|

市場調查報告書

商品編碼

1850213

紫外線穩定劑:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)UV Stabilizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

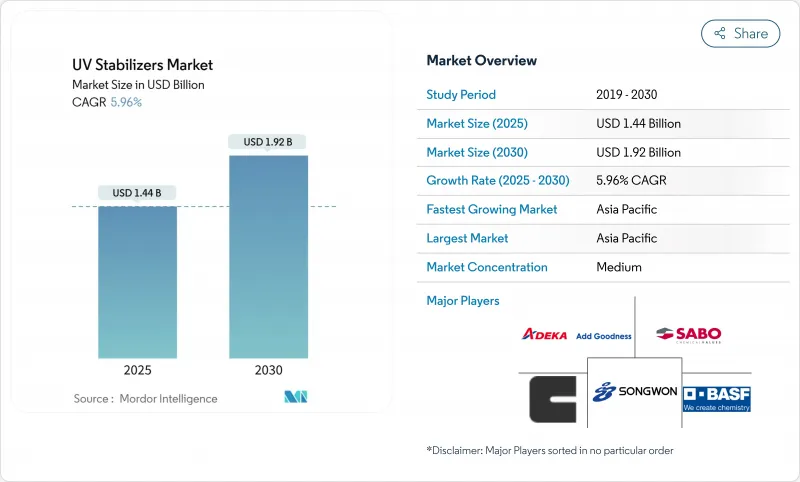

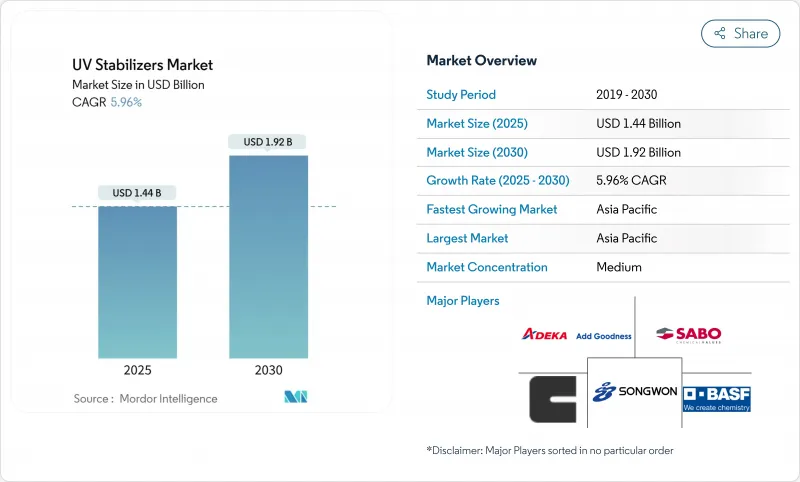

預計 2025 年紫外線穩定劑市場規模將達到 14.4 億美元,預計到 2030 年將達到 19.2 億美元,預測期內(2025-2030 年)的複合年成長率為 5.96%。

這一成長反映出,汽車、包裝和建築應用領域對即使在陽光照射下也能保持外觀和機械完整性的塑膠的需求日益成長。耐久性標準日益嚴格、亞太地區工業化進程迅速推進以及對永續性不斷提升,這些因素促使生產商尋求生物基或生質能平衡的添加劑產品線,從而推動了塑膠市場的成長。監管方面的發展,包括2024年將UV-328列入《斯德哥爾摩公約》,正在加速塑膠再製造進程,而近期美國對特種化學品徵收的關稅則鼓勵區域供應本地化。同時,珠狀和顆粒狀穩定劑以及先進的受阻胺光穩定劑(HALS)系統等快速成長的領域正在提高加工安全性、分散性和長期性能。

全球紫外線穩定劑市場趨勢與洞察

抗紫外線聚烯薄膜在亞洲工業包裝的快速應用

中國和印度的工業運輸商正在用防紫外線聚烯薄膜取代傳統的塑膠包裝。受阻胺光穩定劑 (HALS) 是一種整合抗氧化劑的單粒先進包裝材料,即使在高產量擠出製程中也能保持穩定的性能,因此在電子產品物流領域得到廣泛應用。

歐洲轉向低VOC水性木器塗料

更嚴格的VOC法規正促使歐洲生產商轉向水性體系,這需要與水性介質相容的穩定劑。封裝的紫外線吸收劑在成膜後被激活,保護戶外結構免受褪色和木質素分解的影響。

原物料價格波動

地緣政治事件和石化產業重組推高了受阻胺光穩定劑(HALS)生產中關鍵二胺和受阻酚的成本。製造商正在尋求後向整合和提高催化製程效率,以穩定成本並保障淨利率。亞洲領先的製造商紛紛宣布新增專用前驅產能,以抵銷成本波動。

細分分析

受阻胺光穩定劑預計到2024年將佔銷售額的65%,這反映了其再生自由基清除機制,可維持聚烯在長期戶外使用中的耐久性。競爭焦點正轉向低色度受阻胺光穩定劑等級,例如聖萊科特國際集團的LOWILITE系列,該系列產品在保持透明度的同時,也滿足嚴格的食品接觸標準。

由於三嗪類化合物與受阻胺光穩定劑 (HALS) 具有協同作用,紫外線吸收劑細分市場發展勢頭強勁,尤其是在需要光學透明度的聚碳酸酯和丙烯酸樹脂中。猝滅劑和抗氧化劑則瞄準了需要熱穩定性和光穩定性的狹窄細分市場,例如用於照明透鏡的透明苯乙烯類材料。

到 2024 年,聚烯將佔銷售額的 52%。更有效率的受阻胺光穩定劑 (HALS) 已將吹塑薄膜中的典型添加量從 0.25% 降低至 0.15%,且不會影響伸長率或光澤保持率。

聚氨酯的複合年成長率最高,達到 6.44%,因為其在透明塗層、密封劑和暴露於陽光下的軟質發泡體中的應用日益增多。聚氯乙烯、工程塑膠和彈性體需要多種添加劑來抵抗光氧化以及熱應力和化學應力。

區域分析

預計到2024年,亞太地區將佔全球收益的54%,到2030年,複合年成長率將達到6.59%。三棵樹與索爾維合作生產的TPO BIPV膜,經驗證具有25年的耐候性,彰顯了該地區的材料創新。在中國和印度,政府的激勵措施進一步支持了溫室氣體薄膜和工業包裝的生產,而日本電子產品製造商則正在指定兼顧耐用性和可回收性的下一代穩定劑。

北美排名第二,其特點是交通運輸、航太和積層製造等領域的高價值應用。普渡大學的研究表明,產研合作開發了一種防紫外線噴霧,可在精密表面形成耐用塗層,延長複合材料零件的使用壽命。該地區在電動車TPO面板的應用方面也處於領先地位。

歐洲嚴格的化學品和永續性法規正在推動對低VOC、可回收配方的需求。 Cradle-ALP藍圖強調添加劑的循環性,挑戰配方師在不犧牲產品終身耐候性的前提下,提供生物基替代品。

南美洲溫室和灌溉產品市場呈現溫和成長態勢,主要集中在巴西和阿根廷。在中東和非洲,對保護性農膜的需求以及大型基礎設施計劃推動了高於平均的成長。沙烏地阿拉伯的大型溫室計畫為優質的多季受阻胺光穩定劑 (HALS) 包裝帶來了商機。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 抗紫外線聚烯薄膜在亞洲工業包裝的快速應用

- 歐洲向低VOC水性木器塗料的過渡

- 北美地區耐候性3D列印塑膠的採用率不斷提高

- 中東地區對紫外線穩定溫室薄膜的需求激增

- 原始設備製造商對長壽命汽車外部塑膠的義務

- 市場限制

- 原物料價格波動

- HALS中間體供應鏈中斷

- 高阻隔單層薄膜減少了對穩定劑的需求

- 價值鏈分析

- 波特五力模型

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場規模及成長預測

- 按類型

- 受阻胺光穩定劑(HALS)

- 紫外線吸收劑

- 猝滅劑

- 抗氧化劑

- 按最終用途行業

- 包裹

- 車

- 農業

- 建築/施工

- 黏合劑和密封劑

- 其他最終用戶產業(電氣、電子等)

- 按聚合物類型

- 聚烯(PE、PP)

- PVC

- 聚氨酯

- 工程塑膠(PC、PA、PET)

- 其他(苯乙烯樹脂、橡膠和彈性體)

- 按形式

- 液體

- 粉末

- 珠子/顆粒

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 亞洲其他地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 法國

- 義大利

- 其他歐洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美

- 中東和非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 亞太地區

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- 3V Sigma SpA

- ADEKA Corporation

- Altana AG

- BASF SE

- Chitec Technology Co., Ltd.

- Clariant

- Eastman Chemical Company

- Everlight Chemical Industrial Co.

- Evonik Industries AG

- Kaneka Corporation

- Lycus Ltd. LLC

- Mayzo Inc.

- Rianlon Corporation

- SABO SpA

- SI Group Inc.

- Solvay

- Songwon

- SUQIAN UNITECH CORP..LTD

- Tianjin Baofeng Chemical Co., Ltd.

- Wanhua

第7章 市場機會與未來展望

The UV Stabilizers Market size is estimated at USD 1.44 billion in 2025, and is expected to reach USD 1.92 billion by 2030, at a CAGR of 5.96% during the forecast period (2025-2030).

The expansion reflects rising demand for plastics that retain appearance and mechanical integrity when exposed to sunlight in automotive, packaging, and construction settings. Growth is reinforced by stricter durability standards, rapid industrialization in Asia-Pacific, and mounting sustainability expectations that push producers toward bio-based or biomass-balanced additive lines. Regulatory momentum - including the 2024 listing of UV-328 under the Stockholm Convention - is accelerating reformulation, while recent US tariffs on specialty chemicals are prompting regional supply localization. Concurrently, fast-growing segments such as bead- or granule-form stabilizers and advanced HALS systems are improving processing safety, dispersion, and long-term performance.

Global UV Stabilizers Market Trends and Insights

Rapid Penetration of UV-Stable Polyolefin Films in Asia's Industrial Packaging

Industrial shippers in China and India are replacing conventional wraps with UV-protected polyolefin films that cut material use by up to 15% while extending shelf life. Advanced HALS packages integrated with antioxidants in single-pellet form ensure consistent performance during high-throughput extrusion, leading to broader adoption in electronics logistics.

Shift Toward Low-VOC, Water-Borne Wood Coatings in Europe

Stringent VOC rules are moving European producers toward waterborne systems that need stabilizers compatible with aqueous media. Encapsulated UV absorbers activate after film formation, preventing colour fade and lignin breakdown in outdoor structures, a technology highlighted in recent launches for exterior decking.

Volatility in Feedstock Prices

Geopolitical events and petrochemical realignments have lifted the cost of key diamines and hindered phenols used in HALS production. Manufacturers are pursuing backward integration and catalytic process efficiencies to stabilize costs and protect margins, with one leading Asian producer announcing new on-purpose precursor capacity to offset volatility.

Other drivers and restraints analyzed in the detailed report include:

- Growing Adoption of Weather-Resistant 3D-Printed Plastics in North America

- Surge in UV-Stabilized Greenhouse Films Across the Middle East

- Supply-Chain Disruptions of HALS Intermediates

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hindered amine light stabilizers account for 65% of 2024 revenue, reflecting their regenerative radical-scavenging mechanism that sustains polyolefin durability over extended outdoor service. Competitive focus has shifted to low-colour HALS grades that maintain clarity while meeting stringent food-contact norms, typified by SI Group's LOWILITE series.

The UV absorbers sub-segment is accelerating as triazine chemistries pair synergistically with HALS, particularly in polycarbonate and acrylic systems that demand optical clarity. Quenchers and antioxidants target narrower niches where thermal-light stability is required simultaneously, such as clear styrenics for lighting lenses.

Polyolefins secured 52% of revenue in 2024. Higher-efficiency HALS has reduced typical loading from 0.25% to 0.15% in blown film without compromising retention of elongation or gloss.

Polyurethanes post the highest CAGR at 6.44% on rising use in clear coats, sealants, and flexible foams exposed to sunlight. PVC, engineering plastics, and elastomers round out the demand profile, each requiring tailored multi-additive packages that address photo-oxidation alongside thermal or chemical stresses.

The UV Stabilizers Market Report Segments the Industry by Type (Hindered Amine Light Stabilizers (HALS), UV Absorbers, Quenchers, and More), End-User Industry (Packaging, Automotive, Agriculture, and More), Polymer Type (Polyolefins, PVC, Polyurethane, and More), Form (Liquid, Powder, and Bead/Granule), and Geography (Asia-Pacific, North America, Europe, South America, and Middle East and Africa).

Geography Analysis

Asia-Pacific controlled 54% of 2024 revenue and is forecast for a 6.59% CAGR to 2030, propelled by accelerating automotive builds, infrastructure expansion, and photovoltaic roofing adoption. A collaboration between 3TREES and Solvay produced a TPO BIPV membrane demonstrating 25-year weathering, highlighting regional material innovation. Government incentives in China and India further underpin greenhouse film and industrial packaging volumes, while Japanese electronics majors specify next-generation stabilizers that balance durability with recycling compatibility.

North America ranks second, characterised by high-value applications in transportation, aerospace and additive manufacturing. Research at Purdue University produced a UV-protectant spray that forms a durable film on sensitive surfaces, illustrating academic-industry collaboration to extend service life for composite parts. The region also leads in electric-vehicle TPO fascia adoption.

Europe's stringent chemical and sustainability legislation steers demand toward low-VOC, recyclable formulations. The Cradle-ALP roadmap underscores additive circularity, pressuring formulators to deliver bio-based alternatives without sacrificing lifetime weatherability.

South America shows moderate expansion concentrated in Brazilian and Argentine greenhouse and irrigation products. In the Middle East and Africa, protected-agriculture film demand and big-ticket infrastructure projects fuel above-average growth; Saudi Arabia's large-scale greenhouse initiatives typify the opportunity for premium multi-season HALS packages.

- 3V Sigma S.p.A.

- ADEKA Corporation

- Altana AG

- BASF SE

- Chitec Technology Co., Ltd.

- Clariant

- Eastman Chemical Company

- Everlight Chemical Industrial Co.

- Evonik Industries AG

- Kaneka Corporation

- Lycus Ltd. LLC

- Mayzo Inc.

- Rianlon Corporation

- SABO S.p.A.

- SI Group Inc.

- Solvay

- Songwon

- SUQIAN UNITECH CORP..LTD

- Tianjin Baofeng Chemical Co., Ltd.

- Wanhua

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Penetration of UV-Stable Polyolefin Films in Asia's Industrial Packaging

- 4.2.2 Shift Toward Low-VOC, Water-Borne Wood Coatings in Europe

- 4.2.3 Growing Adoption of Weather-Resistant 3D-Printed Plastics in North America

- 4.2.4 Surge in UV-Stabilized Greenhouse Films Across the Middle East

- 4.2.5 OEM Mandates for Long-Life Exterior Automotive Plastics

- 4.3 Market Restraints

- 4.3.1 Volatility in Feedstock Prices

- 4.3.2 Supply-Chain Disruptions of HALS Intermediates

- 4.3.3 Adoption of High-Barrier Monolayer Films Reducing Need for Stabilizers

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Type

- 5.1.1 Hindered Amine Light Stabilizers (HALS)

- 5.1.2 UV Absorbers

- 5.1.3 Quenchers

- 5.1.4 Antioxidants

- 5.2 By End-Use Industry

- 5.2.1 Packaging

- 5.2.2 Automotive

- 5.2.3 Agriculture

- 5.2.4 Building and Construction

- 5.2.5 Adhesives and Sealants

- 5.2.6 Other End-user Industries (Electrical and Electronics, etc.)

- 5.3 By Polymer Type

- 5.3.1 Polyolefins (PE, PP)

- 5.3.2 PVC

- 5.3.3 Polyurethane

- 5.3.4 Engineering Plastics (PC, PA, PET)

- 5.3.5 Others (Styrenics and Rubber and Elastomers)

- 5.4 By Form

- 5.4.1 Liquid

- 5.4.2 Powder

- 5.4.3 Bead / Granule

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 Asia-Pacific

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 3V Sigma S.p.A.

- 6.4.2 ADEKA Corporation

- 6.4.3 Altana AG

- 6.4.4 BASF SE

- 6.4.5 Chitec Technology Co., Ltd.

- 6.4.6 Clariant

- 6.4.7 Eastman Chemical Company

- 6.4.8 Everlight Chemical Industrial Co.

- 6.4.9 Evonik Industries AG

- 6.4.10 Kaneka Corporation

- 6.4.11 Lycus Ltd. LLC

- 6.4.12 Mayzo Inc.

- 6.4.13 Rianlon Corporation

- 6.4.14 SABO S.p.A.

- 6.4.15 SI Group Inc.

- 6.4.16 Solvay

- 6.4.17 Songwon

- 6.4.18 SUQIAN UNITECH CORP..LTD

- 6.4.19 Tianjin Baofeng Chemical Co., Ltd.

- 6.4.20 Wanhua

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment

- 7.2 Nano-composites in UV Stabilizers