|

市場調查報告書

商品編碼

1850028

智慧城市:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030 年)Smart Cities - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

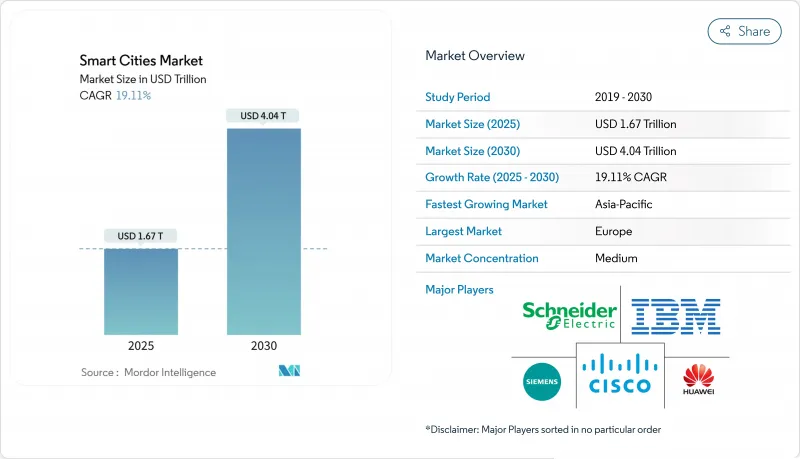

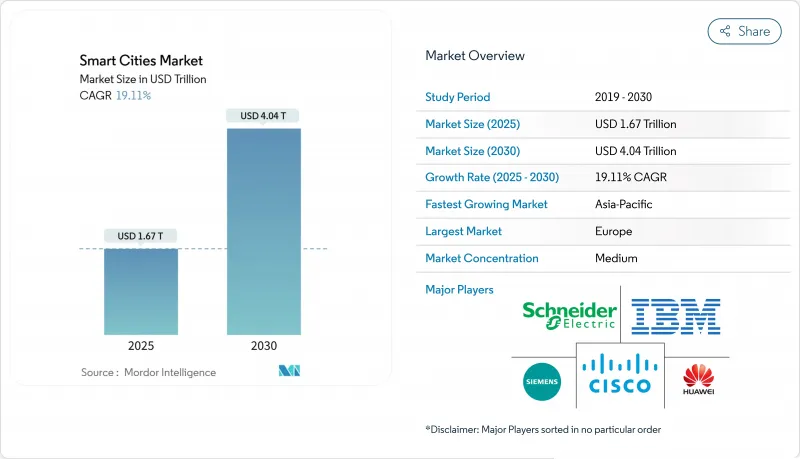

預計2025年智慧城市市場規模將達到1.67兆美元,2030年將達到4.04兆美元。

強力的政府獎勵策略,特別是美國基礎設施投資和就業法案以及每年為亞太地區城市數位化撥款 1580 億美元,正在支持對整合移動性、公共工程、安全和公民服務的整合平台的需求。嵌入在物聯網 (IoT) 網路中的人工智慧引擎將市政採購週期縮短至短短八個月,加快了試點計畫的價值實現時間,並透過在施工前檢驗結果的數位雙胞胎實現逐步擴展。繼 2025 年 1 月宣布投資 5,000 億美元的星際之門人工智慧基礎設施之後,競爭動態愈演愈烈,西門子等基礎設施巨頭面臨微軟和Oracle等雲端超大規模資料中心業者大規模企業的挑戰。雖然硬體仍然是最大的成本塊,但服務正在迅速擴展,因為城市領導者更喜歡承包整合和管理安全契約,而不是零碎的設備購買。

全球智慧城市市場趨勢與洞察

政府對綜合基礎建設的投入快速增加

基礎設施法案為供應商提供了穩定的收入來源。 《基礎設施投資與就業法案》規定到 2026 年每年累計1 億美元用於智慧社區技術,最初的提案徵集吸引了 392 個市政府,平均申請金額為 154 萬美元。國家工程組織估計,現代數位系統可以將資產壽命延長 30%,使智慧平台成為昂貴的混凝土替代品的可行替代方案。拉斯維加斯等城市透過使用基於物聯網網路的自適應交通號誌燈每年可節省 100 萬美元。美國能源局2024 財政年度 519.9 億美元的預算專注於電網現代化和清潔能源勞動力計劃,以加強城市層面的投資能力。多方面的資金投入減少了鄰近計劃的領先障礙,包括交通、能源和安全,並吸引了私人資本。

擴大人工智慧和物聯網平台的採用

國家物聯網戰略建議統一標準,以消除碎片化,加速跨產業應用。新加坡的智慧型運輸系統(ITS) 已透過基於即時分析的自適應交通號誌控制,將擁塞減少了 35%。邊緣運算節點在本地處理感測器數據,隨著智慧型終端的安裝基數到 2030 年接近 5000 億,這將緩解回程傳輸限制。 5G-Advanced 連線與 AIoT 應用相結合,可實現自動駕駛接駁車和預測性維護所必需的亞毫秒響應時間。這些功能將有助於建構一個透過單一資料架構連接交通、公共和緊急服務的整體城市平台。

初期維修和整合成本高

將舊建築改造成智慧建築,尤其是在多用戶住宅中增加汽車充電基礎設施,與新建築相比,資本支出增加 15-25%。學術研究討論了「5R」改裝——居住、重建、重新運輸、重新資本化和重新綠化——該框架將成本分攤到多個資產類別,但使市政預算複雜化。半導體短缺導致物聯網組件的價格在 2024 年後上漲約 30%。聯邦供應鏈審查證實了這一趨勢,其中強調了地緣政治和氣候變遷風險。將棕地(例如緬因州以前的造紙廠)改造成先進材料工廠有可能節省成本,但整合工作仍需要許多城市 IT 團隊所缺乏的高級專業知識。由於不可預見的互通性問題,嘗試零碎採購的計劃報告超支 40-60%。

細分分析

2024年,智慧運輸管理將佔智慧城市市場總收入的18.2%,成為智慧城市市場最大的單一解決方案細分領域。例如,新加坡的自我調整訊號網路縮短了出行時間,並支援資料驅動型擁塞管理的可輸出最佳實踐。受歐洲能源前瞻性區域計畫和北美微電網試點的推動,公用事業相關的智慧城市市場規模預計將成長最快,複合年成長率達19.2%。隨著政府部門將人工智慧視訊、暖通空調最佳化和遠端醫療整合到統一指揮平台,智慧安全、建築自動化和醫療保健領域的投資將穩步成長。

行動數據用於預測能源需求,公共感測器兼作環境監測器。正在嘗試使用區塊鏈檢驗身份的城市正在減少跨機構協作的延遲,並增加整合資料架構的採用。環境監測和廢棄物收集工具的成長一直很緩慢,但預計到本世紀末,零廢棄物強制規定和循環經濟政策將重新引起人們的興趣。

到2024年,硬體將佔支出的42.5%,這反映了城市物聯網的基礎:感測器、閘道器和邊緣運算。然而,由於市長要求承包整合以降低複雜部署的風險,服務支出的複合年成長率將達到19.7%。隨著網路評估、資料管治和託管雲端營運成為不可或缺的要素,智慧城市市場中越來越多的佔有率將傾向於服務。

供應鏈波動將持續推高零件成本,強化供應商透過多年合約攤提硬體成本的訂閱模式。執行預測分析和數位孿生的軟體平台將保持穩定的需求,但差異化將轉向垂直專業知識和開放API套件,而不是千篇一律的儀表板。能夠展示跨照明、行動和電網通訊協定互通性的供應商將獲得更高的價格溢價。

區域分析

亞太地區將維持領先地位,2024年將佔全球營收的31.7%,到2030年複合年成長率將達到20.3%。中國支持近800個試點城市,印度則獲得美國、日本和韓國三個國家的資助。日本的「社會5.0」政策將機器人和人工智慧納入區域振興計劃,並採用成本分攤方案,由零售商等間接受益者資助旅遊服務。亞洲智慧城市大會強調了該地區向零碳港口和氫能走廊轉型的重點,以平衡經濟成長與脫碳。

在北美,計劃持續擴張,每年獲得1億美元的聯邦補貼,並得到私人企業積極推動5G建設的支持。拉斯維加斯的數據驅動主導舉措將逆行駕駛減少了90%,已成為北美基於結果的採購的典範。 「星際之門」基金將深化技術棧,承諾創造10萬個新就業崗位,並為人工智慧密集型市政工作負載提供強大的運算能力。

在歐洲,永續性是歐盟計畫的重中之重,該計畫將能源盈餘目標與嚴格的資料保護法結合,力爭在2025年建成100個正能量區。 Syn.ikia初步試驗已證實,數位雙胞胎主導的設計可實現40%至60%的效率提升。來自私人資本的承諾,例如PATRIZIA的140億歐元智慧城市基金,顯示投資者對綠色維修和城市服務平台帶來的長期現金流充滿信心。在中東,專注於自動駕駛出行和電子政府的專案正在進行中,杜拜的目標是到2030年實現25%的自動駕駛出行。非洲和南美洲提供了新的機遇,但資金限制和技能短缺限制了其應用的步伐。

其他福利:

- Excel 格式的市場預測 (ME) 表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場狀況

- 市場概況

- 市場促進因素

- 政府對綜合基礎設施的資金投入激增

- 人工智慧和物聯網平台的採用率不斷提高

- 能源正向區域試行加速公用事業收費

- 數位雙胞胎部署縮短市政採購週期

- 美國城市私有 CBRS 5G 頻譜部署

- 氣候適應力需求(洪水感測器、中暑風險儀表板)

- 市場限制

- 初期維修和整合成本高昂

- 網路安全和資料隱私問題

- 採購和互通性標準分散

- 新冠疫情後地方政府債務上限面臨壓力

- 供應鏈分析

- 監管格局

- 技術展望

- 波特五力分析

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭對手之間的競爭

- 宏觀經濟趨勢的市場評估

第5章市場規模及成長預測

- 按解決方案

- 智慧運輸管理

- 智慧公共

- 智慧醫療

- 智慧建築

- 智慧公用事業

- 智慧安全

- 其他

- 按組件

- 硬體

- 軟體

- 服務

- 按部署模型

- 雲

- 本地部署

- 按最終用戶

- 政府和地方政府

- 住宅

- 商業和工業

- 運輸/物流

- 公共產業提供者

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 歐洲

- 英國

- 德國

- 法國

- 瑞典

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 澳洲

- 韓國

- 其他亞太地區

- 中東和非洲

- 沙烏地阿拉伯

- 阿拉伯聯合大公國

- 土耳其

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭態勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- ABB Ltd.

- Cisco Systems Inc.

- Emerson Electric Co.

- IBM Corporation

- Ericsson AB

- Schneider Electric SE

- General Electric Co.

- Siemens AG

- Huawei Technologies Co. Ltd.

- Honeywell International Inc.

- Hitachi Ltd.

- Nokia Corporation

- Koninklijke Philips NV

- Microsoft Corporation

- Oracle Corporation

- ATandT Inc.

- Intel Corporation

- NEC Corporation

- Bosch Security Systems

- Samsung Electronics Co., Ltd.

- Panasonic Corporation

- Verizon Communications Inc.

- Alibaba Group(AliCloud)

- Johnson Controls International plc

- SUEZ SA

- Thales Group

第7章 市場機會與未來展望

The smart cities market stood at USD 1.67 trillion in 2025 and is on course to reach USD 4.04 trillion by 2030, reflecting a 19.11% CAGR over the forecast window.

Robust government stimulus, especially the U.S. Infrastructure Investment and Jobs Act and annual Asia-Pacific allocations of USD 158 billion for urban digitization, is anchoring demand for integrated platforms that unite mobility, utilities, safety and citizen-service domains. Artificial-intelligence engines embedded in Internet-of-Things (IoT) networks have condensed municipal buying cycles to as little as eight months, accelerating time-to-value for pilot programs and enabling incremental scaling through digital twins that verify outcomes before construction. Competitive dynamics intensify as infrastructure stalwarts such as Siemens face cloud hyperscalers such as Microsoft and Oracle, following January 2025's USD 500 billion Stargate AI infrastructure announcement that signaled a multi-year race to supply compute, connectivity and applications for next-generation cities. Hardware still accounts for the largest cost block, but services are expanding faster as city leaders prefer turnkey integration and managed security contracts over piecemeal equipment purchases.

Global Smart Cities Market Trends and Insights

Surging Government Funding for Integrated Infrastructure

Infrastructure legislation is unlocking steady revenue streams for vendors. The Infrastructure Investment and Jobs Act budgets USD 100 million per year through 2026 for smart community technologies, with the first call attracting 392 municipal applications that averaged USD 1.54 million each. National engineering bodies estimate that modern digital systems can stretch asset life by as much as 30%, turning smart platforms into viable substitutes for costly concrete rebuilds. Cities like Las Vegas validated the model, saving USD 1 million annually via adaptive traffic signals that run on IoT networks. The U.S. Department of Energy's USD 51.99 billion FY 2024 budget earmarks grid modernization and clean-energy workforce programs, reinforcing city-level investment capacity. Collectively, multilevel funding reduces upfront barriers and crowds in private capital for adjacent projects across mobility, energy, and safety.

Rising Adoption of AI and IoT Platforms

National IoT strategies recommend uniform standards to fight fragmentation and accelerate cross-sector adoption. Singapore's Intelligent Transport System already cuts congestion by 35% through adaptive signal control informed by real-time analytics. Edge-computing nodes process sensor data locally, alleviating backhaul limits as the installed base of smart endpoints heads toward 500 billion by 2030. Marrying 5 G-Advanced connectivity with AIoT applications permits sub-millisecond response times essential for autonomous shuttles and predictive maintenance. These capabilities encourage holistic city platforms that interlink transport, utilities, and emergency services through one data fabric.

High Upfront Retrofit and Integration Costs

Bringing legacy buildings up to smart readiness inflates capital outlays by 15-25% versus new construction, particularly when adding vehicle-charging infrastructure to multi-family units. Academic studies discuss a "5R" retrofit framework: re-inhabitation, rebuilding, re-transportation, re-capitalisation, and re-greening that spreads costs across multiple asset classes but complicates municipal budgeting. Semiconductor shortages have raised IoT component prices by roughly 30% since 2024, a trend confirmed by federal supply-chain reviews highlighting geopolitical and climate-related risks. Repurposing brownfield sites such as a former Maine paper mill into advanced-materials plants shows cost-saving potential, yet integration tasks still demand premium expertise that many city IT teams lack. Projects that attempted piecemeal procurement report 40-60% overruns due to unforeseen interoperability issues.

Other drivers and restraints analyzed in the detailed report include:

- Energy-Positive District Pilots Accelerating Utilities Spend

- Digital-Twin Adoption Shortening Procurement Cycles

- Cyber-Security and Data-Privacy Concerns

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smart mobility management secured 18.2% of 2024 revenue, making it the largest single solution line in the smart cities market. Singapore's adaptive-signal network, for example, has cut travel times and underpinned exportable best practices for data-driven congestion management. The smart cities market size associated with utilities is projected to grow fastest at a 19.2% CAGR due to energy-positive district ambitions in Europe and emerging microgrid pilots in North America. Smart safety, building automation and healthcare capture steady allocations as authorities integrate AI-video, HVAC optimisation and telehealth into consolidated command platforms.

Integration across solutions is rising: mobility data feeds energy demand forecasting, while public-safety sensors double as environmental monitors. Cities experimenting with blockchain-validated identities reduce latency in inter-agency collaboration, bolstering adoption of unified data fabrics. Although environmental monitoring and waste-collection tools grow more slowly, zero-waste mandates and circular-economy policies promise renewed interest by the decade's end.

Hardware retained 42.5% of 2024 spending, reflecting the sensor, gateway, and edge-compute foundation of any urban IoT installation. Yet services are advancing at a 19.7% CAGR as mayors seek turnkey integration to de-risk complex rollouts. The smart cities market share tilted toward services will widen as cyber assessments, data governance, and managed cloud operations become non-negotiable line items.

Supply-chain volatility continues to lift component costs, reinforcing subscription models where vendors amortise hardware over multi-year contracts. Software platforms that run predictive analytics and digital twins sustain steady demand, but differentiation shifts to vertical expertise and open-API toolkits rather than generic dashboards. Vendors able to certify interoperability across lighting, mobility, and grid protocols win premium pricing.

Smart City Market Report is Segmented by Solution (Smart Mobility Management, Smart Public Safety, and More), Component (Hardware, Software, and Services), Deployment Model (Cloud and On-Premises), End-User (Government and Municipal, Residential, and More), and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific contributed 31.7% of 2024 revenue and will keep the lead with a 20.3% CAGR through 2030, as China supports nearly 800 pilot cities and India draws trilateral funding from the United States, Japan, and South Korea. Japan's Society 5.0 policy merges robotics and AI into regional revitalisation plans, using cost-sharing schemes where indirect beneficiaries such as retailers help fund mobility services. The Asia Smart City Conference underscores a regional pivot toward zero-carbon ports and hydrogen corridors that blend economic growth with decarbonisation goals.

North America continues to scale projects on the back of USD 100 million annual federal grants and aggressive private 5G build-outs. Las Vegas' data-driven policing initiative, which cut wrong-way driving by 90%, serves as a North American reference case for outcome-based procurement. The Stargate fund deepens the technology stack, promising 100,000 new jobs and vast compute capacity for AI-heavy municipal workloads.

Europe positions sustainability at the forefront, aiming for 100 Positive Energy Districts by 2025 under EU programs that marry energy surplus targets with stringent privacy laws. Syn.ikia pilots confirm 40-60% efficiency gains achievable through digital-twin-led design. Private-equity commitments such as PATRIZIA's EUR 14 billion smart-city fund validate investor confidence in long-run cash flows from green retrofits and urban-service platforms. Middle East programs emphasise autonomous mobility and e-government, with Dubai aiming for 25% self-driving journeys by 2030. Africa and South America present emerging opportunities, although fiscal constraints and skills shortages temper deployment speed.

- ABB Ltd.

- Cisco Systems Inc.

- Emerson Electric Co.

- IBM Corporation

- Ericsson AB

- Schneider Electric SE

- General Electric Co.

- Siemens AG

- Huawei Technologies Co. Ltd.

- Honeywell International Inc.

- Hitachi Ltd.

- Nokia Corporation

- Koninklijke Philips NV

- Microsoft Corporation

- Oracle Corporation

- ATandT Inc.

- Intel Corporation

- NEC Corporation

- Bosch Security Systems

- Samsung Electronics Co., Ltd.

- Panasonic Corporation

- Verizon Communications Inc.

- Alibaba Group (AliCloud)

- Johnson Controls International plc

- SUEZ SA

- Thales Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging government funding for integrated infrastructure

- 4.2.2 Rising adoption of AI and IoT platforms

- 4.2.3 Energy-positive district pilots accelerating utilities spend

- 4.2.4 Digital-twin adoption shortening municipal procurement cycles

- 4.2.5 Private-CBRS 5G spectrum deployments in U.S. cities

- 4.2.6 Climate-resilience mandates (flood sensors, heat-risk dashboards)

- 4.3 Market Restraints

- 4.3.1 High upfront retrofit and integration costs

- 4.3.2 Cyber-security and data-privacy concerns

- 4.3.3 Fragmented procurement and interoperability standards

- 4.3.4 Municipal debt-ceiling pressure post-COVID

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Force Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Assessment of Macroeconomic Trends on the Market

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Solution

- 5.1.1 Smart Mobility Management

- 5.1.2 Smart Public Safety

- 5.1.3 Smart Healthcare

- 5.1.4 Smart Building

- 5.1.5 Smart Utilities

- 5.1.6 Smart Security

- 5.1.7 Others

- 5.2 By Component

- 5.2.1 Hardware

- 5.2.2 Software

- 5.2.3 Services

- 5.3 By Deployment Model

- 5.3.1 Cloud

- 5.3.2 On-premise

- 5.4 By End-user

- 5.4.1 Government and Municipal

- 5.4.2 Residential

- 5.4.3 Commercial and Industrial

- 5.4.4 Transportation and Logistics

- 5.4.5 Utilities Providers

- 5.4.6 Other

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Sweden

- 5.5.3.5 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 India

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Turkey

- 5.5.5.4 South Africa

- 5.5.5.5 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABB Ltd.

- 6.4.2 Cisco Systems Inc.

- 6.4.3 Emerson Electric Co.

- 6.4.4 IBM Corporation

- 6.4.5 Ericsson AB

- 6.4.6 Schneider Electric SE

- 6.4.7 General Electric Co.

- 6.4.8 Siemens AG

- 6.4.9 Huawei Technologies Co. Ltd.

- 6.4.10 Honeywell International Inc.

- 6.4.11 Hitachi Ltd.

- 6.4.12 Nokia Corporation

- 6.4.13 Koninklijke Philips NV

- 6.4.14 Microsoft Corporation

- 6.4.15 Oracle Corporation

- 6.4.16 ATandT Inc.

- 6.4.17 Intel Corporation

- 6.4.18 NEC Corporation

- 6.4.19 Bosch Security Systems

- 6.4.20 Samsung Electronics Co., Ltd.

- 6.4.21 Panasonic Corporation

- 6.4.22 Verizon Communications Inc.

- 6.4.23 Alibaba Group (AliCloud)

- 6.4.24 Johnson Controls International plc

- 6.4.25 SUEZ SA

- 6.4.26 Thales Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment