|

市場調查報告書

商品編碼

1850349

MicroLED:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Micro LED - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

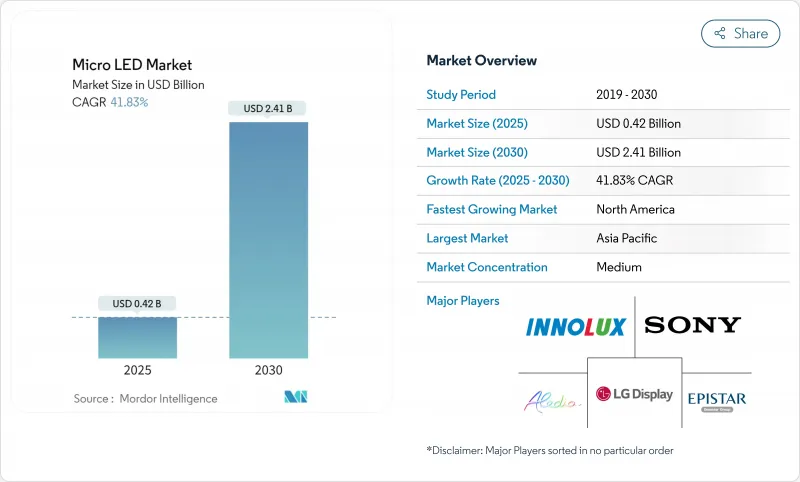

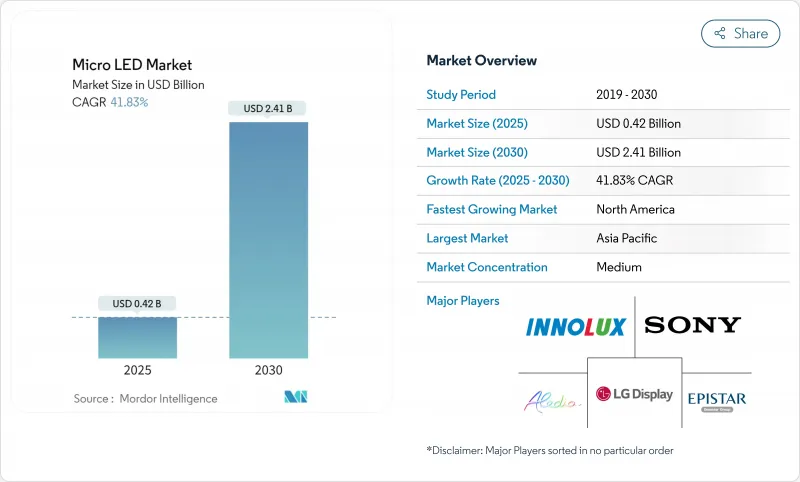

預計到 2025 年,微型 LED 市場規模將達到 4.2 億美元,到 2030 年將達到 24.1 億美元,年複合成長率為 41.83%。

商業性發展依賴於該技術的高亮度、低電力消耗以及超越LCD和OLED顯示器的超長壽命。製造商正在穩步提高量產產量比率,台灣和韓國的資本密集型試點生產線正在擴大該技術在穿戴式裝置、大型標誌和汽車駕駛座等領域的應用規模。亞太地區憑藉著成熟的半導體生態系統和扶持性的產業政策,引領著微型LED的製造主導;而北美則正在加速對國防和AR/VR項目的投資。儘管價格仍然較高,但對功耗、散熱和陽光下可視性有嚴格領先的終端用戶正在增強微型LED市場的長期競爭力。

全球MicroLED市場趨勢與洞察

蘋果和三星的MicroLED穿戴藍圖了對小型顯示器的需求

蘋果收購 LuxVue 後投入的 30 億美元以及三星的同步研發項目,顯示儘管短期內進度有所調整,但雙方仍保持長期的投入。驅動 IC 和處理設備供應商不斷增加的設計訂單表明,供應鏈正在向 2 英寸以下面板轉型。智慧型手錶顯示器預計將以 45% 的複合年成長率成長。專業工具供應商正在將高通量貼片系統商業化,這有助於在旗艦品牌之外推廣試生產。這種動態清晰地表明,這兩家市場領導者的策略藍圖正在影響整個 MicroLED 市場的更廣泛的資本配置。

海灣合作理事會和東亞地區透明彈性零售指示牌的普及

杜拜的豪華購物中心和首爾的旗艦店正在安裝無邊框透明的MicroLED建築幕牆,將數位內容與實體零售融為一體。天馬的PID原型設計戶外亮度高達4000尼特,展現出其優於LCD螢幕的性能優勢。模組化架構簡化了客製化尺寸,縮短了零售整合商的安裝週期。此外,其卓越的能源效率也降低了全天候運作的總擁有成本。這些優勢鞏固了數位指示牌38%的應用領先地位,並為MicroLED市場開闢了新的收入來源。

4吋晶圓上10微米以下LED的量產產量比率低於60%。

在大型基板上放置數百萬個微型發送器,其精度仍低於 60%,導致廢品率上升,生產線運轉率下降。設備製造商正在嘗試採用雷射誘導轉移和電磁拾取技術來實現 99.99% 的放置精度,其中 ViewReal 的 MicroSolid Printing 技術已展現出小於 7µm 間距的放置能力。在這些解決方案成熟之前,MicroLED 的產出成本將高於 OLED,這將限制其在 MicroLED 市場中近期在大眾電視和智慧型手機領域的應用。

細分市場分析

到2024年,數位電子看板將佔總收入的38%,這表明MicroLED非常適合用於打造高衝擊力、日光下清晰可見的電視牆。高階零售連鎖店正在採用可形成無縫拼接的模組化組件,而交通運輸機構則利用MicroLED的低故障率來製作重要的資訊顯示器。該領域的穩定訂單有助於實現早期運轉率,並進一步鞏固MicroLED市場。

相較之下,智慧型手錶的出貨量將與消費性電子產品的發布週期同步成長。受電池續航限制的穿戴式設備需要功耗低於1瓦的顯示螢幕,而3000尼特的峰值亮度則能提升戶外使用體驗。預計該細分市場的複合年成長率將達到45%,成為推動銷售成長的關鍵因素。隨著像素密度超過4000 PPI,近眼AR模組也將取得進展,為更廣泛的應用奠定基礎,並支撐MicroLED小面板市場規模的長期擴張。

到2024年,家用電器將佔microLED需求的72.1%,因為高階電視、手錶和智慧型手機都將採用microLED技術的高對比度和長壽命特性。三星的旗艦電視「The Wall」安裝在大型展示櫃中,售價不斐。這個領域將在microLED市場中扮演核心角色,穩定對背板、驅動IC和偵測工具等組件的需求。

隨著歐洲陽光可見度法規日益嚴格,汽車市場對抬頭顯示器(HUD)的需求正以47%的複合年成長率成長。 HUD原型機的亮度已超過10,000尼特,確保透過偏光擋風玻璃也能清晰可見。其優異的耐溫性和抗振性也符合AEC-Q標準。隨著越來越多的汽車製造商整合先進的駕駛員顯示螢幕,用於駕駛座電子設備的microLED市場規模將不斷擴大,使收入來源不再局限於消費性電子產品。

到2024年,50吋以上尺寸的面板將佔總收入的55.6%。豪華住宅和企業大廳正在採用110英寸至220英寸的面板,其安裝靈活性和無與倫比的峰值亮度使其高昂的價格物有所值。高階酒店場所正在利用無邊框面板打造沉浸式體驗,進一步鞏固其在MicroLED市場的領先地位。

到2030年,隨著製造技術的突破降低晶粒成本,10吋以下面板的複合年成長率將達到49%。 1吋以下微型顯示器的像素密度將達到6500 PPI,用於VR頭戴裝置;而汽車儀錶板需要小尺寸、高解析度的顯示器。先進轉印的應用將加速技術進步,這意味著未來十年,小尺寸面板的產量將日益再形成市場動態。

區域分析

亞太地區預計到2024年將佔全球營收的46.9%,主要得益於台灣的後端優勢和韓國深厚的顯示技術。京東方收購HC SemiTek以及三安半導體20億美元的晶圓廠建設計畫凸顯了持續的資本流入。包括氮化鎵晶圓出口退稅在內的政府支持措施,正幫助該地區保持成本優勢,並鞏固其在MicroLED市場的領先地位。

北美地區將以43%的複合年成長率(CAGR)實現最快成長,直至2030年。 《晶片法案》(CHIPS Act)下的聯邦激勵措施將刺激新的氮化鎵生產線建設,而國防和擴增實境/虛擬實境(AR/VR)項目將鎖定採購合約。蘋果公司多地點的研發中心和Meta公司在頭戴式設備領域的雄心壯志將集中生態系統活動,推動穩健的設計迭代,並支援不斷成長的基板需求。

歐洲將在汽車和工業應用領域發揮專業作用。強制性的太陽能電池可讀性將加速抬頭顯示器(HUD)的整合,而本地一級供應商將與亞洲LED製造商合作,以確保穩定的晶片供應。歐盟對無塵室維修的補貼將促進新興晶圓供應基地的形成,同時為因應亞洲市場壟斷提供戰略對沖。中東和非洲的推廣應用將首先從海灣合作理事會(GCC)購物中心的高階零售指示牌開始,而拉丁美洲將試行與體育基礎設施投資相關的大型場館顯示器。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 蘋果和三星發表MicroLED穿戴裝置藍圖,加速對小型顯示器的需求

- 在波灣合作理事會和東亞地區推廣透明且靈活的零售標牌

- 由美國和歐盟政府資助的國防級微型顯示器

- 台灣迷你LED成本下降,使得微型LED的試生產成為可能。

- 歐洲汽車陽光可視性標準推動微型LED抬頭顯示器的整合

- 市場限制

- 在4吋晶圓上,10µm以下LED的質量傳遞效率低於60%

- 非標準化車輛鑑定通訊協定

- 氮化鎵矽基晶片供應集中在亞洲

- 超過6億美元的資本支出需求限制了南美洲和非洲的擴張。

- 產業生態系分析

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過使用

- 智慧型手錶

- 近場觀看設備(AR/VR)

- 電視機

- 智慧型手機和平板電腦

- 顯示器和筆記型電腦

- 抬頭顯示器

- 數位電子看板

- 微型投影儀

- 醫療和外科展示

- 工業檢查面板

- 按最終用途行業分類

- 消費性電子產品

- 車

- 航太與國防

- 衛生保健

- 廣告與零售

- 工業和製造業

- 其他

- 按面板尺寸

- 10吋以下(小型和微型顯示器)

- 10 至 50 英吋(中)

- 50吋或更大(大號)

- 像素間距

- 細間距(小於1.5毫米)

- 標準(1.5-2.5毫米)

- 大號(超過 2.5 毫米)

- 按技術(彩色)

- RGB全彩

- 單色

- 按組件

- 外延晶片

- 背板

- 驅動IC

- 轉移和連接設備

- 檢查和維修工具

- 透過製造程序

- 傳質

- 外延晶片晶圓鍵合技術

- 雜化鍵

- 報價

- 顯示模組

- 照明模組

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 東南亞

- 亞太其他地區

- 南美洲

- 巴西

- 其他南美洲

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東地區

- 非洲

- 南非

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Samsung Electronics Co. Ltd.

- Sony Corporation

- LG Display Co. Ltd.

- BOE Technology Group Co. Ltd.

- AU Optronics Corp.

- Epistar Corporation

- PlayNitride Inc.

- Innolux Corporation

- Apple Inc.(LuxVue Technology)

- Tianma Microelectronics Co. Ltd.

- Nichia Corporation

- Sharp Corporation

- VueReal Inc.

- Plessey Semiconductors Ltd.

- Aledia SA

- Ostendo Technologies Inc.

- Rohinni LLC

- Leyard Optoelectronics Co. Ltd.

- Seoul Semiconductor Co. Ltd.

- San'an Optoelectronics Co. Ltd.

- Allos Semiconductors GmbH

- Optovate Ltd.

- Foxconn(Hon Hai Precision)

- Konka Group Co. Ltd.

第7章 市場機會與未來展望

The Micro LED market stood at USD 0.42 billion in 2025 and is forecast to reach USD 2.41 billion by 2030, advancing at a 41.83% CAGR.

Commercial traction hinges on the technology's high brightness, low power draw, and proven longevity that outperforms LCD and OLED displays. Manufacturers are steadily lifting mass-transfer yields, and capital-intensive pilot lines in Taiwan and South Korea are scaling the technology for wearables, large-format signage, and automotive cockpits. Asia Pacific commands manufacturing leadership on the back of mature semiconductor ecosystems and supportive industrial policies, while North America is accelerating investment for defense and AR/VR programs. Pricing remains elevated, yet end-users with severe power, thermal, or sunlight-readability constraints are moving first, reinforcing premium positioning and underscoring the long-run competitiveness of the Micro LED market.

Global Micro LED Market Trends and Insights

Apple and Samsung Roadmaps for Micro-LED Wearables Accelerating Small-Display Demand

Apple's USD 3 billion outlay since acquiring LuxVue and Samsung's parallel R&D programs signal long-term commitment despite near-term schedule shifts. Rising design wins for driver ICs and transfer equipment suppliers indicate a supply-chain pivot toward sub-2-inch panels. High brightness, stringent power budgets, and demand for outdoor readability underpin a projected 45% CAGR for smartwatch displays. Specialized tool vendors are commercializing high-throughput pick-and-place systems, helping democratize pilot production beyond flagship brands. This dynamic underlines how strategic roadmaps from two market leaders shape broader capital allocation across the Micro LED market.

Transparent and Flexible Retail Signage Uptake in GCC and East Asia

Luxury malls in Dubai and flagships in Seoul are installing bezel-less, transparent Micro LED facades that merge digital content with physical storefronts. Tianma's PID prototypes, engineered for 4,000-nit outdoor brightness, illustrate performance headroom over LCD alternatives. Modular architectures simplify custom dimensions, trimming installation cycles for retail integrators. Energy efficiency also reduces total cost of ownership for 24/7 operation. These attributes safeguard the 38% application lead held by digital signage and set the stage for new revenue pools inside the Micro LED market.

Mass-Transfer Yield Sub 60% for Sub-10 µm LEDs Beyond 4-Inch Wafers

Placement accuracy for millions of micro-emitters on large substrates remains below 60%, inflating scrap rates and depressing line utilization. Equipment makers are trialing laser-induced transfer and electromagnetic pick-up to reach 99.99% placement accuracy, while VueReal's MicroSolid Printing demonstrates sub-7 µm pitch capability. Until these solutions mature, output costs will stay above OLED equivalents, limiting near-term penetration in mass-market televisions and smartphones inside the Micro LED market.

Other drivers and restraints analyzed in the detailed report include:

- Defense-Grade Micro-Displays Funded by US and EU Governments

- Taiwanese Mini-LED Cost Decline Enabling Pilot Micro-LED Lines

- GaN-on-Si Wafer Supply Concentration in Asia

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Digital signage delivered 38% of 2024 revenue, validating Micro LED's suitability for high-impact, day-light-readable video walls. Luxury retail chains deploy modular tiles that form seamless canvases, while transportation hubs favor Micro LED's low failure rates for critical information boards. The segment's stable order flow underpins early capacity utilization, reinforcing the Micro LED market.

Smartwatch shipments, in contrast, scale with consumer electronics release cycles. Battery-limited wearables demand sub-1-watt displays, and 3,000-nit peak brightness extends outdoor usability. The segment's 45% forecast CAGR positions it as a pivotal volume driver. Near-eye AR modules are also progressing as pixel densities exceed 4,000 PPI, setting the stage for broader adoption and supporting the long-run expansion of the Micro LED market size at the small-panel end.

Consumer electronics captured 72.1% of 2024 demand as premium TVs, watches, and smartphones embraced the technology's high contrast and longevity. Samsung's flagship television line, The Wall, anchors large-screen showcase deployments and validates premium pricing. The segment's breadth stabilizes component demand across backplanes, driver ICs, and inspection tools, cementing its central role in the Micro LED market.

Automotive demand is rising at a projected 47% CAGR amid stricter European sun-readability mandates. HUD prototypes achieve over 10,000 nits, ensuring legibility through polarized windscreens. Extended temperature tolerance and vibration resistance also meet AEC-Q standards. As more carmakers integrate advanced driver displays, the Micro LED market size for cockpit electronics is set to widen, diversifying revenue beyond consumer gadgets.

Panels larger than 50 inches held 55.6% of 2024 revenue. Luxury residential and corporate lobbies adopt 110-inch to 220-inch assemblies where installation flexibility and unrivaled peak luminance justify premium prices. High-end hospitality venues leverage bezel-free surfaces to create immersive experiences, reinforcing share dominance within the Micro LED market.

Panels below 10 inches will grow 49% CAGR to 2030 as manufacturing breakthroughs lower cost per die. Sub-1-inch micro-displays now reach 6,500 PPI for VR headsets, and smart-instrument clusters in vehicles demand compact, high-resolution formats. Adoption of advanced transfer printing hastens the learning curve, signaling that small-panel volumes will increasingly reshape Micro LED market share dynamics later in the decade.

The Micro LED Market Report is Segmented by Application (Smartwatch, and More), End-Use Industry (Automotive, and More), Panel Size (Less Than 10 Inch, and More), Pixel Pitch (Fine Pitch, and More), Technology (Color) (RGB, and More), Component (Epitaxial Wafers, and More), Manufacturing Process (Mass Transfer, and More), Offering (Display Modules, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific held 46.9% of 2024 revenue, powered by Taiwan's role in back-end processing and South Korea's deep display know-how. BOE's acquisition of HC SemiTek and Sanan's USD 2 billion fab plan underscore continued capital inflows. Government facilitation, including export rebates on GaN wafers, sustains regional cost advantages and solidifies leadership in the Micro LED market.

North America is growing fastest at 43% CAGR to 2030. Federal incentives under the CHIPS Act spur new gallium-nitride lines, while defense and AR/VR programs lock in offtake agreements. Apple's multi-site R&D footprint and Meta's headset ambitions concentrate ecosystem activity, driving robust design iterations and supporting higher substrate demand.

Europe carves out a specialty role in automotive and industrial deployments. Sun-readability mandates accelerate HUD integration, and local tier-1 suppliers collaborate with Asian LED makers to secure stable die flow. Parallel EU subsidies for clean-room retrofits nurture a nascent wafer supply base, providing strategic hedges against Asian concentration. Adoption in Middle East and Africa begins with premium retail signage in GCC malls, whereas Latin America pilots large-venue displays tied to sports infrastructure investments.

- Samsung Electronics Co. Ltd.

- Sony Corporation

- LG Display Co. Ltd.

- BOE Technology Group Co. Ltd.

- AU Optronics Corp.

- Epistar Corporation

- PlayNitride Inc.

- Innolux Corporation

- Apple Inc. (LuxVue Technology)

- Tianma Microelectronics Co. Ltd.

- Nichia Corporation

- Sharp Corporation

- VueReal Inc.

- Plessey Semiconductors Ltd.

- Aledia SA

- Ostendo Technologies Inc.

- Rohinni LLC

- Leyard Optoelectronics Co. Ltd.

- Seoul Semiconductor Co. Ltd.

- San'an Optoelectronics Co. Ltd.

- Allos Semiconductors GmbH

- Optovate Ltd.

- Foxconn (Hon Hai Precision)

- Konka Group Co. Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Apple and Samsung Roadmaps for Micro-LED Wearables Accelerating Small-Display Demand

- 4.2.2 Transparent and Flexible Retail Signage Uptake in Gulf Cooperation Council Countries and East Asia

- 4.2.3 Defense-grade Micro-Displays Funded by United States and EU Governments

- 4.2.4 Taiwanese Mini-LED Cost Decline Enabling Pilot Micro-LED Lines

- 4.2.5 European Automotive Sun-Readability Norms Boosting Micro-LED HUD Integration

- 4.3 Market Restraints

- 4.3.1 Mass-Transfer Yield Sub 60 % for Sub-10 µm LEDs Beyond 4-inch Wafers

- 4.3.2 Non-standardised Automotive Qualification Protocols

- 4.3.3 GaN-on-Si Wafer Supply Concentration in Asia

- 4.3.4 More than USD 600 m Capex Requirement Limiting Expansion in South America and Africa

- 4.4 Industry Ecosystem Analysis

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Application

- 5.1.1 Smartwatch

- 5.1.2 Near-to-Eye Devices (AR/VR)

- 5.1.3 Television

- 5.1.4 Smartphone and Tablet

- 5.1.5 Monitor and Laptop

- 5.1.6 Head-up Display

- 5.1.7 Digital Signage

- 5.1.8 Micro-Projector

- 5.1.9 Medical and Surgical Displays

- 5.1.10 Industrial Inspection Panels

- 5.2 By End-use Industry

- 5.2.1 Consumer Electronics

- 5.2.2 Automotive

- 5.2.3 Aerospace and Defense

- 5.2.4 Healthcare

- 5.2.5 Advertising and Retail

- 5.2.6 Industrial and Manufacturing

- 5.2.7 Others

- 5.3 By Panel Size

- 5.3.1 Less than 10 inch (Small and Micro-Displays)

- 5.3.2 10 - 50 inch (Medium)

- 5.3.3 Above 50 inch (Large)

- 5.4 By Pixel Pitch

- 5.4.1 Fine Pitch (Less than 1.5 mm)

- 5.4.2 Standard (1.5 - 2.5 mm)

- 5.4.3 Large (Above 2.5 mm)

- 5.5 By Technology (Color)

- 5.5.1 RGB Full-Color

- 5.5.2 Monochrome

- 5.6 By Component

- 5.6.1 Epitaxial Wafers

- 5.6.2 Backplanes

- 5.6.3 Driver ICs

- 5.6.4 Transfer and Bonding Equipment

- 5.6.5 Inspection and Repair Tools

- 5.7 By Manufacturing Process

- 5.7.1 Mass Transfer

- 5.7.2 Epitaxial Wafer Bonding

- 5.7.3 Hybrid Bonding

- 5.8 By Offering

- 5.8.1 Display Modules

- 5.8.2 Lighting Modules

- 5.9 By Geography

- 5.9.1 North America

- 5.9.1.1 United States

- 5.9.1.2 Canada

- 5.9.1.3 Mexico

- 5.9.2 Europe

- 5.9.2.1 Germany

- 5.9.2.2 United Kingdom

- 5.9.2.3 France

- 5.9.2.4 Italy

- 5.9.2.5 Spain

- 5.9.2.6 Rest of Europe

- 5.9.3 Asia-Pacific

- 5.9.3.1 China

- 5.9.3.2 Japan

- 5.9.3.3 South Korea

- 5.9.3.4 India

- 5.9.3.5 South East Asia

- 5.9.3.6 Rest of Asia-Pacific

- 5.9.4 South America

- 5.9.4.1 Brazil

- 5.9.4.2 Rest of South America

- 5.9.5 Middle East and Africa

- 5.9.5.1 Middle East

- 5.9.5.1.1 United Arab Emirates

- 5.9.5.1.2 Saudi Arabia

- 5.9.5.1.3 Rest of Middle East

- 5.9.5.2 Africa

- 5.9.5.2.1 South Africa

- 5.9.5.2.2 Rest of Africa

- 5.9.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Samsung Electronics Co. Ltd.

- 6.4.2 Sony Corporation

- 6.4.3 LG Display Co. Ltd.

- 6.4.4 BOE Technology Group Co. Ltd.

- 6.4.5 AU Optronics Corp.

- 6.4.6 Epistar Corporation

- 6.4.7 PlayNitride Inc.

- 6.4.8 Innolux Corporation

- 6.4.9 Apple Inc. (LuxVue Technology)

- 6.4.10 Tianma Microelectronics Co. Ltd.

- 6.4.11 Nichia Corporation

- 6.4.12 Sharp Corporation

- 6.4.13 VueReal Inc.

- 6.4.14 Plessey Semiconductors Ltd.

- 6.4.15 Aledia SA

- 6.4.16 Ostendo Technologies Inc.

- 6.4.17 Rohinni LLC

- 6.4.18 Leyard Optoelectronics Co. Ltd.

- 6.4.19 Seoul Semiconductor Co. Ltd.

- 6.4.20 San'an Optoelectronics Co. Ltd.

- 6.4.21 Allos Semiconductors GmbH

- 6.4.22 Optovate Ltd.

- 6.4.23 Foxconn (Hon Hai Precision)

- 6.4.24 Konka Group Co. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment