|

市場調查報告書

商品編碼

1851022

專用LTE:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030年)Private LTE - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

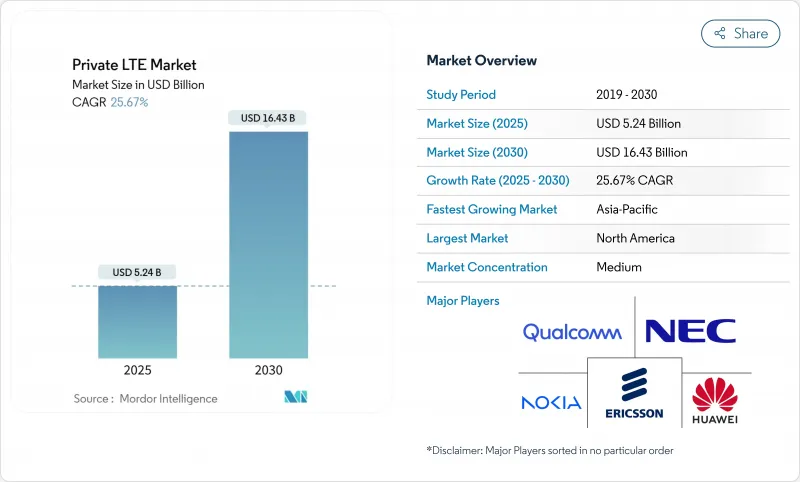

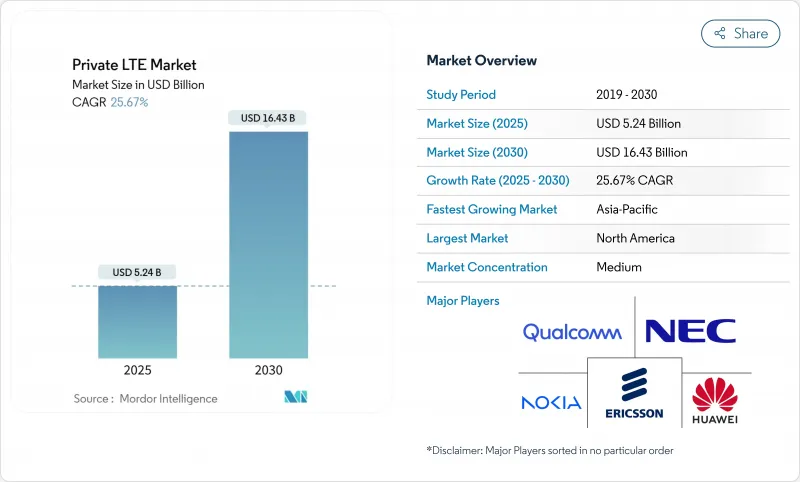

預計到 2025 年,專用 LTE 市場規模將達到 52.4 億美元,到 2030 年將達到 164.3 億美元,年複合成長率為 25.67%。

隨著企業營運數位轉型,並將關鍵業務工作負載部署在專用蜂巢式基礎架構上,安全至上、效能確定性是推動其普及的關鍵因素。共用頻譜的早期商業化、工業4.0專案的快速推進,以及在嚴苛環境下對超可靠、低延遲通訊(URLLC)日益成長的需求,都在推動著私有LTE市場的成長。工業場所現在更傾向於選擇私有LTE而非公共LTE,因為私有LTE能夠提供可預測的覆蓋範圍、簡化的品管,以及敏感營運資料的完整管理選項。邊緣運算的整合是另一個促進因素,它能夠對海量感測器資料流進行本地分析,且無需考慮往返延遲。生態系統創新,特別是開放式小型基地台和CBRS設備的普及,正在降低私有LTE市場的進入門檻,並擴大其潛在用戶群。

全球專用LTE市場趨勢與洞察

頻寬自由化導致企業採用率快速上升。

主要亮點

- 監管機構正在重新分配中頻段頻譜,使企業能夠在類似CBRS的框架下以前所未有的方式獲得高品質頻譜。到2023年底,預計將部署約37萬台CBRS設備,這凸顯了共用頻寬如何降低許可門檻並實現網路所有權的民主化。經濟實惠且干擾可控的存取方式,使得先前缺乏資源取得獨家授權的中型企業也能進入專用LTE市場。在美國以外,德國、日本和澳洲正在發放本地許可證,允許工廠、港口和公共設施部署客製化的覆蓋範圍。這項政策轉變正在擴大供應商生態系統,刺激小型基地台創新,並催生出一批新的工業場所,預計未來三年內將在這些場所部署專用LTE網路。

工業IoT推動製造業轉型

智慧工廠的部署依賴可靠的無線骨幹網,可支援數千個感測器,且延遲低於30毫秒。約79%的早期採用專用LTE網路的用戶表示,在部署專用LTE網路以支援自動導引車、擴增實境輔助維護數位雙胞胎後的六個月內,他們實現了正向投資回報率。低負載連接提高了線路平衡效率,從而促進了預測性維護、品質分析和全廠能源最佳化。隨著首批網路投入運作,製造商們正在發現越來越多的應用場景,例如場地管理和用於保障工人安全的穿戴式設備,這為專用LTE市場形成了一個自我強化的普及曲線。

資本密集型會造成推廣障礙

私有LTE部署需要無線和核心設備、高可靠性回程傳輸、站點建設,以及在某些地區需要支付頻寬使用費。初始成本通常會超過內部預期報酬率,尤其對於中型企業而言。由於營運支出訂閱模式可以緩解資本衝擊並使支出與生產力提升保持一致,因此人們對網路即服務協議的興趣日益濃厚。網路安全加固和避免停機等無形收益仍然難以量化,從而延長了預算週期。開放式無線接取網路(Open RAN)硬體可望降低單位成本,但對於缺乏蜂窩網路專業知識的企業而言,整合成本可能會抵銷節省的成本。

細分市場分析

2024 年市場細分顯示,基礎設施產業佔市場佔有率的 63%,反映出其在小型基地台、封包核心網路和傳輸設備上的大量支出。然而,由於企業依賴系統整合商來規避內部技能短缺問題,服務收入正以 18.4% 的複合年成長率快速成長。託管服務整合了設計、整合和全天候營運,為工廠和公共產業提供可預測的預算,同時加快價值實現速度。綠地計畫對專業服務的需求依然旺盛,但經常性託管合約在新訂單中佔據了相當大的佔有率。

儘管無線存取網仍然是最大的投資項目,但企業越來越重視在地核心系統,以強化安全策略。將多個工廠區域連接到雲端控制套件時,傳輸回程傳輸的升級不可或缺。供應商目前正在推廣「盒裝網路」(預先配置的核心網加小型基地台),並支援當日啟用。 Pente Networks 的一款此類套件在 2025 年洛杉磯山火期間保障了應急人員的通訊,凸顯了這種承包解決方案如何將專用 LTE 市場拓展到技術型買家之外的更廣泛群體。

預計到2024年,時分通訊( TDD)將佔總收入的55%,複合年成長率(CAGR)高達17.1%。視訊監控和遙測非對稱流量有利於TDD動態分配,從而在稀缺的中頻段頻道內實現最大吞吐量。 TDD也與CBRS頻寬分配一致,進一步鞏固了其在新私有LTE市場部署中的預設地位。

頻分雙工 (FDD) 在對延遲敏感的控制系統中仍然佔據一席之地,因為在這些系統中,上行鏈路和下行鏈路之間的嚴格分離至關重要。然而,現代調度器已將 TDD 抖動降低到 10 毫秒以下,縮小了歷史差距。即將發布的 5G通訊將進一步最佳化 TDD 參數,確保企業在向 5G NR 載波聚合過渡的過程中,目前的投資仍然有效。

區域分析

北美將引領潮流,預計到2024年將佔全球收入的38%,這主要得益於其CBRS框架以及成熟的無線電、設備和整合商合作夥伴生態系統。到2024年底,全球將有超過4700個專用LTE和5G網路投入使用,其中美國將佔據相當大的佔有率。製造業、醫療保健和公共產業的本地5G試點計畫將推動市場需求,而超大規模邊緣區域將有助於將低延遲工作負載卸載到主要城市。

亞太地區將在2025年至2030年間實現12.8%的複合年成長率,成為全球5G市場成長最快的地區。中國正在部署國營工廠和礦山網路,日本正在發放毫米波和中頻段的本地5G牌照,韓國則利用其密集的光纖骨幹網路來建造校園核心網。印度近期調整的頻譜政策已在汽車和製藥工廠啟動了試點計畫。澳洲目前已有超過50個私有LTE系統投入營運,主要用於簡化偏遠地區的鐵礦石和鋰礦開採作業。澳洲通訊與媒體管理局(ACMA)預測,到2027年,澳洲電信市場規模將達到6.95億澳元。

根據GSMA的數據,歐洲在5G部署方面位居第二,到2023年中期,將佔全球住宅安裝量的約40%。德國3.7-3.8 GHz頻段的本地牌照正在推動製造業採用5G技術,而英國的共享接入框架則簡化了港口和農場的牌照申請流程。歐洲5G觀察站的數據顯示,截至2024年3月,73%的先鋒頻段已被分配,為工業網路奠定了堅實的頻譜基礎。沃達豐承諾在2500個站點部署開放式無線接取網路(Open RAN),預計將降低整個歐洲大陸的建造成本,間接惠及尋求承包計劃的企業買家。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 頻率自由化與CBRS商業化

- 工業IoT和工業4.0的興起

- 嚴苛環境下的關鍵任務型超可靠低延遲通訊(URLLC)需求

- 向 5G SA 的無縫遷移路徑

- 本地邊緣 AI頻寬需求

- 開放式無線接取網路(Open RAN)小型基地台生態系統可降低整體擁有成本(TCO)。

- 市場限制

- 高額資本支出和不確定的投資報酬率

- 缺乏綜合人才

- 顆粒設備頻段支持

- 私人5G試辦計畫蠶食預算

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 按組件

- 基礎設施

- 無線存取網(RAN)

- 核心(EPC/5GC)

- 回程傳輸和運輸

- 服務

- 專業服務

- 託管服務

- 基礎設施

- 透過技術

- 頻分雙工(FDD)

- 時分雙工(TDD)

- 按部署模式

- 集中式(C-RAN)

- 去中心化

- 頻譜

- 授權

- 免授權(MulteFire,5GHz)

- 共享(CBRS、LAA)

- 按最終用戶行業分類

- 製造業

- 能源與公共產業

- 採礦、石油和天然氣

- 運輸與物流

- 公共與國防

- 衛生保健

- 公司/校園

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 韓國

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 卡達

- 以色列

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Nokia

- Ericsson

- Huawei Technologies

- NEC Corp.

- Qualcomm

- Druid Software

- Sierra Wireless

- JMA Wireless

- Ruckus Networks(CommScope)

- Celona

- Airspan Networks

- Cisco Systems

- ZTE Corp.

- Samsung Electronics

- Airspan Networks

- Athonet(HPE)

- Motorola Solutions

- Mavenir Systems

- Amazon AWS Private 5G

- Verizon Business

- General Dynamics Mission Systems

第7章 市場機會與未來展望

The private LTE market is valued at USD 5.24 billion in 2025 and is forecast to reach USD 16.43 billion by 2030, expanding at a 25.67% CAGR.

Security-focused, deterministic performance is propelling adoption as enterprises digitize operations and place mission-critical workloads on dedicated cellular infrastructure. Early commercialization of shared spectrum, rapid progress on Industry 4.0 programs, and the rising need for ultra-reliable low-latency communications (URLLC) in harsh settings all reinforce growth. Industrial sites now favour private LTE over public alternatives because it delivers predictable coverage, streamlined quality-of-service management, and the option to retain full control of sensitive operational data. Edge computing integration is another accelerant, enabling local analytics on massive sensor streams without round-trip delays. Ecosystem innovation-in particular, open RAN, small-cell form factors, and CBRS device proliferation-is lowering entry barriers and widening the private LTE market addressable base.

Global Private LTE Market Trends and Insights

Spectrum Liberalization Unlocks Enterprise Deployment Surge

Key Highlights

- Regulators are reallocating mid-band frequencies, giving enterprises unprecedented access to high-quality spectrum under frameworks such as CBRS. Around 370,000 CBRS devices had been deployed by end-2023, underscoring how shared bands reduce licensing hurdles and democratize network ownership.Affordable, interference-managed access has opened the private LTE market to mid-sized firms that previously lacked resources for exclusive licences. Beyond the United States, Germany, Japan, and Australia have issued local licences that let factories, ports, and utilities implement bespoke coverage footprints. The policy shift is expanding vendor ecosystems, stimulating small-cell innovation, and creating a pipeline of new industrial sites expected to deploy private LTE networks over the next three years.

Industrial IoT Drives Manufacturing Transformation

Smart-factory rollouts now hinge on reliable wireless backbones capable of sustaining thousands of sensors with latencies below 30 ms. Nearly 79% of early adopters said they achieved positive ROI within six months after installing private LTE to support automated guided vehicles, AR-assisted maintenance, and digital twins. Low-variance connectivity improves line-balance efficiency, which in turn drives predictive maintenance, quality analytics, and plant-wide energy optimisation. Manufacturers consistently discover incremental use cases, such as yard management and worker-safety wearables, once the initial network is live, creating a self-reinforcing adoption curve inside the private LTE market.

Capital Intensity Creates Adoption Barriers

Private LTE deployments involve radio and core equipment, resilient backhaul, site works and, in some regions, spectrum fees. Upfront costs often exceed internal hurdle rates, especially for mid-tier firms. Interest in network-as-a-service contracts is rising because OPEX subscriptions reduce capital shock and match spending to productivity gains. Quantifying intangible benefits such as cyber-hardening and downtime avoidance remains challenging, prolonging budget cycles. Open RAN hardware promises lower unit prices, yet integration overheads can erase savings for organisations lacking cellular expertise.

Other drivers and restraints analyzed in the detailed report include:

- Mission-Critical Communications Enable Remote Operations

- Seamless Migration Path Toward 5G SA

- Integration Complexity Slows Implementation Velocity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The infrastructure segment held 63% of the private LTE market in 2024, reflecting heavy spending on small cells, packet cores, and transport gear. Yet, services revenue is rising faster at an 18.4% CAGR because organisations lean on system integrators to sidestep internal skills shortages. Managed offerings bundle design, integration, and 24/7 operations, giving factories and utilities predictable budgets while accelerating time-to-value. Professional services demand remains high during greenfield projects, but recurring managed contracts are capturing a larger share of new bookings.

Radio access networks still account for the biggest slice of capital, though enterprises increasingly emphasise onsite core systems to enforce security policies. Transport backhaul upgrades are non-negotiable when connecting multiple plant zones to cloud dashboards. Vendors now promote "network-in-a-box" kits-pre-configured core plus small cells-capable of same-day activation. One such kit from Pente Networks maintained communications for emergency crews during the 2025 Los Angeles wildfires, highlighting how turnkey packaging broadens the private LTE market beyond technically-savvy buyers.

Time-division duplexing captured 55% of revenue in 2024 and is projected to sustain the highest 17.1% CAGR. Asymmetric traffic in video surveillance and telemetry favours TDD's dynamic allocation, maximising throughput within scarce mid-band channels. TDD also aligns with CBRS band allocations, reinforcing its position as the default in new private LTE market deployments.

Frequency-division duplexing retains a foothold in latency-sensitive control systems where strict separation of uplink and downlink is prized. However, modern schedulers reduce TDD jitter to sub-10 ms, narrowing the historical gap. Upcoming 5G releases will further refine TDD numerologies, assuring enterprises that today's investment will remain relevant once they transition to 5G NR carrier aggregation.

The Private LTE Market Report is Segmented by Component (Infrastructure and Services), Technology (Frequency-Division Duplexing (FDD) and Time Division Duplex (TDD)), Deployment Model (Centralized (C-RAN), Distributed), End-User Industry (Industrial (Manufacturing, Energy and Utilities, Mining and Oil and Gas, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America led with 38% of 2024 revenue thanks to the CBRS framework and a mature ecosystem of radio, device, and integrator partners. More than 4,700 private LTE and 5G networks were operational worldwide by end-2024, and a substantial share was in the United States. Local 5G pilots in manufacturing, healthcare, and utilities amplify demand, while hyperscaler edge zones make low-latency workload offload straightforward across major metros.

Asia-Pacific records the fastest 12.8% CAGR from 2025 to 2030. China deploys state-backed factory and mine networks, Japan issues local 5G licences in millimetre and mid-bands, and South Korea capitalises on its dense fibre backbone to host campus cores. India's recent spectrum policy changes have unlocked trials in automotive and pharmaceutical plants. Australia already operates more than 50 private LTE systems, primarily to streamline remote-area iron ore and lithium extraction, and its market is forecast to hit AUD 695 million by 2027, according to ACMA.

Europe ranks second in deployment count, holding roughly 40% of global private installations by mid-2023, according to GSMA. Germany's 3.7-3.8 GHz local licences spur manufacturing adoption; the United Kingdom's Shared Access framework simplifies licences for ports and farms. The European 5G Observatory reports that 73% of pioneer bands were assigned by March 2024, forming a solid spectral foundation for industrial networks. Vodafone's pledge to roll out open RAN on 2,500 sites is expected to reduce equipment costs across Continental Europe, indirectly benefiting enterprise buyers seeking turnkey private LTE projects.

- Nokia

- Ericsson

- Huawei Technologies

- NEC Corp.

- Qualcomm

- Druid Software

- Sierra Wireless

- JMA Wireless

- Ruckus Networks (CommScope)

- Celona

- Airspan Networks

- Cisco Systems

- ZTE Corp.

- Samsung Electronics

- Airspan Networks

- Athonet (HPE)

- Motorola Solutions

- Mavenir Systems

- Amazon AWS Private 5G

- Verizon Business

- General Dynamics Mission Systems

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Spectrum liberalization and CBRS commercialization

- 4.2.2 Industrial IoT and Industry 4.0 uptake

- 4.2.3 Mission-critical URLLC demand in harsh sites

- 4.2.4 Seamless migration path toward 5G SA

- 4.2.5 On-prem edge-AI bandwidth requirements

- 4.2.6 Lower TCO via Open RAN small-cell ecosystems

- 4.3 Market Restraints

- 4.3.1 High CAPEX and uncertain ROI

- 4.3.2 Scarcity of integration talent

- 4.3.3 Fragmented device-band support

- 4.3.4 Budget cannibalisation by private 5G pilots

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Infrastructure

- 5.1.1.1 Radio Access (RAN)

- 5.1.1.2 Core (EPC/5GC)

- 5.1.1.3 Backhaul and Transport

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Infrastructure

- 5.2 By Technology

- 5.2.1 Frequency-Division Duplexing (FDD)

- 5.2.2 Time-Division Duplexing (TDD)

- 5.3 By Deployment Model

- 5.3.1 Centralised (C-RAN)

- 5.3.2 Distributed

- 5.4 By Spectrum

- 5.4.1 Licensed

- 5.4.2 Unlicensed (MulteFire, 5 GHz)

- 5.4.3 Shared (CBRS, LAA)

- 5.5 By End-user Industry

- 5.5.1 Manufacturing

- 5.5.2 Energy and Utilities

- 5.5.3 Mining and Oil and Gas

- 5.5.4 Transportation and Logistics

- 5.5.5 Public Safety and Defense

- 5.5.6 Healthcare

- 5.5.7 Enterprise / Campuses

- 5.5.8 Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 India

- 5.6.4.4 South Korea

- 5.6.4.5 Rest of Asia Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Qatar

- 5.6.5.1.4 Israel

- 5.6.5.1.5 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Nokia

- 6.4.2 Ericsson

- 6.4.3 Huawei Technologies

- 6.4.4 NEC Corp.

- 6.4.5 Qualcomm

- 6.4.6 Druid Software

- 6.4.7 Sierra Wireless

- 6.4.8 JMA Wireless

- 6.4.9 Ruckus Networks (CommScope)

- 6.4.10 Celona

- 6.4.11 Airspan Networks

- 6.4.12 Cisco Systems

- 6.4.13 ZTE Corp.

- 6.4.14 Samsung Electronics

- 6.4.15 Airspan Networks

- 6.4.16 Athonet (HPE)

- 6.4.17 Motorola Solutions

- 6.4.18 Mavenir Systems

- 6.4.19 Amazon AWS Private 5G

- 6.4.20 Verizon Business

- 6.4.21 General Dynamics Mission Systems

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment