|

市場調查報告書

商品編碼

1850032

歐洲生質塑膠:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Europe Bioplastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

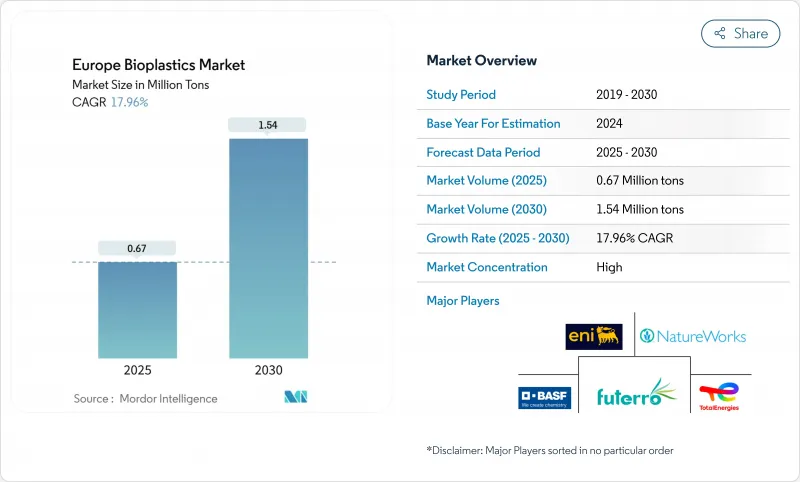

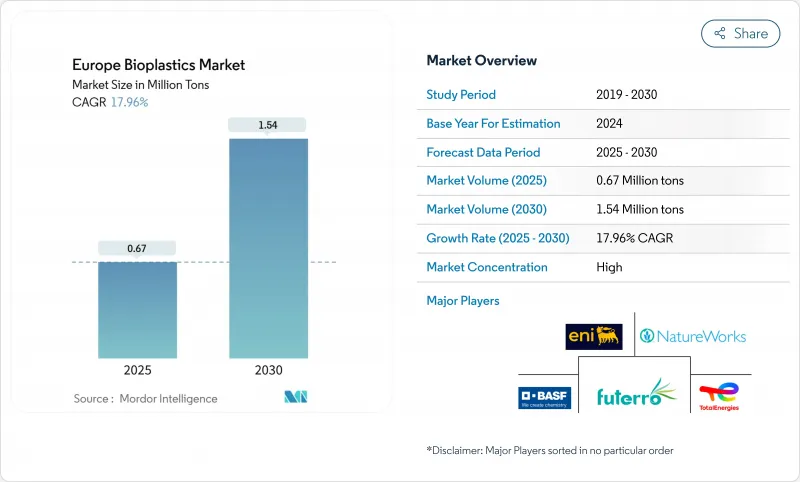

歐洲生質塑膠市場目前正按計畫發展,到 2025 年將達到 67 萬噸,到 2030 年將達到 154 萬噸,2025 年至 2030 年的複合年成長率為 17.96%。

隨著歐盟各國政策制定者收緊對化石基聚合物的限制,製造商將生物基替代品視為必不可少的升級,而不是可有可無的升級,這種轉變正在滲透到食品、零售、汽車和消費品價值鏈的採購領域。

歐洲生質塑膠市場趨勢與洞察

歐盟一次性塑膠指令觸發了2030年實現可堆肥解決方案的強制性要求

該指令的逐步淘汰和再生材料含量配額正在推動咖啡蓋、蔬果袋和快餐托盤等產品採用可堆肥生物聚合物。由於該法律採用材料性能標準而非品牌名稱,生產商可以將PLA、PHA或澱粉混合物定位為符合規範且能降低碳排放強度的途徑。成員國的實施時間表各不相同,因此擁有模組化生產方案的公司正在加速實施的市場中搶佔先機。尤其是在波蘭和愛爾蘭,不同的收費系統鼓勵在地採購可再生原料以減少運輸足跡,從而潛移默化地將供應鏈轉移到區域中心。

包裝用生質塑膠的需求不斷成長

軟質包裝目前已佔據歐洲生質塑膠市場43%的佔有率,並以23%的複合年成長率持續成長。品牌商表示,從化石基聚乙烯(PE)轉向生物基聚乙烯(bio-PE)和可堆肥複合材料所帶來的行銷優勢足以抵消略高的價格。像蒙迪集團旗下的FlexStudios這樣的創新中心正在展示,與客戶共同開發如何能夠縮短前置作業時間,並實現與現有樹脂相當的生產線速度。這意味著,掌握擠出和阻隔塗層技術的加工商將在與跨國食品公司的談判中獲得更多議價能力。

除比荷盧經濟聯盟、義大利和法國以外,其他地區的工業堆肥能力有限。

因此,可堆肥包裝最終可能被掩埋或污染機械回收流程。生產商正在透過推出雙重認證產品來應對這一問題,這些產品既可回收又可工業堆肥,從而將風險分散到整個廢物處理流程中。研究廢棄物管理地圖的投資人注意到,產能缺口與南歐旅遊業已開發地區重疊。這表明,基礎設施瓶頸不僅會影響聚合物的選擇,還會影響新建生質塑膠工廠的位置決策。

細分市場分析

生物基和生物分解性塑膠正鞏固主導地位,預計到2024年將佔據49%的市場佔有率,並預計在2030年之前以22.56%的複合年成長率成長。生產PLA和新興PHA等級產品的高通量生產線採用有利的原料來源和車牌式生產技術,隨著產量的增加,生產成本得以降低。速食連鎖店採用可堆肥刀叉餐具的早期案例表明,與石油基餐具功能相匹配能夠提升消費者對產品品質的感知,從而帶來重複訂單和可預測的規模化生產。這也表明,隨著化石原料價格上漲,成本差距的縮小速度超出預期,成本持平的實現速度可能比先前預期的要快。

儘管生物基生物分解性塑膠在歐洲生質塑膠市場中所佔比例較小,但由於它們能夠融入現有的PET和PE回收流程,因此對那些不願改變其逆向物流系統的飲料品牌來說極具吸引力。此次宣布的對植物來源PET的投資表明,阻礙成長的仍然是供應限制,而非需求疲軟。

到2024年,甘蔗將佔據約44%的原料市場佔有率,這主要得益於巴西和泰國工業發酵槽的全球運作,以及它們透過一體化物流向歐洲的供應。蔗糖穩定的產量和完善的認證系統降低了採購風險,促使買家簽訂多年合約。目前,林業纖維素殘渣和麥秸的基數較小,但隨著Deep Purple等計劃證明了將都市廢水污泥轉化為PHA中間體的可行性,其市場正以22.3%的複合年成長率快速成長。目前的市場觀點認為,纖維素路線將有助於實現地緣政治供應多元化,並緩解與糖業週期相關的價格波動。

歐洲生質塑膠市場報告按類型(生物基可生物分解、生物基不可生物分解)、原料(甘蔗/甜菜、玉米、其他)、加工技術(擠出、射出成型、其他)、應用(軟包裝、硬包裝、汽車和組裝、其他)以及國家(德國、英國、義大利、法國、荷蘭、其他國家)對產業進行細分。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 歐盟一次性塑膠指令將於2030年強制要求使用可堆肥解決方案。

- 包裝領域對生質塑膠的需求不斷成長

- 推動模式轉移的環境因素

- 政府採購政策優先考慮公共部門包裝中的生物基材料。

- 禁止在某些應用中使用石化燃料基塑膠

- 市場限制

- 除比荷盧經濟聯盟、義大利和法國以外,其他地區的工業堆肥能力有限。

- 歐盟27國產品標籤檢視規則的不一致,使品牌推廣變得複雜。

- 歐洲能源價格上漲推高了樹脂擠出成本。

- 放寬新型生物單體的REACH認證途徑

- 價值鏈分析

- 專利分析

- 波特五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章 市場規模與成長預測

- 按類型

- 生物基且可生物分解

- 澱粉類

- 聚乳酸(PLA)

- 聚羥基烷酯(PHA)

- 聚酯(PBS、PBAT、PCL)

- 其他生物基和可生物分解材料

- 生物基不可生物分解

- 生物基聚對苯二甲酸乙二醇酯(PET)

- 生物聚乙烯

- 生物聚醯胺

- 生物聚對苯二甲酸丙二醇酯

- 其他生物基不可生物分解

- 生物基且可生物分解

- 按原料

- 甘蔗/甜菜

- 玉米

- 木薯和土豆

- 纖維素和木材廢棄物

- 其他(藻類和微生物油)

- 透過加工技術

- 擠壓

- 射出成型

- 吹塑成型

- 3D列印

- 其他(熱成型等)

- 透過使用

- 軟包裝

- 硬包裝

- 汽車及組裝業務

- 農業和園藝

- 建造

- 纖維

- 電機與電子工程

- 其他用途

- 按國家/地區

- 德國

- 英國

- 義大利

- 法國

- 荷蘭

- 西班牙

- 北歐的

- 其他歐洲地區

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Arkema

- BASF

- BIO ON SpA

- Biome Bioplastics

- BIOTEC Biologische Naturverpackungen GmbH & Co. KG.

- Eni SpA(Novamont)

- Evonik Industries AG

- FKuR

- FUTERRO

- Green Dot Bioplastics Inc

- Innovia Films

- Lactips

- Minima

- Mitsubishi Chemical Group Corporation

- NatureWorks LLC

- Plantic

- Rodenburg Biopolymers

- Sulapac Oy

- TORAY INDUSTRIES, INC.

- TotalEnergies(Total Corbion)

第7章 市場機會與未來展望

The European bioplastics market is currently 0.67 million tons in 2025 and is on track to reach 1.54 million tons by 2030, supported by a forecast compound annual growth rate (CAGR) of 17.96% between 2025 and 2030.

Policymakers across the EU are tightening rules on fossil-based polymers, so manufacturers are treating bio-based alternatives as an essential rather than optional upgrade, a shift that is filtering through procurement departments in food, retail, automotive, and consumer-goods value chains.

Europe Bioplastics Market Trends and Insights

EU Single-Use Plastics Directive Triggering Mandatory Compostable Solutions by 2030

The Directive's phased bans and recycled-content quotas are creating structural pull for compostable biopolymers in items such as coffee caps, produce bags, and quick-service trays. Since the law uses material performance criteria rather than brand names, producers can position PLA, PHA, or starch blends as compliant pathways that also score carbon-intensity gains. Member-state timelines differ, so companies with modular production recipes are capturing early share in markets that front-load enforcement. An immediate observation is that differing fee structures, especially in Poland and Ireland, encourage local sourcing of renewable feedstocks to cut transport footprints, subtly tilting supply chains toward regionalised hubs.

Growing Demand for Bioplastics in Packaging

Flexible packaging already holds 43% European bioplastics market share and is growing at nearly 23% CAGR, because film and pouch makers can often substitute a single layer without overhauling entire filling lines. Brand owners report that switching from fossil PE to bio-PE or to a compostable laminate yields marketing benefits that offset modest price premiums, so sales teams pitch these materials as revenue protectors rather than pure cost items. Innovation hubs such as Mondi's FlexStudios demonstrate how co-development with customers cuts lead times and unlocks line-speed parity with incumbent resins. The implicit takeaway is that converters who master both extrusion and barrier-coating know-how gain bargaining power in negotiations with multinational food companies.

Limited Industrial-Composting Capacity Outside Benelux, Italy, and France

Only a fraction of EU regions operate certified industrial composting sites, so compostable packaging sometimes ends up in landfills or contaminates mechanical recycling streams. Producers respond by launching dual-certified grades that are both recyclable and industrially compostable, spreading risk across disposal pathways. Investors studying waste-management maps notice that capacity gaps overlap with high tourism regions in Southern Europe, suggesting that new composting plants could tap steady seasonal feedstock from hospitality waste. The inference here is that infrastructure bottlenecks will influence not just polymer selection but also plant-location decisions for new bioplastics facilities.

Other drivers and restraints analyzed in the detailed report include:

- Government Procurement Policies Favoring Bio-content in Public-Sector Packaging

- Ban on Fossil-Based Plastics in Specific Applications

- Inconsistent End-of-Life Labelling Rules Across EU-27 Complicate Brand Adoption

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Bio-based biodegradables command 49% Europe Bioplastics market share in 2024 and are forecast to post a 22.56% CAGR through 2030, reinforcing their leadership position. High throughput lines producing PLA and emerging PHA grades use advantaged feedstock sourcing and license plate technologies that compress production costs as volumes ramp. Early-stage evidence from fast-food chains adopting compostable cutlery shows that product-quality perception improves when functionality matches petro-based equivalents, leading to repeat orders and predictable scale-up. A telling inference is that cost-parity looks achievable earlier than once feared because rising fossil feedstock prices narrow the gap faster than forecast.

Bio-based non-biodegradables, while representing a smaller slice of Europe's Bioplastics market size, provide drop-in compatibility with existing PET and PE recycling streams, which appeals to beverage brands reluctant to alter reverse-logistics systems. Announced investments in plant-based PET confirm that supply constraints, rather than demand hesitation, remain the growth limiter.

Sugarcane accounts for roughly 44% Europe Bioplastics market share by feedstock in 2024 because industrial fermenters in Brazil and Thailand run at world-scale and supply Europe via integrated logistics. Stable sucrose yields and established certification schemes keep procurement risks low, so buyers lock multi-year contracts. Cellulosic residues from forestry and straw hold a smaller base today but expand at a rapid 22.3% CAGR as projects such as DEEP PURPLE demonstrate the feasibility of turning municipal wastewater sludge into PHA intermediates. A current market inference is that cellulosic routes will diversify geopolitical supply, dampening price volatility linked to sugar cycles.

The Europe Bioplastics Market Report Segments the Industry by Type (Bio-Based Biodegradables, Bio-Based Non-Biodegradables), Feedstock (Sugarcane/Sugar Beet, Corn, and More), Processing Technology (Extrusion, Injection Molding, Blow Molding, and More), Application (Flexible Packaging, Rigid Packaging, Automotive and Assembly Operations, and More), and Country (Germany, United Kingdom, Italy, France, Netherlands, and More).

List of Companies Covered in this Report:

- Arkema

- BASF

- BIO ON SpA

- Biome Bioplastics

- BIOTEC Biologische Naturverpackungen GmbH & Co. KG.

- Eni S.p.A. (Novamont)

- Evonik Industries AG

- FKuR

- FUTERRO

- Green Dot Bioplastics Inc

- Innovia Films

- Lactips

- Minima

- Mitsubishi Chemical Group Corporation

- NatureWorks LLC

- Plantic

- Rodenburg Biopolymers

- Sulapac Oy

- TORAY INDUSTRIES, INC.

- TotalEnergies (Total Corbion)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 EU Single-Use Plastics Directive Triggering Mandatory Compostable Solutions by 2030

- 4.2.2 Growing Demand for Bioplastics in Packaging

- 4.2.3 Environmental Factors Encouraging a Paradigm Shift

- 4.2.4 Government Procurement Policies Favoring Bio-Content in Public-Sector Packaging

- 4.2.5 Ban On Fossil-Based Plastics in Specific Applications

- 4.3 Market Restraints

- 4.3.1 Limited Industrial-Composting Capacity Outside Benelux, Italy, And France

- 4.3.2 Inconsistent End-Of-Life Labelling Rules Across the EU-27 Complicating Brand Adoption

- 4.3.3 High Energy Prices in Europe Inflating Resin Extrusion Costs

- 4.3.4 Slow REACH Certification Pathways for Novel Bio-Monomers

- 4.4 Value Chain Analysis

- 4.5 Patent Analysis

- 4.6 Porter's Five Forces

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitutes

- 4.6.5 Degree of Competition

5 Market Size and Growth Forecasts (Volume)

- 5.1 By Type

- 5.1.1 Bio-based Biodegradables

- 5.1.1.1 Starch-based

- 5.1.1.2 Polylactic Acid (PLA)

- 5.1.1.3 Polyhydroxyalkanoates (PHA)

- 5.1.1.4 Polyesters (PBS, PBAT, PCL)

- 5.1.1.5 Other Bio-based Biodegradables

- 5.1.2 Bio-based Non-biodegradables

- 5.1.2.1 Bio Polyethylene Terephthalate (PET)

- 5.1.2.2 Bio Polyethylene

- 5.1.2.3 Bio Polyamides

- 5.1.2.4 Bio Polytrimethylene Terephthalate

- 5.1.2.5 Other Bio-based Non-biodegradables

- 5.1.1 Bio-based Biodegradables

- 5.2 By Feedstock

- 5.2.1 Sugarcane / Sugar Beet

- 5.2.2 Corn

- 5.2.3 Cassava and Potato

- 5.2.4 Cellulosic and Wood Waste

- 5.2.5 Others (Algae and Microbial Oil)

- 5.3 By Processing Technology

- 5.3.1 Extrusion

- 5.3.2 Injection Molding

- 5.3.3 Blow Molding

- 5.3.4 3D Printing

- 5.3.5 Others (Thermoforming, etc.)

- 5.4 By Application

- 5.4.1 Flexible Packaging

- 5.4.2 Rigid Packaging

- 5.4.3 Automotive and Assembly Operations

- 5.4.4 Agriculture and Horticulture

- 5.4.5 Construction

- 5.4.6 Textiles

- 5.4.7 Electrical and Electronics

- 5.4.8 Other Applications

- 5.5 By Country

- 5.5.1 Germany

- 5.5.2 United Kingdom

- 5.5.3 Italy

- 5.5.4 France

- 5.5.5 Netherlands

- 5.5.6 Spain

- 5.5.7 Nordic

- 5.5.8 Rest of Europe

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles {(includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, Recent Developments)}

- 6.4.1 Arkema

- 6.4.2 BASF

- 6.4.3 BIO ON SpA

- 6.4.4 Biome Bioplastics

- 6.4.5 BIOTEC Biologische Naturverpackungen GmbH & Co. KG.

- 6.4.6 Eni S.p.A. (Novamont)

- 6.4.7 Evonik Industries AG

- 6.4.8 FKuR

- 6.4.9 FUTERRO

- 6.4.10 Green Dot Bioplastics Inc

- 6.4.11 Innovia Films

- 6.4.12 Lactips

- 6.4.13 Minima

- 6.4.14 Mitsubishi Chemical Group Corporation

- 6.4.15 NatureWorks LLC

- 6.4.16 Plantic

- 6.4.17 Rodenburg Biopolymers

- 6.4.18 Sulapac Oy

- 6.4.19 TORAY INDUSTRIES, INC.

- 6.4.20 TotalEnergies (Total Corbion)

7 Market Opportunities and Future Outlook

- 7.1 EU Circular Economy and Green Deal Strategies

- 7.2 White-space and Unmet-need Assessment