|

市場調查報告書

商品編碼

1851129

教育機器人:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Educational Robot - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

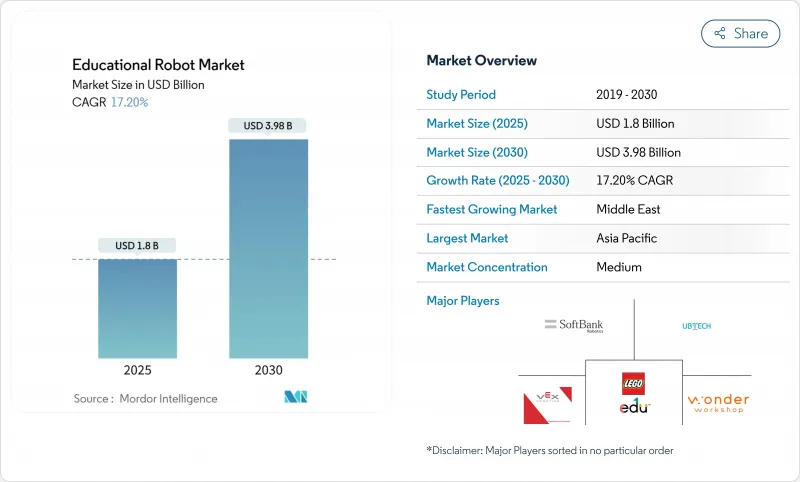

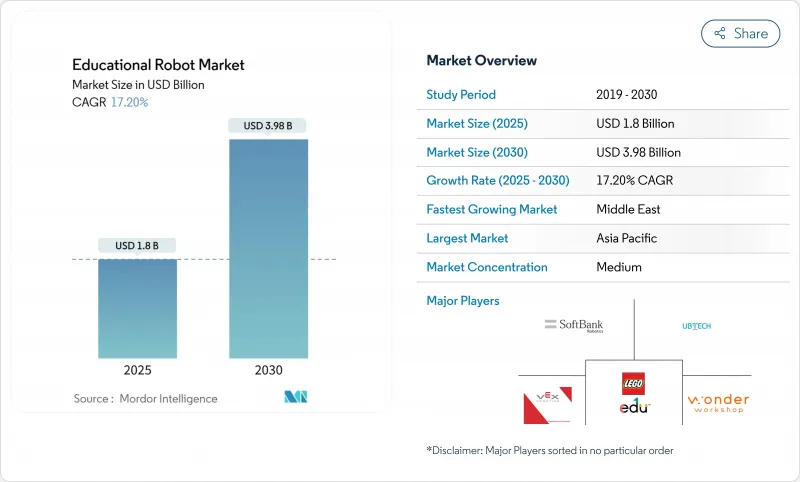

教育機器人市場預計到 2025 年將達到 18 億美元,到 2030 年將達到 39.8 億美元,在此期間的複合年成長率為 17.2%。

大規模語言模式人工智慧的快速整合正將課堂機器人轉變為能夠即時調整教學內容和節奏的自適應學習夥伴。硬體價格正在下降,尤其是中國製造的伺服馬達和感測器,這使得預算有限的學校也能更容易獲得這些設備。東亞、歐洲和北美的政策制定者正在將機器人技術納入國家STEM(科學、技術、工程和數學)發展議程,從而建立穩固的需求基礎。同時,創業投資正湧入專注於特殊教育、多語言內容缺口或機器人即服務模式的新興企業,重塑競爭動態。

全球教育機器人市場趨勢與洞察

在東亞地區,人工智慧社交機器人在幼兒語言教學中的應用日益廣泛。

這款機器人搭載了大規模語言模式自然語言處理引擎,能夠提供文化適應性強的語言課程,即時修正發音,並根據孩子的情緒訊號調整課程難度。對照研究表明,與教師主導的練習相比,其詞彙成長速度提高了28%,記憶維持率提高了34%。出版商只需刷寫新的AI模型,即可將相同硬體移植到多種語言。這種擴充性吸引了投資者,並促使地方政府津貼課堂部署,從而強化了教育機器人市場的成長循環。提供與課程相符的分析儀錶板的供應商可以獲得更高的價格。

歐洲K-12學校的強制機器人課程

歐洲各國教育部門如今要求中小學各階段都配備機器人,將零星的試點計畫轉變為專案預算撥款。學校對能夠同時進行教學和評估的機器人的需求日益成長,促使供應商整合安全的資料收集模組,用於記錄學生互動並自動批改作業。硬體差異化正逐漸消失,內容豐富度、教師培訓方案以及符合GDPR標準的雲端架構如今成為合約的主要驅動力。這項政策轉變也促使課程出版商與機器人製造商合作開發課程計劃,加劇了生態系統的鎖定效應,並提高了教育機構的轉換成本。

課堂連續使用期間電池組故障率高

熱帶氣候會加速鋰離子電池的劣化,導致38%的電池組在課堂負載下一年內失效。頻繁的故障維修會加重學校預算負擔,擾亂教學計劃,並降低學校的採購意願。供應商正在透過混合動力架構來應對這一問題,該架構可在有充電樁可用時切換到直流供電,並採用被動散熱外殼來散熱。電池更換方案正逐漸成為採購標準,尤其是在政府競標中,這些招標通常會規定五年生命週期成本。能夠為電池提供度C環境認證的公司正在獲得競爭優勢。

細分市場分析

到2024年,非人形機器人將佔據教育機器人市場68%的佔有率,其優勢在於堅固耐用、操作簡單且價格親民。像Code & Go Mouse這樣的課堂熱門產品能夠承受日常使用,並能大規模地教授程式設計概念。然而,隨著學校觀察到學生參與度的顯著提高,尤其是在自閉症計畫中,人形機器人平台正以23.4%的複合年成長率快速成長。早期用戶表示,當機器人透過臉部LED燈和軟性關節展現情感時,學生的注意力會更加集中。因此,由於零件成本的下降,人形教育機器人市場規模預計將縮小部分價格差距。

大規模語言模型的整合將使人形機器人能夠提供非腳本化的對話和動態回饋。一項於2025年啟動的Duet系統試點計畫將熟練度評分與基於臉部辨識的參與度指標相結合,使教師能夠僅在必要時進行干預。供應商目前已開始交付預先安裝了語言、社交情緒學習和特殊需求治療課程的人形機器人。儘管前期投入成本仍然很高,但諸如「機器人即服務」(Robots-as-a-Service)之類的資金籌措方案正在降低准入門檻,使人形機器人能夠在小眾但影響巨大的領域迅速佔據市場佔有率。

由於機器人本身俱有實體特性,硬體將在2024年佔總收入的74%:底盤、感測器、處理器和電源系統仍然至關重要。組件創新主要集中在緊湊型人工智慧加速器和低成本伺服上,以降低物料清單成本。同時,隨著學校轉向涵蓋維護、軟體更新和教師培訓的訂閱套餐,服務部門正以25%的複合年成長率成長。供應商強調可預測的預算和持續的功能更新,以證明月費的合理性。

自適應學習演算法、雲端分析和合規模組正在影響採購決策。因此,硬體利潤空間被壓縮,迫使企業捆綁終身軟體授權或完全轉向服務協議。這種轉變重新調整了獎勵,使收入主要來自於續約而非一次性銷售,製造商也因此增加對人工智慧迭代改進的投入。對於學區而言,計量收費模式無需資本支出,並確保教室設備始終保持最新狀態。

區域分析

以中國、日本和韓國為首的亞太地區引領機器人產業的發展,預計2024年將佔全球收入的38%。北京的「十四五」規劃累計4,520萬美元用於機器人創新,而東京的新機器人策略也將投入4.4億美元用於扶持國內產業。韓國每萬名工人擁有1,012台機器人,這項高機器人密度造就了技術純熟勞工隊伍和對機器人技術接受度高的教育產業。深圳的供應商出口低成本的零件套件,壓縮了全球材料清單,並提升了亞洲製造商在教育機器人市場的影響力。

中東地區到2030年將以22%的複合年成長率成為成長最快的地區。沙烏地阿拉伯的「未來智慧計畫」計畫培訓3萬名學生掌握人工智慧技術,而SAMAI舉措的目標對象為100萬公民。企業社會責任預算將用於資助公立學校的機器人實驗室,以避免購買瓶頸。阿拉伯聯合大公國(阿拉伯聯合大公國)正在深化與美國和亞洲晶片製造商的合作,以實現供應鏈獨立,並將杜拜和阿布達比打造為針對阿拉伯語課程最佳化的多語言教育機器人的試驗基地。

北美地區在發展的同時日益成熟。白宮發布的2024年CoSTEM報告指出,美國國家科學基金會(NSF)津貼7,000萬美元用於機器人技術研究,國防部也支持了超過1,300支FIRST機器人競賽團隊。大學與產業界的合作聯盟正在加速從原型到教室的轉化,遠距臨場系統機器人正在幫助解決農村地區教師短缺的問題。與歐洲相比,北美不受GDPR(一般資料保護規範)限制的資料管理模式使得以雲端為中心的分析和更快的部署速度成為可能。

歐洲的強制性機器人課程需求穩定,但GDPR合規性將增加整合成本。 「地平線歐洲」計畫已撥款1.835億美元用於機器人研發,而德國的高科技戰略也已為教育領域劃撥了3.692億美元。供應商正在整合設備端處理技術以滿足資料主權要求。北歐國家正在試行解釋人工智慧模組,這些模組會記錄每次機器人與學生互動的決策樹,為其他國家樹立了標竿。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 將人工智慧社交機器人引入東亞幼兒語言教學

- 歐洲K-12學校的強制機器人課程

- 政府資助的STEM舉措(例如美國國家科學基金會DRK-12計劃)推動大學採購。

- 中國教育級伺服馬達和感測器的平均售價下降

- 北美遠距/混合式學習的激增推動了遠距臨場系統教學機器人的發展

- 企業社會責任預算用於贊助中東公立學校的機器人實驗室

- 市場限制

- 課堂連續使用期間電池組故障率高(熱帶氣候)

- 非拉丁語系國家人形機器人多語言內容庫的局限性

- GDPR 為歐盟雲端連結機器人主導的資料隱私成本

- 非洲農村地區缺乏合格的機器人技術指導員

- 價值/供應鏈分析

- 監理與技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析(資金籌措、曼德勒、創投趨勢)

第5章 市場規模與成長預測

- 按類型

- 人形

- 非人形

- 按組件

- 硬體

- 軟體

- 服務

- 依教育程度

- 學前班(幼兒園)

- 小學教育

- 中等教育

- 高等教育

- 特殊教育

- 學習模式/目的

- 程式設計和STEM

- 語言學習

- 人工智慧和機器人調查

- 特殊需求治療

- 遠距臨場系統與遠距教學

- 最終用戶

- 學校

- 大學和學院

- 職業培訓機構

- 教育科技公司

- 特殊教育中心

- 創客空間與機器人俱樂部

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 北歐國家

- 其他歐洲地區

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 其他非洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 東南亞

- 亞太其他地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略性舉措(夥伴關係、課程合作、企業社會責任實驗室)

- 市佔率分析

- 公司簡介

- SoftBank Robotics Corp.

- UBTECH Robotics Inc.

- Hanson Robotics Ltd.

- Lego Education(The Lego Group)

- Wonder Workshop Inc.

- Robotis Co., Ltd.

- VEX Robotics Inc.

- Makeblock Co., Ltd.

- Sphero Inc.

- Modular Robotics(Cubelets)

- Blue Frog Robotics

- Aisoy Robotics

- Sanbot Innovation(Qihan)

- PAL Robotics

- Probotics America

- Robobuilder Co., Ltd.

- Dash Robotics(Kamigami)

- RobotLAB Inc.

- DJI RoboMaster

- Ozobot and Evollve Inc.

- Fischertechnik GmbH

- RoboTerra Inc.

- Roborisen(e-Bo)

- RoboSense(Edu)

第7章 市場機會與未來展望

The educational robot market size stands at USD 1.8 billion in 2025 and is forecast to reach USD 3.98 billion by 2030, reflecting a brisk 17.2% CAGR during the period.

Rapid integration of large-language-model AI is turning classroom robots into adaptive learning companions that adjust content and pacing in real time. Hardware prices are falling-especially for China-sourced servomotors and sensors-broadening access for budget-constrained schools. Policymakers in East Asia, Europe, and North America are embedding robotics in national STEM agendas, creating assured demand pipelines. Meanwhile, venture capital is flowing to startups that target special education, multilingual content gaps, or Robots-as-a-Service models, reshaping competitive dynamics.

Global Educational Robot Market Trends and Insights

Adoption of AI-enabled Social Robots for Early-Childhood Language Tutoring in East Asia

Robots equipped with large-language-model NLP engines now deliver culturally adaptive language lessons that correct pronunciation in real time and adjust difficulty based on a child's emotional cues. Controlled studies record 28% faster vocabulary gains and 34% higher retention than teacher-led drills. Publishers are porting the same hardware to multiple languages simply by flashing new AI models, enabling manufacturers to chase diverse markets without redesign costs. This scalability is enticing investors and encouraging local governments to subsidize classroom deployments, thereby reinforcing the growth loop for the educational robot market. Suppliers that bundle curriculum-aligned analytics dashboards are capturing premium pricing because schools value quantifiable progress tracking.

Mandatory Robotics Curriculum in K-12 Schools across Europe

European ministries of education now require robotics competencies throughout primary and secondary grades, which has turned sporadic pilot programs into line-item budget allocations. Schools increasingly solicit robots that can both teach and assess, prompting vendors to integrate secure data-collection modules that record student interactions and auto-grade tasks. Hardware differentiation is fading; instead, content depth, teacher-training packages and GDPR-compliant cloud architectures decide contract awards. The policy shift is also inspiring curriculum publishers to co-develop lesson plans with robot makers, tightening ecosystem lock-in and raising switching costs for institutions.

High Failure Rates of Battery Packs in Continuous Classroom Use

In tropical climates, lithium-ion degradation accelerates, with 38% of packs failing within a year under classroom load. Break-fix cycles strain school budgets and disrupt lesson plans, dampening purchase enthusiasm. Suppliers respond with hybrid power architectures that switch to direct current when docks are available and with passive cooling housings to dissipate heat. Battery-swap designs are emerging as a procurement criterion, especially in government tenders that stipulate five-year life-cycle costs. Companies that certify cells for 45 °C environments gain a competitive edge.

Other drivers and restraints analyzed in the detailed report include:

- Government-Funded STEM Initiatives Fueling University Procurement

- Falling ASP of Education-grade Servo Motors & Sensors in China

- Limited Multilingual Content Libraries for Humanoid Robots

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Non-humanoid models retained 68% of the educational robot market in 2024, a position earned through rugged simplicity and entry-level pricing. Classroom favorites such as the Code & Go Mouse withstand daily handling and fulfill coding-concept objectives at scale. Yet, humanoid platforms are accelerating at a 23.4% CAGR as schools observe stronger engagement, especially in autism programs. Early adopters report higher attention spans when robots mirror emotions via facial LEDs and compliant joints. The educational robot market size for humanoids is therefore forecast to close part of the gap as falling part costs narrow the price delta.

Large-language-model integration lets humanoids deliver unscripted dialogue and dynamic feedback. A 2025 pilot using the Duet system linked proficiency scores to facial-recognition-derived engagement metrics, enabling teachers to intervene only when needed. Suppliers now ship humanoids with plug-in curricula for language, social-emotional learning, and special-needs therapy. Although capital costs remain higher, financing schemes such as Robots-as-a-Service lower adoption barriers, positioning humanoids for rapid share gains in niche, high-impact settings.

Hardware accounted for 74% of 2024 revenue due to the tangible nature of robots-chassis, sensors, processors and power systems remain indispensable. Component innovation centers on compact AI accelerators and low-cost servos that reduce bill-of-materials outlays. Simultaneously, the services segment is growing at 25% CAGR as schools pivot to subscription bundles covering maintenance, software updates and teacher training. Vendors highlight predictable budgeting and continual feature refreshes to justify monthly fees.

Software, while a smaller slice, is the value engine: adaptive-learning algorithms, cloud analytics and compliance modules now decide procurement. As a result, hardware margins compress, and firms bundle lifetime software licences or pivot entirely to service contracts. This shift realigns incentives-manufacturers invest in iterative AI improvements because renewals, not one-off sales, drive revenue. For districts, the pay-as-you-go model frees capex and ensures that classroom fleets stay current.

Educational Robots Market Report is Segmented by Type (Humanoid, Non-Humanoid), Component (Hardware, Software and Services), Education Level (Primary Education, Secondary Education, Higher Education and More), Learning Mode / Application (Coding and STEM, Language Learning, Special-Needs Therapy and More), End User (Schools, Universities and Colleges, and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific led with 38% revenue in 2024, anchored by China, Japan and South Korea. Beijing's 14th Five-Year Plan earmarks USD 45.2 million for robotics innovation, while Tokyo's New Robot Strategy deploys USD 440 million to sustain its domestic industry. High robot density-1,012 units per 10,000 workers in Korea-creates a skilled labor pool and a receptive education sector. Shenzhen-based suppliers export low-cost component kits, compressing global bill-of-materials and elevating Asia's manufacturing influence on the educational robot market.

The Middle East records the fastest CAGR at 22% to 2030. Saudi Arabia's Future Intelligence Program intends to train 30,000 students in AI, and the SAMAI initiative targets 1 million citizens. Corporate CSR budgets underwrite robotics labs in public schools, sidestepping procurement bottlenecks. The UAE deepens alliances with US and Asian chipmakers, seeking supply-chain independence and positioning Dubai and Abu Dhabi as testing grounds for multilingual educational robots optimized for Arabic curricula.

North America remains a mature yet expanding arena. The White House's 2024 CoSTEM report confirms USD 70 million in NSF robotics grants and over 1,300 Department of Defense-backed FIRST teams. University-industry consortia accelerate prototype-to-classroom cycles, and telepresence robots address teacher shortages in rural districts. GDPR-free data regimes allow cloud-centric analytics, shortening deployment times relative to Europe.

Europe's mandatory robotics curricula sustain steady demand, but GDPR compliance raises integration costs. Horizon Europe assigns USD 183.5 million to robotics R&D, and Germany's High-Tech Strategy channels USD 369.2 million into educational applications. Vendors embed on-device processing to satisfy data-sovereignty requirements. Nordic countries pilot explainable-AI modules that log decision trees for every robot-student interaction, setting a benchmark others may follow.

- SoftBank Robotics Corp.

- UBTECH Robotics Inc.

- Hanson Robotics Ltd.

- Lego Education (The Lego Group)

- Wonder Workshop Inc.

- Robotis Co., Ltd.

- VEX Robotics Inc.

- Makeblock Co., Ltd.

- Sphero Inc.

- Modular Robotics (Cubelets)

- Blue Frog Robotics

- Aisoy Robotics

- Sanbot Innovation (Qihan)

- PAL Robotics

- Probotics America

- Robobuilder Co., Ltd.

- Dash Robotics (Kamigami)

- RobotLAB Inc.

- DJI RoboMaster

- Ozobot and Evollve Inc.

- Fischertechnik GmbH

- RoboTerra Inc.

- Roborisen (e-Bo)

- RoboSense (Edu)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of AI-enabled Social Robots for Early-Childhood Language Tutoring in East Asia

- 4.2.2 Mandatory Robotics Curriculum in K-12 Schools across Europe

- 4.2.3 Government-funded STEM Initiatives (e.g., US NSF DRK-12) Fueling University Procurement

- 4.2.4 Falling ASP of Education-grade Servo Motors and Sensors in China

- 4.2.5 Surge of Remote/Hybrid Learning Driving Telepresence Teaching Robots in North America

- 4.2.6 Corporate CSR Budgets Sponsoring Robotics Labs in Middle-East Public Schools

- 4.3 Market Restraints

- 4.3.1 High Failure Rates of Battery Packs in Continuous Classroom Use (Tropical Regions)

- 4.3.2 Limited Multilingual Content Libraries for Humanoid Robots in Non-Latin Script Nations

- 4.3.3 GDPR-Driven Data-privacy Compliance Costs for Cloud-connected Robots in EU

- 4.3.4 Shortage of Certified Robotics Instructors in Rural Africa

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory and Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

- 4.7 Investment Analysis (Funding, MandA, VC Trends)

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 Humanoid

- 5.1.2 Non-humanoid

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Education Level

- 5.3.1 Pre-primary (Kindergarten)

- 5.3.2 Primary Education

- 5.3.3 Secondary Education

- 5.3.4 Higher Education

- 5.3.5 Special Education

- 5.4 By Learning Mode / Application

- 5.4.1 Coding and STEM

- 5.4.2 Language Learning

- 5.4.3 AI and Robotics Research

- 5.4.4 Special-needs Therapy

- 5.4.5 Telepresence and Remote Instruction

- 5.5 By End User

- 5.5.1 Schools

- 5.5.2 Universities and Colleges

- 5.5.3 Vocational Institutes

- 5.5.4 Ed-Tech Companies

- 5.5.5 Special-education Centers

- 5.5.6 Maker Spaces and Robotics Clubs

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Nordics

- 5.6.3.6 Rest of Europe

- 5.6.4 Middle East

- 5.6.4.1 United Arab Emirates

- 5.6.4.2 Saudi Arabia

- 5.6.4.3 Turkey

- 5.6.4.4 Rest of Middle East

- 5.6.5 Africa

- 5.6.5.1 South Africa

- 5.6.5.2 Egypt

- 5.6.5.3 Rest of Africa

- 5.6.6 Asia-Pacific

- 5.6.6.1 China

- 5.6.6.2 Japan

- 5.6.6.3 South Korea

- 5.6.6.4 India

- 5.6.6.5 Southeast Asia

- 5.6.6.6 Rest of Asia-Pacific

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves (Partnerships, Curriculum Alliances, CSR Labs)

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 SoftBank Robotics Corp.

- 6.4.2 UBTECH Robotics Inc.

- 6.4.3 Hanson Robotics Ltd.

- 6.4.4 Lego Education (The Lego Group)

- 6.4.5 Wonder Workshop Inc.

- 6.4.6 Robotis Co., Ltd.

- 6.4.7 VEX Robotics Inc.

- 6.4.8 Makeblock Co., Ltd.

- 6.4.9 Sphero Inc.

- 6.4.10 Modular Robotics (Cubelets)

- 6.4.11 Blue Frog Robotics

- 6.4.12 Aisoy Robotics

- 6.4.13 Sanbot Innovation (Qihan)

- 6.4.14 PAL Robotics

- 6.4.15 Probotics America

- 6.4.16 Robobuilder Co., Ltd.

- 6.4.17 Dash Robotics (Kamigami)

- 6.4.18 RobotLAB Inc.

- 6.4.19 DJI RoboMaster

- 6.4.20 Ozobot and Evollve Inc.

- 6.4.21 Fischertechnik GmbH

- 6.4.22 RoboTerra Inc.

- 6.4.23 Roborisen (e-Bo)

- 6.4.24 RoboSense (Edu)

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet Need Analysis