|

市場調查報告書

商品編碼

1740899

軟性保護包裝市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Flexible Protective Packaging Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

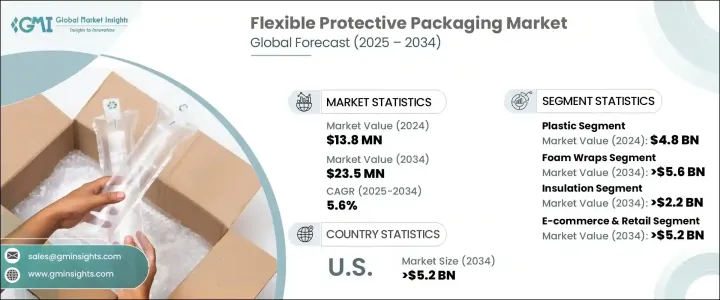

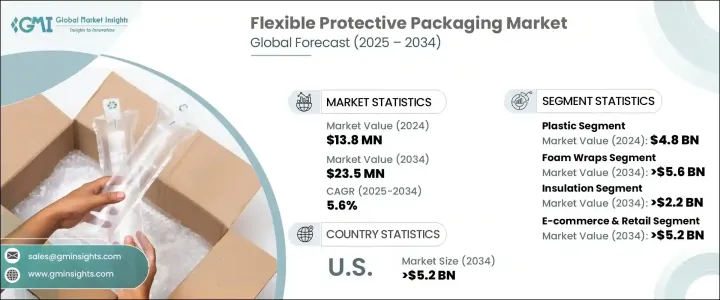

2024年,全球軟性保護性包裝市場規模達138億美元,預計到2034年將以5.6%的複合年成長率成長,達到235億美元,這得益於電子商務產業的蓬勃發展和「最後一公里」配送網路的進步。隨著全球各行各業紛紛轉向輕盈、耐用、永續的包裝替代品,以提供成本效益和高效的產品保護,市場正經歷快速轉變。線上購物平台的日益普及改變了商品的儲存、運輸和配送方式,這推動了對包裝的強烈需求,這種包裝不僅能為運輸中的物品提供緩衝,還能輕鬆適應各種產品的形狀和尺寸。消費者要求更快的配送速度和最小的環境影響,這使得軟性保護性包裝成為尋求在性能和永續性之間取得平衡的企業的首選解決方案。可回收、可堆肥和可生物分解包裝領域的創新正在穩步湧現,幫助品牌滿足監管標準和消費者期望。隨著零售商優先考慮全通路履行,靈活的包裝提供了策略優勢——減輕運輸重量、減少浪費並提高整體營運靈活性。

減少塑膠垃圾和推廣環保實踐的監管壓力日益加大,已成為市場成長的關鍵催化劑。許多企業正積極從剛性、重型包裝轉向更聰明、更靈活的包裝形式,這些包裝形式易於客製化,運輸成本更低。在新興經濟體(尤其是亞太地區),這些趨勢尤其明顯,線上零售活動的激增加速了對兼具保護性和經濟性的包裝的需求。氣泡膜、泡棉內襯、加墊郵寄袋和氣枕等軟性保護包裝形式正日益受到青睞,因為它們在減少材料消耗的同時,能夠提供強大的緩衝作用。它們節省空間的特性不僅降低了物流成本,還有助於減少運輸過程中的碳排放。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 138億美元 |

| 預測值 | 235億美元 |

| 複合年成長率 | 5.6% |

美國貿易管理部門先前推出的持續關稅政策,為依賴進口原料的國內製造商增加了成本壓力。這些關稅促使企業重新思考其供應鏈,導致採購策略和對區域製造中心的投資轉變。如此一來,製造商在提升自身韌性的同時,也最佳化了成本效率。軟性保護性包裝在此背景下發揮著至關重要的作用——它有助於減少材料使用量,降低立體運輸成本,並實現跨產品線的輕鬆擴展,從而幫助企業在不斷變化的市場中佔據競爭優勢。

在材料類型中,塑膠繼續主導軟性保護包裝領域,2024 年市場規模達 48 億美元。聚乙烯、聚丙烯和聚苯乙烯等常見塑膠樹脂因其低成本、耐用性和高抗衝擊性而仍廣受歡迎。這些材料廣泛應用於氣墊、泡棉內襯和氣泡膜等包裝解決方案,對於在長途運輸過程中保護易碎物品至關重要。隨著數位零售的興起,尤其是在消費性電子產品和化妝品等領域,對這些輕質高性能材料的需求絲毫沒有放緩的跡象。

預計到2034年,泡棉包裝市場規模將達到56億美元,成為軟性保護包裝領域成長最快的領域之一。泡棉包裝因其輕盈和強大的緩衝性能而被廣泛應用,是運輸過程中保護易碎物品的理想選擇。這些包裝可以輕鬆塑形成不規則形狀,確保物品穩固地受到緩衝,而不會增加體積。處理精密設備的行業(例如醫療設備、電子產品和高檔玻璃器皿)越來越依賴泡沫包裝來降低破損、退貨和客戶不滿意的風險。

在美國,預計到2034年,軟性保護性包裝市場規模將達到52億美元,這得益於強大的電商生態系統以及美國對永續包裝日益成長的重視。隨著網購習慣的日益普及,企業正迅速採用可生物分解的包裝、紙質緩衝材料和可回收的塑膠郵寄袋,以滿足食品、藥品和消費品等行業的需求。這些產業所需的包裝解決方案不僅要保護產品的完整性,還要符合環保價值和合規要求。

為了保持競爭優勢,安姆科、Smurfit Kappa、Mondi、希悅爾和 Pregis 等行業領導者正在大力投資研發、永續性創新和客製化包裝系統。他們還在擴大區域製造業務,以更好地服務全通路零售模式並滿足複雜的物流需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 川普政府關稅

- 對貿易的影響

- 貿易量中斷

- 報復措施

- 對產業的影響

- 供給側影響(原料)

- 主要材料價格波動

- 供應鏈重組

- 生產成本影響

- 需求面影響(售價)

- 價格傳導至終端市場

- 市佔率動態

- 消費者反應模式

- 供給側影響(原料)

- 受影響的主要公司

- 策略產業反應

- 供應鏈重組

- 定價和產品策略

- 政策參與

- 展望與未來考慮

- 對貿易的影響

- 產業衝擊力

- 成長動力

- 電子商務擴張

- 永續性和法規遵從性

- 成本和營運效率

- 材料科學的進步

- 消費性電子產品和易腐商品的成長

- 產業陷阱與挑戰

- 回收基礎設施缺口

- 原物料價格波動

- 成長動力

- 成長潛力分析

- 監管格局

- 技術格局

- 未來市場趨勢

- 差距分析

- 波特的分析

- PESTEL分析

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 主要市場參與者的競爭分析

- 競爭定位矩陣

- 策略儀表板

第5章:市場估計與預測:按材料類型,2021 - 2034 年

- 塑膠

- 紙和紙板

- 泡棉

- 鋁箔

第6章:市場估計與預測:依產品類型,2021 - 2034 年

- 氣墊

- 氣泡膜

- 泡棉包裝

- 郵件程式

- 收縮包裝

- 拉伸膜

- 其他

第7章:市場估計與預測:依功能,2021 - 2034 年

- 空隙填充

- 阻擋和支撐

- 包裝

- 絕緣

- 緩衝

- 表面保護

第8章:市場估計與預測:依最終用途,2021 - 2034 年

- 電子商務與零售

- 食品和飲料

- 製藥和醫療保健

- 消費者

- 汽車

- 工業的

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Sealed Air Corporation

- Pregis LLC

- Smurfit Kappa Group

- Amcor plc

- Mondi Group

- Huhtamaki Oyj

- Sonoco Products Company

- ProAmpac LLC

- Storopack Hans Reichenecker GmbH

- DS Smith Plc

- Winpak Ltd.

- Mondi Flexible Packaging

- Rengo Co., Ltd.

- AptarGroup, Inc.

- Toray Plastics (America), Inc.

- Schur Flexibles Group

The Global Flexible Protective Packaging Market was valued at USD 13.8 billion in 2024 and is estimated to grow at a CAGR of 5.6% to reach USD 23.5 billion by 2034, driven by the expanding e-commerce sector and advancements in last-mile delivery networks. The market is experiencing a rapid shift as industries across the globe lean toward lightweight, durable, and sustainable packaging alternatives that offer cost-efficiency and high product protection. The growing penetration of online shopping platforms has transformed how goods are stored, shipped, and delivered-fueling a strong need for packaging that not only cushions items in transit but also adapts easily to varying product shapes and sizes. Consumers are demanding faster deliveries with minimal environmental impact, making flexible protective packaging a preferred solution for businesses looking to strike a balance between performance and sustainability. Innovations in recyclable, compostable, and biodegradable packaging are emerging at a steady pace, helping brands meet regulatory benchmarks and consumer expectations alike. As retailers prioritize omnichannel fulfillment, flexible packaging is offering a strategic advantage-reducing shipping weights, limiting waste, and enhancing overall operational agility.

Rising regulatory pressure on reducing plastic waste and promoting eco-friendly practices has become a key growth catalyst for the market. Many businesses are proactively shifting from rigid, heavy-duty formats to smarter, flexible options that can be easily customized and shipped at lower costs. Across emerging economies-especially in Asia-Pacific-these trends are even more pronounced, where the spike in online retail activity is accelerating demand for packaging that is both protective and economical. Flexible protective packaging formats such as bubble wraps, foam inserts, padded mailers, and air pillows are gaining traction because they offer strong cushioning with less material consumption. Their space-saving nature not only drives down logistics costs but also helps reduce carbon emissions during transportation.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $13.8 billion |

| Forecast Value | $23.5 billion |

| CAGR | 5.6% |

Ongoing tariff policies introduced during earlier U.S. trade administrations have added cost pressures on domestic manufacturers relying on imported raw materials. These tariffs have prompted companies to rethink their supply chains, leading to a shift in sourcing strategies and investments in regional manufacturing hubs. In doing so, manufacturers are enhancing their resilience while optimizing cost-efficiency. Flexible protective packaging plays a vital role in this landscape-it helps reduce material usage, lowers dimensional shipping costs, and allows easy scalability across product lines, giving businesses a competitive edge in an evolving market.

Among material types, plastic continues to dominate the flexible protective packaging space, generating USD 4.8 billion in 2024. Common plastic resins such as polyethylene, polypropylene, and polystyrene remain popular due to their low cost, durability, and high impact resistance. These materials are extensively used in packaging solutions like air pillows, foam inserts, and bubble wraps, which are essential for protecting fragile items during long-haul shipments. With the rise of digital retail, particularly in sectors like consumer electronics and cosmetics, the demand for these lightweight, high-performance materials shows no signs of slowing down.

The foam wraps segment is projected to generate USD 5.6 billion by 2034, making it one of the fastest-growing areas in flexible protective packaging. Foam wraps are widely used due to their lightweight nature and strong cushioning properties, which are ideal for safeguarding delicate items during transit. These wraps effortlessly mold to irregular shapes, ensuring that items remain securely cushioned without adding excessive bulk. Industries handling precision equipment-such as medical devices, electronics, and luxury glassware-are increasingly depending on foam wraps to reduce the risk of breakage, returns, and customer dissatisfaction.

In the U.S., the flexible protective packaging market is forecasted to generate USD 5.2 billion by 2034, fueled by a strong e-commerce ecosystem and the nation's growing emphasis on sustainable packaging. As online shopping habits intensify, businesses are rapidly adopting biodegradable wraps, paper-based cushioning, and recyclable poly mailers to meet demand across industries such as food, pharmaceuticals, and consumer goods. These sectors require packaging solutions that not only protect product integrity but also align with eco-conscious values and compliance requirements.

To maintain a competitive edge, industry leaders like Amcor, Smurfit Kappa, Mondi, Sealed Air, and Pregis are heavily investing in R&D, sustainability innovation, and customized packaging systems. They are also expanding their regional manufacturing footprint to better serve omnichannel retail models and address complex logistics demands.

Table of Contents

Chapter 1 Methodology and Scope

- 1.1 Market scope and definitions

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Base estimates and calculations

- 1.3.1 Base year calculation

- 1.3.2 Key trends for market estimation

- 1.4 Forecast model

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.5.2 Data mining sources

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.2 Trump administration tariffs

- 3.2.1 Impact on trade

- 3.2.1.1 Trade volume disruptions

- 3.2.1.2 Retaliatory measures

- 3.2.2 Impact on the industry

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.2.1.1 Price volatility in key materials

- 3.2.2.1.2 Supply chain restructuring

- 3.2.2.1.3 Production cost implications

- 3.2.2.2 Demand-side impact (selling price)

- 3.2.2.2.1 Price transmission to end markets

- 3.2.2.2.2 Market share dynamics

- 3.2.2.2.3 Consumer response patterns

- 3.2.2.1 Supply-side impact (raw materials)

- 3.2.3 Key companies impacted

- 3.2.4 Strategic industry responses

- 3.2.4.1 Supply chain reconfiguration

- 3.2.4.2 Pricing and product strategies

- 3.2.4.3 Policy engagement

- 3.2.5 Outlook and future considerations

- 3.2.1 Impact on trade

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 E-commerce expansion

- 3.3.1.2 Sustainability and regulatory compliance

- 3.3.1.3 Cost and operational efficiency

- 3.3.1.4 Advancements in material science

- 3.3.1.5 Growth in consumer electronics and perishables

- 3.3.2 Industry pitfalls and challenges

- 3.3.2.1 Recycling infrastructure gaps

- 3.3.2.2 Volatility in raw material prices

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.6 Technology landscape

- 3.7 Future market trends

- 3.8 Gap analysis

- 3.9 Porter's analysis

- 3.10 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategy dashboard

Chapter 5 Market Estimates & Forecast, By Material Type, 2021 - 2034 (USD Million and Units)

- 5.1 Plastic

- 5.2 Paper & paperboard

- 5.3 Foam

- 5.4 Aluminum foil

Chapter 6 Market estimates & forecast, By Product Type, 2021 - 2034 (USD Billion and Units)

- 6.1 Air cushions

- 6.2 Bubble wraps

- 6.3 Foam wraps

- 6.4 Mailers

- 6.5 Shrink wraps

- 6.6 Stretch films

- 6.7 Others

Chapter 7 Market Estimates & Forecast, By Function, 2021 - 2034 (USD Billion and Units)

- 7.1 Void Fill

- 7.2 Blocking & bracing

- 7.3 Wrapping

- 7.4 Insulation

- 7.5 Cushioning

- 7.6 Surface protection

Chapter 8 Market estimates & forecast, By End Use, 2021 - 2034 (USD Billion and Units)

- 8.1 E-commerce & retail

- 8.2 Food & beverages

- 8.3 Pharmaceuticals & healthcare

- 8.4 Consumer

- 8.5 Automotive

- 8.6 Industrial

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Billion and Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Sealed Air Corporation

- 10.2 Pregis LLC

- 10.3 Smurfit Kappa Group

- 10.4 Amcor plc

- 10.5 Mondi Group

- 10.6 Huhtamaki Oyj

- 10.7 Sonoco Products Company

- 10.8 ProAmpac LLC

- 10.9 Storopack Hans Reichenecker GmbH

- 10.10 DS Smith Plc

- 10.11 Winpak Ltd.

- 10.12 Mondi Flexible Packaging

- 10.13 Rengo Co., Ltd.

- 10.14 AptarGroup, Inc.

- 10.15 Toray Plastics (America), Inc.

- 10.16 Schur Flexibles Group