|

市場調查報告書

商品編碼

1851189

商業溫室:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Commercial Greenhouse - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

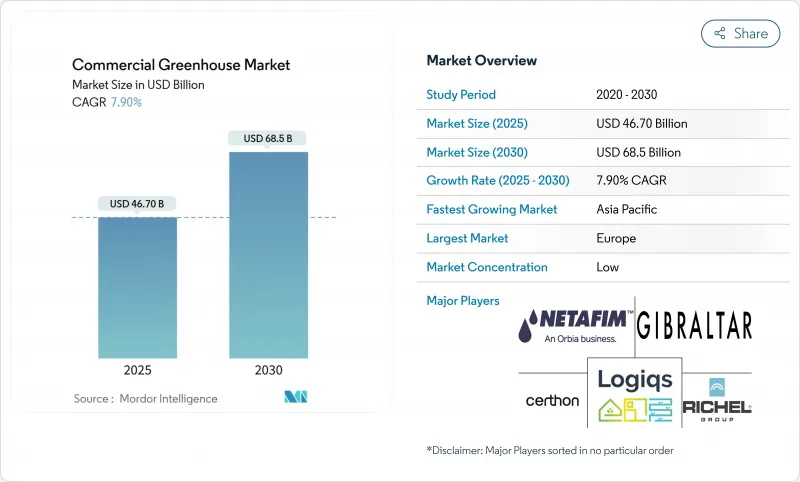

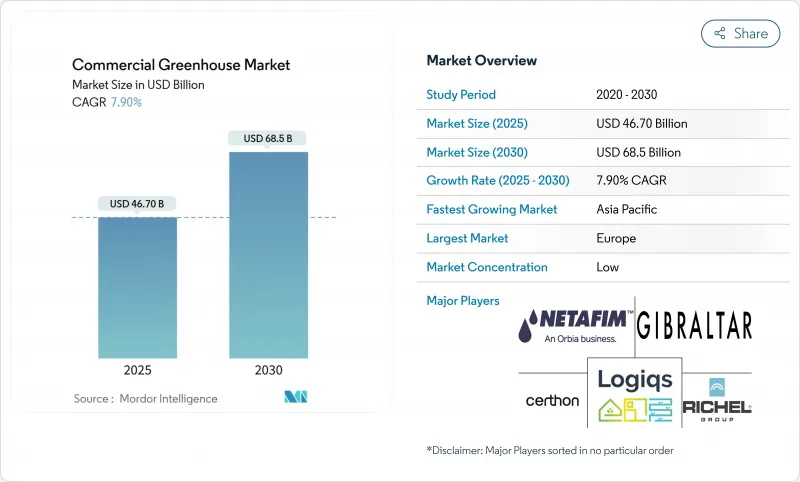

預計到 2025 年,商業溫室市場規模將達到 467 億美元,到 2030 年將達到 685 億美元,預測期內複合年成長率為 7.9%。

隨著適宜露天種植的土地日益減少、極端天氣影響產量穩定性以及零售商要求每週交付無農藥農產品,商業溫室市場正在迅速擴張。種植者正用氣候密封設施取代單層層級構造,這些設施動力來源自發電、人工智慧引導灌溉和高效LED照明,從而降低營運成本和碳排放。溫室即服務合約將一次性建造成本轉化為可預測的費用,使此前難以獲得大規模融資的中型農民也能進入商業溫室市場。雖然歐洲目前佔據最大的市場佔有率,但亞太地區正受到都市化和糧食安全獎勵的推動,快速成長。隨著暖氣、照明和灌溉供應商將產品整合到統一的平台上,分散的競爭格局正在轉向平台化模式。

全球商業溫室市場趨勢與洞察

耕地面積減少,城市擴張

每年約有1200萬公頃可耕地流失,而預計到2030年,城市用地面積將增加三倍。多元化的商業溫室市場營運商正透過保護性栽培系統應對此一壓力,該系統每平方公尺的產量是露天栽培的10到15倍。中國擁有超過400萬公頃的保護性栽培面積,約佔全球總量的80%,這充分證明了該模式的擴充性。資本密集設施採用三層堆疊式苗床、附輸送帶的窄通道以及人工智慧調度系統,可將可用空間提高40%。過去十年,城市附近的土地價格上漲了200%至300%。因此,儘管建設成本不斷上漲,種植者仍認為商業溫室市場具有經濟吸引力。

全年對新鮮農產品的需求

大型連鎖超市希望貨架上的商品供應穩定,不受季節影響。沃爾瑪已與多個州的溫室供應商建立了合作關係,這表明零售商對商業溫室市場充滿信心。隨著Z世代消費者為200公里以內種植的1月上市的番茄支付20%至40%的溢價,採用先進技術的農場正在擴大淨利率夥伴關係。佛羅裡達大學IFAS的水耕溫室每公頃可產生3.3萬美元的現金流。穩定的品質也使得全年生產成為可能,同時減少了損耗並延長了保存期限。

高初始投資

入門級薄膜溫室的成本為每平方公尺250至400美元,而高規格玻璃或聚碳酸酯溫室的成本則為每平方公尺800至1200美元,這使得許多小農戶無力承擔商業溫室市場。為了達到收支平衡,計劃必須達到30%至40%的毛利率和10%至15%的利潤率,這需要製定積極的種植計劃和較高的定價策略。目前,專業貸款機構提供7至10年的貸款,但自2022年起信貸環境收緊,利率已上漲200至300個基點,增加了償債成本。溫室即服務合約可以將資本成本分攤到10至15年,但租賃方仍需要簽訂明確的遠期購買協議以滿足承保人的要求。風暴多發地區較高的保險費進一步增加了固定成本,使得財務可行性更加依賴公用事業收費補貼和碳權收入。因此,許多種植者採取分階段建造的方式,先建造較小的模組,待現金流穩定後再擴大種植面積。

細分市場分析

到2024年,暖氣仍將維持28%的最大市場佔有率,凸顯其在氣候控制領域的普遍作用。 LED陣列正以14.6%的複合年成長率快速成長,預計到2030年,照明市場規模將達到56億美元。可變冷媒流量冷卻器和智慧風門能夠根據蒸騰作用調節氣流,從而減少廢熱。灌溉軟體,例如Netafim GrowSphere,整合了水力學和農藝數據,實現了營養液的自動施用。結構構件正逐漸轉向多層聚碳酸酯,因為其隔熱性能提高了20-30%,但對於價格敏感的農場來說,低成本薄膜仍然佔據主導地位。控制面板是成長最快的細分市場,它將感測器、水泵和照明設備整合到一個類似平板電腦的介面中,從而節省了人力。

硬體製造商現在銷售的捆綁式軟體包包括預先安裝太陽能逆變器的鍋爐、與簾子網同步的LED燈以及為人工智慧作物模型供水的灌溉泵。設備生態系統正趨向於整合式即插即用套件,從而降低了新進入商業溫室市場的企業的准入風險。

水果和蔬菜將佔商業溫室市場的64%,預計到2024年銷售額將超過290億美元。大麻和特種作物的複合年成長率(CAGR)為15%。美國大麻種植者協會(BDSA)估計,到2028年,合法大麻的銷售額將達到580億美元,占美國總銷售額的80%。種植者透過維持遠高於葉菜類蔬菜利潤率的批發價格來證明其高資本支出的合理性。微型菜苗苗盤可在14天內完成生長,每公斤可產生25-40美元的收入,帶來快速的現金回報。育種者正與溫室所有者合作,培育LED最佳化品種,以縮短10-12%的種植週期。

高價值作物需要精確的蒸氣壓差(VPD)、高效能空氣過濾(HEPA)和冗餘電源,這推動了對整合安防和暖通空調(HVAC)套件的需求。垂直育苗架可將幼苗密度提高200-300%,而檯面育苗則可降低電費。

區域分析

到2024年,歐洲將佔商業溫室市場31%的佔有率。荷蘭1萬公頃的高科技玻璃溫室和西班牙2.6萬公頃的塑膠溫室為全年供應提供了保障。歐盟綠色新政的補貼鼓勵使用生質鍋爐、地熱鑽井和LED照明昇級,從而減緩了能源價格的上漲。自動化消除了勞動力瓶頸,如今移動機器人可以在夜間採摘葡萄。

亞太地區是成長最快的地區,複合年成長率達11.6%。中國400萬公頃耕地支撐全球糧食生產。日本2024年水稻歉收引發了對封閉式綠色農場的新一輪投資。印度為兒童遊樂場資本支出提供高達50%的補貼,韓國則在改進半封閉式草莓種植系統以出口。城市消費者收入不斷成長,對食品安全的要求也越來越高,他們正將資金投入更乾淨、可追溯的農產品。

北美地區呈現持續成長態勢。美國新建蔬菜溫室面積超過1.12億平方英尺,較2017年成長19%。安大略省利明頓叢集利用低成本的水力發電和工業二氧化碳,為中西部地區的雜貨店供貨。墨西哥利用政府對節水技術的支持,擴大網室番茄的種植規模,供應國內和美國市場。連鎖餐廳的ESG(環境、社會和治理)承諾進一步提振了國內對生菜的需求,強化了商業溫室產業在區域糧食安全中的作用。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 耕地面積減少,城市擴張

- 全年對新鮮農產品的需求

- 氣候變遷導致天氣變化

- LED和HVAC控制技術的進步

- 低碳農產品的碳權貨幣化

- 溫室即服務租賃模式

- 市場限制

- 高初始資本支出

- 照明和空調能源成本不斷上漲

- 受控環境農業中的人力資源差距

- 深入探討塑膠廢棄物和體積碳排放

- 監管環境

- 技術展望

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過裝置

- 暖氣系統

- 冷卻和通風系統

- LED發光照明

- 灌溉和施肥

- 控制和自動化軟體

- 結構構件(嵌裝玻璃、框架)

- 按作物類型

- 水果和蔬菜

- 花朵

- 香草和微型菜苗

- 大麻和特種作物

- 按溫室類型

- 玻璃溫室

- 溫室

- 硬質聚碳酸酯溫室

- 透過技術

- 水耕

- 非水耕(土壤/基材)

- 混合型和垂直整合型

- 最終用戶

- 商業生產者

- 研究和教育機構

- 園藝中心和苗圃

- 地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 中東其他地區

- 非洲

- 南非

- 埃及

- 肯亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Richel Group

- Certhon

- Gibraltar Industries(RBI)

- Logiqs BV

- Agra-Tech Inc.

- Van Wingerden Greenhouse Company

- Texas Greenhouse Company

- Harnois Industries

- Ceres Greenhouse Solutions

- Netafim

- Van der Hoeven Horticultural Projects

第7章 市場機會與未來展望

The commercial greenhouse market size reached USD 46.7 billion in 2025 and is projected to reach USD 68.5 billion by 2030, advancing at a 7.9% CAGR throughout the forecast period.

The commercial greenhouse market is scaling swiftly as land suited for open-field cultivation dwindles, extreme weather undermines yield reliability, and retailers seek pesticide-free produce that arrives every week of the year. Growers are replacing single-layer structures with climate-tight facilities powered by on-site renewables, AI-guided fertigation, and high-efficacy LEDs that cut operating costs and carbon footprints. Greenhouse-as-a-service contracts convert lump-sum construction bills into predictable fees, opening the commercial greenhouse market to mid-sized farmers who previously lacked collateral for large loans. Europe currently accounts for the largest share, yet Asia-Pacific's urbanization and food-security incentives make it the fastest-growing territory. Fragmented competition is giving way to platform plays, as heating, lighting, and irrigation suppliers merge portfolios into single dashboards.

Global Commercial Greenhouse Market Trends and Insights

Shrinking Arable Land and Urban Expansion

Roughly 12 million hectares of productive soil disappear every year, while urban surfaces are projected to triple by 2030. Diversified commercial greenhouse market operators answer that squeeze with protected cultivation systems that deliver 10-15 times the yield per square meter of open fields. China manages more than 4 million hectares of protected cropping, about 80% of the planet's total, showcasing the model's scalability. Capital-intensive facilities now stack benches three high, run conveyors through narrow aisles, and rely on AI scheduling to boost usable space by 40%. Peri-urban land prices have jumped 200-300% over the last decade; growers, therefore, find the commercial greenhouse market economically superior despite higher construction costs.

Demand for Year-Round Fresh Produce

Big-box grocers want steady shelves regardless of season. Walmart's multi-state partnerships with controlled-environment suppliers illustrate retailer confidence in the commercial greenhouse market, Local Bounti. Generation Z shoppers pay 20-40% premiums for January tomatoes grown within 200 km, widening margins for tech-enabled farms. Net cash flow can reach USD 33,000 per ha in well-run hydroponic houses at the University of Florida IFAS. Consistent caliber also trims shrinkage and lifts shelf life, reinforcing the case for year-round output.

High Up-Front Capital Expenditure

Entry-level film houses cost USD 250-400/m2, while high-spec glass or polycarbonate structures reach USD 800-1,200/m2, locking many smallholders out of the commercial greenhouse market size. To break even, projects must secure gross margins of 30-40% and profit margins of 10-15%, a hurdle that demands tight crop scheduling and premium price realization. Specialized lenders now offer 7-10-year loans, yet monetary tightening since 2022 has pushed interest rates 200-300 bp higher, inflating debt service. Greenhouse-as-a-service contracts spread capital costs over 10-15 years, but lessees still need solid forward-purchase agreements to satisfy underwriters. Higher insurance premiums for storm-prone zones add another layer of fixed cost, making financial viability sensitive to utility rebates and carbon credit revenue. As a result, many growers phase construction in small modules, scaling acreage only after proven cash flow.

Other drivers and restraints analyzed in the detailed report include:

- Climate-Change-Induced Weather Volatility

- Advances in LED and Climate-Control Technology

- Rising Energy Costs for Lighting and HVAC

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Heating retained the largest share at 28% in 2024, underscoring climate control's universal role. LED arrays are the fastest growers at a 14.6% CAGR, with the lighting slice of the commercial greenhouse market size projected to top USD 5.6 billion by 2030. Variable-refrigerant-flow coolers and smart dampers now align airflow with transpiration rates, trimming waste heat. Irrigation software exemplified by Netafim GrowSphere unifies hydraulic and agronomic data, automating nutrient dosing. Structural parts shift toward multi-wall polycarbonate for 20-30% better insulation, but the low-cost film still dominates price-sensitive farms. Control dashboards are the fastest-expanding subsegment, consolidating sensors, pumps, and lights into one tablet view that saves labor.

Hardware makers now market bundled packages: boilers pre-wired to solar inverters, LEDs synchronized with shade screens, and fertigation pumps that feed AI crop models. The equipment ecosystem is converging on integrated, plug-and-play kits that de-risk adoption for newcomers to the commercial greenhouse market.

Fruits and vegetables led revenue with 64% of the commercial greenhouse market in 2024, translating to more than USD 29 billion. Cannabis and specialty crops are advancing at a 15% CAGR. BDSA sees legal cannabis sales hitting USD 58 billion by 2028, 80% of the United States. Producers justify high CAPEX with wholesale prices that remain several multiples above leafy-green margins. Micro-green trays finish in under 14 days and earn USD 25-40/kg, delivering swift cash recovery. Breeders collaborate with greenhouse owners to spawn LED-optimised cultivars that shave grow cycles by 10-12%.

High-value crops need precise VPD, HEPA filtration, and redundant power, fuelling demand for integrated security and HVAC kits. Vertical propagation racks raise seedling density by 200-300%, while bench-level finishing cuts electricity bills, illustrating the hybrid strategies permeating the commercial greenhouse market.

The Greenhouse Market Report is Segmented by Equipment Type (Heating Systems, and More), by Crop Type (Fruits and Vegetables, and More), by Greenhouse Type (Glass Greenhouse, Plastic-Film Greenhouse, and More), by Technology (Hydroponic, Non-Hydroponic, and More), by End-Use (Commercial Growers, and More) and Geography (North America, Europe, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe commanded 31% of the commercial greenhouse market in 2024. The Netherlands' 10,000 ha of high-tech glasshouses and Spain's 26,000 ha plastic-house cluster underpin year-round supply. EU Green Deal subsidies fuel biomass boilers, geothermal drills, and LED upgrades that blunt high energy prices. Automation addresses labor bottlenecks, as mobile robots pick vine crops during night shifts.

Asia-Pacific is the fastest-rising region at an 11.6% CAGR. China's 4 million ha footprint anchors global volume. Japan's 2024 rice shock triggered fresh funding for sealed green farms. India subsidizes up to 50% of playhouse CAPEX, while South Korea refines semi-closed strawberry systems for export. Urban consumers with rising incomes and food-safety expectations are steering capital toward cleaner, traceable produce.

North America shows durable growth. The United States hosts more than 112 million ft2 of vegetable greenhouses, up 19% since 2017. Ontario's Leamington cluster taps low-cost hydropower and industrial CO2 to supply Midwest grocers. Mexico expands net-house tomatoes for both domestic and US markets, leveraging government support for water-efficient tech. ESG pledges from restaurant chains further lift domestic demand for low-mile lettuce, consolidating the commercial greenhouse industry's role in regional food security.

- Richel Group

- Certhon

- Gibraltar Industries (RBI)

- Logiqs B.V.

- Agra-Tech Inc.

- Van Wingerden Greenhouse Company

- Texas Greenhouse Company

- Harnois Industries

- Ceres Greenhouse Solutions

- Netafim

- Van der Hoeven Horticultural Projects

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Shrinking arable land and urban expansion

- 4.2.2 Demand for year-round fresh produce

- 4.2.3 Climate-change-induced weather volatility

- 4.2.4 Advances in LED and climate-control technology

- 4.2.5 Carbon-credit monetization for low-footprint produce

- 4.2.6 Greenhouse-as-a-Service leasing models

- 4.3 Market Restraints

- 4.3.1 High up-front capital expenditure

- 4.3.2 Rising energy costs for lighting and HVAC

- 4.3.3 The talent gap in controlled-environment agronomy

- 4.3.4 Plastic waste and embodied carbon scrutiny

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 By Equipment Type

- 5.1.1 Heating Systems

- 5.1.2 Cooling and Ventilation Systems

- 5.1.3 LED Grow-Lighting

- 5.1.4 Irrigation and Fertigation

- 5.1.5 Control and Automation Software

- 5.1.6 Structural Components (Glazing, Frames)

- 5.2 By Crop Type

- 5.2.1 Fruits and Vegetables

- 5.2.2 Flowers and Ornamentals

- 5.2.3 Herbs and Micro-greens

- 5.2.4 Cannabis and Specialty Crops

- 5.3 By Greenhouse Type

- 5.3.1 Glass Greenhouses

- 5.3.2 Plastic-film Greenhouses

- 5.3.3 Rigid Polycarbonate Greenhouses

- 5.4 By Technology

- 5.4.1 Hydroponic

- 5.4.2 Non-hydroponic (Soil/Substrate)

- 5.4.3 Hybrid and Vertical Integration

- 5.5 By End-user

- 5.5.1 Commercial Growers

- 5.5.2 Research and Educational Institutes

- 5.5.3 Retail Garden Centres and Nurseries

- 5.6 Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.1.4 Rest of North America

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Russia

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of the Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Egypt

- 5.6.6.3 Kenya

- 5.6.6.4 Rest of Africa

- 5.6.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank / Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Richel Group

- 6.4.2 Certhon

- 6.4.3 Gibraltar Industries (RBI)

- 6.4.4 Logiqs B.V.

- 6.4.5 Agra-Tech Inc.

- 6.4.6 Van Wingerden Greenhouse Company

- 6.4.7 Texas Greenhouse Company

- 6.4.8 Harnois Industries

- 6.4.9 Ceres Greenhouse Solutions

- 6.4.10 Netafim

- 6.4.11 Van der Hoeven Horticultural Projects