|

市場調查報告書

商品編碼

1851372

歐洲數位鑑識:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Europe Digital Forensics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

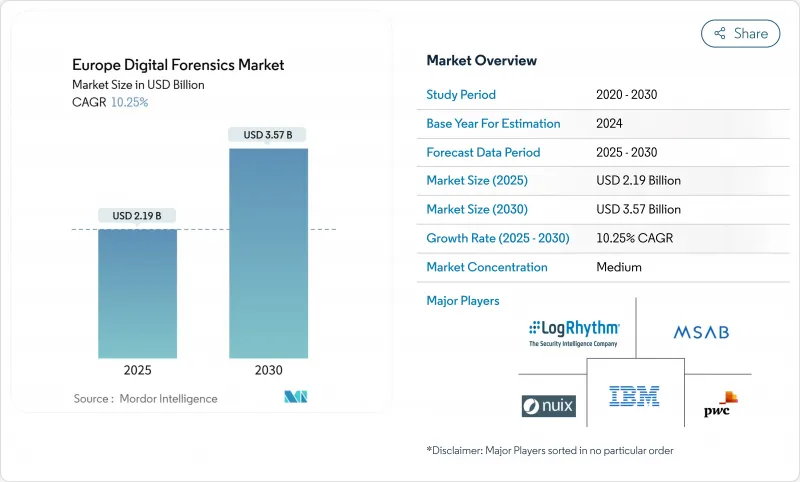

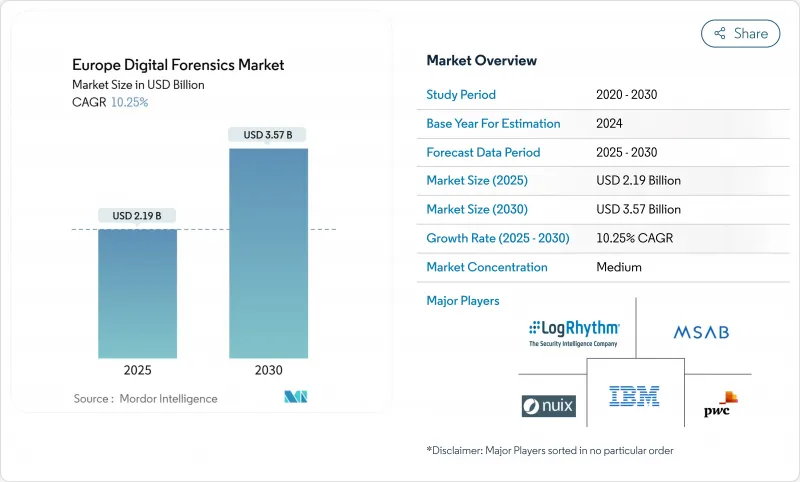

歐洲數位鑑識市場預計到 2025 年將達到 21.9 億美元,到 2030 年將達到 35.7 億美元,在此期間的複合年成長率為 10.25%。

持續的公共部門資金籌措、諸如《數位營運韌性法案》等強化韌性法規的訂定,以及跨境網路犯罪的日益猖獗,正推動著調查平台領域的高額支出。隨著人工智慧分析、雲端證據收集和自動化案件管理取代傳統的單點工具,技術更新周期不斷縮短,促使供應商轉向訂閱模式和託管服務。德語區、比荷盧經濟聯盟和北歐地區叢集勒索軟體活動的增加,迫使企業將取證準備納入其事件回應流程。對智慧汽車和5G安全新興企業的風險資金籌措,正在加速推動對專用於車載系統和高流量邊緣節點的新型資料擷取探針的需求。

歐洲數位鑑識市場趨勢與洞察

透過符合歐盟DORA和NIS2標準,加速法證準備工作。

自2025年1月17日起,歐盟各地的金融機構必須證明其持續監控、事件日誌記錄和第三方監督能力,這將使取證準備從可選附加項轉變為監管基準。監管機構目前正在審核資訊通訊技術(ICT)提供者的註冊訊息,促使銀行採購可直接連接其安全資訊和事件管理(SIEM)系統並自動發送違規通知的企業級證據庫。與NIS2的協調將類似的義務擴展到能源公共和數位服務供應商,從而將歐洲數位鑑識市場擴展到核心金融領域之外。預算重組有利於提供監管鏈檢驗的多租戶雲端平台,從而增加軟體供應商的經常性收入。

加密即時通訊應用程式的興起正在推動對行動取證的需求。

iOS 18 的端對端加密和訊息遺失預設設定促使調查人員採用複雜的繞過技術,這些技術結合了邏輯提取、備份分析和人工智慧模式匹配。研究表明,借助先進的工具,可以從通知痕跡中恢復 83.33% 的已刪除 WhatsApp訊息。日益複雜的技術使得專業服務變得至關重要,從而推動了服務領域的兩位數成長。

GDPR對證據取得的隱私限制

如今,大多數大型取證案件都需要進行隱私影響評估,這延長了合約週期,並迫使規模較小的實驗室推遲處理複雜的跨國案件。各國監管解釋的差異意味著,在一個州合法收集的證據在另一個州可能面臨挑戰,增加了法律審查的成本。投資正轉向選擇性資料擷取軟體,該軟體可以對個人識別資訊進行雜湊處理和標記,而不是提取整個磁碟鏡像,從而使實踐符合資料最小化法規。

細分市場分析

到2024年,軟體將佔據歐洲數位鑑識市場45%的佔有率,這主要得益於規模化的訂閱定價模式以及涵蓋行動、雲端和SaaS平台的數據採集分析的持續功能更新。隨著資料擷取任務轉向虛擬機,硬體支出將會放緩,但用於晶片提取的專用加密狗和高速寫入保護器對於棘手的刑事調查仍然必不可少。總體而言,以服務為中心的營運模式使服務提供者能夠獲得擴張預算,同時保護客戶免受技能短缺的影響。

從2025年到2030年,隨著企業將複雜的證據收集工作外包給營運遠距實驗室和提供按需分析的專業團隊,服務業將以11.2%的複合年成長率實現最快成長。大型金融機構正在簽署多年期的法務會計管理契約,並將顧問納入DORA(資料保護條例)規定的彈性測試週期。供應商透過提供可直接用於法庭的文件工作流程和與電子取證套件的API整合來降低法律顧問的工作效率,從而實現差異化競爭。

到2024年,行動平台將佔歐洲數位鑑識市場規模的35%,反映出智慧型手機在個人和企業工作流程中的普及程度。負責人正轉向加密聊天記錄、感測器融合資料和時間軸拼接等手段來重建使用者行為軌跡。穿戴式裝置的加入進一步增加了證據層級,鞏固了行動裝置分析作為一門基礎學科的地位。

隨著多租戶SaaS將關鍵證據遷移到雲端,雲端取證將以11.4%的複合年成長率成長。服務提供者現在提供簡介工具來凍結虛擬執行個體並自動進行管轄權映射,以確保法律效力。雖然電腦取證的佔有率正在下降,但終端證據仍然是內部威脅和詐欺調查的核心。新興的車輛和物聯網證據類型正在推動整合平台的發展,這些平台可以將來自ECU、智慧感測器和中央雲端的日誌資料整合到單一案件文件中。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 利用歐盟DORA和NIS2加速法證回應

- 加密即時通訊應用程式的興起正在推動對行動取證的需求。

- 德國、奧地利和比荷盧經濟聯盟地區勒索軟體事件激增,推動了事件回應取證工作的發展。

- 連網汽車的成長帶來了新的車輛/物聯網取證工作量

- 5G部署推動了基於人工智慧的網路取證投資。

- 市場限制

- GDPR對證據取得的隱私限制

- 端對端加密會增加調查時間和成本。

- 警務採購預算分散導致招募速度放緩。

- 歐洲缺乏 ISO/IEC 17025 認證的實驗室

- 價值/供應鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按組件

- 硬體

- 軟體

- 服務

- 按類型

- 電腦取證

- 行動裝置取證

- 網路取證

- 雲取證

- 資料庫取證

- 物聯網和嵌入式設備取證

- 透過工具

- 資料收集和存儲

- 資料恢復與重建

- 法醫數據分析

- 審查和報告

- 法證解密與密碼破解

- 按公司規模

- 主要企業

- 小型企業

- 按最終用戶行業分類

- 政府和執法部門

- BFSI

- 資訊科技/通訊

- 衛生保健

- 零售與電子商務

- 能源與公共產業

- 製造業

- 運輸與物流

- 國防/航太

- 教育

- 按國家/地區

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 北歐國家

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- MSAB AB

- LogRhythm Inc.

- IBM Corporation

- PricewaterhouseCoopers LLP

- Nuix Ltd.

- Cellebrite DI Ltd.

- Magnet Forensics Inc.

- OpenText Corp.(Guidance Software)

- FireEye Inc.(Trellix)

- Envista Forensics

- Cellebrite(Digital Intelligence)

- ADF Solutions LLC

- AccessData(Exterro)

- Oxygen Forensics Inc.

- Paraben Corp.

- BAE Systems Applied Intelligence

- Atos SE(Evidian)

- Sytech Digital Forensics

- CCL Solutions Group Ltd.

- Evidence Talks Ltd.

第7章 市場機會與未來展望

The Europe digital forensics market size sits at USD 2.19 billion in 2025 and is forecast to reach USD 3.57 billion by 2030, advancing at a 10.25% CAGR during the period.

Consistent public-sector funding, tighter resilience rules such as the Digital Operational Resilience Act, and rising cross-border cybercrime keep spending on investigation platforms high. Technology refresh cycles are shortening as AI analytics, cloud evidence capture, and automated case management replace legacy point tools, prompting vendors to pursue subscription models and managed offerings. Heightened ransomware activity across DACH, Benelux, and Nordic banking clusters forces enterprises to embed forensic readiness in incident-response playbooks. Venture funding for smart-vehicle and 5G security startups accelerates demand for new data-capture probes focused on in-vehicle systems and high-traffic edge nodes.

Europe Digital Forensics Market Trends and Insights

EU DORA & NIS2 Compliance Accelerating Forensic Readiness

Since 17 January 2025, financial entities across the bloc must prove continuous monitoring, incident logging, and third-party oversight, turning forensic readiness from an optional add-on into a regulatory baseline. Supervisors now audit registers of ICT providers, so banks procure enterprise-wide evidence repositories that plug directly into SIEM stacks and automate breach notification. Harmonisation with NIS2 extends similar obligations to energy utilities and digital service providers, widening the European digital forensics market beyond core finance. Budget reallocations favour multi-tenant cloud platforms offering chain-of-custody validation, which lifts recurring revenue for software vendors.

Proliferation of Encrypted Messaging Apps Boosting Mobile Forensics Demand

End-to-end encryption in iOS 18 and disappearing-message defaults push investigators toward advanced bypass techniques that combine logical extraction, backup parsing, and AI pattern matching. Research shows 83.33% of deleted WhatsApp messages remain recoverable through notification artefacts when sophisticated tooling is used.Greater technical complexity makes professional services indispensable, fuelling the services segment's double-digit growth trajectory.

GDPR Privacy Limits on Evidence Acquisition

Privacy Impact Assessments now accompany most large-scale forensic cases, lengthening engagement cycles and pushing smaller labs to defer complex cross-border work. National differences in supervisory interpretation mean evidence gathered legally in one state may face challenge in another, adding legal-review overhead. Investment is shifting toward selective-collection software that can hash and flag personally identifiable data instead of extracting entire disk images, aligning practice with data-minimisation rules.

Other drivers and restraints analyzed in the detailed report include:

- Spike in Ransomware Incidents Across DACH & Benelux Elevating Incident-Response Forensics

- Connected-Vehicle Growth Creating New Vehicle/IoT Forensics Workloads

- End-to-End Encryption Increasing Investigation Time & Cost

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software retains the dominant 45% slice of the European digital forensics market in 2024, thanks to scaled subscription pricing and continuous feature updates covering mobile, cloud, and SaaS artefact parsing. Hardware spend slows as acquisition tasks shift into virtual machines, yet proprietary dongles for chip-off extraction and high-speed write-blockers stay necessary for severe criminal investigations. Overall, a service-centric operating model positions providers to capture expansion budgets while protecting customers from skills shortages.

Services recorded the quickest 11.2% CAGR between 2025-2030 as corporates outsource complex evidence collection to specialised teams that operate remote labs and on-demand analytics. Large financial institutions sign multi-year managed forensics contracts that embed consultants during resilience-testing cycles mandated by DORA.Vendors differentiate through court-ready documentation workflows and API integrations with e-discovery suites, reducing hand-off friction for legal counsel

Mobile platforms captured 35% of the Europe digital forensics market size in 2024, reflecting smartphone ubiquity across personal and enterprise workflows. Investigators focus on encrypted chat artefacts, sensor fusion data, and artefact timeline stitching to recreate user journeys. Companion wearables add another evidence layer, further cementing handset analysis as a foundational discipline.

Cloud forensics grows at 11.4% CAGR as multi-tenant SaaS moves key evidence off-premise. Providers now supply snapshot tooling that freezes virtual instances and automates jurisdiction mapping to maintain legal validity. Computer forensics share declines, though endpoint artefacts still anchor insider-threat and fraud probes. Emergent vehicle and IoT evidence types spur integrated platforms able to stitch log data from ECUs, smart sensors, and central clouds in a single case file.

The Europe Digital Forensics Market Report is Segmented by Component (Hardware, Software, Services), Type (Computer, Mobile Device, Network, Cloud, and More), Tool (Data Acquisition and Prevention, Data Recovery, and More), Enterprise Size (Large Enterprises, Smes), End-User (Government, BFSI, IT, Healthcare, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- MSAB AB

- LogRhythm Inc.

- IBM Corporation

- PricewaterhouseCoopers LLP

- Nuix Ltd.

- Cellebrite DI Ltd.

- Magnet Forensics Inc.

- OpenText Corp. (Guidance Software)

- FireEye Inc. (Trellix)

- Envista Forensics

- Cellebrite (Digital Intelligence)

- ADF Solutions LLC

- AccessData (Exterro)

- Oxygen Forensics Inc.

- Paraben Corp.

- BAE Systems Applied Intelligence

- Atos SE (Evidian)

- Sytech Digital Forensics

- CCL Solutions Group Ltd.

- Evidence Talks Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU DORA and NIS2 Compliance Accelerating Forensic Readiness

- 4.2.2 Proliferation of Encrypted Messaging Apps Boosting Mobile Forensics Demand

- 4.2.3 Spike in Ransomware Incidents Across DACH and Benelux Elevating Incident-Response Forensics

- 4.2.4 Connected-Vehicle Growth Creating New Vehicle/IoT Forensics Workloads

- 4.2.5 5G Roll-out Driving AI-based Network Forensics Investments

- 4.3 Market Restraints

- 4.3.1 GDPR Privacy Limits on Evidence Acquisition

- 4.3.2 End-to-End Encryption Increasing Investigation Time and Cost

- 4.3.3 Fragmented Police Procurement Budgets Slowing Adoption

- 4.3.4 Shortage of ISO/IEC 17025-Accredited Labs in Europe

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Type

- 5.2.1 Computer Forensics

- 5.2.2 Mobile Device Forensics

- 5.2.3 Network Forensics

- 5.2.4 Cloud Forensics

- 5.2.5 Database Forensics

- 5.2.6 IoT and Embedded Device Forensics

- 5.3 By Tool

- 5.3.1 Data Acquisition and Preservation

- 5.3.2 Data Recovery and Reconstruction

- 5.3.3 Forensic Data Analysis

- 5.3.4 Review and Reporting

- 5.3.5 Forensic Decryption and Password Cracking

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Medium Enterprises

- 5.5 By End-user Industry

- 5.5.1 Government and Law Enforcement Agencies

- 5.5.2 BFSI

- 5.5.3 IT and Telecom

- 5.5.4 Healthcare

- 5.5.5 Retail and E-commerce

- 5.5.6 Energy and Utilities

- 5.5.7 Manufacturing

- 5.5.8 Transportation and Logistics

- 5.5.9 Defense and Aerospace

- 5.5.10 Education

- 5.6 By Country

- 5.6.1 United Kingdom

- 5.6.2 Germany

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Nordics

- 5.6.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 MSAB AB

- 6.4.2 LogRhythm Inc.

- 6.4.3 IBM Corporation

- 6.4.4 PricewaterhouseCoopers LLP

- 6.4.5 Nuix Ltd.

- 6.4.6 Cellebrite DI Ltd.

- 6.4.7 Magnet Forensics Inc.

- 6.4.8 OpenText Corp. (Guidance Software)

- 6.4.9 FireEye Inc. (Trellix)

- 6.4.10 Envista Forensics

- 6.4.11 Cellebrite (Digital Intelligence)

- 6.4.12 ADF Solutions LLC

- 6.4.13 AccessData (Exterro)

- 6.4.14 Oxygen Forensics Inc.

- 6.4.15 Paraben Corp.

- 6.4.16 BAE Systems Applied Intelligence

- 6.4.17 Atos SE (Evidian)

- 6.4.18 Sytech Digital Forensics

- 6.4.19 CCL Solutions Group Ltd.

- 6.4.20 Evidence Talks Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment