|

市場調查報告書

商品編碼

1851252

數位鑑識:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Digital Forensics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

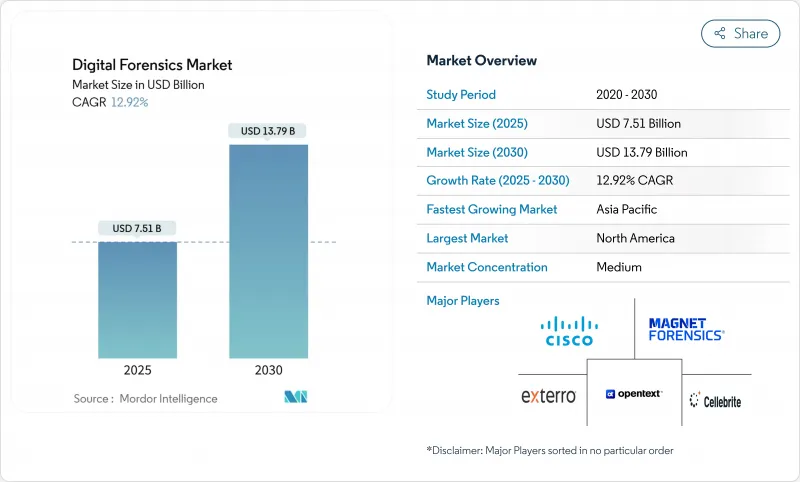

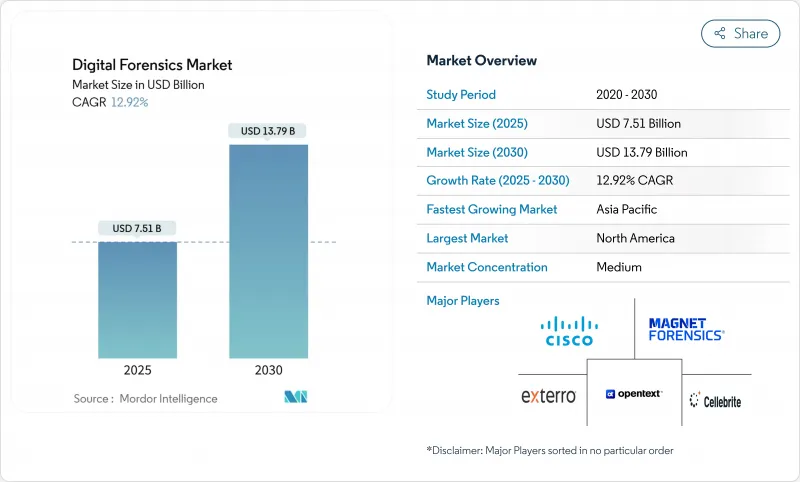

數位取證市場規模預計將在 2025 年達到 75.1 億美元,到 2030 年達到 137.9 億美元,複合年成長率為 12.92%。

成長主要由基於雲端的軟體即服務 (SaaS) 調查、深度造假反制措施以及將數位取證整合到擴展檢測和回應平台中驅動。強制性行動設備提取立法和公共部門的持續投資也進一步支撐了需求。另一方面,加密違約預防和取證人員短缺造成了營運摩擦,同時也推動了自動化、雲端基礎的證據保存技術的創新。隨著現有供應商整合人工智慧和區塊鏈賦能的證據鏈功能以實現差異化,競爭格局正在逐漸瓦解。

全球數位鑑識市場趨勢與洞察

雲端原生SaaS的快速普及催生了對雲端取證的需求。

向雲端遷移正在取代傳統的磁碟鏡像,並推動取證平台的部署,這些平台能夠在分散式、多租戶環境中捕獲易失性數據,同時滿足 ISO/IEC 27035-4:2024 驗收標準。證據隔離要求和自動化監管鏈追蹤推動了對預先整合超大規模保全服務的解決方案的需求。因此,提供雲端原生採集 API 的供應商正在加速獲得企業用戶的青睞,尤其是在跨國公司中,這些公司往往跨越司法管轄區。

深度造假詐欺的激增推動了對高級多媒體分析的需求。

隨著機器產生的音訊和影片詐欺滲透到即時互動中,實驗室正在用神經檢測演算法取代傳統的身份驗證方式,這些演算法在低解析度內容上也能達到 91.82% 的準確率。銀行、金融服務和保險 (BFSI) 機構正在整合區塊鏈概念驗證方案,以確保高價值交易的安全;執法機構則在投資即時篩檢工具,以在調查訪談過程中維護證據鏈的完整性。

iOS/Android 的預設加密增加了資料擷取的複雜性和成本。

硬體加密已將現代設備上的提取成功率降低到 40% 以下,迫使人們依賴昂貴的解密工具和雲端基礎的證據,這給了規模較小的執法機構預算瓶頸,擴大了調查差距,並引發了關於合法存取合作的政策辯論。

細分市場分析

到2024年,軟體將佔據數位鑑識市場45%的佔有率,這主要得益於加密和雲端證據的高階分析。硬體的使用仍將侷限於實體取證領域,而解密加速器將提升調查效率。託管服務將吸引那些尋求承包可擴展解決方案的公司,而專業服務在持續的人才短缺背景下,將以14.7%的複合年成長率成長。

服務供應商正利用中小企業對取證即服務(Fensics-as-a-Service)的接受度,將事件回應與取證服務捆綁在一起。供應商正在整合區塊鏈血緣關係和人工智慧分類技術,以縮短分析週期並增強其軟體優勢。平台授權和週期性服務的策略性互動提高了收入的可預測性,並使供應商能夠交叉銷售相關的安全功能。

2024年,電腦取證將佔總營收的37%,其中雲端取證在多重雲端企業工作負載中成長最快,複合年成長率達13.1%。儘管加密技術面臨挑戰,但行動取證仍將保持成長,這得益於不斷湧現的繞過套件。隨著零信任架構和聯網設備產生多樣化的證據流,網路、資料庫和物聯網調查將會擴展。

銀行、金融服務和保險 (BFSI) 行業的監管審核正在推動對持續雲端取證的需求,從而為專注於雲端原生解決方案的供應商拓展了商機。隨著對軟體即服務 (SaaS) 的依賴日益加深,預計到 2030 年,雲端調查的數位取證市場規模將與電腦取證市場規模相近。因此,工具供應商正優先考慮基於 API 的資料收集、易失性資料保存和司法管轄區分類,從而推動這些技術的普及應用。

區域分析

受第14144號行政命令(該命令加速了人工智慧主導調查的普及)和強勁的聯邦預算的推動,北美地區將在2024年占到公司收入的35%。 Palantir從政府獲得的12億美元收入代表了公共部門平台採購,這帶動了更廣泛的生態系統現代化進程。

亞太地區以 13.4% 的複合年成長率領先,這反映了電子商務的擴張和網路犯罪成本的上升,預計到 2025 年,網路犯罪成本將達到 3.3 兆美元。監管方面的改進,例如中國放寬跨境轉移豁免,正在逐步減少跨國取證服務提供者的調查摩擦。

歐洲透過歐盟人工智慧法律和資料隱私強制令保持平衡擴張,推動對保護隱私的取證工具的需求;中東和非洲分配網路安全預算以保護能源和金融走廊;拉丁美洲在技能短缺的限制下,在區域數位化政策的支持下,取得了漸進式進展。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 雲端原生SaaS的快速普及催生了對雲端取證的需求。

- 深度造假詐欺的激增推動了對高級多媒體分析的需求。

- 整合式數位取證與事件回應 (DFIR) 平台需要採用擴展偵測與回應 (XDR) 技術。

- 美國和歐盟執法部門提取行動裝置資料的法律授權

- 基於區塊鏈的證據鏈試點計畫推動了取證軟體的升級

- 聯邦網路安全投資和監管合規要求推動了取證技術的應用

- 市場限制

- iOS/Android 的預設加密增加了取得的複雜性和成本。

- 一線城市以外地區法院認證調查員短缺

- 分散工具之間的互通性會增加中小企業的整體擁有成本。

- 限制跨境證據轉移的資料駐留規則(例如,中國CSL)

- 價值/供應鏈分析

- 監理展望

- 技術展望

- 波特五力模型

- 買方的議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按組件

- 硬體

- 取證系統、設備和遮光器

- 影像設備

- 其他硬體

- 軟體

- 法醫數據分析與視覺化

- 審查和報告

- 法證解密

- 其他軟體模組

- 服務

- 專業服務

- 事件回應和違規分析

- 諮詢和培訓

- 託管取證服務

- 硬體

- 按類型

- 電腦取證

- 行動裝置取證

- 網路取證

- 雲取證

- 資料庫取證

- 物聯網和嵌入式設備取證

- 透過工具

- 資料收集和存儲

- 資料恢復與重建

- 法醫數據分析

- 審查和報告

- 法證解密與密碼破解

- 按組織規模

- 主要企業

- 小型企業

- 按最終用戶行業分類

- 政府和執法部門

- BFSI

- 資訊科技和電信

- 衛生保健

- 零售與電子商務

- 能源與公共產業

- 製造業

- 運輸與物流

- 國防/航太

- 教育

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 新加坡

- 印尼

- 澳洲

- 紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 以色列

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 肯亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- OpenText Corporation

- Cellebrite DI Ltd.

- Exterro Inc.

- Magnet Forensics Inc.

- Cisco Systems Inc.

- FireEye Inc.(Mandiant)

- LogRhythm Inc.

- KLDiscovery Inc.

- Paraben Corporation

- MSAB AB

- Oxygen Forensics Inc.

- Kroll LLC

- Hexagon AB(Qognify)

- ADF Solutions Inc.

- BAE Systems plc

- Broadcom Inc.(Symantec Enterprise DFIR Tools)

- Micro Systemation AB

- Digital Detective Group

- Nuix Pty Ltd

- Passware Inc.

第7章 市場機會與未來展望

The digital forensics market size generated USD 7.51 billion in 2025 and is projected to reach USD 13.79 billion by 2030, reflecting a 12.92% CAGR.

Growth pivots on cloud-native Software-as-a-Service investigations, deepfake countermeasures, and the integration of digital forensics within Extended Detection and Response platforms. Legislated mobile device extraction mandates and steady public-sector investments further underpin demand. Conversely, encryption-by-default and examiner shortages introduce operational friction yet also spur innovation in automated, cloud-based evidence preservation. Competitive dynamics remain moderately fragmented as established vendors embed artificial intelligence and blockchain-enabled chain-of-custody features to secure differentiation.

Global Digital Forensics Market Trends and Insights

Rapid Proliferation of Cloud-Native SaaS Creating Demand for Cloud Forensics

Cloud migrations displace traditional disk imaging, prompting deployment of forensic platforms that capture volatile data across distributed, multi-tenant environments while meeting ISO/IEC 27035-4:2024 admissibility standards. Evidence isolation requirements and automated chain-of-custody tracking elevate demand for solutions pre-integrated with hyperscaler security services. As a result, vendors offering cloud-native acquisition APIs see accelerated enterprise adoption, particularly among multinational corporations navigating jurisdictional boundaries.

Surge in Deepfake-Enabled Fraud Driving Advanced Multimedia Analysis Needs

Machine-generated audio and video fraud now penetrates live interactions, forcing laboratories to replace legacy authentication with neural detection algorithms that achieve 91.82% accuracy on low-resolution content. BFSI institutions integrate blockchain provenance schemes to secure high-value transactions, while law-enforcement agencies invest in real-time screening tools to preserve evidentiary integrity during investigative interviews.

Encryption-by-Default on iOS/Android Elevating Acquisition Complexity and Cost

Hardware-backed encryption reduces extraction success to below 40% on recent devices, forcing reliance on premium decryption utilities and cloud-based evidence substitutes. Small agencies face budgetary barriers, widening investigative disparity and prompting policy debate on lawful access collaboration.

Other drivers and restraints analyzed in the detailed report include:

- Extended Detection and Response Adoption Necessitating Integrated DFIR Platforms

- Legislated Mobile Device Extraction Mandates in U.S. and EU Law-Enforcement

- Shortage of Court-Certified Examiners Outside Tier-1 Cities

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software retained 45% of the digital forensics market share in 2024, underpinned by advanced analytics for encrypted and cloud evidence. Hardware usage remains niche for physical acquisitions, yet decryption accelerators support investigative throughput. Managed offerings capture enterprises seeking turnkey scalability, while professional services climb 14.7% CAGR as talent shortages persist.

Service providers capitalize on forensic-as-a-service adoption among SMEs, bundling incident response and expert testimony. Vendors integrate blockchain lineage and AI triage to compress analysis cycles, reinforcing software primacy. The strategic interplay between platform licensing and recurring services broadens revenue predictability, positioning vendors for cross-sell of adjacent security capabilities.

Computer forensics controlled 37% of 2024 revenue; however, cloud forensics now logs the fastest 13.1% CAGR amid multi-cloud enterprise workloads. Mobile forensics sustains growth despite encryption headwinds, supported by evolving bypass toolkits. Network, database, and IoT investigations expand as zero-trust architectures and connected devices generate diversified evidence streams.

Regulatory audits in BFSI amplify demand for continuous cloud evidence readiness, widening opportunities for specialized cloud-native vendors. Digital forensics market size for cloud investigations is poised to narrow the gap with computer forensics by 2030 as SaaS reliance deepens. Tool vendors therefore prioritize API-based collection, volatility preservation, and jurisdictional segmentation to boost adoption.

The Digital Forensics Market Report is Segmented by Component (Hardware, Software, Services), Type (Computer Forensics, Mobile Device Forensics, and More), Tool (Data Acquisition and Preservation, and More), Organization Size (Large Enterprises, Small and Medium Enterprises), End-User Vertical (Government and Law Enforcement Agencies, BFSI, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America held 35% of 2024 revenue, aided by Executive Order 14144 and robust federal budgets that accelerate AI-driven investigative adoption. Public-sector platform procurements, exemplified by Palantir's USD 1.20 billion government revenue, cascade into broader ecosystem modernization.

Asia Pacific leads in growth at 13.4% CAGR, reflecting e-commerce expansion and rising cybercrime costs forecast at USD 3.3 trillion by 2025. Regulatory refinements, such as China's eased cross-border transfer exemptions, gradually reduce investigative friction for multinational forensics providers.

Europe sustains balanced expansion through the EU AI Act and data-privacy mandates driving privacy-preserving forensic tool demand. Middle East and Africa allocate cybersecurity budgets to defend energy and financial corridors, while Latin America shows incremental progress constrained by skill shortages yet supported by regional digitalization policies.

- OpenText Corporation

- Cellebrite DI Ltd.

- Exterro Inc.

- Magnet Forensics Inc.

- Cisco Systems Inc.

- FireEye Inc. (Mandiant)

- LogRhythm Inc.

- KLDiscovery Inc.

- Paraben Corporation

- MSAB AB

- Oxygen Forensics Inc.

- Kroll LLC

- Hexagon AB (Qognify)

- ADF Solutions Inc.

- BAE Systems plc

- Broadcom Inc. (Symantec Enterprise DFIR Tools)

- Micro Systemation AB

- Digital Detective Group

- Nuix Pty Ltd

- Passware Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Proliferation of Cloud-Native SaaS Creating Demand for Cloud Forensics

- 4.2.2 Surge in Deepfake-Enabled Fraud Driving Advanced Multimedia Analysis Needs

- 4.2.3 Extended Detection and Response (XDR) Adoption Necessitating Integrated DFIR Platforms

- 4.2.4 Legislated Mobile Device Extraction Mandates in U.S. and EU Law-Enforcement

- 4.2.5 Blockchain-Based Evidence Chain-of-Custody Pilots Boosting Forensic Software Upgrades

- 4.2.6 Federal Cybersecurity Investments & Regulatory Compliance Requirements Expanding Forensic Deployments

- 4.3 Market Restraints

- 4.3.1 Encryption-by-Default on iOS/Android Elevating Acquisition Complexity and Cost

- 4.3.2 Shortage of Court-Certified Examiners Outside Tier-1 Cities

- 4.3.3 Fragmented Tool Inter-Operability Increasing Total Cost of Ownership for SMEs

- 4.3.4 Data-Residency Rules Limiting Cross-Border Evidence Transfers (e.g., China CSL)

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Bargaining Power of Buyers

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Forensic Systems, Devices and Write Blockers

- 5.1.1.2 Imaging and Duplication Devices

- 5.1.1.3 Other Hardware

- 5.1.2 Software

- 5.1.2.1 Forensic Data Analysis and Visualization

- 5.1.2.2 Review and Reporting

- 5.1.2.3 Forensic Decryption

- 5.1.2.4 Other Software Modules

- 5.1.3 Services

- 5.1.3.1 Professional Services

- 5.1.3.1.1 Incident Response and Breach Analysis

- 5.1.3.1.2 Consulting and Training

- 5.1.3.2 Managed Forensic Services

- 5.1.1 Hardware

- 5.2 By Type

- 5.2.1 Computer Forensics

- 5.2.2 Mobile Device Forensics

- 5.2.3 Network Forensics

- 5.2.4 Cloud Forensics

- 5.2.5 Database Forensics

- 5.2.6 IoT and Embedded Device Forensics

- 5.3 By Tool

- 5.3.1 Data Acquisition and Preservation

- 5.3.2 Data Recovery and Reconstruction

- 5.3.3 Forensic Data Analysis

- 5.3.4 Review and Reporting

- 5.3.5 Forensic Decryption and Password Cracking

- 5.4 By Organization Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By End-user Vertical

- 5.5.1 Government and Law Enforcement Agencies

- 5.5.2 BFSI

- 5.5.3 IT and Telecom

- 5.5.4 Healthcare

- 5.5.5 Retail and E-commerce

- 5.5.6 Energy and Utilities

- 5.5.7 Manufacturing

- 5.5.8 Transportation and Logistics

- 5.5.9 Defense and Aerospace

- 5.5.10 Education

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Nordics

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Singapore

- 5.6.4.6 Indonesia

- 5.6.4.7 Australia

- 5.6.4.8 New Zealand

- 5.6.4.9 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Israel

- 5.6.5.1.5 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Kenya

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 OpenText Corporation

- 6.4.2 Cellebrite DI Ltd.

- 6.4.3 Exterro Inc.

- 6.4.4 Magnet Forensics Inc.

- 6.4.5 Cisco Systems Inc.

- 6.4.6 FireEye Inc. (Mandiant)

- 6.4.7 LogRhythm Inc.

- 6.4.8 KLDiscovery Inc.

- 6.4.9 Paraben Corporation

- 6.4.10 MSAB AB

- 6.4.11 Oxygen Forensics Inc.

- 6.4.12 Kroll LLC

- 6.4.13 Hexagon AB (Qognify)

- 6.4.14 ADF Solutions Inc.

- 6.4.15 BAE Systems plc

- 6.4.16 Broadcom Inc. (Symantec Enterprise DFIR Tools)

- 6.4.17 Micro Systemation AB

- 6.4.18 Digital Detective Group

- 6.4.19 Nuix Pty Ltd

- 6.4.20 Passware Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment