|

市場調查報告書

商品編碼

1850981

Gigabit乙太網路測試設備:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Gigabit Ethernet Test Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

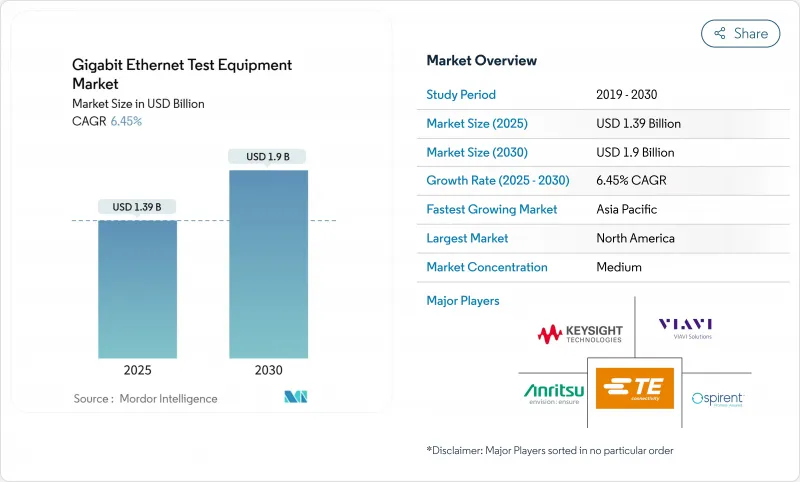

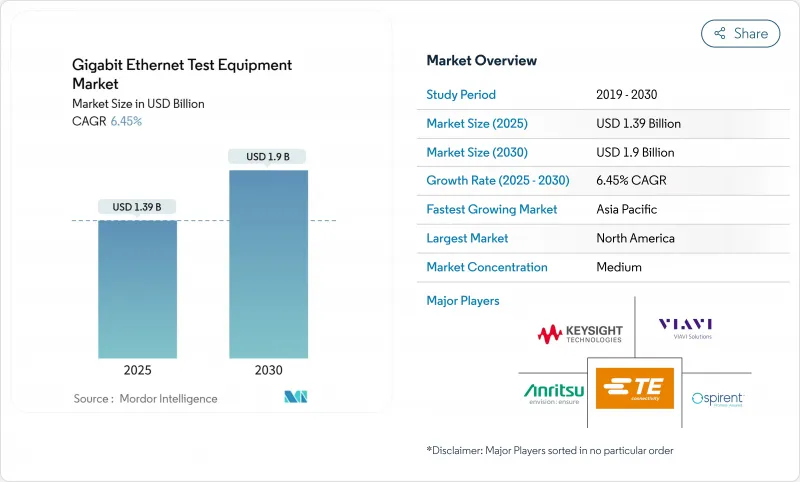

預計到 2025 年,Gigabit乙太網路測試設備市場規模將達到 13.9 億美元,到 2030 年將達到 19 億美元,年複合成長率為 6.45%。

隨著人工智慧工作負載的日益普及和頻寬需求的不斷變化,檢驗團隊不得不超越 400G,擁抱新興的 800G 和 1.6T 標準。資料中心營運商正將預算從傳統的誤碼率測試工具轉向高精度解決方案,以評估資料包噴射、前向糾錯和 RoCEv2 在真實網路擁塞環境下的延遲。超大規模資料中心營運商現在需要能夠結合流量產生、網路模擬和機器學習主導分析的全自動化測試平台,以縮短開發週期。 PAM4 光模組的供應瓶頸和 224Gbps 通道設計專家的短缺導致交貨前置作業時間延長,價格居高不下,但能夠保證儘早提供 1.6T 功能的供應商將獲得高合約。

全球Gigabit乙太網路測試設備市場趨勢與洞察

AI集群基礎設施推動800G測試需求

主要亮點

- 人工智慧訓練正頻寬需求超越傳統的 400G,迫使營運商採用 800G 和 1.6T 鏈路,這需要新的檢驗策略。目前的叢集每個 xPU 需要 1Tbps 的頻寬,這給 SerDes 設計帶來了壓力,因為它們正從 NRZ 調變過渡到 PAM4 調變。供應商現在將自動去嵌入軟體與高速示波器捆綁在一起,使工程師能夠在幾分鐘內(而不是幾天)表徵小於 10 ps 的單元間隔。超乙太網路聯盟 (Ultra Ethernet Consortium) 最終確定了超越 IEEE 802.3 的 v1.0 規範,增加了傳統乙太網路中沒有的壅塞管理測試。率先提供 1.6T 容量的參與企業已與渴望使其 AI 架構面向未來的超大規模資料中心營運商簽訂了多年框架合約。此類計劃能夠加速那些將光通訊、流量產生和分析整合到單一編配層的公司的收入成長。

雲端服務的擴展加速了多速測試

雲端服務供應商正在部署 100G、400G 和 800G 等多種拓撲結構,以平衡效能和成本,應對不斷變化的工作負載,這需要能夠同時檢驗多種速度的測試平台。由於前向糾錯(尤其是 RS-FEC)在這些速度下至關重要,因此解決方案必須即時監控奇偶校驗區塊,同時避免掩蓋潛在缺陷。目前的模擬引擎會重播數天的流量日誌,以模擬微突發擁塞,同時維持亞微秒的延遲指標。營運商需要可程式 API,以便與 CI/CD 工具鏈整合,並支援每日對網路升級進行回歸測試。因此,市場對能夠提供確定性效能基準並降低硬體資本支出的虛擬化測試實驗室的需求日益成長。

技術專家短缺阻礙了市場擴張

從NRZ到PAM4的過渡需要精通斜校正、符號誤差繪圖和224Gbps頻道建模的工程師,然而這些技能在全球範圍內仍然十分稀缺。儘管許多服務提供者依賴自動化演算法來解讀眼圖高度和抖動預算,但複雜的故障仍需要人工分析。 「連接前檢查」等光纖檢測宣傳活動表明,技能短缺正在推高安裝錯誤率。培訓流程落後於技術藍圖,迫使供應商引入人工智慧主導的嚮導程序,以最少的使用者輸入配置設備。然而,PAM4串擾、時延和FEC裕量的高階故障排除仍需要手動完成,這使得計劃進度容易受到人才短缺的影響。

細分市場分析

到2024年,10GbE類別將維持Gigabit乙太網路測試設備市場42%的佔有率,凸顯了其在企業交換骨幹網路中的地位。然而,預計到2030年,800GbE和1.6TbE鑽機的複合年成長率將達到21.5%,高於其他任何速度等級。是德科技的AresONE平台可傳輸6.4Tbps的測試流量,是德科技預計,到2030年,超高速Gigabit乙太網路測試設備市場規模將達4.9億美元。同時,25/40/50GbE和100GbE提供了經濟高效的過渡方案,尤其是在傳統光元件生態系統能夠降低遷移風險的情況下。像Marvell這樣的半導體供應商正在加速這一轉變,他們提供的3nm PAM4 DSP樣品可將模組功耗降低20%,從而擴大高密度底盤的散熱空間。

買家正在權衡升級時機與標準的成熟度。 400GbE 擁有成熟的 RS-FEC 規範,因此仍然是尋求快速回報計劃的首選。相反,正在評估 1.6T 的工程實驗室訂購的是混合速度底盤,這種機箱將滿足當前需求的 800G 刀片與預留的空籠相結合,以便將來安裝 1.6T 可插拔線纜。這種靈活性有助於穩定資本規劃,並保護早期採用者免受過時的影響。隨著超大規模資料中心業者每六個月進行一次網路升級,提供現場可升級硬體和永久軟體授權的供應商可以創造持續的收入來源。這種轉變縮短了產品生命週期,並將競爭重點從硬體物料材料清單轉向可程式功能的速度。

由於5G回程傳輸的部署,通訊將在2024年佔據36.5%的收入佔有率,但資料中心和雲端服務供應商到2030年將以18%的複合年成長率成長,並在2027年超越通訊的絕對支出。人工智慧工作負載密度將迫使資料中心同時檢驗無損資料包噴射、亞微秒級抖動和RoCEv2擁塞控制,所有這些都超過了傳統通訊業者的指標。汽車和交通運輸原始設備製造商(OEM)正在加強乙太網路合規性,以支援駕駛輔助和自動駕駛協議棧,這催生了對能夠進行10GBASE-T1特性分析的堅固型示波器和電磁干擾測試室的需求。

同時,製造業正在加速推進危險區域的乙太網路APL試點項目,這需要兼具本質安全測試儀和電源迴路分析儀功能的設備。航空航太與國防整合商需要能夠承受振動、極端溫度和電磁脈衝的設備,迫使供應商採用軍用級機殼。公共產業和醫療保健行業正在推動測試計劃,這些計劃規定了確定性故障安全通訊協定,並檢驗了零損耗保護開關和網路安全韌體。這些跨產業的細微差別迫使供應商提供模組化平台,以便根據需求插入特定產業的合規軟體包,這種策略既能滿足不同的監管框架,又能降低研發成本。

Gigabit乙太網路測試設備市場報告按類型(1GbE、10GbE、其他)、最終用戶產業(通訊、資料中心、雲端、其他)、應用(研發/實驗室、製造/生產、其他)、測試類型(功能/流量產生、效能/壓力、合規性/一致性、其他)和地區進行細分。

區域分析

北美地區貢獻了33%的收入,這主要得益於半導體研發的集中以及人工智慧叢集的快速部署,這些部署要求在創紀錄的時間內完成800G認證。雖然雲端服務供應商佔據了美國訂單的大部分,但加拿大正憑藉寬頻復興和工業乙太網升級推動成長。美國正利用近岸外包趨勢擴大汽車線束製造,推動對T1合規套件的需求。部分州的低能源成本正在推動資料中心建設,但800G鑽機的高能耗將導致永續性審核,這可能會影響採購週期。

亞太地區以10.25%的複合年成長率引領成長,這主要得益於中國超大規模資料中心的擴張和本地化的1.6T光元件供應鏈。日本汽車產業青睞需要嚴格EMC檢驗的確定性乙太網路協定棧,而韓國則將半導體晶圓廠推進至3nm製程水平,這需要超高速的抖動和串擾偵測設備。東南亞國協正在部署5G回程傳輸和智慧工廠試點項目,並因此獲得了多速率手持分析儀的訂單。印度的政策獎勵促進了通訊設備製造和軟體定義網路實驗室的發展。

隨著德國汽車製造商 (OEM) 正式製定汽車乙太網路測試計劃,以及工業營運商在其流程工廠中採用乙太網路應用效能測試 (Ethernet-APL),歐洲市場呈現穩定成長態勢。英國正在對其光纖骨幹網路進行現代化改造,推動了對可攜式光時域反射儀 (OTDR) 和誤碼率測試儀 (BERT) 的需求。法國和西班牙正在投資可再生能源電網升級,這需要對變電站進行確定性乙太網路測試。中東地區正將石油收入投入海灣地區待開發區資料中心,而非洲礦業公司則訂購了適用於惡劣環境的堅固耐用型 PoE 測試儀。南美洲市場保持相對穩定,這主要得益於巴西通訊業者的升級改造和阿根廷汽車線束出口的成長。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 行動回程成長

- 雲端服務和巨量資料應用

- 乙太網路在製造業的應用日益廣泛

- 適用於傳統線纜的 2.5/5 GbE 升級

- 對用於 800G/1.6T 測試的 AI叢集的需求

- 基於 RoCEv2 的超低延遲檢驗

- 市場限制

- 缺乏技術專長

- 複雜的測量精度限制

- 800G鑽機的能量和熱力限制

- PAM-4光學元件供應鏈瓶頸

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按類型

- 1GbE

- 10GbE

- 25/40/50GbE

- 100GbE

- 400GbE

- 800GbE 和 1.6TbE

- 按最終用戶行業分類

- 通訊

- 資料中心和雲

- 製造業

- 汽車與運輸

- 航太與國防

- 其他(公共產業、醫療保健)

- 透過使用

- 研發/實驗室

- 製造/生產

- 現場服務和安裝

- 認證與合規

- 按測試類型

- 功能/流量生成

- 表現/壓力

- 合規性/一致性

- 網路模擬

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 中東和非洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Keysight Technologies Inc.

- Anritsu Corp.

- VIAVI Solutions Inc.

- Spirent Communications plc

- EXFO Inc.

- Rohde and Schwarz GmbH and Co KG

- Teledyne LeCroy(Xena)

- Yokogawa Test and Measurement

- VeEX Inc.

- GL Communications Inc.

- Trend Networks

- GigaNet Systems

- Xinertel Technology

- Apposite Technologies

- NetScout Systems Inc.

- Te Connectivity Ltd.

- Aquantia(Marvell)

- GAO Tek Inc.

- IDEAL Industries Inc.

- Veryx Technologies

第7章 市場機會與未來展望

The Gigabit Ethernet test equipment market reached USD 1.39 billion in 2025 and is forecast to climb to USD 1.90 billion by 2030, advancing at a 6.45% CAGR.

Rising adoption of artificial intelligence workloads is redefining bandwidth expectations, forcing validation teams to move beyond 400G and embrace emerging 800G and 1.6T standards. Data center operators are reallocating budgets from legacy bit error rate tools to high-precision solutions that evaluate packet spray, forward error correction, and RoCEv2 latency under real-world congestion. Hyperscalers now request fully automated test beds that blend traffic generation, network emulation, and machine-learning-driven analytics to shorten development cycles. Supply bottlenecks for PAM4 optics and a shortage of 224 Gbps channel-design experts keep delivery lead times long and price points high, yet vendors that can guarantee early access to 1.6T capability are commanding premium contracts.

Global Gigabit Ethernet Test Equipment Market Trends and Insights

AI Cluster Infrastructure Drives 800G Testing Demand

Key Highlights

- Artificial intelligence training pushes bandwidth requirements beyond conventional 400G, compelling operators to adopt 800G and 1.6T links that demand fresh validation strategies. Current clusters need 1 Tbps per xPU, stressing SerDes designs that shift from NRZ to PAM4 modulation, which in turn mandates eye-opening precision for signal-to-noise ratio analysis. Vendors now bundle high-speed oscilloscopes with automated de-embedding software so engineers can characterize sub-10-ps unit intervals in minutes rather than days. The Ultra Ethernet Consortium is finalizing v1.0 specifications that extend beyond IEEE 802.3, adding congestion management tests never seen in legacy Ethernet. Early movers that deliver 1.6T capability are winning multi-year framework deals with hyperscalers eager to future-proof AI fabrics. These projects accelerate revenue for companies able to link optics, traffic generation, and analytics into a single orchestration layer.

Cloud Services Expansion Accelerates Multi-Speed Testing

Cloud providers deploy mixed 100G, 400G, and 800G topologies to balance performance and cost across variable workloads, creating a need for test rigs that validate several speeds concurrently. Forward error correction, particularly RS-FEC, is essential at those rates, so solutions must monitor real-time parity blocks without masking latent defects. Emulation engines now replay days of traffic logs to reproduce microburst congestion while maintaining sub-microsecond latency metrics. Operators request programmable APIs that integrate with CI/CD toolchains, enabling daily regression of network upgrades. The result is rising demand for virtualized test labs that cut hardware capex yet still provide deterministic performance baselines.

Technical Expertise Shortage Constrains Market Expansion

Moving from NRZ to PAM4 demands engineers competent in de-skewing, symbol error plotting, and 224 Gbps channel modeling, skills still rare across global labor pools. Many service providers rely on automated algorithms to interpret eye height and jitter budgets, yet complex failures still need human insight. Fiber inspection campaigns such as "Inspect Before You Connect" show how deficit skills inflate installation error rates. Training pipelines lag behind technology roadmaps, compelling vendors to embed AI-driven wizards that configure instruments based on minimal user input. Nevertheless, advanced troubleshooting of PAM4 crosstalk, skew, and FEC margin remains a manual discipline, keeping project timelines vulnerable to talent shortages.

Other drivers and restraints analyzed in the detailed report include:

- Manufacturing Ethernet Adoption Creates Industrial Testing Opportunities

- Legacy Infrastructure Upgrades Drive Multi-Gigabit Testing

- Measurement Accuracy Limitations Impede High-Speed Validation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The 10 GbE category retained 42% of the Gigabit Ethernet test equipment market share in 2024, underscoring its entrenched presence in enterprise switching backbones. Yet 800 GbE and 1.6 TbE rigs are set to grow at 21.5% CAGR to 2030, the fastest pace of any speed grade, fueled by AI cluster architectures that need line-rate validation at 224 Gbps per lane. Keysight's AresONE platform streams 6.4 Tbps of test traffic, marking a leap that positions the Gigabit Ethernet test equipment market size for ultra-high-speed gear at USD 490 million by 2030, according to Keysight. Meanwhile 25/40/50 GbE and 100 GbE serve as cost-efficient stepping-stones, especially where legacy optics ecosystems lower migration risk. Semiconductor vendors such as Marvell accelerate the shift by sampling 3 nm PAM4 DSPs that drop module power by 20%, extending cooling envelopes inside dense chassis.

Buyers weigh upgrade timing against standards maturity. 400 GbE enjoys mature RS-FEC profiles, so projects chasing rapid returns still favor it. Conversely, engineering labs evaluating 1.6 T are ordering mixed-speed chassis that combine 800 G blades for immediate needs and empty cages ready for future 1.6 T pluggables. This flexibility stabilizes capital planning while protecting early adopters from obsolescence. As hyperscalers roll out fabric upgrades in six-month sprints, vendors that ship field-upgradeable hardware and perpetual software licenses gain recurring revenue streams. The transition compresses product lifecycles, shifting competitive focus from hardware bill-of-materials to programmable feature velocity.

Telecommunications captured 36.5% of 2024 revenue due to 5G backhaul rollouts, yet data centers and cloud providers are expanding at an 18% CAGR to 2030, overtaking telcos in absolute spending by 2027. AI workload density drives data centers to validate lossless packet spraying, sub-microsecond jitter, and RoCEv2 congestion control concurrently, all of which exceed traditional telco metrics. Automotive and transport OEMs ramp Ethernet compliance to support driver assistance and autonomous stacks, creating demand for rugged oscilloscopes and EMI chambers capable of 10GBASE-T1 characterization.

Meanwhile, manufacturing outfits accelerate Ethernet-APL pilots within hazardous zones, requiring intrinsically safe testers that double as power loop analyzers. A&D integrators need equipment that withstands vibration, temperature extremes, and electromagnetic pulse, compelling suppliers to adapt military-grade enclosures. Utilities and healthcare specify deterministic fail-safe protocols, pushing test plans to verify zero-loss protection switching and cyber-hardened firmware. These cross-sector nuances pressure vendors to offer modular platforms that slot vertical-specific compliance packages on demand, a strategy that tempers R&D overhead while addressing divergent regulatory frameworks.

The Gigabit Ethernet Test Equipment Market Report is Segmented by Type (1 GbE, 10 GbE, and More), End-User Industry (Telecommunications, Data Centers and Cloud, and More), Application (R&D/Lab, Manufacturing/Production, and More), Test Type (Functional / Traffic Generation, Performance / Stress, Compliance / Conformance, and More), and Geography.

Geography Analysis

North America holds 33% revenue thanks to concentrated semiconductor R&D and aggressive AI cluster deployments that mandate 800G qualification in record time. United States cloud providers anchor most orders, but Canada gains traction through broadband revitalization and industrial Ethernet upgrades. Mexico leverages nearshoring trends to expand automotive harness manufacturing, raising demand for T1 compliance kits. Low energy costs in some states attract additional data center builds, yet the high power draw of 800G rigs prompts sustainability audits that may influence procurement cycles.

Asia Pacific leads growth at 10.25% CAGR on the back of China's hyperscale expansion and localized 1.6 T optics supply chains. Japan's auto sector champions deterministic Ethernet stacks that require stringent EMC validation, while Korea pushes semiconductor fabs into 3 nm class, needing ultra-fast jitter and crosstalk probes. ASEAN states deploy 5G backhaul and smart factory pilots, generating orders for multi-rate handheld analyzers. India's policy incentives spur telco equipment manufacturing and software defined network labs, though patchy infrastructure and a talent shortfall temper near-term adoption.

Europe charts steady gains with German OEMs formalizing in-vehicle Ethernet test plans and industrial operators embracing Ethernet-APL inside process plants. The United Kingdom modernizes fiber backbone networks, fueling demand for portable OTDRs and BERTs. France and Spain invest in renewable energy grid upgrades that require deterministic sub-station Ethernet testing. The Middle East channels oil revenues into greenfield data centers in the Gulf, while African miners commission ruggedized PoE testers for harsh environments. South America remains modest but stable, driven by Brazilian telco upgrades and Argentine automotive wire harness exports.

- Keysight Technologies Inc.

- Anritsu Corp.

- VIAVI Solutions Inc.

- Spirent Communications plc

- EXFO Inc.

- Rohde and Schwarz GmbH and Co KG

- Teledyne LeCroy (Xena)

- Yokogawa Test and Measurement

- VeEX Inc.

- GL Communications Inc.

- Trend Networks

- GigaNet Systems

- Xinertel Technology

- Apposite Technologies

- NetScout Systems Inc.

- Te Connectivity Ltd.

- Aquantia (Marvell)

- GAO Tek Inc.

- IDEAL Industries Inc.

- Veryx Technologies

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth in mobile backhaul

- 4.2.2 Adoption of cloud services and big data

- 4.2.3 Increased Ethernet use in manufacturing

- 4.2.4 2.5 / 5 GbE upgrades on legacy cabling

- 4.2.5 AI cluster demand for 800G/1.6T testing

- 4.2.6 RoCEv2-driven ultra-low-latency validation

- 4.3 Market Restraints

- 4.3.1 Lack of technical expertise

- 4.3.2 Complex measurement accuracy limits

- 4.3.3 Energy and thermal constraints in 800G rigs

- 4.3.4 Supply-chain bottlenecks for PAM-4 optics

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Type

- 5.1.1 1 GbE

- 5.1.2 10 GbE

- 5.1.3 25/40/50 GbE

- 5.1.4 100 GbE

- 5.1.5 400 GbE

- 5.1.6 800 GbE and 1.6 TbE

- 5.2 By End-user Industry

- 5.2.1 Telecommunications

- 5.2.2 Data Centers and Cloud

- 5.2.3 Manufacturing

- 5.2.4 Automotive and Transport

- 5.2.5 Aerospace and Defense

- 5.2.6 Others (Utilities, Healthcare)

- 5.3 By Application

- 5.3.1 RandD/Lab

- 5.3.2 Manufacturing/Production

- 5.3.3 Field Service and Installation

- 5.3.4 Certification and Compliance

- 5.4 By Test Type

- 5.4.1 Functional / Traffic Generation

- 5.4.2 Performance / Stress

- 5.4.3 Compliance / Conformance

- 5.4.4 Network Emulation

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 ASEAN

- 5.5.4.6 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 UAE

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Keysight Technologies Inc.

- 6.4.2 Anritsu Corp.

- 6.4.3 VIAVI Solutions Inc.

- 6.4.4 Spirent Communications plc

- 6.4.5 EXFO Inc.

- 6.4.6 Rohde and Schwarz GmbH and Co KG

- 6.4.7 Teledyne LeCroy (Xena)

- 6.4.8 Yokogawa Test and Measurement

- 6.4.9 VeEX Inc.

- 6.4.10 GL Communications Inc.

- 6.4.11 Trend Networks

- 6.4.12 GigaNet Systems

- 6.4.13 Xinertel Technology

- 6.4.14 Apposite Technologies

- 6.4.15 NetScout Systems Inc.

- 6.4.16 Te Connectivity Ltd.

- 6.4.17 Aquantia (Marvell)

- 6.4.18 GAO Tek Inc.

- 6.4.19 IDEAL Industries Inc.

- 6.4.20 Veryx Technologies

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment