|

市場調查報告書

商品編碼

1850232

光傳送網:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Optical Transport Network - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

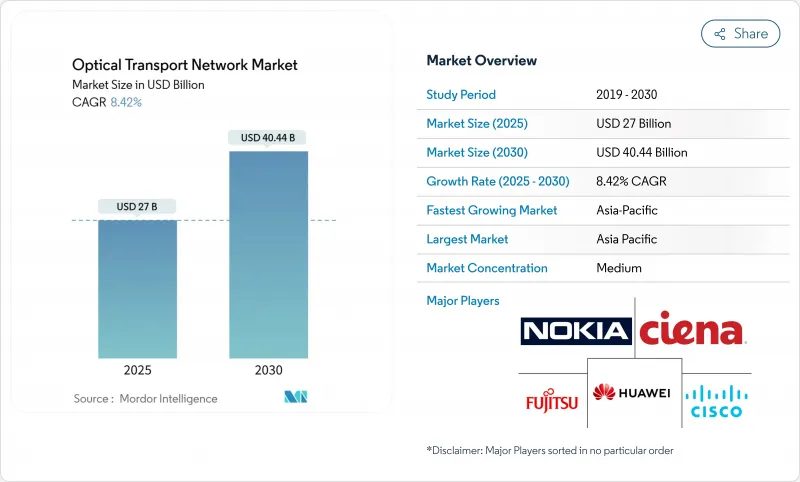

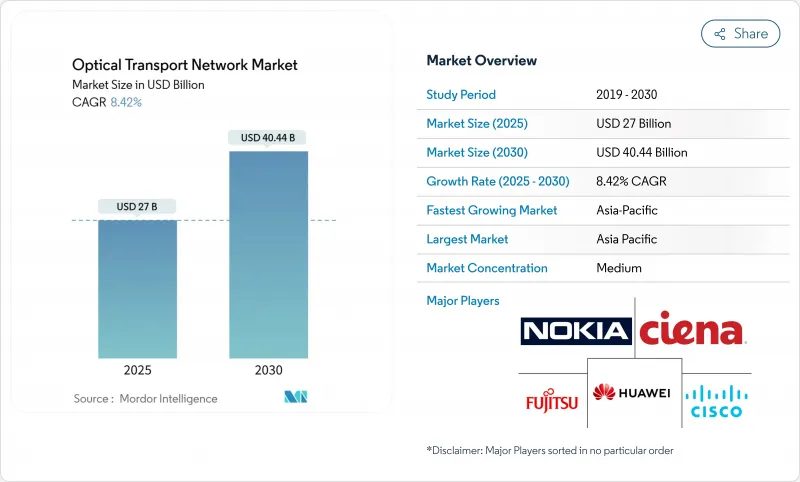

預計到 2025 年,光傳送網市場規模將達到 270 億美元,到 2030 年將達到 404.4 億美元,年複合成長率為 8.42%。

資料中心互連頻寬的不斷提升、400ZR/ZR+連貫插頭光纖的商業化以及政府資助的光纖部署,共同推動了這項擴張。預計到2025年,僅超大規模資料中心營運商就將在數位基礎設施方面投資2,150億美元,這將推動對高容量密集波分複用(DWDM)系統的需求。隨著向6吋磷化銦晶圓的過渡,矽光電的成本曲線正在下降,而開放式線路架構則降低了通訊業者的資本支出。綜上所述,這些因素使得光傳送網市場成為人工智慧集群、雲端互連和寬頻普及的關鍵骨幹網路。

全球光傳送網市場趨勢與洞察

DCI快速採用400ZR/ZR+

標準化的 400ZR 和 ZR+ 插頭電纜的商業化使得營運商能夠將連貫光模組直接插入路由器,從而無需獨立的轉發器,降低了資本成本。 Coherent的工業級 100G ZR QSFP28-DCO 光模組功耗僅 5.5W,可在網路邊緣實現連貫鏈路。透過 IP 光融合,通訊業者的總擁有成本降低了 20% 至 39%,超大規模資料中心營運商也正在重新設計其網路架構以充分利用這些節省的成本。 Ciena 的 1.6T連貫Lite 光模組和新型 448Gb/s PAM4 光模組旨在滿足預計到 2030 年 DCI 吞吐量將增加六倍的需求。短期內,北美和亞太地區將率先受益,因為這些地區的超大規模資料中心叢集產生突發性強、對延遲敏感的流量。

超大規模資料中心AI集群流量激增

與機器學習訓練叢集相關的頻寬擴展速度遠超傳統工作負載。預計到 2028 年,用於人工智慧架構的光纖收發器收入將成長 30%,比非人工智慧部署的成長速度高出 9%。 Lumen Technologies 在 2024 年簽署了價值 80 億美元的新光纖契約,其中包括與微軟的一筆大訂單,凸顯了人工智慧主導的光纖需求規模之大。 Coherent 的 300 埠光路交換器以及Google TPUv4 Pod 中類似技術的部署,標誌著架構正向波長選擇性、可重構架構轉變。這項促進因素將支撐中期成長,尤其是在北美和歐盟超大規模園區擴張的情況下。

二級通訊業者資本支出凍結(2024-2025)

諾基亞表示,由於歐洲和亞洲的客戶推遲了升級,其光纖網路收入下降了23%。 Ciena的光網路收入也降至26.4億美元,反映出歐洲預算收緊以及每位用戶平均收入下降。 Ekinops公佈的光傳輸收入下降了41%,凸顯了普遍的謹慎態度。這種謹慎態度加劇了資金雄厚的超大規模資料中心業者(他們正在大力推進光網路部署)與傳統營運商(他們正在推遲現代化改造)之間的差距。

細分市場分析

到2024年,DWDM將維持62%的光傳送網市場佔有率,鞏固其作為遠距和城域連接骨幹網路的地位。隨著營運商將來自人工智慧叢集和5G回程傳輸的流量聚合到更少的波長上,提高頻譜效率,支援800G的DWDM鏈路到2030年將以14.5%的複合年成長率成長。

持續的DSP創新是這項轉變的基石。 Ciena的WaveLogic 6實現了單波長1.6Tb的傳輸速度,而諾基亞的PSE-6則以800G的速度擴展了傳輸範圍。這些突破性進展正推動光傳送網市場向靈活的網格化運行模式發展,而Infinera的83.6Tbps現場測試表明,傳輸速度的上限仍在不斷提升。 DWDM和分組光纖功能的整合正在影響營運商和雲端環境的採購決策,使整合平台成為首選。

日本402Tbps的現場記錄表明,下一個發展方向是擴展C+ L波段,納入先前未使用的波長窗口。中國博通基於華為技術的400G OTN部署凸顯了高密度交換的趨勢,C+L頻段的整合將每個機架的容量提升至100Tbit/s。隨著數據傳輸超過每通道1Tb,這些舉措將確保光傳送網市場的未來發展。

到2024年,光傳送網市場規模中,組件將佔54%,其中相干收發器、ROADM和光線路交換機將佔據主導地位。標準化插頭電纜的收入預計將從2024年的6億美元加倍,這主要得益於基於400ZR規範的多廠商互通性。

隨著網路解耦技術的進步,營運商和超大規模資料中心能夠直接在匯聚站點插入波長選擇交換(WSS),邊緣ROADM單元的年複合成長率將達到13.2%。同時,網路設計和整合服務正朝著基於意圖的自動化方向發展,以幫助客戶將應用層級需求轉化為光路徑配置。

在頻譜即服務(頻寬-as-a-Service) 模式下,託管網路服務正在復興,該模式將裝置和生命週期管理捆綁在一起。光平台組件(尤其是無色定向無競爭 (CDC) 架構)的快速部署,正在釋放頻譜分配的靈活性。因此,服務供應商正在將其營運模式從以設備為中心的採購轉向基於結果的契約,並圍繞軟體編配重新調整內部技能組合。

光傳送網市場報告按技術(WDM、DWDM、其他)、產品(服務和組件)、最終用戶(IT 和電信營運商、雲端和託管資料中心、醫療保健、其他)、應用(遠距DWDM、都會區網路、其他)、資料速率/波長(100-400Gbit/s、400-800Gbit/s、其他地區進行細分和細分市場進行細分/地區進行細分。

區域分析

預計到2024年,亞太地區將佔總營收的35%,複合年成長率達10.8%。中國政府已選定20多個城市進行10G寬頻試點計畫。光是中國移動一家就擁有2.72億條寬頻線路,其中三分之一達到Gigabit等級。在日本,NTT和英特爾已合作開發政府資助的光半導體;韓國的K-Network 2030計畫已撥款4.81億美元用於6G研發和低地球軌道衛星鏈路建設。 ALPHA海底光纜每對光纖傳輸速率高達18Tbit/s,將增強區域互聯互通。

北美擁有成熟的基礎設施,但耗資424.5億美元的BEAD計畫正透過向中程網路建設注入資金,展現出新的發展動能。 Lumen公司80億美元的光纖交易和Zayo公司40億美元的遠距擴建計畫凸顯了人工智慧主導的邊緣運算如何重塑網路路由需求。勞動力短缺問題依然嚴峻:目前仍需20.5萬名技術人員,促使通訊業者、供應商和光纖寬頻協會之間開展培訓合作。

在歐洲,雄心勃勃的數位主權目標正與營運商融資的緊張局勢相互制約。歐洲投資銀行向德意志玻璃公司提供的3.5億歐元貸款旨在提高農村地區的Gigabit普及率,而「連接歐洲基金數位計畫」(CEF Digital Plan)則提出了建造超高容量網路所需的2000億歐元。由於營運商的平均每用戶收入(ARPU)仍然較低,公共部門聯合融資仍然至關重要。波蘭Orange公司興建的15.5萬套住宅凸顯了混合融資模式的重要性。一條連接英國和歐洲當地的48對海底光纜正在規劃中,預計在某些線路上可將延遲降低至多5.5毫秒。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- DCI 400 ZR/ZR+ 的快速普及

- 超大規模資料中心業者人工智慧叢集流量激增

- 政府光纖回程傳輸獎勵策略(美國BEAD、歐盟 CEF-2)

- 開放式線路系統可減少資本投資

- 矽光電價格波動

- 海底待開發區電纜(>20 Tb/s)

- 市場限制

- 二級通訊業者資本支出凍結(2024-2025)

- 美國和中國限制連貫訊號處理器的出口

- 光纖安裝技術純熟勞工短缺

- 供應鏈對 InP 外延的依賴

- 價值鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 透過技術

- WDM

- DWDM

- O波段及其他技術

- 報價

- 服務

- 網路維護與支援

- 網路設計與整合

- 成分

- 光纖傳輸設備

- 光開關

- 光學平台/邊緣ROADM

- 服務

- 最終用戶

- IT和通訊業者

- 雲端和託管資料中心

- 政府和國防部

- 衛生保健

- 銀行和金融服務

- 其他(公用事業收費、教育)

- 透過使用

- 遠距DWDM

- 資料中心互連(DCI)

- 都會區網路

- 企業網路

- 依數據速率/波長

- 100~400 Gbit/s

- 400~800 Gbit/s

- 超過 800 Gbit/s

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- ASEAN

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Nokia

- Ciena

- Cisco Systems

- Huawei

- Fujitsu

- ZTE

- Infinera

- Ericsson

- NEC

- Coriant(Infinera)

- ADVA Optical Networking

- Ribbon Communications

- Tejas Networks

- ECI Telecom(Ribbon)

- Juniper Networks

- Sterlite Technologies

- NativeWave

- Ciena-Photonera

- Padtec

- FiberHome

第7章 市場機會與未來展望

The optical transport network market is valued at USD 27 billion in 2025 and is on track to reach USD 40.44 billion by 2030, translating into an 8.42% CAGR.

Rising data-center-interconnect bandwidth, the commercialization of 400ZR/ZR+ coherent pluggables, and government-funded fiber rollouts are guiding this expansion. Hyperscalers alone expect to channel USD 215 billion into digital infrastructure in 2025, intensifying demand for high-capacity dense-wavelength-division multiplexing (DWDM) systems. Silicon photonics cost curves are falling after the shift to 6-inch indium-phosphide wafers, while open-line architectures are lowering capital outlays for carriers. Taken together, these forces position the optical transport network market as an essential backbone for artificial-intelligence clusters, cloud interconnects, and broadband inclusion.

Global Optical Transport Network Market Trends and Insights

Rapid 400 ZR/ZR+ Adoption for DCI

Commercial availability of standardized 400ZR and ZR+ pluggables now lets operators plug coherent optics directly into routers, eliminating standalone transponders and trimming equipment cost. Coherent's industrial-temperature 100G ZR QSFP28-DCO ships at only 5.5 W power draw, making coherent links viable in edge locations. Operators are logging 20-39% total-cost-of-ownership reductions from IP-optical convergence, and hyperscalers are already redesigning network fabrics to exploit these savings. Ciena's 1.6T Coherent-Lite and new 448 Gb/s PAM4 optics answer a sixfold rise in DCI throughput expected by 2030. Most short-term gains will materialize in North America and APAC, where hyperscaler campus clusters generate bursty, latency-sensitive traffic.

Hyperscaler AI-Cluster Traffic Boom

Bandwidth tied to machine-learning training clusters is scaling much faster than traditional workloads. Fiber-optical transceiver revenue for AI fabrics is forecast to compound at 30% through 2028, dwarfing the 9% pace for non-AI deployments. Lumen Technologies signed USD 8 billion in new fiber deals during 2024, including a large order with Microsoft that underlines the scale of AI-driven optical demand. Coherent's 300-port optical-circuit switch and Google's deployment of similar technology in TPUv4 pods illustrate the architectural shift toward wavelength-selective, reconfigurable fabrics. This driver supports medium-term growth, especially in North America and the European Union as their hyperscale campuses expand.

Capex Freeze at Tier-2 Telcos (2024-25)

Smaller operators curtailed spending sharply in 2024, with Nokia citing a 23% slide in optical-network revenue because European and Asian customers deferred upgrades. Ciena's optical revenue also fell to USD 2.64 billion, mirroring tight budgets and low average revenue per user in Europe. Ekinops disclosed a 41% decline in optical-transport sales, underscoring widespread caution. This restraint widens the gap between cash-rich hyperscalers advancing optical rollouts and traditional carriers postponing modernization.

Other drivers and restraints analyzed in the detailed report include:

- Government Fibre-Backhaul Stimulus (US BEAD, EU CEF-2)

- Silicon Photonics Price Inflection

- US-China Export Controls on Coherent DSPs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

DWDM retained a 62% share of the optical transport network market in 2024, confirming its status as the backbone for long-haul and metro connections. 800G-ready DWDM links are set to grow at 14.5% CAGR to 2030 as operators consolidate traffic from AI clusters and 5G backhaul into fewer wavelengths, boosting spectral efficiency.

Continuous DSP innovation anchors this shift. Ciena's WaveLogic 6 pushes 1.6 Tb per wavelength, and Nokia's PSE-6s raises reach at 800G speeds. These breakthroughs keep the optical transport network market moving toward flexible-grid operation, while Infinera's 83.6 Tbps field test shows the upper ceiling is still rising. Convergence of DWDM and packet-optical functions now guides procurement decisions in both carrier and cloud settings, embedding integrated platforms as default choices.

The next horizon is C + L band expansion and the inclusion of previously unused wavelength windows, as Japan's 402 Tbps field record revealed. China Broadnet's Huawei-based 400G OTN deployment underscores high-density switching trends, and C+L integration lifts per-rack capacity to 100 Tbit/s. These moves ensure the optical transport network market remains future-proof as data rates climb beyond 1 Tb per channel.

Components accounted for 54% of the optical transport network market size in 2024, led by coherent transceivers, ROADMs, and optical circuit switches. Sales of standardized pluggables are projected to double from USD 600 million in 2024, propelled by multi-vendor interoperability under the 400ZR specification.

Edge-ROADM units grow at a 13.2% CAGR because network disaggregation lets carriers and hyperscalers insert wavelength-selective switching directly at aggregation sites. At the same time, network-design and integration services are pivoting toward intent-based automation, helping customers translate application-level requirements into optical-path provisioning.

Managed network offerings are reviving under bandwidth-as-a-service models that bundle equipment and lifecycle management. Swift rollout of optical platform components, especially colorless-directionless-contentionless (CDC) architectures, is unlocking flexible spectrum allocation. Service providers thus shift operating models away from box-centric procurement to outcome-oriented contracts, realigning internal skill sets around software orchestration.

The Optical Transport Network Market Report is Segmented by Technology (WDM, DWDM, and More), Offering (Services and Components), End-User Vertical (IT and Telecom Operators, Cloud and Colocation Data Centers, Healthcare, and More), Application (Long-Haul DWDM, Metro Networks, and More), Data Rate / Wavelength (100-400 Gbit/S, 400-800 Gbit/S, and More), and Geography.

Geography Analysis

Asia-Pacific controlled 35% of 2024 revenue and is projected to expand at a 10.8% CAGR, the fastest across regions. Chinese authorities selected over 20 cities for 10 G broadband pilots; China Mobile alone serves 272 million broadband lines, with one-third on gigabit tiers. Japan partners NTT and Intel on government-funded optical semiconductors, while South Korea's K-Network 2030 allocates USD 481 million for 6 G research and low-orbit satellite links. The ALPHA subsea cable, with 18 Tbit/s per fiber pair, fortifies regional interconnectivity.

North America sits on mature infrastructure yet sees renewed momentum as the USD 42.45 billion BEAD program funnels capital into middle-mile construction. Lumen's USD 8 billion fiber contracts and Zayo's USD 4 billion long-haul expansion reveal how AI-driven edge compute is reconfiguring route demand. Workforce shortages remain acute: 205,000 additional technicians are needed, spurring training alliances among carriers, vendors, and the Fiber Broadband Association.

Europe balances ambitious digital-sovereignty goals with tight operator cash flow. The European Investment Bank's EUR 350 million loan to Deutsche Glasfaser targets rural gigabit coverage, while the CEF Digital scheme outlines EUR 200 billion requirements for very-high-capacity networks. Operator ARPU remains muted, so public co-funding remains critical. Orange Poland's build for 155,000 homes highlights reliance on blended finance. Planned 48-pair subsea links between the UK and mainland Europe will trim latency by up to 5.5 ms for certain routes.

- Nokia

- Ciena

- Cisco Systems

- Huawei

- Fujitsu

- ZTE

- Infinera

- Ericsson

- NEC

- Coriant (Infinera)

- ADVA Optical Networking

- Ribbon Communications

- Tejas Networks

- ECI Telecom (Ribbon)

- Juniper Networks

- Sterlite Technologies

- NativeWave

- Ciena-Photonera

- Padtec

- FiberHome

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid 400 ZR/ZR+ adoption for DCI

- 4.2.2 Hyperscaler AI-cluster traffic boom

- 4.2.3 Government fibre-backhaul stimulus (US BEAD, EU CEF-2)

- 4.2.4 Open-line systems lowering capex

- 4.2.5 Silicon photonics price inflection

- 4.2.6 Under-sea green-field cables (>20 Tb/s)

- 4.3 Market Restraints

- 4.3.1 Capex freeze at Tier-2 telcos (2024-25)

- 4.3.2 US-China export controls on coherent DSPs

- 4.3.3 Skilled-labour shortage for fibre installation

- 4.3.4 Supply-chain dependency on InP epitaxy

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Technology

- 5.1.1 WDM

- 5.1.2 DWDM

- 5.1.3 O-band and Other Technologies

- 5.2 By Offering

- 5.2.1 Services

- 5.2.1.1 Network Maintenance and Support

- 5.2.1.2 Network Design and Integration

- 5.2.2 Components

- 5.2.2.1 Optical Transport Equipment

- 5.2.2.2 Optical Switch

- 5.2.2.3 Optical Platform/Edge ROADM

- 5.2.1 Services

- 5.3 By End-user Vertical

- 5.3.1 IT and Telecom Operators

- 5.3.2 Cloud and Colocation Data Centres

- 5.3.3 Government and Defence

- 5.3.4 Healthcare

- 5.3.5 Banking and Financial Services

- 5.3.6 Others (Utilities, Education)

- 5.4 By Application

- 5.4.1 Long-Haul DWDM

- 5.4.2 Data-Center-Interconnect (DCI)

- 5.4.3 Metro Networks

- 5.4.4 Enterprise Networks

- 5.5 By Data Rate / Wavelength

- 5.5.1 100-400 Gbit/s

- 5.5.2 400-800 Gbit/s

- 5.5.3 Beyond 800 Gbit/s

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 Europe

- 5.6.2.1 Germany

- 5.6.2.2 UK

- 5.6.2.3 France

- 5.6.2.4 Rest of Europe

- 5.6.3 Asia Pacific

- 5.6.3.1 China

- 5.6.3.2 India

- 5.6.3.3 Japan

- 5.6.3.4 South Korea

- 5.6.3.5 ASEAN

- 5.6.3.6 Rest of Asia Pacific

- 5.6.4 South America

- 5.6.4.1 Brazil

- 5.6.4.2 Argentina

- 5.6.4.3 Rest of South America

- 5.6.5 Middle East

- 5.6.5.1 Saudi Arabia

- 5.6.5.2 United Arab Emirates

- 5.6.5.3 Turkey

- 5.6.5.4 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Nokia

- 6.4.2 Ciena

- 6.4.3 Cisco Systems

- 6.4.4 Huawei

- 6.4.5 Fujitsu

- 6.4.6 ZTE

- 6.4.7 Infinera

- 6.4.8 Ericsson

- 6.4.9 NEC

- 6.4.10 Coriant (Infinera)

- 6.4.11 ADVA Optical Networking

- 6.4.12 Ribbon Communications

- 6.4.13 Tejas Networks

- 6.4.14 ECI Telecom (Ribbon)

- 6.4.15 Juniper Networks

- 6.4.16 Sterlite Technologies

- 6.4.17 NativeWave

- 6.4.18 Ciena-Photonera

- 6.4.19 Padtec

- 6.4.20 FiberHome

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment