|

市場調查報告書

商品編碼

1850217

行動回程:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Mobile Backhaul - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

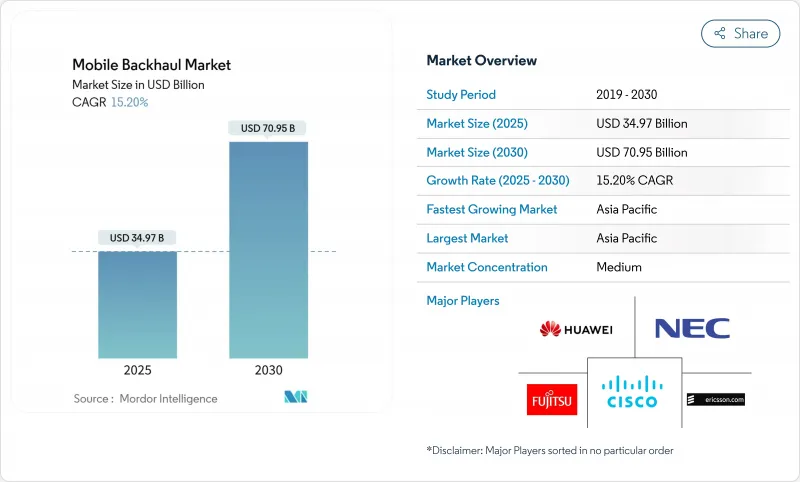

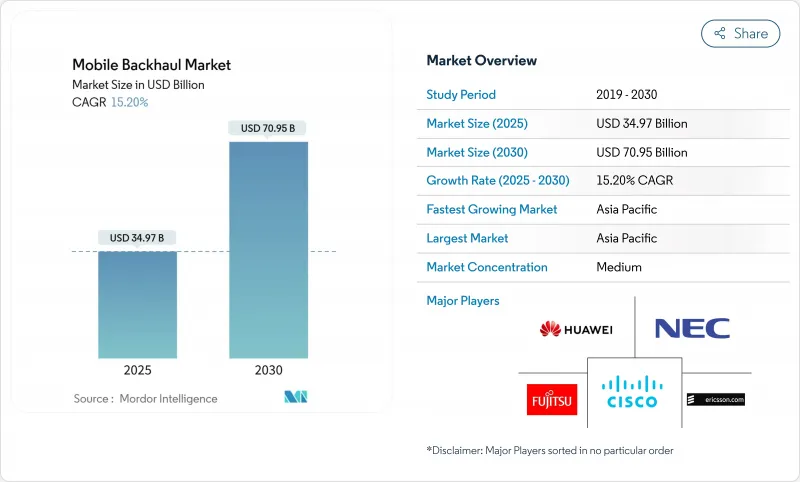

預計到 2025 年,行動回程市場規模將達到 349.7 億美元,到 2030 年將達到 709.5 億美元,預測期(2025-2030 年)的複合年成長率為 15.20%。

智慧型手機普及率的提高、影片串流媒體的爆炸式成長以及密集部署的5G網路正推動著5G市場的發展,這些部署對每個基地台每個小區10Gbps乃至即將達到100Gbps的容量提出了更高的要求。營運商正在用光纖和高容量無線鏈路取代銅線,而中立主機模式則減少了重複建設,預計2020年至2025年間,5G投資將超過1.1兆美元。開放式架構、軟體定義傳輸和邊緣運算對回程傳輸的效能和安全性提出了新的要求,而現成的硬體則可以降低生命週期成本。亞太地區以35%的收入貢獻位居榜首,並維持著17.3%的最快複合年成長率,這主要得益於中國、日本、韓國和印度部署了數百萬個小型基地台。通訊業者目前正在將光纖的規模優勢與微波、毫米波和低地球軌道(LEO)衛星傳輸相結合,以填補覆蓋盲點並加速部署。

全球行動回程市場趨勢與洞察

行動數據流量增加和智慧型手機的廣泛普及

預計智慧型手機用戶每月平均數據使用量將從2023年的21GB激增至2029年的56GB,其中影片流量佔行動流量的75%。區域差異日益顯現:北美用戶每月數據使用量可能達到66GB,而撒哈拉以南非洲用戶則接近23GB,這迫使營運商設計針對不同國家的專用回程傳輸鏈路組合。將光纖幹線與高頻寬微波鏈路連接的混合拓撲結構目前在都市區高密度化建設中佔據主導地位,因為它們無需耗費大量時間進行道路挖掘即可滿足容量需求。小型基地台的普及增加了數千條短距離鏈路,並刺激了對能夠即時調整每個站點容量的自動化網路管理平台的新投資。

快速部署 5G 推動容量需求

5G叢集將基地台密度從每平方公里4-5個站點提高到每平方公里40-50個站點,回程傳輸終端數量也在增加。光是中國預計就將興建超過60萬個5G大型基地台台和小型基地台,是4G基地台數量的1.3-1.5倍。每個5G小區現在需要10Gbps的上行鏈路和低於5毫秒的嚴格延遲,這加速了基於70/80GHz E頻段無線電和光纖的時序敏感型網路(TSN)的普及。資金壓力促使許多業者轉向共用基地台和租賃暗纖,以降低初始成本,同時確保向100Gbps介面的升級路徑。

光纖和頻譜成本方面的高資本投資

在人口密集的城市地區鋪設光纖的成本可能超過每公里10萬美元,而道路通行證稀缺地區的成本更是飆升。此外,4G和5G頻寬重疊時,不斷上漲的電價也會導致宏基地台的電力消耗翻倍,進而推高營運成本。在新興經濟體,低利率融資管道有限,減緩了光纖部署速度,迫使通訊業者即使從長遠經濟角度來看光纖更具優勢,也只能依賴微波技術。結果是城鄉網路體驗品質不均,阻礙了數位包容的目標實現。

細分市場分析

憑藉其無與倫比的容量和低延遲,光纖鏈路將在2024年佔據行動回程市場55%的佔有率。這一佔有率在2024年192億美元的行動回程市場規模中佔據最大佔有率。然而,受都市區密集化和突發事件的推動,預計到2030年,這一差距將縮小,複合年成長率將達到16.4%,因為這些事件需要快速推出。通訊業者正在將70/80 GHz E波段無線電與租用的暗纖幹線進行網狀連接,在避免昂貴的土木工程的同時,實現單跳10 Gbps的傳輸速率。

混合架構如今已成為主流。雖然光纖仍然是核心聚合的首選介質,但微波和毫米波正服務於邊緣的小型基地台和企業設施,在這些地方,由於授權或地理限制,無法進行溝槽鋪設。新興的W波段和D波段鏈路預計在1-2公里範圍內實現多千兆Gigabit的吞吐量,與光纖形成互補,適用於高密度群集。在人口密度較低的地區,營運商正在將低地球軌道衛星回程傳輸熔接至微波環網中,以在不超出預算限制的情況下實現連續覆蓋。這種靈活性有助於營運商在長期內保持市場競爭力。

微波無線電技術將在2024年佔據行動回程市場41%的佔有率,這反映了其數十年來在實際應用中久經考驗的可靠性。供應商已採用鏈路聚合技術來聚合非連續通道,並將頻譜效率提升至16 bps/Hz。目前小型基地台回程傳輸設備收入佔比很小,但隨著體育場館、購物中心和交通樞紐等場所採用室內5G網路,預計其年複合成長率將達到17.4%。

行動回程市場正向整合接取回回程傳輸節點。捆綁自組織網路軟體的供應商正在贏得競標,因為它可以減少負載容量並最佳化複雜環境中的鏈路對齊。

行動回程市場報告按配置(有線[光纖/光纖、銅纜/DSL]、無線[微波、毫米波、其他])、設備類型(路由器和交換器、微波無線電、其他)、服務類型(專業服務、託管服務、其他)、網路架構(大型基地台回程傳輸、其他)、最終用戶(行動通訊業者、主機和主機

區域分析

亞太地區佔據行動回程市場35%的佔有率,並正以17.3%的複合年成長率快速成長,這主要得益於對5G的大量投資、政府補貼以及密集的城市人口。中國、日本和韓國已在主要城市實現了獨立組網(SA)5G的全面覆蓋,從而刺激了對繞過鑽井瓶頸的10Gbps微波鏈路的需求。印度近期舉行的頻譜競標釋放了高速公路沿線和二線城市的光纖部署熱潮,營運商正在試點衛星-微波混合方案,以覆蓋喜馬拉雅山脈和島嶼地區。政府為農村光纖建設提供的補貼計畫也進一步推動了這一趨勢。

儘管北美地區規模較小,但在虛擬化無線存取網路 (RAN) 和暗纖聚合領域卻處於創新領先地位。 Verizon 和 T-Mobile 於 2024 年收購了區域光纖營運商,以增強其光纖網路覆蓋範圍,並確保可擴展的回程傳輸,從而支援固定無線存取部署。美國聯邦通訊委員會 (FCC) 設立的 90 億美元 5G 基金將激勵偏遠地區的行動通訊基地台升級,並指導在地形不適合開挖的情況下投資微波和衛星回程傳輸。隨著營運商將光纖重複用於Gigabit寬頻和行動通訊基地台鏈路,固移融合將加速,資本回報率也將提高。

成熟的歐洲市場正在努力平衡嚴格的監管改革與泛歐5G走廊的建設。基礎設施共用框架正在減少重複的資本支出,而官民合作關係則為跨境光纖線路提供資金,這對於互聯貨運等低延遲服務至關重要。同時,中東正快速推進其智慧城市願景,該願景依賴密集的小型基地台;非洲通訊業者則利用低地球軌道衛星群為偏遠地區的網路回程傳輸傳鏈路。 5G已在17個拉丁美洲國家推出,通訊業者組成聯盟,租賃海底光纜的容量,並透過微波鏈路將其分發到內陸,從而增強國家網路的韌性。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 行動數據流量不斷成長,智慧型手機普及率不斷提高。

- 快速部署5G網路增加了容量需求

- 雲端原生和開放式無線接取網路架構

- 用於農村地區的衛星低地球軌道回程傳輸

- 公共產業光纖租賃和專用LTE網路

- 市場限制

- 光纖和頻譜方面的高資本投資

- 微波頻譜授權的複雜性

- 超低延遲同步的挑戰

- SDN回程傳輸網路安全風險

- 價值鏈/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

- 投資分析

- 新冠疫情對市場的影響

第5章 市場規模與成長預測

- 透過部署

- 有線

- 光纖

- 銅線/DSL

- 無線的

- 微波

- 毫米波(E波段和V波段)

- 衛星

- 自由空間光

- 有線

- 透過裝置

- 路由器和交換機

- 微波無線電

- 光纖傳輸設備

- 小型基地台回程傳輸設備

- 其他

- 按服務類型

- 專業服務

- 託管服務

- 安裝與整合

- 維護和支援

- 透過網路架構

- 大型基地台回程傳輸

- 小型基地台回程傳輸

- 雲端無線存取網/去程傳輸

- 最終用戶

- 行動網路營運商

- 中立主機和鐵塔公司

- 網際網路服務供應商

- 私人公司和公共產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 澳洲

- 亞太其他地區

- 中東

- GCC

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 奈及利亞

- 埃及

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介(包括全球概覽)

- Market level overview

- Huawei Technologies Co.

- Ericsson AB

- Nokia Corporation

- ZTE Corporation

- NEC Corporation

- Cisco Systems

- Fujitsu Limited

- Aviat Networks

- Ceragon Networks Ltd.

- BridgeWave Communications

- ATandT Inc.

- Verizon Communications Inc.

- Ciena Corporation

- Juniper Networks

- Siklu Communication Ltd.

- Infinera Corporation

- CommScope Holding Company

- Telefonica SA

- Intelsat SA

- Parallel Wireless

第7章 市場機會與未來展望

The Mobile Backhaul Market size is estimated at USD 34.97 billion in 2025, and is expected to reach USD 70.95 billion by 2030, at a CAGR of 15.20% during the forecast period (2025-2030).

Growth is propelled by escalating smartphone penetration, the sharp rise in video streaming, and dense 5G rollouts that demand 10 Gbps and soon 100 Gbps per cell per site capacity. Operators are swapping copper lines for fiber and high-capacity wireless links, while neutral-host models reduce duplication as 5G investments top USD 1.1 trillion between 2020 and 2025. Open architectures, software-defined transport, and edge compute place new performance and security pressures on backhaul, yet they can lower life-cycle costs through commercial off-the-shelf hardware. Asia Pacific leads with a 35% revenue contribution and shows the fastest regional CAGR at 17.3% as China, Japan, South Korea, and India install millions of small cells. Operators everywhere now blend fiber's scale with microwave, millimeter-wave, and low-Earth-orbit (LEO) satellite hops to fill coverage gaps and accelerate rollouts.

Global Mobile Backhaul Market Trends and Insights

Growing Mobile Data Traffic & Smartphone Adoption

Average monthly data per smartphone is forecast to soar from 21 GB in 2023 to 56 GB by 2029, with video expected to account for 75% of mobile traffic. Regional divergence is emerging: North American users may hit 66 GB per month while Sub-Saharan Africa lingers near 23 GB, forcing operators to engineer country-specific backhaul mixes. Hybrid topologies that splice fiber trunks with high-band microwave hops now dominate urban densification because they meet capacity needs without prolonged street-dig permitting. Small-cell proliferation adds thousands of short-haul links, prompting fresh investment in automated network-management platforms that can tune capacity per site in real time.

Rapid 5G Rollout Driving Capacity Needs

Base-station density is climbing from 4-5 to 40-50 sites per km2 in 5G clusters, multiplying backhaul terminations. China alone is building more than 600,000 5G macro and small cells, a count projected to outstrip 4G by 1.3-1.5 times . Each 5G cell now requires 10 Gbps uplinks and stringent latency of sub-5 ms, accelerating the adoption of 70/80 GHz E-band radios and time-sensitive networking over fiber. Capital stress is nudging many operators toward shared towers and leased dark fiber, lowering up-front costs while ensuring upgrade paths to 100 Gbps interfaces.

High Capex for Fiber & Spectrum Costs

Fiber trenching in dense cities can run beyond USD 100,000 per Kilometer, a figure that climbs sharply where road-opening permits are scarce. Rising electricity prices also double macro-site power draw when 4G and 5G bands overlap, inflating operational overhead. In developing economies, limited access to low-interest financing delays fiber build-outs, forcing carriers to rely on microwave even where long-term economics favor fiber. The result is uneven quality-of-experience across urban and rural divides, hindering digital-inclusion goals.

Other drivers and restraints analyzed in the detailed report include:

- Cloud-Native & Open RAN Architectures

- Satellite LEO Backhaul for Rural Reach

- SDN Backhaul Cybersecurity Risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Fiber-based links constituted 55% of the mobile backhaul market in 2024 due to their unrivalled capacity and low latency. This share translates to the largest deployment slice of the mobile backhaul market size at USD 19.2 billion in 2024. Wireless alternatives, however, are set to post a 16.4% CAGR through 2030, narrowing the gap as urban densification and pop-up events demand rapid turn-ups. Operators mesh 70/80 GHz E-band radios with leased dark fiber trunks, delivering 10 Gbps per hop while avoiding costly civil works.

Hybrid architectures are now standard: fiber remains the preferred medium for core aggregation, but microwave and millimeter-wave serve edge small cells and enterprise venues where permits or geography stall trenching. Emergent W-band and D-band links promise multi-gigabit throughput over 1-2 km, complementing fiber for dense clusters. In sparsely populated regions, operators splice LEO satellite backhaul into microwave rings, creating contiguous coverage without exceeding budget ceilings. This flexibility underpins the long-term competitiveness of the mobile backhaul market.

Microwave radios held 41% of the mobile backhaul market size in 2024, reflecting decades of field-proven reliability. Vendors have pushed spectral efficiency to 16 bps/Hz while adding link-bonding schemes that aggregate non-contiguous channels. Small cells backhaul gear, though only a fraction of revenue today, is set for a 17.4% CAGR as stadiums, malls, and transport hubs adopt indoor 5G.

The mobile backhaul market is witnessing a pivot toward integrated access and backhaul (IAB), where a 28 GHz radio simultaneously serves user devices and relays traffic upstream. This reduces rooftop congestion and simplifies zoning. Millimeter-wave chipset advances cut power draw by 30% since 2023, enabling pole-mount and window-mount nodes that require minimum site work. Vendors that bundle self-organizing-network software are winning tenders because they lower truck rolls and optimize link alignment in cluttered environments.

The Mobile Backhaul Market Report is Segmented by Deployment (Wired [Fiber/Optical and Copper/DSL], Wireless [Microwave, Millimetre-Wave, and More]), Equipment Type (Routers and Switches, Microwave Radios, and More), Service Type (Professional Services, Managed Services, and More), Network Architecture (Macro-Cell Backhaul, and More), End-User (Mobile Network Operators, Neutral-Host and Tower Companies, and More), and Geography.

Geography Analysis

Asia Pacific commands 35% of the mobile backhaul market, expanding at 17.3% CAGR thanks to outsized 5G investments, state subsidies, and dense urban populations. China, Japan, and South Korea already blanket major cities with standalone 5G, driving steep demand for 10 Gbps microwave hops that skirt excavation bottlenecks. India's recent spectrum auctions have unleashed a fiber-laying spree along highways and into tier-2 cities, while operators also pilot satellite-plus-microwave hybrids for Himalayan and island coverage. Government schemes that underwrite rural fiber further sustain momentum.

North America, while smaller by volume, leads innovation in virtualized RAN and dark-fiber aggregation. Verizon and T-Mobile bolstered their optical footprints by acquiring regional fiber players in 2024, locking in scalable backhaul to support fixed-wireless access rollouts. The Federal Communications Commission's USD 9 billion 5G Fund incentivizes cell-site upgrades in remote counties, channeling investments toward microwave and satellite backhaul where terrain hampers trenching. Fixed-mobile convergence accelerates as operators reuse fiber for both gigabit broadband and cell-site uplinks, amplifying return on capital.

Europe's mature markets balance stringent regulatory reviews with a push for pan-EU 5G corridors. Infrastructure-sharing frameworks lower duplicate capex, while public-private partnerships finance cross-border fiber routes vital for low-latency services such as connected freight. Meanwhile, the Middle East fast-tracks smart-city visions that rely on dense small-cell grids, and African carriers tap LEO constellations to backhaul remote coverage islands. Latin America sees 5G launches in 17 countries, with carriers forming consortia to lease submarine-cable capacity and distribute it inland via microwave chains, weaving resilience into national networks.

- Market level overview

- Huawei Technologies Co.

- Ericsson AB

- Nokia Corporation

- ZTE Corporation

- NEC Corporation

- Cisco Systems

- Fujitsu Limited

- Aviat Networks

- Ceragon Networks Ltd.

- BridgeWave Communications

- ATandT Inc.

- Verizon Communications Inc.

- Ciena Corporation

- Juniper Networks

- Siklu Communication Ltd.

- Infinera Corporation

- CommScope Holding Company

- Telefonica S.A.

- Intelsat S.A.

- Parallel Wireless

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing mobile data traffic and smartphone adoption

- 4.2.2 Rapid 5G rollout driving capacity needs

- 4.2.3 Cloud-native and Open RAN architectures

- 4.2.4 Satellite LEO backhaul for rural reach

- 4.2.5 Fiber leasing by utilities and private LTE networks

- 4.3 Market Restraints

- 4.3.1 High capex for fiber and spectrum costs

- 4.3.2 Microwave spectrum licensing complexity

- 4.3.3 Ultra-low-latency synchronisation challenges

- 4.3.4 SDN backhaul cybersecurity risks

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

- 4.9 Impact of COVID-19 on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Deployment

- 5.1.1 Wired

- 5.1.1.1 Fiber/Optical

- 5.1.1.2 Copper/DSL

- 5.1.2 Wireless

- 5.1.2.1 Microwave

- 5.1.2.2 Millimetre-Wave (E- and V-band)

- 5.1.2.3 Satellite

- 5.1.2.4 Free-Space Optics

- 5.1.1 Wired

- 5.2 By Equipment Type

- 5.2.1 Routers and Switches

- 5.2.2 Microwave Radios

- 5.2.3 Optical Transport Equipment

- 5.2.4 Small-Cell Backhaul Equipment

- 5.2.5 Others

- 5.3 By Service Type

- 5.3.1 Professional Services

- 5.3.2 Managed Services

- 5.3.3 Installation and Integration

- 5.3.4 Maintenance and Support

- 5.4 By Network Architecture

- 5.4.1 Macro-Cell Backhaul

- 5.4.2 Small-Cell Backhaul

- 5.4.3 Cloud RAN/Fronthaul

- 5.5 By End-user

- 5.5.1 Mobile Network Operators

- 5.5.2 Neutral-Host and Tower Companies

- 5.5.3 Internet Service Providers

- 5.5.4 Private Enterprises and Utilities

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.1.3 Mexico

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Argentina

- 5.6.2.3 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 United Kingdom

- 5.6.3.2 Germany

- 5.6.3.3 France

- 5.6.3.4 Spain

- 5.6.3.5 Italy

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 India

- 5.6.4.3 Japan

- 5.6.4.4 South Korea

- 5.6.4.5 Australia

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East

- 5.6.5.1 GCC

- 5.6.5.2 Turkey

- 5.6.5.3 Rest of Middle East

- 5.6.6 Africa

- 5.6.6.1 South Africa

- 5.6.6.2 Nigeria

- 5.6.6.3 Egypt

- 5.6.6.4 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview

- 6.4.1 Market level overview

- 6.4.2 Huawei Technologies Co.

- 6.4.3 Ericsson AB

- 6.4.4 Nokia Corporation

- 6.4.5 ZTE Corporation

- 6.4.6 NEC Corporation

- 6.4.7 Cisco Systems

- 6.4.8 Fujitsu Limited

- 6.4.9 Aviat Networks

- 6.4.10 Ceragon Networks Ltd.

- 6.4.11 BridgeWave Communications

- 6.4.12 ATandT Inc.

- 6.4.13 Verizon Communications Inc.

- 6.4.14 Ciena Corporation

- 6.4.15 Juniper Networks

- 6.4.16 Siklu Communication Ltd.

- 6.4.17 Infinera Corporation

- 6.4.18 CommScope Holding Company

- 6.4.19 Telefonica S.A.

- 6.4.20 Intelsat S.A.

- 6.4.21 Parallel Wireless

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment