|

市場調查報告書

商品編碼

1851048

託管專用交換機(PBX):市場佔有率分析、產業趨勢、統計資料和成長預測 (2025-2030)Hosted Private Branch Exchange (PBX) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

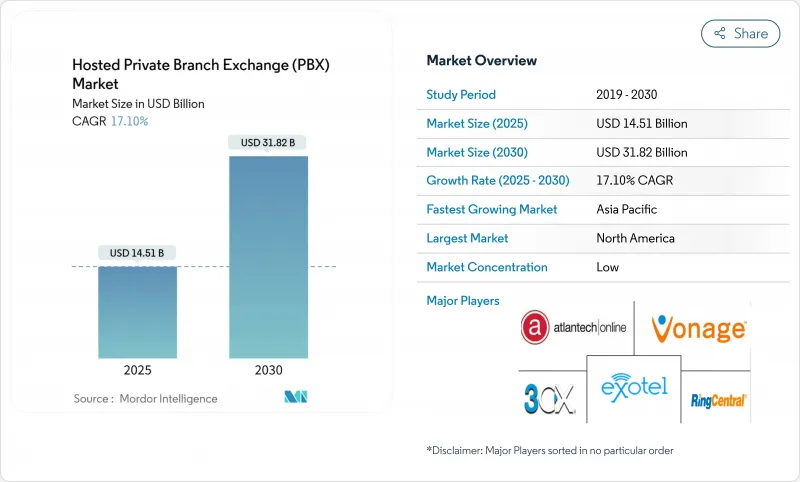

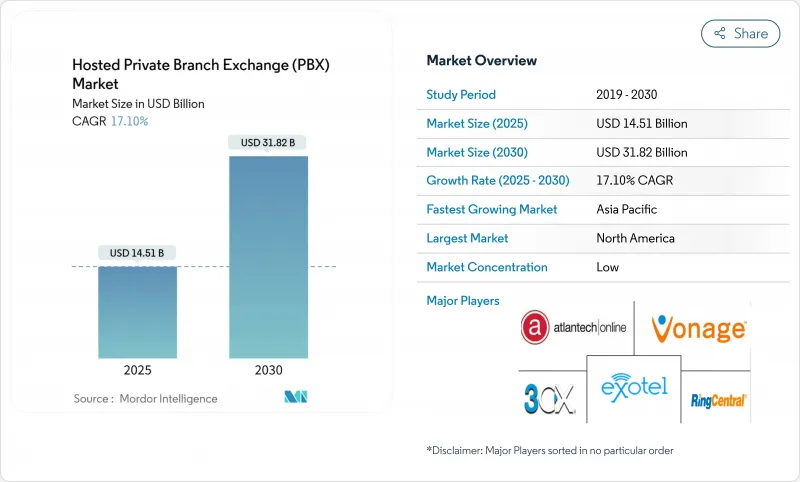

預計到 2025 年,託管私人分支交易所市場規模將達到 145.1 億美元,到 2030 年將達到 318.2 億美元,複合年成長率為 17.1%。

企業對雲端語音的需求日益成長,希望以靈活的雲端語音解決方案取代資本密集的本地交換機,以適應分散式辦公室模式的擴展。中型企業將託管式PBX視為降低營運成本、更輕鬆地整合人工智慧分析、多通路路由和行動功能的有效途徑。供應商正將PBX與更廣泛的統一通訊即服務(UCaaS)套件捆綁銷售,為企業提供集語音、視訊、通訊和協作於一體的統一平台。 5G的部署、SIP中繼的遷移以及固網行動整合將進一步推動這一成長,使員工能夠在任何裝置上保持安全的企業身分。

全球託管專用專用交換機(PBX) 市場趨勢與洞察

自帶設備辦公室 (BYOD)主導的需求激增正在重塑企業行動策略

美國中型企業正在放棄桌上型電話,轉而採用行動優先的雲端語音服務,將公司號碼保留在個人行動電話上。 Cavell Group預測,行動雲端席位將從2022年的100萬增加到2027年的730萬,證實了託管專用交換機( BPEX)市場如今是由智慧型手機而非行動電話主導的。固網與行動網路整合已成為企業的重要功能,因為它簡化了合規流程,即使員工遠端辦公也能維持通話品質。 AT&T的Webex Go雲端語音服務展示了通訊業者如何將網路覆蓋與協作軟體結合,從而彌合辦公室用戶和現場用戶之間的差距。

5G網路消除雲端語音普及的服務品質障礙

獨立組網的5G網路將延遲降低至10毫秒以下,確保了關鍵任務語音所需的頻寬。中國、韓國和印度的企業預計,5G賦能的工業4.0應用場景將帶來高達20%的收益,這將推動託管式PBX在現場協調的應用。隨著可靠的無線鏈路消除工廠和物流中心雲端呼叫的最後障礙,託管式專用專用交換機市場也將從中受益。通訊服務提供者目前正將PBX席位與5G切片打包銷售,在單一合約中涵蓋網路連線和語音服務。

資料主權要求對多租戶架構構成挑戰

《歐洲經濟共同體指令》(EECC Directive) 和《一般資料保護規範》(GDPR) 要求服務提供者將語音錄音儲存在歐盟境內,並提供詳細的使用者同意流程。多租戶 PBX 架構必須分類特定國家/地區的資料區域,否則將面臨高達全球收入 4% 的罰款。託管式專用交換器 (PBX) 市場的供應商正在透過開設區域資料中心和提供客戶控制的加密金鑰來應對這些要求。

細分市場分析

到2024年,解決方案仍將佔據託管專用交換器市場67%的收入佔有率,這主要得益於對核心呼叫控制、自動應答和語音信箱的持續需求。然而,隨著企業尋求諮詢和託管支持,將雲端語音整合到其複雜的應用堆疊中,服務預計將以每年18.1%的速度成長。專業服務團隊負責評估準備、設定連接埠號碼和培訓用戶,而託管服務團隊則負責監控服務品質和執行策略。這種轉變將使託管專用交換器行業從純粹的SaaS模式轉向基於結果的合約模式,從而使提供者和客戶的成功指標保持一致。

人工智慧可自動完成配置和異常檢測,使服務合作夥伴即使在全球範圍內也能保證 99.999% 的執行時間。 8x8 的 eXperience 通訊平台展示如何在單一管理面板下整合語音、視訊、簡訊和 API。這種整合提高了託管服務的連接速率 [eclipsewholesale.co.uk]。託管專用交換器 (BPX) 管理服務的市場預計將從 2025 年的 49 億美元成長到 2030 年的 114 億美元。

擁有 51 至 250 個席位的中小型企業將在 2024 年佔據 62% 的收入佔有率,因為雲端語音消除了以往阻礙其發展的巨額資本支出。固定的月費涵蓋了升級和安全保障,使財務團隊能夠預測現金流。隨著這些企業開設分店,管理員可以在幾分鐘內添加席位,從而幫助企業保持高生產力。大型企業的成長速度最快,年複合成長率高達 17.3%,這得益於全球 IT 部門將數十個本地 PBX 系統整合到單一租戶中,並在全球範圍內實施統一的策略。

預計2030年,大型企業的託管專用交換器(BPEX)市場規模將達82億美元,縮小與中階市場支出規模的差距。然而,分析師估計,每個席位的平均月收入為40至50美元,這表明在實現自動化註冊的情況下,該方案具有盈利。新參與企業正透過免費試用和自助設定來開拓這一細分市場,從而避免現有企業在頂級帳戶上苦苦掙扎。

區域分析

北美市場領先,預計2024年將佔全球收入的35%,這主要得益於成熟的寬頻網路、寬鬆的自帶設備辦公室(BYOD)政策以及雲端優先的採購模式。美國監管機構強制要求緊急呼叫使用公共交換電話網路(PSTN)作為備用線路,雖然增加了成本,但並未影響可靠性。營運商透過部署地理位置冗餘的中繼線路和E911緊急呼叫服務來應對這項挑戰。人工智慧驅動的語音分析技術正迅速普及,它利用客戶對話來改善服務。

亞太地區將以17.5%的複合年成長率實現最快成長。中國和韓國5G的大規模普及將消除延遲問題,而印度的新興企業將簽訂月度合約而非購買設備。日本企業集團將堅持使用開放API以避免被鎖定,從而推動託管專用交換機市場向基於標準的擴展轉型。政府獎勵策略提供的雲端採用共同資金將推動東南亞地區的雲端採用。

歐洲在機會與監管之間尋求平衡。 TDM交換機故障和昂貴的ISDN線路正促使小型企業轉向SIP中繼和託管撥號方案,而GDPR則迫使營運商投資於區域內儲存和合法攔截。儘管面臨這些挑戰,歐洲託管專用交換器市場規模仍將從2025年的43億美元成長到2030年的84億美元。旨在將光纖延伸至農村地區的國家寬頻計劃,預計將在本世紀後半葉縮小城鄉之間的網路品質差距。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 自帶設備辦公室 (BYOD)主導北美中型企業對行動整合 PBX 的需求激增

- 在亞洲部署5G獨立組網,以實現對服務品質敏感的雲端語音服務

- 歐洲中小企業正從TDM遷移到SIP中繼,以降低整體擁有成本。

- 疫情後的混合辦公政策加速了紐澳地區公司雲端通訊的更新週期

- 中東一級營運商的UCaaS捆綁獎勵推動了託管席位的普及

- 內建於託管式PBX系統中的人工智慧語音分析功能,吸引了拉丁美洲的客服中心。

- 市場限制

- 歐盟GDPR資料居住義務限制了多租戶語音存儲

- 印度一線城市以外地區的最後一公里光纖普及率有限,為服務品質帶來了挑戰。

- 美國持續的公共交換電話網路(PSTN)備用方案監管要求推高了合規成本。

- 日本大型企業對專有API相關的供應商鎖定問題表示擔憂

- 價值鏈分析

- 監理展望

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 組件段

- 解決方案

- 服務

- 託管服務

- 專業服務

- 網路和IT服務

- 按公司規模分類

- 小型企業

- 主要企業

- 應用領域

- 整合通訊與協作

- 賦能行動辦公室和自備設備辦公室 (BYOD)。

- 客服中心

- SIP中繼和呼叫路由

- 按最終用戶行業進行細分

- BFSI

- 製造業

- 零售與電子商務

- 醫療保健和生命科學

- 政府/公共部門

- 資訊科技和電信

- 教育

- 物流和運輸

- 飯店業

- 其他行業

- 區域細分

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 北歐國家

- 瑞典

- 挪威

- 丹麥

- 芬蘭

- 冰島

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 以色列

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 肯亞

- 其他非洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Mitel Networks Corp

- Avaya Inc

- Amazon Web Services(Amazon.com Inc)

- Microsoft Corporation

- 3CX

- Exotel Techcom Pvt Ltd

- Vonage

- RingCentral Inc

- Atlantech Online Inc

- Clearly Core Inc

- OnePipe Telecom

- Zaplee Inc

- G12 Communications LLC

- Yeastar Information Technology Co Ltd

- 8x8 Inc

- Cisco Systems Inc

- Nextiva Inc

- Twilio Inc

- Zoom Video Communications Inc

- Ooma Inc

第7章 市場機會與未來展望

The hosted private branch exchange market is valued at USD 14.51 billion in 2025 and is predicted to reach USD 31.82 billion by 2030, reflecting a 17.1% CAGR.

Demand is rising as organizations swap capital-heavy on-premises switches for flexible cloud voice that scales with distributed workforces. Mid-market firms view hosted PBX as a route to lower operating costs and easy integration of AI analytics, multi-channel routing, and mobility features. Vendors are bundling PBX with wider UCaaS suites, giving enterprises a single platform for voice, video, messaging, and collaboration. Growth is further lifted by 5G rollouts, SIP trunk migration, and fixed-mobile convergence that lets employees keep a secure business identity on any device.

Global Hosted Private Branch Exchange (PBX) Market Trends and Insights

Surge in BYOD-Driven Demand Reshapes Enterprise Mobility Strategy

Mid-market firms in the United States are retiring desk phones in favor of mobile-first cloud voice that keeps corporate numbers on personal handsets. Cavell Group forecasts mobile-enabled cloud seats rising from 1 million in 2022 to 7.3 million by 2027, confirming that the hosted private branch exchange market is now shaped by smartphones rather than handsets. Businesses see fixed-mobile convergence as an essential feature because it simplifies compliance and preserves call quality while staff work remotely. AT&T's Cloud Voice with Webex Go shows how carriers integrate network reach with collaboration software to remove the divide between office and field users.

5G Networks Eliminate QoS Barriers to Cloud Voice Adoption

Standalone 5G is cutting latency below 10 ms and delivering the guaranteed bandwidth that mission-critical voice needs. Enterprises in China, South Korea, and India expect up to 20% returns from 5G-enabled Industry 4.0 use cases, which fuels the adoption of hosted PBX for shop-floor coordination. The hosted private branch exchange market gains because reliable wireless links remove the last objection to cloud calling in factories and logistics hubs. Communications service providers now package PBX seats with 5G slices so a single contract covers connectivity and voice.

Data Sovereignty Requirements Challenge Multi-Tenant Architectures

The EECC Directive and GDPR oblige providers to store voice recordings inside the EU and to furnish detailed consent workflows. Multi-tenant PBX architectures must carve out country-specific data zones or risk fines up to 4% of global turnover. Vendors in the hosted private branch exchange market respond by opening regional data centers and offering customer-managed encryption keys, which raises operating costs yet preserves feature parity across borders.

Other drivers and restraints analyzed in the detailed report include:

- SIP Trunking Migration Delivers Transformative Cost Benefits

- Hybrid Work Models Drive Comprehensive Communication Refresh

- Infrastructure Gaps Impede Quality Service Delivery in Emerging Markets

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Solutions continued to command a 67% revenue share of the hosted private branch exchange market in 2024, thanks to evergreen demand for core call control, auto-attendant, and voicemail. However, services are set to grow 18.1% annually as enterprises seek advisory and managed support to weave cloud voice into complex application stacks. Professional services teams run readiness assessments, port numbers, and train users, while managed services teams monitor quality of service and enforce policy. This shift broadens the hosted private branch exchange industry from pure SaaS toward outcome-based contracts, aligning providers with customer success metrics.

AI now automates provisioning and anomaly detection, letting service partners guarantee 99.999% uptime even at a global scale. 8x8's eXperience Communications Platform demonstrates how a single management pane unifies voice, video, SMS, and APIs; such consolidation bolsters attach rates for managed services [eclipsewholesale.co.uk]. The hosted private branch exchange market size for managed services is projected to expand from USD 4.9 billion in 2025 to USD 11.4 billion by 2030, reflecting this demand-led swing toward expertise backed by SLAs.

SMEs with 51-250 seats held 62% of 2024 revenue because cloud voice removes the capital spikes that traditionally deterred smaller firms. Fixed monthly pricing covers upgrades and security, letting finance teams predict cash flow. As these firms open branch offices, administrators add seats in minutes, keeping productivity high. Large enterprises now show the fastest growth at 17.3% CAGR as global IT departments consolidate dozens of local PBXs into a single tenant that enforces consistent policies worldwide.

The hosted private branch exchange market size for large enterprises is forecast to reach USD 8.2 billion by 2030, closing the historical gap with mid-market spending. Micro-enterprises remain underserved; yet analysts peg average monthly revenue at USD 40-50 per seat, proving profitability when onboarding is automated. New entrants use freemium trials and self-service setup to attack this niche, preventing incumbents from coasting on top-tier accounts.

The Hosted Private Branch Exchange (PBX) Market is Segmented by Component (Solutions and Services), Enterprise Size (Small and Medium Enterprises and Large Enterprises), Application (Unified Communication and Collaboration, Mobility and BYOD Enablement, and More), End-User Industry (BFSI, Manufacturing, Retail and E-Commerce, and More) and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 35% of 2024 revenue, buoyed by mature broadband, permissive BYOD policies, and cloud-first procurement. U.S. regulators compel PSTN fall-back for emergency calls, adding cost but cementing trust. Providers answer with geo-redundant trunks and E911 provisioning that complies out of the box. AI-driven voice analytics gain rapid traction, turning customer conversations into data that fuels service improvements.

Asia Pacific is the fastest climber at a 17.5% CAGR. Mass 5G coverage in China and South Korea removes latency complaints, while India's digital-first start-ups sign monthly subscriptions instead of buying gear. Japanese conglomerates insist on open APIs to avoid lock-in, pushing the hosted private branch exchange market toward standards-based extensions. Government stimulus packages that co-fund cloud adoption amplify uptake across Southeast Asia.

Europe balances opportunity with regulation. TDM switch shut-offs and expensive ISDN lines push SMBs toward SIP trunks and hosted dial plans, yet GDPR forces providers to invest in in-region storage and lawful intercept. Despite the burden, the hosted private branch exchange market size in Europe will grow from USD 4.3 billion in 2025 to USD 8.4 billion in 2030. National broadband plans that extend fiber to rural zones promise to shrink the urban-rural quality divide by the second half of the decade.

- Mitel Networks Corp

- Avaya Inc

- Amazon Web Services (Amazon.com Inc)

- Microsoft Corporation

- 3CX

- Exotel Techcom Pvt Ltd

- Vonage

- RingCentral Inc

- Atlantech Online Inc

- Clearly Core Inc

- OnePipe Telecom

- Zaplee Inc

- G12 Communications LLC

- Yeastar Information Technology Co Ltd

- 8x8 Inc

- Cisco Systems Inc

- Nextiva Inc

- Twilio Inc

- Zoom Video Communications Inc

- Ooma Inc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in BYOD-driven demand for mobile-integrated PBX among North-American mid-market firms

- 4.2.2 Roll-out of 5G standalone networks enabling QoS-sensitive cloud voice in Asia

- 4.2.3 Migration from TDM to SIP trunking across European SMBs lowering total cost of ownership

- 4.2.4 Post-pandemic hybrid-work policies accelerating cloud communication refresh cycles in ANZ enterprises

- 4.2.5 UCaaS bundling incentives offered by tier-1 carriers in the Middle-East driving hosted seat uptake

- 4.2.6 AI-powered voice analytics embedded in hosted PBX attracting contact-centres in Latin-America

- 4.3 Market Restraints

- 4.3.1 Data-residency mandates under EU GDPR restricting multi-tenant voice storage

- 4.3.2 Limited last-mile fiber penetration outside Tier-1 Indian cities causing QoS issues

- 4.3.3 Persistent PSTN-fallback regulatory requirements inflating compliance cost in the U.S.

- 4.3.4 Vendor lock-in concerns linked to proprietary APIs among Japanese large enterprises

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 Segmentation by Component

- 5.1.1 Solution

- 5.1.2 Services

- 5.1.2.1 Managed Services

- 5.1.2.2 Professional Services

- 5.1.2.3 Network and IT Services

- 5.2 Segmentation by Enterprise Size

- 5.2.1 Small and Medium Enterprises

- 5.2.2 Large Enterprises

- 5.3 Segmentation by Application

- 5.3.1 Unified Communication and Collaboration

- 5.3.2 Mobility and BYOD Enablement

- 5.3.3 Contact Center

- 5.3.4 SIP Trunking and Call Routing

- 5.4 Segmentation by End-Use Industry

- 5.4.1 BFSI

- 5.4.2 Manufacturing

- 5.4.3 Retail and E-commerce

- 5.4.4 Healthcare and Life Sciences

- 5.4.5 Government and Public Sector

- 5.4.6 IT and Telecom

- 5.4.7 Education

- 5.4.8 Logistics and Transportation

- 5.4.9 Hospitality

- 5.4.10 Other Industries

- 5.5 Segmentation by Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Nordics

- 5.5.4.1 Sweden

- 5.5.4.2 Norway

- 5.5.4.3 Denmark

- 5.5.4.4 Finland

- 5.5.4.5 Iceland

- 5.5.5 Middle East

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 Israel

- 5.5.5.5 Rest of Middle East

- 5.5.6 Africa

- 5.5.6.1 South Africa

- 5.5.6.2 Nigeria

- 5.5.6.3 Egypt

- 5.5.6.4 Kenya

- 5.5.6.5 Rest of Africa

- 5.5.7 Asia Pacific

- 5.5.7.1 China

- 5.5.7.2 India

- 5.5.7.3 Japan

- 5.5.7.4 South Korea

- 5.5.7.5 ASEAN

- 5.5.7.6 Rest of Asia Pacific

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Mitel Networks Corp

- 6.4.2 Avaya Inc

- 6.4.3 Amazon Web Services (Amazon.com Inc)

- 6.4.4 Microsoft Corporation

- 6.4.5 3CX

- 6.4.6 Exotel Techcom Pvt Ltd

- 6.4.7 Vonage

- 6.4.8 RingCentral Inc

- 6.4.9 Atlantech Online Inc

- 6.4.10 Clearly Core Inc

- 6.4.11 OnePipe Telecom

- 6.4.12 Zaplee Inc

- 6.4.13 G12 Communications LLC

- 6.4.14 Yeastar Information Technology Co Ltd

- 6.4.15 8x8 Inc

- 6.4.16 Cisco Systems Inc

- 6.4.17 Nextiva Inc

- 6.4.18 Twilio Inc

- 6.4.19 Zoom Video Communications Inc

- 6.4.20 Ooma Inc

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment