|

市場調查報告書

商品編碼

1851109

智慧型手機:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Smartphones - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

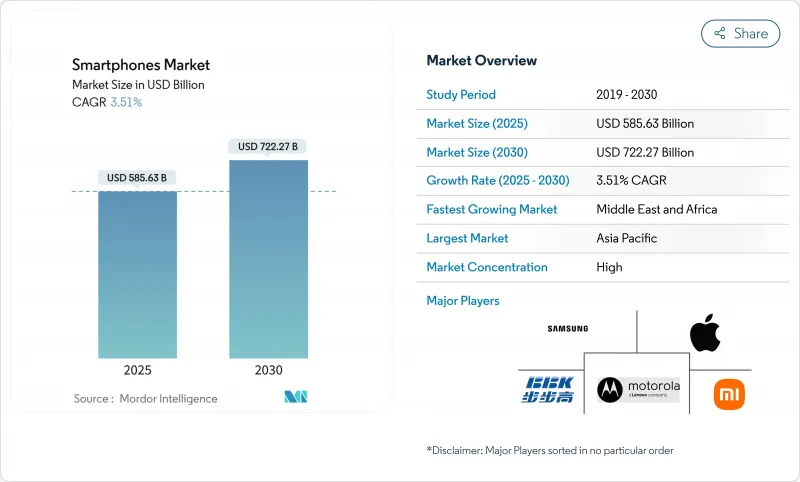

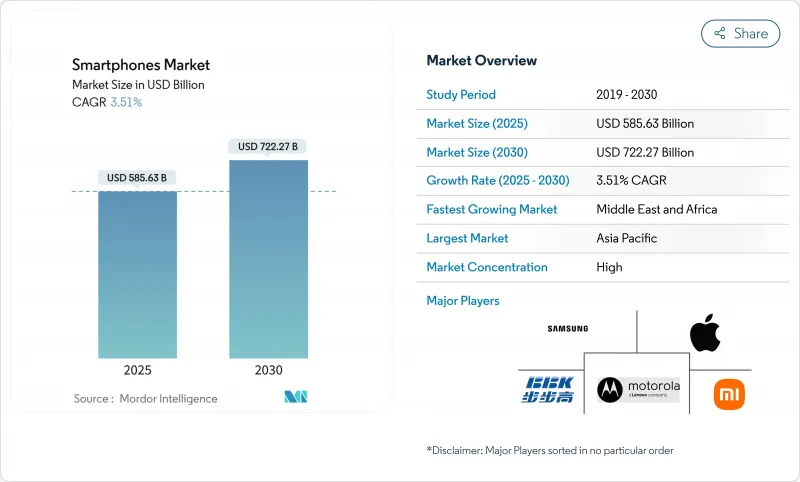

預計到 2025 年智慧型手機市場規模將達到 5,856.3 億美元,到 2030 年將達到 7,222.7 億美元,在預測期(2025-2030 年)內複合年成長率為 3.51%。

由於用戶傾向於選擇更高記憶體配置、多攝影機陣列和嵌入式人工智慧 (AI) 引擎,並對高階產品提出更高的價格要求,因此收入成長速度超過了出貨量成長速度。儘管售價超過 800 美元的設備在全球銷量中所佔比例不高,但它們在行業利潤中所佔的佔有率卻越來越大。到 2024 年,亞太地區的智慧型手機市佔率將達到 56.9%,但成長方向正在分化:中國目前是一個更換主導的市場,而印度、印尼和越南仍擁有大量首次購買智慧型手機的用戶。近期零售價格和關稅數據顯示,一些新興國家本幣貶值正在刺激國內組裝,在外匯波動的情況下維持入門級產品價格的穩定。

未來十年,三大結構性因素將塑造智慧型手機產業。首先,5G網路覆蓋範圍正從4G網路覆蓋不足的低人口密度地區擴展至全國,使得後發廠商能夠跳過一代網路。其次,即時翻譯、影像產生和會議記錄摘要等生成式人工智慧功能正從雲端處理轉向設備端處理,引發了神經網路處理單元和記憶體頻寬的新一輪規格之爭。第三,先進半導體的地緣政治限制迫使各大品牌實現採購多元化並重新設計供應鏈。這些因素共同作用,使得智慧型手機產業雖然整體滲透率已趨於成熟,但隨著廠商將功能部署與靈活的生產佈局相匹配,仍能找到盈利的細分市場。 2024-2025年的產品發表計畫便體現了這種調整。許多品牌將旗艦產品的發布間隔從12個月延長至大約18個月。

全球智慧型手機市場趨勢與洞察

5G網路商業化:加速設備升級週期

5G的廣泛應用推動了消費者對更高吞吐量和更低延遲的需求,縮短了更換週期。目前全球已有近300個商用網路運作,通訊業者也已開始取代老舊的3G頻譜,以擴展中頻段5G容量。隨著代工廠提供更具成本效益的6nm和4nm製程工藝,設備平均售價持續下降,即使在價格敏感型市場,也推動了主流市場的普及。雖然增強型行動寬頻仍然是主要應用場景,但固定無線存取(FWA)用戶數量正在快速成長,滿足了服務不足的農村地區不斷成長的設備需求。這項發展動能將提振整體無線存取投資,並確保一系列功能豐富的中階智慧型手機能夠滿足升級用戶的需求。

印度和東南亞對中高階設備的需求激增

印度、印尼和越南消費者可支配收入的成長和消費意願的提升,推動了200-499美元價位段智慧型手機的蓬勃發展。消費者希望以實惠的價格分佈獲得高更新率OLED面板、多鏡頭成像和5G功能,而中國OEM廠商正積極瞄準這一市場。預計到2023年,印度智慧型手機的平均售價將上漲至255美元,這標誌著消費者對入門級設備的消費需求將顯著下降。在地化的線上管道和精準的新品發布計劃,使得智慧型手機銷售出現週期性高峰,且往往與節日季節相吻合。因此,中高階機型在電商平台的限時搶購活動中佔據了更大的佔有率,進一步強化了網路升級和設備功能需求的循環。

全球經濟放緩影響更換週期

通膨壓力和外匯波動促使消費者延長手機使用壽命至三年以上。廠商紛紛承諾提供七年安全更新和電池更換服務以應對,但整體銷售成長乏力。翻新智慧型手機市場受益於向通訊業者提供支援4G或5G頻段的低成本入門級設備。高利率也抑制了發展中地區的資金籌措活動,並促使主要零售商謹慎管理庫存。儘管平均售價(ASP)有所上漲,但不斷上漲的零件成本限制了利潤率的擴張。

細分市場分析

預計到2024年,Android仍將維持84.1%的市場佔有率,但iOS將以4.5%的複合年成長率成為成長最快的市場,從而支撐其營收成長動能。隨著蘋果在中價格分佈拓展銷售,並在新興國家支援在地化支付方式,iOS智慧型手機市場規模預計將迅速擴張。近95%的專利使用費確保了穩定的升級換代,而蘋果晶片的持續整合將帶來更高的能效,延長設備壽命並提升殘值。 Android將與完全運行在裝置端的Gemini AI引擎競爭,後者能夠增強隱私保護和情境感知能力。 OEM廠商正在利用開放原始碼的靈活性來實現差異化,但系統碎片化仍然阻礙著及時發布安全性修補程式。

蘋果帶著全新SE系列進軍小螢幕市場,目標客群是那些在經濟衰退期間更換購機的用戶。鴻蒙操作系統Next採用微核心架構,使華為成為中國唯一垂直整合的替代生態系統。 KaiOS仍然非常適合對成本敏感的市場中功能豐富的4G設備,它以極低的記憶體佔用提供以語音為中心的服務。儘管未來互通的AI框架可能會模糊作業系統之間的界限,但iOS和Android成熟的應用程式庫將繼續支援開發者的投入,並鞏固兩家公司在智慧型手機市場的主導地位。

入門級智慧型手機(售價低於200美元)預計在2024年將佔出貨量的38.5%,為數百萬用戶提供首次網路存取。然而,超高階智慧型手機市場將實現6.2%的複合年成長率,顯示消費者願意在更長的使用週期內分攤更高的支出。儘管在上市初期銷售佔有率下降,但高階旗艦機型將貢獻高達75%的收入,進而提升廠商的盈利。由於折疊式和人工智慧手機等需要昂貴組件的產品也受到強勁需求,預計超高階智慧型手機市場規模將穩定成長。

售價在 200 至 499 美元之間的中階如今也配備了高解析度顯示器、大尺寸感測器和即時充電功能,這些功能以往通常只出現在價格分佈更高的機型上。隨著中國 OEM 廠商每季更新換代產品以維持市場熱度,競爭動態激烈。在巴西等市場,進口關稅推高了成本,促使消費者轉向翻新的中高階機型。售價在 500 至 799 美元之間的高階機型則扮演著光環產品的角色,吸引用戶加入一個能夠透過雲端儲存等售後服務實現盈利的生態系統。這條產業鏈平衡了銷售和價值,這是智慧型手機市場中各個細分市場盈利健康的先決條件。

區域分析

2024年,亞太地區將佔全球智慧型手機出貨量的56.9%,主要得益於中國和印度龐大的裝置量以及5G的快速普及。中國本土品牌憑藉極具競爭力的價格和攝影機創新贏得了市場佔有率,而印度政府支持的生產連結獎勵計畫吸引了新工廠入駐並降低了進口關稅。農村寬頻舉措鼓勵了新廠商首次進入智慧型手機市場,從而提升了整體滲透率。以舊換新方案和分期付款選項進一步刺激了用戶升級換代,尤其是在二線城市。日益嚴格的本地化要求將促使供應商在國內採購顯示器和電池,從而增強區域供應的韌性。加強資料本地化的監管措施可能會增加合規成本,但也可能透過自主雲端整合為供應商創造機會。

北美市場按以金額為準排名第二,但由於市場高度飽和,銷售成長正在放緩。 iOS 57.9% 的市佔率反映了硬體、服務和內容生態系統的整合。通訊業者正在偏遠地區試驗衛星通訊作為安全功能,這需要支援L波段鏈路的數據機。企業採用人工智慧設備進行現場診斷,使得企業更換週期接近 24 個月,部分抵銷了消費者較長的更換週期。中頻段 5G 頻譜競標正在進行中,確保了網路持續增強,並支撐了對相容旗艦設備的需求。

預計到2030年,中東和非洲智慧型手機市場將以5.2%的複合年成長率成長。年輕化人口結構、5G網路的逐步普及以及透過小額貸款應用程式進行的設備資金籌措的興起將支撐市場需求。埃及正在崛起為區域組裝中心,為洲內分銷提供海關優勢。與發薪日相契合的限時搶購活動刺激了銷售快速成長,使那些能夠有效協調物流的品牌受益。在撒哈拉以南非洲地區,太陽能充電亭提供離網充電服務,並提高了農村地區的設備普及率。營運商與金融科技平台之間的合作促進了小額信貸的發展,使入門級智慧型手機價格更加親民,從而提升了智慧型手機市場的整體普及率。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 5G網路的商業化將加快設備升級週期。

- 印度和東南亞對中高階設備的需求激增

- 來自輕晶圓代工廠(例如台積電 6nm)的低成本 5G 晶片組的興起

- 營運商主導的設備融資模式在北美地區擴展

- 非洲的電子商務閃購和促銷活動推動了銷售量。

- 企業移動性計畫提升了澳洲礦業領域對加強型智慧型手機的採用率

- 市場限制

- 全球經濟放緩將影響更換週期

- 美國和中國的技術制裁限制了高階零件的供應。

- 記憶體和顯示面板價格上漲對OEM廠商利潤率帶來壓力。

- 對更長軟體支援期限的更嚴格監管將增加成本結構。

- 價值/供應鏈分析

- 宏觀經濟影響分析(新冠疫情與通貨膨脹率)

- 監理與技術展望

- 無線電頻譜分配趨勢

- ESIM和物聯網相容作業系統的發展趨勢

- 智慧型手機設備生命週期分析

- 相關人員生命週期圖

- 相關人員關鍵痛點分析

- 技術藍圖

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按作業系統

- Android

- iOS

- 其他系統(KaiOS、HarmonyOS 等)

- 價格分佈範圍

- 入門級(200 美元以下)

- 中階(200-499 美元)

- 高級版(500-799 美元)

- 超高階(超過 800 美元)

- 透過技術

- 5G

- 4G/LTE

- 3G 或更低

- 按外形規格

- 酒吧

- 折疊式/翻轉

- 堅固耐用/工業

- 透過分銷管道

- 營運商/承運商商店

- 品牌零售

- 多品牌零售

- 線上D2C

- 按地區

- 北美洲

- 美國

- 加拿大

- 拉丁美洲

- 墨西哥

- 巴西

- 阿根廷

- 其他拉丁美洲地區

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 亞太其他地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Samsung Electronics Co. Ltd

- Apple Inc.

- BBK Electronics Corp. Ltd(Oppo, Vivo, Realme, OnePlus)

- Xiaomi Corp.

- Transsion Holdings

- Huawei Technologies Co. Ltd

- Motorola Mobility LLC(Lenovo Group Ltd)

- Google LLC(Pixel)

- Sony Corp.

- ZTE Corp.

- HMD Global Oy(Nokia)

- ASUSTeK Computer Inc.

- Honor Device Co. Ltd

- TCL Technology(Group)Co. Ltd(Alcatel)

- Sharp Corp.

- Panasonic Holding Corp.

- Nothing Technology Ltd

- Fairphone BV

- CAT Phones(Bullitt Group)

- Meizu Technology Co. Ltd

第7章 市場機會與未來展望

The Smartphones Market size is estimated at USD 585.63 billion in 2025, and is expected to reach USD 722.27 billion by 2030, at a CAGR of 3.51% during the forecast period (2025-2030).

Revenue is rising more quickly than unit shipments because users are selecting higher memory configurations, multi-camera arrays, and embedded artificial-intelligence (AI) engines that command premium prices. Devices priced above USD 800 now generate a widening share of industry profit, even though they account for a minority of global volume. Asia-Pacific holds 56.9 % smartphone market share in 2024, yet growth vectors vary: China is now a replacement-driven arena, while India, Indonesia, and Vietnam continue to welcome large cohorts of first-time buyers. A review of recent retail-pricing and customs-duty data implies that local-currency weakness across several emerging economies is accelerating domestic assembly, keeping entry-level pricing stable despite exchange-rate volatility.

Three structural forces will shape the smartphone industry through the remainder of the decade. First, nationwide 5G coverage is extending into sparsely populated districts that never enjoyed robust 4G, enabling late adopters to leapfrog one network generation. Second, generative-AI functions real-time translation, image creation, and meeting-note summarization, are shifting from cloud reliance to handset-level processing, sparking a new specification race around neural-processing units and memory bandwidth. Third, geopolitical restrictions on advanced semiconductors are prompting brands to diversify component sourcing and redesign supply chains. The combined effect is a sector that, while mature in headline penetration, still delivers profitable niches when vendors align feature roll-outs with flexible manufacturing footprints. Product-launch calendars for 2024-2025 illustrate this adjustment: many brands are spacing flagship introductions by roughly eighteen months rather than twelve, a cadence that lengthens accessory-sales tails and improves return on research expenditure.

Global Smartphones Market Trends and Insights

5G Network Commercialization: Accelerating Device Upgrade Cycles

Widespread 5G availability is shortening replacement intervals as consumers seek higher throughput and lower latency. Nearly 300 commercial networks now operate worldwide, and operators have begun switching off older 3G spectrum to widen mid-band 5G capacity. Device ASPs continue to fall as foundries offer cost-efficient 6 nm and 4 nm nodes, driving mainstream adoption even in price sensitive markets. Enhanced Mobile Broadband remains the anchor use case, yet FWA subscriptions are scaling quickly and support incremental device demand in underserved rural zones. The momentum raises overall radio access investment, guaranteeing a healthy pipeline of feature rich mid-range smartphones that appeal to upgrade-minded users.

Surging Demand for Mid-Premium Devices in India and SEA

Rising disposable income and aspirational consumption in India, Indonesia, and Vietnam are lifting the USD 200-499 sweet spot. Consumers seek high refresh-rate OLED panels, multi-lens imaging, and 5G at accessible price points, a window that Chinese OEMs actively target. The average selling price in India rose to USD 255 in 2023, underscoring migration away from entry devices. Localized online channels and targeted launch calendars align with festival seasons, creating periodic spikes in smartphone market sales. Consequently, mid-premium models now account for a larger share of e-commerce flash events, reinforcing the cycle of network upgrades and device capability demand.

Global Economic Slowdown Impacting Replacement Cycles

Inflationary pressure and currency volatility encourage consumers to extend handset life beyond three years. Vendors respond by promising seven years of security updates and offering battery replacement services, yet overall unit volumes remain subdued. The refurbished smartphone market benefits, providing operators with low-cost entry devices that still support 4G or 5G bands. High-interest rates also dampen financing uptake in developing regions, leading to cautious inventory management among retailers. Although ASPs rise, margin expansion is tempered by elevated component costs.

Other drivers and restraints analyzed in the detailed report include:

- Rise of Affordable 5G Chipsets from Fab-Lite Foundries

- Carrier-Led Device Financing Models Expanding in North America

- US-China Tech Sanctions Limiting High-End Component Supply

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Android retained 84.1% unit leadership in 2024, but iOS delivered the fastest 4.5% CAGR outlook, underpinning revenue momentum. The smartphone market size for iOS devices is expected to climb quickly as Apple widens distribution in mid-price bands and supports localized payments in emerging economies. Loyalty rates near 95% ensure stable upgrade flows, and sustained integration of Apple Silicon delivers power efficiency gains that lengthen device lifespans and boost residual values. Android counters with the Gemini AI engine running entirely on-device, enhancing privacy and context awareness. OEM skins leverage open-source flexibility to differentiate, though fragmentation still complicates timely security patches.

Apple's push into smaller-screen markets via a new SE line targets replacement cycles for users who postponed purchases during macro downturns. HarmonyOS Next adopts a microkernel architecture and positions Huawei as the only vertically integrated alternative ecosystem in China. KaiOS remains relevant for feature-rich 4G devices in cost-sensitive markets, powering voice-centric services that require minimal memory. Over the forecast horizon, interoperable AI frameworks could blur OS boundaries, but the established application libraries of iOS and Android will continue to anchor developer commitment, reinforcing their shared dominance in the smartphone market.

The entry tier below USD 200 accounted for 38.5% of shipments in 2024, providing first-time internet access to millions. Nonetheless, the ultra-premium tier generated 6.2% CAGR, underlining consumer willingness to amortize higher outlays over longer ownership spans. During launch weeks, premium flagships contribute up to 75% of revenue despite lower unit share, cushioning vendor profitability. The smartphone market size for the ultra-premium category is projected to rise steadily as foldables and AI-centric models command higher bills of materials yet enjoy robust demand.

Mid-range devices at USD 200-499 now include high-refresh displays, large sensors, and instant charging that were previously reserved for costlier products. Competitive dynamics intensify as Chinese OEMs orchestrate quarterly refreshes to preserve buzz. In markets such as Brazil, import duties inflate costs, nudging buyers toward refurbished mid-premium devices. Premium models priced at USD 500-799 serve as halo products, encouraging users into ecosystems that monetize after-sales services like cloud storage. This cascading structure balances volume and value, a prerequisite for healthy segment profitability in the smartphone market.

The Smartphone Market Report is Segmented by Operating System (Android, IOS, and More), Price Band (Entry-Level [Less Than USD 200], Mid-Range [USD 200 - 499], and More), Technology (5G, 4G/LTE, and 3G and Below), Form Factor (Bar, Foldable/Flip, and Rugged/Industrial), Distribution Channel (Operator/Carrier Stores, Brand-Owned Retail, and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific commanded 56.9% of global shipments in 2024, driven by China's and India's vast install bases and rapid 5G adoption. Domestic Chinese brands expanded their share via competitive pricing and camera innovation, while India's government-backed production-linked incentives attracted new factories that lowered import duties. Rural broadband initiatives encourage first-time smartphone market entrants, lifting overall penetration. Trade-in programs and EMI options further stimulate upgrades, particularly in tier-2 cities. Rising localization mandates push suppliers to source displays and batteries domestically, bolstering regional supply resilience. Regulatory moves to tighten data localization may increase compliance costs but also create vendor opportunities via sovereign cloud integrations.

North America ranked second by value but faces slower unit growth due to high saturation. Here, financing plans underpin premium shipments, and average selling prices are the world's highest. iOS enjoys a 57.9% share, reflecting cohesive ecosystem integration across hardware, services, and content. Carriers trial satellite messaging as a safety feature in remote areas, requiring modems capable of L-band links. Enterprise adoption of AI-enabled devices for field diagnostics keeps corporate replacement cycles closer to 24 months, partly offsetting consumer lengthening. Ongoing spectrum auctions for mid-band 5G ensure continued network enhancement, supporting demand for compatible flagships.

The Middle East & Africa smartphone market is forecast to expand at a 5.2% CAGR by 2030. Youthful demographics, gradual 5G rollout, and the rise of device financing through micro-lending apps underpin demand. Egypt is emerging as a regional assembly hub, offering customs advantages for intracontinental distribution. Flash-sale events aligned with pay-day cycles spur short bursts of volume, benefiting brands that coordinate logistics effectively. In Sub-Saharan Africa, solar-powered kiosks provide off-grid charging, increasing device utility in rural zones. Carrier partnerships with fintech platforms enable nano-credit, making entry-level smartphones affordable for first-time buyers, thereby enlarging overall smartphone market penetration.

- Samsung Electronics Co. Ltd

- Apple Inc.

- BBK Electronics Corp. Ltd (Oppo, Vivo, Realme, OnePlus)

- Xiaomi Corp.

- Transsion Holdings

- Huawei Technologies Co. Ltd

- Motorola Mobility LLC (Lenovo Group Ltd)

- Google LLC (Pixel)

- Sony Corp.

- ZTE Corp.

- HMD Global Oy (Nokia)

- ASUSTeK Computer Inc.

- Honor Device Co. Ltd

- TCL Technology (Group) Co. Ltd (Alcatel)

- Sharp Corp.

- Panasonic Holding Corp.

- Nothing Technology Ltd

- Fairphone BV

- CAT Phones (Bullitt Group)

- Meizu Technology Co. Ltd

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 5G Network Commercialisation Accelerating Device Upgrade Cycles

- 4.2.2 Surging Demand for Mid-Premium Devices in India and SEA

- 4.2.3 Rise of Affordable 5G Chipsets from Fab-Lite Foundries (e.g., TSMC 6 nm)

- 4.2.4 Carrier-Led Device Financing Models Expanding in North America

- 4.2.5 E-commerce Flash-Sale Events Driving Volume in Africa

- 4.2.6 Enterprise Mobility Programmes Increasing Rugged Smartphone Adoption in Mining (Australia)

- 4.3 Market Restraints

- 4.3.1 Global Economic Slow-down Impacting Replacement Cycles

- 4.3.2 US-China Tech Sanctions Limiting High-end Component Supply

- 4.3.3 Escalating Memory and Display Panel Prices Squeezing OEM Margins

- 4.3.4 Regulatory Push for Longer Software Support Raising Cost Structures

- 4.4 Value / Supply-Chain Analysis

- 4.5 Macroeconomic Impact Analysis (COVID-19 and Inflation)

- 4.6 Regulatory and Technological Outlook

- 4.6.1 Radio-frequency Spectrum Allocation Trends

- 4.6.2 ESIM and IOT-Ready OS Developments

- 4.7 Smartphone Device Lifecycle Analysis

- 4.7.1 Stakeholder Lifecycle Mapping

- 4.7.2 Key Pain-Point Analysis by Stakeholder

- 4.8 Technology Roadmap

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Buyers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitutes

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Operating System

- 5.1.1 Android

- 5.1.2 iOS

- 5.1.3 Others (KaiOS, HarmonyOS, etc.)

- 5.2 By Price Band

- 5.2.1 Entry-level ( Less than USD 200)

- 5.2.2 Mid-range (USD 200 - 499)

- 5.2.3 Premium (USD 500 - 799)

- 5.2.4 Ultra-premium (Greater than or equal to USD 800)

- 5.3 By Technology

- 5.3.1 5G

- 5.3.2 4G/LTE

- 5.3.3 3G and Below

- 5.4 By Form Factor

- 5.4.1 Bar

- 5.4.2 Foldable/Flip

- 5.4.3 Rugged/Industrial

- 5.5 By Distribution Channel

- 5.5.1 Operator/Carrier Stores

- 5.5.2 Brand-Owned Retail

- 5.5.3 Multi-brand Physical Retail

- 5.5.4 Online Direct-to-Consumer

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.2 Latin America

- 5.6.2.1 Mexico

- 5.6.2.2 Brazil

- 5.6.2.3 Argentina

- 5.6.2.4 Rest of Latin America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Middle East and Africa

- 5.6.4.1 United Arab Emirates

- 5.6.4.2 Saudi Arabia

- 5.6.4.3 South Africa

- 5.6.4.4 Rest of Middle East and Africa

- 5.6.5 Asia-Pacific

- 5.6.5.1 China

- 5.6.5.2 Japan

- 5.6.5.3 South Korea

- 5.6.5.4 India

- 5.6.5.5 Rest of Asia-Pacific

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)}

- 6.4.1 Samsung Electronics Co. Ltd

- 6.4.2 Apple Inc.

- 6.4.3 BBK Electronics Corp. Ltd (Oppo, Vivo, Realme, OnePlus)

- 6.4.4 Xiaomi Corp.

- 6.4.5 Transsion Holdings

- 6.4.6 Huawei Technologies Co. Ltd

- 6.4.7 Motorola Mobility LLC (Lenovo Group Ltd)

- 6.4.8 Google LLC (Pixel)

- 6.4.9 Sony Corp.

- 6.4.10 ZTE Corp.

- 6.4.11 HMD Global Oy (Nokia)

- 6.4.12 ASUSTeK Computer Inc.

- 6.4.13 Honor Device Co. Ltd

- 6.4.14 TCL Technology (Group) Co. Ltd (Alcatel)

- 6.4.15 Sharp Corp.

- 6.4.16 Panasonic Holding Corp.

- 6.4.17 Nothing Technology Ltd

- 6.4.18 Fairphone BV

- 6.4.19 CAT Phones (Bullitt Group)

- 6.4.20 Meizu Technology Co. Ltd

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-need Assessment