|

市場調查報告書

商品編碼

1848285

中國太陽能市場:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030年)China Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

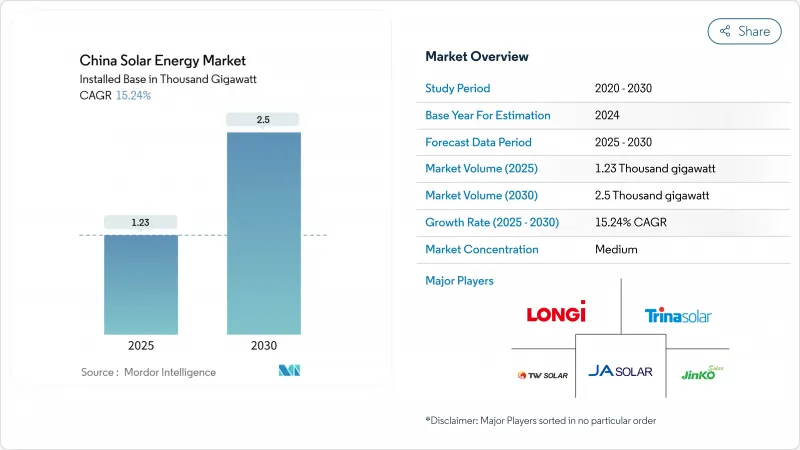

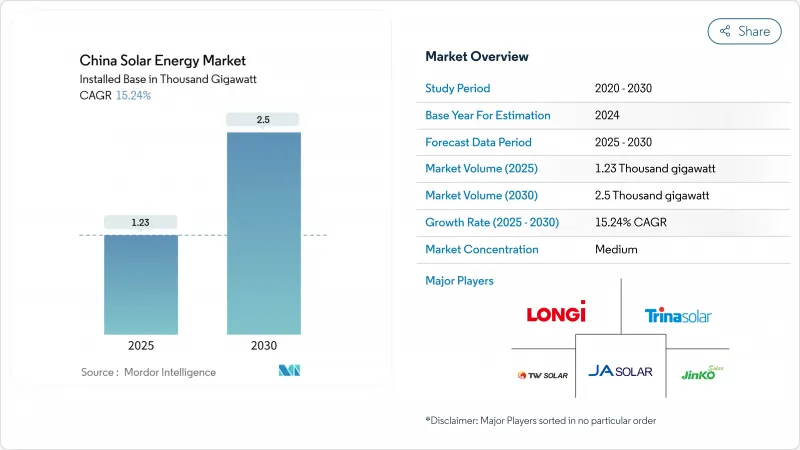

預計到 2025 年,中國太陽能裝置容量將從 1230 吉瓦成長到 2030 年的 2500 吉瓦,預測期(2025-2030 年)複合年成長率為 15.24%。

受「十四五」規劃加速推進、組件價格創歷史新低以及企業購電協議(PPA)生態系統不斷擴大的推動,中國太陽能市場成長動能將保持強勁。 N型電池效率的快速提升、超高壓輸電網的建設以及公共設施屋頂安裝太陽能系統的政策,將帶動新計劃的湧現。同時,西北省份電網擁塞、市場化電價機制的引入以及全球貿易壁壘的加強,構成了一定的結構性阻力。然而,憑藉持續的技術創新和政策協調,中國太陽能市場預計在2030年之前繼續保持全球最大可再生能源市場的地位。

中國太陽能市場趨勢與洞察

創紀錄的低組件價格提升了平準化度電成本競爭力

隨著中國光電產能飆升至861吉瓦,組件價格在2024年初降至0.75元/瓦。成本領先優勢使得太陽能的平準化度電成本在超過25個省份低於煤炭發電,這鼓勵開發商在沒有補貼的情況下加快建設吉瓦級計劃。儘管產業整合不可避免,但隆基和晶科能源等主要廠商正受惠於其N型拓普康生產線,該生產線能夠帶來淨利率。

「十四五」規劃旨在加速產能擴張

該計畫將優先發展庫布齊等特大沙漠基地和「太陽能長城」叢集,確保其與土地、電網和資金籌措管道的對接。地方政府將把屋頂和農業太陽能光電發電及儲能試點計畫與國家配額掛鉤,以鼓勵農村家庭參與能源轉型。

西北地區的電網擁塞限制了其容量利用率。

儘管全國電力短缺狀況緩解,但新疆維吾爾自治區和甘肅省部分地區仍面臨超過5%的電力缺口。目前正在建設中的±800千伏高壓直流輸電線路每年將增加36太瓦時的可再生能源供電量,但電力短缺問題要到2027年才能完全緩解。

細分市場分析

到2024年,光伏發電將佔中國太陽能市場的99.5%。其中,N型TOPCon、HJT和背接觸式光伏電池的轉換效率將達到創紀錄的25.4%,到2024年底,其出貨量將佔比達到70%。更高的功率密度降低了系統總成本,從而維持了價格優勢。新疆維吾爾自治區的一座示範電站於2024年12月併網發電,其聚光型太陽熱能發電裝置容量超過1吉瓦。青海省為聚光太陽能發電企業提供0.55元/千瓦時的專項補貼,確保其獲利能力,並實現發電來源多元化,以平衡光伏滲透率較高的地區的電力供應。

由於規模經濟、本地化的供應鏈和政策確定性,光伏發電在中國太陽能市場佔據主導地位。聚光太陽能發電(CSP)目前仍處於小眾市場,但在日益嚴格的逆變器相關電網監管政策下,作為一種穩定能源,正受益於政策支持。 2027年後,鈣鈦礦和矽材料協同研究的進展可望重新定義這兩種技術的效率閾值。

中國太陽能市場報告按技術(光伏、聚光型太陽光電)、併網類型(併網、離網)和終端用戶(住宅、商業/工業和公共產業)進行細分。市場規模和預測以裝置容量(GW)為單位。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 創紀錄的低組件價格降低了平準化度電成本

- 「十四五」計畫產能目標

- 企業購電協議/綠色能源交易蓬勃發展

- 新建公共建築必須強制安裝屋頂太陽能發電系統。

- 有利於併網的逆變器維修政策

- CSP Plus 儲能補助計劃

- 市場限制

- 中國西北地區電網壅塞及限電問題

- 逐步取消上網電價補助和低價競標

- 中國製造模組面臨的對外貿易壁壘

- 對新疆多晶矽供應的ESG調查

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力模型

- 競爭對手之間的競爭

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 新進入者的威脅

- PESTEL 分析

第5章 市場規模與成長預測

- 透過技術

- 光伏(PV)

- 聚光型太陽光電(CSP)

- 按連線類型

- 併網

- 離網

- 最終用戶

- 住宅

- 商業和工業

- 公用事業

第6章 競爭情勢

- 市場集中度

- 策略性舉措(併購、夥伴關係、購電協議)

- 市場佔有率分析(主要企業的市場排名和佔有率)

- 公司簡介

- LONGi Green Energy Technology Co Ltd

- Trina Solar Co Ltd

- JA Solar Technology Co Ltd

- JinkoSolar Holding Co Ltd

- Tongwei Solar Co Ltd

- Zhejiang Chint Electrics Co Ltd

- Hanwha Q CELLS Co Ltd

- Yingli Green Energy Holding Co Ltd

- Huasun Energy Co Ltd

- Drinda New Energy Technology Co Ltd

- GCL-Poly Energy Holdings Ltd

- Risen Energy Co Ltd

- Suntech Power Co Ltd

- Seraphim Solar System Co Ltd

- GoodWe Technologies Co Ltd

- Sungrow Power Supply Co Ltd

- Huawei Digital Power Technologies Co Ltd

- Tianjin Zhonghuan Semiconductor Co Ltd

- Aiko Solar Energy Co Ltd

- Shunfeng International Clean Energy Ltd

- Envision Energy Ltd

第7章 市場機會與未來展望

The China Solar Energy Market size in terms of installed base is expected to grow from 1.23 Thousand gigawatt in 2025 to 2.5 Thousand gigawatt by 2030, at a CAGR of 15.24% during the forecast period (2025-2030).

Accelerated deployment under the 14th Five-Year Plan, record-low module prices, and an expanding corporate PPA ecosystem keep growth momentum high. Rapid improvement in N-type cell efficiency, ultra-high voltage transmission build-out, and policies mandating rooftop systems on public buildings create new project pipelines. At the same time, grid congestion in northwestern provinces, the incoming market-based tariff regime, and intensifying global trade barriers pose structural headwinds. Nonetheless, continued innovation and policy coordination position the Chinese solar energy market to remain the world's largest renewable-power arena through 2030.

China Solar Energy Market Trends and Insights

Record-Low Module Prices Drive LCOE Competitiveness

Module prices fell to RMB 0.75/W in early 2024 after China's manufacturing capacity ballooned to 861 GW against global demand of 600 GW . Cost leadership pushed solar LCOE below coal in more than 25 provinces, prompting developers to accelerate gigawatt-scale projects without subsidies. Industry consolidation is inevitable, yet leading firms such as LONGi and JinkoSolar benefit from N-type TOPCon lines that preserve margins.

14th Five-Year Plan Targets Accelerate Capacity Expansion

The plan prioritizes gigantic desert bases such as Kubuqi and "Great Solar Wall" clusters, ensuring land, grid, and financing coordination. Local governments link rooftop, agro-PV, and storage pilots to national quotas, bringing rural households into the energy transition.

Grid Congestion Constrains Northwestern Capacity Utilization

Curtailment has subsided nationally but remains above 5% in parts of Xinjiang and Gansu . +-800 kV UHVDC lines now under construction will raise renewable transfer by 36 TWh a year, yet full relief comes only after 2027.

Other drivers and restraints analyzed in the detailed report include:

- Corporate PPA Market Transforms Energy Procurement

- Mandatory Rooftop PV Policies Drive Distributed Growth

- Feed-in-Tariff Phase-out Intensifies Market Competition

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solar photovoltaic retained 99.5% of the Chinese solar energy market in 2024. Within PV, N-type TOPCon, HJT, and back-contact cells reached 70% shipment share by the end of 2024 as conversion efficiency climbed to 25.4% record. Higher power density lowers balance-of-system costs, sustaining price premiums. Concentrated solar power capacity topped 1 GW after Xinjiang's demonstration plant joined the grid in December 2024, pairing 8-hour storage with Linear Fresnel heliostats to enhance peak-shaving capability. CSP's dedicated subsidy of 0.55 yuan/kWh in Qinghai secures returns and diversifies generation sources that balance high-penetration PV provinces.

The PV segment's economies of scale, localized supply chain, and policy certainty make it the Chinese solar energy market anchor. CSP remains niche but gains policy tailwinds as a stabilizing resource amid rising inverter-related grid regulations. Advancements in perovskite-silicon tandem research could arrive after 2027, potentially redefining efficiency thresholds across both technologies.

The China Solar Energy Market Report is Segmented by Technology (Solar Photovoltaic and Concentrated Solar Power), Connection Type (On-Grid and Off-Grid), and End-User (Residential, Commercial and Industrial, and Utilities). The Market Size and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- LONGi Green Energy Technology Co Ltd

- Trina Solar Co Ltd

- JA Solar Technology Co Ltd

- JinkoSolar Holding Co Ltd

- Tongwei Solar Co Ltd

- Zhejiang Chint Electrics Co Ltd

- Hanwha Q CELLS Co Ltd

- Yingli Green Energy Holding Co Ltd

- Huasun Energy Co Ltd

- Drinda New Energy Technology Co Ltd

- GCL-Poly Energy Holdings Ltd

- Risen Energy Co Ltd

- Suntech Power Co Ltd

- Seraphim Solar System Co Ltd

- GoodWe Technologies Co Ltd

- Sungrow Power Supply Co Ltd

- Huawei Digital Power Technologies Co Ltd

- Tianjin Zhonghuan Semiconductor Co Ltd

- Aiko Solar Energy Co Ltd

- Shunfeng International Clean Energy Ltd

- Envision Energy Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Record-low module prices cut LCOE

- 4.2.2 14th Five-Year Plan capacity targets

- 4.2.3 Corporate PPAs/green-power trading boom

- 4.2.4 Mandatory rooftop PV on new public buildings

- 4.2.5 Grid-friendly inverter retrofits policy

- 4.2.6 CSP-plus-storage subsidy scheme

- 4.3 Market Restraints

- 4.3.1 Grid congestion & curtailment in NW China

- 4.3.2 Feed-in-tariff phase-out & low auction prices

- 4.3.3 Overseas trade barriers to Chinese modules

- 4.3.4 ESG scrutiny of Xinjiang polysilicon supply

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Competitive Rivalry

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Threat of New Entrants

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecasts

- 5.1 By Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 By Connection Type

- 5.2.1 On-Grid

- 5.2.2 Off-Grid

- 5.3 By End-User

- 5.3.1 Residential

- 5.3.2 Commercial and Industrial

- 5.3.3 Utilities

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 LONGi Green Energy Technology Co Ltd

- 6.4.2 Trina Solar Co Ltd

- 6.4.3 JA Solar Technology Co Ltd

- 6.4.4 JinkoSolar Holding Co Ltd

- 6.4.5 Tongwei Solar Co Ltd

- 6.4.6 Zhejiang Chint Electrics Co Ltd

- 6.4.7 Hanwha Q CELLS Co Ltd

- 6.4.8 Yingli Green Energy Holding Co Ltd

- 6.4.9 Huasun Energy Co Ltd

- 6.4.10 Drinda New Energy Technology Co Ltd

- 6.4.11 GCL-Poly Energy Holdings Ltd

- 6.4.12 Risen Energy Co Ltd

- 6.4.13 Suntech Power Co Ltd

- 6.4.14 Seraphim Solar System Co Ltd

- 6.4.15 GoodWe Technologies Co Ltd

- 6.4.16 Sungrow Power Supply Co Ltd

- 6.4.17 Huawei Digital Power Technologies Co Ltd

- 6.4.18 Tianjin Zhonghuan Semiconductor Co Ltd

- 6.4.19 Aiko Solar Energy Co Ltd

- 6.4.20 Shunfeng International Clean Energy Ltd

- 6.4.21 Envision Energy Ltd

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment