|

市場調查報告書

商品編碼

1850308

網際網路通訊協定電視(IPTV):市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Internet Protocol Television (IPTV) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

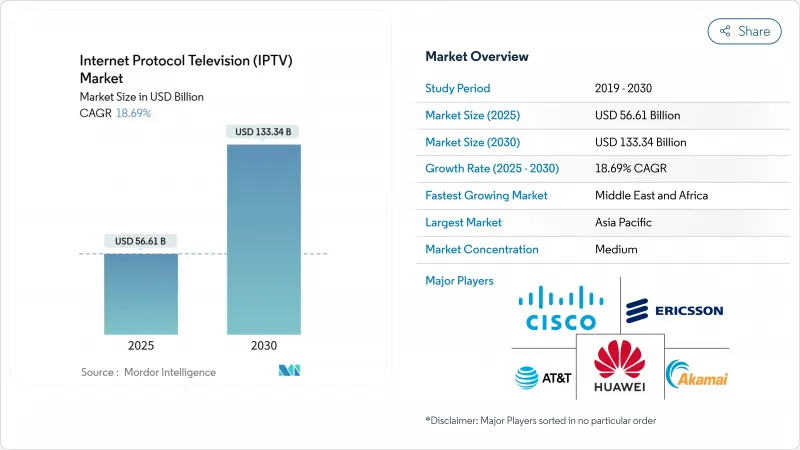

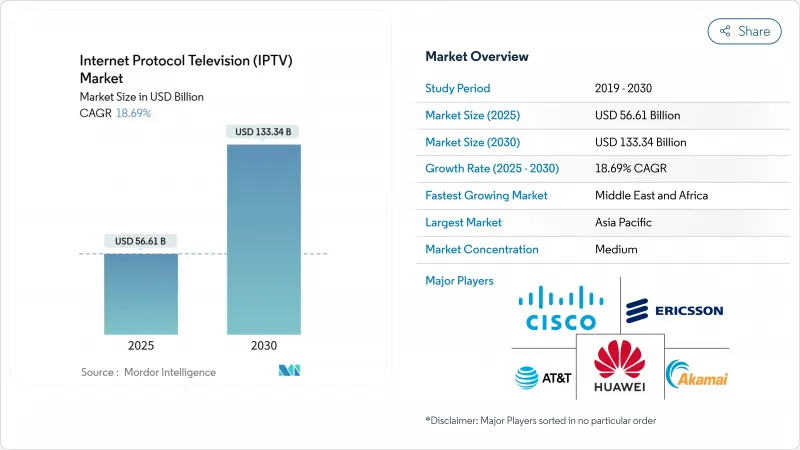

預計到 2025 年,IPTV 市場規模將達到 566.1 億美元,預計到 2030 年將成長至 1,333.4 億美元,預測期內複合年成長率為 18.69%。

光纖到府 (FTTH) 的普及、4K/8K 視訊需求的成長以及混合型用戶和廣告模式的興起,共同推動了下一波需求浪潮,並將衡量成功的標準從用戶成長轉向每兆比特傳輸的觀看時長。多播輔助架構降低了傳輸成本,提高了毛利率,而聯網電視廣告的插入則提升了入門級套餐的平均用戶收入。擁有密集光纖網路覆蓋範圍的營運商報告稱,隨著家庭用戶體驗到零延遲的超高清串流媒體,高階用戶的普及速度顯著加快。

全球網際網路通訊協定電視(IPTV)市場趨勢與洞察

光纖到戶部署與4K/8K內容需求融合

美國營運商計劃在2024年新增1,200萬戶光纖到戶(FTTH)家庭,而日本、韓國和德國的營運商已在大都會圈擴展了對稱Gigabit覆蓋範圍。光纖寬頻協會指出,現有光纖可在35年的使用壽命內支援每秒600Terabit的傳輸速度,從而消除消費者視訊的「最後一公里」瓶頸。因此,串流媒體服務供應商可以自信地提供8K體育賽事和HDR自然紀錄片,吸引用戶訂閱高級套餐。一家日本通訊業者透露,擁有Gigabit套餐的用戶觀看超高畫質影片的長度比Gigabit用戶多出32%,證明了頻寬與用戶參與度之間的直接聯繫。到2025年,亞太地區25G和50G無源光網路(PON)的部署將為立體視訊和全像視訊頻寬,使今天的資本投資成為應對未來身臨其境型視訊格式的保障。

歐洲和北美超級聚合平台的興起

一家西歐老牌業者於2024年推出了雲端原生平台,將該國的點播影片、付費點播影片和體育直播整合到一個統一的搜尋平台。在西班牙,三分之二的新寬頻用戶在60天內透過營運商的控制面板啟動了至少一個第三方應用程式,由此產生的批發平台費用抵消了線性廣告收入的下滑。在美國,七家串流媒體服務提供商的收費整合使每位用戶每月收入增加了4美元,而寬頻價格並未上漲。一家區域性光纖合資企業獲得了承包聚合中間件的授權,取代了傳統的有線電視機上盒,儘管資本投入有限,卻成為了IPTV市場的熱門話題。從更宏觀的角度來看:便利的內容發現將發行管道轉變為商店,使營運商能夠從每個新增的內容合作夥伴中獲利。

成熟市場中持續的剪線潮轉向純OTT服務

預計到2024年,北美付費電視家庭用戶數將進一步下降4%,因為消費者會將支出重點放在寬頻和行動連線上,頻道方案則淪為可附加元件。巴西天空電視台(Sky Brazil)計畫於2024年4月全面轉向光纖網路,凸顯了現有業者將基礎設施所有權視為抵禦OTT(網路電視)普及的唯一保障。歐洲有線電視集團也紛紛效仿,透過過度建設光纖到府(FTTH)或將同軸電纜升級到DOCSIS 4.0來應對,但用戶成長仍停滯不前。用戶價值正轉向低延遲接入,內容正從核心驅動力轉變為提升銷售。除非營運商能夠提升IP傳輸的經濟效益,否則即使總觀看時間增加,IPTV市場的平均每用戶收入(ARPU)仍面臨停滯的風險。

細分市場分析

到2024年,隨著營運商將託管營運、平台整合和客戶支援外包,服務將佔IPTV市場規模的61%。用於人工智慧主導的個人化引擎的預算正在增加,這些引擎可以在不增加內容成本的情況下延長觀看時間。供應商提供雲端原生支援服務和預測性維護,從而降低客戶流失率和現場服務成本。利潤取決於客戶參與度,因此銷售推薦演算法的服務合作夥伴會收取更高的費用。 IPTV市場也對那些將安全、分析和收費整合到單一服務等級協定(SLA)中的整合商給予了豐厚的回報,這使得營運商能夠專注於擴展光纖網路。

傳輸和編碼設備雖然目前基數較小,但預計到2030年將以22.4%的複合年成長率成長,因為低延遲邊緣編碼器對於4K體育賽事直播和互動式疊加至關重要。營運商發現,在2025年的現場升級中,將多播模組整合到用戶閘道器中,可以在不犧牲位元率的情況下,將串流媒體每小時成本降低三分之一。隨著轉碼器從H.264加速演進到AV1再到VVC,韌體可升級性如今已成為一個賣點。因此,硬體供應商正在推出面向未來的設計,以在8K普及率不斷提高的情況下保護資本投資。競爭差異化正在轉向每Gigabit傳輸的功率效率,這項指標正日益受到監管機構和投資者的關注。

到2024年,訂閱模式將佔IPTV市場佔有率的74.3%,因為許多家庭仍然偏愛無廣告的節目庫和捆綁的體育賽事通行證。多螢幕觀看、雲端DVR和跨裝置回看等功能提升了IPTV的價值,尤其是在家庭用戶中。營運商透過提供可兌換院線電影的串流積分來增強用戶忠誠度計劃,從而防止用戶轉向按月付費的OTT服務。然而,這些業者也不斷推出價格較低的廣告套餐,以吸引注重預算的觀眾,同時又不蠶食高階套餐的市場佔有率。

AVoD(廣告支援視訊點播)產業正以28.7%的複合年成長率快速成長,這主要得益於廣告技術的成熟,使其能夠支援家庭級定向和可購物廣告位。 2025年1月,加拿大一家雜貨店在烹飪節目直播中投放的廣告點擊率高達9%,顯示當廣告與內容契合時,使用者有購買意願。營運商正在將需求方平台(DSP)整合到其中間件中,以便直接獲取廣告收入,而不僅僅是支付傳輸費用。雖然按次付費(PPV)模式對於拳擊和音樂會等熱門節目仍然有效,但為了最大化用戶終身價值,越來越多的賽事版權被納入中檔訂閱套餐中。最初為PPV微支付而設計的工具正被重新用於打賞和直播電商,從而拓展了每位觀眾的收入來源,使其不再局限於門票。

IPTV市場按組件(硬體、服務)、收入模式(訂閱制、按次付費、廣告支援)、串流媒體類型(直播/線性電視、時移/回放電視、視訊點播)、裝置/接取平台(智慧型電視、行動裝置/平板多播、PC/筆記型電腦、機上盒、串流媒體裝置)、傳輸方式(群組播放器、單線設備/單線器)和地區進行細分。市場預測以美元計價。

區域分析

到2024年,亞太地區將佔據IPTV市場35.8%的佔有率,其收入主要得益於光纖到府(FTTH)的廣泛覆蓋、智慧型手機的高普及率以及多語言內容庫。中國平台透過同步播出主要體育賽事的普通話和粵語說明,最大限度地提高了版權費收入。日本的8K衛星廣播測試吸引了都市區光纖用戶選擇高級套餐,這些套餐保證零降採樣。印度的二線城市已經採用了每月699印度盧比(約8.45美元)的光纖+本地OTT套餐,將有線電視用戶轉變為IP用戶。在超當地語系化電視劇以精準廣告投放蓬勃發展,證明隨著傳輸成本的降低,文化特色也能實現規模化成長。

中東和非洲的基數雖小,但預計到2030年將以24.7%的複合年成長率成長,這主要得益於模擬廣播的淘汰和智慧型手機價格的下降刺激了市場需求。一家北非廣播公司為了節省流量,以480p的解析度播放了一部齋月劇,吸引了120萬獨立觀眾。奈及利亞的開放接入走廊以批發價出租頻寬,並利用支援多播的路由器實現全城Wi-Fi覆蓋。肯亞和加納正在利用政府資金在傳統電纜難以覆蓋的農村地區推廣光纖網路建設。價格實惠、高品質的串流媒體已成為最有效的反盜版工具。

北美和歐洲的IPTV市場已經成熟,但透過超聚合定價和聯網電視廣告實現盈利的模式仍在繼續。一家北歐光纖合作社將Gigabit接入與四家獨立串流服務捆綁銷售,每月收費54.90歐元(約60.14美元)。儘管家庭用戶成長緩慢,美國通訊業者仍利用行動套餐零費率來留住用戶。拉丁美洲的發展路徑則有所不同:巴西正準備採用ATSC 3.0地面電波-IP混合廣播,而阿根廷和智利則避免對光纖進行投資,轉而依賴衛星回程傳輸。用於農村光纖到府(FTTH)的頻譜競標收入正在推動安第斯市場從有線電視向IP電視轉型,這可能會重塑該地區的IPTV格局。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 光纖網路部署與4K/8K內容需求的融合

- 歐洲和北美超級聚合平台的興起

- 亞洲地區將IPTV與固定行動方案捆綁銷售

- 廣告支援的視訊點播 (AVoD) 獲利模式

- 市場限制

- 成熟市場中用戶持續停掉有線電視服務服務,轉而使用純OTT服務

- 體育賽事尖峰時段期單播頻寬

- 監理展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

第5章 市場規模與成長預測

- 按組件

- 硬體

- 機上盒(STB)

- 中介軟體

- 傳輸和編碼設備

- 條件存取系統

- 服務

- 託管式 IPTV 服務

- 整合與諮詢

- 支援與維護

- 硬體

- 按收入模式

- 訂閱制

- 按次付費觀看

- 廣告支持型(AVoD)

- 按串流媒體類型

- 直播/線性電視

- 時移/重播電視

- 視訊點播

- 按設備/訪問平台

- 智慧電視

- 手機和平板電腦

- 桌上型電腦/筆記型電腦

- 機上盒和串流媒體裝置

- 按配送方式

- 多播IPTV

- 單播IPTV

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 西班牙

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 紐西蘭

- 亞太其他地區

- 中東和非洲

- 中東

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 肯亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- Strategic Developments

- Vendor Positioning Analysis

- 公司簡介

- AT & T Inc.

- Verizon Communications Inc.

- Deutsche Telekom AG

- China Telecom Corp. Ltd.

- Orange SA

- British Telecom plc

- Telefonica SA

- Dish Network Corp.

- Comcast Corp.

- Vodafone Group plc

- Akamai Technologies Inc.

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd.

- Ericsson AB

- ARRIS(CommScope Holding Co.)

- Sagemcom Broadband SAS

- ZTE Corp.

- Imagine Communications Corp.

- Broadpeak SA

- Amino Technologies plc

- Tripleplay Services Ltd.

- Sterlite Technologies Ltd.

- Moftak Solutions

第7章 市場機會與未來展望

The IPTV market size is estimated at USD 56.61 billion in 2025 and is projected to scale to USD 133.34 billion by 2030, reflecting an 18.69% CAGR during the forecast window.

Fiber-to-the-home (FTTH) ubiquity, rising 4 K/8 K video appetite, and hybrid subscription-advertising models act together to unlock the next demand layer, moving the metric of success from headline subscriber additions to incremental viewing hours per delivered megabit. Lower transport cost from multicast-assisted architectures widens gross margins, while connected-TV ad insertion boosts average revenue per user on entry-level plans. Operators that already own dense fiber footprints report faster premium-tier uptake once households experience latency-free ultra-high-definition streams.

Global Internet Protocol Television (IPTV) Market Trends and Insights

Convergence of FTTH Roll-outs With 4 K/8 K Content Demand

Operators in the United States lit 12 million new FTTH homes in 2024, while peers in Japan, South Korea, and Germany extended symmetrical gigabit coverage to entire metropolitan belts. The Fiber Broadband Association notes that existing fibers can accommodate 600 terabits per second over a 35-year lifespan, eliminating last-mile constraints for consumer video. As a result, streaming providers confidently debut 8 K sports and HDR nature documentaries that lock customers into premium bundles. A Japanese carrier disclosed that households on its 10-gigabit plan stream 32% more ultra-HD hours than 1-gigabit users, proving a direct bandwidth-to-engagement link. Deployments of 25 G and 50 G PON in Asia-Pacific during 2025 quietly lay the groundwork for volumetric and holographic video, turning today's capex into insurance against future immersive formats.

Emergence of Super-Aggregation Platforms in Europe And North America

Western European incumbents launched cloud-native hubs in 2024 that unify national catch-up, subscription video-on-demand, and live sports in one search layer. In Spain, two-thirds of new broadband households activated at least one third-party app through the operator dashboard inside 60 days, generating wholesale platform fees that offset linear ad declines. Billing integration across seven U.S. streamers added USD 4 per user in incremental monthly revenue without raising broadband prices. Regional fiber ventures license turnkey aggregation middleware to leapfrog legacy cable boxes, placing them squarely in the IPTV market conversation despite limited capex. The larger picture is that discovery convenience converts distribution pipes into storefronts where operators monetize every additional content partner.

Persistent Cord-Cutting Toward Pure-OTT Services in Mature Markets

North American pay-TV households fell another 4% in 2024 as consumers focused spending on broadband and mobile connectivity, relegating channel bundles to optional add-ons. Sky Brasil's April 2024 pivot toward fiber underscores how incumbents view infrastructure ownership as the sole hedge against pure-play OTT disruption. European cable groups follow by over-building FTTH or upgrading coax to DOCSIS 4.0, yet subscriber growth remains flat. Customer value perception has shifted toward low-latency access, making content an upsell, not a core driver. Unless operators strengthen IP delivery economics, the IPTV market risks ARPU stagnation even if total viewing hours rise.

Other drivers and restraints analyzed in the detailed report include:

- Telco Bundling With Fixed-Mobile Convergent Plans in Asia

- AVoD Monetization Gains

- Unicast Bandwidth Bottlenecks During Peak Sporting Events

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Services represented 61% of the IPTV market size in 2024 as operators outsourced managed operations, platform integration, and customer support. Budgets increasingly flow to AI-driven personalization engines that raise viewing minutes without inflating content costs. Vendors offer cloud-native support desks and predictive maintenance that lower churn and truck-roll expenses. Because margins hinge on engagement, service partners selling recommendation algorithms command premium rates. The IPTV market also rewards integrators who wrap security, analytics, and billing into one SLA, letting operators focus on fiber expansion.

Transmission & encoding equipment, although smaller in base, is projected to grow at a 22.4% CAGR through 2030 as low-latency edge encoders become mandatory for live 4K sports and interactive overlays. Operators learned in the 2025 field upgrades that embedding multicast modules in consumer gateways cuts per-hour streaming cost by one-third without compromising bitrates. Firmware upgradability is now a selling point as codec evolution from H.264 to AV1 and VVC gathers pace. Hardware suppliers thus market future-proof designs that preserve capex even when 8K adoption rises. Competitive differentiation is shifting toward power efficiency per delivered gigabit, a metric regulators and investors increasingly scrutinize.

Subscriptions controlled 74.3% of the IPTV market share in 2024 because many households still prefer ad-free catalogs and bundled sports passes. Multi-screen allowances, cloud DVR, and cross-device resumption sustain perceived value, especially among families. Operators enrich loyalty programs by offering streaming credits redeemable for theatrical releases, preventing churn to month-to-month OTT rivals. Yet the same players keep introducing lower-priced ad tiers to capture budget-conscious viewers without cannibalizing premium packages.

AVoD is the fastest-growing slice, racing at 28.7% CAGR, fuelled by maturing ad tech that supports household-level targeting and shoppable placements. A January 2025 Canadian campaign for a grocer logged a 9% click-through rate within cooking show streams, evidencing purchase intent when ads align with content. Operators integrate demand-side platforms into middleware, capturing a direct share of ad revenue rather than mere carriage fees. Pay-per-view remains useful for marquee boxing or concerts, but event rights increasingly feed mid-tier subscription bundles to maximize lifetime value. Tools originally built for PPV micropayments are repurposed for tipping and live commerce, broadening revenue per viewer beyond tickets alone.

IPTV Market is Segmented by Component (Hardware, Services), Revenue Model (Subscription-Based, Pay-Per-View, Advertising-Supported), Streaming Type (Live/Linear TV, Time-Shifted/Replay TV, Video-On-Demand), Device/Access Platform (Smart TV, Mobile and Tablet, PC/Laptop, Set-Top Box and Media Streamer), Delivery Method (Multicast IPTV, Unicast IPTV), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific dominated revenue with 35.8% of the IPTV market in 2024, propelled by FTTH roll-outs, high smartphone penetration, and multilingual libraries. Chinese platforms simulcast Mandarin and Cantonese commentary on premier sports, maximizing rights fees. Japan's 8 K satellite trials nudged urban fiber households into premium plans that guarantee zero down-sampling. Tier-II Indian cities adopted bundled fiber plus local OTT packs at INR 699 (USD 8.45) per month, converting cable homes into IP ecosystems. Hyper-local dramas thrive on targeted advertising, proving that cultural specificity scales when transport costs fall.

The Middle East and Africa holds a smaller base but is forecast for a 24.7% CAGR through 2030 as analog switch-off deadlines and cheap smartphones stimulate demand. A North African broadcaster streamed Ramadan dramas at 480p to conserve data, attracting 1.2 million unique viewers. Nigeria's open-access corridors lease bandwidth at wholesale rates, enabling city-wide Wi-Fi with multicast-ready routers that lessen piracy by improving legitimate quality. Government funds earmarked for rural fiber accelerate uptake in Kenya and Ghana, where traditional cable never reached scale. Affordable, high-quality streams emerge as the most effective antipiracy tool.

North America and Europe are mature, yet monetization continues via super-aggregation fees and connected-TV ads. A Nordic fiber cooperative bundled gigabit access with four indie streamers for EUR 54.90 (USD 60.14) per month, tapping patriotic content demand amid macro pressures. U.S. carriers leverage zero-rating into mobile plans, retaining subscribers despite slower household growth. Latin America represents divergent paths: Brazil readies ATSC 3.0 hybrid terrestrial-IP, whereas Argentina and Chile rely on satellite backhaul pending fiber investment. Spectrum auction proceeds earmarked for rural FTTH could let Andean markets leapfrog cable straight to IP, reshaping the regional IPTV market landscape.

- AT & T Inc.

- Verizon Communications Inc.

- Deutsche Telekom AG

- China Telecom Corp. Ltd.

- Orange S.A.

- British Telecom plc

- Telefonica S.A.

- Dish Network Corp.

- Comcast Corp.

- Vodafone Group plc

- Akamai Technologies Inc.

- Cisco Systems Inc.

- Huawei Technologies Co. Ltd.

- Ericsson AB

- ARRIS (CommScope Holding Co.)

- Sagemcom Broadband SAS

- ZTE Corp.

- Imagine Communications Corp.

- Broadpeak S.A.

- Amino Technologies plc

- Tripleplay Services Ltd.

- Sterlite Technologies Ltd.

- Moftak Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Convergence of Fiber-to-Home Roll-outs With 4K/8K Content Demand

- 4.2.2 Emergence of Super-Aggregation Platforms in Europe and North America

- 4.2.3 Telco Bundling of IPTV With Fixed-Mobile Convergent Plans in Asia

- 4.2.4 Advertising-Supported Video-on-Demand (AVoD) Monetization Gains

- 4.3 Market Restraints

- 4.3.1 Persistent Cord-Cutting Toward pure-OTT Services in Mature Markets

- 4.3.2 Unicast Bandwidth Bottlenecks During Peak Sporting Events

- 4.4 Regulatory Outlook

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitutes

- 4.5.5 Competitive Rivalry

- 4.6 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.1.1 Set-Top Box (STB)

- 5.1.1.2 Middleware

- 5.1.1.3 Transmission and Encoding Equipment

- 5.1.1.4 Conditional Access Systems

- 5.1.2 Services

- 5.1.2.1 Managed IPTV Services

- 5.1.2.2 Integration and Consulting

- 5.1.2.3 Support and Maintenance

- 5.1.1 Hardware

- 5.2 By Revenue Model

- 5.2.1 Subscription-Based

- 5.2.2 Pay-Per-View

- 5.2.3 Advertising-Supported (AVoD)

- 5.3 By Streaming Type

- 5.3.1 Live/Linear TV

- 5.3.2 Time-Shifted/Replay TV

- 5.3.3 Video-on-Demand

- 5.4 By Device/Access Platform

- 5.4.1 Smart TV

- 5.4.2 Mobile and Tablet

- 5.4.3 PC/Laptop

- 5.4.4 Set-Top Box and Media Streamer

- 5.5 By Delivery Method

- 5.5.1 Multicast IPTV

- 5.5.2 Unicast IPTV

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 United Kingdom

- 5.6.3.3 France

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 India

- 5.6.4.5 Australia

- 5.6.4.6 New Zealand

- 5.6.4.7 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 United Arab Emirates

- 5.6.5.1.2 Saudi Arabia

- 5.6.5.1.3 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Kenya

- 5.6.5.2.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Strategic Developments

- 6.2 Vendor Positioning Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products and Services, and Recent Developments)

- 6.3.1 AT & T Inc.

- 6.3.2 Verizon Communications Inc.

- 6.3.3 Deutsche Telekom AG

- 6.3.4 China Telecom Corp. Ltd.

- 6.3.5 Orange S.A.

- 6.3.6 British Telecom plc

- 6.3.7 Telefonica S.A.

- 6.3.8 Dish Network Corp.

- 6.3.9 Comcast Corp.

- 6.3.10 Vodafone Group plc

- 6.3.11 Akamai Technologies Inc.

- 6.3.12 Cisco Systems Inc.

- 6.3.13 Huawei Technologies Co. Ltd.

- 6.3.14 Ericsson AB

- 6.3.15 ARRIS (CommScope Holding Co.)

- 6.3.16 Sagemcom Broadband SAS

- 6.3.17 ZTE Corp.

- 6.3.18 Imagine Communications Corp.

- 6.3.19 Broadpeak S.A.

- 6.3.20 Amino Technologies plc

- 6.3.21 Tripleplay Services Ltd.

- 6.3.22 Sterlite Technologies Ltd.

- 6.3.23 Moftak Solutions

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment