|

市場調查報告書

商品編碼

1850167

MEA 位置分析:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)MEA Location Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

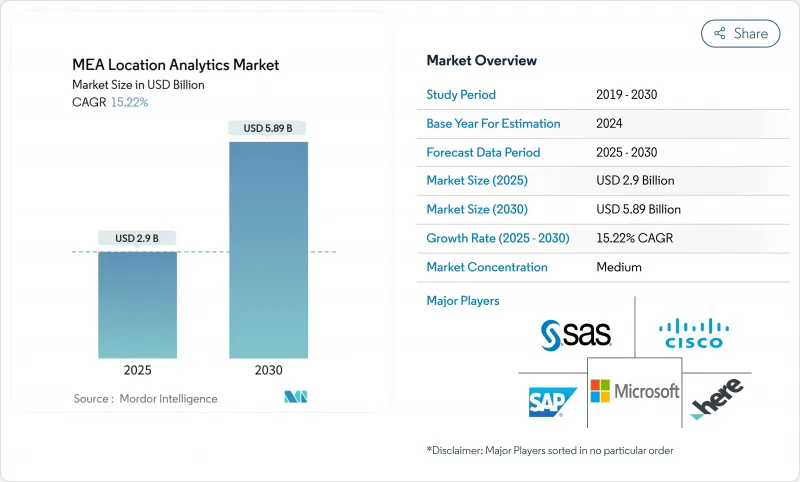

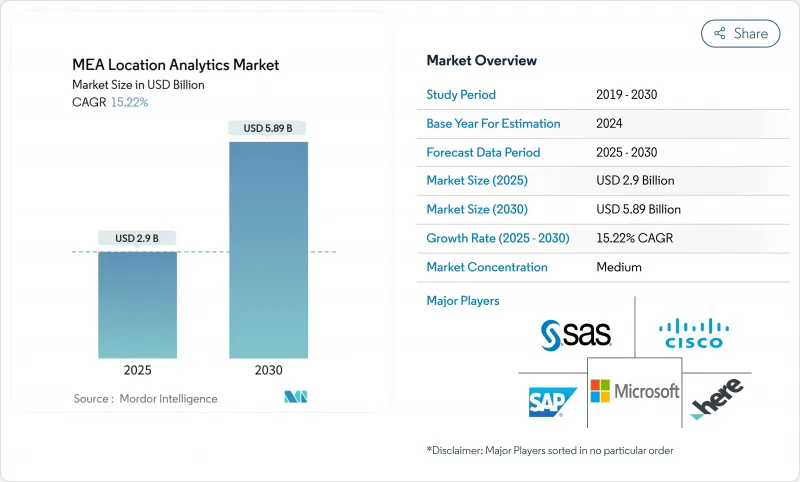

預計到 2025 年,MEA 位置分析市場規模將達到 29 億美元,到 2030 年將達到 58.9 億美元,複合年成長率為 15.22%。

波灣合作理事會(GCC) 的智慧城市投資正在激增,推動了對空間智慧的需求,而 5G 的採用和主權雲端的推出正在提高資料收集和處理的速度和安全性。由於大型交通和基礎設施計劃需要持續的地理數據資料饋送來最佳化交通、安全和城市服務,室外分析仍然佔據主導地位。同時,室內和室外追蹤的整合正在重塑電子商務物流,而 NEOM 等大型企劃的數位雙胞胎位孿生舉措正在推動供應商提供更高頻率的數據和即時視覺化。監管機構對資料主權的關注正在推動架構選擇轉向本地和主權雲,而地理空間分析領域日益嚴重的技能短缺正在提升專業服務提供者的作用。

MEA 位置分析市場趨勢和洞察

物聯網感測器在海灣合作理事會智慧城市專案中的滲透率

利雅德、杜拜和杜哈無所不在的感測器網路不斷產生帶有地理標記的資料流,這些資料流需要強大的分析平台進行即時提取和視覺化。杜拜已部署了 200 多項智慧服務,麥加則整合了支援 LoRa 的設備,以便在朝覲季節維持山區的連結性。市政機構正在利用這些數據流來預測交通密度、最佳化廢棄物收集並監控安全事件。由此產生的大量數據正促使市政當局採用邊緣處理和人工智慧演算法,從源頭過濾和分析訊息,從而加快決策速度。隨著試點部署逐步進入全面生產階段,市政競標擴大指定開放 API 和多重通訊協定相容性,從而促進了更廣泛的供應商生態系統的形成。

加速 5G 小型基地台部署,實現即時分析

海灣合作理事會 (GCC) 各國首都的 5G 覆蓋範圍廣泛,延遲低於 10 毫秒,可支援自動駕駛接駁車、無人機巡檢和擴增實境導航等高級應用。營運商正與市政規劃人員合作,將小型基地台嵌入街道設施,以提高高解析度追蹤和視訊分析的訊號密度。新的頻寬將支援向控制室即時傳輸高解析度 3D 地圖,增強緊急應變協調能力。石油、公共和物流行業的公司正在根據分析藍圖調整其網路升級,理由是需要移動資產的不間斷資料流。早期採用者報告稱,邊緣 AI 可以在本地處理感測器警報,從而實現預測性維護以降低營運成本。

資料主權和隱私監管

沙烏地阿拉伯的《個人資料保護法》和阿拉伯聯合大公國的《聯邦資料保護法令》要求資料處理者在境內儲存敏感的位置資訊。醫療保健、金融和國防計劃面臨嚴格的同意和審核追蹤要求,迫使它們部署本地或主權雲端。跨國供應商正在透過推出本地雲端區域並提供隔離個人識別資訊的資料本地化層來應對。這通常需要法律審查、加密金鑰管理和本地事件回應通訊協定。

細分分析

隨著交通運輸和公共工程部對高速公路、港口和地鐵系統數位化,到2024年,戶外解決方案將佔據中東和非洲(MEA)位置分析市場的72%。攝影機訊號與地理圍欄演算法相結合,支援動態收費和交通號誌最佳化,從而緩解主要幹道的擁塞。預計到2030年,MEA戶外位置分析市場規模將穩定成長,受益於覆蓋全市的行動即服務平台。在室內,購物中心、機場和醫院正在部署信標和雷射雷達,以了解顧客路徑和資產使用情況。一線商場的應用最為廣泛,其營運效益足以抵消硬體和校準成本。近場追蹤彌合了店內應用程式和會員計畫之間的差距,從而提高了宣傳活動的轉換率。

新興用例正在融合室內外資料集,以便在不中斷訊號的情況下跨供應鏈節點追蹤資產。物流業者正在單一平台上繪製跨碼頭倉庫和最後一哩路線圖,以提高交接準確性並減少錯放事故。設施管理人員正在將建築資訊模型與 GIS 儀表板結合,以便在空間環境中可視化維護工單。這種整合正在推動更廣泛的中東和非洲 (MEA) 位置分析產業實現兩位數成長,新的供應商提供樓層平面圖數位化、Wi-Fi 熱圖和全球導航衛星系統 (GNSS) 校正服務的整合服務。

到2024年,雲端平台將佔據中東和非洲地區(MEA)位置分析市場的66%,並以19.50%的複合年成長率繼續超越本地系統。電訊營運商、零售商和公共部門組織依賴超大規模資料中心營運商營運的區域資料中心,以彈性方式儲存和處理Terabyte的地理空間記錄。隨著越來越多的地區遵守資料主權規定,預計到2027年,MEA地區雲端託管工作負載的位置分析市場規模將超過本地部署。特定區域的安全身份驗證和低延遲邊緣區域正在推動延遲敏感型應用(例如自動穿梭巴士控制和即時人群監控)的遷移。

對於機密計劃和與公共網路隔離的設施而言,本地部署解決方案仍然至關重要。國防和關鍵基礎設施營運商正在部署強化伺服器和私有雲端,以滿足嚴格的效能和保密性目標。混合架構正在逐漸普及,它整合了邊緣設備,這些設備在本地處理流數據,然後將聚合的洞察遷移到主權雲端進行長期分析。供應商透過預先建置的連接器、零信任框架和計量收費付費定價來緩解預算限制,從而脫穎而出,這表明部署彈性是整個中東和非洲 (MEA) 位置分析行業採購決策的基礎。

中東和非洲位置分析市場按位置(室外、室內)、部署模式(本地部署、按需部署(雲端))、應用(遠端監控、資產管理、設施管理)、組件(軟體、服務)、垂直行業(零售、製造等)和國家細分。市場預測以美元計算。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 物聯網感測器在海灣合作理事會智慧城市專案中的滲透率

- 加速部署支援即時分析的 5G小型基地台

- 零售業和政府部門採用雲端優先 GIS/BI

- 大型能源計劃強製本地ESG報告

- 市場限制

- 資料主權和隱私監管

- 室內定位資金投入高、技能差距大

- 價值/供應鏈分析

- 監管格局

- 技術展望

- 五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 競爭對手之間的競爭

- 替代品的威脅

- 投資分析

第5章市場規模及成長預測

- 按位置

- 戶外

- 室內的

- 按部署模型

- 本地部署

- 按需(雲端)

- 按用途

- 遠端監控

- 資產管理

- 設施管理

- 按行業

- 零售

- 製造業

- 衛生保健

- 政府

- 能源和電力

- 其他行業

- 按組件

- 軟體

- 服務

- 按國家

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 以色列

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Cisco Systems

- Microsoft Corporation

- HERE Technologies

- SAS Institute Inc.

- Oracle Corporation

- SAP SE

- Esri

- Tibco Software Inc.

- Pitney Bowes

- Galigeo

- Hexagon AB

- TomTom

- Trimble Inc.

- Mapbox

- Alteryx

- CARTO

- Foursquare

- Splunk Inc.

- Ubisense

第7章 市場機會與未來展望

The MEA location analytics market size is valued at USD 2.9 billion in 2025 and is forecast to advance at a 15.22% CAGR, reaching USD 5.89 billion by 2030.

Surging smart-city investments across the Gulf Cooperation Council (GCC) are expanding demand for spatial intelligence, while 5G deployments and sovereign cloud rollouts improve the speed and security of data gathering and processing. Outdoor analytics remains dominant because large-scale mobility and infrastructure projects require continuous geodata feeds for traffic, safety, and urban-services optimization. At the same time, the fusion of indoor and outdoor tracking is reshaping e-commerce logistics, and digital twin initiatives for mega-projects such as NEOM are pushing vendors to deliver higher-frequency data and real-time visualization. Regulatory focus on data sovereignty is guiding architecture choices toward local or sovereign clouds, and mounting skills shortages in geospatial analytics are elevating the role of specialized service providers.

MEA Location Analytics Market Trends and Insights

Proliferation of IoT Sensors in GCC Smart-City Programmes

Ubiquitous sensor networks in Riyadh, Dubai, and Doha generate continuous geotagged streams that demand powerful analytics platforms capable of real-time ingestion and visualization. Dubai has implemented more than 200 smart services, while Makkah is integrating LoRa-enabled devices to maintain connectivity in mountainous terrain during the Hajj season. Municipal agencies use these data flows to predict traffic density, optimize waste collection, and monitor public safety incidents. The resulting data volume pushes city authorities to adopt edge processing and AI algorithms that filter and analyze information at the source, accelerating decision-making. As pilot deployments shift to full production, municipal tenders increasingly specify open APIs and multi-protocol compatibility, encouraging a broader supplier ecosystem.

Accelerated 5G Small-Cell Rollout Enabling Real-Time Analytics

Widespread 5G coverage in GCC capitals delivers sub-10-millisecond latency, allowing advanced applications such as autonomous shuttles, drone-based inspection, and augmented-reality wayfinding. Operators collaborate with municipal planners to embed small cells in street furniture, which improves signal density for high-resolution tracking and video analytics. The new bandwidth permits live streaming of high-definition 3D maps to control rooms, enhancing emergency response coordination. Enterprises across oil, utilities, and logistics verticals are aligning network upgrades with analytics roadmaps, citing the need for uninterrupted data flows from mobile assets. Early adopters report operational cost savings from predictive maintenance once edge AI processes sensor alerts locally.

Data-Sovereignty and Privacy Regulations

Saudi Arabia's Personal Data Protection Law and the UAE's Federal Decree-Law on Data Protection oblige processors to store sensitive location attributes within national borders. Healthcare, finance, and defense projects face strict consent and audit trails, prompting on-premises or sovereign cloud deployments. Multinational vendors respond by launching local cloud regions and offering data-localization tiers that segregate personally identifiable information. Compliance checks elevate project timelines and costs, often requiring legal reviews, encryption key management, and local incident-response protocols.

Other drivers and restraints analyzed in the detailed report include:

- Cloud-First GIS/BI Adoption Across Retail and Government

- Mandatory ESG Geo-Reporting for Large Energy Projects

- High CAPEX and Skills Gap for Indoor Positioning

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Outdoor solutions represented 72% of the MEA location analytics market in 2024 as ministries of transport and public works digitized highways, ports, and metro systems. Camera feeds combined with geofencing algorithms support dynamic tolling and traffic-signal optimization, cutting congestion on flagship corridors. The MEA location analytics market size for outdoor deployments is forecast to climb steadily through 2030, benefiting from city-wide mobility-as-a-service platforms. Indoors, malls, airports, and hospitals deploy beacons and LiDAR to gain customer-journey and asset-utilization insights. Uptake is strongest in tier-one malls where operational gains offset hardware and calibration costs. Near-field tracking bridges the gap between store apps and loyalty programs, enhancing campaign conversion.

Emerging use cases blend indoor and outdoor datasets to track assets across supply-chain nodes without signal drop. Logistics operators map cross-dock warehouses and final-mile routes on a single platform, improving hand-off accuracy and reducing misplacement incidents. Facility managers integrate building information modeling with GIS dashboards to visualize maintenance tickets in spatial context. This convergence draws new vendors that bundle floor-plan digitization, Wi-Fi heat-mapping, and global navigation satellite system (GNSS) correction services into unified offerings, positioning them for double-digit gains within the broader MEA location analytics industry.

Cloud platforms owned 66% of the MEA location analytics market in 2024 and continue to outpace on-premises systems with a 19.50% CAGR. Telecom operators, retailers, and public agencies rely on regional data centers operated by hyperscalers to elastically store and process terabytes of geospatial records. The MEA location analytics market size for cloud-hosted workloads is projected to surpass on-premises spending before 2027 as data-sovereignty-compliant regions multiply. Region-specific security certifications and low-latency edge zones encourage migration of latency-sensitive applications such as autonomous shuttle control and real-time crowd monitoring.

On-premises solutions remain essential for classified projects and installations disconnected from public networks. Defense and critical-infrastructure operators deploy ruggedized servers and private clouds to meet stringent performance and confidentiality targets. Hybrid architectures gain traction, integrating edge appliances that process streaming data locally before offloading aggregated insights to sovereign clouds for long-term analytics. Vendors differentiate through pre-built connectors, zero-trust frameworks, and pay-as-you-go pricing to ease budget constraints, illustrating how deployment flexibility underpins purchasing decisions across the MEA location analytics industry.

Middle East and Africa Location Analytics Market Segmented by Location (Outdoor, Indoor), Deployment Model (On-Premise, On-Demand (Cloud)), Application (Remote Monitoring, Asset Management, and Facility Management), Component (Software and Services), Vertical (Retail, Manufacturing, and More), and by Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Cisco Systems

- Microsoft Corporation

- HERE Technologies

- SAS Institute Inc.

- Oracle Corporation

- SAP SE

- Esri

- Tibco Software Inc.

- Pitney Bowes

- Galigeo

- Hexagon AB

- TomTom

- Trimble Inc.

- Mapbox

- Alteryx

- CARTO

- Foursquare

- Splunk Inc.

- Ubisense

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Proliferation of IoT sensors in GCC smart-city programmes

- 4.2.2 Accelerated 5G small-cell rollout enabling real-time analytics

- 4.2.3 Cloud-first GIS/BI adoption across retail and government

- 4.2.4 Mandatory ESG geo-reporting for large energy projects

- 4.3 Market Restraints

- 4.3.1 Data-sovereignty and privacy regulations

- 4.3.2 High CAPEX and skills gap for indoor positioning

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Intensity of Competitive Rivalry

- 4.7.5 Threat of Substitutes

- 4.8 Investment Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Location

- 5.1.1 Outdoor

- 5.1.2 Indoor

- 5.2 By Deployment Model

- 5.2.1 On-premise

- 5.2.2 On-demand (Cloud)

- 5.3 By Application

- 5.3.1 Remote Monitoring

- 5.3.2 Asset Management

- 5.3.3 Facility Management

- 5.4 By Vertical

- 5.4.1 Retail

- 5.4.2 Manufacturing

- 5.4.3 Healthcare

- 5.4.4 Government

- 5.4.5 Energy and Power

- 5.4.6 Other Verticals

- 5.5 By Component

- 5.5.1 Software

- 5.5.2 Services

- 5.6 By Country

- 5.6.1 United Arab Emirates

- 5.6.2 Saudi Arabia

- 5.6.3 Israel

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Cisco Systems

- 6.4.2 Microsoft Corporation

- 6.4.3 HERE Technologies

- 6.4.4 SAS Institute Inc.

- 6.4.5 Oracle Corporation

- 6.4.6 SAP SE

- 6.4.7 Esri

- 6.4.8 Tibco Software Inc.

- 6.4.9 Pitney Bowes

- 6.4.10 Galigeo

- 6.4.11 Hexagon AB

- 6.4.12 TomTom

- 6.4.13 Trimble Inc.

- 6.4.14 Mapbox

- 6.4.15 Alteryx

- 6.4.16 CARTO

- 6.4.17 Foursquare

- 6.4.18 Splunk Inc.

- 6.4.19 Ubisense

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment