|

市場調查報告書

商品編碼

1850049

歐洲行銷自動化軟體市場:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Europe Marketing Automation Software Market - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

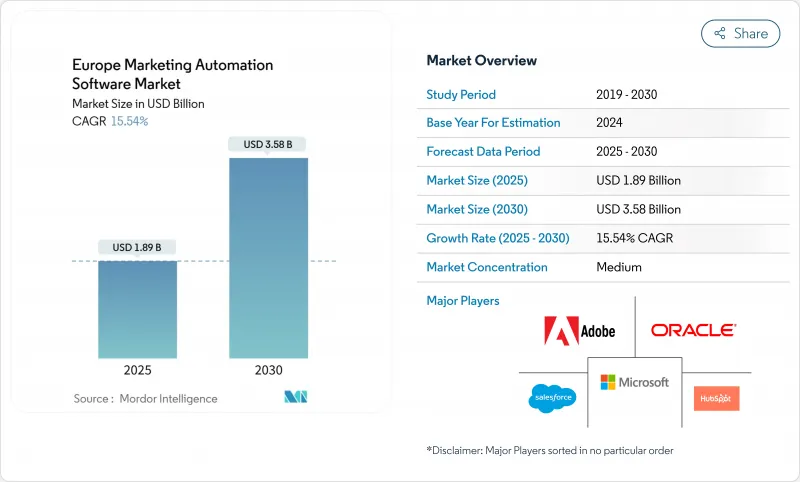

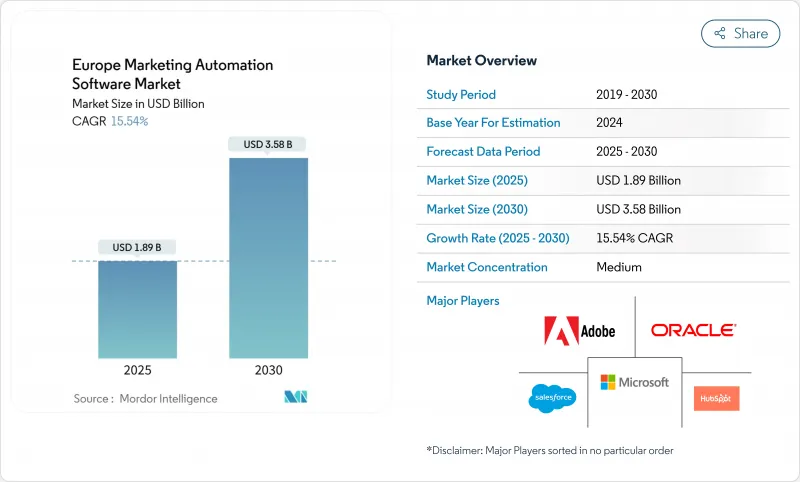

歐洲行銷自動化軟體市場預計到 2025 年將達到 18.9 億美元,到 2030 年將達到 35.8 億美元,在此期間的複合年成長率為 15.54%。

歐盟的「數位單一市場」計畫旨在2030年實現75%的雲端採用率,同時,79億歐元(約85.5億美元)的「數位歐洲計畫」將透過津貼中小企業採用SaaS來支持近期雲端技術的普及。同時,預計到2023年,該地區的電子商務經濟規模將達到8,870億歐元(約9,600億美元),這將推動對以客戶為中心的互動工具的需求,這些工具能夠在遵守GDPR的同時實現精細化的個人化服務。隨著全球平台供應商在歐洲不斷擴張,競爭日益激烈,而本地專家則憑藉其多語言能力和監管方面的專業知識脫穎而出。儘管雲端部署模式因其可擴展的合規管理而日益普及,但企業正迅速將支出轉向將技術與精通GDPR的實施人才相結合的託管服務。德國18.5%的複合年成長率以及德語區(DACH)和北歐國家對人工智慧主導的個人化服務的重視,凸顯了人工智慧準備度與行銷自動化應用之間的連結。

歐洲行銷自動化軟體市場趨勢與洞察

德國、奧地利和北歐地區電子商務中人工智慧驅動的個人化需求激增,正在推動市場發展。

人工智慧引擎正在德語區(德國、奧地利和瑞士)以及北歐零售業迅速普及,65%的高階主管認為人工智慧將成為2025年核心成長要素。負責人正利用該地區先進的雲端基礎設施和較高的資料共用授權率來部署建議模型,從而提升轉換率。 Telmore採用人工智慧主導的個人化策略後,銷售額成長了11%,展現了可量化的投資報酬率,並正在加速同業的採用。 80%的公司計劃增加人工智慧預算,但只有12%的公司能夠證明其投資回報率,因此,擁有完善衡量框架的早期採用者正在獲得競爭優勢。德國公司正在利用生成式人工智慧來簡化宣傳活動創建和彙報流程,消除重複性任務,使員工能夠專注於數據分析。因此,德語區和北歐地區將成為下一代個人化功能的試驗場,這些功能隨後將推廣到整個歐洲。

歐盟數位單一市場計劃促進中小企業採用SaaS服務

79億歐元(約85.5億美元)的「數位歐洲」計畫透過協調雲端運算法規並資助設立歐洲數位創新中心提供實務指導,降低了中小企業的進入門檻。標準化API提高了資料可移植性,簡化了不同行銷應用程式之間的整合,並降低了供應商鎖定風險。歐盟企業的雲端運算採用率已達41%,預計2030年將達到75%。這些政策利好因素降低了中階市場買家的合規複雜性,並擴大了歐洲行銷自動化軟體市場的潛在需求。

缺乏精通 GDPR 的行銷自動化架構師

具備行銷技術能力和法律洞察力的專業人才短缺,正日益阻礙實施計劃的進展。銀行業員工結構調整預示著數據專家的跨行業競爭加劇,此前,傳統崗位的就業人數在2007年至2022年間下降了21%。中小企業受到的影響尤其嚴重,它們越來越依賴外部管理服務,這也解釋了服務業16.1%的複合年成長率。歐洲數位創新中心的認證舉措帶來了一定的緩解,但短期內的人才短缺仍將阻礙中小企業採用相關技術。

細分市場分析

儘管軟體在2024年將佔歐洲行銷自動化軟體市場收入的72%,但到2030年,託管服務將以16.1%的複合年成長率超越軟體,凸顯了企業傾向於將合規專業知識外包。服務的激增表明,企業對技術執行和監管檢驗的重視程度與對核心功能的重視程度不相上下。在軟體領域,整合套件的表現優於獨立工具,因為買家尋求的是資料隱私審核和人工智慧模型管治的單一資料資訊來源。專業服務在遺留系統整合和GDPR差距分析方面取得了成功,這使得顧問公司和系統整合成為供應商選擇的安全隔離網閘。

對人工智慧立法日益嚴格的審查將促使企業更加重視從設計之初就融入審核的解決方案。供應商正將套裝軟體與諮詢服務結合,以創造類似年金的收入模式。因此,歐洲行銷自動化軟體產業將出現混合型經營模式,將軟體利潤與高觸感服務結合,以應對GDPR、PSD2以及特定產業義務等動態規則。

到2024年,雲端解決方案將佔據歐洲行銷自動化軟體市場78%的佔有率,這主要得益於歐盟對主權可信任雲端框架的支持。雲端採用率正以15.8%的複合年成長率成長,持續的平台更新使客戶能夠在無需大幅增加資本支出的情況下應對新的數據處理需求。行銷團隊可以利用彈性運算運行人工智慧模型,從而即時實現個人化的客戶旅程。只有在公共和國防部門客戶對資料駐留有嚴格要求的情況下,本地部署才仍然可行。

監管機構傾向於採用集中式雲端控制平台,以支援自動化的授權日誌記錄、違規通知和加密管理。這種監管一致性降低了用戶感知到的風險,並促進了更廣泛的雲端遷移。 Oracle 和Oracle在歐盟安全雲端區域的夥伴關係,展現了超大規模雲端服務供應商如何透過在地化其技術堆疊來滿足主權要求。隨著雲端遷移的成熟,雲端供應商可能會在零信任架構和預認證 AI 沙箱等增值層展開競爭。

歐洲行銷自動化軟體市場按元件(軟體、服務)、部署類型(雲端基礎、本地部署)、組織規模(中小企業、大型企業)、通路/功能(電子郵件行銷、社群媒體行銷、宣傳活動管理等)、最終用戶產業(零售/電子商務、銀行、金融服務和保險等)以及國家進行細分。市場預測以美元計價。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 人工智慧驅動的個人化服務引領德語區和北歐地區的電子商務市場。

- 歐盟的數位單一市場計劃鼓勵中小企業使用軟體即服務(SaaS)。

- B2B科技中心採用帳戶為基礎的行銷方式推動市場發展

- 歐洲金融服務領域的開放銀行API整合推動市場發展

- 在分散的市場中編配多語言旅程

- 市場限制

- 精通 GDPR 的行銷自動化架構師非常稀缺。

- 多語言個人化模組的總擁有成本較高

- 歐盟更嚴格的反垃圾郵件規則影響電子郵件的送達

- 價值鏈分析

- 監理展望

- 技術展望

- 評估市場宏觀經濟趨勢

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按組件

- 軟體

- 整合平台

- 獨立工具

- 線索管理

- 社群媒體

- 電子郵件和分析

- 服務

- 專業服務

- 託管服務

- 軟體

- 透過部署模式

- 雲端基礎的

- 本地部署

- 按公司規模

- 小型企業

- 主要企業

- 按通道/功能

- 電子郵件行銷

- 社群媒體行銷

- 宣傳活動管理

- 行動/簡訊行銷

- 入境內容行銷

- 其他頻道

- 按最終用戶行業分類

- 零售與電子商務

- 銀行、金融服務和保險業 (BFSI)

- 資訊科技和電信

- 製造業

- 醫療保健和生命科學

- 媒體與娛樂

- 政府和公共部門

- 其他終端用戶產業

- 按國家/地區

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 荷蘭

- 北歐國家

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Salesforce, Inc.

- Adobe Inc.(Marketo Inc.)

- HubSpot Inc.

- Oracle Corporation

- Microsoft Corporation

- SAP SE

- SAS Institute Inc.

- Act-On Software, Inc.

- Dotdigital Group PLC

- Force24 Ltd.

- ActiveCampaign LLC

- Mailchimp(Intuit Inc.)

- Sendinblue SAS(Brevo)

- GetResponse Sp. z oo

- Zoho Corporation

- Pipedrive OU

- SugarCRM Inc.

- Acoustic LP

- Iterable Inc.

- Klaviyo Inc.

第7章 市場機會與未來展望

The Europe marketing automation software market is valued at USD 1.89 billion in 2025 and is forecast to reach USD 3.58 billion by 2030, registering a brisk 15.54% CAGR across the period.

Ongoing EU Digital Single Market measures that target 75% cloud adoption by 2030, together with the EUR 7.9 billion (USD 8.55 billion) Digital Europe Programme, underpin near-term expansion by subsidizing SaaS adoption among small and medium-sized enterprises. Meanwhile, the region's EUR 887 billion (USD 960 billion) e-commerce economy in 2023 fuels demand for customer-centric engagement tools that remain compliant with GDPR while still delivering granular personalization. Competitive intensity is increasing as global platform vendors reinforce European footprints while local specialists differentiate through multilingual and regulatory expertise. Cloud deployment models dominate because they offer scalable compliance controls, yet the fastest corporate spending shift is toward managed services that bundle technology with GDPR-fluent implementation talent. Germany's 18.5% CAGR and the DACH-Nordics focus on AI-driven personalization highlight the link between AI readiness and marketing automation uptake, whereas EU AI Act obligations and a scarcity of certified data-privacy architects temper roll-out velocity.

Europe Marketing Automation Software Market Trends and Insights

AI-Powered Personalisation Surge in DACH and Nordics E-commerce Drives the Market

AI-enabled engines have permeated DACH and Nordic retail, with 65% of executives naming AI a core growth lever in 2025. Marketers exploit the regions' advanced cloud infrastructure and high data-sharing consent rates to roll out recommendation models that elevate conversion. Telmore recorded an 11% uplift in sales after adopting AI-driven personalization, illustrating quantifiable ROI that accelerates peer adoption. As 80% of companies earmark higher AI budgets yet only 12% prove ROI, early adopters with strong measurement frameworks gain competitive distance. German practitioners use generative AI to streamline campaign production and reporting, cutting repetitive tasks and redeploying staff toward analytics. Consequently, the DACH-Nordic corridor functions as a test bed for next-wave personalization capabilities that subsequently diffuse across Europe.

EU Digital Single-Market Initiatives Boosting SME SaaS Uptake

The EUR 7.9 billion (USD 8.55 billion) Digital Europe Programme lowers barriers for SMEs by harmonizing cloud regulations and funding European Digital Innovation Hubs that provide hands-on guidance. Standardized APIs improve data portability, easing integration among disparate marketing applications and mitigating vendor lock-in risks. Cloud adoption among EU enterprises stands at 41% and is slated to reach 75% by 2030, translating into a sizeable new customer pool for SaaS-based marketing automation. These policy tailwinds curtail compliance complexity for mid-market buyers and amplify addressable demand within the Europe marketing automation software market.

Scarcity of GDPR-Fluent Marketing-Automation Architects

Implementation projects increasingly stall because only a narrow cadre of professionals combines martech proficiency with legal insight. Banking workforce realignment illustrates cross-industry competition for data specialists after a 21% employment contraction in traditional roles between 2007 and 2022. SMEs are disproportionately affected, leading to a reliance on external managed services, which explains their 16.1% CAGR within the services component. Certification initiatives by European Digital Innovation Hubs provide relief, but near-term talent gaps constrain uptake within smaller economies.

Other drivers and restraints analyzed in the detailed report include:

- Account-Based Marketing Adoption in B2B Tech Hubs Drives the Market

- Open-Banking API Integration in European Financial Services Drives the Market

- High TCO for Multi-Language Personalisation Modules

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Software continued to generate 72% of Europe marketing automation software market revenue in 2024, though managed services outpaced with a 16.1% CAGR to 2030, underscoring corporates' preference for outsourced compliance know-how. The services surge signals that enterprises consider technical execution and regulatory validation equally critical as core functionality. Within software, integrated suites eclipse point tools because buyers demand one source of truth for data privacy audits and AI model governance. Professional services thrive on legacy-system integration and GDPR gap analysis, positioning consultancies and system integrators as gatekeepers for vendor selection.

Heightened AI Act scrutiny places a premium on solution blueprints that embed auditability by design. Vendors combine packaged software with advisory retainers, generating annuity-style revenue. The Europe marketing automation software industry will therefore see blended business models, where software margins pair with high-touch services to address dynamic rule-sets spanning GDPR, PSD2, and sector-specific mandates.

Cloud options owned 78% of the Europe marketing automation software market in 2024, bolstered by EU backing for sovereign and trusted cloud frameworks. Cloud deployments are expanding at 15.8% CAGR because continuous platform updates help clients absorb new data-handling obligations without capex spikes. Marketing teams benefit from elastic compute to run AI models that personalize journeys in real time. On-premise persists only where public-sector or defense clients demand strict data residency.

Regulators favor cloud's centralized control planes that support automated consent logging, breach notification, and encryption management. This regulatory alignment reduces perceived risk, spurring broader cloud migration. Partnerships, such as Oracle's tie-up with Palantir for secure EU cloud regions, illustrate how hyperscale providers localize stacks to satisfy sovereignty narratives. As uptake matures, cloud vendors will compete on value-add layers like zero-trust architectures and pre-certified AI sandboxing.

Europe Marketing Automation Software Market is Segmented by Component (Software, Services), Deployment Mode (Cloud-Based, On-Premise), Organisation Size (Small and Medium Enterprises, Large Enterprises), Channel / Function (Email Marketing, Social Media Marketing, Campaign Management, and More), End-User Industry (Retail and E-Commerce, BFSI, and More), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Salesforce, Inc.

- Adobe Inc.(Marketo Inc.)

- HubSpot Inc.

- Oracle Corporation

- Microsoft Corporation

- SAP SE

- SAS Institute Inc.

- Act-On Software, Inc.

- Dotdigital Group PLC

- Force24 Ltd.

- ActiveCampaign LLC

- Mailchimp (Intuit Inc.)

- Sendinblue SAS (Brevo)

- GetResponse Sp. z o.o.

- Zoho Corporation

- Pipedrive OU

- SugarCRM Inc.

- Acoustic LP

- Iterable Inc.

- Klaviyo Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI-Powered Personalisation Surge in DACH and Nordics E-commerce Drives the Market

- 4.2.2 EU Digital Single-Market Initiatives Boosting SME SaaS Uptake

- 4.2.3 Account-Based Marketing Adoption in B2B Tech Hubs Drives the Market

- 4.2.4 Open-Banking API Integration in European Financial Services Drives the Market

- 4.2.5 Multi-Lingual Journey Orchestration Across Fragmented Market

- 4.3 Market Restraints

- 4.3.1 Scarcity of GDPR-Fluent Marketing-Automation Architects

- 4.3.2 High TCO for Multi-Language Personalisation Modules

- 4.3.3 Stringent EU Anti-Spam Rules Impacting Email Deliverability

- 4.4 Value Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Assessment of Macro Economic Trends on the Market

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitutes

- 4.8.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Component

- 5.1.1 Software

- 5.1.1.1 Integrated Platforms

- 5.1.1.2 Stand-Alone Tools

- 5.1.1.2.1 Lead Management

- 5.1.1.2.2 Social Media

- 5.1.1.2.3 Email and Analytics

- 5.1.2 Services

- 5.1.2.1 Professional Services

- 5.1.2.2 Managed Services

- 5.1.1 Software

- 5.2 By Deployment Mode

- 5.2.1 Cloud-Based

- 5.2.2 On-Premise

- 5.3 By Organisation Size

- 5.3.1 Small and Medium Enterprises

- 5.3.2 Large Enterprises

- 5.4 By Channel / Function

- 5.4.1 Email Marketing

- 5.4.2 Social Media Marketing

- 5.4.3 Campaign Management

- 5.4.4 Mobile / SMS Marketing

- 5.4.5 Inbound and Content Marketing

- 5.4.6 Other Channels

- 5.5 By End-user Industry

- 5.5.1 Retail and E-commerce

- 5.5.2 BFSI (Banking, FinServ and Insurance)

- 5.5.3 IT and Telecom

- 5.5.4 Manufacturing

- 5.5.5 Healthcare and Life-Sciences

- 5.5.6 Media and Entertainment

- 5.5.7 Government and Public Sector

- 5.5.8 Other End-user Industries

- 5.6 By Country

- 5.6.1 United Kingdom

- 5.6.2 Germany

- 5.6.3 France

- 5.6.4 Italy

- 5.6.5 Spain

- 5.6.6 Netherlands

- 5.6.7 Nordics

- 5.6.8 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Salesforce, Inc.

- 6.4.2 Adobe Inc.(Marketo Inc.)

- 6.4.3 HubSpot Inc.

- 6.4.4 Oracle Corporation

- 6.4.5 Microsoft Corporation

- 6.4.6 SAP SE

- 6.4.7 SAS Institute Inc.

- 6.4.8 Act-On Software, Inc.

- 6.4.9 Dotdigital Group PLC

- 6.4.10 Force24 Ltd.

- 6.4.11 ActiveCampaign LLC

- 6.4.12 Mailchimp (Intuit Inc.)

- 6.4.13 Sendinblue SAS (Brevo)

- 6.4.14 GetResponse Sp. z o.o.

- 6.4.15 Zoho Corporation

- 6.4.16 Pipedrive OU

- 6.4.17 SugarCRM Inc.

- 6.4.18 Acoustic LP

- 6.4.19 Iterable Inc.

- 6.4.20 Klaviyo Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-Space and Unmet-Need Assessment