|

市場調查報告書

商品編碼

1851253

檸檬酸:市場佔有率分析、產業趨勢、統計數據、成長預測(2025-2030)Citric Acid - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

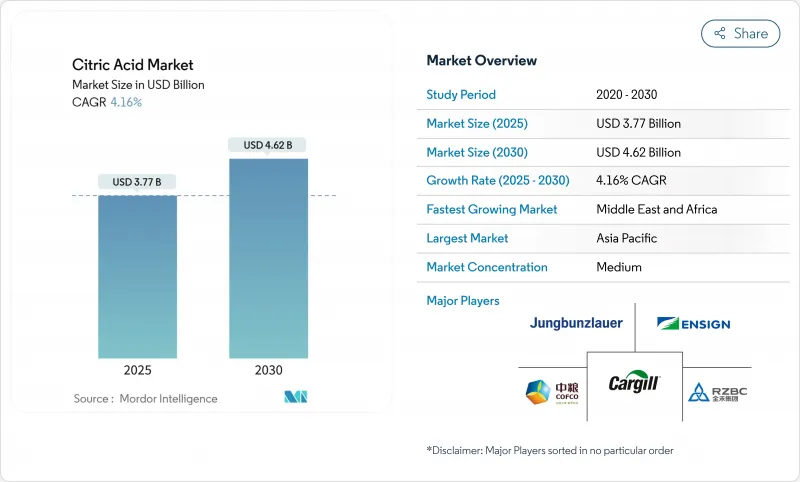

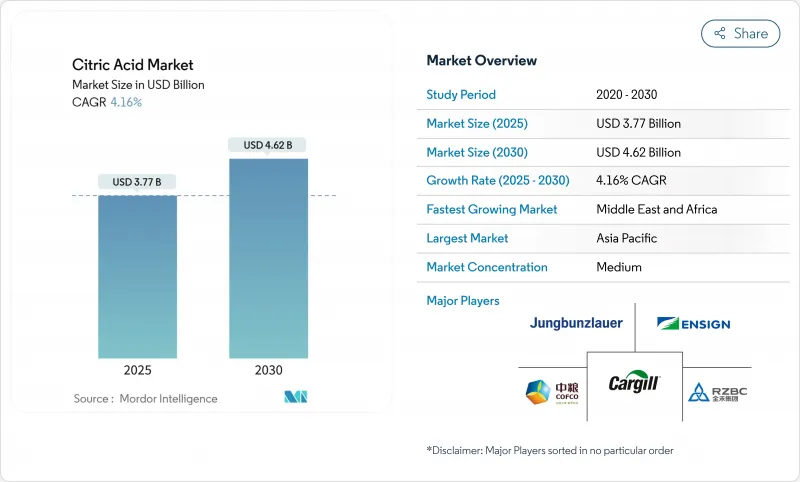

預計到 2025 年,檸檬酸市場規模將達到 37.7 億美元,到 2030 年將成長至 46.2 億美元,複合年成長率高達 4.16%。

消費者對潔淨標示產品的偏好日益成長、生物技術工藝的進步以及檸檬酸在食品飲料、製藥和清潔產品等行業的應用日益多元化,是推動市場成長的主要因素。監管政策的進一步明確,包括美國授予的GRAS認證和歐盟的量子飽和度核准,持續降低市場進入門檻,促進市場准入並鼓勵新參與企業。然而,對中國進口產品徵收反傾銷稅正在重塑全球籌資策略,並促使製造商將產能轉移到中國以外地區,以降低供應鏈風險。此外,供應鏈的垂直整合以及節能發酵技術的創新正在提高生產效率和成本效益。便利飲料、可生物分解清潔液、發泡藥品和其他新興應用領域對檸檬酸的需求不斷成長,進一步拓寬了市場範圍。這些因素支撐著檸檬酸市場的成長潛力及其適應不斷變化的監管、技術和消費者主導趨勢的能力。

全球檸檬酸市場趨勢與洞察

消費者越來越傾向於在碳酸飲料中使用天然酸味劑

隨著飲料業轉向天然酸味劑,檸檬酸的需求量激增,這主要得益於潔淨標示產品的推廣。檸檬酸已在巴西獲得批准,成為食品添加劑,相關法規為211/2023號規範。該法規規定了飲料中檸檬酸的典型添加量,介於0.1%至0.3%之間,為生產商提供了亟需的指南。這項明確的監管規定不僅消除了配方的不確定性,也使品牌能夠宣稱其產品具有天然防腐劑的功效。此舉與消費者日益成長的對成分透明度和簡化的期望相契合。檸檬酸的重要性不僅限於其作為天然酸味劑的主要作用。它還具有pH調節劑和防腐劑的功能,使生產商能夠在簡化成分配方的同時提高產品穩定性。這項策略與產業遵守監管標準並滿足消費者對潔淨標示產品需求的整體目標一致。此外,領先的飲料生產商目前傾向於使用藥用級檸檬酸,這凸顯了品質穩定性和市場合規性的重要性。對經過認證的高品質檸檬酸日益成長的需求,不僅為經過認證的供應商提供了溢價,而且還激發了市場上的競爭和創新精神。

即飲飲料對檸檬酸的需求不斷成長

即飲飲料市場正經歷強勁成長,顯著推動了檸檬酸在各種應用領域的需求。檸檬酸因其多功能特性而成為關鍵成分,這些特性包括增強風味、穩定色澤和延長保存期限,對於保持產品品質和吸引力至關重要。新興市場的都市化進程加速了便利消費習慣的普及,為即飲飲料創造了巨大的成長機會。檸檬酸作為一種保色劑,在果味飲料中尤其重要,因為它直接影響視覺吸引力、消費者偏好以及在競爭激烈的市場中實現品牌差異化。此外,發酵技術的進步徹底改變了生產能力。製造商目前採用工程改造的黑麴菌株,使檸檬酸濃度超過174 g/L。這些技術創新提高了生產效率,降低了營運成本,並增強了供應鏈的可靠性。因此,供應商能夠更好地滿足不斷成長的需求,同時保持價格競爭力,從而促進市場擴張,尤其是在對價格敏感的新興細分市場。

新興國家原物料價格波動

原料成本的波動給整個檸檬酸供應鏈帶來了巨大的利潤壓力,尤其是玉米、甘蔗糖蜜和其他碳水化合物等發酵基材。這種波動在新興市場尤其顯著,因為這些地區的農產品價格極易受到外部因素的影響,例如難以預測的天氣、政策改革、地緣政治緊張局勢和基礎設施不足。除了投入成本上漲之外,製造商還面臨外匯波動和物流成本上升的挑戰,這進一步加劇了成本管理的複雜性,並迫使他們採用複雜的避險策略。然而,基材利用技術的進步為緩解這些挑戰提供了一個有希望的途徑。近期研究表明,利用甘蔗渣、乳清和其他產品流等農業廢棄物成功生產檸檬酸是可行的。這些技術創新提供了經濟高效且環境友善的替代方案,不僅可以減少對大宗商品市場的依賴,而且符合永續性目標,並增強檸檬酸供應鏈的韌性。

細分市場分析

無水檸檬酸在2024年仍佔據市場主導地位,市佔率高達55.35%。這主要歸功於其優異的穩定性、較長的保存期限以及完善的供應鏈體系,使其能夠滿足多種終端用途的需求。其晶體結構確保了品質的穩定性,使其成為食品和製藥生產商的熱門選擇。工業應用也青睞無水檸檬酸,因為它溶解速率可預測,並且在製劑過程中不易受水分影響。然而,隨著加工效率日益重要,市場格局逐漸轉變。例如,榮邦茨勞爾(Jungbunzlauer)的CITROCOAT N等可直接壓片的檸檬酸產品,在製藥片劑生產領域越來越受歡迎。這些產品透過提高片劑硬度、縮短加工時間以及改善特定應用中的性能,滿足了行業需求。

液態檸檬酸製劑市場正經歷強勁成長,預計到2030年將以6.82%的複合年成長率成長。這一成長主要得益於製造商日益重視營運效率和成本最佳化。液態製劑無需溶解步驟,可在自動化生產系統中實現精確的劑量控制,從而簡化生產流程。這一趨勢在飲料行業尤其明顯,液態檸檬酸可無縫整合到糖漿製備過程中,降低粉末處理帶來的污染風險。此外,儲存和運輸技術的進步也緩解了傳統的穩定性問題,使液態檸檬酸更具可行性。這些進步推動了液態檸檬酸在以往以無水檸檬酸為主的應用領域中廣泛應用,並在整個預測期內保持持續成長。

檸檬酸市場報告按形態(無水和液體)、應用領域(食品飲料、醫藥、個人護理和化妝品及其他)、等級(醫藥級、食品級、工業級)以及地區(北美、南美、歐洲、亞太、中東和非洲)對行業進行分類。各細分市場的市場規模及預測均以美元計價。

區域分析

到2024年,亞太地區的市佔率將達到37.74%,這主要得益於中國強大的生產能力以及食品加工和工業領域國內需求的激增。該地區的優勢包括完善的發酵基礎設施、具有競爭力的生產成本以及便捷獲取玉米和甘蔗等關鍵原料。然而,貿易摩擦和反傾銷措施正在改變該地區的格局。印度、泰國和其他東南亞國家正在擴大產能,以滿足國內和出口需求。日本先進的製藥和食品加工業提供了良好的市場前景,而澳洲快速成長的食品飲料產業也將促進區域消費。

中東和非洲地區值得關注,預計到2030年將以7.43%的複合年成長率成長。這一成長主要得益於沙烏地阿拉伯和阿拉伯聯合大公國等國蓬勃發展的食品加工業和基礎設施投資。該地區各國政府為加強糧食安全和實現產業多元化所採取的舉措,正在為檸檬酸創造新的需求中心。 NEOM與Liberation Labs合作建立精密發酵設施,凸顯了該地區在先進生物製造領域的雄心。同時,北美和歐洲憑藉其成熟的食品和製藥行業,提供了穩定的需求,但市場飽和和監管不一致限制了其成長速度。

歐洲憑藉在食品、飲料和個人護理領域的強勁需求,以及嚴格的品質標準和完善的加工設施,保持著穩固的市場地位。北美市場正經歷穩定成長,這主要得益於即飲飲料、簡便食品和藥品產業的快速擴張。該地區的消費者將檸檬酸用作天然防腐劑和增味劑,並且越來越傾向於選擇潔淨標示的配料。南美洲,尤其是巴西和阿根廷等國家,由於食品加工業的擴張和消費者對包裝食品日益成長的偏好,也實現了成長。南美洲的生產商擁有豐富的檸檬酸生產原料,為其提供了雙重優勢,降低了對進口的依賴。歐洲、北美和南美洲有利於天然添加劑的法律規範進一步提升了檸檬酸的市場潛力,為全球巨頭和本土企業都創造了機會。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 消費者越來越傾向於在碳酸飲料中使用天然酸味劑

- 即飲飲料對檸檬酸的需求不斷成長

- 發泡藥物的使用日益增多

- 加強對工業清潔劑中可生物分解螯合劑的監管

- 糖果甜點中減少糖分的需求日益成長

- 生產流程創新可提高產量比率並降低成本。

- 市場限制

- 新興國家原物料價格波動

- 提高對中國檸檬酸的反傾銷稅

- 來自其他酸味劑的競爭。

- 季節性變化影響柑橘類水果的供應。

- 供應鏈分析

- 監理展望

- 波特五力模型

- 新進入者的威脅

- 買方/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按形式

- 無水

- 液體

- 透過使用

- 飲食

- 麵包店

- 糖果甜點

- 乳製品

- 飲料

- 鹹味小吃

- 其他食品和飲料

- 製藥

- 個人護理和化妝品

- 清潔劑和家用清潔劑

- 其他

- 飲食

- 按年級

- 醫藥級

- 食品級

- 工業級

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 哥倫比亞

- 智利

- 秘魯

- 其他南美洲

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 荷蘭

- 波蘭

- 比利時

- 瑞典

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 印尼

- 韓國

- 泰國

- 新加坡

- 亞太其他地區

- 中東和非洲

- 南非

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 奈及利亞

- 埃及

- 摩洛哥

- 土耳其

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市場排名分析

- 公司簡介

- Shandong Ensign Industry Co., Ltd.

- Jungbunzlauer Suisse AG

- COFCO Corporation

- RZBC Group Co., Ltd.

- TTCA Co., Ltd.

- Archer Daniels Midland Company

- Cargill, Incorporated

- Gadot Biochemical Industries Ltd.

- Foodchem International Corporation

- Merck KGaA

- Hawkins, Inc.

- Citrique Belge NV

- BBCA Group(Anhui BBCA)

- FUSO Chemical Co., Ltd.

- Wang Pharmaceuticals and Chemicals

- Hemadri Chemicals

- Vinipul Inorganics India Pvt. Ltd

- Arihant Chemicals

- Anmol Chemicals Private Limited

- Innova Corporate

第7章 市場機會與未來展望

The Citric Acid market size is anticipated to be USD 3.77 billion in 2025, and is projected to grow to USD 4.62 billion by 2030, registering a steady CAGR of 4.16%.

The rising consumer preference for clean-label products, advancements in biotechnology processes, and the increasing diversification of applications across industries such as food and beverages, pharmaceuticals, and cleaning products primarily drive this growth. Regulatory clarity, including the GRAS status in the United States and quantum satis approval in the European Union, continues to lower entry barriers, fostering market accessibility and encouraging participation from new players. However, the imposition of anti-dumping duties on Chinese imports is reshaping global sourcing strategies, prompting manufacturers to expand production capacities in regions outside China to mitigate supply chain risks. Additionally, vertical integration across the supply chain and innovations in energy-efficient fermentation technologies are improving production efficiency and cost-effectiveness. The growing demand for citric acid in convenience beverages, biodegradable cleaning solutions, effervescent pharmaceuticals, and other emerging applications is further broadening its market scope. These factors collectively underscore the market's strong growth potential and its ability to adapt to evolving regulatory, technological, and consumer-driven trends.

Global Citric Acid Market Trends and Insights

Growing Consumer Shift to Natural Acidulants in Carbonated Soft Drinks

As the beverage industry pivots towards natural acidulants, citric acid is witnessing a surge in demand, largely fueled by a commitment to clean-label product reformulations. In Brazil, regulatory shifts have bolstered this momentum, with citric acid receiving the green light as an additive under Normative Instruction 211/2023. This regulation delineates typical dosages for beverages, set between 0.1% and 0.3%, offering manufacturers much-needed guidance. Such regulatory clarity not only dispels formulation uncertainties but also empowers brands to flaunt their natural preservation credentials. This move resonates with a growing consumer appetite for transparency and simplicity in ingredient lists. Citric acid's significance transcends its primary role as a natural acidulant. Its added functions as a pH regulator and preservative allow manufacturers to enhance product stability while streamlining ingredient formulations. This strategy dovetails with the industry's overarching objectives: adhering to regulatory benchmarks and aligning with consumer demands for clean-label offerings. Moreover, top-tier beverage manufacturers are now gravitating towards pharmaceutical-grade citric acid, underscoring the importance of consistent quality and market compliance. This heightened demand for certified, high-quality citric acid not only paves the way for premium pricing for certified suppliers but also ignites a spirit of competition and innovation in the market.

Increasing Demand for Citric Acid in Ready-to-drink Beverages

The ready-to-drink beverage market is experiencing robust growth, significantly driving the demand for citric acid across various applications. Citric acid is a key ingredient due to its multifunctional properties, including flavor enhancement, color stabilization, and shelf-life extension, which are critical for maintaining product quality and appeal. The increasing urbanization in emerging markets has accelerated the adoption of convenience-driven consumption habits, creating substantial growth opportunities for ready-to-drink beverages. In fruit-based beverages, citric acid's role as a color retention agent is particularly vital, as it directly influences visual appeal, consumer preferences, and brand differentiation in a competitive market. Additionally, advancements in fermentation technology have transformed production capabilities. Manufacturers are now employing engineered Aspergillus niger strains, achieving citric acid titers exceeding 174 g/L, a significant improvement over traditional methods. These innovations have enhanced production efficiency, reduced operational costs, and improved supply chain reliability. As a result, suppliers are well-positioned to meet the rising demand while maintaining competitive pricing, fostering market expansion, particularly in price-sensitive and emerging segments.

Price Volatility of Raw Materials in Emerging Countries

Fluctuations in raw material costs are exerting considerable margin pressures across the citric acid supply chain, with fermentation substrates such as corn, sugarcane molasses, and other carbohydrate sources being particularly impacted. This volatility is most evident in emerging markets, where agricultural commodity prices are highly susceptible to external factors, including unpredictable weather conditions, policy reforms, geopolitical tensions, and infrastructure deficiencies. Beyond the rising input costs, manufacturers are also grappling with currency fluctuations and increasing logistics expenses, which further complicate cost management and necessitate the adoption of sophisticated hedging strategies. However, advancements in substrate utilization technologies are providing a promising avenue for mitigation. Recent research highlights the successful production of citric acid from agricultural waste streams, such as sugarcane bagasse, cheese whey, and other by-products. These innovations not only reduce dependence on primary commodity markets but also align with sustainability goals, offering a cost-effective and environmentally friendly alternative that strengthens the resilience of the citric acid supply chain.

Other drivers and restraints analyzed in the detailed report include:

- Rising Adoption in Effervescent Pharmaceuticals

- Rise in Regulatory Push for Biodegradable Chelating Agents in Industrial Cleaners

- Rise in Anti-dumping Duties on Chinese Citric Acid

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2024, anhydrous citric acid continues to dominate the market with a 55.35% share, attributed to its superior stability, extended shelf life, and well-established supply chain infrastructure supporting diverse end-use applications. Its crystalline structure ensures consistent quality, making it a preferred choice for food manufacturers and pharmaceutical companies. Industrial applications also favor anhydrous forms due to their predictable dissolution rates and reduced moisture-related challenges during formulation processes. However, the market is gradually shifting as processing efficiency becomes a critical factor. Direct compressible citric acid variants, such as Jungbunzlauer's CITROCOAT N, are gaining traction in pharmaceutical tableting. These variants address industry needs by offering improved tablet hardness, faster processing times, and enhanced performance in specific applications.

Liquid citric acid formulations are witnessing robust growth, with a projected CAGR of 6.82% through 2030. This growth is driven by manufacturers' increasing focus on operational efficiency and cost optimization. The liquid form eliminates the need for dissolution steps, enabling precise dosing control in automated production systems and streamlining manufacturing processes. This trend is particularly prominent in the beverage industry, where liquid citric acid integrates seamlessly with syrup preparation processes, reducing contamination risks associated with powder handling. Additionally, advancements in storage and transportation technologies have mitigated traditional stability concerns, further enhancing the viability of liquid forms. These improvements are expanding the adoption of liquid citric acid in applications that were previously dominated by anhydrous variants, positioning the segment for sustained growth in the forecast period.

The Citric Acid Market Report Segments the Industry by Form (Anhydrous and Liquid); by Application (Food and Beverage, Pharmaceuticals, Personal Care and Cosmetics, and More); by Grade (Pharmaceutical Grade, Food Grade, and Industrial Grade); and by Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa). For Each Segment, The Market Sizing and Forecasts Have Been Based On Values in USD.

Geography Analysis

In 2024, Asia-Pacific commands a 37.74% market share, largely due to China's robust production capabilities and its surging domestic appetite in food processing and industrial sectors. The region's advantages include a well-established fermentation infrastructure, competitive production costs, and close access to vital raw materials like corn and sugarcane derivatives. Yet, trade tensions and anti-dumping measures are altering the regional landscape. Countries like India, Thailand, and other Southeast Asian nations are ramping up production capacities to cater to both local and export demands. Japan's sophisticated pharmaceutical and food processing sectors present lucrative market prospects, while Australia's burgeoning beverage industry bolsters regional consumption.

Middle East and Africa is the region to watch, boasting a 7.43% CAGR through 2030. This growth is largely attributed to the burgeoning food processing sectors and infrastructural investments in nations such as Saudi Arabia and the UAE. Government initiatives in the region, aimed at bolstering food security and diversifying industries, are birthing new demand hubs for citric acid. NEOM's collaboration with Liberation Labs to set up precision fermentation facilities underscores the region's ambition in advanced biomanufacturing. Meanwhile, North America and Europe, with their entrenched food and pharmaceutical sectors, offer stable demand, albeit with tempered growth rates due to market saturation and regulatory consistency.

Europe, with its robust demand from the food, beverage, and personal care sectors, remains a stable player, bolstered by stringent quality standards and established processing facilities. North America's growth is steady, driven by a surge in ready-to-drink beverages, convenience foods, and pharmaceuticals. Consumers here increasingly lean towards clean-label ingredients, using citric acid as a natural preservative and flavor enhancer. South America, particularly in nations like Brazil and Argentina, is on the rise, thanks to its expanding food processing sectors and a growing appetite for packaged foods. South American manufacturers enjoy the dual advantage of abundant agricultural feedstocks for citric acid production and a reduced reliance on imports. Across Europe, North America, and South America, regulatory frameworks that favor natural additives further enhance citric acid's market potential, presenting opportunities for both global giants and local players.

- Shandong Ensign Industry Co., Ltd.

- Jungbunzlauer Suisse AG

- COFCO Corporation

- RZBC Group Co., Ltd.

- TTCA Co., Ltd.

- Archer Daniels Midland Company

- Cargill, Incorporated

- Gadot Biochemical Industries Ltd.

- Foodchem International Corporation

- Merck KGaA

- Hawkins, Inc.

- Citrique Belge NV

- BBCA Group (Anhui BBCA)

- FUSO Chemical Co., Ltd.

- Wang Pharmaceuticals and Chemicals

- Hemadri Chemicals

- Vinipul Inorganics India Pvt. Ltd

- Arihant Chemicals

- Anmol Chemicals Private Limited

- Innova Corporate

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing consumer shift to natural acidulants in carbonated soft drinks

- 4.2.2 Increasing demand for citric acid in ready-to-drink beverages

- 4.2.3 Rising adoption in effervescent pharmaceuticals

- 4.2.4 Rise in regulatory push for biodegradable chelating agents in industrial cleaners

- 4.2.5 Increasing need for sugar-reduction reformulation in confectionery

- 4.2.6 Innovations in production processes are improving yield and reducing costs.

- 4.3 Market Restraints

- 4.3.1 Price volatility of raw materials in emerging countries

- 4.3.2 Rise in anti-dumping duties on chinese citric acid

- 4.3.3 Competition from alternative acidulants.

- 4.3.4 Seasonal variations impacting citrus fruit availability.

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Form

- 5.1.1 Anhydrous

- 5.1.2 Liquid

- 5.2 By Application

- 5.2.1 Food and Beverage

- 5.2.1.1 Bakery

- 5.2.1.2 Confectionery

- 5.2.1.3 Dairy

- 5.2.1.4 Beverages

- 5.2.1.5 Savory and Snacks

- 5.2.1.6 Other Foods and Beverages

- 5.2.2 Pharmaceuticals

- 5.2.3 Personal Care and Cosmetics

- 5.2.4 Detergents and Household Cleaners

- 5.2.5 Others

- 5.2.1 Food and Beverage

- 5.3 By Grade

- 5.3.1 Pharmaceutical Grade

- 5.3.2 Food Grade

- 5.3.3 Industrial Grade

- 5.4 By Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.1.4 Rest of North America

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Colombia

- 5.4.2.4 Chile

- 5.4.2.5 Peru

- 5.4.2.6 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 Germany

- 5.4.3.2 United Kingdom

- 5.4.3.3 Italy

- 5.4.3.4 France

- 5.4.3.5 Netherlands

- 5.4.3.6 Poland

- 5.4.3.7 Belgium

- 5.4.3.8 Sweden

- 5.4.3.9 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 Australia

- 5.4.4.5 Indonesia

- 5.4.4.6 South Korea

- 5.4.4.7 Thailand

- 5.4.4.8 Singapore

- 5.4.4.9 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 South Africa

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 United Arab Emirates

- 5.4.5.4 Nigeria

- 5.4.5.5 Egypt

- 5.4.5.6 Morocco

- 5.4.5.7 Turkey

- 5.4.5.8 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Shandong Ensign Industry Co., Ltd.

- 6.4.2 Jungbunzlauer Suisse AG

- 6.4.3 COFCO Corporation

- 6.4.4 RZBC Group Co., Ltd.

- 6.4.5 TTCA Co., Ltd.

- 6.4.6 Archer Daniels Midland Company

- 6.4.7 Cargill, Incorporated

- 6.4.8 Gadot Biochemical Industries Ltd.

- 6.4.9 Foodchem International Corporation

- 6.4.10 Merck KGaA

- 6.4.11 Hawkins, Inc.

- 6.4.12 Citrique Belge NV

- 6.4.13 BBCA Group (Anhui BBCA)

- 6.4.14 FUSO Chemical Co., Ltd.

- 6.4.15 Wang Pharmaceuticals and Chemicals

- 6.4.16 Hemadri Chemicals

- 6.4.17 Vinipul Inorganics India Pvt. Ltd

- 6.4.18 Arihant Chemicals

- 6.4.19 Anmol Chemicals Private Limited

- 6.4.20 Innova Corporate