|

市場調查報告書

商品編碼

1851243

防護包裝:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Protective Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

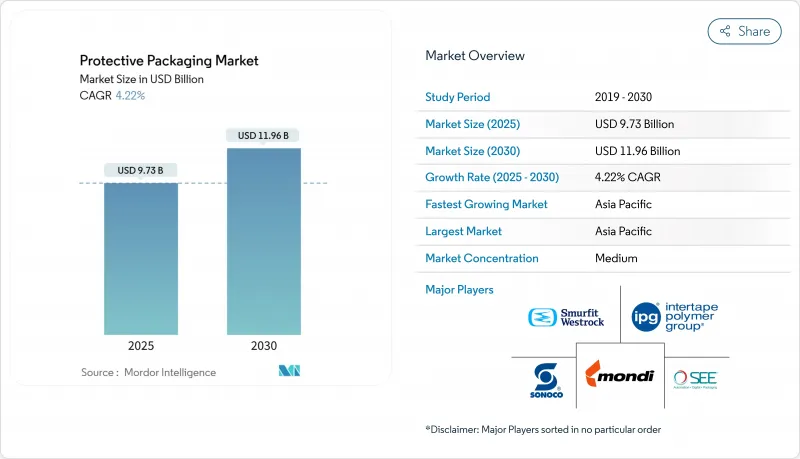

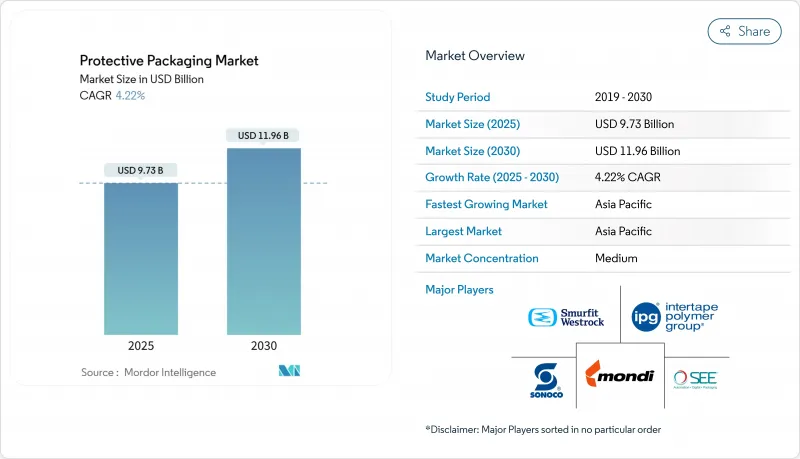

預計到 2025 年,防護包裝市場規模將達到 97.3 億美元,到 2030 年將達到 119.6 億美元,年複合成長率為 4.22%。

電子商務交易量的成長、日益嚴格的永續性法規以及消費者對優質開箱體驗的追求,正在重塑包裝解決方案,使其從後端成本轉變為提升品牌價值的關鍵因素。如今,市場需求青睞輕質材料,以減少體積重量費用;監管環境的確定性也推動了紙質和纖維替代品的快速發展,這些替代品必須具備可回收性。加速整合旨在釋放永續技術的規模經濟效益,而自動化平台則有助於加工商控制人事費用和廢棄物成本。亞太地區仍是重要的策略支柱,既擁有高密度的製造業,也具備全球最快的電子商務成長速度;而歐洲則在塑造全球投資藍圖方面擁有舉足輕重的監管影響力。

全球防護包裝市場趨勢與洞察

電子商務出貨量快速成長

小包裹的指數級成長正在重塑防護包裝市場的物流,迫使各大品牌縮小包裝體積,並轉向符合承運商尺寸重量閾值的纖維包裝形式。惠普重新設計了其一體機電腦的包裝,減少了98%的發泡聚乙烯,體積減少了高達67%,並提高了其27吋機型的托盤密度,從而降低了運輸成本和碳排放。羅技計畫在2025年完成全線產品包裝的紙質化,每年可減少660噸塑膠和6,000噸二氧化碳排放。因此,各大品牌不再僅僅將防護包裝市場視為成本支出,而是視為維持其線上線下經濟的關鍵槓桿。

促進產品安全和減少傷害法規

除了可回收性之外,新法規還將包裝視為保障消費者安全的關鍵要素。歐洲的《通用產品安全條例》(GPSS) 要求製造商檢驗包裝的完整性,確保其能防止污染和竄改。賽默飛世爾科技的防篡改紙盒耐低溫達-80°C,無需膠水,且可稱重,適用於任何尺寸的管瓶。在美國,序列化法規將追蹤碼與緩衝層關聯起來,從而推動了對智慧標籤的需求。合規時間表允許生產商在法規強制執行前數年確認其防護包裝已做好市場應對力。

對塑膠和EPS(聚苯乙烯泡沫塑膠)有嚴格的環境法規。

歐洲已強制規定到2040年可回收率達15%,並正在禁用某些全氟烷基和多氟烷基物質(PFAS)。英國將於2025年10月實施生產者責任延伸制度(EPR),將全部處置成本轉嫁給品牌商;而加州將限制使用回收標誌,除非能夠證明車輛旁回收服務可以接受回收。這些措施將推高合規成本,延長發泡體包裝的投資回收期,並減緩防護包裝市場的成長速度。

細分市場分析

到2024年,軟性包裝將佔防護包裝市場收入的65.34%,這反映出其能夠以最小的體積容納大件小包裹,並降低運費。發泡體包裝雖然規模較小,但由於電子產品和生技藥品對客製化模具的靜電釋放產量比率要求較高,預計到2030年將以6.75%的複合年成長率快速成長。隨著低溫運輸的擴展,泡棉防護包裝市場規模預計將同步成長,這將使泡棉製造商能夠憑藉更高的阻隔性能獲得更高的溢價。

Sealed Air 的 KORRVU 懸掛式包裝展示了紙張和紙板如何模擬發泡體的回彈力,同時兼具路邊回收和扁平運輸的優點,從而降低入境運費。另一方面,硬紙板則適用於大型白色家電和機械設備,這些產品對堆疊強度要求較高。產品組合分為軟性包裝和技術泡沫包裝。軟性包裝滿足電子商務的成本節約需求,而技術泡棉包裝則因其精準的緩衝和隔熱材料性能而價格更高。

到2024年,塑膠仍將佔總噸位的58.23%,但發泡聚合物將以7.34%的複合年成長率成為成長最快的材料,這主要得益於高價值電子產品和生命科學領域的成長。大麥基生質塑膠和再生聚乙烯薄膜正在擴大試點生產線,證明了其大規模應用的潛力。隨著食品和製藥行業的買家尋求可堆肥或生物基密封件,生物複合材料保護性包裝的市場佔有率也在穩步成長。

紙張和紙板加工商正在升級阻隔塗層,以幫助纖維包裝材料更好地防水防油。維吉尼亞理工大學的低壓纖維素處理技術在增強紙張強度的同時,也能維持紙張的透明度,進而提升生鮮食品的貨架吸引力。生產商正將這些先進技術與碳足跡揭露相結合,並將材料創新與保護性包裝市場的採購優勢相結合。

這份防護包裝市場報告按產品類型(硬質、軟質、發泡)、材料(紙、塑膠、發泡聚合物、可生物分解材料)、功能(緩衝、填充、包裝、其他)、終端用戶產業(食品飲料、電子、醫藥、電子商務)和地區(北美、歐洲、亞太、中東和非洲、南美)進行細分。市場預測以美元計價。

區域分析

預計到2024年,亞太地區將佔全球收入的40.23%,年複合成長率達7.76%,這主要得益於高密度製造業、行動通訊的快速普及以及既支持又具有約束力的政策。中國塑膠產量佔全球一半,為加工商提供了利潤豐厚且在地化的樹脂供應管道;而日本正在探索發泡紙的應用,以滿足高階電子產品出口商的需求。各國正試行推行政府補貼,以支持自動化包裝生產線,確保包裝市場能滿足跨境電商激增的需求。

北美地區的優質化仍在持續。惠普和亞馬遜等美國品牌正在進行零塑膠試點項目,這些項目隨後將推廣至全球,使該地區成為這一趨勢的先驅。以加州SB 343法案為開端,各州將推出生產者延伸責任制法規,要求企業在2026年前提交可回收性聲明,並對保護性包裝市場的早期採用者給予獎勵。加拿大正在推廣閉合迴路紙張回收,而墨西哥則利用近岸外包擴大消費性電子產品和家用電器的出口,增加了對工廠緩衝材料的需求。

歐洲在製定相關規則方面處於領先地位。 《包裝廢棄物法規》將鎖定可回收性和再利用配額,為全球採購政策樹立標竿。德國的押金制度和英國的塑膠稅將加速纖維材料的普及應用。由於市場新進業者必須應對因聚合物種類而異的複雜環境調整費用,跨國公司正將研發中心集中於該地區,以開發前瞻性配方。因此,在整個防護包裝市場,合規意識是一項商業性優勢。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 電子商務出貨量快速成長

- 加強產品安全和減少危害方面的法規

- 家用電器需求不斷成長

- 偏好輕便靈活的保護形式

- 採用按需包裝自動化

- 擴大生技藥品和疫苗的低溫運輸

- 市場限制

- 對塑膠和EPS(聚苯乙烯泡沫塑膠)有嚴格的環境法規。

- 原物料價格波動

- 都市區最後一公里配送中心的空間限制

- 重新設計產品,以最大限度地減少對保護性包裝的需求

- 供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 難的

- 紙板保護套

- 模塑紙漿

- 保溫運輸容器

- 其他硬核類型

- 靈活的

- 保護性郵件袋

- 氣泡膜

- 空氣枕/氣囊

- 紙張填充

- 其他軟性包裝類型(鋁箔袋、拉伸膜、收縮膜)

- 形式

- 發泡成型

- 原位成型(FIP)

- 散裝填充物

- 發泡捲/片

- 其他類型的泡沫材料(角塊等)

- 難的

- 材料

- 紙和紙板

- 塑膠

- 聚乙烯(PE)

- 聚丙烯(PP)

- 聚對苯二甲酸乙二醇酯(PET)

- 發泡聚合物

- 發泡聚苯乙烯(EPS)

- 發泡聚乙烯(EPE)

- 發泡聚丙烯(EPP)

- 可生物分解和可堆肥

- 模塑纖維

- 澱粉類

- 聚乳酸(PLA)

- 其他材料

- 按功能

- 緩衝材料

- 阻擋和支撐

- 空隙填充

- 隔熱和溫度控制

- 包裝

- 墊材和其他

- 按最終用戶行業分類

- 飲食

- 工業產品

- 製藥和生命科學

- 家用電器

- 美容及居家護理

- 汽車和航太

- 電子商務與零售履約

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 澳洲和紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 奈及利亞

- 其他非洲地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Sealed Air Corporation

- Pregis LLC

- Intertape Polymer Group Inc.

- Sonoco Products Company

- Smurfit Westrock

- Mondi Group

- International Paper Company

- Storopack Hans Reichenecker GmbH

- Ranpak Holdings Corp.

- Huhtamaki Oyj

- Signode Industrial Group LLC

- Crown Holdings Inc.

- Amcor plc

- Pro-Pac Packaging Ltd.

- ProAmpac Holdings Inc.

- Reflex Packaging LLC

- Pactiv Evergreen Inc.

- AirPack Systems Ltd.

- Polyair Inter Pack Inc.

第7章 市場機會與未來展望

The protective packaging market size reached USD 9.73 billion in 2025 and is projected to advance at a 4.22% CAGR, touching USD 11.96 billion by 2030.

Rising e-commerce volumes, intensifying sustainability regulations, and the search for premium unboxing experiences are recasting protective solutions from a back-end expense into a brand value lever. Demand patterns now reward lightweight materials that curb dimensional-weight fees, and regulatory certainty is prompting rapid shifts toward paper and fiber alternatives that can demonstrate recyclability. Accelerating mergers aim to unlock scale economies in sustainable technology, while automation platforms help converters contain labor and waste costs. Asia-Pacific remains the strategic fulcrum, supplying both manufacturing density and the world's fastest e-commerce growth, yet Europe wields outsized regulatory influence that shapes global investment roadmaps.

Global Protective Packaging Market Trends and Insights

Surging E-commerce Shipping Volumes

Exponential parcel growth is redefining protective packaging market logistics, compelling brands to shrink cube sizes and pivot toward fiber formats that meet carrier dimensional weight thresholds. HP's redesign of its All-in-One PC packaging eliminated 98% of expanded polyethylene, reduced volume by up to 67%, and raised pallet density for the 27-inch model, trimming freight spend and carbon load. Logitech completed a portfolio-wide switch to paper in 2025, removing 660 tons of plastic and 6,000 tons of CO2 each year, while 61% of surveyed buyers favored recyclable packs . Brands thus regard the protective packaging market not only as a cost line but as a retention lever in a doorstep economy.

Regulatory Push for Product Safety and Damage Reduction

New statutes go beyond recyclability to treat packaging as intrinsic to consumer safety. Europe's General Product Safety Regulation obliges manufacturers to validate that pack integrity prevents contamination or tampering.Thermo Fisher's carton with built-in tamper evidence withstands -80 °C, discards glue, and scales across vial sizes. In the United States, serialization laws link tracking codes with cushioning layers, catalyzing smart-label demand. Compliance timetables push producers to confirm protective packaging market readiness years ahead of enforcement.

Stringent Environmental Rules on Plastics and EPS

Europe mandates reusable targets climbing to 15% by 2040 and bans certain PFAS, triggering immediate material substitutions and extended-producer fees that squeeze converters' margins. The United Kingdom's October 2025 EPR rollout shifts full disposal costs onto brands, while California restricts the recycling symbol unless curbside acceptance is documented. These moves inflate compliance costs and lengthen payback periods for foam installations, dragging on the protective packaging market growth curve.

Other drivers and restraints analyzed in the detailed report include:

- Growing Consumer Electronics Demand

- Preference for Lightweight Flexible Protective Formats

- Raw-material Price Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Flexible formats generated 65.34% of 2024 sales within the protective packaging market, reflecting their ability to serve high-volume parcels with minimal cube and lower freight spend. Foam categories, though smaller, are accelerating at 6.75% CAGR toward 2030 as electronics and biologics rely on custom molds with electrostatic discharge yields. The protective packaging market size for foam is projected to widen in tandem with cold-chain expansion, positioning foam makers for premium pricing aligned with higher barrier performance.

Sealed Air's KORRVU suspension format illustrates how paper and corrugate can mimic foam resilience, offering curbside recyclability and shipping flat to cut inbound freight. Rigid corrugated, meanwhile, remains relevant for large white-goods and machinery where stacking strength matters. The product mix signals a divide: flexibles satisfy cost-down mandates in e-commerce, whereas technical foams win where precision cushioning and thermal insulation command a price premium.

Plastics still supplied 58.23% of 2024 tonnage, yet foam polymers log the quickest 7.34% CAGR, tracking growth in high-value electronics and life sciences. Barley-based bioplastics and recycled polyethylene films are scaling pilot lines, proving viability for mass adoption. Protective packaging market share for biocomposites remains modest but expands as food and pharma buyers seek compostable or bio-based seals.

Paper and board converters upgrade barrier coatings so that fiber wraps repel moisture and grease. Virginia Tech's low-pressure cellulose treatment strengthens paper while preserving transparency, unlocking shelf-ready appeal for perishables. Producers bundle such advances with carbon footprint disclosures, translating material innovation into procurement gains within the protective packaging market.

The Protective Packaging Market Report is Segmented by Product Type (Rigid, Flexible, Foam), Materials (Paper, Plastics, Foam Polymers, Biodegradable), Function (Cushioning, Void Fill, Wrapping, Others), End-User Industry (Food & Beverage, Electronics, Pharmaceuticals, E-Commerce), and Geography (North America, Europe, Asia-Pacific, MEA, South America). Market Forecasts are in Value (USD).

Geography Analysis

Asia-Pacific controlled 40.23% revenue in 2024 and is set for 7.76% CAGR, underpinned by dense manufacturing, rapid mobile penetration, and supportive yet tightening policy. China funnels half of global plastic output, offering localized resin access that favors converters, while Japan advances foamed paper research that can satisfy premium electronics exporters. Countries pilot government subsidies for automated packing lines, ensuring the protective packaging market keeps pace with cross-border e-commerce surges.

North America follows through premiumization. United States brands like HP and Amazon test zero-plastic pilots that later migrate worldwide, positioning the region as a trend bellwether. State-level Extended Producer Responsibility rules, beginning with California SB 343, compel recyclability declarations by 2026, rewarding early adopters in the protective packaging market. Canada promotes closed-loop paper recycling, whereas Mexico leverages near-shoring to grow appliance and electronics exports, widening demand for in-plant cushioning.

Europe leads rulemaking. The Packaging and Packaging Waste Regulation locks in recyclability and reuse quotas that benchmark global sourcing policies. Germany's deposit systems and the UK's plastic tax accelerate fiber uptake. Market entrants must navigate complex eco-modulation fees that vary by polymer, so multinationals cluster R&D hubs in the region to future-proof formulations. Compliance mastery therefore becomes a commercial edge across the protective packaging market.

- Sealed Air Corporation

- Pregis LLC

- Intertape Polymer Group Inc.

- Sonoco Products Company

- Smurfit Westrock

- Mondi Group

- International Paper Company

- Storopack Hans Reichenecker GmbH

- Ranpak Holdings Corp.

- Huhtamaki Oyj

- Signode Industrial Group LLC

- Crown Holdings Inc.

- Amcor plc

- Pro-Pac Packaging Ltd.

- ProAmpac Holdings Inc.

- Reflex Packaging LLC

- Pactiv Evergreen Inc.

- AirPack Systems Ltd.

- Polyair Inter Pack Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging e-commerce shipping volumes

- 4.2.2 Regulatory push for product safety and damage reduction

- 4.2.3 Growing consumer electronics demand

- 4.2.4 Preference for lightweight flexible protective formats

- 4.2.5 Adoption of on-demand packaging automation

- 4.2.6 Expansion of cold-chain biologics and vaccines

- 4.3 Market Restraints

- 4.3.1 Stringent environmental rules on plastics and EPS

- 4.3.2 Raw-material price volatility

- 4.3.3 Space constraints at urban last-mile hubs

- 4.3.4 Product redesign minimising protective-packaging need

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Rigid

- 5.1.1.1 Corrugated Paperboard Protectors

- 5.1.1.2 Molded Pulp

- 5.1.1.3 Insulated Shipping Containers

- 5.1.1.4 Other Rigid Types

- 5.1.2 Flexible

- 5.1.2.1 Protective Mailers

- 5.1.2.2 Bubble Wrap

- 5.1.2.3 Air Pillows / Air Bags

- 5.1.2.4 Paper Fill

- 5.1.2.5 Other Flexible Types (Foil Pouches, Stretch and Shrink Films)

- 5.1.3 Foam

- 5.1.3.1 Molded Foam

- 5.1.3.2 Foam-in-Place (FIP)

- 5.1.3.3 Loose Fill

- 5.1.3.4 Foam Rolls / Sheets

- 5.1.3.5 Other Foam Types (Corner Blocks etc.)

- 5.1.1 Rigid

- 5.2 By Materials

- 5.2.1 Paper and Paperboard

- 5.2.2 Plastics

- 5.2.2.1 Polyethylene (PE)

- 5.2.2.2 Polypropylene (PP)

- 5.2.2.3 Polyethylene Terephthalate (PET)

- 5.2.3 Foam Polymers

- 5.2.3.1 Expanded Polystyrene (EPS)

- 5.2.3.2 Expanded Polyethylene (EPE)

- 5.2.3.3 Expanded Polypropylene (EPP)

- 5.2.4 Biodegradable and Compostable

- 5.2.4.1 Molded Fiber

- 5.2.4.2 Starch-based

- 5.2.4.3 Polylactic Acid (PLA)

- 5.2.5 Other Materials

- 5.3 By Function

- 5.3.1 Cushioning

- 5.3.2 Blocking and Bracing

- 5.3.3 Void Fill

- 5.3.4 Insulation and Temperature Control

- 5.3.5 Wrapping

- 5.3.6 Dunnage and Others

- 5.4 By End-user Industry

- 5.4.1 Food and Beverage

- 5.4.2 Industrial Goods

- 5.4.3 Pharmaceuticals and Life Sciences

- 5.4.4 Consumer Electronics

- 5.4.5 Beauty and Home Care

- 5.4.6 Automotive and Aerospace

- 5.4.7 E-commerce and Retail Fulfilment

- 5.4.8 Other End-user Industry

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Italy

- 5.5.2.5 Spain

- 5.5.2.6 Russia

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 South Korea

- 5.5.3.5 Australia and New Zealand

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Middle East

- 5.5.4.1.1 Saudi Arabia

- 5.5.4.1.2 United Arab Emirates

- 5.5.4.1.3 Turkey

- 5.5.4.1.4 Rest of Middle East

- 5.5.4.2 Africa

- 5.5.4.2.1 South Africa

- 5.5.4.2.2 Egypt

- 5.5.4.2.3 Nigeria

- 5.5.4.2.4 Rest of Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Chile

- 5.5.5.4 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Sealed Air Corporation

- 6.4.2 Pregis LLC

- 6.4.3 Intertape Polymer Group Inc.

- 6.4.4 Sonoco Products Company

- 6.4.5 Smurfit Westrock

- 6.4.6 Mondi Group

- 6.4.7 International Paper Company

- 6.4.8 Storopack Hans Reichenecker GmbH

- 6.4.9 Ranpak Holdings Corp.

- 6.4.10 Huhtamaki Oyj

- 6.4.11 Signode Industrial Group LLC

- 6.4.12 Crown Holdings Inc.

- 6.4.13 Amcor plc

- 6.4.14 Pro-Pac Packaging Ltd.

- 6.4.15 ProAmpac Holdings Inc.

- 6.4.16 Reflex Packaging LLC

- 6.4.17 Pactiv Evergreen Inc.

- 6.4.18 AirPack Systems Ltd.

- 6.4.19 Polyair Inter Pack Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment