|

市場調查報告書

商品編碼

1850371

現場服務管理(FSM):市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Field Service Management (FSM) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

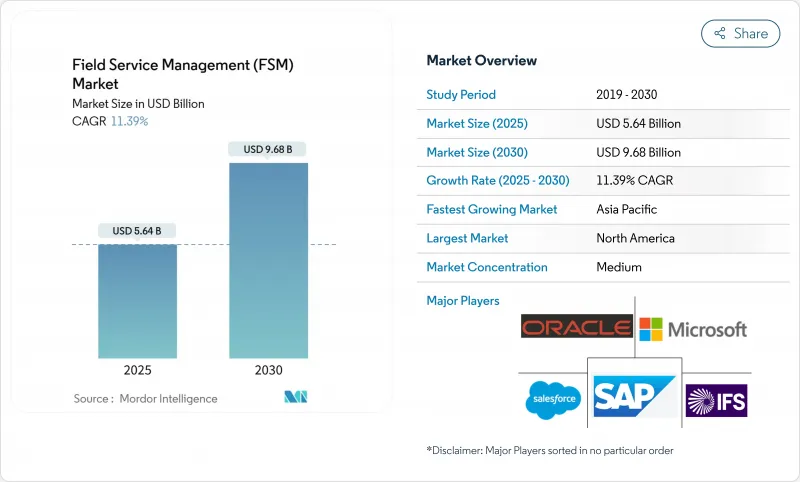

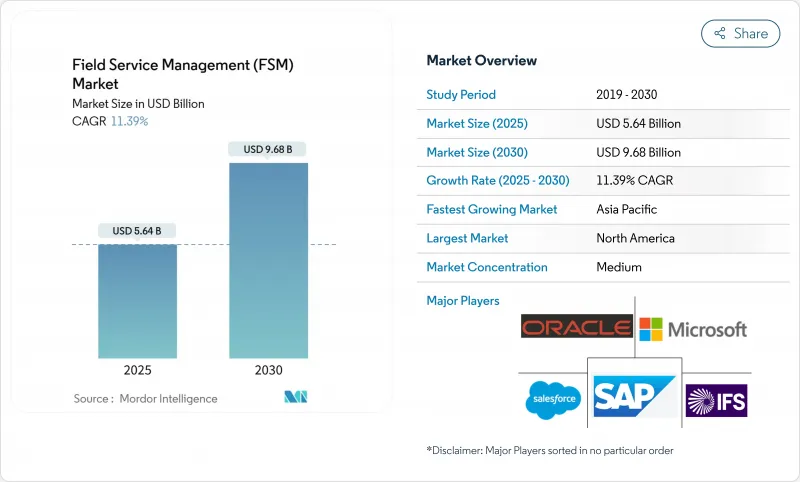

預計到 2025 年,現場服務管理市場規模將達到 56.4 億美元,到 2030 年將擴大到 96.8 億美元,複合年成長率為 11.39%。

人工智慧驅動的調度、物聯網驅動的預測性維護以及5G驅動的連接技術的快速普及推動了市場成長,這些技術共同縮短了服務週期,提高了首次修復率。為了獲得更大的靈活性、更低的資本成本和更便捷的整合,企業正在將工作負載遷移到雲端,而高階分析技術正在重塑技術人員調度和庫存規劃。供應商正在拓展合作夥伴生態系統,加速實施服務和特定產業擴展,從而為軟體和服務供應商開闢新的收益來源。現場服務管理市場也受惠於設備即服務(EaaS)等經常性收益模式,這些模式將一次性產品銷售轉化為長期服務協議,從而鞏固客戶關係。

全球現場服務管理 (FSM) 市場趨勢與洞察

公共產業和電訊對即時技術人員可視性的需求

公共產業和電訊公司面臨著縮短停電時間和滿足日益成長的客戶期望的壓力。能夠即時傳輸位置、活動和資產資料的現場平台可以縮短決策週期,並在現場部署過程中節省 30-40% 的時間。物聯網賦能的狀態監控透過優先處理真正的故障風險來減少現場服務次數,而整合的行動應用程式則可以在現場顯示檢查清單、示意圖和零件庫存。隨著更多資產點需要維護,電網現代化計畫和光纖升級將推動更廣泛的部署。

大規模5G部署增加了現場複雜性。

5G大型基地台和小型基地台的密集部署增加了網路元件的數量,使得路由規劃和備件管理更加複雜。電信現場團隊現在可以在他們安裝的5G線路上使用高清視訊支援和AR疊加功能,使初級技術人員能夠在遠端專家的指導下完成高級任務。隨著網路覆蓋範圍的擴大,通訊業者正在尋求現場服務管理市場的解決方案,以便能夠管理每個區域的數千個站點,並平衡外包團隊和內部員工的工作。

公共部門的網路安全和資料主權障礙

公共產業、交通運輸機構和醫療保健提供者必須在國界範圍內管理營運數據,並遵守嚴格的違規通知法律。諸如《歐洲資料管治法案》之類的框架,強制要求在地化和控制措施證明,往往會減緩雲端功能狀態管理(FSM)的普及。擁有區域託管、精細存取控制和認證加密的供應商最有能力克服這些障礙。

細分市場分析

到2024年,本地部署將佔現場服務管理市場佔有率的57%,這反映了大型企業已建成的基礎設施和嚴格的資料管理策略。儘管成長放緩,但與本地部署相關的現場服務管理市場規模仍將持續成長,因為未來十年內,現有設施的維護工作仍在繼續。

然而,雲端平台正以14.2%的複合年成長率成長,並贏得了大多數新計畫。較低的推出成本、快速部署和自動功能更新對正在擴展行動辦公室團隊的企業極具吸引力。其豐富的API環境簡化了與CRM、ERP和物聯網系統的整合,並逐步取代客製化的本地部署方案。

擁有全球服務網路和複雜多品牌資產組合的大型企業,將在 2024 年佔據 66% 的收入佔有率。這些公司通常會在基本調度的基礎上疊加現場服務管理市場分析,以推動各全部區域的持續改善。

中小企業是成長最快的群體,複合年成長率高達 13.5%。經濟實惠的 SaaS 版本和引導式入門指南讓用戶輕鬆上手。隨著核心工單流程的日益成熟,中型企業開始添加物聯網遠端檢測和客戶門戶,這不僅擴大了現場服務管理市場規模,還透過減少差旅和加快結算週期實現了投資回報。

現場服務管理市場按部署類型(本地部署、雲端部署)、組織規模(大型企業、中小企業)、FSM解決方案和服務類型(解決方案、服務)、最終用戶產業(設施管理(硬體維修和軟體設施管理)、IT和電訊、其他)以及地區進行細分。市場預測以美元(USD)計價。

區域分析

到2024年,北美將佔全球收入的34%,這主要得益於早期採用者和成熟的合作夥伴生態系統。服務供應商正面臨勞動力短缺問題,四分之一的建築業從業人員年齡超過55歲,這推動了對人工智慧調度和承包商市場的需求。隨著越來越多的公司採用北美託管的SaaS環境並集中管治,雲端採用率也不斷上升。

亞太地區正以15.2%的複合年成長率快速成長。在日益工業化的經濟體中,為了因應不斷上漲的工資,現場作業正在數位化;而已開發國家則正在部署民用5G網路和無人機,以便觸及偏遠地區的資產。在香港,一項5G-AR試驗將作業時間縮短了30-40%,證明了其在更大區域推廣中的投資回報率。政府的智慧城市津貼將進一步加速以資產為中心的現場服務管理市場應用的投入。

歐洲佔據了相當大的市場佔有率,這主要得益於製造業和公共產業的推動。嚴格的GDPR法規提高了對資料居住和加密的要求,促使一些買家轉向本地或混合部署。永續性要求也在影響供應商的選擇,路線最佳化對於減少車輛排放變得越來越重要。 GAIA-X等舉措正在推動自主雲端產品的發展,並促進歐盟跨境現場服務管理市場在合規驅動下的擴張。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 公共產業和通訊業工程師需要即時可視性

- 大規模5G部署增加了現場的複雜性。

- 推動脫碳進程將促進智慧電錶和電動車充電樁的安裝。

- 加速人工智慧驅動的排班,以應對勞動力老化問題

- 創造持續收益來源的OEM服務模式

- 遠距工作安全規則有助於基於擴增實境技術的遠端援助

- 市場限制

- 公共部門的網路安全和資料主權障礙

- 棕地工廠傳統ERP/OT整合的複雜性

- 中小企業的初始訂閱和變更管理成本

- 跨境監管碎片化阻礙了人工智慧的普及應用。

- 監理展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟衝擊(包括新冠疫情和供應鏈)的影響

- 現場應用案例的演進(AR/VR、預測性維護、自動化)

- 買家必備分析

第5章 市場規模與成長預測

- 依部署類型

- 本地部署

- 雲

- 按組織規模

- 主要企業

- 小型企業

- 按FSM解決方案和服務類型

- 解決方案

- 調度、派車和路線最佳化

- 服務合約管理

- 工單管理

- 客戶管理

- 庫存管理

- 其他軟體(收費、發票、保固)

- 服務(整合、實施、支援)

- 解決方案

- 最終用戶

- 設施管理(硬體維修和軟體設施管理)

- 資訊科技和通訊

- 醫療保健和生命科學

- 能源和公共產業

- 石油和天然氣

- 製造業

- 運輸/物流

- 房地產及其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 秘魯

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 紐西蘭

- 其他亞太地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- Strategic Developments

- Vendor Positioning Analysis

- 公司簡介

- Oracle Corp.(Oracle Field Service)

- Salesforce Inc.(Field Service)

- Microsoft Corp.(Dynamics 365 Field Service)

- SAP SE(Coresystems)

- IFS AB

- ServiceMax Inc.(PTC)

- ServicePower PLC

- Trimble Inc.

- FieldAware US Inc.

- Accruent LLC(Fortive)

- Zinier Inc.

- simPRO Group Pty Ltd.

- OverIT SpA

- Praxedo SA

- KloudGin Inc.

- Jobber

- FieldEZ Technologies

- ProntoForms Corp.

- Zuper Inc.

- KloudGin Inc.

第7章 市場機會與未來展望

The field service management market size is valued at USD 5.64 billion in 2025 and is forecast to expand to USD 9.68 billion by 2030, reflecting an 11.39% CAGR.

Growth stems from rapid adoption of AI-assisted scheduling, IoT-enabled predictive maintenance, and 5G-powered connectivity that jointly compress service cycle times and improve first-time fix rates. Organisations are shifting workloads to the cloud to secure flexibility, lower capital expense, and easier integrations, while advanced analytics reshape technician dispatch and inventory planning. Vendors are widening partner ecosystems to accelerate implementation services and industry-specific extensions, opening fresh revenue pools for both software and services providers. The field service management market also benefits from recurring revenue models such as Equipment-as-a-Service, which convert one-time product sales into long-life service contracts and lock in customer relationships.

Global Field Service Management (FSM) Market Trends and Insights

Real-time Technician Visibility Needs across Utilities And Telecom

Utilities and telecom operators are under pressure to cut outage durations and meet rising customer expectations. Field platforms that stream live location, job status, and asset data shorten decision cycles, delivering 30-40% time savings in live deployments . IoT-enabled condition monitoring reduces truck rolls by prioritising genuine failure risks, while integrated mobile apps surface checklists, schematics, and parts availability onsite. Broader roll-out is set to intensify as grid modernisation programmes and fibre upgrades multiply asset points needing service.

Large-scale 5G Roll-outs Raising Field Complexity

5G macro- and small-cell densification multiplies network elements, making route planning and spares management far more intricate. Telecom field teams now access high-definition video support and AR overlays via the same 5G links they install, letting junior technicians handle advanced tasks with remote expert guidance . As coverage accelerates, operators demand field service management market solutions that can orchestrate thousands of sites per region and balance outsourced crews with in-house staff.

Cyber-security & Data-sovereignty Barriers in Public Sector

Utilities, transport agencies, and healthcare providers must keep operational data inside national borders and comply with stringent breach-notification laws. Frameworks such as the European Data Governance Act mandate localisation and proof of control, often delaying cloud FSM deployments. Vendors with region-specific hosting, granular access controls, and certified encryption overcome these hurdles fastest.

Other drivers and restraints analyzed in the detailed report include:

- Decarbonisation Push Driving Smart-Meter & EV-Charger Installs

- Ageing Workforce Accelerating AI-assisted Scheduling

- Legacy ERP/OT Integration Complexity in Brownfield Plants

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

On-premise installations held 57% of the field service management market in 2024, reflecting sunk infrastructure and tight data-control policies among large enterprises. The field service management market size linked to on-premise deployments will still expand, albeit slowly, as maintenance of existing estates persists through the decade.

Cloud platforms, however, are growing at a 14.2% CAGR and capture most net-new projects. Lower start-up costs, rapid provisioning, and automatic feature updates appeal to organisations scaling mobile workforces. API-rich environments simplify integration with CRM, ERP, and IoT stacks, gradually eclipsing bespoke on-premise customisations.

Large enterprises commanded 66% revenue in 2024 thanks to global service footprints and complex multi-brand asset portfolios. These accounts often layer field service management market analytics atop base scheduling to drive continuous improvement across regions.

SMEs are the fastest-growing cohort at 13.5% CAGR. Affordable SaaS editions and guided onboarding demystify adoption. Once core work-order flows mature, midsize firms add IoT telemetry and customer portals, widening the field service management market size while proving ROI through reduced travel and quicker invoice cycles.

Field Service Management Market is Segmented by Deployment Type (On-Premise, Cloud), Organization Size (Large Enterprises, Small and Medium Enterprises), FSM Solution and Service Type (Solutions, Services), End-User Vertical (Facilities Management (Hard-FM and Soft-FM), IT and Telecom, and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 34% of global revenue in 2024, sustained by early adopter enterprises and well-developed partner ecosystems. Service providers face mounting labour shortages-one quarter of construction staff exceed 55 years of age, which intensifies demand for AI scheduling and contractor marketplaces. Cloud adoption also rises as enterprises standardise on North America-hosted SaaS environments to centralise governance.

Asia-Pacific is expanding at a 15.2% CAGR. Industrialising economies digitise field work to offset rising wages, while advanced nations deploy private 5G and drones to reach remote assets. In Hong Kong, a 5 G-AR pilot delivered 30-40% task-time reductions, proving ROI for broader regional roll-outs. Government smart-city grants further accelerate spending on asset-centric field service management market applications.

Europe holds a substantial share, driven by manufacturing and utilities. Strict GDPR rules elevate data-residency and encryption demands, nudging some buyers toward local or hybrid deployments. Sustainability mandates also shape vendor selection, with route optimisation prized for lowering fleet emissions. Initiatives such as GAIA-X boost sovereign-cloud offers, enabling compliant scaling of the field service management market across EU borders.

- Oracle Corp. (Oracle Field Service)

- Salesforce Inc. (Field Service)

- Microsoft Corp. (Dynamics 365 Field Service)

- SAP SE (Coresystems)

- IFS AB

- ServiceMax Inc. (PTC)

- ServicePower PLC

- Trimble Inc.

- FieldAware US Inc.

- Accruent LLC (Fortive)

- Zinier Inc.

- simPRO Group Pty Ltd.

- OverIT S.p.A.

- Praxedo SA

- KloudGin Inc.

- Jobber

- FieldEZ Technologies

- ProntoForms Corp.

- Zuper Inc.

- KloudGin Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Real-time Technician Visibility Needs across Utilities and Telecom

- 4.2.2 Large-scale 5G Roll-outs Raising Field Complexity

- 4.2.3 Decarbonization Push Driving Smart-Meter and EV-Charger Installs

- 4.2.4 Ageing Workforce Accelerating AI-assisted Scheduling

- 4.2.5 OEM Servitization Models Creating Recurring Revenue Streams

- 4.2.6 Remote-work Safety Rules Fueling AR-based Remote Assistance

- 4.3 Market Restraints

- 4.3.1 Cyber-security and Data-sovereignty Barriers in Public Sector

- 4.3.2 Legacy ERP/OT Integration Complexity in Brownfield Plants

- 4.3.3 Up-front Subscription and Change-management Costs for SMEs

- 4.3.4 Cross-border Regulatory Fragmentation Hindering AI Dispatch

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of Macroeconomic Shocks (incl. COVID-19 and Supply Chain)

- 4.7 Field Use-Case Evolution (AR/VR, Predictive Maintenance, Automation)

- 4.8 Buyer Imperatives Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment Type

- 5.1.1 On-premise

- 5.1.2 Cloud

- 5.2 By Organization Size

- 5.2.1 Large Enterprises

- 5.2.2 Small and Medium Enterprises

- 5.3 By FSM Solution and Service Type

- 5.3.1 Solutions

- 5.3.1.1 Scheduling, Dispatch and Route Optimization

- 5.3.1.2 Service Contract Management

- 5.3.1.3 Work-order Management

- 5.3.1.4 Customer Management

- 5.3.1.5 Inventory Management

- 5.3.1.6 Other Software (Billing, Invoicing, Warranty)

- 5.3.2 Services (Integration, Implementation, Support)

- 5.3.1 Solutions

- 5.4 By End-User Vertical

- 5.4.1 Facilities Management (Hard-FM and Soft-FM)

- 5.4.2 IT and Telecom

- 5.4.3 Healthcare and Life Sciences

- 5.4.4 Energy and Utilities

- 5.4.5 Oil and Gas

- 5.4.6 Manufacturing

- 5.4.7 Transportation and Logistics

- 5.4.8 Real Estate and Others

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Peru

- 5.5.2.5 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 New Zealand

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 United Arab Emirates

- 5.5.5.2 Saudi Arabia

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 Oracle Corp. (Oracle Field Service)

- 6.3.2 Salesforce Inc. (Field Service)

- 6.3.3 Microsoft Corp. (Dynamics 365 Field Service)

- 6.3.4 SAP SE (Coresystems)

- 6.3.5 IFS AB

- 6.3.6 ServiceMax Inc. (PTC)

- 6.3.7 ServicePower PLC

- 6.3.8 Trimble Inc.

- 6.3.9 FieldAware US Inc.

- 6.3.10 Accruent LLC (Fortive)

- 6.3.11 Zinier Inc.

- 6.3.12 simPRO Group Pty Ltd.

- 6.3.13 OverIT S.p.A.

- 6.3.14 Praxedo SA

- 6.3.15 KloudGin Inc.

- 6.3.16 Jobber

- 6.3.17 FieldEZ Technologies

- 6.3.18 ProntoForms Corp.

- 6.3.19 Zuper Inc.

- 6.3.20 KloudGin Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment