|

市場調查報告書

商品編碼

1850135

苜蓿牧草:市場佔有率分析、行業趨勢、統計數據、成長預測(2025-2030 年)Alfalfa Hay - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

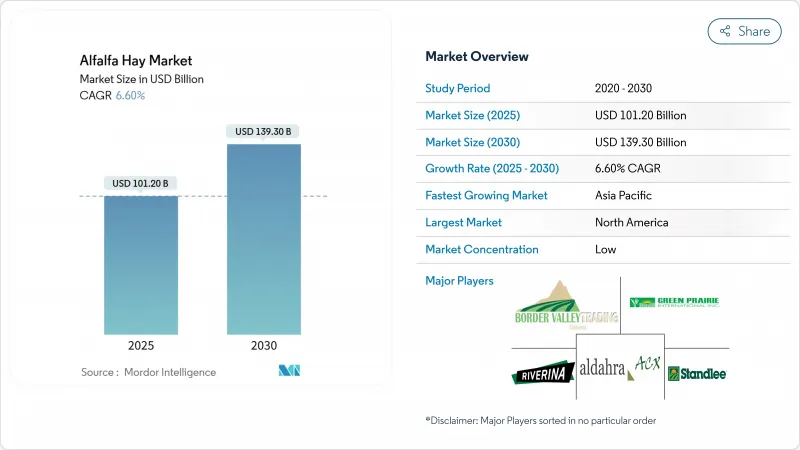

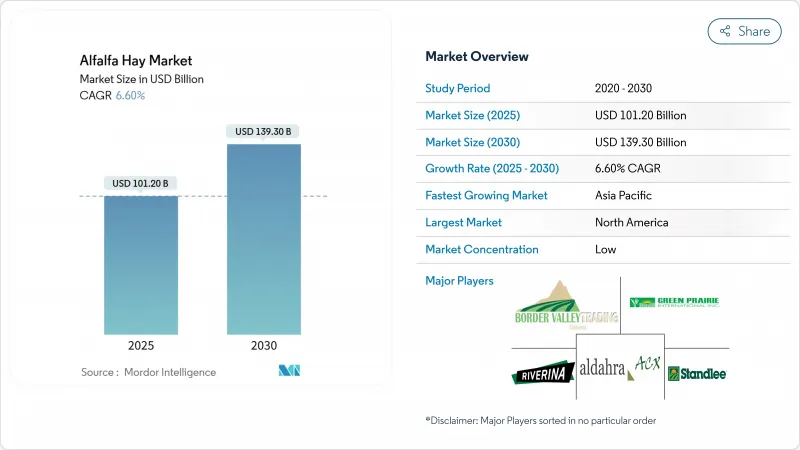

預計到 2025 年,苜蓿牧草市場規模將達到 1,012 億美元,到 2030 年將達到 1,393 億美元,年複合成長率為 6.6%。

儘管全球46%的紫花苜蓿種植面積面臨乾旱,但市場成長仍受到乳製品需求增加、紫花苜蓿高營養價值以及節水加工技術投資的推動。北美仍然是最大的市場,而亞太地區由於蛋白質消費量上升和強勁的飼料進口計劃,正呈現快速成長態勢。市場仍然分散,這為資金雄厚、能夠應對不斷上漲的水、勞動力和運輸成本的公司創造了機會。永續性發展舉措,例如碳權計畫和太陽能脫水工藝,將有助於抵消這些營運成本,並提高苜蓿牧草市場的長期盈利。

全球苜蓿牧草市場趨勢與洞察

對乳製品和動物性蛋白質的需求激增

全球對動物性蛋白質的需求成長正在影響飼料籌資策略。印度、印尼和越南不斷擴張的酪農簽訂了正式的採購協議,強調蛋白質密度的穩定性,這使得高離胺酸紫花苜蓿成為日糧配方中不可或缺的一部分。美國原乳加工商報告稱,日糧中含有18-22%粗蛋白紫花苜蓿可以提高牛奶產量和乳脂品質。在馬匹養殖領域,對性能的關注促使企業持續採購優質苜蓿,從而支撐了高品質紫花苜蓿的穩定溢價。牛的擴大和飼料轉換率的提高,使得苜蓿牧草成為生產者提高生產力的關鍵組成部分。

擴大飼料進口計劃

結構完善的進口計劃有助於穩定價格並建立穩定的需求模式。儘管外匯波動,日本在2023年仍維持了356,504噸的進口量;沙烏地阿拉伯在實施更嚴格的用水法規後,進口量增加至431,400噸。中國計劃在2030年將國內種植面積擴大到900萬公頃,這正在推動進口需求,並為北美出口商提供穩定的業務,儘管2023年的出貨量下降了47%。這些計劃下的長期供應合約提供了清晰的需求預測,並支持出口商投資脫水和壓縮設備,以提高運輸效率。

水足跡與乾旱政策壓力

亞利桑那州將於2024年終止外資紫花苜蓿農場的租賃契約,這凸顯了人們對密集型耗水農業日益成長的擔憂。乾旱影響全球約50%的紫花苜蓿產區,迫使農民採用虧損灌溉法。這些做法會使產量降低15%至20%,但可能會提高苜蓿作為飼料的價值。精準灌溉系統和耐旱品種有助於降低風險,但其高昂的成本對小農戶造成了影響。加州水庫水位下降和澳洲的水資源分配限制造成了市場的不確定性,並促使北美各地的紫花苜蓿生產向北部和內陸地區轉移。

細分市場分析

到2024年,捆包苜蓿乾草將佔苜蓿牧草市場43.0%的佔有率,這主要得益於成熟的處理系統和畜牧生產者的廣泛採用。機械化酪農偏好大型方形捆包,而圓形捆包則能為大型肉牛養殖場提供防風雨保護。這種多樣化的包裝形式確保了各地區需求的穩定。脫水顆粒飼料的市佔率較小,但由於自動化飼餵系統和貨櫃裝載密度的提高(從而降低了海運成本),其複合年成長率將達到7.6%。顆粒飼料還具有品質穩定、簡化飼料廠配製流程的優點,尤其適用於酪農和馬匹飼料市場。

移動式顆粒生產線的投資抵消了能源消費量的增加,並使每噸苜蓿的價格比草捆價格高出 30 至 40 美元。立方體草捆和壓縮草捆主要面向馬匹和小反芻動物市場,這些使用者更注重便利性而非成本。田間乾燥機可在 1.5 小時內將水分含量降低至 12% 以下,從而最大限度地降低收割期間的天氣風險。這些技術進步增強了苜蓿牧草市場,並加速了向加工產品的轉型。

到2024年,特級苜蓿牧草將佔據28.3%的市場佔有率,複合年成長率(CAGR)高達6.1%,顯示市場對富含蛋白質飼料的需求不斷成長。優質級苜蓿(RFV 170-185)酪農養殖場。由於買家對黴菌毒素和污染物的限制日益嚴格,中等級和實用級苜蓿的肉牛佔有率正在下降。

品質評估發現所有中國受檢樣本均含有黴菌毒素,導致高階買家轉向北美供應商。採用精準收割時間、高效能現場乾燥方法和先進倉儲監控系統的生產商,每噸可獲得50-60美元的溢價,展現了基於品質標準的市場價值差異化優勢。

苜蓿牧草市場報告按產品類型(例如,捆包)、等級(例如,特級)、加工技術(例如,田間乾燥傳統工藝)、配銷通路(例如,直接送貨到農場)、牲畜用途(例如,乳牛飼料)、最終用戶行業(例如,商業農場)和地區(例如,北美)進行細分。市場預測以價值(美元)和數量(公噸)為單位。

區域分析

2024年,北美將佔全球銷售額的36.2%,這得益於機械化作業、品質評級體係以及通往太平洋出口碼頭的便利。美國乾草產量增加3.3%,達到1.225億噸,但亞利桑那州和加州水資源政策的變化給產區帶來了風險。威斯康辛州的產量增加了75%,達到303萬噸,這表明該地區已做出相應調整,也預示著未來可能會轉移到水資源更穩定的地區。

預計到2030年,亞太地區的複合年成長率將達到6.8%。印度和東南亞酪農的現代化將推動飼料需求,而中國儘管進口量有所調整,仍是最大的進口國,進口量達886,661噸。中國計劃擴大國內產量,但不斷成長的牛數量在短期內仍將需要進口飼料。澳洲納穆爾迪計劃暫停後,乾草供應受限,凸顯了氣候變遷帶來的脆弱性。

歐洲市場需求穩定,注重永續性和可追溯性,這使得獲得碳認證的生產商在市場上更具優勢。南美洲正在發展成為一個具有競爭力的出口地區,尤其是智利和阿根廷,這得益於有利的氣候條件和不斷完善的港口設施。由於水資源限制,中東市場仍依賴進口,預計沙烏地阿拉伯將在2024年超越日本,成為第二大進口國。非洲市場展現出早期成長潛力,肯亞和奈及利亞的商業性酪農業務不斷擴張,預示著苜蓿牧草市場未來蘊藏著巨大機會。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 對乳製品和動物性蛋白質的需求激增

- 擴大飼料進口計劃

- 優良的蛋白質和纖維含量

- 碳權貨幣化與土壤健康

- 利用移動式乾燥和包塊壓縮技術減少損失

- DDGS(酒糟乾粉可溶性穀物)價格上漲推動飼料蛋白用量增加

- 市場限制

- 水足跡與乾旱政策壓力

- 海運和貨櫃運費的波動

- 水耕飼料和取代粗飼料的興起

- 出口通道上的植物檢疫屏障

- 價值鏈/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 依產品類型

- 面紗

- 圓形面紗

- 方形捆包

- 顆粒

- 立方體

- 脫水顆粒

- 壓縮捆

- 面紗

- 按等級/質量

- 最上(RFV 185 或以上)

- 頂部(RFV 170-185)

- 良好(RFV 150-169)

- 是的(RFV 130-149)

- 實用性(低於 RFV 130)

- 透過加工技術

- 戶外晾曬常規型

- 強制空氣移動式烘乾機

- 旋轉滾筒脫水

- 利用陽光脫水

- 透過分銷管道

- 農場直達大門

- 出口公司

- 飼料整合商和磨坊

- 電子商務/線上平台

- 畜牧用途

- 乳牛飼料

- 肉牛飼料

- 家禽飼料

- 秣

- 小型反芻動物飼料

- 駱駝科動物和其他

- 按最終用途行業分類

- 商業農場

- 複合飼料生產商

- 在家飼養動物的人/以飼養動物為嗜好的人

- 寵物食品與特殊營養

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 北美其他地區

- 歐洲

- 德國

- 英國

- 法國

- 西班牙

- 義大利

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 紐西蘭

- 韓國

- 亞太其他地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 其他南美洲

- 中東

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 其他中東地區

- 非洲

- 南非

- 埃及

- 肯亞

- 其他非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- AL Dahra ACX Global Inc.

- Anderson Hay & Grain Co., Inc.

- Standlee Premium Products, LLC

- Border Valley Trading

- Alfalfa Monegros

- Grupo Oses(Nafosa)

- Gruppo Carli

- Green Prairie International Inc

- Cubeit Hay Company

- Haykingdom Inc.

- SL Follen Company

- Riverina

- McCracken Hay Company

- Bailey Farms International

- Hay USA Inc

第7章 市場機會與未來展望

The alfalfa hay market is valued at USD 101.2 billion in 2025 and is projected to reach USD 139.3 billion by 2030, growing at a CAGR of 6.6%.

The market growth is driven by increasing dairy demand, alfalfa's high nutritional value, and investments in water-efficient processing technologies, despite 46% of global alfalfa acreage facing drought conditions. North America maintains its position as the largest market, while the Asia-Pacific region shows the fastest growth due to increased protein consumption and strong forage import programs. The market remains fragmented, creating opportunities for well-funded companies capable of managing increased water, labor, and transportation costs. The development of sustainability initiatives, including carbon credit programs and solar-powered dehydration processes, helps offset these operational costs and improves long-term profitability in the alfalfa hay market.

Global Alfalfa Hay Market Trends and Insights

Dairy and Animal-Protein Demand Surge

The global shift toward animal-based proteins is influencing feed procurement strategies. Expanding dairy operations across India, Indonesia, and Vietnam are establishing formal purchasing contracts that emphasize consistent protein density, making high-lysine alfalfa essential in feed formulations. U.S. milk processors report that feed rations containing 18-22% crude-protein alfalfa improve milk yield and butter-fat quality. The equine sector maintains premium grade purchases due to its focus on performance, supporting stable price premiums for high-quality alfalfa. The combination of expanding herds and feed-conversion requirements establishes alfalfa hay as a key component for producers aiming to increase productivity.

Expansion of Forage-Import Programs

Import programs with defined structures help stabilize prices and establish consistent demand patterns. Japan maintained imports of 356,504 metric tons in 2023 despite currency fluctuations, while Saudi Arabia increased imports to 431,400 metric tons following stricter water-use regulations. China's plan to expand domestic production area to 9 million hectares by 2030 drives current import demand, providing steady business for North American exporters despite a 47% decline in 2023 shipments. The long-term supply agreements under these programs provide clear demand forecasts and support exporter investments in dehydration and compression facilities to improve shipping efficiency.

Water-Footprint and Drought Policy Pressure

The 2024 termination of foreign-owned alfalfa farm leases in Arizona highlighted growing concerns over water-intensive agriculture. Drought affects approximately 50% of global alfalfa production areas, leading farmers to adopt deficit-irrigation methods. These practices reduce yields by 15-20% but may enhance feeding value. While precision irrigation systems and drought-resistant varieties help manage risks, their high costs impact smaller farms. Declining reservoir levels in California and water allocation restrictions in Australia create market uncertainty, driving alfalfa production to shift northward and inland across North America.

Other drivers and restraints analyzed in the detailed report include:

- Superior Protein and Fiber Profile

- Carbon-Credit and Soil-Health Monetization

- Ocean-Freight and Container-Rate Volatility

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bales account for 43.0% of the alfalfa hay market in 2024, supported by established handling systems and widespread adoption among livestock operators. Mechanized dairy farms prefer large square bales, while round bales provide weather protection for extensive beef operations. This format diversity ensures consistent demand across different regions. Dehydrated pellets, representing a smaller market share, are experiencing a 7.6% CAGR, driven by automated feeding systems and increased container-load density that reduces ocean transportation costs. Pellets also provide consistent quality, simplifying formulation processes for compound-feed mills serving dairy and equine markets.

Mobile pellet line investments generate premiums of USD 30-40 per metric ton above bale prices, compensating for increased energy consumption. Cubes and compressed bales serve equine and small-ruminant segments where users prioritize convenience over cost. Field dryers that reduce moisture content to below 12% within 1.5 hours minimize weather-related risks during harvest periods. These technological advancements strengthen the alfalfa hay market and accelerate the transition to processed formats.

Supreme grade alfalfa hay captured 28.3% of the 2024 market share and achieved the highest growth rate at 6.1% CAGR, indicating increased demand for protein-rich feed. Premium grade (RFV 170-185) maintains its dominant position among commercial dairy farms by providing an optimal balance between cost and milk production targets. Good grade serves primarily beef cattle operations that focus on cost-effective digestible protein content. Fair and Utility grades show declining market presence as buyers implement stricter mycotoxin and contaminant limits.

Quality assessments revealed mycotoxin presence in all tested Chinese samples, prompting premium buyers to shift toward North American suppliers. Producers who implement precise harvest timing, efficient field drying methods, and advanced storage monitoring systems can secure price premiums of USD 50-60 per metric ton, demonstrating the market's value differentiation based on quality standards.

The Alfalfa Hay Market Report is Segmented by Product Type (Bales and More), Grade (Supreme and More), Processing Technology (Field-Dried Conventional and More), Distribution Channel (Direct Farm Gate and More), Livestock Application (Dairy Cattle Feed and More), End-Use Sector (Commercial Farms and More), and Geography (North America and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Metric Tons).

Geography Analysis

North America accounted for 36.2% of 2024 revenue, supported by mechanized operations, quality grading systems, and access to Pacific export terminals. U.S. hay production increased by 3.3% to 122.5 million metric tons, though water policy changes in Arizona and California pose risks to production areas. Wisconsin demonstrated regional adaptation by increasing production by 75% to 3.03 million tons, suggesting a potential shift of cultivation to regions with secure water resources.

Asia-Pacific is anticipated to grow at a 6.8% CAGR through 2030. The modernization of dairy operations in India and Southeast Asia drives feed demand, while China maintains its position as the largest importer at 886,661 metric tons despite volume adjustments. While China aims to expand domestic production, near-term import requirements persist due to herd growth. Australia's hay supply constraints following the Nammuldi project suspension highlight climate-related vulnerabilities.

Europe maintains a stable demand with an emphasis on sustainability and traceability, where producers with carbon certifications gain market advantages. South America is developing as a competitive exporter, particularly in Chile and Argentina, benefiting from suitable climate conditions and improved port facilities. Middle Eastern markets continue to depend on imports due to water limitations, with Saudi Arabia becoming the second-largest importer in 2024, surpassing Japan. Africa shows initial growth potential as commercial dairy operations expand in Kenya and Nigeria, indicating future opportunities in the alfalfa hay market.

- AL Dahra ACX Global Inc.

- Anderson Hay & Grain Co., Inc.

- Standlee Premium Products, LLC

- Border Valley Trading

- Alfalfa Monegros

- Grupo Oses (Nafosa)

- Gruppo Carli

- Green Prairie International Inc

- Cubeit Hay Company

- Haykingdom Inc.

- SL Follen Company

- Riverina

- McCracken Hay Company

- Bailey Farms International

- Hay USA Inc

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Dairy and Animal-Protein Demand Surge

- 4.2.2 Expansion of Forage-Import Programs

- 4.2.3 Superior Protein and Fiber Profile

- 4.2.4 Carbon-Credit and Soil-Health Monetization

- 4.2.5 On-the-Go Drying and Bale-Compression Tech Cuts Losses

- 4.2.6 Distiller's Dried Grains with Solubles (DDGS) Inflation Driving Forage Protein Use

- 4.3 Market Restraints

- 4.3.1 Water-Footprint and Drought Policy Pressure

- 4.3.2 Ocean-Freight and Container-Rate Volatility

- 4.3.3 Rise of Hydroponic Fodder and Alternative Roughage

- 4.3.4 Phytosanitary Barriers in Export Lanes

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value and Volume)

- 5.1 By Product Type

- 5.1.1 Bales

- 5.1.1.1 Round Bales

- 5.1.1.2 Square Bales

- 5.1.2 Pellets

- 5.1.3 Cubes

- 5.1.4 Dehydrated Pellets

- 5.1.5 Compressed Bales

- 5.1.1 Bales

- 5.2 By Grade/Quality

- 5.2.1 Supreme (RFV More Than 185)

- 5.2.2 Premium (RFV 170-185)

- 5.2.3 Good (RFV 150-169)

- 5.2.4 Fair (RFV 130-149)

- 5.2.5 Utility (RFV Less Than 130)

- 5.3 By Processing Technology

- 5.3.1 Field-Dried Conventional

- 5.3.2 Forced-Air Mobile Dryer

- 5.3.3 Rotary Drum Dehydration

- 5.3.4 Solar-Assisted Dehydration

- 5.4 By Distribution Channel

- 5.4.1 Direct Farm Gate

- 5.4.2 Export Trading Houses

- 5.4.3 Feed Integrators and Mills

- 5.4.4 E-commerce/Online Platforms

- 5.5 By Livestock Application

- 5.5.1 Dairy Cattle Feed

- 5.5.2 Beef Cattle Feed

- 5.5.3 Poultry Feed

- 5.5.4 Equine Feed

- 5.5.5 Small Ruminant Feed

- 5.5.6 Camelids and Other

- 5.6 By End-Use Sector

- 5.6.1 Commercial Farms

- 5.6.2 Compound Feed Manufacturers

- 5.6.3 Household/Hobby Animal Owners

- 5.6.4 Pet-food and Specialty Nutrition

- 5.7 By Geography

- 5.7.1 North America

- 5.7.1.1 United States

- 5.7.1.2 Canada

- 5.7.1.3 Mexico

- 5.7.1.4 Rest of North America

- 5.7.2 Europe

- 5.7.2.1 Germany

- 5.7.2.2 United Kingdom

- 5.7.2.3 France

- 5.7.2.4 Spain

- 5.7.2.5 Italy

- 5.7.2.6 Russia

- 5.7.2.7 Rest of Europe

- 5.7.3 Asia-Pacific

- 5.7.3.1 China

- 5.7.3.2 Japan

- 5.7.3.3 India

- 5.7.3.4 Australia

- 5.7.3.5 New Zealand

- 5.7.3.6 South Korea

- 5.7.3.7 Rest of Asia-Pacific

- 5.7.4 South America

- 5.7.4.1 Brazil

- 5.7.4.2 Argentina

- 5.7.4.3 Chile

- 5.7.4.4 Rest of South America

- 5.7.5 Middle East

- 5.7.5.1 Saudi Arabia

- 5.7.5.2 United Arab Emirates

- 5.7.5.3 Turkey

- 5.7.5.4 Rest of Middle East

- 5.7.6 Africa

- 5.7.6.1 South Africa

- 5.7.6.2 Egypt

- 5.7.6.3 Kenya

- 5.7.6.4 Rest of Africa

- 5.7.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 AL Dahra ACX Global Inc.

- 6.4.2 Anderson Hay & Grain Co., Inc.

- 6.4.3 Standlee Premium Products, LLC

- 6.4.4 Border Valley Trading

- 6.4.5 Alfalfa Monegros

- 6.4.6 Grupo Oses (Nafosa)

- 6.4.7 Gruppo Carli

- 6.4.8 Green Prairie International Inc

- 6.4.9 Cubeit Hay Company

- 6.4.10 Haykingdom Inc.

- 6.4.11 SL Follen Company

- 6.4.12 Riverina

- 6.4.13 McCracken Hay Company

- 6.4.14 Bailey Farms International

- 6.4.15 Hay USA Inc