|

市場調查報告書

商品編碼

1851107

5G連結:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030年)5G Connection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

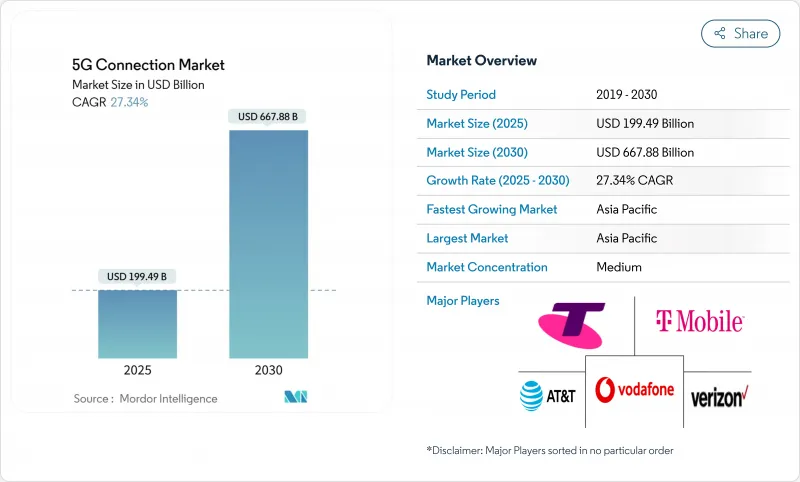

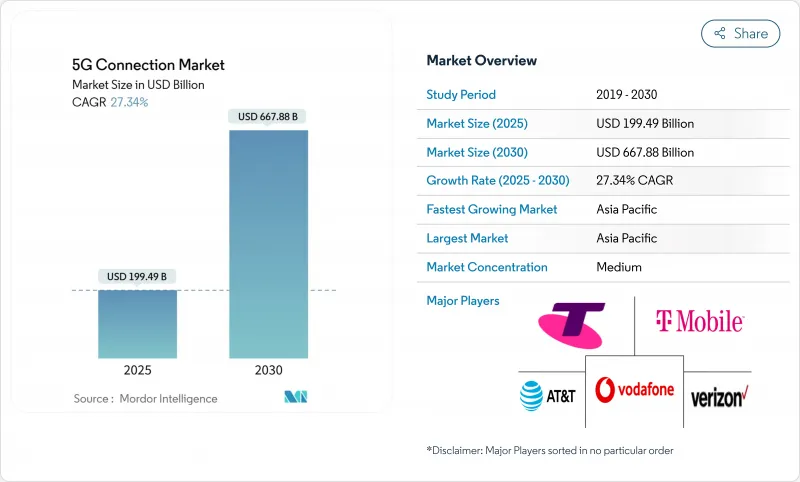

5G 連接市場目前創造的收入為 1,994.9 億美元,預計到 2030 年將達到 6,678.8 億美元,年複合成長率為 27.34%。

商業部署正從覆蓋範圍擴大轉向網路密集化,從而推動了切片、邊緣運算和RedCap設備等先進功能的快速普及。亞太地區佔全球52%的5G用戶,這主要得益於中國440萬基地台和印度全國範圍內的獨立組網建設;而北美則在固定無線接入(FWA)的普及方面處於領先地位。通訊業者正在加速從非獨立組網(NSA)核心網向獨立組網(SA)核心網的遷移,因為後者能夠釋放更高的獲利潛力,尤其是在企業級應用和超可靠低延遲(URLLC)場景中。製造業、醫療保健和汽車行業的專用5G網路正在快速擴展,網路API市場預計將在不久的將來帶來更多收入來源。然而,不斷上漲的中頻段頻譜價格、農村地區的覆蓋成本以及光纖價格戰仍然限制某些地區的成長。

全球5G連結市場趨勢與洞察

行動資料流程量的快速成長需要高容量網路

每個5G連線的月均數據使用量將接近70GB,是4G的四倍。中國440萬個5G基地台的規模足以支撐如此龐大的流量,而中頻段頻譜仍然至關重要,目前中國以外地區僅部署了四分之一的中頻段頻譜。隨著流量模式的轉變,通訊業者正優先推動載波聚合、大規模MIMO升級和動態頻譜共享等技術。這些投資將推動5G連結市場的營收成長,同時也促使營運商更加重視最佳化網路能源效率。

固定無線存取(FWA)正逐漸成為主流寬頻替代方案。

美國營運商總合提供1,150萬條固定無線存取(FWA)線路,並預測到2028年這一數字將達到2,000萬,屆時平均下載速度將超過200Mbps。印度營運商利用光纖部署成本優勢,目標在2027年實現3000萬FWA用戶。 Verizon在2024年第一季累計4.52億美元的FWA收入,顯示其近期盈利前景良好。整體而言,這些市場發展將提高每位用戶平均收入,並擴大5G連結市場的潛在用戶群。

高昂的資本支出和中頻段頻譜成本

預計2022年至2025年間,全球基礎建設投資將超過6,000億美元,但歐洲競標的資金籌措負擔分配不均,擁有獨立核心網的區域通訊業者僅能獲得2%的資金,而中國業者則可獲得80%。新興市場通訊業者正在推遲競標,並探索鐵塔共享模式以緩解槓桿率上升的問題。北歐經濟體的網路共享模式樹立了一個正面的榜樣,但資金壓力仍然限制它們全面進入5G連結市場。

細分市場分析

到2024年,行動寬頻將佔據5G連接市場62%的佔有率,這主要得益於智慧型手機的普及和影片消費的成長。同時,在智慧工廠、醫院和物流中心等場所部署專用5G網路的推動下,機器對機器(M2M)和物聯網(IoT)鏈路正以28.63%的複合年成長率快速成長。尤其值得一提的是,關鍵任務通訊和固定無線存取(FWA)用戶正在推動流量成長,顯著擴大了網路切片的5G連接市場規模,而企業級應用的需求也起到了關鍵作用。硬體廠商推出的RedCap晶片組能夠降低工業感測器的耗電量,加速M2M計劃的可行性。隨著即時分析成為製造業競爭的關鍵挑戰,邊緣原生架構將進一步促進M2M的商業化。

預計到2028年,蜂巢式物聯網終端的持續成長將使設備數量加倍,從而不斷催生對成本最佳化模組和簡化部署工具的需求。從美國FirstNet的擴展到韓國全國公共網路,關鍵任務通訊應用場景正在拓展服務差異化的機會。因此,一種新的平衡已經形成:儘管消費者流量仍然佔據主導地位,但企業流量將在未來5G連接市場成長中佔據主導地位。

隨著串流媒體和遊戲推動行動寬頻流量成長,到2024年,消費者使用5G連線市場規模將維持76%的佔有率。然而,受汽車、醫療保健和能源等產業數位轉型需求的驅動,企業連接市場到2030年將達到30.47%的複合年成長率。製造業尤為突出。超過1000個活躍計劃報告稱,在切換到專用5G網路後,連接效率提高了15-20%。新加坡和瑞典的醫院在整合超低延遲視訊鏈路後,手術時間縮短,病患治療效果也得到改善。

此外,智慧城市計畫正在部署監視錄影機、連網路燈和環境監測器,這些都推動了企業用戶數量的成長。公共產業正在利用5G進行即時電網平衡,而石油和天然氣營運商則優先考慮自主巡檢無人機。這些因素正在使長期收入向企業傾斜,提高每個連接的平均收入,並加深5G連接市場的黏性。

5G 連線市場報告依連線類型(行動寬頻、固定無線存取、其他)、最終用戶(消費者、企業)、頻譜頻段(1 GHz 以下、1-6 GHz、其他)、網路架構(非獨立組網、獨立組網)、裝置類別(智慧型手機、平板電腦、FWA CPE、其他) 、服務類型(增強型雲端)、裝置類別(智慧型手機、行動寬頻電腦、FWA CPE.

區域分析

亞太地區將在2024年佔據全球52%的5G用戶佔有率,預計到2030年將以30.28%的複合年成長率成長,這主要得益於中國440萬基地台的建設以及印度獨立組網(SA)的快速擴張。預計到2030年,中國對數位經濟的貢獻將達到2兆美元,反映了5G平台在製造業、零售業和服務業的廣泛應用。印度的Reliance Jio營運超過100萬個雲端原生行動通訊基地台,預計到2027年,固定無線存取(FWA)線路數量將從500萬個增加到3,000萬條。日本和韓國透過率先推出先進的5G商用服務,維持了區域創新領先地位,預計到2030年,東南亞地區的GDP將因此受益1,300億美元。

北美是一個日趨成熟且創新驅動的市場,98% 的人口已在使用 5G 網路。 T-Mobile 在全國範圍內部署獨立組網 (SA) 網路,並擁有 643 萬條固定無線接入 (FWA) 線路,這體現了 5G 在消費者和企業用戶中的多元化應用。 Verizon 正與 AST SpaceMobile 合作,利用衛星通訊來彌合農村地區的網路覆蓋缺口;加拿大和墨西哥的通訊業者也在整合 RedCap 等 5G 先進功能。目前,5G 連接市場的重點在於如何將網路 API、邊緣運算和人工智慧輔助服務編配商業化,從而提高每個站點的效益密度。

歐洲的進展喜憂參半:德國、丹麥和芬蘭的5G人口覆蓋率超過95%,但僅有2%的合約在運作頻譜核心網投入使用。英國沃達豐和Three的合併已投入148.6億美元用於網路升級,旨在提升農村地區的網路覆蓋率;而北歐的頻譜共用模式則以低成本實現了高可用性。目前,歐洲各地的通訊業者正呼籲監管機構簡化競標並降低牌照費用,以維持投資週期,彌合獨立頻譜覆蓋缺口,並在5G連接市場釋放更大的價值。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 行動資料流程量的快速成長需要高容量網路

- 固定無線存取(FWA)正逐漸成為主流寬頻替代方案。

- 企業數位化和物聯網將加速5G的普及應用。

- 生成式人工智慧主導的上行鏈路流量激增推動了5G-SA的早期部署

- 透過開放的API生態系統實現獲利

- 市場限制

- 高昂的資本支出和中頻段頻譜成本

- 農村地區的健保覆蓋經濟效益仍不理想。

- 光纖價格戰阻礙了固定無線接入在都市區的普及

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按連線類型

- 行動寬頻

- 固定無線存取

- 機器對機器通訊和物聯網

- 關鍵任務通訊

- 私人網路

- 最終用戶

- 消費者

- 公司

- 製造業

- 衛生保健

- 汽車和運輸設備

- 智慧城市與公共

- 能源與公共產業

- 零售和物流

- 按頻寬

- 1 GHz 以下(低頻段)

- 1-6 GHz(中頻段)

- 24GHz 或更高(毫米波/高頻段)

- 透過網路架構

- 非獨立式(NSA)

- 獨立版 (SA)

- 按設備類別

- 智慧型手機和平板電腦

- FWA CPE

- 物聯網模組和閘道器

- 穿戴式裝置和增強/虛擬實境設備

- 工業路由器和加固模組

- 按服務類型

- 增強型行動寬頻(eMBB)

- 大規模機器通訊(mMTC)

- 超可靠、低延遲通訊(URLLC)

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 其他南美洲

- 歐洲

- 德國

- 法國

- 英國

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- AT&T Inc.

- Verizon Communications Inc.

- Vodafone Group Plc

- China Mobile Ltd.

- China Telecommunications Corp.

- T-Mobile US Inc.

- Telstra Corp. Ltd.

- Telefonica SA

- Deutsche Telekom AG

- Reliance Jio Infocomm Ltd.

- SK Telecom Co. Ltd.

- NTT Docomo Inc.

- KT Corp.

- Orange SA

- KDDI Corp.

- Bharti Airtel Ltd.

- Saudi Telecom Company(stc)

- Rakuten Mobile Inc.

- Etisalat by eand

- MTN Group Ltd.

第7章 市場機會與未來展望

The 5G connections market currently generates USD 199.49 billion in revenue and is forecast to reach USD 667.88 billion by 2030, advancing at a 27.34% CAGR.

Commercial roll-outs have progressed from coverage expansion to network densification, enabling rapid adoption of advanced capabilities such as slicing, edge computing, and RedCap devices. Asia-Pacific accounts for 52% of global subscriptions thanks to China's 4.4 million base stations and India's nationwide standalone build-out, while North America leads in Fixed Wireless Access (FWA) penetration. Operators are accelerating the shift from non-standalone (NSA) to standalone (SA) cores as SA unlocks higher monetization potential, particularly for enterprise and ultra-reliable low-latency (URLLC) use cases. Private 5G networks in manufacturing, healthcare, and automotive are scaling quickly, and network-API marketplaces promise additional revenue streams in the near term. However, high mid-band spectrum prices, rural coverage economics, and fiber price wars continue to temper growth in selected regions.

Global 5G Connection Market Trends and Insights

Surge in mobile data traffic requiring higher-capacity networks

Monthly data usage per 5G line averages close to 70 GB-four times the 4G figure-fueled by cloud gaming and extended-reality services. China's 4.4 million 5G base stations illustrate the scale needed to carry this load, and mid-band spectrum remains vital, although only one quarter of non-Chinese sites currently deploy it. As traffic migrates, operators prioritize additional carrier aggregation, Massive MIMO upgrades, and dynamic spectrum sharing. These investments underpin revenue growth in the 5G connections market while raising the urgency to optimize network energy efficiency.

Fixed Wireless Access (FWA) emerging as mainstream broadband alternative

US operators collectively serve 11.5 million FWA lines, with projections of 20 million by 2028 as median download speeds exceed 200 Mbps. Operators in India aim for 30 million FWA subscribers by 2027 by exploiting cost advantages over limited fiber roll-outs. Verizon generated USD 452 million in Q1 2024 FWA revenue, demonstrating the format's near-term profitability. mmWave deployments increase urban capacity, and customer surveys show 44% preference for wireless home broadband. Collectively, these developments boost average revenue per user and broaden the 5G connections market addressable base.

High CAPEX and mid-band spectrum costs

Global infrastructure outlays will exceed USD 600 billion during 2022-2025, and European auctions drive disproportionate financing burdens that leave only 2% of regional operators with SA cores versus 80% in China. Emerging-market carriers postpone auctions and explore tower-sharing to mitigate rising leverage. Network sharing in Nordic economies shows positive examples, but capital pressures still curb full participation in the 5G connections market.

Other drivers and restraints analyzed in the detailed report include:

- Enterprise digitization and IoT accelerating 5G adoption

- Generative-AI-driven uplink surge spurring early 5G-SA roll-outs

- Rural coverage economics remain unattractive

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Mobile broadband accounted for 62% of the 5G connections market in 2024, underpinned by smartphone adoption and video consumption growth. At the same time, M2M and IoT links are expanding at a 28.63% CAGR, encouraged by private 5G network deployments across smart factories, hospitals, and logistics hubs. The enterprise tilt is materially increasing the 5G connections market size for network slicing, particularly as mission-critical communications and FWA subscriptions contribute incremental traffic. Hardware vendors have introduced RedCap chipsets that lower power draw for industrial sensors, accelerating M2M project viability. Edge-native architectures further catalyze M2M monetization as real-time analytics become table stakes in competitive manufacturing.

Continued proliferation of cellular IoT endpoints is projected to double device counts by 2028, creating relentless demand for cost-optimized modules and simplified onboarding tools. Mission-critical communication use cases, from FirstNet expansion in the US to nationwide public-safety networks in Korea, widen service differentiation opportunities. The resulting diversity cements a new equilibrium in which consumer traffic remains large, yet enterprise traffic captures the outsized share of future 5G connections market growth.

Consumer use retained 76% share of the 5G connections market size in 2024 as streaming and gaming sustained mobile broadband traffic. Nonetheless, enterprise lines will deliver a 30.47% CAGR through 2030, powered by digital-transformation mandates in automotive, healthcare, and energy. Manufacturing stands out: more than 1,000 active projects report 15-20% gains in line efficiency after switching to private 5G. Hospitals in Singapore and Sweden show reduced surgery times and enhanced patient outcomes once ultra-low-latency video links are integrated.

Smart-city programs are also deploying surveillance cameras, connected streetlights, and environmental monitors, each adding to the enterprise subscriber base. Utilities turn to 5G for real-time grid balancing, and oil-and-gas operators prioritize automated inspection drones. These converging drivers tilt long-term revenue concentration toward the enterprise, increasing average revenue per connection and deepening stickiness within the 5G connections market.

5G Connection Market Report is Segmented by Connection Type (Mobile Broadband, Fixed Wireless Access, and More), End-User (Consumer and Enterprise), Spectrum Band (Sub-1 GHz, 1-6 GHz, and More), Network Architecture (Non-Standalone and Standalone), Device Category (Smartphones and Tablets, FWA CPE, and More), Service Type (Enhanced Mobile Broadband (eMBB), Massive Machine-Type Communications (mMTC), and More), and Geography.

Geography Analysis

Asia-Pacific accounted for 52% of global subscriptions in 2024 and is forecast to grow at a 30.28% CAGR through 2030, led by China's 4.4 million base stations and India's rapid standalone expansion. China's digital-economy contribution is set to reach USD 2 trillion by 2030, reflecting widespread 5G platform adoption in manufacturing, retail, and services. India's Reliance Jio operates over 1 million cloud-native cell sites, while expected FWA lines could climb from 5 million to 30 million by 2027. Japan's and South Korea's early commercial 5G Advanced launches sustain regional innovation leadership, and Southeast Asia projects USD 130 billion in incremental GDP impact by 2030.

North America is a mature yet innovation-centric arena where 98% of the population already has 5G coverage. T-Mobile's nationwide SA deployment and 6.43 million FWA lines illustrate consumer and enterprise diversification. Verizon's satellite partnership with AST SpaceMobile seeks to close residual rural gaps, while Canadian and Mexican carriers integrate 5G Advanced features such as RedCap. Focus now turns to monetizing network APIs, edge compute, and AI-assisted service orchestration, driving higher revenue density per site across the 5G connections market.

Europe displays mixed progress: Germany, Denmark and Finland exceed 95% population coverage, yet only 2% of subscriptions run on SA cores. The United Kingdom's Vodafone-Three merger injects USD 14.86 billion into network upgrades aimed at rural inclusion, and Nordic spectrum-sharing models yield higher availability at lower cost. Continental operators now press regulators to streamline auctions and lower license fees to sustain investment cycles, seeking to close the SA gap and unlock greater value in the 5G connections market.

- AT&T Inc.

- Verizon Communications Inc.

- Vodafone Group Plc

- China Mobile Ltd.

- China Telecommunications Corp.

- T-Mobile US Inc.

- Telstra Corp. Ltd.

- Telefonica SA

- Deutsche Telekom AG

- Reliance Jio Infocomm Ltd.

- SK Telecom Co. Ltd.

- NTT Docomo Inc.

- KT Corp.

- Orange SA

- KDDI Corp.

- Bharti Airtel Ltd.

- Saudi Telecom Company (stc)

- Rakuten Mobile Inc.

- Etisalat by eand

- MTN Group Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in mobile data traffic requiring higher-capacity networks

- 4.2.2 Fixed Wireless Access (FWA) emerging as mainstream broadband alternative

- 4.2.3 Enterprise digitization and IoT accelerating 5G adoption

- 4.2.4 Generative-AI-driven uplink surge spurring early 5G-SA roll-outs

- 4.2.5 Monetization via Open-API ecosystems

- 4.3 Market Restraints

- 4.3.1 High CAPEX and mid-band spectrum costs

- 4.3.2 Rural coverage economics remain unattractive

- 4.3.3 Fiber price wars dampen urban FWA uptake

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Connection Type

- 5.1.1 Mobile Broadband

- 5.1.2 Fixed Wireless Access

- 5.1.3 M2M and IoT

- 5.1.4 Mission-critical Communications

- 5.1.5 Private Networks

- 5.2 By End-user

- 5.2.1 Consumer

- 5.2.2 Enterprise

- 5.2.2.1 Manufacturing

- 5.2.2.2 Healthcare

- 5.2.2.3 Automotive and Transportation

- 5.2.2.4 Smart Cities and Public Safety

- 5.2.2.5 Energy and Utilities

- 5.2.2.6 Retail and Logistics

- 5.3 By Spectrum Band

- 5.3.1 Sub-1 GHz (Low-Band)

- 5.3.2 1-6 GHz (Mid-Band)

- 5.3.3 above 24 GHz (mmWave / High-Band)

- 5.4 By Network Architecture

- 5.4.1 Non-Standalone (NSA)

- 5.4.2 Standalone (SA)

- 5.5 By Device Category

- 5.5.1 Smartphones and Tablets

- 5.5.2 FWA CPE

- 5.5.3 IoT Modules and Gateways

- 5.5.4 Wearables and AR/VR Devices

- 5.5.5 Industrial Routers and Rugged Modules

- 5.6 By Service Type

- 5.6.1 Enhanced Mobile Broadband (eMBB)

- 5.6.2 Massive Machine-Type Communications (mMTC)

- 5.6.3 Ultra-Reliable Low-Latency Communications (URLLC)

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.2 South America

- 5.7.2.1 Brazil

- 5.7.2.2 Rest of South America

- 5.7.3 Europe

- 5.7.3.1 Germany

- 5.7.3.2 France

- 5.7.3.3 United Kingdom

- 5.7.3.4 Rest of Europe

- 5.7.4 Asia Pacific

- 5.7.4.1 China

- 5.7.4.2 India

- 5.7.4.3 Japan

- 5.7.4.4 South Korea

- 5.7.4.5 ASEAN

- 5.7.4.6 Rest of Asia Pacific

- 5.7.5 Middle East and Africa

- 5.7.5.1 Middle East

- 5.7.5.1.1 Saudi Arabia

- 5.7.5.1.2 UAE

- 5.7.5.1.3 Turkey

- 5.7.5.1.4 Rest of Middle East

- 5.7.5.2 Africa

- 5.7.5.2.1 South Africa

- 5.7.5.2.2 Nigeria

- 5.7.5.2.3 Rest of Africa

- 5.7.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AT&T Inc.

- 6.4.2 Verizon Communications Inc.

- 6.4.3 Vodafone Group Plc

- 6.4.4 China Mobile Ltd.

- 6.4.5 China Telecommunications Corp.

- 6.4.6 T-Mobile US Inc.

- 6.4.7 Telstra Corp. Ltd.

- 6.4.8 Telefonica SA

- 6.4.9 Deutsche Telekom AG

- 6.4.10 Reliance Jio Infocomm Ltd.

- 6.4.11 SK Telecom Co. Ltd.

- 6.4.12 NTT Docomo Inc.

- 6.4.13 KT Corp.

- 6.4.14 Orange SA

- 6.4.15 KDDI Corp.

- 6.4.16 Bharti Airtel Ltd.

- 6.4.17 Saudi Telecom Company (stc)

- 6.4.18 Rakuten Mobile Inc.

- 6.4.19 Etisalat by eand

- 6.4.20 MTN Group Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment