOMMA5°GmbH

- Centrotherm International AG

第7章 市場機會與未來展望

The Germany Solar Energy Market size in terms of installed base is expected to grow from 100.93 gigawatt in 2025 to 230.71 gigawatt by 2030, at a CAGR of 17.98% during the forecast period (2025-2030).

The expansion is reinforced by the country's 80% renewables-by-2030 target and the early-2025 milestone of surpassing 100 GW of installed solar capacity . Streamlined permitting under Solar Package I, the 87% plunge in module prices, and corporate off-take agreements are accelerating project pipelines across all system sizes. Rooftop mandates, balcony-plug-in adoption, and grid-fee inflation have turned households and small businesses into pivotal investors, while dispatchable technologies such as CSP are starting to secure pilot funding for evening peak support. Competitive intensity is heightening as institutional capital flows in, yet grid congestion and skilled-labour shortages continue to constrain the pace of new grid connections.

Germany Solar Energy Market Trends and Insights

Solar Package I & Rooftop Mandates Accelerating Approvals

Germany's solar energy market projects now clear rooftops without construction permits, as Solar Package I cut residential approval times by 70% and commercial by 45%. Higher feed-in incentives for specific system types and state-level obligations on new roofs have formed a multi-layered push that lifts annual installation potential by 4-5 GW by 2026. Legal simplification has broadened installer pipelines, reduced soft costs, and strengthened investor confidence in urban retrofit opportunities.

Corporate PPA Boom Lifting Unsubsidised Utility Projects

Falling feed-in tariffs redirected utility developers toward long-term corporate power purchase agreements. Germany became Europe's second-largest PPA market by 2024, with triple-digit growth in contracted volumes. Off-takers like Amazon and Mercedes-Benz use PPAs to lock in price certainty and meet Scope 2 decarbonisation goals, encouraging developers to move forward without subsidy dependence. The trend is spurring 100-plus-MW projects on reclaimed industrial land, closing financing swiftly, and diversifying revenue streams beyond traditional auctions.

Distribution-Grid Congestion & 24-Month Queue Times

Queue delays stretch to two years in several rural districts, curtailing 97% more solar output in 2024 than in 2023 and eroding investor returns. The mismatch between rapid capacity additions and slower grid reinforcement elevates balancing costs above EUR 4 billion, which feeds into retail tariffs. Dynamic line rating and hybrid plant designs offer partial relief, while the Solar Peak Law introduces feed-in caps during negative price hours. These measures, though helpful, cannot substitute for expanded conductor upgrades and digital substation roll-outs.

Other drivers and restraints analyzed in the detailed report include:

- Rising Grid-Fee Inflation Driving Behind-the-Meter PV + Storage

- Mass Adoption of Balcony-Plug-in PV by Renters

- Skilled-Labour Shortages in Licensed Electricians & Installers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solar photovoltaic commanded 100% of Germany's solar energy market size in 2024, enabled by module prices as low as 6-13 euro cents per W-p and LCOE near 3.7 euro cents per kWh. Residential, commercial, and utility stakeholders favour high-efficiency mono-PERC and increasingly bifacial modules that push yield without expanding footprint. Research by Fraunhofer ISE demonstrates perovskite-silicon tandem cell lab efficiencies above 33% , pointing toward future gains that can underpin further price declines.

Concentrated solar power holds no share today, yet is forecast to grow at an 18.5% CAGR through 2030. Its integrated thermal storage delivers evening peaking power and process heat, addressing intermittency concerns as PV penetration rises. European Commission roadmaps identify CSP hybridisation with existing district-heating networks and industrial steam loops, indicating supportive funding for demonstrators. If current pilot plants meet dispatchability and cost targets, the segment could evolve into a complementary pillar of the German solar energy market by the next decade.

The Germany Solar Energy Market Report is Segmented by Technology (Solar Photovoltaic and Concentrated Solar Power), Component (PV Modules, Inverters, Balance-Of-System, Battery Energy-Storage Systems, and Others), Application (Utility-Scale Solar Parks, Commercial and Industrial Rooftop, Residential Rooftop, and Others). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- BayWa r.e. AG

- SMA Solar Technology AG

- EnBW Energie Baden-Wurttemberg AG

- Hanwha Q CELLS GmbH

- IBC Solar AG

- Enerparc AG

- RWE Renewables GmbH

- Encavis AG

- juwi GmbH

- ABO Wind AG

- Vattenfall GmbH

- BayWa r.e. Power Solutions GmbH

- Next2Sun GmbH

- Solnet Green Energy OY

- Axitec Energy GmbH & Co. KG

- Solarwatt GmbH

- Meyer Burger Technology AG (Freiberg)

- Tesla Germany GmbH (Powerwall & Roof)

- 1KOMMA5° GmbH

- Centrotherm International AG

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Solar Package I & Rooftop Mandates Accelerating Approvals

- 4.2.2 Corporate PPA Boom Lifting Unsubsidised Utility Projects

- 4.2.3 Rising Grid-Fee Inflation Driving Behind-the-Meter PV + Storage

- 4.2.4 Mass Adoption of Balcony-Plug-in PV by Renters

- 4.2.5 87 % Module-Price Collapse Enables Cost-Parity vs. Wholesale

- 4.2.6 Integrated BIPV Requirements in New-Build Codes (from 2026)

- 4.3 Market Restraints

- 4.3.1 Distribution-Grid Congestion & 24-Month Queue Times

- 4.3.2 Skilled-Labour Shortages in Licensed Electricians & Installers

- 4.3.3 60 % Cost Gap on EU-vs-China Modules Creating Supply-Risk

- 4.3.4 Declining FiTs & Sudden Subsidy Tweaks Eroding Residential ROI

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook (EEG 2023, Solar-Paket I, State Rooftop Mandates)

- 4.6 Technological Outlook (Perovskite Tandems, Agrivoltaics, Vehicle-Integrated PV)

- 4.7 Porter's Five Forces

- 4.7.1 Competitive Rivalry

- 4.7.2 Threat of New Entrants

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Bargaining Power of Suppliers

- 4.7.5 Threat of Substitutes (Wind, Heat-Pumps, Demand Response)

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 By Component

- 5.2.1 PV Modules

- 5.2.2 Inverters (String, Central, Micro/Power-Optimiser)

- 5.2.3 Balance-of-System (Mounts, Cables)

- 5.2.4 Battery Energy-Storage Systems

- 5.2.5 Monitoring and SCADA Software

- 5.2.6 EPC and O&M Services

- 5.3 By Application

- 5.3.1 Utility-Scale Solar Parks

- 5.3.2 Commercial and Industrial Rooftop (30 kW - 1 MW)

- 5.3.3 Residential Rooftop (below 30 kW incl. Balcony PV)

- 5.3.4 Others (Agricultural/Agrivoltaics)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 BayWa r.e. AG

- 6.4.2 SMA Solar Technology AG

- 6.4.3 EnBW Energie Baden-Wurttemberg AG

- 6.4.4 Hanwha Q CELLS GmbH

- 6.4.5 IBC Solar AG

- 6.4.6 Enerparc AG

- 6.4.7 RWE Renewables GmbH

- 6.4.8 Encavis AG

- 6.4.9 juwi GmbH

- 6.4.10 ABO Wind AG

- 6.4.11 Vattenfall GmbH

- 6.4.12 BayWa r.e. Power Solutions GmbH

- 6.4.13 Next2Sun GmbH

- 6.4.14 Solnet Green Energy OY

- 6.4.15 Axitec Energy GmbH & Co. KG

- 6.4.16 Solarwatt GmbH

- 6.4.17 Meyer Burger Technology AG (Freiberg)

- 6.4.18 Tesla Germany GmbH (Powerwall & Roof)

- 6.4.19 1KOMMA5° GmbH

- 6.4.20 Centrotherm International AG

7 Market Opportunities & Future Outlook

- 7.1 White-Space & Unmet-Need Assessment (e.g., Vehicle-to-Grid PV, Industrial Heat-via-PV-Electrolysis)