|

市場調查報告書

商品編碼

1851250

智慧恆溫器:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Smart Thermostat - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

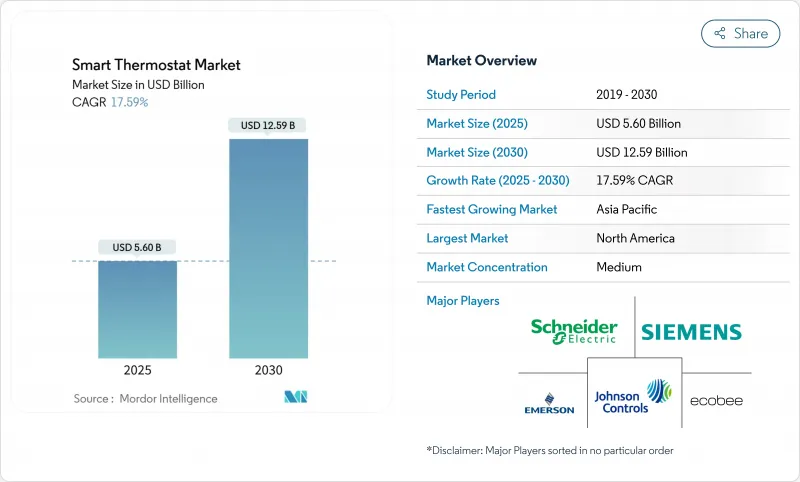

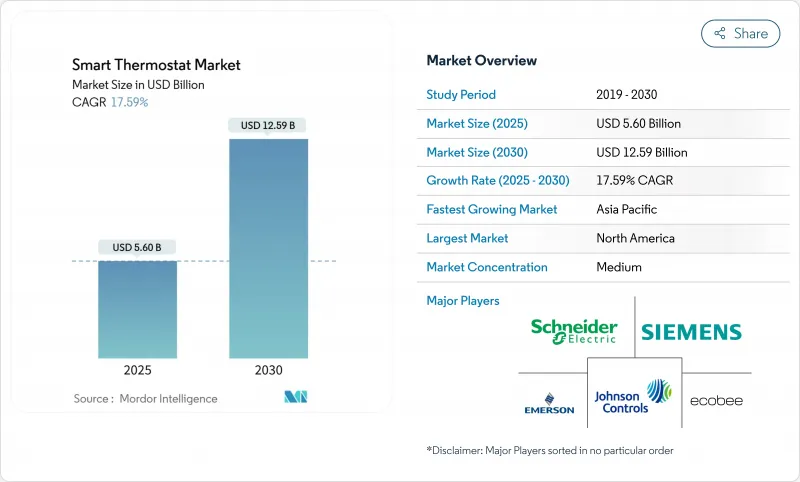

預計到 2025 年,智慧恆溫器市場規模將達到 56 億美元,到 2030 年將達到 125.9 億美元,在預測期內將維持 17.59% 的強勁複合年成長率。

成長的主要驅動力來自不斷加強的能源效率政策、持續的電網現代化投資以及Matter互通性標準的廣泛應用,該標準消除了生態系統鎖定。公用事業公司將連網恆溫器視為電網資產,並將其註冊到虛擬電廠,以降低尖峰需求和備用容量成本。同時,製造商正透過強調高級軟體功能而非單純的硬體價格競爭來應對不斷上漲的半導體和銅成本。

全球智慧恆溫器市場趨勢與洞察

政府獎勵有助於加速市場接受度。

慷慨的補貼和動態電價機制正推動智慧溫控器市場超越早期用戶群。加州已累計5000萬美元,用於在低收入家庭安裝智慧暖通空調控制設備,將能源公平與靈活負載的採用掛鉤。法國、德國和韓國也推出了類似的補貼計劃,將大多數家庭的投資回收期縮短至三年以內。這些措施將推動高能源價格和氣候政策目標地區的智慧溫控器普及,促進維修計劃數量的成長,並刺激建築商在新房屋中預先安裝智慧控制設備的需求。

智慧家庭生態系統整合拓展價值提案

Thread 1.4 預計將於 2024 年底發布,屆時憑證共用和自癒式網狀網路將成為家庭物聯網的標配功能。蘋果、谷歌和亞馬遜已承諾在 2026 年前在其智慧家庭中心產品中支援 Thread 1.4,從而確保無需廠商應用程式即可實現跨平台配對。消費者將享受更快的註冊流程和更低的初始設定掉線率,從而提高訂閱式能源服務計畫的留存率。對於商業建築而言,開放的 API 將簡化與現有建築管理軟體的整合,並縮短安裝人員的培訓時間。這些網路效應將透過單一介面賦能涵蓋照明、安防和暖通空調等領域的生態系統,從而擴大潛在需求。

供應鏈成本上漲對購買力帶來壓力。

半導體短缺和銅價波動導致智慧溫控器的材料成本在2024年至2025年間上漲了15%至20%。美國對中國製造的智慧家居設備加徵關稅將進一步加速成本上漲,迫使品牌商在低利潤率銷售和提高零售價之間做出選擇。一些製造商正將最終組裝轉移到台灣、越南和墨西哥,以避免貿易壁壘並分散供應風險。安裝商反映,包括人事費用在內的維修總成本總合超過400美元,超出新興市場的支付意願。因此,一些供應商正在其銷售入口網站上提供融資和公用事業補貼訊息,以降低客戶的初始投入。

細分市場分析

2024年,Wi-Fi設備出貨量佔比高達64.30%,反映出路由器的普及率接近100%,且安裝流程簡單。這一優勢使Wi-Fi在基準年佔據了最大的市場佔有率。隨著住宅設備更換更換的成長,Wi-Fi市場將繼續受益,但隨著支援網狀網路的Thread晶片開始量產,其成長速度將會放緩。預計到2030年,Thread設備的複合年成長率將達到21.05%,憑藉其低功耗、無縫接入和自動網路修復等優勢,將逐步蠶食Wi-Fi的領先地位。同時,Zigbee由於能夠與傳統建築管理系統(BMS)軟體無縫整合,在商業性維修仍然廣受歡迎。 Z-Wave則在那些優先考慮Sub-GHz頻段無干擾連結的安防系統安裝商中佔有一席之地。 Matter控制器橋接Wi-Fi和Thread流量的能力日益增強,這表明未來的家庭將採用混合部署方案,從而最佳化成本、通訊和電池續航時間,而無需將用戶鎖定在單一供應商。

第二代 Thread 晶片已具備雙堆疊功能,可在邊界路由器發生故障時回退至 2.4GHz Wi-Fi。蘋果承諾在 2026 年前向機上盒發布 Thread 1.4韌體,屆時可尋址集線器的數量預計將達到數千萬。在商業建築中,Thread 的確定性延遲和多路徑路由功能可提高對網路斷線敏感的居住者舒適度應用的可靠性。為了因應這一趨勢,廠商正在其行動應用中整合網路品質儀表板,以突顯 Thread 連結的狀態,從而簡化安裝人員的故障排除工作,並增強企業設施管理人員的信心。

到2024年,改造計劃將佔智慧溫控器需求的57.80%,這得益於現有標準可程式溫控器龐大的安裝基數,這些溫控器可以進行替換。此類改裝活動將使智慧溫控器市場在整個預測期內佔據最大佔有率。隨著設備製造商推出通用安裝板和C線轉接器,業主可以在30分鐘內自行安裝,這一領域將蓬勃發展。同時,建築規範的變更和綠色債券獎勵措施將推動新建房屋的需求,預計2025年後新建房屋預載式系統的複合年成長率將達到20.21%。大型多用戶住宅開發人員擴大指定使用開放通訊協定溫控器,這使得物業管理軟體能夠匯總整個物業組合的能源數據,從而提高ESG報告的可靠性。

商業維修正日益普及,例如,一座辦公大樓只需一個週末即可更換 1000 個傳統壁掛式溫控器,從而立即實現節能并快速收回成本。當地公用事業公司也提供基於績效的補貼,如果負載轉移指標得到檢驗,最高可報銷計劃成本的 30%,以此吸引提案。在新建築中,整合設計方案將溫控器與照明和門禁系統共用IP 主幹網,簡化了試運行。因此,市場參與企業正在細分產品線:價格較低的 DIY 設備面向家庭用戶,而專業級、支援 BACnet 的型號則滿足大型計劃承包商的競標。

智慧恆溫器市場報告按連接類型(有線和無線)、安裝類型(新建和維修)、產品類型(聯網/可程式設計、聯網/可程式設計、其他)、最終用戶(住宅、商業、其他)、連接協定(Wi-Fi、Zigbee、Z-Wave、其他)、產品智慧等級(學習型智慧恆溫器、連網/可程式設計、其他)和地區進行通訊協定。

區域分析

北美地區預計在2024年將佔據最高的市場佔有率,達到38.60%,這主要得益於能源之星認證、各州的需量反應獎勵以及較高的人均暖通空調普及率。歐洲緊隨其後,主要受「Fit-for-55」計畫的推動,該計畫要求到2030年對建築進行大規模的節能維修。然而,亞太地區將以17.66%的複合年成長率實現最快的成長。中國預計2024年出貨1.85億空調,龐大的裝置量將促進智慧家庭系統升級為智慧控制器。日本的碳中和藍圖要求對現有住宅存量進行節能改造,而韓國的智慧家居稅額扣抵正在降低整合式暖通空調控制系統的成本。

在快速都市化的東南亞,中產階級家庭將智慧恆溫器視為身分的象徵,同時也將其視為應對季節性熱浪的節能工具。泰國和馬來西亞的政府補貼計畫現已將連網空調系統納入補貼範圍,擴大了潛在需求。拉丁美洲其他地區也呈現溫和成長,巴西利用淨計量改革,墨西哥則為新建商業建築制定了智慧型能源標準。中東買家關注的是控制玻璃幕牆大樓的高冷氣負荷,但成本仍是低收入族群的一大障礙。區域差異意味著製造商必須調整通路策略,在新興市場提供廉價的產品,並在成熟市場提升銷售雲端服務。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 節能設備的需求不斷成長

- 政府獎勵和動態關稅

- 智慧家庭生態系統和物聯網中心的快速普及

- 透過需量反應實現虛擬電廠(VPP)的商業化

- Matter通訊協定降低了互通性的門檻

- 人工智慧驅動的暖通空調預測性維護訂閱

- 市場限制

- 產品和安裝的初始成本較高

- 資料隱私和網路安全問題

- 傳統暖通空調線路碎片化

- 成熟市場中早期採用者群體的飽和

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過連接技術

- 無線的

- Wi-Fi

- ZigBee

- Z-Wave

- 線

- Bluetooth

- 有線

- 無線的

- 按安裝類型

- 新成立

- 改裝

- 依產品類型

- 學習型智慧恆溫器

- 聯網/可編程

- 獨立/僅限應用程式

- 最終用戶

- 住宅

- 獨立式住宅

- 多用戶住宅

- 商業的

- 辦公室

- 零售和酒店

- 醫療機構

- 教育設施

- 工業及其他

- 輕工業

- 資料中心

- 住宅

- 透過連接通訊協定

- Wi-Fi

- ZigBee

- Z-Wave

- 線(物質女士)

- Bluetooth/BLE

- 專有的 915 MHz/Sub-GHz 射頻

- 乙太網路/乙太網路供電

- 按產品智慧等級

- 學習型智慧恆溫器

- 獨立/僅限應用程式(以手機為中心)

- 聯網/可編程

- 多感測器環境支援

- 整合語音助手

- 預測性維護/自診斷控制器

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 東南亞

- 亞太其他地區

- 中東和非洲

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Nest Labs Inc.(Google)

- Resideo Technologies Inc.

- ecobee Inc.

- Emerson Electric Co.(Sensi)

- Lennox International Inc.

- Alarm.com Inc.

- LUX Products Corp.

- APX Group Inc.(Vivint)

- Johnson Controls plc

- Netatmo SA

- Tantalus Systems Corp.

- tado GmbH

- Centrica Hive Ltd.

- Siemens AG

- Amazon.com Inc.

- Schneider Electric SE

- Bosch Thermotechnology

- Carrier Global Corp.

- Trane Technologies plc

- Daikin Industries Ltd.

- Copeland LP

- Robertshaw Controls Co.

第7章 市場機會與未來展望

The smart thermostat market stands at USD 5.60 billion in 2025 and is projected to reach USD 12.59 billion by 2030, reflecting a solid 17.59% CAGR through the forecast period.

Growth is primarily driven by a tightening policy focus on energy efficiency, steady grid-modernization investments, and the spread of the Matter interoperability standard that removes ecosystem lock-in. Utilities are treating connected thermostats as grid assets, enrolling them in virtual power plants to shave peak demand and reduce reserve-margin costs.Uptake is further supported by falling sensor prices, the availability of Wi-Fi and Thread dual-band chips, and AI-based optimization that fine-tunes HVAC operation to weather forecasts and occupancy patterns. At the same time, manufacturers are absorbing higher semiconductor and copper costs by emphasizing premium software features rather than competing purely on hardware prices.

Global Smart Thermostat Market Trends and Insights

Government Incentives Drive Accelerated Market Penetration

Generous subsidy programs and dynamic tariffs are moving the smart thermostat market beyond early adopters. Japan's "Energy Saving 2025 Project" covers high-efficiency connected heating systems and offers bonus payments for removing legacy equipment, influencing replacement cycles in condominiums and single-family homes.California has earmarked USD 50 million for low-income households to install intelligent HVAC controls, linking energy equity to flexible-load adoption. Similar rebate structures appear in France, Germany, and South Korea, trimming payback periods to less than three years for most households. Together, these measures lift adoption in regions with both high power prices and climate-policy targets, reinforcing volume growth among retrofit projects and spurring builder demand for pre-installed controls in new homes.

Smart-Home Ecosystem Integration Amplifies Value Proposition

Thread 1.4, released in late 2024, makes credential sharing and self-healing mesh networking standard features for home IoT. The update lets thermostats serve as border routers, routing traffic when Wi-Fi falters and improving whole-home reliability.Apple, Google, and Amazon have publicly committed to Thread 1.4 support in their hub products by 2026, guaranteeing cross-platform pairing without vendor apps. Consumers experience faster onboarding and fewer drop-offs during initial setup, which translates to higher retention for subscription-based energy-services plans. For commercial facilities, open APIs simplify integration with existing building-management software and reduce installer training time. These network effects enlarge addressable demand by rewarding ecosystems that can span lighting, security, and HVAC in a single interface.

Supply Chain Cost Inflation Pressures Affordability

Semiconductor shortages and copper-price swings raised bill-of-materials costs for connected thermostats by 15-20% between 2024 and 2025. U.S. tariffs on Chinese-made smart-home devices compound the increase, leaving brands with a choice of thinner margins or higher shelf prices. Some producers are shifting final assembly to Taiwan, Vietnam, and Mexico to navigate trade barriers and diversify supply risk. Installers report that total retrofit costs, including labor, frequently exceed USD 400, outpacing willingness-to-pay in emerging economies. As a result, several vendors now bundle financing or utility rebate documentation inside their sales portals to soften the initial outlay.

Other drivers and restraints analyzed in the detailed report include:

- Virtual Power Plant Monetization Creates New Revenue Streams

- Matter Protocol Standardization Eliminates Interoperability Friction

- Cybersecurity Vulnerabilities Undermine Consumer Confidence

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wi-Fi-enabled units accounted for 64.30% of shipments in 2024, reflecting near-universal router penetration and straightforward installation workflows. This stronghold gives Wi-Fi the single-largest smart thermostat market share in the base year. The segment continues to benefit from higher residential replacement activity, but growth moderates as mesh-capable Thread chips enter mass production. Thread devices are expected to post 21.05% CAGR through 2030, steadily eroding Wi-Fi's lead by offering lower power draw, seamless onboarding, and automatic network healing. Meanwhile, Zigbee remains popular in commercial retrofits because it integrates cleanly with legacy BMS software. Z-Wave keeps a niche among security-system installers that prioritize sub-GHz interference-free links. The rising ability of Matter controllers to bridge Wi-Fi and Thread traffic suggests future homes will carry mixed-stack deployments that optimize cost, range, and battery life without locking owners into one vendor.

Second-generation Thread silicon already embeds dual-stack capability, allowing fallback to 2.4 GHz Wi-Fi if border routers fail. Apple's commitment to release Thread 1.4 firmware to its set-top boxes by 2026 will enlarge the potential addressable base by tens of millions of hubs. For commercial properties, Thread's deterministic latency and multi-path routing improve reliability for occupant-comfort applications, which are sensitive to dropouts. Vendors anticipating this shift are loading mobile apps with network-quality dashboards that highlight Thread link status, easing installer troubleshooting and reinforcing confidence among corporate facility managers.

Retrofit projects represented 57.80% of 2024 unit demand, capitalizing on the vast installed base of standard programmable thermostats ready for replacement. This activity positions retrofit as the largest slice of the smart thermostat market size across the forecast window. The category prospers as device makers introduce universal mounting plates and C-wire adapters that let homeowners self-install in under 30 minutes. In parallel, building-code revisions and green-bond incentives accelerate new-construction demand, driving a 20.21% CAGR for pre-installed systems in homes built after 2025. Larger multifamily developers often specify open-protocol thermostats so that property-management software can aggregate energy data portfolio-wide, enhancing ESG reporting credibility.

Commercial retrofits now draw attention because a single office tower can swap 1,000 conventional wall stats in a weekend, generating immediate energy reductions and fast payback. Regional utilities sweeten the proposition with performance-based rebates that refund up to 30% of project cost once load-shifting metrics are validated. In new buildings, integrated design approaches place thermostats on a shared IP backbone with lighting and access control, simplifying commissioning. Market participants therefore segment their product lines: value-priced do-it-yourself units target homeowners, while professional-grade, BACnet-compatible models satisfy contractors bidding large projects.

Smart Thermostat Market Report is Segmented by Connectivity Type (Wired and Wireless), Installation Type (New Construction and Retrofit), Product Type (Connected/Programmable, Connected/Programmable, and More), End-User (Residential, Commercial, and More), Connectivity Protocol (Wi-Fi, Zigbee, Z-Wave, and More), Product Intelligence Level (Learning Smart Thermostats, Connected/Programmable, and More), and Geography.

Geography Analysis

North America posted the highest 2024 revenue with 38.60% share, aided by Energy Star labeling, state-level demand-response incentives, and high per-capita HVAC penetration. Europe followed, driven by the Fit-for-55 package that compels deep building-energy retrofits by 2030. The Asia Pacific region, however, will record the fastest gains at 17.66% CAGR. China shipped 185 million air-conditioner units in 2024, providing a vast install base that primes upgrades to connected controllers. Japan's carbon-neutrality roadmap requires efficiency upgrades in existing housing stock, and South Korea's smart-home tax credits lower the cost of integrated HVAC controls.

In rapidly urbanizing Southeast Asia, middle-class households view smart thermostats as both status symbols and energy-saving tools during seasonal heatwaves. Government subsidy pools in Thailand and Malaysia now include connected HVAC as eligible equipment, expanding addressable demand. Elsewhere, Latin America posts moderate growth, with Brazil leveraging net-metering reforms and Mexico adopting smart-energy codes for new commercial builds. Middle East buyers focus on controlling the high cooling loads in glass-clad towers, yet cost remains a hurdle in lower-income segments. Regional disparities mean manufacturers must tailor channel strategies, offering budget SKUs in emerging economies while upselling cloud services in mature markets.

- Nest Labs Inc. (Google)

- Resideo Technologies Inc.

- ecobee Inc.

- Emerson Electric Co. (Sensi)

- Lennox International Inc.

- Alarm.com Inc.

- LUX Products Corp.

- APX Group Inc. (Vivint)

- Johnson Controls plc

- Netatmo SA

- Tantalus Systems Corp.

- tado GmbH

- Centrica Hive Ltd.

- Siemens AG

- Amazon.com Inc.

- Schneider Electric SE

- Bosch Thermotechnology

- Carrier Global Corp.

- Trane Technologies plc

- Daikin Industries Ltd.

- Copeland LP

- Robertshaw Controls Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing demand for energy-saving devices

- 4.2.2 Government incentives and dynamic tariff roll-outs

- 4.2.3 Rapid adoption of smart-home ecosystems and IoT hubs

- 4.2.4 Virtual-power-plant (VPP) monetisation via demand response

- 4.2.5 Matter protocol lowers interoperability barriers

- 4.2.6 AI-driven HVAC predictive-maintenance subscriptions

- 4.3 Market Restraints

- 4.3.1 High upfront product and installation cost

- 4.3.2 Data-privacy and cybersecurity concerns

- 4.3.3 Legacy HVAC wiring fragmentation

- 4.3.4 Early-adopter saturation in mature markets

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Connectivity Technology

- 5.1.1 Wireless

- 5.1.1.1 Wi-Fi

- 5.1.1.2 Zigbee

- 5.1.1.3 Z-Wave

- 5.1.1.4 Thread

- 5.1.1.5 Bluetooth

- 5.1.2 Wired

- 5.1.1 Wireless

- 5.2 By Installation Type

- 5.2.1 New Construction

- 5.2.2 Retrofit

- 5.3 By Product Type

- 5.3.1 Learning Smart Thermostats

- 5.3.2 Connected/Programmable

- 5.3.3 Stand-alone/App-only

- 5.4 By End-User

- 5.4.1 Residential

- 5.4.1.1 Single-family Homes

- 5.4.1.2 Multi-family Units

- 5.4.2 Commercial

- 5.4.2.1 Offices

- 5.4.2.2 Retail and Hospitality

- 5.4.2.3 Healthcare Facilities

- 5.4.2.4 Education Campuses

- 5.4.3 Industrial and Others

- 5.4.3.1 Light Industrial

- 5.4.3.2 Data Centres

- 5.4.1 Residential

- 5.5 By Connectivity Protocol

- 5.5.1 Wi-Fi

- 5.5.2 Zigbee

- 5.5.3 Z-Wave

- 5.5.4 Thread (Matter-ready)

- 5.5.5 Bluetooth / BLE

- 5.5.6 Proprietary 915 MHz / Sub-GHz RF

- 5.5.7 Ethernet / Power-over-Ethernet

- 5.6 By Product Intelligence Level

- 5.6.1 Learning Smart Thermostats

- 5.6.2 Stand-alone/App-only (phone-centric)

- 5.6.3 Connected/Programmable

- 5.6.4 Multi-sensor Environment-Aware

- 5.6.5 Voice-assistant-integrated

- 5.6.6 Predictive-maintenance / Self-diagnostic Controllers

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Russia

- 5.7.3.7 Rest of Europe

- 5.7.4 Asia Pacific

- 5.7.4.1 China

- 5.7.4.2 Japan

- 5.7.4.3 South Korea

- 5.7.4.4 India

- 5.7.4.5 Australia

- 5.7.4.6 South-East Asia

- 5.7.4.7 Rest of Asia Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 GCC

- 5.7.5.1.2 Turkey

- 5.7.5.1.3 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 Nest Labs Inc. (Google)

- 6.4.2 Resideo Technologies Inc.

- 6.4.3 ecobee Inc.

- 6.4.4 Emerson Electric Co. (Sensi)

- 6.4.5 Lennox International Inc.

- 6.4.6 Alarm.com Inc.

- 6.4.7 LUX Products Corp.

- 6.4.8 APX Group Inc. (Vivint)

- 6.4.9 Johnson Controls plc

- 6.4.10 Netatmo SA

- 6.4.11 Tantalus Systems Corp.

- 6.4.12 tado GmbH

- 6.4.13 Centrica Hive Ltd.

- 6.4.14 Siemens AG

- 6.4.15 Amazon.com Inc.

- 6.4.16 Schneider Electric SE

- 6.4.17 Bosch Thermotechnology

- 6.4.18 Carrier Global Corp.

- 6.4.19 Trane Technologies plc

- 6.4.20 Daikin Industries Ltd.

- 6.4.21 Copeland LP

- 6.4.22 Robertshaw Controls Co.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment