|

市場調查報告書

商品編碼

1851153

雲端計費:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Cloud Billing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

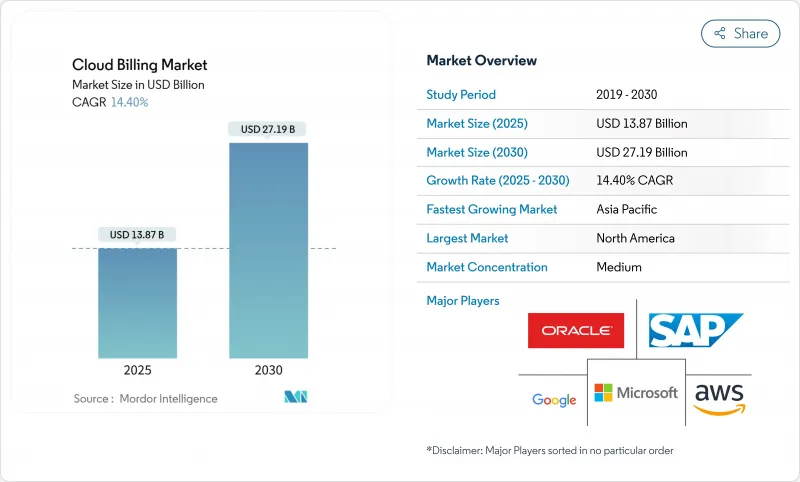

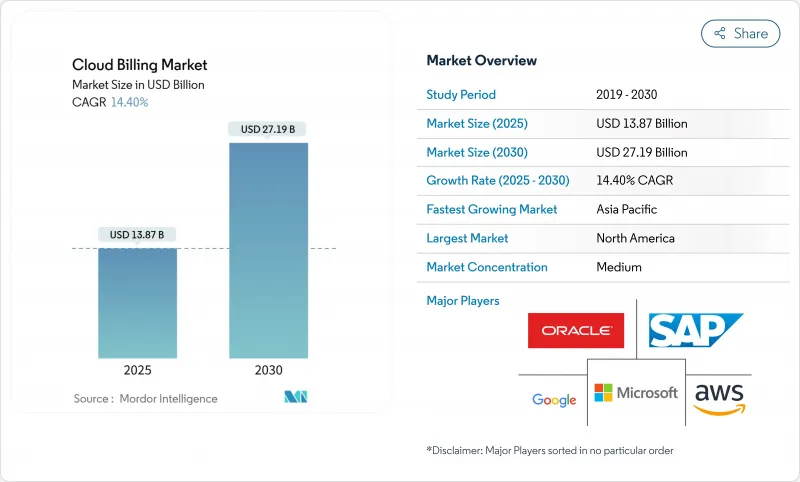

據估計,2025 年雲端計費市場規模為 138.7 億美元,預計到 2030 年將達到 271.9 億美元,預測期(2025-2030 年)複合年成長率為 14.40%。

企業正將支出轉向客製化的商業模式,以便將數百萬筆計量記錄無延遲地轉化為發票。向多重雲端環境的遷移以及由此產生的對精細化成本歸因的需求,是推動這兩位數成長的關鍵因素。超大規模企業加大基礎設施投資、即時計量技術的進步,以及採購模式從基於容量向基於結果的顯著轉變,都提升了雲端計費市場的重要性。同時,採用機器學習驅動的成本最佳化功能的專業供應商正在縮短部署週期,並減輕企業財務營運團隊的技能負擔。

全球雲端計費市場趨勢與洞察

加速多重雲端採用

隨著企業分散工作負載以平衡彈性、價格和資料居住義務,多重雲端策略正日益普及。 Kubernetes 基於策略的資源控制表明,細粒度的自動擴展能夠在保持管治的同時,有效控制不可預測的支出。收費平台現在可以即時協調不同的價格手冊、貨幣和分類標準,並提供有助於實現單元級責任制的扣回爭議帳款報告。隨著超大規模雲端服務商開放消費 API 以縮短資料擷取週期,以及企業為避免單一供應商風險而採用多種雲端服務供應商,雲端計費市場正在蓬勃發展。這將推動對能夠規範多重雲端遠端檢測並提供統一儀錶板的收費引擎的需求。

電子商務訂閱模式的興起

訂閱式商務不再侷限於SaaS。零售商正在整合實體商品、內容包、混合會員模式,這些都需要複雜的定價、分級附加元件和定期促銷活動。平台必須協調行為觸發定價,並針對特定國家/地區的支付方式、PSD2義務和GDPR要求對結帳流程進行在地化。循環型商務的成長透過拓展使用者群體,從軟體發行商擴展到銷售實體產品的商家,從而增強了雲端發票市場。

從傳統本地收費到新系統的複雜遷移

長期沿用的本地收費系統通常包含未記錄的業務邏輯,導致資料映射和規則轉換困難。對於受監管行業的公司而言,PCI-DSS、SOX 和 HIPAA 等遷移要求同時適用,需要雙重營運環境,從而增加計劃預算。這些資源負擔阻礙了全面遷移,並減緩了雲端計費市場的近期成長。

細分市場分析

混合環境正以 16.3% 的複合年成長率成長,它將本地資產與超大規模彈性相結合。預計從 2025 年到 2030 年,混合解決方案的雲端計費市場規模也將以 16.3% 的複合年成長率成長。企業重視在不犧牲資料駐留或延遲敏感型處理的情況下遷移工作負載的能力,但卻面臨成本結構片段化的問題。收費供應商正在透過發布適配器來應對這項挑戰,這些適配器能夠協調私有雲端雲遙測資料與公共雲端費率表。

公共雲端憑藉其簡易性和廣泛的工具生態系統,保持著 66.7% 的收入領先優勢。然而,合規性、邊緣用例和地緣政治因素都強化了混合支出管治的重要性。因此,雲端計費市場正在轉向統一的編配引擎,以計算混合有效費率並顯示跨地域的差異報告。

隨著企業將藍圖規劃、整合和最佳化外包,服務收入正以17.1%的複合年成長率成長。服務提供者將諮詢、實施和營運管理打包,以更快地實現投資回報。平台仍佔60.8%的市場佔有率,但在客製化管理至關重要的監管領域,以服務主導的合作模式正逐漸站穩腳步。

雲端計費市場受益於服務專家將領域細微差別轉化為配置基準,從而降低部署風險。將平台許可與生命週期服務相結合的捆綁服務有助於建立更牢固的契約,並支持擴展到相鄰的成本管治模組,例如碳排放追蹤和合作夥伴支付。

雲端計費市場按部署方式(公共雲端、私有雲端、混合雲端)、組件(平台和服務)、收費模式(基於訂閱、基於使用量、混合)、雲端服務模式(SaaS收費、PaaS收費、IaaS收費)、組織規模(大型企業和中小企業)、最終用戶垂直行業(零售和電子商務、銀行、金融服務和電子商務地區進行市場進行細分、金融和地區進行金融服務和電子商務地區。

區域分析

北美地區預計到2024年將佔全球營收的37.2%,並將繼續受益於超大規模資料中心、創業投資資金和金融營運(FinOps)人才的集中。該地區重視遵守《薩班斯-奧克斯利法案》等框架以及州級隱私法的供應商。人工智慧工作負載的高利用率也推動了收費服務的普及,並增加了對即時計費的需求。

亞太地區以16.8%的複合年成長率成為成長最快的地區,這主要得益於公共部門數位化、行動優先的消費群以及政府的人工智慧運算舉措。印度的國家GPU計畫展現了政府補貼如何推動雲端運算能力的發展。日本的Carbon Link電池網路凸顯了該地區對成本和環境關鍵績效指標(KPI)兼顧的重視。提供本地化和語言支援的供應商搶佔了先機。

歐洲正努力在GDPR領導地位與數位主權計劃興起之間尋求平衡。企業需要本地資料中心和透明的資料處理鏈,因此,能夠確保在地化的收費平台成為重中之重。鼓勵碳排放最佳化調度的舉措正推動雲端居住市場向環境扣回爭議帳款報告模式發展。各國法規的碎片化延長了採購週期,但也增加了新進入者的門檻,並鞏固了客戶對那些能夠駕馭合規細微之處的供應商的忠誠度。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加速多重雲端採用

- 電子商務訂閱模式的興起

- 對即時按使用量定價的需求日益成長

- 面向Web3Start-Ups的憑證式的雲端消費模式

- 考慮碳排放的工作負載調度獎勵

- 市場限制

- 從傳統本地收費遷移的複雜性

- 數據主權和跨境合規成本

- FinOps 工具的興起蠶食了原生收費利潤

- 產業價值鏈分析

- 監管環境

- 技術視角(用於自動開票的生成式人工智慧)

- 產業吸引力:波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟因素如何影響市場

第5章 市場規模及成長預測(金額)

- 透過部署

- 公有雲

- 私有雲端

- 混合雲

- 按組件

- 平台

- 服務

- 按收費模式

- 基於訂閱

- 使用群體

- 混合模式(訂閱+使用量)

- 透過雲端服務模式

- SaaS收費

- PaaS收費

- IaaS收費

- 按組織規模

- 主要企業

- 中小企業

- 按最終用戶行業分類

- 零售與電子商務

- BFSI

- 通訊業

- 醫療保健和生命科學

- 能源與公共產業

- 政府/公共部門

- 媒體與娛樂

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 新加坡

- 馬來西亞

- 澳洲

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Amazon Web Services(AWS)Inc.

- Microsoft Corporation(Azure)

- Google Cloud Platform

- Oracle Corporation

- SAP SE

- Salesforce Inc.(Revenue Cloud)

- Zuora Inc.

- Aria Systems Inc.

- BillingPlatform LLC

- FinancialForce LLC

- IBM Corporation

- Comarch SA

- Tencent Cloud

- Huawei Cloud

- Alibaba Cloud

- CloudBlue(An Ingram Micro Co.)

- CloudHealth(Vmware)

- Chargebee Inc.

- Recurly Inc.

- Stripe Billing

- Paddle.com Market Ltd.

- ChargeOver LLC

- Vertex Inc.

- GoCardless Ltd.

- Orb Inc.

- SaaSOptics(An Ramped Co.)

- LogiSense Corp.

- Gotransverse LLC

- Rev.io Technologies

第7章 市場機會與未來趨勢

- 閒置頻段與未滿足需求評估

The Cloud Billing Market size is estimated at USD 13.87 billion in 2025, and is expected to reach USD 27.19 billion by 2030, at a CAGR of 14.40% during the forecast period (2025-2030).

Enterprises are diverting spending toward usage-aligned commercial models that can translate millions of metering records into invoices without latency. Migration toward multi-cloud environments and the attendant demand for granular cost attribution are the pivotal forces behind this double-digit expansion. Heightened infrastructure outlays by hyperscalers, advances in real-time metering, and a pronounced shift from capacity-based to outcome-based purchasing have all amplified the relevance of the cloud billing market. In parallel, specialized vendors that embed machine-learning cost-optimization features are compressing implementation timelines and easing the skills burden on enterprise FinOps teams.

Global Cloud Billing Market Trends and Insights

Accelerating Multi-Cloud Adoption

Multi-cloud strategies are rising as organizations distribute workloads to balance resilience, pricing, and data-residency mandates. Policy-driven resource controls inside Kubernetes have demonstrated that finely tuned autoscaling curbs unpredictable spend while maintaining governance. Billing platforms now reconcile divergent price books, currencies, and taxonomies in real time and supply chargeback reports that promote unit-level accountability. The cloud billing market gains tailwinds as hyperscalers publish consumption APIs that shorten data-ingestion cycles and as enterprises escape single-vendor risk by embracing provider diversity. Demand, therefore, concentrates on billing engines that normalise multi-cloud telemetry and present unified dashboards.

Expansion of E-Commerce Subscription Models

Subscription commerce no longer applies exclusively to SaaS. Retailers integrate physical goods, content bundles, and hybrid memberships that require intricate proration, tiered add-ons, and cyclical promotions. Platforms must orchestrate price adjustments triggered by customer behaviour and localise checkout in line with country-specific payment methods, PSD2 mandates, and GDPR obligations. Growth in recurring commerce strengthens the cloud billing market by broadening the user base from software publishers to merchants that ship tangible products.

Migration Complexities from Legacy On-Premises Billing

Long-standing on-prem billing stacks often carry undocumented business logic, making data mapping and rule translation difficult. Enterprises in regulated verticals simultaneously uphold PCI-DSS, SOX, or HIPAA mandates during cut-over, obliging dual-run environments that inflate project budgets. The resource burden deters some organisations from full transition and tempers the near-term expansion pace of the cloud billing market.

Other drivers and restraints analyzed in the detailed report include:

- Rising Demand for Real-Time Usage-Based Pricing

- Token-Based Cloud Consumption Models in Web3 Startups

- Data-Sovereignty and Cross-Border Compliance Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hybrid environments are recording a 16.3% CAGR as organisations pair on-prem assets with hyperscale elasticity. The cloud billing market size for hybrid solutions is projected to expand at a 16.3% CAGR between 2025-2030. Enterprises value the capacity to shift workloads without forfeiting data residency or latency-sensitive processing, yet they encounter fractured cost structures. Billing vendors respond by releasing adapters that harmonise private-cloud telemetry with public-cloud rate cards.

Public deployment retains a 66.7% revenue lead thanks to simplicity and broad tooling ecosystems. Nevertheless, compliance triggers, edge use cases, and geopolitics strengthen the case for hybrid spend governance. The cloud billing market, therefore, pivots toward unified orchestration engines that calculate blended effective rates and surface variance reports across locations.

Services revenue is climbing at 17.1% CAGR as enterprises outsource roadmap planning, integration, and optimisation. Providers bundle advisory, implementation, and managed operations that target rapid payback. Platforms continue to dominate with a 60.8% share, yet service-led engagement secures footholds in regulated domains where bespoke controls are pivotal.

The cloud billing market benefits because service specialists translate domain nuances into configuration baselines that shrink deployment risk. Bundled offerings that pair platform licences with lifecycle services foster stickier contracts and unlock expansion into adjacent cost-governance modules such as carbon tracing and partner settlement.

Cloud Billing Market is Segmented by Deployment (Public Cloud, Private Cloud, and Hybrid Cloud), Component (Platform and Services), Billing Model (Subscription-Based, Usage-Based, and Hybrid), Cloud Service Model (SaaS Billing, Paas Billing, and IaaS Billing), Organization Size (Large Enterprises and Small and Medium Enterprises), End-User Industry (Retail and E-Commerce, BFSI, and More), and Geography.

Geography Analysis

North America generated 37.2% of 2024 revenue and continues to benefit from a concentration of hyperscalers, venture funding, and FinOps talent. The region rewards vendors that comply with frameworks such as SOX and state-level privacy statutes. High usage of AI workloads also catalyses the adoption of token-metered services, reinforcing demand for real-time rating.

Asia-Pacific posts the fastest 16.8% CAGR due to public-sector digitisation, mobile-first consumer bases, and sovereign AI compute initiatives. India's national GPU programme exemplifies how government grants catalyse cloud capacity that must be monetised through scalable billing. Japan's carbon-linked battery network highlights regional appetite for merging cost with environmental KPIs. Providers that bundle localisation and language support gain early footholds.

Europe balances GDPR leadership with emerging digital sovereignty plans. Enterprises require local data centres and transparent data-processing chains, so billing platforms that guarantee regional residency gain preference. Initiatives encouraging carbon-aware scheduling drive the cloud billing market toward environmental chargeback reports. Fragmented national rules prolong procurement cycles, yet they also amplify barriers for newcomers and solidify loyalty to vendors adept at navigating compliance nuances.

- Amazon Web Services (AWS) Inc.

- Microsoft Corporation (Azure)

- Google Cloud Platform

- Oracle Corporation

- SAP SE

- Salesforce Inc. (Revenue Cloud)

- Zuora Inc.

- Aria Systems Inc.

- BillingPlatform LLC

- FinancialForce LLC

- IBM Corporation

- Comarch SA

- Tencent Cloud

- Huawei Cloud

- Alibaba Cloud

- CloudBlue (An Ingram Micro Co.)

- CloudHealth (Vmware)

- Chargebee Inc.

- Recurly Inc.

- Stripe Billing

- Paddle.com Market Ltd.

- ChargeOver LLC

- Vertex Inc.

- GoCardless Ltd.

- Orb Inc.

- SaaSOptics (An Ramped Co.)

- LogiSense Corp.

- Gotransverse LLC

- Rev.io Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating multi-cloud adoption

- 4.2.2 Expansion of e-commerce subscription models

- 4.2.3 Rising demand for real-time usage-based pricing

- 4.2.4 Token-based cloud consumption models in Web3 startups

- 4.2.5 Carbon-aware workload scheduling incentives

- 4.3 Market Restraints

- 4.3.1 Migration complexities from legacy on-prem billing

- 4.3.2 Data-sovereignty and cross-border compliance costs

- 4.3.3 Rising FinOps tooling cannibalising native billing margins

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (Generative AI for automated invoicing)

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Deployment

- 5.1.1 Public Cloud

- 5.1.2 Private Cloud

- 5.1.3 Hybrid Cloud

- 5.2 By Component

- 5.2.1 Platform

- 5.2.2 Services

- 5.3 By Billing Model

- 5.3.1 Subscription-based

- 5.3.2 Usage-based

- 5.3.3 Hybrid (Subscription + Usage)

- 5.4 By Cloud Service Model

- 5.4.1 SaaS Billing

- 5.4.2 PaaS Billing

- 5.4.3 IaaS Billing

- 5.5 By Organization Size

- 5.5.1 Large Enterprises

- 5.5.2 Small and Medium Enterprises (SMEs)

- 5.6 By End-user Industry

- 5.6.1 Retail and E-commerce

- 5.6.2 BFSI

- 5.6.3 Telecommunications

- 5.6.4 Healthcare and Life Sciences

- 5.6.5 Energy and Utilities

- 5.6.6 Government and Public Sector

- 5.6.7 Media and Entertainment

- 5.6.8 Other End-user Industries

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Argentina

- 5.7.2.3 Chile

- 5.7.2.4 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 United Kingdom

- 5.7.3.3 France

- 5.7.3.4 Italy

- 5.7.3.5 Spain

- 5.7.3.6 Russia

- 5.7.3.7 Rest of Europe

- 5.7.4 Asia-Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 Singapore

- 5.7.4.6 Malaysia

- 5.7.4.7 Australia

- 5.7.4.8 Rest of Asia-Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 United Arab Emirates

- 5.7.5.1.2 Saudi Arabia

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Egypt

- 5.7.5.2.4 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Amazon Web Services (AWS) Inc.

- 6.4.2 Microsoft Corporation (Azure)

- 6.4.3 Google Cloud Platform

- 6.4.4 Oracle Corporation

- 6.4.5 SAP SE

- 6.4.6 Salesforce Inc. (Revenue Cloud)

- 6.4.7 Zuora Inc.

- 6.4.8 Aria Systems Inc.

- 6.4.9 BillingPlatform LLC

- 6.4.10 FinancialForce LLC

- 6.4.11 IBM Corporation

- 6.4.12 Comarch SA

- 6.4.13 Tencent Cloud

- 6.4.14 Huawei Cloud

- 6.4.15 Alibaba Cloud

- 6.4.16 CloudBlue (An Ingram Micro Co.)

- 6.4.17 CloudHealth (Vmware)

- 6.4.18 Chargebee Inc.

- 6.4.19 Recurly Inc.

- 6.4.20 Stripe Billing

- 6.4.21 Paddle.com Market Ltd.

- 6.4.22 ChargeOver LLC

- 6.4.23 Vertex Inc.

- 6.4.24 GoCardless Ltd.

- 6.4.25 Orb Inc.

- 6.4.26 SaaSOptics (An Ramped Co.)

- 6.4.27 LogiSense Corp.

- 6.4.28 Gotransverse LLC

- 6.4.29 Rev.io Technologies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment