|

市場調查報告書

商品編碼

1850315

客戶自助服務軟體:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Customer Self-Service Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

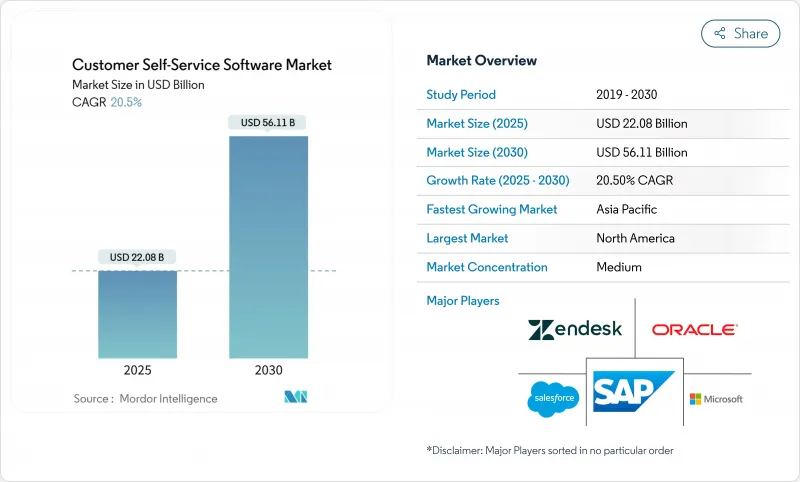

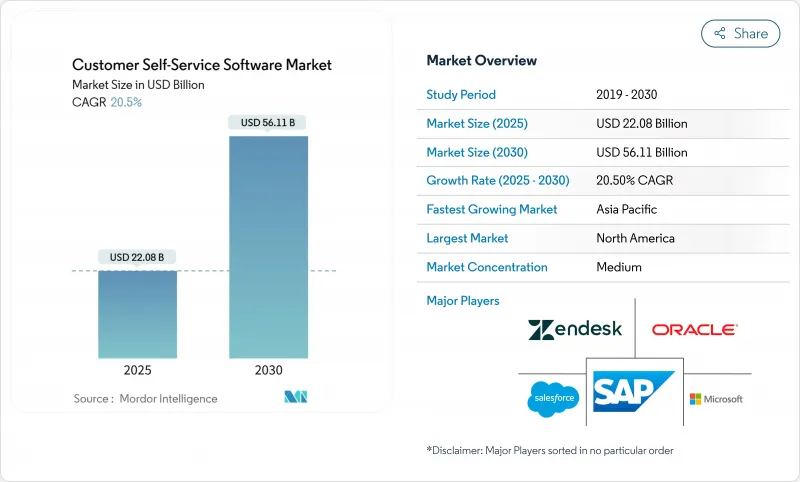

預計到 2025 年,客戶自助服務軟體市場規模將達到 220.8 億美元,到 2030 年將達到 561.1 億美元,預測期(2025-2030 年)複合年成長率為 20.5%。

這種成長反映了用戶互動模式向自主模式轉變的趨勢,該模式利用對話式人工智慧、雲端部署和高度個人化的工作流程來縮短等待時間並降低營運成本。中小企業也在加速採用這些模式,因為訂閱定價模式無需大量資本支出。對話式介面正吸引持續的投資,因為它們符合消費者對自然、按需幫助的期望。區域資金籌措模式顯示出整體發展勢頭,北美公司正在推進最佳化計劃,而亞太公司則部署了第一批系統,以服務以行動端為中心的客戶。

全球客戶自助服務軟體市場趨勢與洞察

雲端優先的客戶體驗轉型

遷移到雲端原生客戶經驗架構的企業報告稱,成本節省高達 40-60%,並可實現 24 小時全天候服務,這促使企業進一步投資客戶自助服務軟體市場。跨觸點的近乎即時的資料同步使客服人員和聊天機器人能夠存取完整的歷史記錄,從而提高首次通話解決率 (FCR)。中小企業最能從訂閱模式中獲益,無需前期投資。然而,多區域資料駐留規則會使部署變得複雜,因此擁有強大遷移支援的供應商更具優勢。

人工智慧驅動的自助服務成熟度曲線

生成式人工智慧如今能夠讓自動化入口網站透過解讀使用者意圖、搜尋記錄和執行多步驟工作流程,解決高達 80% 的常見查詢。將大規模語言模式整合到票務流程中的公司能夠獲得更高的淨推薦值 (NPS),並讓員工騰出精力專注於異常處理。隨著準確率的提高,客戶自助服務軟體市場將從處理常規常見問題轉向完成高價值、受監管的交易。

API 安全標準碎片化

不同的令牌通訊協定和不一致的加密方式推高了整合成本,並延緩了客戶自助服務軟體市場的推廣。嚴格監管的行業正迫使CRM、ERP和知識庫連接在單一安全模型下整合,但這也暴露出一些漏洞,從而引發新的安全隱患。一些供應商透過提供預認證連接器來解決這一痛點,並因此獲得了市場認可。

細分市場分析

預計到2024年,雲端運算市場佔有率將達到58.7%,並在2030年之前維持22.1%的複合年成長率。雲端運算的興起提高了規模彈性,無需擴展資料中心即可實現全球發布。訂閱定價模式降低了前期投資,並使財務團隊能夠將成本計入營運費用。供應商不斷增強其產品,內建分析功能,使用戶能夠了解產品流失率和用戶情緒。

在政府機構中,混合框架正變得越來越普遍。由於主權法規限制了敏感司法管轄區內SaaS的使用,而完整的本地部署架構仍然主要集中在政府機構中。從本地部署遷移到雲端的公司通常會採取分階段部署的方式,將新流量遷移到雲端,同時保留原有的工單記錄。維護負擔的減輕和即時修補程式的更新進一步提升了混合框架的吸引力,也進一步鞏固了客戶自助服務軟體市場的發展趨勢。

到2024年,端到端套件將佔總收入的62.3%,凸顯了買家對融合知識庫、聊天機器人和分析功能的整合平台的需求。隨著企業對配置、培訓和定期最佳化的需求不斷成長,服務類別將以21.6%的複合年成長率成長。實施合作夥伴將制定行業指南,用於繪製工作流程圖和管理基於角色的存取權限,從而指導企業克服變革管理中的各種挑戰。

供應商透過加速器擴展價值,這些加速器與預先建置的範本打包在一起,符合 ITIL 流程或零售訂單狀態流程。持續的互動確保模組始終處於最佳狀態,避免不斷變化的業務規則與機器人意圖之間出現偏差。這套專業服務層提高了平台的使用者黏性,並擴大了每次配置所附帶的客戶自助服務軟體的市場規模。

客戶自助服務軟體市場按配置(雲端、本地部署、混合部署)、產品/服務(解決方案和服務)、通路(入口網站、行動應用程式、其他)、公司規模(大型企業和中小企業)、最終用戶行業(銀行、金融服務和保險、醫療保健、零售和電子商務、其他)以及地區進行細分。市場預測以美元計價。

區域分析

北美地區將在2024年貢獻34.2%的收入,這主要得益於高雲端採用率、成熟的全通路策略以及精通人工智慧模式調優的技術人才儲備。許多公司已經完成了第一階段的部署,目前正專注於透過更深入的分析來最佳化其部署路徑。聯邦政府對網路安全的重視正促使各機構和承包商轉向符合零信任要求的平台,加劇了系統更新換代的循環。

亞太地區是成長最快的市場,預計到2030年將以21.7%的複合年成長率成長。以Z世代為首的行動優先消費者需要能夠理解方言和卡拉OK式音譯的聊天機器人。各國政府正在為中小企業提供數位化補貼,間接推動了零售、旅遊、銀行等產業對客戶自助服務軟體的需求。擁有多語言自然語言處理(NLP)流程的供應商能夠在這種環境下脫穎而出。

在歐洲,儘管資料隱私法十分嚴格,但進展依然穩步推進。主權雲端框架正在興起,推動了區域資料中心的建設,並確保了合規性。企業買家在部署解決方案前會仔細審查審核能力和使用者許可管理,這有效地提高了競爭門檻。監管方面的繁瑣流程會阻礙發展速度,但一旦某個解決方案被證明合規,它就能迅速擴展到相鄰領域,從而確保長期穩定性。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 雲端優先的客戶體驗轉型

- 人工智慧驅動的自助服務成熟度曲線

- 利用客戶數據平台實現超個人化

- Z世代消費者對自助服務的接受度不斷提高

- 將自助服務融入垂直 SaaS「分層蛋糕」中

- 自助式網路保險保費獎勵

- 市場限制

- API 安全標準碎片化

- 使用「靜默退出」來減少支援人員的訓練數據

- 主權雲端中資料儲存位置的限制

- 中小企業採用顧客體驗工具的成本不斷上升

- 產業價值鏈分析

- 監管格局

- 技術展望

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 供應商的議價能力

- 買方的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 影響市場的宏觀經濟因素

第5章 市場規模及成長預測(數值)

- 透過部署

- 雲

- 本地部署

- 混合

- 報價

- 解決方案

- 服務

- 按頻道

- 入口網站

- 行動應用

- 對話式聊天機器人/API

- 語音/互動語音應答

- 按公司規模

- 主要企業

- 小型企業

- 按最終用戶產業

- BFSI

- 衛生保健

- 零售與電子商務

- 政府

- 資訊科技/通訊

- 教育

- 其他終端用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 新加坡

- 馬來西亞

- 澳洲

- 其他亞太地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Oracle Corporation

- Salesforce Inc.

- SAP SE

- Microsoft Corporation

- Zendesk Inc.

- Verint Systems Inc.

- NICE Ltd.

- Genesys Telecommunications Laboratories Inc.

- Freshworks Inc.

- ServiceNow Inc.

- Atlassian Corporation(Jira Service Management)

- HubSpot Inc.

- Intercom Inc.

- Pega Systems Inc.

- Zoho Corporation Pvt. Ltd.

- Zappix Inc.

- Ada Support Inc.

- LivePerson Inc.

- Richpanel Technologies Pvt. Ltd.

- Help Scout PBC

- Drift.com Inc.

- WalkMe Ltd.

- Kustomer LLC

- RingCentral Inc.

- Avaya Inc.

- BMC Software Inc.

第7章 市場機會與未來趨勢

- 閒置頻段與未滿足需求評估

The Customer Self-Service Software Market size is estimated at USD 22.08 billion in 2025, and is expected to reach USD 56.11 billion by 2030, at a CAGR of 20.5% during the forecast period (2025-2030).

The growth reflects a shift toward autonomous engagement models in which conversational AI, cloud deployment, and hyper-personalised workflows reduce wait times and trim operating costs. Vendors offering integrated platforms rather than narrow point tools earn preference, while small and mid-sized enterprises (SMEs) accelerate adoption as subscription pricing removes large capital outlays. Conversational interfaces attract sustained investment because they align with consumer expectations for natural, on-demand help. Regional funding patterns reinforce overall momentum as North American enterprises pursue optimisation projects and Asia-Pacific companies deploy first-wave systems to serve mobile-centric customers.

Global Customer Self-Service Software Market Trends and Insights

Cloud-first CX Transformation Wave

Enterprises migrating to cloud-native customer experience stacks report 40-60% cost reductions and round-the-clock availability, results that encourage further investment in the customer self-service software market. Near-instant data synchronisation across touchpoints lets agents and bots access complete history, which raises first-contact resolution rates. SMEs gain the most because subscription models avoid up-front capital requirements. Nevertheless, multi-region data residency rules complicate rollouts and reward vendors with strong migration support.

AI-powered Self-service Maturity Curves

Generative AI now interprets intent, retrieves records, and executes multi-step workflows, letting automated portals resolve up to 80% of common queries. Companies that embed large language models inside ticketing flows register higher net-promoter scores and free staff to handle exceptions. As accuracy improves, the customer self-service software market will transition from handling routine FAQs to completing high-value, regulated transactions.

Fragmented API Security Standards

Mismatched token protocols and inconsistent encryption raise integration costs, slowing deployments in the customer self-service software market. Highly regulated verticals must align CRM, ERP, and knowledge-base connections under one security model, and gaps expose new vulnerability surfaces. Vendors answering this pain point with pre-certified connectors gain traction.

Other drivers and restraints analyzed in the detailed report include:

- Hyper-personalisation via Customer Data Platforms

- Rising Self-service Adoption by Gen-Z Consumers

- Data Residency Constraints in Sovereign Clouds

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

The cloud segment commanded 58.7% customer self-service software market share in 2024 and is forecast to maintain a 22.1% CAGR through 2030. Its rise adds scale elasticity, enabling global releases without data-centre expansion. Subscription pricing trims up-front investment and lets finance teams recognise expenses as operating outlays. Vendors continue to enrich offerings with built-in analytics that surface deflection rates and user sentiment.

Hybrid frameworks persist where sovereignty rules block SaaS in sensitive jurisdictions, while fully on-premise stacks remain concentrated in government agencies. Firms migrating from on-premises commonly adopt phased rollouts that preserve legacy ticket records yet shift new traffic to the cloud. Lower maintenance burdens and instant patching further cement the appeal, reinforcing the customer self-service software market trajectory.

End-to-end suites held 62.3% of revenue in 2024, revealing buyer desire for unified hubs that blend knowledge bases, chatbots, and analytics. The services category will grow at 21.6% CAGR as enterprises need configuration, training, and periodic optimisation. Implementation partners craft industry playbooks that map workflows and govern role-based access, guiding firms through change-management hurdles.

Vendors extend value with packaged accelerators-pre-built templates that align to ITIL processes or retail order-status flows. Continuous-improvement engagements keep modules tuned, avoiding drift between evolving business rules and bot intents. These professional-service layers deepen platform stickiness and enlarge the customer self-service software market size attached to each deployment.

Customer Self-Service Software Market is Segmented by Deployment (Cloud, On-Premise, and Hybrid), Offering (Solution and Service), Channel (Web Portal, Mobile App, and More), Enterprise Size (Large Enterprises and Small and Mid-Sized Enterprises), End-User Industry (BFSI, Healthcare, Retail and E-Commerce, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America generated 34.2% of 2024 revenue, supported by high cloud penetration, mature omnichannel strategies, and a tech workforce skilled in AI model tuning. Many enterprises completed first-wave deployments and now focus on fine-tuning journeys using deeper analytics. Federal-level attention to cybersecurity nudges agencies and contractors toward platforms meeting zero-trust mandates, sustaining replacement cycles.

Asia-Pacific represents the fastest expansion vector with a projected 21.7% CAGR through 2030. Its mobile-first consumer base, dominated by Gen-Z cohorts, demands chatbots that understand local dialects and karaoke-style transliteration. Governments sponsor SME digitalisation grants, indirectly enlarging demand for the customer self-service software market across retail, travel, and banking. Vendors with multilingual NLP pipelines differentiate in these environments.

Europe advances steadily despite stringent privacy statutes. The emergence of sovereign-cloud frameworks spurs regional data-centre builds, ensuring compliance. Enterprise buyers scrutinise audit capabilities and consent management before green-lighting rollouts, effectively raising the competitive bar. Although regulatory overhead tempers speed, once solutions prove compliant, adoption spreads quickly across adjacent departments, securing long-run stability.

- Oracle Corporation

- Salesforce Inc.

- SAP SE

- Microsoft Corporation

- Zendesk Inc.

- Verint Systems Inc.

- NICE Ltd.

- Genesys Telecommunications Laboratories Inc.

- Freshworks Inc.

- ServiceNow Inc.

- Atlassian Corporation (Jira Service Management)

- HubSpot Inc.

- Intercom Inc.

- Pega Systems Inc.

- Zoho Corporation Pvt. Ltd.

- Zappix Inc.

- Ada Support Inc.

- LivePerson Inc.

- Richpanel Technologies Pvt. Ltd.

- Help Scout PBC

- Drift.com Inc.

- WalkMe Ltd.

- Kustomer LLC

- RingCentral Inc.

- Avaya Inc.

- BMC Software Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Cloud-first CX transformation wave

- 4.2.2 AI-powered self-service maturity curves

- 4.2.3 Hyper-personalisation via customer data platforms

- 4.2.4 Rising self-service adoption by Gen-Z consumers

- 4.2.5 Embedded self-service in vertical SaaS "layer-cake"

- 4.2.6 Cyber-insurance premium incentives for self-service

- 4.3 Market Restraints

- 4.3.1 Fragmented API security standards

- 4.3.2 "Quiet quit" of support agents lowering training data

- 4.3.3 Data residency constraints in sovereign clouds

- 4.3.4 Rising CX tool sprawl cost for SMEs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Deployment

- 5.1.1 Cloud

- 5.1.2 On-premise

- 5.1.3 Hybrid

- 5.2 By Offering

- 5.2.1 Solution

- 5.2.2 Service

- 5.3 By Channel

- 5.3.1 Web Portal

- 5.3.2 Mobile App

- 5.3.3 Conversational Chatbot/API

- 5.3.4 Voice/IVR

- 5.4 By Enterprise Size

- 5.4.1 Large Enterprises

- 5.4.2 Small and Mid-Sized Enterprises (SMEs)

- 5.5 By End-user Industry

- 5.5.1 BFSI

- 5.5.2 Healthcare

- 5.5.3 Retail and E-commerce

- 5.5.4 Government

- 5.5.5 IT and Telecommunication

- 5.5.6 Education

- 5.5.7 Other End-user Industries

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Chile

- 5.6.2.4 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Singapore

- 5.6.4.6 Malaysia

- 5.6.4.7 Australia

- 5.6.4.8 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Egypt

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Oracle Corporation

- 6.4.2 Salesforce Inc.

- 6.4.3 SAP SE

- 6.4.4 Microsoft Corporation

- 6.4.5 Zendesk Inc.

- 6.4.6 Verint Systems Inc.

- 6.4.7 NICE Ltd.

- 6.4.8 Genesys Telecommunications Laboratories Inc.

- 6.4.9 Freshworks Inc.

- 6.4.10 ServiceNow Inc.

- 6.4.11 Atlassian Corporation (Jira Service Management)

- 6.4.12 HubSpot Inc.

- 6.4.13 Intercom Inc.

- 6.4.14 Pega Systems Inc.

- 6.4.15 Zoho Corporation Pvt. Ltd.

- 6.4.16 Zappix Inc.

- 6.4.17 Ada Support Inc.

- 6.4.18 LivePerson Inc.

- 6.4.19 Richpanel Technologies Pvt. Ltd.

- 6.4.20 Help Scout PBC

- 6.4.21 Drift.com Inc.

- 6.4.22 WalkMe Ltd.

- 6.4.23 Kustomer LLC

- 6.4.24 RingCentral Inc.

- 6.4.25 Avaya Inc.

- 6.4.26 BMC Software Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-Space and Unmet-Need Assessment