|

市場調查報告書

商品編碼

1851005

膠帶:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Adhesive Tapes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

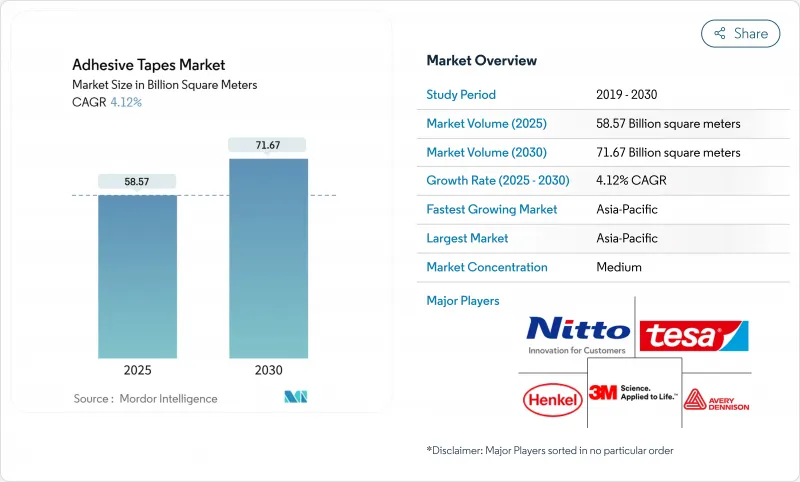

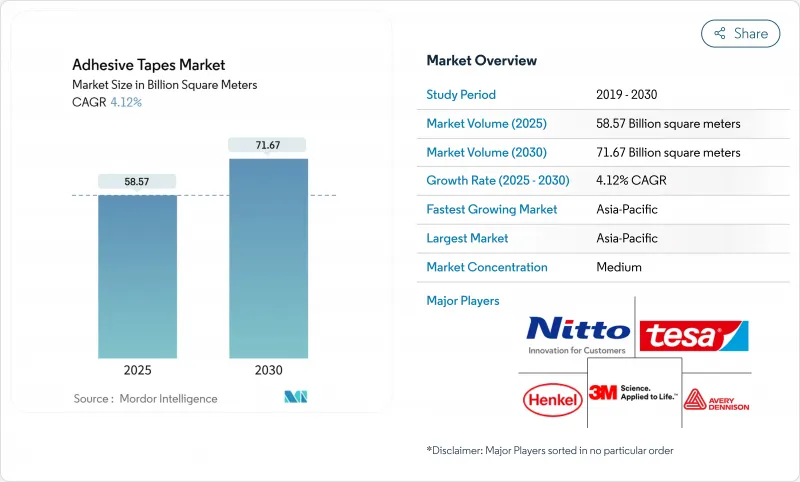

預計到 2025 年,膠帶市場規模將達到 585.7 億平方公尺,到 2030 年將達到 716.7 億平方公尺,在預測期(2025-2030 年)內,複合年成長率為 4.12%。

來自包裝、電子和汽車製造業的穩定需求抵消了原料成本波動和日益嚴格的揮發性有機化合物 (VOC)排放法規的影響。隨著加工商轉向低 VOC 化學品,水性技術正在迅速發展,而壓敏膠因其瞬時黏合性和適用於自動化點膠生產線的特性,保持著銷量領先地位。亞太地區引領消費和成長,這主要得益於電子產品密集的供應鏈和龐大的基礎設施投入。醫療保健產業正在成為成長最快的經銷店,因為親膚型矽酮黏合劑能夠延長醫療設備的使用壽命,從而將價值轉移到利潤更高的特種等級產品上。領先的製造商正透過垂直整合、區域產能擴張和產品組合調整(轉向永續解決方案)來應對成本壓力。

全球膠帶市場趨勢與洞察

電子商務和包裝行業的需求增加

數位零售持續推動物流業者採用更快、更安全、更永續的包裝。品牌擁有者現在指定使用纖維基易撕膠帶和無溶劑紙箱封口系統,以滿足可回收性目標並能承受長時間的配送週期。 HB Fuller 的 Earthic 系列產品正是這項轉變的典範,它在提供經認證的生物基成分的同時,又不犧牲剪切強度。對合適尺寸紙箱的需求也加速了封箱膠帶的客製化,這些膠帶可在自動化生產線上黏附於各種瓦楞紙板等級。亞太地區的成長最為顯著,跨境小包裹量不斷成長,履約中心正在標準化使用水性膠帶以減少塑膠用量。這些因素推高了高性能包裝平方公尺的平均價格,從而推動了膠帶市場的發展。

原始設備製造商轉向使用輕質線束膠帶

tesa SuperSleeve 51026 PV6 代表了新一代的包覆材料,它將 PET 布與無溶劑丙烯酸黏合劑結合,在高溫環境下具有出色的耐磨性。電動車平台正迎來新的發展機遇,因為線束的使用時間更長,並且必須保持柔韌性以便於電池組檢查。更輕的線束重量有助於延長續航里程,從而促進 OEM 廠商的採用。這些趨勢也直接反映在膠帶市場,加工商正在調整膠帶的寬度和模切方式,以適應自動化線束包覆的需求。

原物料價格波動

增粘樹脂和專門食品炭黑等原料價格隨原油價格和運輸成本波動,對加工商的利潤空間造成壓力。卡博特公司宣布,受通膨壓力影響,炭黑價格將於2024年12月起調高。儘管生產商正透過多供應商採購和指數化合約來緩解價格上漲的影響,但他們仍然面臨著營運資金壓力,這阻礙了中小加工商的擴張計劃,並在短期內拖累了膠帶市場。

細分市場分析

丙烯酸酯配方將成為膠帶市場最大的貢獻者,預計到2024年將銷售量的41.12%。其優異的抗紫外線性能和老化穩定性推動了其在戶外電子產品和太陽能電池組件領域的應用。橡膠基系統雖然耐久性稍遜,但由於汽車製造商青睞其在線束捆紮和車內NVH控制方面具有高初始粘合力,因此其市場正以4.24%的複合年成長率快速成長。矽酮壓敏膠的銷售量雖然不高,但其生物相容性和200°C的工作溫度使其在醫療穿戴式裝置和耐高溫電子產品領域擁有較高的價格。環氧樹脂和聚氨酯材料則滿足了結構膠合劑的需求,這類材料更注重剪切強度而非可重複定位性。像Lohmann這樣的供應商目前提供導熱性能優異的丙烯酸-矽酮混合材料,其散熱性能可達2 W/mK,適用於電動車電池組。

樹脂產品組合的多元化滿足了特定終端應用的需求,同時又不影響丙烯酸樹脂的市場佔有率。橡膠升級的重點是能夠承受引擎室125°C高溫的合成橡膠,填補了丙烯酸樹脂長期以來的空白。矽酮樹脂的研發重點是符合歐洲醫療法規的低環矽氧烷等級,而環氧樹脂膠帶則添加了常溫固化潛伏催化劑,以增強其在航太複合材料修復方面的應用。這些創新使樹脂化學成分與不斷變化的性能需求相匹配,並保持了市場競爭力。

2024年,水性體系將佔銷售額的45.19%,反映出該產業對低VOC(揮發性有機化合物)加工的重視。自1990年以來,3M等製造商通過去除溶劑載體,已將VOC含量降低了99%。隨著加工商改進塗佈機以處理與溶劑型剪切機相當的高固態丙烯酸乳液,該行業將以4.47%的複合年成長率成長。溶劑型生產線由於其在低表面能基板上優異的潤濕性能,仍然主導著高溫電子產業,但它們面臨資本投資監管收緊的挑戰。熱熔壓敏膠在電子商務包裝領域市場佔有率不斷成長,其瞬時黏合速度可最大限度地提高生產效率。反應性化學品,包括可與環境水分交聯的聚氨酯泡棉,正在汽車結構連接領域找到新的應用。

雙系統塗佈機現已具備水溶性混合塗佈能力,可快速換型並節省能源。創新也延伸至源自萜烯和澱粉的生物基分散體,使水性黏合劑能夠應用於下一代循環經濟領域。隨著加工商將環保目標與高性能需求相結合,這種技術的多元化將擴大膠帶市場。

區域分析

到2024年,亞太地區將佔全球產量的58.91%,年複合成長率達5.01%,主要得益於中國、印度和東南亞地區電子、汽車和建築業的快速發展。該地區的製造商正在增加本地化的塗佈和切斷機能力,以縮短前置作業時間並提供符合當地需求的客製化產品。中國和印度政府對半導體工廠的激勵措施正在推動對超級淨切割膠帶和遮罩膠帶的需求。同時,位於清奈和蘇州的太陽能膠合劑工廠正在加強永續性力度,增強膠帶市場的供應韌性。

北美憑藉著在醫療保健和航太領域的先進研發實力,保持其技術領先地位。 3M的無溶劑平台和艾利丹尼森的UL-94認證電動車電池膠帶,體現了創新主導的向特種應用領域的轉變。勞動市場緊張刺激了自動化投資,有利於採用模切壓敏膠零件以加快組裝。 《美國墨加協定》也支持汽車線束膠帶生產的近岸外包,並有助於緩解外匯波動的影響。

歐洲對生態設計和VOC合規性的重視正在加速水性壓敏膠的普及。汽車輕量化和電氣化政策推動了對高性能黏合膠帶的需求,以取代鉚釘和焊接。同時,中東和非洲市場正在大型基礎建設計劃中採用耐高溫外牆膠帶。受巴西農產品包裝產業和區域性軟質包裝工廠的推動,南美膠帶市場正經歷穩定擴張。新興市場的擴張和已開發地區產業回流的共同作用將支撐全球成長前景。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 來自電子商務和包裝行業的需求不斷成長

- 原始設備製造商開始使用輕量化線束膠帶

- 在穿戴醫療設備中採用低創傷矽膠帶

- 東協和中東地區的建築熱潮推動了膠帶使用量的成長。

- 電子業對膠帶的需求不斷成長

- 市場限制

- 原物料價格波動

- 極端條件下產品性能的局限性

- 對揮發性有機化合物排放的擔憂

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代產品和服務的威脅

- 競爭程度

第5章 市場規模與成長預測

- 樹脂

- 丙烯酸纖維

- 橡膠底座

- 矽酮

- 環氧樹脂

- 聚氨酯

- 透過技術

- 水溶液

- 溶劑型

- 熱熔膠

- 反應型

- 依產品類型

- 感壓膠帶

- 水活化膠帶

- 導熱膠帶

- 特殊膠帶

- 按最終用途行業分類

- 包裹

- 車

- 電機與電子工程

- 衛生保健

- 消費者/DIY

- 其他(建築、施工等)

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞太其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率(%)/排名分析

- 公司簡介

- 3M

- Avery Dennison Corporation

- Berry Global Inc.

- CCT(Coating & Converting Technologies, LLC)

- DuPont

- HB Fuller Company

- Henkel AG & Co. KGaA

- IPG

- LINTEC Corporation

- Lohmann

- Mativ

- Nitto Denko Corporation

- Oji Holdings Corporation

- Scapa Group Ltd

- Sekisui Chemical Co., Ltd.

- Shurtape Technologies, LLC

- Sika AG

- tesa SE-A Beiersdorf Company

第7章 市場機會與未來展望

The Adhesive Tapes Market size is estimated at 58.57 billion square meters in 2025, and is expected to reach 71.67 billion square meters by 2030, at a CAGR of 4.12% during the forecast period (2025-2030).

Consistent demand from packaging, electronics, and automotive manufacturing is offsetting raw-material cost swings and stricter limits on volatile organic compound (VOC) emissions. Water-based technologies are scaling quickly as converters pivot toward low-VOC chemistries, while pressure-sensitive formats retain volume leadership because they bond instantly and suit automated application lines. Asia-Pacific leads consumption and growth, propelled by a dense electronics supply chain and large-scale infrastructure spending. Healthcare is emerging as the fastest-growing outlet as skin-friendly silicone adhesives enable longer-wear medical devices and shift value toward high-margin specialty grades. Major producers are countering cost pressures through vertical integration, regional capacity additions, and portfolio realignment toward sustainable solutions.

Global Adhesive Tapes Market Trends and Insights

Rising Demand from E-Commerce and the Packaging Industry

Digital retail continues to push logistics operators toward faster, safer, and more sustainable packaging. Brand owners now specify fiber-based tear tapes and solvent-free box-closing systems that meet recyclability targets while surviving long distribution cycles. H.B. Fuller's Earthic portfolio exemplifies this shift, delivering certified bio-based content without sacrificing shear strength. Demand for right-sized cartons is also accelerating the customization of carton-sealing tapes that adhere to diverse corrugate grades in automated lines. Growth is most pronounced in Asia-Pacific, where cross-border parcel volumes are rising and fulfillment centers standardize on water-activated tapes to cut plastic use. These forces collectively lift the adhesive tapes market by improving the average price per square meter for high-performance packaging grades.

OEM Shift to Lightweight Wire-Harness Tapes

Automakers are replacing bulky PVC tubing with specialty cloth and PET adhesive tapes that save up to 50% harness weight while absorbing vibration and withstanding 150 °C engine-bay temperatures. tesa SuperSleeve 51026 PV6 typifies next-generation wraps that combine PET cloth with a solvent-free acrylic adhesive to resist abrasion in high-heat zones. Electric-vehicle platforms amplify the opportunity because harnesses run longer and must remain flexible for battery-pack servicing. Lighter harness assemblies help extend driving range, reinforcing OEM adoption curves. These trends feed directly into the adhesive tapes market as converters qualify tailored widths and die-cuts for automated loom wrapping.

Volatility in Prices of Raw Materials

Feedstocks such as tackifier resins and specialty carbons swing with crude oil and freight costs, compressing converter margins. Cabot announced carbon-black price increases effective December 2024, citing inflationary pressures. Producers mitigate spikes through multi-supplier sourcing and indexed contracts, but still face working-capital strain that can stall smaller converters' expansion plans, placing a near-term drag on the adhesive tapes market.

Other drivers and restraints analyzed in the detailed report include:

- Adoption of Low-Trauma Silicone Tapes for Wearable Medical Devices

- Construction Boom in ASEAN and Middle East Region

- Limitations in Product Performance Under Extreme Conditions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Acrylic formulations secured 41.12% of 2024 volume, making them the largest contributor to adhesive tapes market size because they bond metals, plastics, and glass without extensive surface treatment. Their excellent UV resistance and aging stability drive uptake in outdoor electronics and solar assemblies. Rubber systems, despite lower durability, are scaling at 4.24% CAGR as automakers favor their high initial tack for wire-loom bundling and interior NVH control. Silicone PSAs, though niche in volume, command premium pricing in medical wearables and high-heat electronics thanks to biocompatibility and 200 °C service temperatures. Epoxy and polyurethane chemistries cater to structural bonding niches where shear strength outweighs repositionability. Suppliers such as Lohmann now offer thermally conductive acrylic-silicone hybrids that dissipate 2 W/mK in electric-vehicle battery packs.

Diversification within resin portfolios supports specialized end-use needs without cannibalizing acrylic share. Rubber upgrades focus on synthetic variants that withstand 125 °C engine-bay peaks, closing the historical gap with acrylics. Silicone development centers on low-cyclic-siloxane grades to satisfy European medical regulations, while epoxy tapes add latent catalysts for room-temperature cure, expanding repair capabilities in aerospace composites. These innovations collectively keep the adhesive tapes market competitive as formulators match resin chemistries to evolving functional demands.

Water-based systems represented 45.19% of 2024 sales, reflecting the sector's pivot to low-VOC processing. Producers such as 3M have slashed VOCs by 99% since 1990 by phasing out solvent carriers. The segment grows at 4.47% CAGR as converters retrofit coaters to handle high-solids acrylic emulsions that rival solvent-borne shear. Solvent-based lines still dominate high-temperature electronics because of superior wet-out on low-surface-energy substrates, but they face tightening regulatory capex. Hot-melt PSAs gain share in e-commerce packaging, where instant bond speeds maximize throughput. Reactive chemistries, including polyurethane foams that crosslink with ambient moisture, secure niche adoption in structural automotive joints.

Twin-system coaters now deliver hybrid water/solvent capability, allowing rapid changeovers and energy savings. Innovation extends to bio-based dispersions from terpene or starch feedstocks, positioning water-based adhesives for next-generation circular-economy metrics. This technology heterogeneity broadens the adhesive tapes market as converters align environmental targets with high-performance demands.

The Adhesive Tapes Market Report Segments the Industry by Resin (Acrylic, Rubber-Based, and More), Technology (Water-Based, Solvent-Based, and More), Product Type (Pressure-Sensitive Tapes, Water-Activated Tapes, and More), End-User Industry (Packaging, Automotive, and More), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific held 58.91% of the 2024 volume and is set to grow at a 5.01% CAGR as China, India, and Southeast Asia expand electronics, automotive, and construction output. Regional producers add local coating and slitting capacity, reducing lead times and tailoring SKUs to domestic requirements. Government incentives for semiconductor fabs in China and India amplify demand for ultra-clean dicing and masking tapes. Concurrently, solar-powered adhesive plants in Chennai and Suzhou demonstrate growing sustainability commitments, reinforcing supply resilience in the adhesive tapes market.

North America retains technology leadership, leveraging advanced R&D in healthcare and aerospace. 3M's solvent-free platforms and Avery Dennison's UL-94-rated EV battery tapes illustrate an innovation-driven shift toward specialized applications. Tight labor markets stimulate automation investments, favoring die-cut PSA components that accelerate assembly. The United States-Mexico-Canada Agreement also supports near-shoring of automotive harness tape production, buffering currency volatility.

Europe emphasizes eco-design and VOC compliance, accelerating water-based PSA adoption. Automotive lightweighting and electrification policies sustain demand for high-performance bonding tapes that replace rivets and welds. Meanwhile, Middle East and Africa markets benefit from infrastructure megaprojects that specify high-temperature exterior facade tapes. South America's adhesive tapes market gains incrementally through Brazil's agriculture-linked packaging sector and localized flexible-packaging plants. The combined effect of emerging-market expansion and industrial re-shoring in developed regions sustains the global growth outlook.

- 3M

- Avery Dennison Corporation

- Berry Global Inc.

- CCT (Coating & Converting Technologies, LLC)

- DuPont

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- IPG

- LINTEC Corporation

- Lohmann

- Mativ

- Nitto Denko Corporation

- Oji Holdings Corporation

- Scapa Group Ltd

- Sekisui Chemical Co., Ltd.

- Shurtape Technologies, LLC

- Sika AG

- tesa SE - A Beiersdorf Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Demand from the E-Commerce and Packaging Industry

- 4.2.2 OEM shift to lightweight wire-harness tapes

- 4.2.3 Adoption of low-trauma silicone tapes for wearable medical devices

- 4.2.4 Construction boom in ASEAN and Middle-East region boosting adhesive tape usage

- 4.2.5 Growing Demand for Adhesive Tapes from Electronics Industry

- 4.3 Market Restraints

- 4.3.1 Volatility in Prices of Raw Materials

- 4.3.2 Limitations in Product Performance Under Extreme Conditions

- 4.3.3 Concerns of VOC Emissions

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Resin

- 5.1.1 Acrylic

- 5.1.2 Rubber-based

- 5.1.3 Silicone

- 5.1.4 Epoxy

- 5.1.5 Polyurethane

- 5.2 By Technology

- 5.2.1 Water-based

- 5.2.2 Solvent-based

- 5.2.3 Hot-melt

- 5.2.4 Reactive

- 5.3 By Product Type

- 5.3.1 Pressure-Sensitive Tapes

- 5.3.2 Water-Activated Tapes

- 5.3.3 Heat-Sensitive Tapes

- 5.3.4 Specialty Tapes

- 5.4 By End-use Industry

- 5.4.1 Packaging

- 5.4.2 Automotive

- 5.4.3 Electrical and Electronics

- 5.4.4 Healthcare

- 5.4.5 Consumer/DIY

- 5.4.6 Others (Building and Construction, etc.)

- 5.5 By Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share(%)/Ranking Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)}

- 6.4.1 3M

- 6.4.2 Avery Dennison Corporation

- 6.4.3 Berry Global Inc.

- 6.4.4 CCT (Coating & Converting Technologies, LLC)

- 6.4.5 DuPont

- 6.4.6 H.B. Fuller Company

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 IPG

- 6.4.9 LINTEC Corporation

- 6.4.10 Lohmann

- 6.4.11 Mativ

- 6.4.12 Nitto Denko Corporation

- 6.4.13 Oji Holdings Corporation

- 6.4.14 Scapa Group Ltd

- 6.4.15 Sekisui Chemical Co., Ltd.

- 6.4.16 Shurtape Technologies, LLC

- 6.4.17 Sika AG

- 6.4.18 tesa SE - A Beiersdorf Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment