|

市場調查報告書

商品編碼

1797785

Micro-LED 市場機會、成長動力、產業趨勢分析及 2025 - 2034 年預測Micro-LED Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

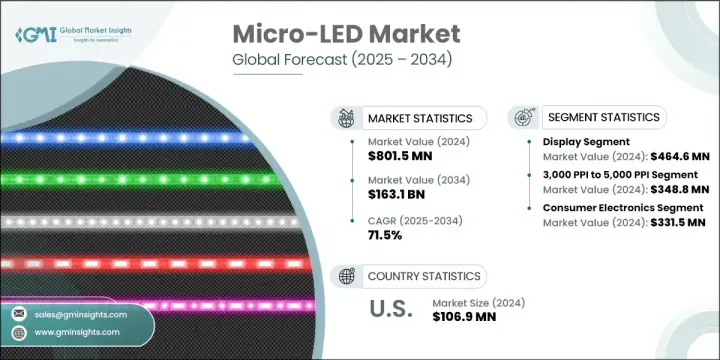

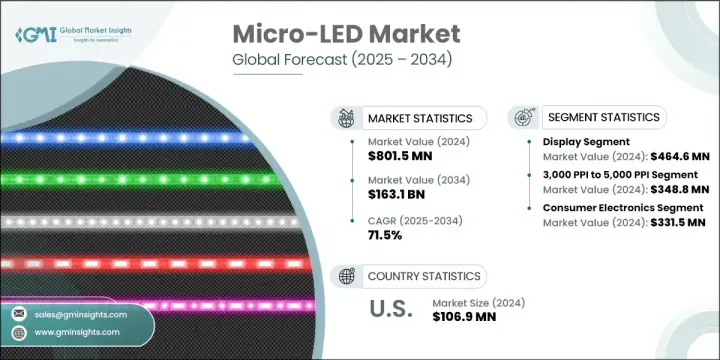

2024年,全球Micro-LED市場規模達8.015億美元,預計2034年將以71.5%的複合年成長率成長,達到1,631億美元。這一強勁成長的動力源自於各類應用對節能、高效能顯示技術日益成長的需求。 Micro-LED在汽車系統中的廣泛應用是這一成長的主要催化劑,數位儀表板、AR抬頭顯示器和高解析度資訊娛樂面板正成為汽車系統的標準配備。此外,消費者對下一代電視、先進數位看板和高階視覺體驗的日益青睞,也推動了Micro-LED在消費性電子和廣告領域的應用。

Micro-LED 顯示器憑藉著卓越的亮度、能源效率和耐用性,成為取代傳統 OLED 和 LCD 技術的首選替代方案。市場也正強勁轉向採用模組化架構和超薄材料設計的軟性透明顯示螢幕,以滿足穿戴式電子產品、智慧窗和零售標牌等新應用的需求。隨著生產成本持續下降,Micro-LED 預計將實現更廣泛的商業化,尤其是在顯示器品質和壽命至關重要的高階市場。

| 市場範圍 | |

|---|---|

| 起始年份 | 2024 |

| 預測年份 | 2025-2034 |

| 起始值 | 8.015億美元 |

| 預測值 | 1631億美元 |

| 複合年成長率 | 71.5% |

2024年,Micro-LED市場中的顯示器細分市場產值達到4.646億美元。由於個人電子設備對超高清和節能顯示器的需求持續飆升,Micro-LED需求持續成長。 Micro-LED面板憑藉更高的亮度、更寬的色域、更高的對比度以及顯著延長的使用壽命,優於OLED和LCD等替代產品。這使得它們尤其適合整合到AR/VR設備和下一代智慧手錶中。全球科技巨頭不斷加強研發力度,進一步加速Micro-LED的普及,並推動消費性電子產品的創新。

2024年,3,000 PPI至5,000 PPI細分市場創造了3.488億美元的市場規模。此像素範圍在顯示清晰度和功耗之間實現了良好的平衡,使其對高階電子產品和沈浸式現實應用極具吸引力。領先的顯示研究團隊已經認知到,這種解析度對於在混合實境環境中提供逼真的體驗至關重要。對微顯示器研發的持續投入,尤其是針對國防級光學元件和高性能穿戴式裝置的研發,正在增強其在各個高階市場的勢頭。

2024年,美國Micro-LED市場產值達1.069億美元。這一主導地位得益於國家戰略政策的支持,這些政策旨在促進先進半導體製造的發展,例如聯邦政府為微電子和顯示器創新提供的大規模資助項目。這些投資正在重塑美國國內生產能力,同時強化下一代顯示技術的供應鏈。美國持續保持全球創新領先地位,企業高度重視在智慧型手機、穿戴式裝置、AR/VR設備和其他智慧型系統中部署Micro-LED解決方案。

全球 Micro-LED 市場充滿活力且高度分散,既有老牌企業,也有新興創新者,競爭格局十分激烈。主要參與者包括京東方科技、索尼公司、LG Display 株式會社、三星電子和晶元光電。為了鞏固市場地位,領先的 Micro-LED 公司正大力投資研發,以提高顯示器性能、能源效率和生產可擴展性。與材料供應商和半導體製造商的策略合作有助於簡化 Micro-LED 在不同應用領域的整合。各公司也正在進行收購,以獲取創新的製造技術和智慧財產權。一些參與者專注於內部製造能力,以減少對外部供應商的依賴,從而改善供應鏈控制。客製化和模組化產品正在開發中,以滿足從汽車到穿戴式裝置等不同行業的需求。

目錄

第1章:方法論與範圍

第2章:執行摘要

第3章:行業洞察

- 產業生態系統分析

- 供應商格局

- 利潤率

- 成本結構

- 每個階段的增值

- 影響價值鏈的因素

- 中斷

- 產業生態系統分析

- 產業衝擊力

- 成長動力

- 穿戴式科技的成長

- 卓越的顯示性能

- 節能顯示器的需求不斷增加

- 在汽車應用中的快速採用

- 高階電視和數位看板的需求

- 陷阱與挑戰

- 製造成本高和產量問題

- OLED和Mini LED的競爭

- 成長動力

- 成長潛力分析

- 監管格局

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 波特的分析

- PESTEL分析

- 技術和創新格局

- 當前的技術趨勢

- 新興技術

- 新興商業模式

- 合規性要求

- 永續性措施

- 專利和智慧財產權分析

- 地緣政治與貿易動態

第4章:競爭格局

- 介紹

- 公司市佔率分析

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東和非洲

- 市場集中度分析

- 按地區

- 關鍵參與者的競爭基準

- 財務績效比較

- 收入

- 利潤率

- 研發

- 產品組合比較

- 產品範圍廣度

- 科技

- 創新

- 地理位置比較

- 全球足跡分析

- 服務網路覆蓋

- 各地區市場滲透率

- 競爭定位矩陣

- 領導者

- 挑戰者

- 追蹤者

- 利基市場參與者

- 戰略展望矩陣

- 財務績效比較

- 2021-2024 年關鍵發展

- 併購

- 夥伴關係和合作

- 技術進步

- 擴張和投資策略

- 永續發展舉措

- 數位轉型舉措

- 新興/新創企業競爭對手格局

第5章:市場估計與預測:按技術,2021 - 2034 年

- 主要趨勢

- RGB全彩

- 單色

第6章:市場估計與預測:按像素密度,2021 - 2034 年

- 主要趨勢

- 小於 3,000ppi

- 3,000ppi 至 5000ppi

- 大於5000ppi

第7章:市場估計與預測:按應用,2021 - 2034 年

- 主要趨勢

- 顯示器

- AR/VR頭戴設備

- 智慧手錶

- 智慧型手機

- 平板電腦和筆記型電腦

- 電視和顯示器

- 數位看板和視訊牆

- 其他

- 燈光

- 普通照明

- 汽車照明

- 其他

第8章:市場估計與預測:按行業,2021 - 2034 年

- 主要趨勢

- 消費性電子產品

- 汽車

- 航太與國防

- 衛生保健

- 零售和酒店

- 其他

第9章:市場估計與預測:按地區,2021 - 2034 年

- 主要趨勢

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 荷蘭

- 亞太地區

- 中國

- 印度

- 日本

- 澳洲

- 韓國

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 阿拉伯聯合大公國

第10章:公司簡介

- Global Key Players

- Regional Key Players

- 顛覆者/利基市場參與者

- 艾比森

- 利亞德

- TCL華星

The Global Micro-LED Market was valued at USD 801.5 million in 2024 and is estimated to grow at a CAGR of 71.5% to reach USD 163.1 billion by 2034. This robust expansion is driven by rising demand for energy-efficient, high-performance display technologies across various applications. A major catalyst behind this growth is the widespread adoption of micro-LEDs in automotive systems, where digital dashboards, AR heads-up displays, and high-resolution infotainment panels are becoming standard. In addition, the increasing consumer preference for next-generation televisions, advanced digital signage, and premium visual experiences is boosting micro-LED adoption in the consumer electronics and advertising sectors.

With superior brightness, energy efficiency, and durability, micro-LED displays emerge as the go-to alternative over traditional OLED and LCD technologies. The market is also witnessing a strong shift toward flexible and transparent displays designed with modular architecture and ultra-thin materials, aligning with new applications such as wearable electronics, smart windows, and retail-based signage. As production costs continue to decline, broader commercialization is anticipated, particularly in premium segments where quality and longevity display are of paramount importance.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $801.5 Million |

| Forecast Value | $163.1 Billion |

| CAGR | 71.5% |

In 2024, the display segment in the micro-LED market generated USD 464.6 million. Demand continues to surge due to the need for ultra-high-definition and power-efficient displays in personal electronic devices. Micro-LED panels outperform OLED and LCD alternatives by offering enhanced brightness, broader color range, higher contrast, and significantly longer lifespan. This makes them especially appealing for integration in AR/VR devices and next-gen smartwatches. Growing research and development efforts by global tech giants are further accelerating adoption and pushing innovation across consumer electronics.

The 3,000 PPI to 5,000 PPI segment generated USD 348.8 million in 2024. This pixel range strikes a strong balance between display clarity and power efficiency, making it highly attractive for premium electronics and immersive reality applications. Leading display research groups have identified this resolution as increasingly critical in delivering lifelike experiences in mixed reality environments. Continued investment in micro-display R&D-especially targeting defense-grade optics and high-performance wearables-is reinforcing momentum across diverse high-end markets.

United States Micro-LED Market generated USD 106.9 million in 2024. This dominance is supported by strategic national policies promoting advanced semiconductor manufacturing, such as large-scale federal funding programs dedicated to microelectronics and display innovation. These investments are helping reshape domestic production capabilities while reinforcing the supply chain for next-generation display technologies. The US continues to be a global innovation leader, with a strong corporate focus on deploying micro-LED solutions across smartphones, wearables, AR/VR devices, and other smart systems.

The Global Micro-LED Market is dynamic and highly fragmented, featuring a competitive landscape of established players and emerging innovators. Key participants include BOE Technology, Sony Corporation, LG Display Co., Ltd., Samsung Electronics, and Epistar Corporation. To strengthen their market position, leading micro-LED companies are heavily investing in research and development to enhance display performance, energy efficiency, and production scalability. Strategic collaborations with material suppliers and semiconductor manufacturers are helping streamline micro-LED integration across diverse applications. Companies are also pursuing acquisitions to gain access to innovative manufacturing techniques and intellectual property. Several players are focusing on internal fabrication capabilities to reduce reliance on external suppliers, which improves supply chain control. Customization and modular product offerings are being developed to cater to varying industry demands, from automotive to wearables.

Table of Contents

Chapter 1 Methodology and scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1 Technology trends

- 2.2.2 Pixel density trends

- 2.2.3 Application trends

- 2.2.4 End use industry trends

- 2.2.5 Regional trends

- 2.3 TAM Analysis, 2025-2034 (USD Billion)

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry ecosystem analysis

- 3.3 Industry impact forces

- 3.3.1 Growth drivers

- 3.3.1.1 Growth in wearable technology

- 3.3.1.2 Superior display performance

- 3.3.1.3 Increasing demand for energy-efficient displays

- 3.3.1.4 Rapid adoption in automotive applications

- 3.3.1.5 Demand for high-end televisions and digital signage

- 3.3.2 Pitfalls and challenges

- 3.3.2.1 High manufacturing costs and yield issues

- 3.3.2.2 Competition from OLED and mini LED

- 3.3.1 Growth drivers

- 3.4 Growth potential analysis

- 3.5 Regulatory landscape

- 3.5.1 North America

- 3.5.2 Europe

- 3.5.3 Asia Pacific

- 3.5.4 Latin America

- 3.5.5 Middle East & Africa

- 3.6 Porter's analysis

- 3.7 PESTEL analysis

- 3.8 Technology and Innovation landscape

- 3.8.1 Current technological trends

- 3.8.2 Emerging technologies

- 3.9 Emerging business models

- 3.10 Compliance requirements

- 3.11 Sustainability measures

- 3.12 Patent and IP analysis

- 3.13 Geopolitical and trade dynamics

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 Latin America

- 4.2.1.5 Middle East & Africa

- 4.2.2 Market concentration analysis

- 4.2.1 By region

- 4.3 Competitive benchmarking of key players

- 4.3.1 Financial performance comparison

- 4.3.1.1 Revenue

- 4.3.1.2 Profit margin

- 4.3.1.3 R&D

- 4.3.2 Product portfolio comparison

- 4.3.2.1 Product range breadth

- 4.3.2.2 Technology

- 4.3.2.3 Innovation

- 4.3.3 Geographic presence comparison

- 4.3.3.1 Global footprint analysis

- 4.3.3.2 Service network coverage

- 4.3.3.3 Market penetration by region

- 4.3.4 Competitive positioning matrix

- 4.3.4.1 Leaders

- 4.3.4.2 Challengers

- 4.3.4.3 Followers

- 4.3.4.4 Niche players

- 4.3.5 Strategic outlook matrix

- 4.3.1 Financial performance comparison

- 4.4 Key developments, 2021-2024

- 4.4.1 Mergers and acquisitions

- 4.4.2 Partnerships and collaborations

- 4.4.3 Technological advancements

- 4.4.4 Expansion and investment strategies

- 4.4.5 Sustainability initiatives

- 4.4.6 Digital transformation initiatives

- 4.5 Emerging/ startup competitors landscape

Chapter 5 Market Estimates and Forecast, By Technology, 2021 - 2034 (USD Million)

- 5.1 Key trends

- 5.2 RGB full-color

- 5.3 Monochrome

Chapter 6 Market Estimates and Forecast, By Pixel Density, 2021 - 2034 (USD Million)

- 6.1 Key trends

- 6.2 Less than 3,000ppi

- 6.3 3,000ppi to 5000ppi

- 6.4 Greater than 5000ppi

Chapter 7 Market Estimates and Forecast, By Application, 2021 - 2034 (USD Million)

- 7.1 Key trends

- 7.2 Displays

- 7.2.1 AR/VR headsets

- 7.2.2 Smartwatches

- 7.2.3 Smartphones

- 7.2.4 Tablets & laptops

- 7.2.5 Televisions & monitors

- 7.2.6 Digital signage & video walls

- 7.2.7 Others

- 7.3 Lighting

- 7.3.1 General lighting

- 7.3.2 Automotive lighting

- 7.3.3 Others

Chapter 8 Market Estimates and Forecast, By Industry, 2021 - 2034 (USD Million)

- 8.1 Key trends

- 8.2 Consumer electronics

- 8.3 Automotive

- 8.4 Aerospace & defense

- 8.5 Healthcare

- 8.6 Retail & hospitality

- 8.7 Others

Chapter 9 Market Estimates and Forecast, By Region, 2021 - 2034 (USD Million)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Netherlands

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

Chapter 10 Company Profiles

- 10.1 Global Key Players

- 10.1.1 Samsung Electronics

- 10.1.2 Sony Corporation

- 10.1.3 LG Display Co., Ltd.

- 10.1.4 BOE Technology

- 10.1.5 AU Optronics (AUO)

- 10.2 Regional Key Players

- 10.2.1 North America

- 10.2.1.1 X-Celeprint

- 10.2.1.2 Nanosys

- 10.2.1.3 Kopin Corp

- 10.2.1.4 eLux Inc

- 10.2.1.5 VueReal

- 10.2.2 Europe

- 10.2.2.1 Aledia SA

- 10.2.2.2 Plessey Semiconductors

- 10.2.2.3 MICLEDI Microdisplays

- 10.2.3 Asia-Pacific

- 10.2.3.1 Epistar Corporation

- 10.2.3.2 PlayNitride

- 10.2.3.3 Jade Bird Display (JBD)

- 10.2.3.4 Konka Global

- 10.2.1 North America

- 10.3 Disruptors / Niche Players

- 10.3.1 Absen

- 10.3.2 Leyard

- 10.3.3 TCL CSOT